| Revision as of 23:18, 18 January 2014 editEllenCT (talk | contribs)Extended confirmed users11,831 edits Replace deleted text per the amortization charts in the original source and obvious WP:CK math as per User_talk:EllenCT#Edits_to_Government_spending← Previous edit | Revision as of 23:30, 18 January 2014 edit undoMorphh (talk | contribs)Extended confirmed users, Pending changes reviewers18,366 edits Undid revision 591338490 by EllenCT (talk) I see no mention of government subsidy returns in the amortization charts - discuss on talkNext edit → | ||

| Line 19: | Line 19: | ||

| Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is called gross fixed capital formation, or government investment, which usually is the largest part of the government.<ref name=eugcf> ''Statistics Explained'' European Union Statistics Directorate, European Commission</ref> Acquisition of goods and services is made through production by the government (using the government's labour force, fixed assets and purchased goods and services for ]) or through purchases of goods and services from market producers. In ] or in ], investment is the amount purchased per unit time of ] which are not consumed but are to be used for future production (i.e. ]). Examples include ] or ] construction. | Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is called gross fixed capital formation, or government investment, which usually is the largest part of the government.<ref name=eugcf> ''Statistics Explained'' European Union Statistics Directorate, European Commission</ref> Acquisition of goods and services is made through production by the government (using the government's labour force, fixed assets and purchased goods and services for ]) or through purchases of goods and services from market producers. In ] or in ], investment is the amount purchased per unit time of ] which are not consumed but are to be used for future production (i.e. ]). Examples include ] or ] construction. | ||

| ⚫ | Infrastructure spending is considered government ] because it will usually save money in the long run, and thereby reduce the ] of government liabilities. Spending on ] in the U.S. returns an average of about $1.92 for each $1.00 spent on nonresidential construction because it is almost always less expensive to maintain than repair or replace once it has become unusable.<ref>{{Cite report |first= Isabelle |last= Cohen |first2= Thomas |last2= Freiling |first3= Eric |last3= Robinson |date= January 2012 |title= ''The Economic Impact and Financing of Infrastructure Spending'' |type= report |publisher= Thomas Jefferson Program in Public Policy, College of William & Mary |location= Williamsburg, Virginia |url= http://www.aednet.org/government/pdf-2012/infrastructure_report.pdf |page= 5 |accessdate= October 1, 2012}}</ref> Likewise, ] expenditures can save several hundreds of billions of dollars per year in the U.S., because for example ] patients are more likely to be diagnosed at ] where curative treatment is typically a few outpatient visits, instead of at ] or later in an ] where treatment can involve years of hospitalization and is often terminal.<ref>{{cite pmid|15755330|noedit}}</ref> | ||

| ] | |||

| ⚫ | Infrastructure spending is considered government ] because it will usually save money in the long run, and thereby reduce the ] of government liabilities. Spending on ] in the U.S. returns an average of about $1.92 for each $1.00 spent on nonresidential construction because it is almost always less expensive to maintain than repair or replace once it has become unusable.<ref>{{Cite report |first= Isabelle |last= Cohen |first2= Thomas |last2= Freiling |first3= Eric |last3= Robinson |date= January 2012 |title= ''The Economic Impact and Financing of Infrastructure Spending'' |type= report |publisher= Thomas Jefferson Program in Public Policy, College of William & Mary |location= Williamsburg, Virginia |url= http://www.aednet.org/government/pdf-2012/infrastructure_report.pdf |page= 5 |

||

| == Transfer payments == | == Transfer payments == | ||

Revision as of 23:30, 18 January 2014

- "Public Purse" redirects here. For the term used in relation to the British monarchy, see Privy Purse.

| Public finance |

|---|

|

| Policies |

| Fiscal policy |

| Monetary policy |

| Trade policy |

| Optimum |

| Reform |

In National Income Accounting, government spending, government expenditure, or government spending on goods and services includes all government consumption and investment but excludes transfer payments made by a state. Government acquisition of goods and services for current use to directly satisfy individual or collective needs of the members of the community is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (gross fixed capital formation). Government outlays that are not acquisition of goods and services, and instead represent transfers of money, such as social security payments, are called transfer payments and are not included in what the national income accounts refer to as government expenditure. The two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

