| Revision as of 09:46, 16 March 2009 editNJGW (talk | contribs)12,586 edits →Comparisons to the Great Depression: what Mr. Williams actually argues← Previous edit | Revision as of 09:50, 16 March 2009 edit undoNJGW (talk | contribs)12,586 edits →Comparisons to the Great Depression: rm a bunch of stats repeated from above sections... these aren't refs talking about the great depressionNext edit → | ||

| Line 255: | Line 255: | ||

| ]s have yet to drop as low as in previous recessions. On this issue, "it is critically important, though, to recognize that different analysts have different earnings expectations, and the consensus view is more often wrong than right."<ref></ref> Some argue that price-to-earnings ratios remain high because of unprecedented falls in earnings.<ref>http://www.businessweek.com/magazine/content/09_11/b4123026586146.htm</ref> | ]s have yet to drop as low as in previous recessions. On this issue, "it is critically important, though, to recognize that different analysts have different earnings expectations, and the consensus view is more often wrong than right."<ref></ref> Some argue that price-to-earnings ratios remain high because of unprecedented falls in earnings.<ref>http://www.businessweek.com/magazine/content/09_11/b4123026586146.htm</ref> | ||

| Three years into the Great Depression, unemployment reached a peak of 25%.<ref>http://www.fdrlibrary.marist.edu/unempl71.html</ref> The United States entered into recession in December 2007<ref>http://www.cbsnews.com/stories/2008/12/01/national/main4640509.shtml</ref> and in February 2009, U-3 unemployment reached 8.1%.<ref>http://www.bls.gov/news.release/empsit.t12.htm</ref> |

Three years into the Great Depression, unemployment reached a peak of 25% in the U.S.<ref>http://www.fdrlibrary.marist.edu/unempl71.html</ref> The United States entered into recession in December 2007<ref>http://www.cbsnews.com/stories/2008/12/01/national/main4640509.shtml</ref> and in February 2009, U-3 unemployment reached 8.1%.<ref>http://www.bls.gov/news.release/empsit.t12.htm</ref> In March 2009, statistician<ref>http://www.reuters.com/article/marketsNews/idUSN0944970920090309</ref> John Williams "argue that measurement changes implemented over the years make it impossible to compare the current unemployment rate with that seen during the Great Depression".<ref>http://www.reuters.com/article/marketsNews/idUSN0944970920090309</ref> | ||

| In March 2009, unemployment reached 10.4% in Ireland and is projected to reach 14% this year.<ref>http://www.offalyindependent.ie/articles/1/37152/</ref> Housing prices fell about 30% in the United States during the Great Depression.<ref>http://www.google.com/hostednews/ap/article/ALeqM5hBhCEUMgwFoSt1e4IthEyJKDJU2QD96P9S180</ref> They have already fallen 26.7% during the current recession<ref>http://www.reuters.com/article/topNews/idUSN2453058020090224</ref> and the Federal Reserve estimates that they may fall an additional 18 to 29%.<ref>http://www.google.com/hostednews/ap/article/ALeqM5hBhCEUMgwFoSt1e4IthEyJKDJU2QD96P9S180</ref> In some areas, housing prices have fallen more than 50%.<ref>http://www.cbsnews.com/blogs/2009/03/11/business/econwatch/entry4859913.shtml</ref> In the United Kingdom, housing prices have fallen by 21% and could, according to Numis Securities, fall by a further 40 to 55%.<ref>http://www.telegraph.co.uk/finance/economics/houseprices/4974499/House-prices-could-fall-by-further-55-per-cent.html</ref> According to ] CEO ], "Between 40 and 45 percent of the world's wealth has been destroyed in little less than a year and a half."<ref>http://www.reuters.com/article/wtUSInvestingNews/idUSTRE52966Z20090310</ref> Since Q2 2007, United States household wealth has dropped by 20%, or $12.9 trillion.<ref>http://www.reuters.com/article/domesticNews/idUSTRE52B58720090312</ref> | |||

| On January 4, 2009, ] prize winning economist ] wrote that "This looks an awful lot like the beginning of a second Great Depression." and "So this is our moment of truth. Will we in fact do what’s necessary to prevent Great Depression II?"<ref>http://www.nytimes.com/2009/01/05/opinion/05krugman.html</ref> On March 2, 2009, he wrote that "the odds that this slump really will turn into Great Depression II keep rising."<ref>http://krugman.blogs.nytimes.com/2009/03/02/failing-the-test/</ref> On January 20, ], chairman of the ], said "I don't remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world."<ref>http://uk.reuters.com/article/marketsNewsUS/idUKN2029103720090220</ref> On January 24 Edmund Conway, Economics Editor for ], wrote that "The plight facing Britain is uncannily similar to the 1930s, since prices of many assets - from shares to house prices - are falling at record rates, but the value of the debt against which they are held remains unchanged."<ref>http://www.telegraph.co.uk/finance/financetopics/recession/4326894/Britain-on-the-brink-of-an-economic-depression-say-experts.html</ref> | On January 4, 2009, ] prize winning economist ] wrote that "This looks an awful lot like the beginning of a second Great Depression." and "So this is our moment of truth. Will we in fact do what’s necessary to prevent Great Depression II?"<ref>http://www.nytimes.com/2009/01/05/opinion/05krugman.html</ref> On March 2, 2009, he wrote that "the odds that this slump really will turn into Great Depression II keep rising."<ref>http://krugman.blogs.nytimes.com/2009/03/02/failing-the-test/</ref> On January 20, ], chairman of the ], said "I don't remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world."<ref>http://uk.reuters.com/article/marketsNewsUS/idUKN2029103720090220</ref> On January 24 Edmund Conway, Economics Editor for ], wrote that "The plight facing Britain is uncannily similar to the 1930s, since prices of many assets - from shares to house prices - are falling at record rates, but the value of the debt against which they are held remains unchanged."<ref>http://www.telegraph.co.uk/finance/financetopics/recession/4326894/Britain-on-the-brink-of-an-economic-depression-say-experts.html</ref> | ||

Revision as of 09:50, 16 March 2009

| This article may require cleanup to meet Misplaced Pages's quality standards. No cleanup reason has been specified. Please help improve this article if you can. (March 2009) (Learn how and when to remove this message) |

| The neutrality of this article is disputed. Relevant discussion may be found on the talk page. Please do not remove this message until conditions to do so are met. (March 2009) (Learn how and when to remove this message) |

| Late 2000s recession |

- Central banks gold reserves - $0.845 tn.

- M0 (paper money) - - $3.9 tn.

- traditional (fractional reserve) banking assets - $39 tn.

- shadow banking assets - $62 tn.

- other assets - $290 tn.

- Bail-out money (early 2009) - $1.9 tn.

In 2008-2009 much of the industrialized world entered into a deep recession. The complex of vicious circles which contributed to this crisis included high oil prices, high food prices and the collapse of a substantial housing bubble centered in the United States, which sparked an interrelated and ongoing financial crisis. Around the world, many large and well established investment and commercial banks suffered massive losses and even faced bankruptcy. It has been argued that the huge increases in commodity and asset prices came as a consequence of an extended period of easily available credit and that the primary cause of the downturn was exceptionally financial. This crisis has led to increased unemployment, and other signs of contemporaneous economic downturns in major economies of the world.

