| Revision as of 13:36, 26 February 2014 editSroc (talk | contribs)Extended confirmed users, Pending changes reviewers9,714 edits →Security: remove weasel words and template← Previous edit | Revision as of 13:44, 26 February 2014 edit undoSroc (talk | contribs)Extended confirmed users, Pending changes reviewers9,714 edits →Series detail: add comma to "$1,000" and "$5,000" for consistency with "$10,000"Next edit → | ||

| Line 156: | Line 156: | ||

| |- | |- | ||

| ! 1918 | ! 1918 | ||

| | $500, $ |

| $500, $1,000, $5,000, $10,000 | ||

| |} | |} | ||

| Line 168: | Line 168: | ||

| |- | |- | ||

| ! ] | ! ] | ||

| |rowspan="2"| $5, $10, $20, $50, $100, $500, $ |

|rowspan="2"| $5, $10, $20, $50, $100, $500, $1,000, $5,000, $10,000 | ||

| | ''Redeemable in gold on demand at the United States Treasury, or in gold or lawful money at any Federal Reserve Bank'' | | ''Redeemable in gold on demand at the United States Treasury, or in gold or lawful money at any Federal Reserve Bank'' | ||

| | Branch ID in numerals | | Branch ID in numerals | ||

| Line 423: | Line 423: | ||

| | style="text-align:center; background:#000;"| ] | | style="text-align:center; background:#000;"| ] | ||

| | style="text-align:center; background:#000;"| ] | | style="text-align:center; background:#000;"| ] | ||

| | ] | | ] | ||

| | ] | | ] | ||

| | "One Thousand Dollars" | | "One Thousand Dollars" | ||

| Line 429: | Line 429: | ||

| | style="text-align:center; background:#000;"| ] | | style="text-align:center; background:#000;"| ] | ||

| | style="text-align:center; background:#000;"| ] | | style="text-align:center; background:#000;"| ] | ||

| | ] | | ] | ||

| | ] | | ] | ||

| | "Five Thousand Dollars" | | "Five Thousand Dollars" | ||

Revision as of 13:44, 26 February 2014

"FRN" redirects here. For other uses, see FRN (disambiguation).| This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. Find sources: "Federal Reserve Note" – news · newspapers · books · scholar · JSTOR (September 2013) (Learn how and when to remove this message) |

A Federal Reserve Note, also a United States banknote or U.S. banknote, is a type of banknote used in the United States of America. Denominated in United States dollars, Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts. Federal Reserve Notes are the only type of U.S. banknote currently produced. They are distinct from Federal Reserve Bank Notes, each of which was issued (until 1971) and backed by one, rather than all collectively, of the twelve Federal Reserve Banks.

Federal Reserve Notes are authorized by Section 16 of the Federal Reserve Act of 1913 (codified at 12 U.S.C. § 411) and are issued to the Federal Reserve Banks at the discretion of the Board of Governors of the Federal Reserve System. The notes are then put into circulation by the Federal Reserve Banks, at which point they become liabilities of the Federal Reserve Banks and obligations of the United States.

Federal Reserve Notes are legal tender, with the words "this note is legal tender for all debts, public and private" printed on each note. (See generally 31 U.S.C. § 5103.) They have replaced United States Notes, which were once issued by the Treasury Department. Federal Reserve Notes are backed by the assets of the Federal Reserve Banks, which serve as collateral under Federal Reserve Act Section 16. These assets are generally Treasury securities which have been purchased by the Federal Reserve through its Federal Open Market Committee in a process called debt monetizing. (See Monetization.) This monetized debt can increase the money supply, either with the issuance of new Federal Reserve Notes or with the creation of debt money (deposits). This increase in the monetary base leads to larger increase in the money supply through the fractional-reserve banking as deposits are lent and re-deposited where they form the basis of further loans.