John Maynard Keynes was one of the first economists to advocate government deficit spending as part of the fiscal policy response to an economic contraction. In Keynesian economics, increased government spending is thought to raise aggregate demand and increase consumption, which in turn leads to increased production. Keynesian economists argue that the Great Depression was ended by government spending programs such as the New Deal and military spending during World War II. According to the Keynesian view, a severe recession or depression may never end if the government does not intervene. Classical economists, on the other hand, believe that increased government spending exacerbates an economic contraction by shifting resources from the private sector, which they consider productive, to the public sector, which they consider unproductive.

Government spending can be financed by seigniorage, taxes, or government borrowing.

Current use: final consumption expenditure

Main article: Government final consumption expenditureGovernment acquisition of goods and services for current use to directly satisfy individual or collective needs of the members of the community is called government final consumption expenditure (GFCE.) It is a purchase from the national accounts "use of income account" for goods and services directly satisfying of individual needs (individual consumption) or collective needs of members of the community (collective consumption). GFCE consists of the value of the goods and services produced by the government itself other than own-account capital formation and sales and of purchases by the government of goods and services produced by market producers that are supplied to households - without any transformation – as "social transfers" in kind.

Infrastructure and investment: gross fixed capital formation

Main article: Gross fixed capital formation Further information: Investment § In economics or macroeconomicsGovernment acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is called gross fixed capital formation, or government investment, which usually is the largest part of the government. Acquisition of goods and services is made through production by the government (using the government's labour force, fixed assets and purchased goods and services for intermediate consumption) or through purchases of goods and services from market producers. In economic theory or in macroeconomics, investment is the amount purchased per unit time of goods which are not consumed but are to be used for future production (i.e. capital). Examples include railroad or factory construction.

Infrastructure spending is considered government investment because it will usually save money in the long run, and thereby reduce the net present value of government liabilities. Spending on physical infrastructure in the U.S. returns an average of about $1.92 for each $1.00 spent on nonresidential construction because it is almost always less expensive to maintain than repair or replace once it has become unusable. Likewise, preventative health care expenditures can save several hundreds of billions of dollars per year in the U.S., because for example cancer patients are more likely to be diagnosed at Stage I where curative treatment is typically a few outpatient visits, instead of at Stage III or later in an emergency room where treatment can involve years of hospitalization and is often terminal.

Transfer payments

Main article: Transfer paymentGovernment expenditures that are not acquisition of goods and services, and instead just represent transfers of money, such as social security payments, are called transfer payments. These payments are considered to be exhaustive because they do not directly absorb resources or create output. In other words, the transfer is made without any exchange of goods or services. Examples of certain transfer payments include welfare (financial aid), social security, and government giving subsidies to certain businesses (firms).

International government spending

Per capita

In 2010, the Federal government of the USA spent an average of $11,041 per citizen (per capita). This compares to the 2010 World average spending of $2,376 per citizen and an average of $16,110 per citizen for the World's 20 largest economies (in terms of GDP). Of the 20 largest economies, only six spent less per citizen: South Korea ($4,557), Brazil ($2,813), Russia ($2,458), China ($1,010), and India ($226). Of the 13 that spent more, Norway and Sweden top the list with per citizen spending of $40,908 and $26,760 respectively.