In December 2008, the NBER declared that the United States had been in recession since December 2007, and several economists expressed their concern that there is no end in sight for the downturn and that recovery may not appear until as late as 2011. The recession is the worst since the Great Depression of the 1930s. However, so far many economists and politicians have avoided using the term depression, as it is generally recognized to refer to a downturn which lasts considerably longer and has a significantly higher unemployment rate.

Pre-recession conditions

Commodity boom

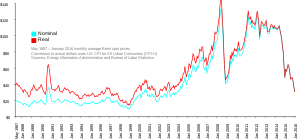

Further information: ] See also: 2008 Central Asia energy crisis and 2008 Bulgarian energy crisis Brent barrel petroleum spot prices, May 1987 – Oct. 2008. The red dot indicates the price as of 24 December 2008

Brent barrel petroleum spot prices, May 1987 – Oct. 2008. The red dot indicates the price as of 24 December 2008

The decade of the 2000s saw a global explosion in prices, focused especially in commodities and housing, marking an end to the commodities recession of 1980-2000. In 2008, the prices of many commodities, notably oil and food, rose so high as to cause genuine economic damage, threatening stagflation and a reversal of globalization.

In January 2008, oil prices surpassed $100 a barrel for the first time, the first of many price milestones to be passed in the course of the year. In July, oil peaked at $147.30 a barrel and a gallon of gasoline was more than $4 across most of the U.S.A. These high prices caused a dramatic drop in demand and prices fell below $35 a barrel at the end of 2008.

The food and fuel crises were both discussed at the 34th G8 summit in July.

Sulfuric acid (an important chemical commodity used in processes such as steel processing, copper production and bioethanol production) increased in price 3.5-fold in less than 1 year while producers of sodium hydroxide have declared force majeur due to flooding, precipitating similarly steep price increases.

In the second half of 2008, the prices of most commodities fell dramatically on expectations of diminished demand in a world recession.

Housing bubble

By 2007, real estate bubbles existed in the recent past were still under way in many parts of the world, especially in the United States, Argentina, Britain, Netherlands, Italy, Australia, New Zealand, Ireland, Spain, France, Poland, South Africa, Israel, Greece, Bulgaria, Croatia, Canada, Norway, Singapore, South Korea , Sweden, Baltic states, India, Romania, Russia, Ukraine and China. U.S. Federal Reserve Chairman Alan Greenspan said in mid-2005 that "at a minimum, there's a little 'froth' (in the U.S. housing market) … it's hard not to see that there are a lot of local bubbles" . The Economist magazine, writing at the same time, went further, saying "the worldwide rise in house prices is the biggest bubble in history". Real estate bubbles are invariably followed by severe price decreases (also known as a house price crash) that can result in many owners holding negative equity (a mortgage debt higher than the current value of the property).

Inflation

In February 2008, Reuters reported that global inflation was at historic levels, and that domestic inflation was at 10-20 year highs for many nations. "Excess money supply around the globe, monetary easing by the Fed to tame financial crisis, growth surge supported by easy monetary policy in Asia, speculation in commodities, agricultural failure, rising cost of imports from China and rising demand of food and commodities in the fast growing emerging markets," have been named as possible reasons for the inflation.

In mid-2008, IMF data indicated that inflation was highest in the oil-exporting countries, largely due to the unsterilized growth of foreign exchange reserves, the term “unsterilized” referring to a lack of monetary policy operations that could offset such a foreign exchange intervention in order to maintain a country´s monetary policy target. However, inflation was also growing in countries classified by the IMF as "non-oil-exporting LDCs" (Least Developed Countries) and "Developing Asia", on account of the rise in oil and food prices.

Inflation was also increasing in the developed countries, but remained low compared to the developing world.

Causes

Further information: ]Debate over origins

On October 15, 2008, Anthony Faiola, Ellen Nakashima, and Jill Drew wrote a lengthy article in The Washington Post titled, "What Went Wrong". In their investigation, the authors claim that former Federal Reserve Board Chairman Alan Greenspan, Treasury Secretary Robert Rubin, and SEC Chairman Arthur Levitt vehemently opposed any regulation of financial instruments known as derivatives. They further claim that Greenspan actively sought to undermine the office of the Commodity Futures Trading Commission, specifically under the leadership of Brooksley E. Born, when the Commission sought to initiate regulation of derivatives. Ultimately, it was the collapse of a specific kind of derivative, the mortgage-backed security, that triggered the economic crises of 2008.

While Greenspan's role as Chairman of the Federal Reserve has been widely discussed (the main point of controversy remains the lowering of Federal funds rate at only 1% for more than a year which, according to the Austrian School of economics, allowed huge amounts of "easy" credit-based money to be injected into the financial system and thus create an unsustainable economic boom), there is also the argument that Greenspan actions in the years 2002–2004 were actually motivated by the need to take the U.S. economy out of the early 2000s recession caused by the bursting of dot-com bubble — although by doing so he did not help avert the crisis, but only postpone it.

Sub-prime lending as a cause

Further information: Subprime mortgage crisisBased on the assumption that sub-prime lending precipitated the crisis, some have argued that the Clinton Administration may be partially to blame, while others have pointed to the passage of the Gramm-Leach-Bliley Act by the 106th Congress, and the over leveraging by banks and investors eager to achieve high returns on capital.

Some believe the roots of the crisis can be traced directly to sub-prime lending by Fannie Mae and Freddie Mac, which are government sponsored entities. The New York Times published an article that reported the Clinton Administration pushed for Sub-prime Lending: "Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people" (NYT, 30 September 1999).

In 1995, the administration also tinkered with the Carter's Community Reinvestment Act of 1977 by regulating and strengthening the anti-redlining procedures. It is felt by many that this was done to help a stagnated home ownership figure that had hovered around 65% for many years. The result was a push by the administration for greater investment, by financial institutions, into riskier loans. In a 2000 United States Department of the Treasury study of lending trends for 305 cities from 1993 to 1998 it was shown that $467 billion of mortgage credit poured out of CRA-covered lenders into low and mid level income borrowers and neighborhoods. (See "The Community Reinvestment Act After Financial Modernization, April 2000).

Deregulation as a cause

In 1992, the 102nd Congress and the Clinton administration weakened regulation of Fannie Mae and Freddie Mac with the goal of making available more money for the issuance of home loans. The Washington Post wrote: "Congress also wanted to free up money for Fannie Mae and Freddie Mac to buy mortgage loans and specified that the pair would be required to keep a much smaller share of their funds on hand than other financial institutions. Where banks that held $100 could spend $90 buying mortgage loans, Fannie Mae and Freddie Mac could spend $97.50 buying loans. Finally, Congress ordered that the companies be required to keep more capital as a cushion against losses if they invested in riskier securities. But the rule was never set during the Clinton administration, which came to office that winter, and was only put in place nine years later."

