| Revision as of 16:00, 26 May 2010 edit128.83.176.162 (talk) Undid revision 364315060 by 24.218.32.223 (talk)← Previous edit | Latest revision as of 09:08, 17 December 2024 edit undoDormskirk (talk | contribs)Autopatrolled, Extended confirmed users, Pending changes reviewers, Rollbackers409,982 edits reverted some POV material per talk pageTag: Undo | ||

| Line 1: | Line 1: | ||

| {{short description|British multinational oil and gas company}} | |||

| {{otheruse|this=the energy corporation}} | |||

| {{About|the energy company}} | |||

| {{pp-move}} | |||

| {{Infobox company|krunal | |||

| {{Use dmy dates|date=October 2023}} | |||

| |company_name = BP plc | |||

| {{Use British English|date=April 2013}} | |||

| | company_logo = ] | |||

| {{Infobox company | |||

| | company_type = ]<br>({{lse|BP}})<br>({{nyse|BP}}) | |||

| | name = BP p.l.c. | |||

| | company_slogan = Beyond petroleum.<br>Make the day a little better. | |||

| | logo = BP Helios logo.svg | |||

| | foundation = 1909 (as the ])<br />1954 (as the British Petroleum Company)<br />1998 (merger of British Petroleum and ]) | |||

| | logo_size = 125 | |||

| | location = {{flagicon|UK}} ], ], ] | |||

| | image = BPheadoffice.JPG | |||

| | area_served = Worldwide, Hurf Durf, Newfoundland | |||

| | image_size = 250 | |||

| | key_people = ] <small>(Chairman)</small><br>] <small>(])</small><br>] <small>(])</small> | |||

| | image_caption = Headquarters at 1 ] in ], London | |||

| | industry = ], ]s | |||

| | former_name = {{Plainlist| | |||

| | products = BP petroleum and derived products<br />BP service stations<br />] Aviation Fuels <br />] motor oil<br />] gas stations<br />am/pm convenience stores<br />] service stations solar pannels | |||

| * ] (1909–1935) | |||

| | revenue = ]246.1 billion <small>(2009)</small><ref name="AR2009">{{cite web |url=http://www.bp.com/liveassets/bp_internet/globalbp/STAGING/global_assets/downloads/B/bp_fourth_quarter_and_full_year_2009_results.pdf |title=Annual Results 2009 |accessdate=2 February 2010 |publisher=BP}}</ref> | |||

| * Anglo-Iranian Oil Company (1935–1954) | |||

| | operating_income = US $26.43 billion <small>(2009)</small><ref name="AR2009"/> | |||

| * The British Petroleum Company Limited (1954–1981) | |||

| | net_income = US $16.58 billion <small>(2009)</small><ref name="AR2009"/> | |||

| * The British Petroleum Company p.l.c. (1981–1998) | |||

| | assets = US $236.0 billion <small>(2009)</small> | |||

| * BP Amoco p.l.c. (1998–2001) | |||

| | equity = US $101.6 billion <small>(2009)</small> | |||

| }} | |||

| | num_employees = 92,000 <small>(March 2009)</small> | |||

| | type = ] | |||

| | homepage = | |||

| | traded_as = {{Unbulleted list|class=nowrap|{{LSE|BP.}}|] component}} | |||

| | ISIN = {{ISIN|GB0007980591|sl=n}} | |||

| | industry = ] | |||

| | predecessors = {{Unbulleted list|class=nowrap|Anglo-Persian Oil Company|]|]|]|]|]|]}} | |||

| | foundation = {{Start date and age|df=yes|1909|04|14}} (as the ]) | |||

| | founders = {{unbulleted list|]|]}} | |||

| | location = ], England, UK | |||

| | area_served = Worldwide | |||

| | key_people = {{Unbulleted list|df=yes|class=nowrap | |||

| | ] (]) | |||

| | ] (]) }} | |||

| | products = {{hlist|]|]|]s|]s}} | |||

| | production = {{steady}} {{convert|2.3|Moilbbl/d|abbr=on}} of ] (2023)<ref name="AR23-glance"/> | |||

| | services = Service stations | |||

| | revenue = {{nowrap|{{increase}} ]210.13 billion (2023)}}<ref name="AR23-finances" /> | |||

| | operating_income = {{nowrap|{{increase}} US$27.35 billion (2023)}}<ref name="AR23-finances" /> | |||

| | net_income = {{nowrap|{{increase}} US$15.88 billion (2023)}}<ref name="AR23-finances" /> | |||

| | assets = {{nowrap|{{decrease}} US$280.29 billion (2023)}}<ref name="AR23-finances" /> | |||

| | equity = {{nowrap|{{increase}} US$85.49 billion (2023)}}<ref name="AR23-finances" /> | |||

| | num_employees = {{nowrap|87,800 (2023)}}<ref name="AR23-glance"/> | |||

| | brands = {{hlist|]|]|]|BP|BP Connect|]|]|}} | |||

| | divisions = | |||

| | subsid = | |||

| | homepage = {{official URL}} | |||

| }} | }} | ||

| '''BP p.l.c.''' (formerly '''The British Petroleum Company p.l.c.''' and '''BP Amoco p.l.c.'''; stylised in all lowercase) is a British ] ] and ] company headquartered in ], England. It is one of the oil and gas "]" and one of the ] measured by revenues and profits.<ref name="reut1808" /> It is a ] company operating in all areas of the oil and gas industry, including ] and ], ], ], ], and ]. | |||

| ] | |||

| '''BP ]'''<ref>{{Cite press release | title = BP plc 2009 Securities and Exchange Commission Form 20-F | publisher = BP plc | date = 2010 | url = http://www.bp.com/liveassets/bp_internet/globalbp/STAGING/global_assets/downloads/I/BP_20-F_2009.pdf | accessdate = 22 May 2010}}</ref> is a British global energy company which is the third largest global energy company and the fourth largest company in the world. As a ] oil company ("oil major") BP is the UK's largest corporation, with its headquarters in ], ], ].<ref>"." BP. Retrieved on 9 April 2010.</ref><ref>"." BP. Retrieved on 18 August 2009.</ref><ref name="Map">"." City of Westminster. Retrieved on 28 August 2009.</ref> BP America's headquarters is in the ] in the ] area of Houston, Texas. The company is among the largest ] energy corporations in the world, and one of the six "]s" (] private sector ], ], and ] product marketing companies).<ref></ref> The company is listed on the ] and is a constituent of the ]. | |||

| BP's origins date back to the founding of the ] in 1909, established as a subsidiary of ] to exploit oil discoveries in ]. In 1935, it became the ] and in 1954, adopted the name '''British Petroleum'''.<ref name="BPhistory-postwar" /><ref name="time020610" /> BP acquired majority control of ] in 1978. Formerly majority state-owned, the British government privatised the company in stages between 1979 and 1987. BP merged with ] in 1998, becoming '''BP Amoco p.l.c.''', and acquired ], ] and ] shortly thereafter. The company's name was shortened to '''BP p.l.c.''' in 2001. | |||

| ==History== | |||

| {{See|Anglo-Iranian Oil Company}} | |||

| === Activity in 1909–1979 === | |||

| In May 1901, ] was granted a concession by the ] to search for oil which he discovered in May 1908.<ref name="bio"></ref> This was the first commercially significant find in the Middle East. On 14 April 1909, the ] (APOC) was incorporated to exploit this.<ref name="bio"/> In 1923, the company secretly gave £5,000 to future Prime Minister ] to lobby the British government to allow them to monopolise Persian oil resources.<ref></ref> In 1935, it became the ] (AIOC).<ref name="bio"/> | |||

| {{as of|2018}}, BP had operations in nearly 80 countries, produced around {{convert|3.7|e6oilbbl/d}} of ], and had total proven reserves of {{convert|19.945|e9oilbbl}} of oil equivalent.<ref name="AR18-glance" /> The company has around 18,700 ] worldwide,<ref name="AR18-glance" /> which it operates under the BP brand (worldwide) and under the Amoco brand (in the U.S.) and the Aral brand (in Germany).<ref name="ourbrands">{{cite web|url=https://www.bp.com/en/global/corporate/who-we-are/our-brands.html|title=Our brands|publisher=BP|access-date=10 October 2022}}</ref> Its largest division is BP America in the United States. BP is the fourth-largest investor-owned oil company in the world by 2021 revenues (after ], ], and ]).<ref>{{Cite web |title=Global 500 |url=https://fortune.com/global500/2022/ |access-date=15 September 2022 |website=]|language=en}}</ref> BP had a market capitalisation of US$98.36 billion as of 2022, placing it 122nd in the world,<ref>{{Cite web |title=Companies ranked by Market Cap – page 2 |url=https://companiesmarketcap.com/page/2/ |access-date=15 September 2022 |website=companiesmarketcap.com |language=en-us}}</ref><ref>{{Cite web |title=BP Market Cap |url=https://ycharts.com/companies/BP/market_cap |access-date=15 September 2022 |website=ycharts.com}}</ref> and its Fortune Global 500 rank was 35th in 2022 with revenues of US$164.2 billion.<ref>{{Cite web |title=BP {{!}} 2022 Global 500 |url=https://fortune.com/company/bp/global500/ |access-date=15 September 2022 |website=]|language=en}}</ref> The company's primary stock listing in on the ], where it is a member of the ]. | |||

| After World War II, AIOC and the Iranian government initially resisted nationalist pressure to revise AIOC's concession terms still further in ]'s favour. But in March 1951, the pro-western Prime Minister ] was assassinated.<ref>Yousof Mazandi, United Press, and Edwin Muller, Government by Assassination (Reader's Digest September 1951)</ref> The ] (parliament) elected a nationalist, ], as prime minister. In April, the Majlis ] the oil industry by unanimous vote.<ref name="NYTRoots"></ref> The ] was formed as a result, displacing the AIOC.<ref name="BPHistory"></ref> The AIOC withdrew its management from Iran, and organised an effective boycott of Iranian oil. The British government - which owned the AIOC - contested the nationalisation at the ] at ], but its complaint was dismissed.<ref name="Sztucki">{{cite book|last=Sztucki|first=Jerzy|title=Interim measures in the Hague Court|publisher=Brill Archive|date=1984|page=43|url=http://books.google.com/books?id=3yDlnBv6Y8cC&lpg=PA43&ots=3VRY_7MGuX&dq=AIOC%20hague%20iran&pg=PA43|isbn=9789065440938}}</ref> | |||