History

Prior to centralized banking, each commercial bank issued their own notes. The first institution with responsibilities of a central bank in the U.S. was the First Bank of the United States, chartered in 1791 by Alexander Hamilton. Its charter was not renewed in 1811. In 1816, the Second Bank of the United States was chartered; its charter was not renewed in 1836, after it became the object of a major attack by President Andrew Jackson. From 1837 to 1862, in the Free Banking Era there was no formal central bank, and banks issued their own notes again. From 1862 to 1913, a system of national banks was instituted by the 1863 National Banking Act. The first printed notes were Series 1914. In 1928, cost-cutting measures were taken to reduce the note to the size it is today.

Value

The authority of the Federal Reserve Banks to issue notes comes from the Federal Reserve Act of 1913. Legally, they are liabilities of the Federal Reserve Banks and obligations of the United States government. Although not issued by the Treasury Department, Federal Reserve Notes carry the (engraved) signature of the Treasurer of the United States and the United States Secretary of the Treasury.

At the time of the Federal Reserve's creation, the law provided for notes to be redeemed to the Treasury in gold or "lawful money." The latter category was not explicitly defined, but included United States Notes, National Bank Notes, and certain other notes held by banks to meet reserve requirements, such as clearing certificates. The Emergency Banking Act of 1933 removed the gold obligation and authorized the Treasury to satisfy these redemption demands with current notes of equal face value (effectively making change). Under the Bretton Woods system, although citizens could not possess gold, the federal government continued to maintain a stable international gold price. This system ended with the Nixon Shock of 1971. Present-day Federal Reserve Notes are not backed by convertibility to any specific commodity, but only by the legal requirement that they are issued against collateral.

Production and distribution

A commercial bank that maintains a reserve account with the Federal Reserve can obtain notes from the Federal Reserve Bank in its district whenever it wishes. The bank must pay the face value of the notes by debiting (drawing down) its reserve account. Smaller banks without a reserve account at the Federal Reserve can maintain their reserve accounts at larger "correspondent banks" which themselves maintain reserve accounts with the Federal Reserve.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing (BEP), a bureau of the Department of the Treasury. When Federal Reserve Banks require additional notes for circulation, they must post collateral in the form of direct federal obligations, private bank obligations, or assets purchased through open market operations. If the notes are newly printed, they also pay the BEP for the cost of printing (about 4¢ per note). This differs from the issue of coins, which are purchased for their face value.

A Federal Reserve Bank can retire notes that return from circulation by exchanging them for collateral that the bank posted for an earlier issue. Retired notes in good condition are held in the bank's vault for future issues. Notes in poor condition are destroyed and replacements are ordered from the BEP. The Federal Reserve shreds 7,000 tons of worn out currency each year.

Federal Reserve notes, on average, remain in circulation for the following periods of time:

| Denomination | $1 | $5 | $10 | $20 | $50 | $100 |

| Years in circulation | 5.9 | 4.9 | 4.2 | 7.7 | 3.7 | 15.0 |

The Federal Reserve does not publish an average life span for the $2 bill. This is likely due to its treatment as a collector's item by the general public; it is, therefore, not subjected to normal circulation.

Nicknames

U.S. paper currency has had many nicknames and slang terms. The notes themselves are generally referred to as bills (as in "five-dollar bill") and any combination of U.S. notes as bucks (as in "fifty bucks"), or, much less commonly, bones or beans. Notes can be referred to by the first or last name of the person on the portrait (George for One Dollar, or even more popularly, "Benjamins" for $100 notes).

- See tables below for nicknames for individual denomination

- Greenbacks, any amount in any denomination of Federal Reserve Note (from the green ink used on the back). The Demand Notes issued in 1861 had green-inked backs, and the Federal Reserve Note of 1914 copied this pattern.

- "dead presidents", any amount in any denomination of Federal Reserve Note (from the portrait of a U.S. president on most denominations).

- Toms for the picture of Thomas Jefferson on the two-dollar bill.

- fin, finif (from the Yiddish word for five), or finski is a slang term for a five-dollar bill.

- sawbuck is a slang term for a ten-dollar bill, from the image of the Roman numeral X.

- double sawbuck is slang term for a twenty-dollar bill, from the image of the Roman numeral XX, and in some cases can be used to denote a pair of ten-dollar bills, which would be double sawbucks, depending on the situation and type and amount of currency on hand.