Other deregulation efforts have also been identified as contributing to the collapse. In 1999, the 106th Congress passed the Gramm-Leach-Bliley Act, which repealed part of the Glass-Steagall Act of 1933. This repeal has been criticized for having contributed to the proliferation of the complex and opaque financial instruments which are at the heart of the crisis.

Over-leveraging, credit default swaps and collateralized debt obligations as causes

Another probable cause of the crisis -- and a factor that unquestionably amplified its magnitude -- was widespread miscalculation by banks and investors of the level of risk inherent in the unregulated Collateralized debt obligation and Credit Default Swap markets. Under this theory, banks and investors systematized the risk by taking advantage of low interest rates to borrow tremendous sums of money that they could only pay back if the housing market continued to increase in value.

The risk was further systematized by the use of David X. Li's Gaussian copula model function to rapidly price Collateralized debt obligations based on the price of related Credit Default Swaps. This formula assumed that the price of Credit Default Swaps was correlated with and could predict the correct price of mortgage backed securities. Because it was highly tractable, it rapidly came to be used by a huge percentage of CDO and CDS investors, issuers, and rating agencies. According to one wired.com article: "Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li's formula hadn't expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system's foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril...Li's Gaussian copula formula will go down in history as instrumental in causing the unfathomable losses that brought the world financial system to its knees."

The pricing model for CDOs clearly did not reflect the level of risk they introduced into the system. It has been estimated that the "from late 2005 to the middle of 2007, around $450bn of CDO of ABS were issued, of which about one third were created from risky mortgage-backed bonds...ut of that pile, around $305bn of the CDOs are now in a formal state of default, with the CDOs underwritten by Merrill Lynch accounting for the biggest pile of defaulted assets, followed by UBS and Citi."

The average recovery rate for high quality CDOs has been approximately 32 cents on the dollar, while the recovery rate for mezzanine CDO's has been approximately five cents for every dollar. These massive, practically unthinkable, losses have dramatically impacted the balance sheets of banks across the globe, leaving them with very little capital to continue operations.

Credit creation as a cause

The Austrian School of Economics proposes that the crisis is an excellent example of the Austrian Business Cycle Theory, in which credit created through the policies of central banking gives rise to an artificial boom, which is inevitably followed by a bust.

This perspective argues that the monetary policy of central banks creates excessive quantities of cheap credit by setting interest rates below where they would be set by a free market. This easy availability of credit inspires a bundle of malinvestments, particularly on long term projects such as housing and capital assets, and also spurs a consumption boom as incentives to save are diminished. Thus an unsustainable boom arises, characterized by malinvestments and overconsumption.

But the created credit is not backed by any real savings nor is in response to any change in the real economy, hence, there are physically not enough resources to finance either the malinvestments or the consumption rate indefinitely. The bust occurs when investors collectively realize their mistake. This happens usually some time after interest rates rise again. The liquidation of the malinvestments and the consequent reduction in consumption throw the economy into a recession, whose severity mirrors the scale of the boom's excesses.

The Austrian School argues that the conditions previous to the crisis of the late 2000s correspond exactly to the scenario described above. The central bank of the United States, led by Federal Reserve Chairman Alan Greenspan, kept interest rates very low for a long period of time to blunt the recession of the early 2000s. The resulting malinvestment and overconsumption of investors and consumers prompted the development of a housing bubble that ultimately burst, precipitating the financial crisis. This crisis, together with sudden and necessary deleveraging and cutbacks by consumers, businesses and banks, led to the recession. Austrian Economists argue further that while they probably affected the nature and severity of the crisis, factors such as a lack regulation, the Community Reinvestment Act, and entities such as Fannie Mae and Freddie Mac are insufficient by themselves to explain it.

Other causes

Many libertarians, including Congressman and former 2008 Presidential candidate Ron Paul and Peter Schiff in his book Crash Proof, predicted the crisis prior to its occurrence. They are critical of theories that the free market caused the crisis and instead argue that expansionary monetary policy and the Community Reinvestment Act are the primary causes of the crisis. However Alan Greenspan himself has conceded he was partially wrong to oppose regulation of the markets, and expressed "shocked disbelief" at the failure of the self interest of the markets.

An empirical study by John B. Taylor concluded that the crisis was: (1) caused by excess monetary expansion; (2) prolonged by an inability to evaluate counter-party risk due to opaque financial statements; and (3) worsened by the unpredictable nature of government's response to the crisis.

It has also been debated that the root cause of the crisis is overproduction of goods caused by globalization (and especially vast investments in countries such as China and India by western multinational companies over the past 15–20 years, which greatly increased global industrial output at a reduced cost). Overproduction tends to cause deflation and signs of deflation were evident in October and November 2008, as commodity prices tumbled and the Federal Reserve was lowering its target rate to an all-time-low 0.25%. On the other hand, Professor Herman Daly suggests that it is not actually an economic crisis, but rather a crisis of overgrowth beyond sustainable ecological limits. This reflects a claim made in the 1972 book Limits to Growth, which stated that without major deviation from the policies followed in the 20th century, a permanent end of economic growth could be reached sometime in the first two decades of the 21st century, due to gradual depletion of natural resources.

Effects

Trade and industrial production

In middle-October 2008, the Baltic Dry Index, a measure of shipping volume, fell by 50% in one week, as the credit crunch made it difficult for exporters to obtain letters of credit.

In February 2009, The Economist claimed that the financial crisis had produced a "manufacturing crisis", with the strongest declines in industrial production occurring in export-based economies.

In March 2009, Britain's Daily Telegraph reported the following declines in industrial output, from January 2008 to January 2009: Japan -31%, Korea -26%, Russia -16%, Brazil -15%, Italy -14%, Germany -12%.

Some analysts even say the world is going through a period of deglobalization and protectionism after years of increasing economic integration.

Sovereign funds and private buyers from the Middle East and Asia, including China, are increasingly buying in on stakes of European and U.S. businesses, including industrial enterprises. Due to the global recession they are available at a low price. The Chinese government has concentrated on natural-resource deals across the world, securing supplies of oil and minerals.

Unemployment

The International Labour Organization (ILO) predicted that at least 20 million jobs will have been lost by the end of 2009 due to the crisis — mostly in "construction, real estate, financial services, and the auto sector" — bringing world unemployment above 200 million for the first time. The number of unemployed people worldwide could increase by more than 50 million in 2009 as the global recession intensifies, the ILO has forecast.

The rise of advanced economies in Brazil, India, and China increased the total global labor pool dramatically. Recent improvements in communication and education in these countries has allowed workers in these countries to compete more closely with workers in traditionally strong economies, such as the United States. This huge surge in labor supply has provided downward pressure on wages and contributed to unemployment.

Return of volatility

For a time, major economies of the 21st century were believed to have begun a period of decreased volatility, which was sometimes dubbed The Great Moderation, because many economic variables appeared to have achieved relative stability. The return of commodity, stock market, and currency value volatility are regarded as indications that the concepts behind the Great Moderation were guided by false beliefs.