| From 1988 to 2015, BP was responsible for 1.53% of global industrial ]<ref name="guardian100717" /> and has been directly involved in several major environmental and safety incidents. Among them were the 2005 ], which caused the death of 15 workers and which resulted in a record-setting ] fine; Britain's largest oil spill, the wreck of ] in 1967; and the 2006 ], the largest oil spill on ], which resulted in a US$25 million civil penalty, the largest per-barrel penalty at that time for an oil spill.<ref name="Roach2006"/> BP's worst environmental catastrophe was the 2010 ], the largest accidental release of oil into marine waters in history, which leaked about {{convert|4.9|Moilbbl|MUSgal m3}} of oil,<ref name="report2011" /> causing severe environmental, human health, and economic consequences<ref name="AccidentalRelease" /> and serious legal and public relations repercussions for BP, costing more than $4.5 billion in fines and penalties, and an additional $18.7 billion in Clean Water Act-related penalties and other claims, the largest criminal resolution in US history.<ref name="guardian151112" /><ref name="NYTimes2012-11" /><ref name="BP fined, profit over prudence" /><ref name="abc020715">{{cite news|url= https://www.washingtontimes.com/news/2015/jul/2/gulf-states-reach-187b-settlement-with-bp-over-oil/ |title=Gulf States Reach $18.7B Settlement With BP Over Oil Spill|last=McGill|first=Kevin|agency=Associated Press| newspaper =]|date=2 July 2015|access-date=2 July 2015}}</ref> Altogether, the oil spill cost the company more than $65 billion.<ref name="reuters160118" /><ref name="ft010518" /> | |||

| By spring of 1953, incoming U.S. President ] authorised the ] (CIA) to organise a coup against the Mossadeq government with support from the British government.<ref name="NYTIntro"></ref> On 19 August 1953, Mossadeq was forced from office by the CIA conspiracy, involving the Shah and the Iranian military, and known by its codename, ].<ref name="NYTIntro"/> | |||

| {{TOC_limit|4}} | |||

| ], used from 1979 to 2000 and still in use in a small number of petrol stations.]] | |||

| == History == | |||

| Mossadeq, prince (Shahzadeh) of Qajar Dynasty, was replaced by pro-Western general ],<ref></ref> and the Shah, who returned to Iran after having left the country briefly to await the outcome of the coup. He{{Who|date=May 2010}} abolished the democratic Constitution and assumed autocratic powers. | |||

| === 1909 to 1954 === | |||

| After the coup, Mossadeq's ] became an international consortium, and AIOC resumed operations in Iran as a member of it.<ref name="BPHistory"/> The consortium agreed to share profits on a 50–50 basis with Iran, "but not to open its books to Iranian auditors or to allow Iranians onto its board of directors."<ref>Kinzer, ''All the Shah's Men'', (2003), p.195–6</ref> AIOC, as a part of the Anglo-American coup d'état deal, was not allowed to monopolise Iranian oil as before. It was limited to a 40% share in a new international consortium. For the rest, 40% went to the five major American companies and 20% went to ] and Compagnie Française des Pétroles, now ].<ref></ref> | |||

| {{Further|Anglo-Iranian Oil Company|Iraq Petroleum Company}} | |||

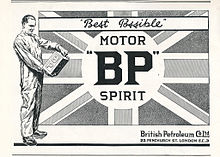

| ]]] | |||

| ] | |||

| In May 1908, a group of British ]s discovered a large amount of oil at ] located in the ] in the southwest of Persia (]). It was the first commercially significant find of oil in the ]. ], by contract with ], obtained permission to explore for oil for the first time in the Middle East,<ref name=":0">{{Cite book|title=Historical Dictionary of the Petroleum Industry|last=Vassiliou|first=M. S|publisher=Lanham, MD: Scarecrow|year=2009}}</ref> an event which changed the history of the entire region. The oil discovery led to ] development and also the establishment of industries that strongly depended on oil. On 14 April 1909, the ] (APOC) was incorporated as a ] of ]. Some of the shares were sold to the public.<ref name=Gasson/> The first chairman and minority shareholder of the company became ].<ref name=masjid/> | |||

| Immediately after establishing the company, the ] asked ], British resident to ], to negotiate an agreement with ] of ] for APOC to obtain a site on ] Island for a ], depot, ]s, and other operations. The refinery was built and began operating in 1912.<ref name=":0" /> In 1914, the British government acquired a controlling interest (50.0025%) in the company, at the urging of ], the then ], and the British navy quickly switched from coal to oil for the majority of their war ships.<ref name=masjid/><ref name=bbc110898/><ref name=beale/> APOC also signed a 30-year contract with the ] for supplying oil for the ] at the fixed price.<ref name="Atabaki"/> In 1915, APOC established its shipping subsidiary the ] and in 1916, it acquired the British Petroleum Company which was a marketing arm of the German ''Europäische Petroleum Union'' in Britain.<ref name=masjid/> In 1919, the company became a ] producer by establishing a subsidiary named Scottish Oils which merged remaining Scottish ].<ref name="ferrier-shale"/><ref name=marwick/><ref name=uphall/><ref name=museum/> | |||

| The AIOC became the British Petroleum Company in 1954. In 1959 the company expanded beyond the Middle East to Alaska<ref></ref> and in 1965 it was the first company to strike oil in the ].<ref></ref> In 1978 BP acquired a controlling interest in ] or Sohio, a breakoff of the former Standard Oil that had been broken up after anti-trust litigation.<ref name="sohio"></ref> | |||

| After ], APOC started marketing its products in ] and acquired stakes in the local ] companies in several European countries. Refineries were built in ] in Wales (the first refinery in the United Kingdom) and ] in Scotland. It also acquired the controlling stake in the ] refinery in France and formed, in conjunction with the ], a partnership named ], which built the Australian's first refinery in ].<ref name=masjid/> In 1923, Burmah employed ] as a paid consultant to ] the British government to allow APOC have exclusive rights to ] oil resources, which were subsequently granted by the Iranian monarchy.<ref name=independent030909/> | |||

| BP continued to operate in Iran until the ] in 1979. After 1979, during the Iran-Iraq war, the oil refineries were destroyed and Iran became a raw supplier of oil. The new regime of ] broke all prior oil contracts and signed new contracts with British Petroleum with 90% to BP and 10% to Ayatollah Khomeini and his followers.{{Citation needed|date=May 2010}} | |||

| APOC and the Armenian businessman ] were the driving forces behind the creation of ] (TPC) in 1912, to explore oil in ] (now Iraq); and by 1914, APOC held 50% of TPC shares.<ref name=MetzTPC/> In 1925, TPC received concession in the ] from the ] under British mandate. TPC finally struck oil in Iraq on 14 October 1927. By 1928, the APOC's shareholding in TPC, which by now was named ] (IPC), was reduced to 23.75%; as the result of the changing geopolitics post ] break-up, and the ].<ref name="GT-DEX-1920-78"/> Relations were generally cordial between the pro-west ] in Iraq and IPC, in spite of disputes centred on Iraq's wish for greater involvement and more royalties. During the 1928–68 time period, IPC monopolised oil exploration inside the ]; excluding Saudi Arabia and Bahrain.<ref name=SH/><ref name=yergin/> | |||

| ===1980s and 1990s=== | |||

| Sir Peter Walters was BP's chairman from 1981 to 1990.<ref></ref> This was the era of the ] strategy. The British government sold its entire holding in BP in several tranches between 1979 and 1987.<ref></ref> The sale process was marked by an attempt by the ], the investment arm of the ] government, to acquire control of BP.<ref></ref> This was ultimately blocked by the strong opposition of the British government. In 1987, British Petroleum negotiated the acquisition of ]<ref></ref> and the remaining publicly traded shares of Standard Oil of Ohio.<ref name="sohio"/> | |||

| ] | |||

| In 1927, Burmah Oil and ] formed the joint marketing company ]. In 1928, APOC and Shell formed the Consolidated Petroleum Company for sale and marketing in Cyprus, South Africa and Ceylon, which in 1932 followed by a joint marketing company ] in the United Kingdom.<ref name=beale/><ref name=Ferrier1982a>], p. 463</ref> In 1937, AIOC and Shell formed the Shell/D'Arcy Exploration Partners partnership to explore for oil in ]. The partnership was equally owned but operated by Shell. It was later replaced by Shell-D'Arcy Petroleum Development Company and Shell-BP Petroleum Development Company (now ]).<ref name=James2000>], pp. 109–110</ref> | |||

| Walters was replaced by ] in 1989. Horton carried out a major corporate down-sizing exercise removing various tiers of management within the BP Head Office.<ref></ref> | |||

| In 1934, APOC and ] founded the ] as an equally owned partnership. The oil concession rights were awarded to the company on 23 December 1934 and the company started drilling operations in 1936.<ref name=brune/><ref name=alsharhan/> In 1935, ] requested the international community to refer to Persia as ']', which was reflected in the name change of APOC to the ] (AIOC).<ref name="bio"/> | |||

| Standard Oil of California and ] merged in 1984, the largest merger in history at that time. Under the antitrust regulation, SoCal divested many of Gulf's operating subsidiaries, and sold some Gulf stations and a refinery in the eastern United States.<ref>{{cite web|url=http://www.chevron.com/about/leadership/|title=Company Profile|publisher=chevron.com|accessdate=2010-05-05}}</ref> BP bought many of the stations in the ].{{Citation needed|date=May 2010}} | |||