As a percentage of GDP

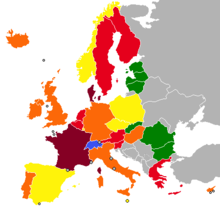

Legend: maroon > 55%, red 50–55%, orange 45–50%, yellow 40–45%, green 35–40%, blue 30–35%

This is a list of countries by government spending as a percentage of gross domestic product (GDP) for the listed countries, according to the 2011 Index of Economic Freedom by The Heritage Foundation and The Wall Street Journal. Tax revenue is included for comparison.

| Country | Tax burden % GDP | Govt. expend. % GDP |

|---|---|---|

| 9.2 | 23.7 | |

| 23.3 | 28.8 | |

| 10.4 | 43.1 | |

| 6.1 | 41.6 | |

| 26.1 | 24.7 | |

| 16.8 | 21.8 | |

| 30.8 | 34.3 | |

| 42.0 | 50.5 | |

| 17.7 | 31.1 | |

| 16.8 | 20.9 | |

| 4.8 | 25.7 | |

| 8.8 | 15.9 | |

| 32.9 | 41.3 | |

| 30.4 | 49.6 | |

| 46.5 | 50.0 | |

| 22.7 | 28.2 | |

| 17.2 | 23.0 | |

| 9.0 | 34.6 | |

| 28.5 | 34.8 | |

| 37.6 | 50.3 | |

| 30.2 | 40.2 | |

| 34.4 | 41.0 | |

| 33.3 | 37.3 | |

| 12.1 | 21.6 | |

| 3.0 | 8.0 | |

| 18.0 | 40.0 | |

| 10.5 | 13.9 | |

| 18.5 | 18.5 | |

| 32.2 | 39.7 | |

| 20.6 | 31.1 | |

| 7.9 | 15.5 | |

| 5.3 | 22.1 | |

| 18.6 | 21.1 | |

| 18.0 | 20.8 | |

| 19.3 | 26.5 | |

| 10.8 | 27.2 | |

| 5.3 | 26.0 | |

| 13.1 | 22.7 | |

| 15.6 | 20.9 | |

| 15.2 | 19.7 | |

| 23.3 | 40.7 | |

| 18.2 | 75.2 | |

| 39.2 | 42.6 | |

| 36.2 | 42.9 | |

| 48.2 | 56.0 | |

| 22.7 | 40.6 | |

| 30.4 | 42.5 | |

| 15.0 | 19.1 | |

| 16.0 | 40.8 | |

| 15.4 | 34.0 | |

| 13.0 | 20.0 | |

| 0.9 | 25.5 | |

| 50.0 | 38.9 | |

| 32.3 | 39.9 | |

| 9.9 | 19.4 | |

| 21.1 | 25.0 | |

| 42.1 | 54.1 | |

| 42.9 | 56.1 | |

| 9.9 | 20.1 | |

| 19.2 | 26.0 | |

| 24.9 | 36.4 | |

| 40.6 | 43.7 | |

| 20.6 | 42.4 | |

| 35.1 | 46.8 | |

| 11.3 | 13.7 | |

| 14.7 | 17.4 | |

| 10.2 | 38.8 | |

| 20.2 | 48.6 | |

| 10.3 | 18.2 | |

| 16.3 | 21.8 | |

| 13.0 | 18.6 | |

| 40.5 | 49.2 | |

| 36.3 | 46.1 | |

| 18.6 | 27.2 | |

| 13.3 | 19.2 | |

| 6.1 | 28.3 | |

| N/A | 69.8 | |

| 30.8 | 42.0 | |

| 33.5 | 42.9 | |

| 43.1 | 48.8 | |

| 26.0 | 34.3 | |

| 28.3 | 37.1 | |

| 18.3 | 36.1 | |

| 27.7 | 26.8 | |

| 20.9 | 30.1 | |

| 20.7 | 85.9 | |

| 1.5 | 31.8 | |

| 23.3 | 29.3 | |

| 12.5 | 18.2 | |

| 29.1 | 38.5 | |

| 16.6 | 34.2 | |

| 57.7 | 62.1 | |

| 28.6 | 33.4 | |

| 3.4 | 43.0 | |

| 30.6 | 37.4 | |

| 36.5 | 37.2 | |

| 25.9 | 14.9 | |

| 28.3 | 34.5 | |

| 12.9 | 18.5 | |

| 16.5 | 38.0 | |

| 15.3 | 26.3 | |

| 11.0 | 53.4 | |

| 15.0 | 21.2 | |

| 36.0 | 44.8 | |

| 13.4 | 29.5 | |

| 19.0 | 25.8 | |

| 8.2 | 23.7 | |

| 11.9 | 66.9 | |

| 33.4 | 41.6 | |

| 30.8 | 41.0 | |

| 30.0 | 48.8 | |

| 26.9 | 29.1 | |

| 14.2 | 28.0 | |

| 24.8 | 29.0 | |

| 39.8 | 45.9 | |

| 10.4 | 19.7 | |

| 34.5 | 41.1 | |