Financial markets

Main article: Global financial crisis of 2008January 2008 was an especially volatile month in world stock markets, with a surge in implied volatility measurements of the US-based S&P 500 index, and a sharp decrease in non-U.S. stock market prices on Monday, January 21, 2008 (continuing to a lesser extent in some markets on January 22). Some headline writers and a general news columnist called January 21 "Black Monday" and referred to a "global shares crash," though the effects were quite different in different markets.

The effects of these events were also felt on the Shanghai Composite Index in China which lost 5.14 percent, most of this on financial stocks such as Ping An Insurance and China Life which lost 10 and 8.76 percent respectively. Investors worried about the effect of a recession in the US economy would have on the Chinese economy. Citigroup estimates due to the number of exports from China to America a one percent drop in US economic growth would lead to a 1.3 percent drop in China's growth rate.

There were several large Monday declines in stock markets world wide during 2008, including one in January, one in August, one in September, and another in early October. As of October 2008, stocks in North America, Europe, and the Asia-Pacific region had all fallen by about 30% since the beginning of the year. The Dow Jones Industrial Average had fallen about 37% since January 2008.

The simultaneous multiple crises affecting the US financial system in mid-September 2008 caused large falls in markets both in the US and elsewhere. Numerous indicators of risk and of investor fear (the TED spread, Treasury yields, the dollar value of gold) set records.

Russian markets, already falling due to declining oil prices and political tensions with the West, fell over 10% in one day, leading to a suspension of trading, while other emerging markets also exhibited losses.

On September 18, UK regulators announced a temporary ban on short-selling of financial stocks. On September 19 the United States' SEC followed by placing a temporary ban of short-selling stocks of 799 specific financial institutions. In addition, the SEC made it easier for institutions to buy back shares of their institutions. The action is based on the view that short selling in a crisis market undermines confidence in financial institutions and erodes their stability.

On September 22, the Australian Securities Exchange (ASX) delayed opening by an hour after a decision was made by the Australian Securities and Investments Commission (ASIC) to ban all short selling on the ASX. This was revised slightly a few days later.

As is often the case in times of financial turmoil and loss of confidence, investors turned to assets which they perceived as tangible or sustainable. The price of gold rose by 30% from middle of 2007 to end of 2008. A further shift in investors’ preference towards assets like precious metals or land is discussed in the media.

In March 2009, Blackstone Group CEO Stephen Schwarzman said that up to 45% of global wealth had been destroyed in little less than a year and a half.

Insurance

A February 2009 research on the main British insurers showed that most of them do not consider officially to rise the insurance premiums for the year 2009, in spite of the 20% raise predictions made by The Telegraph or The Daily Mirror. However, it is expected that the capital liquidity will become an issue and determine increases, having their capital tied up in investments yielding smaller dividends, corroborated with the £644 million underwriting losses suffered in 2007.

Political instability related to the economic crisis

In January of 2009 the government leaders of Iceland were forced to call elections two years early after the people of Iceland staged mass protests and clashed with the police due to the government's handling of the economy. Hundreds of thousands protested in France against President Sarkozy's economic policies. Prompted by the financial crisis in Latvia, the opposition and trade unions there organized a rally against the cabinet of premier Ivars Godmanis. The rally gathered some 10-20 thousand people. In the evening the rally turned into a Riot. The crowd moved to the building of the parliament and attempted to force their way into it, but were repelled by the state's police. In late February many Greeks took part in a massive general strike because of the economic situation and they shut down schools, airports, and many other services in Greece. Police and protesters clashed in Lithuania where people protesting the economic conditions were shot by rubber bullets. In addition to various levels of unrest in Europe, Asian countries have also seen various degrees of protest. Communists and others rallied in Moscow to protest the Russian government's economic plans. Protests have also occurred in China as demands from the west for exports have been dramatically reduced and unemployment has increased.

These limited and disparate events do not justify concluding that there is widespread political instability resulting from the economic recession or financial crisis.

Beginning February 26, 2009 an Economic Intelligence Briefing was added to the daily intelligence briefings prepared for the President of the United States. This addition reflects the assessment of United States intelligence agencies that the global financial crisis presents a serious threat to international stability.

Policy responses

Further information: ]The financial phase of the crisis led to emergency interventions in many national financial systems. As the crisis developed into genuine recession in many major economies, economic stimulus meant to revive economic growth became the most common policy tool.

Economic stimulus plans were announced or under discussion in China, the United States, and the European Union. Bailouts of failing or threatened businesses were carried out or discussed in the USA, the EU, and India.

In the final quarter of 2008, the financial crisis saw the G-20 group of major economies assume a new significance as a focus of economic and financial crisis management.

Countries in economic recession or depression

Main article: Timeline of countries in recessionMany countries experienced recession in 2008. The countries/territories currently in a technical recession are Estonia, Latvia, Ireland, New Zealand, Japan, Hong Kong, Singapore, Italy, Russia and Germany.

Denmark went into recession in the first quarter of 2008, but came out again in the second quarter. Iceland fell into an economic depression in 2008 following the collapse of its banking system.

The following countries went into recession in the second quarter of 2008: Estonia, Latvia, Ireland and New Zealand.

The following countries/territories went into recession in the third quarter of 2008: Japan, Sweden, Hong Kong, Singapore, Italy , Turkey and Germany. As a whole the fifteen nations in the European Union that use the euro went into recession in the third quarter. In addition, the European Union, the G7, and the OECD all experienced negative growth in the third quarter .

The following countries went into technical recession in the fourth quarter of 2008: United States, Spain and Britain.

Of the seven largest economies in the world by GDP, only China and France avoided a recession in 2008. France experienced a 0.3% contraction in Q2 and 0.1% growth in Q3 of 2008. In the year to the third quarter of 2008 China grew by 9%. This is interesting as China has until recently considered 8% GDP growth to be required simply to create enough jobs for rural people moving to urban centres. This figure may more accurately be considered to be 5-7% now that the main growth in working population is receding. Growth of between 5%-8% could well have the type of effect in China that a recession has elsewhere.

The following countries went into technical depression in the fourth quarter of 2008: Japan, with a nominal annualized GDP growth of -12.7% ., and Taiwan.

The following country went into technical depression in January 2009: Ukraine, with a nominal annualized GDP growth of -20%.

Official forecasts in parts of the world

On November 3, 2008, according to all newspapers, the European Commission in Brussels predicted for 2009 only an extremely low increase by 0.1% of the GDP, for the countries of the Euro zone (France, Germany, Italy, etc.). They also predicted negative numbers for the UK (-1.0%), Ireland, Spain, and other countries of the EU. Three days later, the IMF at Washington, D.C., predicted for 2009 a worldwide decrease, -0.3%, of the same number, on average over the developed economies (-0.7% for the US, and -0.8% for Germany). Economically, the car industry is especially concerned; as a consequence, several countries have already launched immediate help-packages, each involving several billions of dollars, euros or pounds.