| In 1937, ], 23.75% owned by BP,<ref name="RLA">{{Cite web|url=https://history.state.gov/milestones/1921-1936/red-line|title=Milestones: 1921–1936 – Office of the Historian|website=history.state.gov}}</ref> signed an oil concession agreement with the Sultan of Muscat that covers the entire region of the Sultanate, which was in fact limited to the coastal area of present-day Oman. After several years of failure to discover oil in the Sultanate's region, IPC presumed that oil was more likely to be found in the interior region of Oman, which was part of the Imamate of Oman. IPC offered financial support to raise an armed force that would assist the Sultanate in occupying the interior region of Oman. Later, in 1954, the Sultan of Muscat, backed by the British government and the financial aid he received from IPC, started occupying regions within the interior of Oman, which led to the outbreak of ] that lasted for more than 5 years.<ref name="OmansInsurgencies">{{cite book|url=https://books.google.com/books?id=wkUhBQAAQBAJ&pg=PT43|title=Oman's Insurgencies: The Sultanate's Struggle for Supremacy|first=J. E.|last=Peterson|date=2013|publisher=Saqi|isbn=978-0-86356-702-5|page=43}}</ref> | |||

| ], who had been on the board as managing director since 1991, was appointed group chief executive in 1995.<ref></ref> Browne was responsible for three major acquisitions; ], ] and ] (see below). | |||

| In 1947, British Petroleum Chemicals was incorporated as a joint venture of AIOC and ]. In 1956, the company was renamed British Hydrocarbon Chemicals.<ref name=James2000c>], pp. 350–352</ref> | |||

| ===Recent years=== | |||

| {{Globalize/USA|section}} | |||

| British Petroleum merged with ] (formerly Standard Oil of Indiana) in December 1998,<ref></ref> becoming BP Amoco plc.<ref name="namechg">; Press Release, 1 May 2001.</ref> In 2000, BP Amoco acquired ]<ref></ref> and ] plc.<ref>; Press Release, 14 March 2000.</ref> In 2001 the company formally renamed itself as BP plc<ref name="namechg" /> and adopted the tagline "Beyond Petroleum," which remains in use today. It states that BP was never meant to be an abbreviation of its tagline. Most Amoco stations in the United States were converted to BP's brand and corporate identity. In many states, however, BP continued to sell Amoco branded gasoline even in service stations with the BP identity as Amoco was rated the best petroleum brand by consumers for 16 consecutive years and also enjoyed one of the three highest brand loyalty reputations for gasoline in the US, comparable only to ] and ]. In May 2008, when the Amoco name was mostly phased out in favour of "BP Gasoline with Invigorate", promoting BP's new additive, the highest grade of BP gasoline available in the United States was still called Amoco Ultimate. | |||

| Following World War II, nationalistic sentiments were on the rise in the Middle East; most notable being ], and ]. In Iran, the AIOC and the pro-western Iranian government led by Prime Minister ] resisted nationalist calls to revise AIOC's concession terms in Iran's favour. In March 1951, Razmara was assassinated and ], a nationalist, was elected as the new prime minister by the ] (parliament).<ref name="Ref-B-William1991"/> In April 1951, the Iranian government ] the Iranian oil industry by unanimous vote, and the ] (NIOC) was formed, displacing the AIOC.<ref name="NYTRoots"/><ref name="BPHistory"/> The AIOC withdrew its management from Iran, and Britain organised an effective worldwide embargo of Iranian oil. The British government, which owned the AIOC, contested the nationalisation at the ] at ], but its complaint was dismissed.<ref name="Sztucki"/> | |||

| ] | |||

| Prime Minister Churchill asked President Eisenhower for help in overthrowing Mossadeq. The anti-Mossadeq plan was orchestrated under the code-name ']' by CIA, and 'Operation Boot' by ] (MI6). The CIA and the British helped stage a coup in August 1953, the ], which established pro-Western general ] as the new PM, and greatly strengthened the political power of Shah ]. The AIOC was able to return to Iran.<ref>{{Cite journal|title=CIA Admits It Was Behind Iran's Coup |first=Malcolm|last=Bryne |date=18 August 2013|journal=Foreign Policy | url = https://foreignpolicy.com/2013/08/19/cia-admits-it-was-behind-irans-coup/}}</ref> | |||

| In April 2004, BP decided to move most of its petrochemical businesses into a separate entity called Innovene within the BP Group. BP sought to sell the new company possibly via an ] (IPO) in the US, and filed IPO plans for Innovene with the ] on 12 September 2005. On 7 October 2005, however, BP announced that it had agreed to sell Innovene to ], a privately held UK chemical company for $9 billion, thereby scrapping its plans for the IPO.<ref></ref> | |||

| In 2005, BP announced that it would be leaving the ] market.<ref></ref> Many locations were re-branded as ].<ref></ref> | |||

| ] area of ]]] | |||

| ===1954 to 1979=== | |||

| On 19 July 2006, BP announced that it would close the last 12 out of 57 oil wells in Alaska, mostly in Prudhoe Bay, that had been leaking. The wells were leaking insulating agent called Arctic pack, consisting of ] and ], between the wells and ice.<ref>{{cite news|author=Mark Tran|title=BP shuts leaking Alaskan wells|url=http://money.guardian.co.uk/businessnews/article/0,,1824145,00.html|work="Guardian Unlimited"|date=19 July 2006 | location=London}}</ref> | |||

| ] | |||

| In 1954, the AIOC became the British Petroleum Company. After the ], ] (IOP), a ], was founded in October 1954, in London to bring Iranian oil back to the international market.<ref name="Ref-B-Vassiliou2009"/><ref name="Ref-B-Lauterpacht1973"/> British Petroleum was a founding member of this company with 40% stake.<ref name="Ref-B-William1991"/><ref name="Ref-B-Vassiliou2009"/> IOP operated and managed oil facilities in Iran on behalf of NIOC.<ref name="Ref-B-Vassiliou2009"/><ref name="Ref-B-Lauterpacht1973"/> Similar to the ],<ref name="Ref-B-Christine2008"/> the consortium agreed to share profits on a 50–50 basis with Iran, "but not to open its books to Iranian auditors or to allow Iranians onto its board of directors."<ref name=Stephen2003/> | |||

| In 1953, British Petroleum entered the Canadian market through the purchase of a minority stake in Calgary-based Triad Oil Company, and expanded further to Alaska in 1959, resulting discovery of oil at ] in 1969.<ref name=beale/><ref name=investfairbanks/> In 1956, its subsidiary D'Arcy Exploration Co. (Africa) Ltd. was granted four oil concessions in ].<ref name=wsj230256/> In 1962, Scottish Oils ceased ] operations.<ref name=museum/> In 1965, it was the first company to strike oil in the ].<ref name=gulliver/> In 1969, BP entered the United States by acquiring the East Coast refining and marketing assets of ].<ref name=James2000b>], p. 273</ref> The Canadian holding company of British Petroleum was renamed ] in 1969; and in 1971, it acquired 97.8% stake of ].<ref>{{cite web|url=http://members.tripod.com/williams_j/supertesthistory.html|title=Supertest History|access-date=13 September 2015}}</ref> | |||

| BP has recently looked to grow its oil exploration activities in frontier areas such as the former Soviet Union for its future reserves.<ref>{{cite web|title=Penny Shares Online: BP(BP.)|url=http://www.pennysharesonline.com/company/B/BP-BP..asp|author=|publisher=|date=10 July 2006|accessdate=10 July 2006}}</ref> | |||

| In Russia, BP owns 50% of ] with the other half owned by three Russian billionaires. TNK-BP accounts for a fifth of BP's global reserves, a quarter of BP's production, and nearly a tenth of its global profits.<ref>"BP Set to Leave Russia Gas Project" by Guy Chazan and Gregory White, Wall Street Journal, 22 June 2007 p. A3.</ref> | |||

| By the 1960s, British Petroleum had developed a reputation for taking on the riskiest ventures. It earned the company massive profits; it also earned them the worst safety record in the industry. In 1967, the giant oil tanker '']'' foundered off the English coast. Over {{convert|32|MUSgal|oilbbl m3}} of crude oil was spilled into the Atlantic and onto the beaches of Cornwall and Brittany, causing ].<ref name="Legacy of the Torrey Canyon"/> The ship was owned by the ]-based Barracuda Tanker Corporation and was flying the flag of ], a well-known ], but was being chartered by British Petroleum.<ref name="Legacy of the Torrey Canyon"/> The ship was bombed by ] ]s in an effort to break up the ship and burn off the leaking oil, but this failed to destroy the oil slick.<ref name=bbc290367/> | |||

| In 2007, according to some private BP-branded gasoline center operators in the Metro Atlanta area, BP planned to leave the Southern market in the next few years. All corporate-owned BP stations, typically known as "BP Connect", were to be sold to local ].<ref></ref> | |||

| In 1967, BP acquired chemical and plastics assets of The Distillers Company which were merged with British Hydrocarbon Chemicals to form BP Chemicals.<ref name=James2000d>], pp. 385–389</ref> | |||

| On 12 January 2007, it was announced that Lord Browne would retire at the end of July 2007.<ref></ref> The new Chief Executive will be the current head of exploration and production, Tony Hayward. It had been expected that Lord Browne would retire in February 2008 when he reached the age of 60, the standard retirement age at BP. Browne resigned abruptly from BP on 1 May 2007, following the lifting of a legal injunction preventing ] from publishing details about his private life. Hayward succeeded Browne with immediate effect.<ref></ref> | |||

| The company's oil assets were nationalised in Libya in 1971, in Kuwait in 1975, and in Nigeria in 1979.<ref name=alsharhan/><ref name="BPHistory"/><ref name="GT-DEX-21C-O-01"/> In Iraq, IPC ceased its operations after it was nationalised by the ]i government in June 1972, although legally Iraq Petroleum Company still remains in existence but as a dormant company,<ref name=cds/> and one of its associated companies —] (ADPC), formerly Petroleum Development (Trucial Coast) Ltd – also continues with the original shareholding intact.<ref name="GT-DEX-2012-100"/><ref name="GT-DEX-2012-101"/> | |||