- One hundred dollar bills are sometimes called "Benjamins" (in reference to their portrait of Benjamin Franklin) or C-Notes (the letter "C" is the Roman numeral 100).

- One thousand dollars ($1000) can be referenced as "Large", "K" (short for "kilo"), "Grand" or "Stack", and as a "G" (short for "grand").

- The popularity of the Saturday Night Live skit "Lazy Sunday" has led to $10 notes sometimes being referred to as "Hamiltons".

- In Raymond Chandler's novel, The Long Goodbye, the protagonist Marlowe refers to a five thousand dollar bill as "a portrait of Madison", due to the president portrayed on the bill being James Madison.

Many more slang terms refer to money in general (green stamps, moolah, paper, bread, dough, do-re-mi, freight, loot, cheese, cake, stacks, greenmail, jack, rabbit, cabbage, pie, cheddar, scrilla, scratch, etc.).

Criticisms

| This section needs additional citations for verification. Please help improve this article by adding citations to reliable sources in this section. Unsourced material may be challenged and removed. (May 2008) (Learn how and when to remove this message) |

Security

Despite the relatively late addition of color and other anti-counterfeiting features to U.S. currency, critics hold that it is still a straightforward matter to counterfeit these bills. They point out that the ability to reproduce color images is well within the capabilities of modern color printers, most of which are affordable to many consumers. These critics suggest that the Federal Reserve should incorporate holographic features, as are used in most other major currencies, such as the pound sterling, Canadian dollar and euro banknotes, which are more difficult and expensive to forge. Another robust technology, the polymer banknote, has been developed for the Australian dollar and adopted for the New Zealand dollar, Romanian leu, Papua New Guinea kina, Canadian dollar, and other circulating, as well as commemorative, banknotes of a number of other countries. Polymer banknotes are a deterrent to the counterfeiter, as they are much more difficult and time consuming to reproduce. They are said to be more secure, cleaner and more durable than paper notes. One major issue with implementing these or any new counterfeiting countermeasures, however, is that (other than under Executive Order 6102) the United States has never demonetized or required a mandatory exchange of existing currency. Consequently would-be counterfeiters can easily circumvent any new security features simply by counterfeiting older designs.

U.S. currency does, however, bear several anti-counterfeiting features. Two of the most critical anti-counterfeiting features of U.S. currency are the paper and the ink. The exact composition of the paper is classified, as is the formula for the ink. The ink and paper combine to create a distinct texture, particularly as the currency is circulated. The paper and the ink alone have no effect on the value of the dollar until post print. These characteristics can be hard to duplicate without the proper equipment and materials. Furthermore, recent redesigns of the $5, $10, $20, and $50 notes have added EURion constellation patterns which can be used by scanning software to recognize banknotes and refuse to scan them.

The differing sizes of other nations' banknotes are a security feature that eliminates one form of counterfeiting to which U.S. currency is prone: Counterfeiters can simply bleach the ink off a low-denomination note, such as a $1 or $5 bill, and reprint it as a higher-value note, such as a $100 bill. To counter this, the U.S. government has included in all $5 and higher denominated notes since the 1990 series a vertical laminate strip imprinted with denomination information, which under ultraviolet light fluoresces a different color for each denomination ($5 note: blue; $10 note: orange; $20 note: green; $50 note: yellow; $100 note: red).

According to the central banks, the number of counterfeited bank notes seized annually is about 10 in one million of real bank notes for the Swiss franc, of 50 in one million for the Euro, of 100 in one million for United States dollar and of 300 in one million for Pound sterling.

Differentiation

Critics, such as the American Council of the Blind, note that U.S. bills are relatively hard to tell apart: they use very similar designs, they are printed in the same colors (until the 2003 banknotes, in which a faint secondary color was added), and they are all the same size. The American Council of the Blind has argued that American paper currency design should use increasing sizes according to value and/or raised or indented features to make the currency more usable by the vision-impaired, since the denominations cannot currently be distinguished from one another non-visually. Use of Braille codes on currency is not considered a desirable solution because (1) these markings would only be useful to people who know how to read Braille, and (2) one Braille symbol can become confused with another if even one bump is rubbed off. Though some blind individuals say that they have no problems keeping track of their currency because they fold their bills in different ways or keep them in different places in their wallets, they nevertheless must rely on sighted people or currency-reading machines to determine the value of each bill before filing it away using the system of their choice. This means that no matter how organized they are, blind people still have to trust sighted people or machines each time they receive US banknotes.