According to new forecasts of the Deutsche Bank (end of November 2008), the economy of Germany will contract by more than 4% in 2009.

On January 19, 2009, the EU commission in Brussels updated their earlier predictions: the numbers are now -2.25 % for Germany and -1.8 % on average for the 27 EU countries.

On February 18, 2009, the US Federal Reserve cut their economic forecast of 2009, expecting the US output to shrink between 0.5% and 1.5%, down from its forecast in October 2008 of output between +1.1% (growth) and -0.2% (contraction).

Comparisons to the Great Depression

Although some casual comparisons between the late 2000s recession and the Great Depression have been made, there remain large differences between the two events. For example, over the 79 years between 1929 and 2008, great changes occurred in economic philosophy and policy, the stock market has not fallen as far as it did in 1932 or 1982, the 10-year price-to-earnings ratio of stocks is not as low as the 30s or 80s, inflation-adjusted U.S. housing prices in March 2009 were higher than any time since 1890 (including the housing booms of the 1970s and 80s), the recession of the early 30s lasted over three and a half years, and during the 1930s the supply of money (currency plus demand deposits) fell by 25% (where as in 2008 and 2009 the Fed "has taken an ultraloose credit stance"). Furthermore, the unemployment rate in 2008 and early 2009 and the rate at which it rose was comparable most of the recessions occurring after World War II, and was dwarfed by the 25% unemployment rate peak of the Great Depression.

Nobel Prise winning Economist Paul Krugman predicted a series of depressions in his Return to Depression Economics (2000), based on "failures on the demand side of the economy." He wrote a January 5, 2009 editorial about preventing depressions, commenting that, "preventing depressions isn’t that easy after all," and that at the time, "the economy is still in free fall." In March 2009, Krugman explained that a major difference is that the causes of this financial crisis were from the shadow banking system. "The crisis hasn't involved problems with deregulated institutions that took new risks... Instead, it involved risks taken by institutions that were never regulated in the first place."

Market strategist Phil Dow "said he believes distinctions exist between the current market malaise" and the Great Depression. The Dow's fall of over 50% in 17 months is similar to a 54.7% fall in the Great Depression, followed by a total drop of 89% over the next 16 months. "It's very troubling if you have a mirror image," said Dow. Floyd Norris, chief financial correspondent of The New York Times, wrote in a blog entry in March 2005 that the decline has not been a mirror image of the Great Depression, explaining that although the decline amounts were nearly the same at the time, the rates of decline had started much faster in 2007, and that the past year had only ranked eighth among the worst recorded years of percentage drops in the Dow. The past two years ranked third however.

Price-to-earnings ratios have yet to drop as low as in previous recessions. On this issue, "it is critically important, though, to recognize that different analysts have different earnings expectations, and the consensus view is more often wrong than right." Some argue that price-to-earnings ratios remain high because of unprecedented falls in earnings.

Three years into the Great Depression, unemployment reached a peak of 25% in the U.S. The United States entered into recession in December 2007 and in February 2009, U-3 unemployment reached 8.1%. In March 2009, statistician John Williams "argue that measurement changes implemented over the years make it impossible to compare the current unemployment rate with that seen during the Great Depression".

In March 2009, unemployment reached 10.4% in Ireland and is projected to reach 14% this year. Housing prices fell about 30% in the United States during the Great Depression. They have already fallen 26.7% during the current recession and the Federal Reserve estimates that they may fall an additional 18 to 29%. In some areas, housing prices have fallen more than 50%. In the United Kingdom, housing prices have fallen by 21% and could, according to Numis Securities, fall by a further 40 to 55%. According to Blackstone Group CEO Stephen Schwarzman, "Between 40 and 45 percent of the world's wealth has been destroyed in little less than a year and a half." Since Q2 2007, United States household wealth has dropped by 20%, or $12.9 trillion.

On January 4, 2009, Nobel prize winning economist Paul Krugman wrote that "This looks an awful lot like the beginning of a second Great Depression." and "So this is our moment of truth. Will we in fact do what’s necessary to prevent Great Depression II?" On March 2, 2009, he wrote that "the odds that this slump really will turn into Great Depression II keep rising." On January 20, Paul Volcker, chairman of the President's Economic Recovery Advisory Board, said "I don't remember any time, maybe even in the Great Depression, when things went down quite so fast, quite so uniformly around the world." On January 24 Edmund Conway, Economics Editor for The Daily Telegraph, wrote that "The plight facing Britain is uncannily similar to the 1930s, since prices of many assets - from shares to house prices - are falling at record rates, but the value of the debt against which they are held remains unchanged."

On February 9, International Monetary Fund Managing Director Dominique Strauss-Kahn said that Japan, Western Europe, and the United States are "already in depression." On February 10, Ed Balls, Secretary of State for Children, Schools and Families of the United Kingdom, said that "I think that this is a financial crisis more extreme and more serious than that of the 1930s and we all remember how the politics of that era were shaped by the economy." On February 11, South Africa's Finance Minister Trevor Manuel said that "what started as a financial crisis might well become a second Great Depression." On February 20, investor George Soros said that "The problem itself is larger than it was in the 30s." and "The closest comparison that I can think of is actually the collapse of the Soviet system." On February 21 Yale economics professor Robert J. Shiller wrote that "The Great Depression does appear genuinely relevant. The bursting of twin bubbles in the stock and real estate markets, accompanied by huge failures of financial institutions and a drop in confidence, has no more recent example than that of the 1930s." On February 22, NYU economics professor Nouriel Roubini said that "This could become as bad as the Great Depression." On March 5, he wrote that "There is, in fact, a rising risk of a global L-shaped depression that would be even worse than the current, painful U-shaped global recession." and "The scale and speed of synchronized global economic contraction is really unprecedented (at least since the Great Depression)." On February 23, journalist William Rees-Mogg wrote in The Times that "it increasingly looks as if the world is experiencing a full-blown depression."

On March 8, journalist Will Hutton of The Observer wrote that "We are living through terrible times - and the risk of a global depression is very real." On March 9, Senator Arlen Specter said "I think we're on the brink of a depression." and "Our economic problems are enormously serious, more serious than is publicly disclosed." On the same day, journalist Chris Jansing of NBC covered a tent city in Sacramento, California. She described "images, hauntingly reminescent of the iconic photos of the 1930s and the Great Depression" and "evocative Depression-era images." On March 10, journalist Nicholas von Hoffman wrote in The Nation that "Whether the odds are one in six or five or four, we could be looking at a 20 percent unemployment rate in ten months' time. The atmospherics are right for a typhoon of misery on a scale of that which Americans suffered in the early 1930s." On the same day, Spain's Industry Minister Miguel Sebastian said that there are "unmistakable symptoms of a global depression." On March 11, Richard Posner wrote that "The word itself is taboo in respectable circles, reflecting a kind of magical thinking: if we don’t call the economic crisis a "depression," it can’t be one. But no one who has lived through the modest downturns in the American economy of recent decades could think them comparable to the present situation. ... It is the gravity of the economic downturn, the radicalism of the government’s responses, and the pervading sense of crisis that mark what the economy is going through as a depression." On March 12, Helen Thomas wrote that "the U.S. ... struggles with an economic depression that has no end in sight." On March 13, Interactive Brokers market analyst Andrew Wilkinson wrote about "the current economic depression."