| ==Governance== | |||

| ], ]]] | |||

| The Board Members are:<ref></ref> | |||

| * ] – Chairman | |||

| * Sir ] – Non-executive director | |||

| * ] – Chief Financial Officer | |||

| * ] – Chief executive, Exploration and Production | |||

| * ] – Non-executive director, board of ], ], ] | |||

| * ] – Non-executive director, CEO of ], also board of ] | |||

| * Sir ] – Non-executive director chairman of ] | |||

| * ] – Non-executive director | |||

| * ] – CEO/MD BP Worldwide | |||

| * ] | |||

| * ] vice-chairman of the ] | |||

| * ], board of ] and ]. | |||

| * ], CBE director ] | |||

| * Dr ], director of ] | |||

| The intensified power struggle between oil companies and host governments in Middle East, along with the oil price shocks that followed the ] meant British Petroleum lost most of its direct access to crude oil supplies produced in countries that belonged to the Organization of Petroleum Exporting Countries (]), and prompted it to diversify its operations beyond the heavily Middle East dependent oil production. In 1976, BP and Shell de-merged their marketing operations in the United Kingdom by dividing Shell-Mex and BP. In 1978, the company acquired a controlling interest in ] (Sohio).<ref name="NYtimes"/> | |||

| ==Financial data== | |||

| ] | |||

| In Iran, British Petroleum continued to operate until the ] in 1979. The new regime of ] nationalised all of the company's assets in Iran without compensation: as a result, BP lost 40% of its global crude oil supplies.<ref name="nyt200379"/> | |||

| {| class="wikitable" | |||

| |+ '''Financial data in millions of US$''' | |||

| In 1970–1980s, BP diversified into ], ] and ] businesses which all were divested later.<ref name=beale/> | |||

| ! Year | |||

| ! 2002 | |||

| ===1979 to 1997=== | |||

| ! 2003 | |||

| The ] sold 80 million shares of BP at $7.58 in 1979, as part of ] privatisation. This sale represented slightly more than 5% of BP's total shares and reduced the government's ownership of the company to 46%.<ref name="Globe1979"/> On 19 October 1987, Prime Minister ] authorised the sale of an additional GBP7.5 billion ($12.2 billion) of BP shares at 333 pence, representing the government's remaining 31% stake in the company.<ref name="Lohr1987"/><ref>{{cite news|first=Steve |last=Lohr |url=https://www.nytimes.com/1987/10/30/business/bp-issue-to-proceed-safeguard-put-on-price.html |title=B.P. Issue to Proceed; Safeguard Put on Price |newspaper=] |date=30 October 1987 |access-date=13 April 2014}}</ref> | |||

| ! 2004 | |||

| ! 2005 | |||

| In November 1987, the ] purchased a 10.06% interest in BP, becoming the largest institutional shareholder.<ref name="TorontoStar1987"/> The following May, the KIO purchased additional shares, bringing their ownership to 21.6%.<ref name=nyt191187/> This raised concerns within BP that operations in the United States, BP's primary country of operations, would suffer. In October 1988, the British ] required the KIO to reduce its shares to 9.6% within 12 months.<ref name="OConnor1988"/> | |||

| ! 2006 | |||

| ] was the company chairman from 1981 to 1990.<ref name=lat080989/> During his period as chairman he reduced the company's refining capacity in Europe.<ref name=lat080989/> In 1982, the ] assets of BP Canada were sold to ]. In 1984, ] was renamed the ]; it bought Gulf Oil—the largest merger in history at that time.<ref name="CVX-H-01"/> To meet anti-trust regulations, Chevron divested many of Gulf's operating subsidiaries, and sold some Gulf stations and a refinery in the eastern United States to British Petroleum and ] in 1985.<ref name="chevron-profile"/> In 1987, British Petroleum negotiated the acquisition of ]<ref name=ap050288/> and the remaining publicly traded shares of Standard Oil of Ohio.<ref name="NYtimes"/> At the same year it was listed on the ] where its share were traded until delisting in 2008.<ref name=reuters240608/> | |||

| Walters was replaced as chair by ] in 1990. Horton wrote on his appointment that he and his senior colleagues would adopt values representing the interests of "all ]s", including the company's employees, customers, shareholders, suppliers and the community".<ref>Thomas, P., "Stakeholders and Strategic Management: The Misappropriation of Discourse", Critical Management Studies Conference, 14–16 July 1999, p. 13. Thomas uses Horton's text as a "real" example portraying ] being put into practice.</ref> Horton carried out a major corporate downsizing exercise, removing various tiers of management at the head office.<ref name=roberts/> In 1992, British Petroleum sold off its 57% stake in BP Canada (] operations), which was renamed as ].<ref name="TLM-H-01"/> ],<!-- not ennobled until 2001 --> who had joined BP in 1966 and rose through the ranks to join the board as managing director in 1991, was appointed group chief executive in 1995.<ref name=browne/> | |||

| In 1981, British Petroleum entered into the solar technology sector by acquiring 50% of Lucas Energy Systems, a company which became Lucas BP Solar Systems, and later ]. The company was a manufacturer and installer of ] ]. It became wholly owned by British Petroleum in the mid-1980s.<ref>{{cite journal|title=BP and Lucas form solar company |journal=Electronics and Power |date=March 1981|doi=10.1049/ep.1981.0091|volume=27|page=204 | issn = 0013-5127}}</ref> | |||

| British Petroleum entered the Russian market in 1990 and opened its first service station in Moscow in 1996.<ref name=":3">{{Cite news |last=Wilson |first=Tom |date=24 March 2022 |title=Oligarchs, power and profits: the history of BP in Russia |work=] |url=https://www.ft.com/content/e9238fa2-65a2-4753-a845-ce8129f93a0c |url-access=subscription|access-date=25 March 2022}}</ref> In 1997, it acquired a 10% stake for $571 million in the Russian oil company ], which later became a part of TNK-BP.<ref name=mt290212/><ref name=":3" /> Sidanco was run by Russian oligarch ] who obtained Sidanco through the controversial ] privatization scheme.<ref name=":3" /> In 2003, BP invested $8 billion into a joint venture with Russian oligarch ]'s TNK.<ref name=":3" /> | |||

| In 1992, the company entered the Azerbaijani market. In 1994, it signed the production sharing agreement for the ] oil project and in 1995 for the ] development.<ref name=caspia>{{cite web | url=https://www.bp.com/en_az/caspian/aboutus/history.html | title= BP in Azerbaijan. Our history | publisher= BP |access-date=2 March 2018}}</ref> | |||

| ===1998 to 2009=== | |||

| Under John Browne, British Petroleum acquired other oil companies, transforming BP into the third largest oil company in the world. British Petroleum merged with ] (formerly Standard Oil of Indiana) in December 1998, becoming BP Amoco plc.<ref name=bbc110899/><ref name="namechg"/> Most Amoco stations in the United States were converted to BP's brand and corporate identity. In 2000, BP Amoco acquired ] and ].<ref name="independent.co.uk"/><ref name=bp140300/><ref name="Brierley"/><ref name="BBCNews2000"/> Together with the acquisition of ARCO in 2000, BP became owner of a 33.5% stake in the Olympic Pipeline. Later that year, BP became an operator of the pipeline and increased its stake up to 62.5%.<ref name=ogj070201/><ref name=ap280901/> | |||

| As part of the merger's brand awareness, the company helped the ] gallery of British Art launch ''RePresenting Britain 1500–2000''.<ref name=observer190300/> In 2001, in response to negative press on British Petroleum's poor safety standards, the company adopted a green ] logo and rebranded itself as BP ("Beyond Petroleum") plc.<ref name="namechg" /> | |||

| ] | |||

| In the beginning of the 2000s, BP became the leading partner (and later operator) of the ] project which opened a new oil transportation route from the Caspian region.<ref name=ft260505/> In 2002, BP acquired the majority of Veba Öl AG, a subsidiary of ], and subsequently rebranded its existing stations in Germany to the ] name.<ref name=BPAral/> As part of the deal, BP acquired also the Veba Öl's stake in Ruhr Öl joint venture. Ruhr Öl was dissolved in 2016.<ref>{{cite news |url= https://www.ogj.com/articles/print/volume-115/issue-1c/general-interest/rosneft-bp-finalize-dissolution-of-german-refining-jv.html |title=Rosneft, BP finalize dissolution of German refining JV|date=23 January 2017|publisher=Oil & Gas Journal|access-date=25 February 2018 |url-access=subscription }}</ref> | |||

| On 1 September 2003, BP and a group of Russian billionaires, known as AAR (]–]–]), announced the creation of a strategic partnership to jointly hold their oil assets in Russia and Ukraine. As a result, TNK-ВР was created.<ref name=cnn260603/> | |||

| In 2004, BP's ] and ] business was moved into a separate entity which was sold to ] in 2005.<ref name=bbc071005/><ref name=bp161205/> In 2007, BP sold its corporate-owned convenience stores, typically known as "]", to local ]s and ].<ref name=bp151107/> | |||

| On 23 March 2005, 15 workers were killed and more than 170 injured in the ]. To save money, major upgrades to the 1934 refinery had been postponed.<ref name=autogenerated5>{{cite news|url= http://fortune.com/2011/01/24/bp-an-accident-waiting-to-happen/ |title=BP: 'An accident waiting to happen' |work=]|date=24 January 2011 |access-date=13 April 2014}}</ref> Browne pledged to prevent another catastrophe. Three months later, ']', BP's giant new production platform in the Gulf of Mexico, nearly sank during a hurricane. In their rush to finish the $1 billion platform, workers had installed a valve backwards, allowing the ballast tanks to flood. Inspections revealed other shoddy work. Repairs costing hundreds of millions would keep Thunder Horse out of commission for three years.<ref name=autogenerated5 /> | |||

| Lord Browne resigned from BP on 1 May 2007. The head of exploration and production ] became the new chief executive.<ref name=guardian020507/> In 2009, Hayward shifted emphasis from Lord Browne's focus on alternative energy, announcing that safety would henceforth be the company's "number one priority".<ref name=bbc110509/> | |||

| In 2007, BP formed with ] and ] a joint venture Vivergo Fuels which opened a bioethanol plant in ] near ], United Kingdom in December 2012.<ref name=reuters061212> | |||

| {{Cite news | |||

| |url = https://www.reuters.com/article/uk-vivergo-biofuels/vivergo-uk-biorefinery-starts-operations-idUKBRE8B50J820121206 | |||