By contrast, other major currencies, such as the pound sterling and euro, feature notes of differing sizes: the size of the note increases with the denomination and different denominations are printed in different, contrasting colors. This is useful not only for the vision-impaired; they nearly eliminate the risk that, for example, someone might fail to notice a high-value note among low-value ones.

Multiple currency sizes were considered for U.S. currency, but makers of vending machines and change machines successfully argued that implementing such a wide range of sizes would greatly increase the cost and complexity of such machines. Similar arguments were unsuccessfully made in Europe prior to the introduction of multiple note sizes.

Alongside the contrasting colors and increasing sizes, many other countries' currencies contain tactile features missing from U.S. banknotes to assist the blind. For example, Canadian banknotes have a series of raised dots (not Braille) in the upper right corner to indicate denomination. Mexican peso banknotes also have raised patterns of dashed lines. The Indian Rupee has raised patterns of different shapes printed for various denominations on the left of the watermark window (20: vertical rectangle, 50: square, 100: triangle, 500: circle, 1,000: diamond).

Suit by the blind over U.S. banknote design

Ruling on a lawsuit filed in 2002 (American Council of the Blind v. Paulson), on November 28, 2006, U.S. District Judge James Robertson ruled that the American bills gave an undue burden to the blind and denied them "meaningful access" to the U.S. currency system. In his ruling, Robertson noted that the United States was the only nation out of 180 issuing paper currency that printed bills that were identical in size and color in all their denominations and that the successful use of such features as varying sizes, raised lettering and tiny perforations used by other nations is evidence that the ordered changes are feasible.

Robertson accepted the plaintiff's argument that current practice violates Section 504 of the Rehabilitation Act. The Treasury is appealing the decision. The judge ordered the Treasury Department to begin working on a redesign within 30 days.

The plaintiff's attorney was quoted as saying "It's just frankly unfair that blind people should have to rely on the good faith of people they have never met in knowing whether they've been given the correct change."

Government attorneys estimated that the cost of such a change ranges from $75 million in equipment upgrades and $9 million annual expenses for punching holes in bills to $178 million in one-time charges and $50 million annual expenses for printing bills of varying sizes.

On May 20, 2008, in a 2-to-1 decision, the United States Court of Appeals for the District of Columbia Circuit upheld the earlier ruling, pointing out that the cost estimates were inflated and that the burdens on blind and visually impaired currency users had not been adequately addressed.

As a result of the court's injunction, the Bureau of Engraving and Printing is planning to implement a raised tactile feature in the next redesign of each note, except the $1 bill (which is by law not allowed to be redesigned), though the version of the $100 bill already is in progress. It also plans larger, higher-contrast numerals, more color differences, and distribution of currency readers to assist the visually impaired during the transition period. The Bureau received a comprehensive study on accessibility options in July 2009, and solicited public comments from May to August 2010.

Fiat currency

Former Congressman Ron Paul, and libertarians influenced by Austrian economics, criticize Federal Reserve Notes because they are a form of fiat currency and are not backed by tangible assets such as gold or silver. Such critics argue that Federal Reserve Notes can lose value easily and point to the currency's inflation rates as proof of this claim.

Constitutionality

See also: Legal tender casesCritics, including former U.S. Congressman Ron Paul, allege that according to the U.S. Constitution, Article I, Section 8, that only the U.S. Congress has the ability

To coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures;

and, according to section 10, that

No State shall... make any Thing but gold and silver Coin a Tender in Payment of Debts;

and thus Federal Reserve banknotes are not legal tender, as they were not issued by Congress, states have no authority to recognize anything but gold or silver (including federal reserve notes), and the Federal Reserve does not have the authority to print or create money. Though the printing of money is physically done by the Department of the Treasury, that agency is told by the Federal Reserve how much to print. The Federal Reserve also does "regulate the value" of the U.S. dollar through its various operations, as authorized by Congress.