In the late 1970s, Ravi Batra wrote the book The Downfall of Capitalism and Communism. In 1990, he was proven correct about the collapse of Soviet Communism. His consistently held prediction for a major financial crisis to engulf the capitalist system seems to be unfolding since 2007. If so, economic and social upheaval may follow that is comparable in magnitude of the Great Depression of the 1930s. On November 15, 2008, Batra said he is "afraid the global financial debacle will turn into a steep recession and be the worst since the Great Depression, even worse than the painful slump of 1980-1982 that afflicted the whole world".

See also

- 2000s energy crisis

- 2007–2008 world food price crisis

- 2008 Chinese economic stimulus plan

- 2008 United States bank failures

- 2008–2009 Keynesian resurgence

- 2008–2009 Latvian financial crisis

- 2008–2009 Russian financial crisis

- 2008-2009 UK retail crisis

- American Recovery and Reinvestment Act of 2009

- Automotive industry crisis of 2008–2009

- Bank run

- Bankruptcy of Lehman Brothers

- Bear Stearns subprime mortgage hedge fund crisis

- Credit crunch

- Crisis of capitalism

- Crisis theory

- Decline

- Depression

- Derivative (finance)

- Dot-com crash

- Economic bubble

- Economic collapse

- Fall of Communism

- Federal takeover of Fannie Mae and Freddie Mac

- Financial crisis

- Financial crisis of 2007–2009

- Global financial crisis of 2008–2009

- Global recession

- Great Depression

- Hyperinflation

- List of entities involved in 2007–2008 financial crises

- Long Depression

- Malthusian catastrophe

- National bankruptcy

- Predatory lending

- Real estate bubble

- Recession

- Savings and loan crisis

- Social disintegration

- Societal collapse

- Statistical Arbitrage Events of summer 2007

- Stock market bubble

- Stock market crash

- Stagflation

- Subprime crisis impact timeline

- Subprime lending

- Subprime mortgage crisis

- Survivalism

- United States housing bubble

- United States housing market correction

- US bear market of 2007-2009

- Zombie bank

- The Limits to Growth

References

- www.guardian.co.uk “Global recession - where did all the money go?“ 2009-01-29

- Foldvary, Fred E. (September 18, 2007). The Depression of 2008 (PDF). The Gutenberg Press. ISBN 0-9603872-0-X. Retrieved 2009-01-04.

- Nouriel Roubini (January 15, 2009). "A Global Breakdown Of The Recession In 2009".

- www.guardian.co.uk 2008-06-03

- It's official: Recession since Dec. '07

- Congressional Budget Office compares downturn to Great Depression. By David Lightman. McClatchy Washington Bureau. January 27, 2009.

- Twenty-five people at the heart of the meltdown .... Julia Finch. The Guardian, January 26, 2009.

- StrategEcon. CIBC World Markets. May 27, 2008 http://research.cibcwm.com/economic_public/download/smay08.pdf. Retrieved 2009-01-04.

{{cite journal}}: Missing or empty|title=(help) - "Crude oil prices set record high 102.08 dollars per barrel".

- ^ "Light Crude Oil EmiNY (QM, NYMEX): Monthly Price Chart". Tfc-charts.com. Retrieved 2009-01-04.

- "Africa's Plight Dominates First Day of G8 Summit".

- "Sulfuric acid prices explode".

- "Dow Declares Force Majeure for Caustic Soda".

- "Commodities crash".

- Monica Davey (December 25, 2005). "2005: In a Word". New York Times.

- "The global housing boom". The Economist. June 16, 2005.

- "Global inflation climbs to historic levels". International Herald Tribune. 2008-02-12. Retrieved 2008-07-11.

- "Are emerging economies causing inflation?". Economic Times (India). 2008-07-08. Retrieved 2008-07-11.

- "Prospects for Inflation outside America - Guest Post from Menzie Chinn". Jeff Frankel's Weblog. 2008-06-26. Retrieved 2008-07-11.

- "EU slashes growth forecast, foresees inflation surge".

- "EU cuts growth forecast".

- See http://www.washingtonpost.com/wp-dyn/content/article/2008/10/14/AR2008101403343.html?hpid=topnews&sid=ST2008101403344&s_pos=

- Whitney, Mike (August 6, 2007). "Stock Market Meltdown". Global Research. Retrieved 2009-01-04.

- Polleit, Thorsten (2007-12-13). "Manipulating the Interest Rate: a Recipe for Disaster". Mises Institute. Retrieved 2009-01-04.

- Pettifor, Ann (16 September 2008). "America's financial meltdown: lessons and prospects". openDemocracy. Retrieved 2009-01-04.

- Karlsson, Stefan (2004-11-08). "America's Unsustainable Boom". Mises Institute. Retrieved 2009-01-04.

- Appelbaum, Binyamin; Leonnig, Carol D.; Hilzenrath, David S. (September 14, 2008), "How Washington Failed to Rein In Fannie, Freddie", The Washington Post, pp. A1, retrieved 2009-03-08

- Ekelund, Robert (2008-09-04). "More Awful Truths About Republicans". Ludwig von Mises Institute. Retrieved 2008-09-07.

{{cite web}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - http://moneyfeatures.blogs.money.cnn.com/2009/02/27/the-financial-crisis-why-did-it-happen/

- http://www.wired.com/techbiz/it/magazine/17-03/wp_quant

- http://www.wired.com/techbiz/it/magazine/17-03/wp_quant

- http://tpmcafe.talkingpointsmemo.com/talk/blogs/paulw/2009/03/the-power-of-belief.php

- http://tpmcafe.talkingpointsmemo.com/talk/blogs/paulw/2009/03/the-power-of-belief.php

- Powerpoint slides created by Roger Garrison, one one of the leading Austrian economists, explaining the Austrian Theory http://www.auburn.edu/~garriro/frontdoor.htm

- Short article written by Lawrence H. White and David C. Rose describing the downturn from an Austrian perspective https://www.cato.org/pub_display.php?pub_id=9901

- Paul, Rep., Ron (September 10, 2003). "Fannie and Freddie". LewRockwell.com. Retrieved 2009-01-04.

- Reisman, George (October 24, 2008). "The Myth that Laissez Faire Is Responsible for Our Financial Crisis". LewRockwell.com. Retrieved 2009-01-04.

- "The Depression Reader". LewRockwell.com. Retrieved 2009-01-04.

- Felsenthal, Mark (2008-10-23). "Greenspan "shocked" at credit system breakdown". Retrieved 2008-11-06.

- The Financial Crisis and the Policy Responses: An Empirical Analysis of What Went Wrong

- How Government Created the Financial Crisis

- Bello, Walden (18 October 2008). "Afterthoughts : A primer on the Wall Street meltdown". Focus on the Global South. Retrieved 2009-01-04.