| |title = Vivergo UK biorefinery starts operations | |||

| |last1 = Hunt |first1 = Nigel | |||

| |work = ] | |||

| |date = 6 December 2012 | |||

| |access-date = 16 September 2017}} | |||

| </ref> Together with DuPont, BP formed a ] joint venture Butamax by acquiring biobutan technology company Biobutanol LLC in 2009.<ref name=reuters080709> | |||

| {{Cite news | |||

| |url = https://www.reuters.com/article/eu-bp-dupont-idUSBRQ00743220090708 | |||

| |title = EU clears BP, DuPont to take over biobutanol firm | |||

| |work = ] | |||

| |date = 8 July 2009 | |||

| |access-date = 16 September 2017}} | |||

| </ref> | |||

| In 2009, BP obtained a ] to develop the supergiant ] with joint venture partner ].<ref name="GT-DEX-2012-83"/><ref name="GT-DEX-2010-66"/> | |||

| ===2010 to 2020=== | |||

| ]]] | |||

| ], with a Wild Bean Cafe and BP Connect]] | |||

| ], ]]] | |||

| In January 2010, ] became chairman of BP board of directors.<ref name=wsj191017>{{cite news | url=https://www.wsj.com/articles/bp-chairman-carl-henric-svanberg-to-retire-1508429234 | title=BP Chairman Carl-Henric Svanberg to Retire | last=Kent | first=Sarah | newspaper= The Wall Street Journal | date=19 October 2017 | access-date=19 July 2019}}</ref> | |||

| On 20 April 2010, the ], a major industrial accident, happened.<ref name=report2011/> Consequently, ] replaced Tony Hayward as the company's CEO, serving from October 2010 to February 2020.<ref name=reuters300910>{{Cite news |url = https://uk.reuters.com/article/uk-bp-dividend/new-bp-ceo-says-hopes-to-restore-dividend-in-2011-idUKTRE68T3WR20100930 |archive-url = https://web.archive.org/web/20200302201441/https://uk.reuters.com/article/uk-bp-dividend/new-bp-ceo-says-hopes-to-restore-dividend-in-2011-idUKTRE68T3WR20100930 |url-status = dead |archive-date = 2 March 2020 |title = New BP CEO says hopes to restore dividend in 2011 |last1 = Young |first1 = Sarah |last2 = Falloon |first2 = Matt |work = ] |date = 30 September 2010 |access-date = 30 January 2011}}</ref><ref name="DudleyRetires">{{cite news |title=BP Chief Executive Bob Dudley Is to Retire |url=https://www.nytimes.com/2019/10/04/business/bp-ceo-bob-dudley-bernard-looney.html |last1=Reed |first1=Stanley |newspaper=] |date=4 October 2019 |access-date=28 February 2020}}</ref> BP announced a divestment program to sell about $38 billion worth of non-core assets to compensate its liabilities related to the accident.<ref name=wsj100912/><ref name=nasdaq> | |||

| {{Cite news | |||

| |url = http://www.nasdaq.com/article/bp-close-to-gom-assets-sale-analyst-blog-cm171508 | |||

| |title = BP Close to GoM Assets Sale – Analyst Blog | |||

| |work = Zacks Equity Research | |||

| |publisher= ] | |||

| |date = 9 September 2012 | |||

| |access-date = 10 September 2012}} | |||

| </ref> In July 2010, BP sold its natural gas activities in ] and ], Canada, to ].<ref name=fp300712> | |||

| {{Cite news | |||

| |url= http://business.financialpost.com/commodities/energy/bp-back-in-growth-mode-eyes-oil-sands | |||

| |title= BP back in growth mode, eyes oil sands | |||

| |newspaper = ] | |||

| |first1= Claudia | last1= Cattaneo | |||

| |date= 30 July 2012 | |||

| |access-date= 19 September 2012}} | |||

| </ref> It sold its stake in the Petroperijá and Boquerón fields in Venezuela and in the Lan Tay and Lan Do fields, the Nam Con Son pipeline and terminal, and the ] in Vietnam to TNK-BP,<ref name=reuters271010/><ref name=bloomberg181010/> ]s and supply businesses in Namibia, Botswana, Zambia, Tanzania and Malawi to ],<ref name=reuters151110> | |||

| {{Cite news | |||

| |url= https://uk.reuters.com/article/bp-trafigura/update-3-bp-sells-southern-africa-fuel-retail-units-idUKLDE6AE0D020101115 | |||

| |archive-url= https://web.archive.org/web/20200604124202/https://uk.reuters.com/article/bp-trafigura/update-3-bp-sells-southern-africa-fuel-retail-units-idUKLDE6AE0D020101115 | |||

| |url-status= dead | |||

| |archive-date= 4 June 2020 | |||

| |title= BP sells Southern Africa fuel retail units | |||

| |work=] | |||

| |first1= Tom| last1= Bergin | |||

| |first2= Emma |last2 = Farge | |||

| |date= 15 November 2010 | |||

| |access-date= 10 September 2012}} | |||

| </ref> the ] onshore oilfield in ] and a package of North Sea gas assets to ],<ref name=wsj270312> | |||

| {{Cite news | |||

| |url= http://www.marketwatch.com/story/bp-sells-uk-gas-assets-to-perenco-for-400-million-2012-03-27 | |||

| |title= BP sells UK gas assets to Perenco for $399.253 million | |||

| |work=] | |||

| |first = Alexis | last = Flynn | |||

| |date= 27 March 2012 | |||

| |access-date= 10 September 2012}} | |||

| </ref> natural-gas liquids business in Canada to ],<ref name=bloomberg011211/> natural gas assets in Kansas to ],<ref name=wichita280212> | |||

| {{Cite news | |||

| |url= https://www.bizjournals.com/wichita/news/2012/02/28/bp-sell-kansas-natural-gas-assets-to.html | |||

| |title= BP sell Kansas natural gas assets to Linn Energy for $1.2 billion | |||

| |newspaper= Wichita Business Journal | |||

| |first1 = Daniel | last1 = McCoy | |||

| |date= 28 February 2012 | |||

| |access-date= 10 September 2012}} | |||

| </ref> Carson Refinery in ] and its ARCO retail network to ], Sunray and Hemphill gas processing plants in ], together with their associated gas gathering system, to Eagle Rock Energy Partners,<ref name="ft180912"> | |||

| {{Cite news | |||

| |url= https://www.ft.com/content/fe474230-01a3-11e2-8aaa-00144feabdc0 | |||

| |title= BP in talks to sell Texas City refinery | |||

| |newspaper=] | |||

| |first1 = Guy | last1 = Chazan | |||

| |first2 = Anousha | last2 = Sakoui | |||

| |date= 18 September 2012 | |||

| |access-date= 21 September 2012 | |||

| |url-access=registration }} | |||

| </ref><ref name="CarsonSale">{{cite press release |title=BP Agrees to Sell Carson Refinery and ARCO Retail Network in US Southwest to Tesoro for $2.5 Billion |url=http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7076807 |publisher=BP |date=13 August 2012 |access-date=17 August 2012 |archive-url= https://web.archive.org/web/20120815055325/http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7076807 |archive-date= 15 August 2012}}</ref><ref name="bp100812">{{Cite press release | |||

| |url= http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7076777 | |||

| |title= BP To Sell Texas Midstream Gas Assets | |||

| |publisher= BP | |||

| |date= 10 August 2012 | |||

| |access-date= 10 September 2012 | |||

| |archive-url=https://web.archive.org/web/20120815022054/http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7076777 | |||

| |archive-date= 15 August 2012}} | |||

| </ref> the Texas City Refinery and associated assets to ],<ref name="reuters081012">{{Cite news | |||

| |url= https://uk.reuters.com/article/us-marathon-bp/marathon-to-buy-bp-texas-city-refinery-for-up-to-2-5-billion-idUSBRE8970KG20121008 | |||

| |archive-url= https://web.archive.org/web/20200604122245/https://uk.reuters.com/article/us-marathon-bp/marathon-to-buy-bp-texas-city-refinery-for-up-to-2-5-billion-idUSBRE8970KG20121008 | |||

| |url-status= dead | |||

| |archive-date= 4 June 2020 | |||

| |title= Marathon to buy BP Texas City refinery for up to $2.5 billion | |||

| |work=] | |||

| |first1= Kristen | last1= Hays | |||

| |date= 8 October 2012 | |||

| |access-date= 22 October 2012}} | |||

| </ref><ref name="biz010213">{{Cite news | |||

| |url= https://www.bizjournals.com/houston/news/2013/02/01/bp-completes-texas-city-refinery-sale.html | |||

| |title= BP completes Texas City refinery sale to Marathon Petroleum | |||

| |newspaper = Houston Business Journal | |||

| |first1= Olivia | last1= Pulsinelli | |||

| |date= 1 February 2013 | |||

| |access-date= 1 February 2013}} | |||

| </ref> the ] located Marlin, Dorado, King, Horn Mountain, and Holstein fields as also its stake in non-operated Diana Hoover and Ram Powell fields to ],<ref name="wsj100912">{{Cite news | |||

| |url= https://www.wsj.com/articles/SB10000872396390444554704577643112090398808 | |||

| |title= BP in Deal to Sell Some Gulf Fields | |||

| |newspaper= The Wall Street Journal | |||

| |first1 = Anupreeta | last1 = Das | |||

| |first2 = Ryan | last2 = Dezember | |||

| |first3 = Alexis | last3 = Flynn | |||

| |date= 9 September 2012 | |||

| |access-date= 10 September 2012 | |||

| |url-access=subscription }} | |||

| </ref> non-operating stake in the ] to ],<ref name=reuters130912> | |||

| {{Cite news | |||

| |url= https://www.reuters.com/article/bp-brief/brief-bp-to-sell-interest-in-draugen-field-to-shell-for-240-mln-idUSWLA324220120913 | |||

| |title= BP to sell interest in Draugen field to Shell for $240 mln | |||

| |work=] | |||

| |date= 13 September 2012 | |||

| |access-date= 22 October 2012}} | |||

| </ref> and the UK's liquefied petroleum gas distribution business to DCC.<ref name=be090812> | |||

| {{Cite news | |||

| |url= https://uk.reuters.com/article/bp-dcc/update-1-bp-sells-uk-lpg-distribution-business-to-dcc-idINL6E8J83R020120808 | |||