Others contend that, since Congress passed the Federal Reserve Act, the Federal Reserve is constitutional as it was created by Congress and Congress retains oversight over the Federal Reserve System. Congress retains the ability to delegate some of its legislative powers to other branches of the government or agencies based on the U.S. Supreme Court's interpretation of the nondelegation doctrine.

Anti–Federal Reserve argumentation generally ignores the established U.S. Supreme Court precedent McCulloch v. Maryland, which ruled constitutional the Second Bank of the United States, forerunner to the Federal Reserve. McCulloch v. Maryland explicitly states that Congressional delegation of these powers to chartered entities is valid under the Necessary and Proper Clause.

Design regulations

There are a few regulations to which the U.S. Treasury must adhere when redesigning banknotes. The state motto "In God We Trust" must appear on every banknote. The bill requiring this, H.R. 619, was introduced by Representative Charles Edward Bennett of Florida. The inclusion of the motto was meant to serve as a frequent claim that the country was founded upon faith in God as well as spiritual values during the era of McCarthyism. President Dwight D. Eisenhower signed this bill in 1955, but it was not until 1957 that banknotes bearing this motto were first circulated.

The portraits appearing on the U.S. currency can feature only deceased individuals, whose names should be included below each of the portraits. Since the standardization of the bills in 1928, the Department of the Treasury has chosen to feature the same portraits on the bills. These portraits were decided upon in 1929 by a committee appointed by the Treasury. Originally, the committee had decided to feature U.S. presidents because they were more familiar to the public than other potential candidates. The Treasury altered this decision, however, to include three statesmen who were also well-known to the public: Alexander Hamilton (the first Secretary of the Treasury who appears on the $10 bill), Salmon P. Chase (the Secretary of the Treasury during the American Civil War who appeared on the now uncirculated $10,000 bill), and Benjamin Franklin (a signer of the Declaration of Independence, who appears on the $100 bill).

In 2001, the Legal Tender Modernization Act was proposed which would prohibit any redesign of the $1 bill. This act would have superseded the Federal Reserve Act (Section 16, paragraph 8) which gives the Treasury permission to redesign any banknote to prevent counterfeiting. More recently, the Omnibus Appropriations Act (2009) has stated that none of the funds set aside for either the Treasury or the Bureau of Engraving and Printing may be used to redesign the $1 bill. This is because any change would affect vending machines and the risk of counterfeiting is low for this small bill.

Series detail

Series overview

| Series | Denominations | Obligation clause |

|---|---|---|

| 1914 | $5, $10, $20, $50, $100 | This note is receivable by all national and member banks and Federal Reserve Banks and for all taxes, customs and other public dues. It is redeemable in gold on demand at the Treasury Department of the United States in the city of Washington, District of Columbia or in gold or lawful money at any Federal Reserve Bank. |

| 1918 | $500, $1,000, $5,000, $10,000 |

| Series | Denominations | Obligation clause | Remarks |

|---|---|---|---|

| 1928 | $5, $10, $20, $50, $100, $500, $1,000, $5,000, $10,000 | Redeemable in gold on demand at the United States Treasury, or in gold or lawful money at any Federal Reserve Bank | Branch ID in numerals |

| 1934 | This note is legal tender for all debts, public and private, and is redeemable in lawful money at the United States Treasury, or at any Federal Reserve Bank | Branch ID in letters; during the Great Depression | |

| 1950 | $5, $10, $20, $50, $100 | Slight design changes: branch logo; placements of signatures, "Series xxxx", and "Washington, D.C.", | |

| 1963, 1969, 1969A,1969B,1969C, 1974 | $1, $5, $10, $20, $50, $100 | This note is legal tender for all debts, public and private | First $1 FRN; "Will pay to the bearer on demand" removed; Seal in Latin replaced by seal in English in 1969 |

| 1976 | $2 | First $2 FRN, Bicentennial |

| Series | Denominations | Obligation clause |

|---|---|---|

| 1977, 1977A, 1981, 1981A, 1985, 1988, 1988A | $1, $5 | This note is legal tender for all debts, public and private |

| 1977, 1977A, 1981, 1981A, 1985, 1988A | $10, $20 | |

| 1977, 1981, 1981A, 1985, 1988 | $50, $100 | |

| 1990 | $10, $20, $50, $100 | |

| 1993 | $1, $5, $10, $20, $50, $100 | |

| 1995 | $1, $2, $5, $10, $20 | |

| Large-portrait ($1 and $2 remain small-portrait) | ||

| 1996 | $20, $50, $100 | |

| 1999, 2001 | $1, $5, $10, $20, $50, $100 | |

| 2003 | $1, $2, $5, $10, $100 | |

| 2003A | $1, $2, $5, $100 | |

| 2006 | $5, $100 | |

| 2009 A | $100 | |

| Color notes ($1 and $2 remain unchanged) | ||

| 2004 | $20, $50 | |

| 2004A | $10, $20, $50 | |

| 2006 | $1, $5, $10, $20, $50 | |

| 2009 | $1, $2, $5, $10, $20, $50, $100 | |

| 2009A | $100 | |

| 2013 | $1, $2, $5, $10, $20 | |

Series 1914

All banknotes in the following table are Series 1914 Federal Reserve Notes from the National Numismatic Collection at the National Museum of American History (Smithsonian Institution).

| Value | Series | Fr. | Image | Portrait |

|---|---|---|---|---|

| 5$5 | 1914 | Fr.832a |

|

Lincoln1Abraham Lincoln |

| 5$5 | 1914 | Fr.848 |

|

Lincoln2Abraham Lincoln |

| 10$10 | 1914 | Fr.894b |

|

Jackson1Andrew Jackson |

| 10$10 | 1914 | Fr.919a |

|

Jackson2Andrew Jackson |

| 20$20 | 1914 | Fr.958a |

|

Cleveland1Grover Cleveland |

| 20$20 | 1914 | Fr.1010 |

|

Cleveland2Grover Cleveland |

| 50$50 | 1914 | Fr.1019a |

|

Grant1Ulysses Grant |

| 50$50 | 1914 | Fr.1053 |

|

Grant2Ulysses Grant |

| 100$100 | 1914 | Fr.1074a |

|

Franklin2Benjamin Franklin |

| 100$100 | 1914 | Fr.1131 |

|

Franklin1Benjamin Franklin |

Series 1914 (District Seals)

-

Federal Reserve Bank of Boston

Federal Reserve Bank of Boston

-

Federal Reserve Bank of New York

Federal Reserve Bank of New York

-

Federal Reserve Bank of Philadelphia

Federal Reserve Bank of Philadelphia

-

Federal Reserve Bank of Cleveland

Federal Reserve Bank of Cleveland

-

Federal Reserve Bank of Richmond

Federal Reserve Bank of Richmond

-

Federal Reserve Bank of Atlanta

Federal Reserve Bank of Atlanta

-

Federal Reserve Bank of Chicago

Federal Reserve Bank of Chicago

-

Federal Reserve Bank of St. Louis

Federal Reserve Bank of St. Louis

-

Federal Reserve Bank of Minneapolis

Federal Reserve Bank of Minneapolis

-

Federal Reserve Bank of Kansas City

Federal Reserve Bank of Kansas City

-

Federal Reserve Bank of Dallas

Federal Reserve Bank of Dallas

-

Federal Reserve Bank of San Francisco

Federal Reserve Bank of San Francisco

Series 1928–1995

| Small size notes | ||||||

|---|---|---|---|---|---|---|

| Image | Value | Description | Date of | |||

| Obverse | Reverse | Obverse | Reverse | first series | last series | |

| $1 | George Washington | Great Seal of the United States | 1963 | current (2013) | ||

| $2 | Thomas Jefferson | Trumbull's Declaration of Independence | 1976 | current (2013) | ||

| $5 | Abraham Lincoln | Lincoln Memorial | 1928 | 1995 | ||

| $10 | Alexander Hamilton | Treasury Department Building | ||||

| $20 | Andrew Jackson | White House | ||||

| File:US $50 1993 Federal Reserve Note Obverse.jpg | File:US $50 1993 Federal Reserve Note Reverse.jpg | $50 | Ulysses S. Grant | United States Capitol | 1993 | |

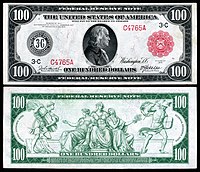

| $100 | Benjamin Franklin | Independence Hall | ||||

| $500 | William McKinley | "Five Hundred Dollars" | 1934 | |||

| $1,000 | Grover Cleveland | "One Thousand Dollars" | ||||

| $5,000 | James Madison | "Five Thousand Dollars" | ||||

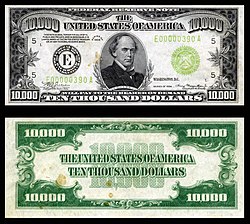

| $10,000 | Salmon P. Chase | "Ten Thousand Dollars" | ||||

Series 1996–2006

| Small size notes | ||||||

|---|---|---|---|---|---|---|

| Image | Value | Description | series | |||

| Obverse | Reverse | Obverse | Reverse | first | last | |

| $5 | As small-size, small-portrait notes | 1999 | 2006 | |||

| $10 | 2003 | |||||

| $20 | 1996 | 2001 | ||||

| $50 | ||||||

| $100 | 2006A | |||||

Post-2004 redesigned series

Beginning in 2003, the Federal Reserve introduced a new series of bills, featuring images of national symbols of freedom. The new $20 bill was first issued on October 9, 2003; the new $50 on September 28, 2004; the new $10 bill on March 2, 2006; the new $5 bill on March 13, 2008; the new $100 bill on October 8, 2013. The one and two dollar bills still remain small portrait, unchanged, and unwatermarked.

| Color series | ||||||||

|---|---|---|---|---|---|---|---|---|

| Images | Value | Background color | Description | Date of | ||||

| Obverse | Reverse | Obverse | Reverse | Watermark | first series | Issue | ||

| $5 | Purple | President Abraham Lincoln; Great Seal of the United States | Lincoln Memorial | Two Watermarks of the Number "5" | 2006 | March 13, 2008 | ||

| $10 | Orange | Secretary Alexander Hamilton; The phrase "We the People" from the United States Constitution and the torch of the Statue of Liberty | Treasury Building | Alexander Hamilton | 2004 A | March 2, 2006 | ||

| $20 | Green | President Andrew Jackson; Eagle | White House | Andrew Jackson | 2004 | October 9, 2003 | ||

| $50 | Pink | President Ulysses S. Grant; Flag of the United States | United States Capitol | Ulysses S. Grant | 2004 | September 28, 2004 | ||

| File:NEW100FRONT.jpg | File:NEW100BACK.jpg | $100 | Teal | Benjamin Franklin; Declaration of Independence | Independence Hall | Benjamin Franklin | 2009, 2009A | October 8, 2013 |

| These images are to scale at 0.7 pixel per millimetre. For table standards, see the banknote specification table. | ||||||||

All small-sized bills measure 6.14 in × 2.61 in (156 mm × 66 mm), with thickness of 0.0043 in (0.11 mm).

See also

References

- This article incorporates text from the website of the US Treasury, which is in the public domain.

- Sullivan, Arthur (2003). Economics: Principles in action. Upper Saddle River, N.J.: Pearson Prentice Hall. p. 255. ISBN 0-13-063085-3.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help) - ^ "Section 411 of Title 12 of the United States Code". Retrieved 2010-03-11.

- Bryan A. Garner, editor, Black's Law Dictionary 8th ed. (West Group, 2004) ISBN 0-314-15199-0.

- Section 415 of Title 12 of the United States Code. Section 415 describes circulating Federal Reserve Notes as liabilities of the issuing Federal Reserve Bank.

- Cross, Ira B. (June 1938). "A Note on Lawful Money". The Journal of Political Economy. 46 (3): 409–413.

- ^ Federal Reserve Bank of New York (April 2007). "How Currency Gets into Circulation". Retrieved 2008-02-17.

- United States Department of the Treasury. "Organization chart of the Department of the Treasury" (PDF). Archived from the original (PDF) on 2008-02-16. Retrieved 2008-02-17.

- 12 U.S.C. § 412

- 12 U.S.C. § 416

- 12 U.S.C. § 413

- Fleur-de-coin.com. "US Coin Facts". Retrieved 2009-02-18.

- Federal Reserve System (2013-10-08). "How long is the life span of U.S. paper money?". Retrieved 2013-11-15.

- ^ USPaperMoney.info. "History of Currency Designs - A last few changes, and then stability". Retrieved 2008-02-19.

- "Where's George? ® 2.4 - Track Your Dollar Bills". Wheresgeorge.com. 2011-09-22. Retrieved 2013-05-05.

- Note Printing Australia (March 2008). "Polymer substrate - the foundation for a secure banknote=2008-03-15".

- Anti-Counterfeiting: Security Features. The United States Treasury Bureau of Engraving and Printing. Accessed 11 January 2012.

- Template:Fr icon Michel Beuret, "Les mystères de la fausse monnaie", Allez savoir !, no. 50, May 2011.

- ^ "Judge rules paper money unfair to blind". CNNMoney.com. 2006-11-29. Retrieved 2008-02-17.

- "Government appeals currency redesign". USA Today. Associated Press. 2006-12-13. Retrieved 2010-03-26.

- (Ruling as PDF file)

- Court Says Next Gen Currency Must Be Accessible to the Blind

- Court Says the Blind Will Have Meaningful Access to Currency, Tells Government 'No Unnecessary Delays'

- Federal Court Tells U.S. Treasury Department That It Must Design and Issue Accessible Paper Currency

- Article about the Court Order from the San Francisco Chronicle

- "Court rules paper money unfair to blind". CNNMoney.com. 2008-05-20. Retrieved 2008-05-22.

- , Footnote on page 3

- "Administrative Provisions : Department of the Treasury". Retrieved 2012-01-02.

- "Federal Register, Volume 75 Issue 97 (Thursday, May 20, 2010)". Edocket.access.gpo.gov. Retrieved 2013-05-05.

- The study, request for comments, and public comments filed before the August deadline can be read in the Federal Register; see http://www.bep.treas.gov/uscurrency/meaningfulaccess.html

- U.S. Congressman Ron Paul. "Speech at U.S. House of Representatives, 9-10-02". Archived from the original on 2008-08-02. Retrieved 2008-11-30.

- ^ U.S. Constitution. "Article 1, Section 8". Retrieved 2008-11-30.

- American Institute for Economic Research. "The Federal Reserve Conspiracy". Retrieved 2008-11-30.

- Jim Saxton. "Joint Economic Committee Report, 3-97, The Importance of the Federal Reserve". Retrieved 2008-11-30.

- ^ 31 U.S.C. § 5114

- H.R. 619

- "The legislation placing "In God We Trust" on national currency | US House of Representatives: History, Art & Archives". Artandhistory.house.gov. 1955-07-11. Retrieved 2013-05-05.

- "U.S. Bureau of Engraving and Printing - Small Denominations". Moneyfactory.gov. Retrieved 2013-05-05.

- "U.S. Bureau of Engraving and Printing - FAQ Library". Moneyfactory.gov. Retrieved 2013-05-05.

- H.R. 2528

- "FRB: Federal Reserve Act: Section 16". Federalreserve.gov. Retrieved 2013-05-05.

- H.R. 1105

- Mimms, Sarah. "Why the $1 bill hasn't changed since 1929". Quartz (publication). Atlantic Media. Retrieved 28 January 2014.

- Devoted to Truth. "Evolution from Gold to Fiat Money". Retrieved 2008-02-19.

External links

- Bureau of Engraving and Printing

- Six Kinds of United States Paper Currency

- Federal Reserve Act: Section 16—The Federal Reserve Board