| 18.0 | 25.0 | |

| 11.4 | 23.8 | |

| 5.9 | 30.0 | |

| 42.8 | 44.6 | |

| 3.0 | 32.6 | |

| 10.2 | 19.3 | |

| 10.6 | 19.5 | |

| 26.6 | 35.0 | |

| 11.8 | 14.8 | |

| 16.0 | 17.3 | |

| 14.1 | 17.3 | |

| 34.9 | 43.3 | |

| 37.7 | 46.1 | |

| 4.9 | 27.0 | |

| 28.5 | 37.6 | |

| 34.1 | 34.1 | |

| 13.5 | 26.7 | |

| 27.5 | 30.9 | |

| 25.6 | 34.1 | |

| 23.0 | 32.7 | |

| 16.1 | 32.9 | |

| 6.6 | 29.1 | |

| 18.3 | 26.6 | |

| 36.3 | 44.0 | |

| 28.1 | 39.8 | |

| 10.8 | 21.0 | |

| 14.2 | 17.0 | |

| 29.3 | 34.8 | |

| 37.6 | 44.3 | |

| 29.6 | 55.9 | |

| 25.7 | 27.4 | |

| 26.6 | 30.0 | |

| 33.9 | 41.1 | |

| 13.3 | 22.6 | |

| 21.1 | 25.6 | |

| 36.0 | 33.7 | |

| 47.9 | 52.5 | |

| 29.4 | 32.0 | |

| 10.2 | 22.1 | |

| 12.9 | 18.5 | |

| 18.7 | 27.5 | |

| 14.8 | 25.5 | |

| 16.0 | 17.7 | |

| 342.0 | 156.4 | |

| 16.3 | 19.5 | |

| 25.7 | 29.9 | |

| 19.4 | 28.4 | |

| 22.4 | 27.3 | |

| 23.5 | 23.4 | |

| 21.8 | 12.3 | |

| 11.9 | 17.8 | |

| 37.7 | 47.3 | |

| 1.8 | 26.4 | |

| 38.9 | 47.3 | |

| 26.9 | 38.9 | |

| 17.9 | 28.0 | |

| 19.6 | 31.1 | |

| 19.7 | 26.4 | |

| 13.6 | 34.0 | |

| 23.6 | 28.8 | |

| 7.3 | 43.0 | |

| 17.5 | 24.6 | |

| 31.7 | 97.8 |

United States of America

Government spending in the United States of America occurs at several levels of government, including primarily federal, state, and local governments. The Organisation for Economic Co-operation and Development (OECD) reports that total federal, state and local spending in the United States was $6.134 trillion in 2010.

Federal spending

Further information: United States federal budget| This section needs to be updated. Please help update this article to reflect recent events or newly available information. (November 2010) |

As of September 2001 the U.S. Congressional Budget Office reported that federal government spending for 2004 was projected to be $2.293 trillion, or slightly less than 20% of the GDP. Of that, $646.7 billion was for net interest, $486 billion for defense, $492 billion for Social Security, $473 billion for Medicare and Medicaid, $191 billion for various welfare programs, $136 billion for "retirement and disability" benefits, and $64 billion was projected to be spent elsewhere.

There are two types of government spending – discretionary and mandatory. Discretionary spending, which accounts for roughly one-third of all Federal spending, includes money for things like the Army, FBI, the Coast Guard, and highway projects. Congress explicitly determines how much to spend (or not spend) on these programs on an annual basis. Mandatory spending accounts for two-thirds of all government spending. This kind of spending is authorized by permanent laws.