| |archive-url= https://web.archive.org/web/20170917032317/http://uk.reuters.com/article/bp-dcc/update-1-bp-sells-uk-lpg-distribution-business-to-dcc-idINL6E8J83R020120808 | |||

| |url-status= dead | |||

| |archive-date= 17 September 2017 | |||

| |title= BP sells UK LPG distribution business to DCC | |||

| |work=] | |||

| |date= 8 August 2012 | |||

| |access-date= 16 September 2017}} | |||

| </ref> In November 2012, the U.S. Government temporarily banned BP from bidding any new federal contracts. The ban was conditionally lifted in March 2014.<ref name="Times 3-14-14">{{cite news | url=https://www.nytimes.com/2014/03/14/business/energy-environment/epa-to-lift-suspension-of-oil-leases-for-bp.html | title=U.S. Agrees to Allow BP Back into Gulf Waters to Seek Oil | newspaper=] | date=14 March 2014 | access-date=14 March 2014 | last =Krauss | first = Clifford}}</ref> | |||

| In February 2011, BP formed a partnership with ], taking a 30% stake in a new Indian joint-venture for an initial payment of $7.2 billion.<ref>{{Cite news| url= https://nypost.com/2011/02/21/bp-announces-7-2b-partnership-with-indias-reliance/ | newspaper = ] | title = BP announces $7.2B partnership with India's Reliance | date=21 February 2011| access-date = 9 September 2012}}</ref> In September 2012, BP sold its subsidiary BP Chemicals (Malaysia) Sdn. Bhd., an operator of the Kuantan ] (PTA) plant in Malaysia, to Reliance Industries for $230 million.<ref name=bl290912> | |||

| {{Cite news | |||

| |url= https://www.thehindubusinessline.com/companies/Reliance-Global-to-buy-BP%E2%80%99s-Malaysian-petrochem-unit-for-230-mn/article20506813.ece | |||

| |title= Reliance Global to buy BP's Malaysian petrochem unit for $230 mn | |||

| |newspaper = ] | |||

| |date= 29 September 2012 | |||

| |access-date= 22 October 2012}} | |||

| </ref> In October 2012, BP sold its stake in TNK-BP to Rosneft for $12.3 billion in cash and 18.5% of Rosneft's stock.<ref name=":2">{{Cite journal |last1=Overland |first1=Indra |last2=Godzimirski |first2=Jakub |last3=Lunden |first3=Lars Petter |last4=Fjaertoft |first4=Daniel |date=2013 |title=Rosneft's offshore partnerships: the re-opening of the Russian petroleum frontier? |url=https://www.researchgate.net/publication/259431566 |journal=Polar Record |language=en |volume=49 |issue=2 |pages=140–153 |doi=10.1017/S0032247412000137 |issn=0032-2474 |doi-access=free|bibcode=2013PoRec..49..140O |hdl=11250/2442558 |hdl-access=free }}</ref><ref name=reuters221012> | |||

| {{Cite news | |||

| |url= https://uk.reuters.com/article/bp-rosneft/update-5-russias-rosneft-beefs-up-with-tnk-bp-purchase-idUSL5E8LM23U20121022 | |||

| |archive-url= https://web.archive.org/web/20200604123638/https://uk.reuters.com/article/bp-rosneft/update-5-russias-rosneft-beefs-up-with-tnk-bp-purchase-idUSL5E8LM23U20121022 | |||

| |url-status= dead | |||

| |archive-date= 4 June 2020 | |||

| |title= Rosneft beefs up with TNK-BP purchase | |||

| |work=] | |||

| |first1= Darya | last1= Korsunskaya | |||

| |first2= Andrew |last2 = Callus | |||

| |date= 22 October 2012 | |||

| |access-date= 22 October 2012}} | |||

| </ref> The deal was completed on 21 March 2013.<ref name=reuters220313> | |||

| {{cite news | |||

| | url= https://uk.reuters.com/article/uk-rosneft-tnkbp-deal/rosneft-pays-out-in-historic-tnk-bp-deal-completion-idUKBRE92K0IX20130322 | |||

| | archive-url= https://web.archive.org/web/20190104171501/https://uk.reuters.com/article/uk-rosneft-tnkbp-deal/rosneft-pays-out-in-historic-tnk-bp-deal-completion-idUKBRE92K0IX20130322 | |||

| | url-status= dead | |||

| | archive-date= 4 January 2019 | |||

| | title= Rosneft pays out in historic TNK-BP deal completion | |||

| | work = ] | |||

| | first1 = Vladimir | last1 = Soldatkin | |||

| | first2 = Andrew | last2 = Callus | |||

| | date=22 March 2013 | |||

| | access-date=25 March 2013}} | |||

| </ref> In 2012, BP acquired an acreage in the ] but these developments plans were cancelled in 2014.<ref name=platts29042014/> | |||

| In 2011–2015, BP cut down its alternative energy business. The company announced its departure from the solar energy market in December 2011 by closing its solar power business, BP Solar.<ref name=reuters211211>{{cite news | work=] | title = BP turns out lights at solar business | url= https://uk.reuters.com/article/us-bp-solar/bp-turns-out-lights-at-solar-business-idUSTRE7BK1CC20111221| archive-url= https://web.archive.org/web/20181205123303/https://uk.reuters.com/article/us-bp-solar/bp-turns-out-lights-at-solar-business-idUSTRE7BK1CC20111221| url-status= dead| archive-date= 5 December 2018| first1 = Tom | last1 = Bergin | first2 = Sarah | last2 = Young | date = 21 December 2011 | access-date=21 December 2011}}</ref> In 2012, BP shut down the ] project which was developed since 2008 to make ] from emerging energy crops like ] and from ].<ref name=sunshine>{{cite news | work= Sunshine State News | title = BP Changes Ethanol Plans in Florida | url= http://www.sunshinestatenews.com/story/bp-changes-ethanol-plans-florida | first1 = Michael | last1 = Peltier | date = 26 October 2012 | access-date=3 November 2012}}</ref><ref name=bfd261012> | |||

| {{Cite news | |||

| |url = http://www.biofuelsdigest.com/bdigest/2012/10/26/the-october-surprise-bp-cancels-plans-for-us-cellulosic-ethanol-plant/ | |||

| |title = The October Surprise: BP Cancels Plans for US Cellulosic Ethanol Plant | |||

| |last1 = Lane |first1 = Jim | |||

| |work= Biofuels Digest | |||

| |date = 26 October 2012 | |||

| |access-date = 17 September 2017}} | |||

| </ref> In 2015, BP decided to exit from other ] businesses.<ref name=bfd180115> | |||

| {{Cite news | |||

| |url = http://www.biofuelsdigest.com/bdigest/2015/01/18/bps-exit-from-cellulosic-ethanol-the-assets-the-auction-the-process-the-timing-the-skinny/ | |||

| |title = BP's exit from cellulosic ethanol: the assets, the auction, the process, the timing, the skinny | |||

| |last1 = Lane |first1 = Jim | |||

| |work= Biofuels Digest | |||

| |date = 18 January 2015 | |||

| |access-date = 16 September 2017}} | |||

| </ref> It sold its stake in Vivergo to ].<ref name=farmersweekly080515> | |||

| {{Cite news | |||

| |url = http://www.fwi.co.uk/business/bp-sells-vivergo-fuels-stake-abf.htm | |||

| |title = BP sells its Vivergo Fuels stake to ABF | |||

| |last1 = Horne |first1 = Suzie | |||

| |work= Farmers Weekly | |||

| |date = 8 May 2015 | |||

| |access-date = 16 September 2017}} | |||

| </ref> BP and DuPont also mothballed their joint biobutanol pilot plant in Saltend.<ref name=bfd171215> | |||

| {{Cite news | |||

| |url = http://www.biofuelsdigest.com/bdigest/2015/12/17/bp-and-dupont-to-mothball-uk-biobutanol-rd-facility-by-mid-2016/ | |||

| |title = BP and Dupont to mothball UK biobutanol R&D facility by mid-2016 | |||

| |last1 = Sapp |first1 = Meghan | |||

| |work= Biofuels Digest | |||

| |date = 17 December 2015 | |||

| |access-date = 16 September 2017}} | |||

| </ref> | |||

| In June 2014, BP agreed to a deal worth around $20 billion to supply ] with liquefied natural gas.<ref name=reuters17062014/> In 2014, ] sold its aviation fuel business to BP. To ensure the approval of competition authorities, BP agreed to sell the former Statoil aviation fuel businesses in ], ], ] and ] airports to ] in 2015.<ref name=ain19082015/> | |||

| In 2016, BP sold its ], plant to ], of ].<ref name="Blum16">{{cite news |title=BP sells Alabama petrochemical complex to Thai company |last1=Blum |first1=Jordan |url=http://fuelfix.com/blog/2016/01/06/bp-sells-alabama-petrochemical-complex-to-thai-company/ |newspaper=Fuel Fix |date=6 January 2016 |access-date=26 April 2016 |archive-date=29 January 2021 |archive-url=https://web.archive.org/web/20210129055105/https://www.houstonchronicle.com/business/fuelfix/blog/2016/01/06/bp-sells-alabama-petrochemical-complex-to-thai-company/ |url-status=dead }}</ref> At the same year, its Norwegian daughter company BP Norge merged with Det Norske Oljeselskap to form ].<ref name="rigzone300916"> | |||

| {{cite news | |||

| | url = http://www.rigzone.com/news/oil_gas/a/146868/det_norske_completes_merger_with_bp_norge_creates_aker_bp | |||

| | title = Det Norske Completes Merger with BP Norge, Creates Aker BP | |||

| | work= Rigzone | |||

| | date = 30 September 2016 | |||

| | access-date = 10 June 2017}} | |||

| </ref> | |||

| In April 2017, the company reached an agreement to sell its ] in the North Sea to ] for $250 million. The sale included terminals at ] and Kinneil, a site in Aberdeen, and the Forties Unity Platform.<ref>{{cite news|title=BP sells Forties North Sea pipeline to Ineos|url=https://www.bbc.co.uk/news/uk-scotland-scotland-business-39476674|access-date=3 April 2017|work=]|date=3 April 2017}}</ref> In 2017, the company floated its subsidiary BP Midstream Partners LP, a pipeline operator in the United States, at the New York Stock Exchange. In Argentina, BP and ] agreed to merge their interests in Pan American Energy and Axion Energy to form a jointly owned Pan American Energy Group.<ref name=reuters110917>{{cite news|url= https://uk.reuters.com/article/uk-bp-bridas-m-a/bp-in-south-american-venture-with-argentinas-bridas-idUKKCN1BM1F7|archive-url= https://web.archive.org/web/20170911135552/http://uk.reuters.com/article/uk-bp-bridas-m-a/bp-in-south-american-venture-with-argentinas-bridas-idUKKCN1BM1F7|url-status= dead|archive-date= 11 September 2017|title=BP in South American venture with Argentina's Bridas | work=] |date=11 September 2017 |access-date = 26 December 2017}}</ref> | |||

| In 2017, BP invested $200 million to acquire a 43% stake in the solar energy developer Lightsource Renewable Energy, a company which was renamed ].<ref name=bloomberg151217/><ref name=reuters151217/> In March 2017, the company acquired Clean Energy's biomethane business and assets, including its production sites and existing supply contracts.<ref name="Hardcastle17"/> In April 2017, its subsidiary Butamax bought an ] production company Nesika Energy.<ref name=biomass030417/> | |||

| In 2018, the company purchased ]'s shale assets in Texas and Louisiana, including ], for $10.5 billion, which were integrated with its subsidiary BPX Energy.<ref name=denver040220/> Also in 2018, BP bought a 16.5% interest in the Clair field in the UK from ], increasing its share to 45.1%. BP paid £1.3 billion and gave to ConocoPhillips its 39.2% non-operated stake in the ] and satellite oil fields in Alaska.<ref name=energyvoice300419/> In December 2018, BP sold its wind assets in Texas.<ref name=renewablenow261218/> | |||

| In 2018, BP acquired ], which operated the UK's largest electric vehicle charging network.<ref name=electrive200319/> In 2019, BP and ] formed a joint venture to build out electric vehicle charging infrastructure in China. In September 2020, BP announced it will build out a rapid charging network in London for ].<ref name=icis141020/> | |||

| In January 2019, BP discovered {{convert|1|Goilbbl}} oil at its Thunder Horse location in the Gulf of Mexico. The company also announced plans to spend $1.3 billion on a third phase of its Atlantis field near New Orleans.<ref>{{Cite web|url=https://www.cnbc.com/2019/01/08/bp-just-discovered-a-billion-barrels-of-oil-in-gulf-of-mexico.html|title=BP just discovered a billion barrels of oil in Gulf of Mexico|last=DiChristopher|first=Tom|date=8 January 2019|website=www.cnbc.com|access-date=8 January 2019}}</ref> | |||

| === 2020 to present === | |||

| ] succeeded Carl-Henric Svanberg on 1 January 2019 as chairman of BP Plc board of directors,<ref name=bp280418>{{cite press release|url=https://www.bp.com/en/global/corporate/news-and-insights/press-releases/helge-lund-to-suceed-carl-henric-svanberg-as-chairman.html |title=Helge Lund to succeed Carl-Henric Svanberg as BP chairman |publisher=BP | date = 28 April 2018 |access-date=21 March 2019}}</ref> and ] succeeded Bob Dudley on 5 February 2020 as chief executive.<ref name="LooneyCEO">{{cite news |title=New BP boss Bernard Looney pledges net-zero emissions by 2050 |work=] |url=https://www.ft.com/content/e1ee8ab4-4d89-11ea-95a0-43d18ec715f5 |last1=Raval |first1=Anjli |date=12 February 2020 |access-date=12 February 2020}}</ref> Amidst the ], BP claimed that it would "accelerate the transition to a lower carbon economy and energy system" after announcing that the company had to write down $17.5 billion for the second quarter of 2020.<ref>{{Cite web|url=https://www.barrons.com/articles/bp-takes-up-to-17-5-billion-writedown-and-lowers-30-year-oil-price-forecast-heres-what-it-means-51592235645|title=BP Takes Up To $17.5 Billion Writedown and Lowers 30-Year Oil Price Forecast. Here's What It Means|first=Callum|last=Keown|website=www.barrons.com}}</ref> | |||

| On 29 June 2020, BP sold its petrochemicals unit to ] for $5 billion. The business was focused on ] and ]s. It had interests in 14 plants in Asia, Europe and the U.S., and achieved production of 9.7 million metric tons in 2019.<ref>{{Cite news|title=BP sells petrochemicals unit to INEOS for $5B|url=https://www.marketwatch.com/story/bp-sells-petrochemicals-unit-to-ineos-for-5b-2020-06-29|access-date=29 June 2020}}</ref> On 30 June 2020, BP sold all its Alaska upstream operations and interests, including interests in ], to ] for $5.6 billion.<ref name=reuters270819/><ref name=adn300620/> On 14 December 2020, it sold its 49% stake in the ] to Harvest Alaska.<ref name=hbj181220/><ref name=rigzone231220/> | |||

| ]]] | |||

| In September 2020, BP formed a partnership with Equinor to develop offshore wind and announced it will acquire 50% non-operating stake in the Empire Wind off New York and Beacon Wind off Massachusetts offshore wind farms. The deal is expected to be completed at the first half of 2021.<ref name=reuters100920/> In December 2020, BP acquired a majority stake in Finite Carbon, the largest forest ]s developer in the United States.<ref name=reuters161220/> | |||

| In response to the ], BP announced that it would sell its 19.75% stake in Rosneft, although no timeline was announced.<ref>{{cite news | url= https://www.bbc.co.uk/news/business-60548382|title=BP to offload stake in Rosneft amid Ukraine conflict|publisher=]|date=27 February 2022|access-date=27 February 2022}}</ref> At the time of BP's decision, Rosneft's activities accounted for around half of BP's oil and gas reserves and a third of its production.<ref>{{Cite news |last1=Bousso |first1=Ron |last2=Zhdannikov |first2=Dmitry |date=27 February 2022 |title=BP retreats from Russia's Rosneft at cost of $25 bln over Ukraine invasion |language=en |work=]|url=https://www.reuters.com/business/energy/britains-bp-says-exit-stake-russian-oil-giant-rosneft-2022-02-27/ |access-date=27 February 2022}}</ref> BP's decision came after the British government expressed concern about BP's involvement in Russia.<ref>{{Cite news |last=Strasburg |first=Max Colchester and Jenny |date=25 February 2022 |title=BP Faces Pressure From U.K. Government Over Stake in Russia's Rosneft |language=en-US |work=] |url=https://www.wsj.com/articles/bp-faces-pressure-from-u-k-government-over-stake-in-russias-rosneft-11645817245 |access-date=27 February 2022 |issn=0099-9660}}</ref><ref>{{Cite web |date=25 February 2022 |title=BP's ties to Russia draw UK government 'concern' |url=https://www.theguardian.com/business/2022/feb/25/bps-ties-to-russia-draw-uk-government-concern |access-date=27 February 2022 |website=] |language=en}}</ref> However, BP remained a Rosneft shareholder throughout the whole 2022 year, which caused some criticism from the Ukrainian president's office.<ref>{{cite news|url=https://www.bbc.com/news/63821028 | title=BP 'stands to receive blood money' from Ukraine war | date=2 December 2022 | publisher=] |access-date=2 December 2022 }}</ref> | |||

| In October 2022, BP announced that it would be acquiring Archaea Energy Inc., a renewable natural gas producer, for $4.1 billion.<ref>{{Cite news |last1=Bousso |first1=Ron |last2=Soni |first2=Ruhi |date=17 October 2022 |title=BP to buy U.S. biogas producer Archaea for $4.1 bln |language=en |work=]|url=https://www.reuters.com/markets/deals/archaea-energy-be-bought-by-bp-41-bln-including-debt-2022-10-17/ |access-date=17 October 2022}}</ref> In December 2022, it was announced BP had completed the acquisition of Archaea Energy Inc. for $3.3 billion.<ref>{{Cite web |title=TOP NEWS: BP completes USD3.3 billion acquisition of Archaea Energy {{!}} Financial News |url=https://www.lse.co.uk/news/top-news-bp-completes-usd33-billion-acquisition-of-archaea-energy-mbfybrzhf006ql2.html |access-date=29 December 2022 |website=www.lse.co.uk |language=en}}</ref> In November 2022, the company announced a large increase in profit for the period from July to September due to the high fuel prices caused by the ].<ref>{{cite news|url=https://www.bbc.com/news/business-63468313 | title=BP sees huge profit due to high oil and gas prices | date=November 2022 | publisher=] |access-date=1 November 2022}}</ref> | |||

| In February 2023, BP reported record annual profits, on a replacement cost basis, for the year 2022. On that basis, 2022 profits were more than double than in 2021, and they were also the biggest profits in the whole 114-year long history of BP.<ref>{{cite news|url=https://www.bbc.com/news/business-64544110 | title=BP sees biggest profit in 114-year history after oil and gas prices soar | date=7 February 2023 | publisher=] |access-date=7 February 2023}}</ref> | |||

| After 10 years of force majeure, BP, ] and ] resumed exploration in their blocks in the Ghadames Basin (A-B) and offshore Block C in August 2023, continuing their contract obligations.<ref>{{Cite web |title=BP, Sonatrach and ENI resume operations in Libya |url=https://www.theafricareport.com/317982/bp-sonatrach-and-eni-resume-operations-in-libya/ |access-date=2023-10-24 |website=The Africa Report.com |language=en}}</ref><ref>{{Cite news |date=2023-08-03 |title=Libya's NOC says ENI, BP, Sonatarch to lift force majeure and resume activities |language=en |work=Reuters |url=https://www.reuters.com/business/energy/libyas-noc-says-eni-bp-sonatarch-lift-force-majeure-resume-activities-2023-08-03/ |access-date=2023-10-24}}</ref> | |||

| BP increased its ] by 10% year-on-year in early 2024 and accelerated share buybacks. It has already announced $1.75 billion before reporting first quarter results and intends to announce a $3.5 billion share buyback in the first half of the year.<ref>{{Cite web|language=en|url=https://www.cnbc.com/2024/02/06/bp-earnings-q4-and-fy-2023.html|title=Oil major BP accelerates pace of share buybacks even as full-year profit slides over 50%|website=CNBC|date=6 February 2024 |access-date=2024-02-08|archive-date=2024-02-06|archive-url=https://web.archive.org/web/20240206073645/https://www.cnbc.com/2024/02/06/bp-earnings-q4-and-fy-2023.html}}</ref> | |||

| ] became CEO in January 2024.<ref>{{cite news|url=https://www.bbc.co.uk/news/articles/cw0zj77e145o|title=New BP boss gets £8m pay packet in 2023|newspaper=BBC News|date=8 March 2024|access-date=15 April 2024}}</ref> | |||

| In June 2024, BP announced the acquisition of Bunge Bioenergia from ] for {{USD}}1.4 billion. The purchase will increase BP's ethanol production to 50,000 barrels per day.<ref>{{cite news |title=BP to Take Control of Brazilian Biofuels JV in $1.4 Billion Deal |work=The Wall Street Journal |date=20 June 2024 |access-date=20 June 2024 |last1=Walker |first1=Ian |url=https://www.wsj.com/business/energy-oil/bp-to-take-control-of-brazilian-biofuels-jv-in-1-4-billion-deal-e8eb172a}}</ref><ref>{{cite news |last1=Mann |first1=Richard |title=BP Acquires Full Control of Bioenergy Venture in Brazil for $1.4 Billion |url=https://www.riotimesonline.com/bp-acquires-full-control-of-bioenergy-venture-in-brazil-for-1-4-billion/ |access-date=20 June 2024 |work=The Rio Times |date=20 June 2024}}</ref><ref>{{cite news |title=BP to buy out Bunge's stake in Brazilian biofuels JV in $1.4 bln deal |last1=Bousso |first1=Ron |last2=Bose |first2=Sourasis |work=Reuters |date=June 20, 2024 |access-date=July 15, 2024 |url=https://www.reuters.com/markets/deals/bp-buy-out-bunges-stake-brazilian-biofuels-jv-14-bln-deal-2024-06-20/}}</ref> | |||

| In November 2024, BP and partners announced its plan to invest $7 billion to a carbon capture and gas field development in Indonesia’s Papua region that has the potential of almost 3 trillion cubic feet of gas resource. Production plans are expected to start in 2028 in the Ubadari field.<ref>{{Cite web |date=November 22, 2024 |title=BP and partners to invest $7 billion in carbon capture project in Indonesia's Papua |url=https://www.reuters.com/business/energy/bp-partners-invest-7-billion-carbon-capture-project-indonesias-papua-2024-11-22/}}</ref> | |||

| ==Logo evolution== | |||

| <gallery> | |||

| Bp logo1920.png|1920–1930 | |||

| Bp logo1930.png|1930–1947 | |||

| Bp logo1947.png|1947–1961 | |||

| Bp logo1961.png|1961–1989 | |||

| Bp logo89.svg|1989–2000 | |||

| BP Helios logo.svg|2000–present | |||

| </gallery> | |||

| ==Operations== | |||

| ] Headquarters, built by the Bowmer and Kirkland group at a cost of £50 million]] | |||

| {{As of|2018|12|31}}, BP had operations in 78 countries worldwide<ref name="AR18-glance"/> with the global headquarters in London, United Kingdom. BP operations are organized into three business segments, ], ], and ].<ref name="AR18-segments"/> | |||

| Since 1951, BP has annually published its ''Statistical Review of ]'', which is considered an energy industry benchmark.<ref name=reuters120613/> | |||

| ===Operations by location=== | |||

| ==== United Kingdom ==== | |||

| ] near ], United Kingdom]] | |||

| BP has a major corporate campus in ] which is home to around 3,500 employees and over 50 business units.<ref name="BP-Sunbury">{{cite web |url=http://www.bp.com/en_gb/united-kingdom/where-we-operate/sunbury.html |title=ICBT Sunbury |publisher=BP |access-date=9 August 2017}}</ref> Its ] operations are headquartered in ], ]. BP's trading functions are based at ] in ], London. BP has three major research and development centres in the UK.<ref name=commons2012/> | |||

| As of 2020, and following the sale of its Andrew and Shearwater interests, BP's operations were focussed in the ], Quad 204 and ] hubs.<ref>{{cite web|url=https://www.worldoil.com/news/2020/1/7/bp-reshapes-its-uk-north-sea-portfolio-with-625-million-asset-sale|title=BP reshapes its UK North Sea portfolio with $625 million asset sale|date=1 July 2020|publisher=World Oil|access-date=27 December 2020}}</ref> In 2011, the company announced that it is focusing its investment in the UK North Sea into four development projects including the Clair, Devenick, ], and Kinnoull oilfields.<ref name=Swint2011>{{cite news |title= BP cleared to develop £4.5bn North Sea oilfield |url= https://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/8824186/BP-cleared-to-develop-4.5bn-North-Sea-oilfield.html |archive-url=https://ghostarchive.org/archive/20220111/https://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/8824186/BP-cleared-to-develop-4.5bn-North-Sea-oilfield.html |archive-date=11 January 2022 |url-status=live | newspaper=] |date=13 October 2011 |access-date= 17 September 2017|url-access=subscription}}{{cbignore}}</ref> BP is the operator of the Clair oilfield, which has been appraised as the largest hydrocarbon resource in the UK.<ref name="Bawden2011">{{cite news |title=BP to pump £4.5bn into North Sea projects |author=Tom Bawden |url=https://www.independent.co.uk/environment/green-living/bp-to-pump-45bn-into-north-sea-projects-2370250.html |newspaper=] |date=14 October 2011 |access-date=10 July 2012 |location=London}}</ref> | |||

| There are 1,200 BP service stations in the UK.<ref name="Gosden16"/><ref name="BP-UK"/> Since 2018 BP operates the UK's largest ] charging network through its subsidiary ] (formerly Chargemaster).<ref name="AR18-glance"/> | |||

| In February 2020, BP announced a Joint Venture with ] to develop and operate 3GW off Offshore Wind capacity in the ] Leasing Round 4.<ref>{{Cite news|last=Twidale|first=Susanna|date=8 February 2021|title=RWE, Total, BP among winners in UK offshore wind farm auction|language=en|work=]|url=https://www.reuters.com/article/us-britain-windpower-auction-idINKBN2A80RN|access-date=18 February 2021}}</ref> This is BP's first move into ], however, BP currently provides a range of services to the Offshore Wind sector in the UK through its subsidiary ONYX InSight who provide a range of ] and Engineering Consultancy services to the sector.<ref>{{Cite news|date=23 January 2020|title=BP's unicorn seeker not afraid to back the occasional wrong horse - News for the Oil and Gas Sector|language=en-US|work=Energy Voice|url=https://www.energyvoice.com/renewables-energy-transition/219707/bps-unicorn-seeker-not-afraid-to-back-the-occasional-wrong-horse/|access-date=18 February 2021}}</ref> | |||

| In February 2022, BP announced it acquired a 30% stake in the ]-based company, Green Biofuels Ltd, a producer of ] fuels that can be used as a direct replacement for diesel.<ref>{{Cite web|title=BP acquires 30% stake in UK producer of hydrogenated vegetable oil|url=https://www.autocar.co.uk/car-news/business-environment-and-energy/bp-acquires-30-stake-uk-producer-hydrogenated-vegetable-oil|access-date=3 February 2022|website=Autocar|language=en}}</ref> | |||

| ====United States==== | |||

| ], ]]] | |||

| ]'' semi-submersible oil platform in the ]]] | |||

| The United States operations comprise nearly one-third of BP's operations.<ref name="NYTBusiness2012">{{cite news |title=BP Plc. |url= https://www.nytimes.com/topic/company/bp-plc |newspaper=The New York Times |date=2 May 2012 |access-date=7 June 2012 |first=Emma G. |last=Fitzsimmons}}</ref> BP employs approximately 14,000 people in the United States.<ref name="AR18-USlabour"/> In 2018, BP's total production in the United States included {{convert|385000|oilbbl/d}} of oil and {{convert|1.9|e9cuft/d|abbr=off}} of natural gas,<ref name="AR18-USproduction"/> and its refinery throughput was {{convert|703000|oilbbl/d}}.<ref name="AR18-USrefinery"/> | |||

| BP's major subsidiary in the United States is BP America, Inc. (formerly: Standard Oil Company (Ohio) and ]) based in ].<ref name=biz030513/> BP Exploration & Production Inc., a 1996 established Houston-based subsidiary, is dealing with oil exploration and production.<ref name=bpexploration/> BP Corporation North America, Inc., provides petroleum refining services as also transportation fuel, heat and light energy.<ref name=bpcorporation/> BP Products North America, Inc., a 1954 established Houston-based subsidiary, is engaged in the exploration, development, production, refining, and marketing of oil and natural gas.<ref name=bpproduct/> BP America Production Company, a ]-based subsidiary, engages in oil and gas exploration and development.<ref name=bpproduction/> BP Energy Company, a Houston-based subsidiary, is a provider of natural gas, power, and risk management services to the industrial and utility sectors and a retail electric provider in Texas.<ref name=bpenergy/> | |||

| BP's upstream activities in the Lower 48 states are conducted through Denver-based BPX Energy.<ref name=denver040220/> It has a {{convert|7.5|Goilbbl|abbr=off}} resource base on {{convert|5.7|e6acre}}.<ref name=OGJ15>{{cite news |title=BP's US Lower 48 unit buys Devon's New Mexico assets |url= https://www.ogj.com/articles/2015/12/bp-s-lower-48-unit-buys-devon-s-new-mexico-assets.html |newspaper = ] |date=18 December 2015 |access-date=5 April 2016}}</ref> It has ] in the ], ], and ] shales.<ref name="Pulsinelli2014"/><ref name="Rouan2012"/> It has ] (] or ]) stakes also in Colorado, ] and Wyoming, primarily in the ].<ref name="Hasterok2012"/><ref name="ZacksJun2012"/><ref name="BPUSExploration"/> | |||