- Willis, Bob (December 16, 2008). "U.S. Economy: Consumer Prices, Housing Starts Slide". Bloomberg.com. Retrieved 2009-01-04.

{{cite news}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - Hagens, Nate (October 13, 2008). "Herman Daly on the Credit Crisis, Financial Assets, and Real Wealth". The Oil Drum. Retrieved 2009-01-04.

- Graham Turner (2008). "A Comparison of `The Limits to Growth` with Thirty Years of Reality". Commonwealth Scientific and Industrial Research Organisation (CSIRO).

- A juddering halt to world trade

- The collapse of manufacturing

- Thanks to the Bank it's a crisis; in the eurozone it's a total catastrophe

- A Global Retreat As Economies Dry Up. The Washington Post. March 5, 2009.

- Economic Crisis Poses Threat To Global Stability. NPR. February 18, 2009·

- China heads to Europe for a multi-billion trade deal. People's Daily Online. February 25, 2009.

- Strange rise of Eastern neo-colonialism, The Times of India, January 20, 2008

- Sovereign Wealth Funds Bail Out Major Banks, InvestorPlace Asia

- Colonialism Goes Into Reverse Gear As The Libyan Government Bails Out Italy's UniCredit

- Chinese sovereign fund turning to natural resources. Reuters. February 19, 2009.

- China, taking advantage of global recession, goes on a buying spree. The Christian Science Monitor. February 21, 2009

- Financial crisis to cost 20 mn jobs: UN

- Global unemployment heads towards 50 million, The Times, January 29, 2009

- Volatility returns with a vengeance

- Markets, Uncertain Times, The Economist, February 4, 2008

- MacMahon, Peter (2008-01-22). "Market falls continue as £84bn is lost on Black Monday". The Scotsman. Johnston Press Digital Publishing. Retrieved 2008-01-25.

-

Sources including:

- Zhixin, Dong (2008-01-21). "Black Monday for Chinese stocks, down 5%". China Daily. Retrieved 2008-01-25.

- Warmington, Joe (2008-01-22). "Black Monday again". Toronto Sun. Conoe, Inc. Retrieved 2008-01-25.

- Wilson, Greg (2008-01-22). "It's a Black Monday as stock markets tank in every corner of the globe". Daily News. NYDailyNews.com. Retrieved 2008-01-25.

- Zhixin, Dong (2008-01-21). "Black Monday for Chinese stocks, down 5%". Chinadaily.com.cn. Retrieved 2009-01-04.

- Paul Krugman. "Contagion, revisited" (PDF).

- "Yahoo Finance Historical Data".

- "Panic grips credit markets".

- "Behind the Russian Stock Market Meltdown".

- "Markets Drop Around the World on Turmoil, Fears About Growth".

- Short Selling Restriction

- SEC Halts Short Selling of Fiancial Stocks on 09-19-2008

- "ASX opens after delay". SBS World News. 2008-09-22. Retrieved 2008-09-23.

- "ASIC bans all short-selling". The Age (Fairfax Media). 2008-09-22. Retrieved 2008-09-23.

- "ASIC issues new short selling guidance". The Age (Fairfax Media). 2008-09-25. Retrieved 2008-09-26.

- Hale, David (2009-01-05). "There is only one alternative to the dollar". Financial Times. Retrieved 2009-01-08.

- Branford, Sue (2008-11-22). "Land Grab". guardian.co.uk. Retrieved 2009-01-08.

investment banks and private equity (...) seeing land as a safe haven from the financial storm.

- "The 2008 landgrab for food and financial security". grain.org (NGO). 2008-October. Retrieved 2009-01-08.

{{cite news}}: Check date values in:|date=(help) - Stephen Schwarzman says 45 per cent of global wealth written off by financial crisis. NEWS.com.au. March 11, 2009.

- "Which insurers are planning on raising premiums this year?". NCD News. Retrieved 2009-02-22.

- "CIA Adds Economy To Threat Updates White House Given First Daily Briefing" article by Joby Warrick, Washington Post Staff Writer, Thursday, February 26, 2009

- EU Proposes €200 Billion Stimulus Plan

- Bailout Binge

- ^ http://stats.oecd.org/WBOS/Index.aspx?QueryName=350&QueryType=View&Lang=en

- "Denmark". Oxford Economic Country Briefings. Findarticles.com. September 17, 2008. Retrieved 2009-01-04.

- Mardiste, David (2008-08-13). "UPDATE 3-Estonia follows Denmark into recession in Q2". TALLINN: Reuters. Retrieved 2009-01-04.

- "Latvia". Oxford Economic Country Briefings. Findarticles.com. September 26, 2008. Retrieved 2009-01-04.

- Evans-Pritchard, Ambrose. "Ireland leads eurozone into recession". Telegraph. Retrieved 2009-01-04.

- "New Zealand falls into recession". BBC News. 2008-09-26. Retrieved 2009-01-04.

- "HIGHLIGHTS: Crisis sends Japan into first recession in 7 years". TOKYO: Reuters. 2008-11-17. Retrieved 2009-01-04.

- "HK shares may fall; exporters may drop". HONG KONG: Reuters. 2008-11-16. Retrieved 2009-01-04.

- "Singapore slides into recession". Telegraph. 10 October 2008. Retrieved 2009-01-04.

- http://www.oecd.org/dataoecd/53/27/41700068.pdf

- Fitzgibbons, Patrick (2008-11-14). "TOPWRAP 10-Germany, China, US feel pain of global downturn". NEW YORK: Reuters. Retrieved 2009-01-04.

- Strupczewski, Jan (2008-11-14). "Euro zone in recession, December rate cut expected". BRUSSELS: Reuters.com. Retrieved 2009-01-04.

- http://news.bbc.co.uk/2/hi/business/7856080.stm

- "=Reflating the dragon". BEIJING: The Economist. November 13, 2008. Retrieved 2009-01-04.

- http://www.theaustralian.news.com.au/business/story/0,28124,25061452-20142,00.html

- http://www.straitstimes.com/Breaking%2BNews/Asia/Story/STIStory_339980.html

- http://www.kyivpost.com/business/35635

- Prognosis of the EU from Nov. 3, 2008

- Prognosis of the IMF from Nov. 6, 2008

- Von Thomas Schmid (2008-12-07). "Abschwung: Vielleicht bald wieder sechs Millionen Arbeitslose[[Category:Articles containing German-language text]]" (in German). WELT ONLINE. Retrieved 2009-01-04.

{{cite web}}: URL–wikilink conflict (help) - Radio news from http://www.dradio.de/nachrichten/archiv (called on Jan. 19, 2009, 23:00, "Steinbrück ...")

- BBC News reporting from http://news.bbc.co.uk/1/hi/business/7898223.stm

- Collyns, Charles (December 2008). "The Crisis through the Lens of History". Finance and Development. 45 (4).

- "Extremist nightmares". The Economist. March 5th 2009. Retrieved 2009-03-12.

{{cite news}}:|first=missing|last=(help); Check date values in:|date=(help) - ^ John Tatom (02 February 2009), The Superlative Recession and economic policies (PDF), MPRA Paper No. 13115

{{citation}}: Check date values in:|date=(help) - BAJAJ, VIKAS (March 14, 2009). "Has the Economy Hit Bottom Yet?". New York Times. Retrieved 2009-03-15.

- Steve H. Hanke (March 16, 2009). "Unconventional Wisdom". Forbes.

- http://www.nytimes.com/2009/01/05/opinion/05krugman.html

- Not the Great Depression

- http://news.cnet.com/8301-1001_3-10185559-92.html

- http://norris.blogs.nytimes.com/2009/03/05/plunging-markets-then-and-now/

- When to get back into the market?

- http://www.businessweek.com/magazine/content/09_11/b4123026586146.htm

- http://www.fdrlibrary.marist.edu/unempl71.html

- http://www.cbsnews.com/stories/2008/12/01/national/main4640509.shtml

- http://www.bls.gov/news.release/empsit.t12.htm

- http://www.reuters.com/article/marketsNews/idUSN0944970920090309

- http://www.reuters.com/article/marketsNews/idUSN0944970920090309

- http://www.offalyindependent.ie/articles/1/37152/

- http://www.google.com/hostednews/ap/article/ALeqM5hBhCEUMgwFoSt1e4IthEyJKDJU2QD96P9S180

- http://www.reuters.com/article/topNews/idUSN2453058020090224

- http://www.google.com/hostednews/ap/article/ALeqM5hBhCEUMgwFoSt1e4IthEyJKDJU2QD96P9S180

- http://www.cbsnews.com/blogs/2009/03/11/business/econwatch/entry4859913.shtml

- http://www.telegraph.co.uk/finance/economics/houseprices/4974499/House-prices-could-fall-by-further-55-per-cent.html

- http://www.reuters.com/article/wtUSInvestingNews/idUSTRE52966Z20090310

- http://www.reuters.com/article/domesticNews/idUSTRE52B58720090312

- http://www.nytimes.com/2009/01/05/opinion/05krugman.html

- http://krugman.blogs.nytimes.com/2009/03/02/failing-the-test/

- http://uk.reuters.com/article/marketsNewsUS/idUKN2029103720090220

- http://www.telegraph.co.uk/finance/financetopics/recession/4326894/Britain-on-the-brink-of-an-economic-depression-say-experts.html

- http://online.wsj.com/article/SB123412011581660991.html

- http://news.bbc.co.uk/2/hi/uk_news/politics/7880189.stm

- http://www.thetimes.co.za/News/Article.aspx?id=937281

- http://qtss.cc.columbia.edu/ccs/financial_crisis_soros.mov

- http://www.nytimes.com/2009/02/22/business/economy/22view.html

- http://abcnews.go.com/Video/playerIndex?id=6932460

- http://www.forbes.com/2009/03/04/global-recession-insolvent-opinions-columnists-roubini-economy.html

- http://www.timesonline.co.uk/tol/comment/columnists/william_rees_mogg/article5785815.ece

- http://www.guardian.co.uk/commentisfree/2009/mar/08/will-hutton-recession-money

- http://blogs.abcnews.com/thenote/2009/03/sen-specters-ap.html

- http://www.msnbc.msn.com/id/3032619/#29603738

- http://www.thenation.com/doc/20090323/howl

- http://www.reuters.com/article/GCA-Economy/idUSTRE5292EW20090310

- http://freakonomics.blogs.nytimes.com/2009/03/11/yes-were-in-a-depression/

- http://seattlepi.nwsource.com/opinion/403461_thomas13.html

- http://www.forbes.com/2009/03/13/las-vegas-sands-personal-finance-investing-ideas-general-electric.html

- Ravi Batra, "The Global Financial Crisis: What Caused it, Where it is heading?"

Further reading

- Brau, Eduard and McDonald, Ian (editors). Successes of the International Monetary Fund : untold stories of cooperation at work. New York : Palgrave Macmillan, 2009. ISBN 9780230203136 ISBN 0230203132

- Carney, Richard (editor). Lessons from the Asian financial crisis. New York, NY : Routledge, 2009. ISBN 9780415481908 (hardback) ISBN 0415481902 (hardback) ISBN 9780203884775 (ebook) ISBN 0203884779 (ebook)

- Funnell, Warwick N. In government we trust : market failure and the delusions of privatisation / Warwick Funnell, Robert Jupe and Jane Andrew. Sydney : University of New South Wales Press, 2009. ISBN 9780868409665 (pbk.)

- Hunnicutt, Susan, book editor. The American housing crisis. Farmington Hills, MI : Greenhaven Press, c2009. ISBN 9780737743104 (hbk.) ISBN 9780737743098 (pbk.)

- Lowenstein, Roger. While America aged : how pension debts ruined General Motors, stopped the NYC subways, bankrupted San Diego, and loom as the next financial crisis / Roger Lowenstein. New York : Penguin Press, 2008. 274 p. ; ISBN 9781594201677 ISBN 1594201676

- Read, Colin. Global financial meltdown : how we can avoid the next economic crisis / Colin Read. New York : Palgrave Macmillan, c2009. ISBN 9780230222182

- Robertson, Justin. US-Asia economic relations : a political economy of crisis and the rise of new business actors. Abingdon, Oxon ; New York, NY : Routledge, 2008. ISBN 9780415469517 (hbk.) ISBN 9780203890523 (ebook)

- United States. Congress. House. Committee on the Judiciary. Subcommittee on Commercial and Administrative Law. Working families in financial crisis : medical debt and bankruptcy : hearing before the Subcommittee on Commercial and Administrative Law of the Committee on the Judiciary, House of Representatives, One Hundred Tenth Congress, first session, July 17, 2007. Washington : U.S. G.P.O. : For sale by the Supt. of Docs., U.S. G.P.O., 2008. 277 p. : ISBN 9780160813764 ISBN 016081376X http://purl.access.gpo.gov/GPO/LPS99198

- Woods, Thomas E. Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse / Washington DC: Regnery Publishing 2009. ISBN 1596985879

- Zandi, Mark M. Financial shock : a 360° look at the subprime mortgage implosion, and how to avoid the next financial crisis / Mark Zandi. Upper Saddle River, N.J. : FT Press, c2009. Description: 270 p. : ISBN 0137142900 (hardback : alk. paper) ISBN 9780137142903 (hardback : alk. paper) 2830026

External links

Template:Wikinews3 Template:Wikiversity2

- "Stimulus Watch".

{{cite news}}: Cite has empty unknown parameters:|1=and|2=(help) - UK in Recession ongoing coverage from BBC News

- Recession Britain ongoing coverage from The Guardian

♥♥

Categories:- Articles with dead external links from January 2009

- Articles needing cleanup from March 2009

- Cleanup tagged articles without a reason field from March 2009

- Misplaced Pages pages needing cleanup from March 2009

- Misplaced Pages neutral point of view disputes from March 2009

- Late 2000s global financial crisis

- 2000s economic history

- Economic disasters