It includes insurance programs like Social Security, Medicare/Medicaid, the Supplemental Nutrition Assistance Program, and federal retirement and disability programs that provide benefits to federal civilian employees, members of the military, and veterans. Spending levels in these areas are dictated by the number of people who sign up for these benefits, rather than by Congress.

State and local spending

The United States Census Bureau conducts a Census of Governments every five years for fiscal years ending in 2 or 7. The latest fiscal year covered by the Census of Governments is 2007.

History

The United States Census Bureau publishes historical data on government spending in the United States in its Statistical Abstract of the United States and in its special release of historical statistics in 1976 at the time of the US Bicentennial.

Over the last century, overall government spending in the United States has increased substantially from about seven percent of GDP in 1902 to about 35 percent of GDP in 2010. Major spikes in spending occurred in World War I and World War II.

When broken down by major function, the history of US government spending as a percent of GDP shows a slow and consistent increase in education spending; it shows the spikes in defense spending during World War I and World War II, and the sustained high level maintained during the Cold War. Spending on welfare shows a clear takeoff during the Great Depression and a modest decline following reform in 1996. Spending on pensions (primarily Social Security) begins to show up in the 1950s. Health care spending takes off after the birth of Medicare and Medicaid in the 1960s and shows sustained growth ever since.

See also

2References

- Robert Barro and Vittorio Grilli (1994), European Macroeconomics, Ch. 15–16. Macmillan, ISBN 0-333-57764-7.

- F. Lequiller, D. Blades: Understanding National Accounts, Paris: OECD 2006, pp. 127–30

- "Gross capital formation" Statistics Explained European Union Statistics Directorate, European Commission

- Cohen, Isabelle; Freiling, Thomas; Robinson, Eric (January 2012). The Economic Impact and Financing of Infrastructure Spending (PDF) (report). Williamsburg, Virginia: Thomas Jefferson Program in Public Policy, College of William & Mary. p. 5. Retrieved 1 October 2012.

- Attention: This template ({{cite pmid}}) is deprecated. To cite the publication identified by PMID 15755330, please use {{cite journal}} with

|pmid=15755330instead. - Bishop, Matthew (2012). "Economics A-Z terms beginning with T;transfer". The Economist. Retrieved 11 July 2012.

Payments that are made without any good or service being received in return. Much PUBLIC SPENDING goes on transfers, such as pensions and WELFARE benefits. Private-sector transfers include charitable donations and prizes to lottery winners.

- CIA World Factbook, population data from 2010, Spending and GDP data from 2011These numbers fail however to account for State and Local Government Spending which when included bring the per Capital Spending to $16,755

- 2013 Index of Economic Freedom

- An offshore investment fund underwrites government spending. For more information see: Kiribati information on economic freedom. Facts, data, analysis, charts and more. Heritage Foundation.

- Offshore petroleum projects are sources of tax revenue. For more information see: Timor-Leste information on economic freedom. Facts, data, analysis, charts and more. Heritage Foundation.

- http://www.gov.east-timor.org/old/fbea/wage_income_tax.php

- http://siakhenn.tripod.com/capita.html

- Federal Budget Spending and the National Debt

- "11. Government expenditure by function (COFOG)". OECD.Stats. Retrieved 18 April 2012.

- Statistical Abstract of the United States

- Bicentennial Edition: Historical Statistics of the United States, Colonial Times to 1970, Part 2

External links

- Higgs, Robert (2008). "Government Growth". In David R. Henderson (ed.) (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

{{cite encyclopedia}}:|editor=has generic name (help) - Seater, John J. (2008). "Government Debt and Deficits". In David R. Henderson (ed.) (ed.). Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

{{cite encyclopedia}}:|editor=has generic name (help) - Tullock, Gordon (2002). "Government Spending". In David R. Henderson (ed.) (ed.). Concise Encyclopedia of Economics (1st ed.). Indianapolis: Library of Economics and Liberty.

{{cite encyclopedia}}:|editor=has generic name (help) OCLC 317650570, 50016270, 163149563 - OECD Government spending statistics

- Canadian Governments Compared

Categories: