| Revision as of 01:52, 3 May 2015 editStickee (talk | contribs)Extended confirmed users, Pending changes reviewers, Rollbackers19,599 edits you were just blocked for this behaviour. Consensus has said otherwise on talk← Previous edit | Revision as of 09:22, 3 May 2015 edit undoKrull The Eternal (talk | contribs)67 edits Consensus is when everybody agrees, but I do not.Next edit → | ||

| Line 9: | Line 9: | ||

| |currency = US$ (])<br/>{{increase}}'']'' | |currency = US$ (])<br/>{{increase}}'']'' | ||

| |year = October 1, 2014 – September 30, 2015 | |year = October 1, 2014 – September 30, 2015 | ||

| |gdp rank = {{nowrap|] (nominal) / ] (PPP)}} | |gdp rank = {{nowrap|] (nominal) / ] (PPP)}} | ||

| |gdp = $17.710 trillion (2015)<ref name="Bureau of Economic Analysis">{{Cite web|url = | |gdp = $17.710 trillion (2015)<ref name="Bureau of Economic Analysis">{{Cite web|url = | ||

| http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm|title = National Income and Product Accounts: 1st Quarter & Annual 2015|date = 29 April 2015|accessdate = 29 April 2015|publisher = Bureau of Economic Analysis}}</ref> | http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm|title = National Income and Product Accounts: 1st Quarter & Annual 2015|date = 29 April 2015|accessdate = 29 April 2015|publisher = Bureau of Economic Analysis}}</ref> | ||

Revision as of 09:22, 3 May 2015

"Social problems of the United States" redirects here. For other social problems in the United States, see Social issues in the United States.

New York City, the financial center of the United States and the world. New York City, the financial center of the United States and the world. | |

| Currency | US$ (USD) |

|---|---|

| Fiscal year | October 1, 2014 – September 30, 2015 |

| Statistics | |

| GDP | $17.710 trillion (2015) |

| GDP rank | 1st (nominal) / 2nd (PPP) |

| GDP growth | |

| GDP per capita | $54,710 (2014) 9th (nominal) / 10th (PPP) |

| GDP by sector | Agriculture: 1.2% Industry: 19% Services: 80% (2011) |

| Inflation (CPI) | 1.7% (October 2014) |

| Population below poverty line | 14.5% (2013) |

| Gini coefficient | .38 (2013) |

| Labor force | 156 million (8.6 mil. unemployed) |

| Labor force by occupation | Farming, Forestry, and Fishing: 0.7% Manufacturing, Extraction, Transportation, and Crafts: 12% Managerial, Professional, and Technical: 38% Sales and Office: 23% Installation and Maintenance: 3.3% Other Services: 23% (June 2014) |

| Unemployment | 5.5% (February 2015) |

| Main industries | petroleum, steel, motor vehicles, aerospace, telecommunication, chemicals, arms industry, electronics, food processing, consumer goods, lumber, mining |

| External | |

| Exports | $1.64 trillion (2014) |

| Export goods | capital goods, 33.9% industrial supplies, 31.2% consumer goods (except automotive), 12.3% motor vehicles and components, 9.8% food, feed, and beverages, 8.9% other, 3.9%. (2014) |

| Main export partners | (2014) |

| Imports | $2.37 trillion (2014) |

| Import goods | capital goods, 25.2% consumer goods (except automotive), 23.8% industrial supplies (except crude oil), 17.8% motor vehicles and components, 14.0% crude oil, 10.5% food, feed, and beverages, 5.4% other, 3.3%. (2014) |

| Main import partners | (2014) |

| FDI stock | $2.8 trillion (2013) |

| Public finances | |

| Government debt | $18.1 trillion; 102% of GDP (Q1 2015) |

| Revenues | $3.0 trillion (individual income tax, 46.2%; social insurance, 33.9%; corporate taxes, 10.6%; other, 9.3% – FY2014) |

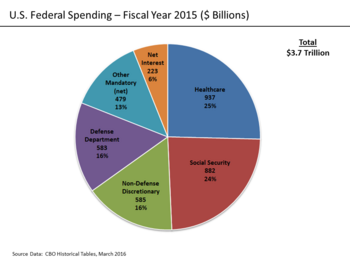

| Expenses | $3.5 trillion (Social Security, 24.3%; defense, 17.2%; Medicare, 14.6%; unemployment and other income security, 14.6%; Medicaid, 11.7%; interest, 6.5%; veterans, 4.3%; education and training, 2.6%; other, 4.2% – FY2014) |

| Economic aid | ODA $48 billion, 0.03% of GDP (2012) |

| Credit rating |

|

| Foreign reserves | $143 billion (May 16, 2014) |

| All values, unless otherwise stated, are in US dollars. | |

- Throughout this article, the unqualified term "dollar" and the $ symbol refer to the US dollar.

The United States is the world's largest national economy, representing 22% of nominal global GDP and 17% of global GDP (PPP). The United States' GDP was estimated to be $17.710 trillion as of Q1 2015. The U.S. dollar is the currency most used in international transactions and is the world's foremost reserve currency. Several countries use it as their official currency, and in many others it is the de facto currency. The United States has a mixed economy and has maintained a stable overall GDP growth rate, a moderate unemployment rate, and high levels of research and capital investment. Its six largest trading partners are Canada, China, Mexico, Japan, Germany, and South Korea.

The US has abundant natural resources, a well-developed infrastructure, and high productivity. It has the world's ninth-highest per capita GDP (nominal) and tenth-highest per capita GDP (PPP) as of 2013. Americans have the highest average household and employee income among OECD nations, and in 2010 had the fourth highest median household income, down from second highest in 2007. It has been the world's largest national economy (not including colonial empires) since at least the 1890s.

The U.S. is the world's third largest producer of oil and natural gas. It is the second-largest trading nation in the world as well as the world's second largest manufacturer, representing a fifth of the global manufacturing output. Of the world's 500 largest companies, 128 are headquartered in the US.

The United States has one of the world's largest and most influential financial markets. The New York Stock Exchange is by far the world's largest stock exchange by market capitalization. Foreign investments made in the US total almost $2.4 trillion, while American investments in foreign countries total over $3.3 trillion. The economy of US leads in international ranking on venture capital and Global Research and Development funding. Consumer spending comprises 71% of the US economy in 2013. The United States has the largest consumer market in the world, with a household final consumption expenditure five times larger than Japan's. The labor market has attracted immigrants from all over the world and its net migration rate is among the highest in the world. The U.S. is one of the top-performing economies in studies such as the Ease of Doing Business Index, the Global Competitiveness Report, and others.

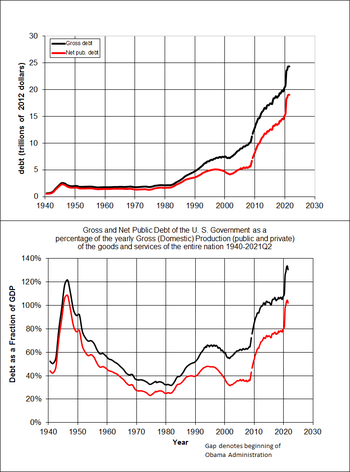

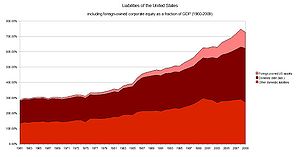

The US economy went through an economic downturn following the financial crisis of 2007–08, with output as late as 2013 still below potential according to the Congressional Budget Office. The economy, however, began to recover in the second half of 2009, and as of February 2015, unemployment had declined from a high of 10% to 5.5%; the government's broader U-6 unemployment rate, which includes the part-time underemployed, was 11.0% (it had reached 16% in 2009). At 11.3%, the U.S. has one of the lowest labor union participation rates in the OECD. Households living on less than $2 per day before government benefits, doubled from 1996 levels to 1.5 million households in 2011, including 2.8 million children. The gap in income between rich and poor is greater in the United States than in any other developed country. Total public and private debt was $50 trillion at the end of the first quarter of 2010, or 3.5 times GDP. In December 2014, public debt was slightly more than 100% of GDP. Domestic financial assets totaled $131 trillion and domestic financial liabilities totaled $106 trillion.

History

Main article: Economic history of the United StatesColonial era

The economic history of the United States has its roots in European settlements in the 16th, 17th, and 18th centuries. The American colonies went from marginally successful colonial economies to a small, independent farming economy, which in 1776 became the United States of America. In 180 years, the US grew to a huge, integrated, industrialized economy that made up around one fifth of the world economy. As a result, the US GDP per capita converged on and eventually surpassed that of the U.K., as well as other nations that it previously trailed economically. The economy maintained high wages, attracting immigrants by the millions from all over the world.

1800s

In the 19th century, recessions frequently coincided with financial crises. The Panic of 1837 was followed by a five-year depression, with the failure of banks and then-record-high unemployment levels. Because of the great changes in the economy over the centuries, it is difficult to compare the severity of modern recessions to early recessions. Recessions after World War II appear to have been less severe than earlier recessions, but the reasons for this are unclear.

1900s

The United States has been the world's largest national economy since at least the 1920s. For many years following the Great Depression of the 1930s, when danger of recession appeared most serious, the government strengthened the economy by spending heavily itself or cutting taxes so that consumers would spend more, and by fostering rapid growth in the money supply, which also encouraged more spending. Ideas about the best tools for stabilizing the economy changed substantially between the 1930s and the 1980s. From the New Deal era that began in 1933, to the Great Society initiatives of the 1960s, national policy makers relied principally on fiscal policy to influence the economy.

The approach, advanced by British economist John Maynard Keynes, gave elected officials a leading role in directing the economy, since spending and taxes are controlled by the U.S. President and the Congress. The "Baby Boom" saw a dramatic increase in fertility in the period 1942–1957; it was caused by delayed marriages and childbearing during depression years, a surge in prosperity, a demand for suburban single-family homes (as opposed to inner city apartments) and new optimism about the future. The boom crested about 1957, then slowly declined. A period of high inflation, interest rates and unemployment after 1973 weakened confidence in fiscal policy as a tool for regulating the overall pace of economic activity.

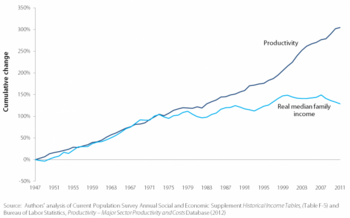

The U.S. economy grew by an average of 3.8% from 1946 to 1973, while real median household income surged 74% (or 2.1% a year). The economy since 1973, however, has been characterized by both slower growth (averaging 2.7%), and nearly stagnant living standards, with household incomes increasing by 10%, or only 0.2% annually.

The worst recession in recent decades, in terms of lost output, occurred during the financial crisis of 2007–08, when GDP fell by 5.0% from the spring of 2008 to the spring of 2009. Other significant recessions took place in 1957–58, when GDP fell 3.7%, following the 1973 oil crisis, with a 3.1% fall from late 1973 to early 1975, and in the 1981–82 recession, when GDP dropped by 2.9%. Recent, mild recessions have included the 1990–91 downturn, when output fell by 1.3%, and the 2001 recession, in which GDP slid by 0.3%; the 2001 downturn lasted just eight months. The most vigorous, sustained periods of growth, on the other hand, took place from early 1961 to mid-1969, with an expansion of 53% (5.1% a year), from mid-1991 to late in 2000, at 43% (3.8% a year), and from late 1982 to mid-1990, at 37% (4% a year).

In the 1970s and 1980s, it was popular in the U.S. to believe that Japan's economy would surpass that of the U.S., but this did not happen.

Since the 1970s, several emerging countries have begun to close the economic gap with the United States. In most cases, this has been due to moving the manufacture of goods formerly made in the U.S. to countries where they could be made for sufficiently less money to cover the cost of shipping plus a higher profit. In other cases, some countries have gradually learned to produce the same products and services that previously only the U.S. and a few other countries could produce. Real income growth in the U.S. has slowed.

The North American Free Trade Agreement, or NAFTA, created one of the largest trade blocs in the world in 1994.

Since 1976, the U.S. has sustained merchandise trade deficits with other nations, and since 1982, current account deficits. The nation's long-standing surplus in its trade in services was maintained, however, and reached a record US$231 billion in 2013. In recent years, the primary economic concerns have centered on: high household debt ($11 trillion, including $2.5 trillion in revolving debt), high net national debt ($9 trillion), high corporate debt ($9 trillion), high mortgage debt (over $15 trillion as of 2005 year-end), high external debt (amount owed to foreign lenders), high trade deficits, a serious deterioration in the United States net international investment position (NIIP) (−24% of GDP), and high unemployment. In 2006, the U.S. economy had its lowest saving rate since 1933. These issues have raised concerns among economists and national politicians.

2000s

The United States economy experienced a crisis in 2008 led by a derivatives market and subprime mortgage crisis, and a declining dollar value. On December 1, 2008, the NBER declared that the United States entered a recession in December 2007, citing employment and production figures as well as the third quarter decline in GDP. The recession did, however, lead to a reduction in record trade deficits, which fell from $840 billion annually during the 2006–08 period, to $500 billion in 2009, as well as to higher personal savings rates, which jumped from a historic low of 1% in early 2008, to nearly 5% in late 2009. The merchandise trade deficit rose to $670 billion in 2010; savings rates, however, remained at around 5%.

US real GDP grew by an average of 1.7% from 2000 to the first half of 2014, a rate around half the historical average up to 2000.

The U.S. public debt was $909 billion in 1980, an amount equal to 33% of America's gross domestic product (GDP); by 1990, that number had more than tripled to $3.2 trillion – or 56% of GDP. In 2001 the national debt was $5.7 trillion; however, the debt-to-GDP ratio remained at 1990 levels. Debt levels rose quickly in the following decade, and on January 28, 2010, the US debt ceiling was raised to $14.3 trillion. Based on the 2010 United States federal budget, total national debt will grow to nearly 100% of GDP, versus a level of approximately 80% in early 2009. The White House estimates that the government's tab for servicing the debt will exceed $700 billion a year in 2019, up from $202 billion in 2009.

The U.S. Treasury statistics indicate that, at the end of 2006, non-US citizens and institutions held 44% of federal debt held by the public. As of 2014, China, holding $1.26 trillion in treasury bonds, is the largest foreign financier of the U.S. public debt.

The distribution of household incomes in the United States has become more unequal during the post-2008 economic recovery, a first for the US but in line with the trend over the last ten economic recoveries since 1949. Income inequality in the United States has grown from 2005 to 2012 in more than 2 out of 3 metropolitan areas. Median household wealth fell 35% in the US, from $106,591 to $68,839 between 2005 and 2011.

Business culture

A central feature of the U.S. economy is the economic freedom afforded to the private sector by allowing the private sector to make the majority of economic decisions in determining the direction and scale of what the U.S. economy produces. This is enhanced by relatively low levels of regulation and government involvement, as well as a court system that generally protects property rights and enforces contracts. Today, the United States is home to 29.6 million small businesses, 30% of the world's millionaires, 40% of the world's billionaires, as well as 139 of the world's 500 largest companies.

From its emergence as an independent nation, the United States has encouraged science and innovation. As a result, the United States has been the birthplace of 161 of Britannica's 321 Greatest Inventions, including items such as the airplane, internet, microchip, laser, cellphone, refrigerator, email, microwave, personal computer, LCD and LED technology, air conditioning, assembly line, supermarket, bar code, electric motor, ATM, and many more.

The United States is rich in mineral resources and fertile farm soil, and it is fortunate to have a moderate climate. It also has extensive coastlines on both the Atlantic and Pacific Oceans, as well as on the Gulf of Mexico. Rivers flow from far within the continent and the Great Lakes—five large, inland lakes along the U.S. border with Canada—provide additional shipping access. These extensive waterways have helped shape the country's economic growth over the years and helped bind America's 50 individual states together in a single economic unit.

The number of workers and, more importantly, their productivity help determine the health of the U.S. economy. Consumer spending in the US rose to about 62% of GDP in 1960, where it stayed until about 1981, and has since risen to 71% in 2013. Throughout its history, the United States has experienced steady growth in the labor force, a phenomenon that is both cause and effect of almost constant economic expansion. Until shortly after World War I, most workers were immigrants from Europe, their immediate descendants, or African Americans who were mostly slaves taken from Africa, or their descendants.

Demographic shift

Beginning in the late 20th century, many Latin Americans immigrated, followed by large numbers of Asians after the removal of nation-origin based immigration quotas. The promise of high wages brings many highly skilled workers from around the world to the United States, as well as millions of illegal immigrants seeking work in the informal economy. Over 13 million people officially entered the United States during the 1990s alone.

Labor mobility has also been important to the capacity of the American economy to adapt to changing conditions. When immigrants flooded labor markets on the East Coast, many workers moved inland, often to farmland waiting to be tilled. Similarly, economic opportunities in industrial, northern cities attracted black Americans from southern farms in the first half of the 20th century, in what was known as the Great Migration.

In the United States, the corporation has emerged as an association of owners, known as stockholders, who form a business enterprise governed by a complex set of rules and customs. Brought on by the process of mass production, corporations, such as General Electric, have been instrumental in shaping the United States. Through the stock market, American banks and investors have grown their economy by investing and withdrawing capital from profitable corporations. Today in the era of globalization, American investors and corporations have influence all over the world. The American government is also included among the major investors in the American economy. Government investments have been directed towards public works of scale (such as from the Hoover Dam), military-industrial contracts, and the financial industry.

GDP

GDP growth

The development of the United States' GDP according to World Bank:

| Year | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % GDP | 4.8 | 4.1 | 1.0 | 1.8 | 2.8 | 3.8 | 2.8 | 3.0 | 2.6 | 0.3 | -2.8 | 2.5 | 1.6 | 2.3 | 2.2 |

GDP by industry

Industries by GDP value added 2011.

| Industry | GDP value added $ billions 2011 | % of total GDP |

|---|---|---|

| Real estate, renting, leasing | 1,898 | 13% |

| State and Local Government | 1,336 | 9% |

| Finance and insurance | 1,159 | 8% |

| Health/social care | 1,136 | 8% |

| Durable manufacturing | 910 | 6% |

| Retail trade | 905 | 6% |

| Wholesale trade | 845 | 6% |

| Non-durable manufacturing | 821 | 6% |

| Federal Government | 658 | 5% |

| Information | 646 | 4% |

| Arts, entertainment | 591 | 4% |

| Construction | 529 | 4% |

| Waste services | 448 | 3% |

| Other services | 447 | 3% |

| Utilities | 297 | 2% |

| Mining | 290 | 2% |

| Corporate management | 284 | 2% |

| Education services | 174 | 1% |

| Agriculture | 173 | 1% |

| Total | 15,075 | 100% |

Employment

Further information: List of largest employers in the United States

There are approximately 154.4 million employed individuals in the US. Government is the largest employment sector with 22 million. Small businesses are the largest employer in the country representing 53% of US workers. The second largest share of employment belongs to large businesses that employ 38% of the US workforce.

The private sector employs 91% of working Americans. Government accounts for 8% of all US workers. Over 99% of all employing organizations in the US are small businesses. The 30 million small businesses in the U.S. account for 64% of newly created jobs (those created minus those lost). Jobs in small businesses accounted for 70% of those created in the last decade.

The proportion of Americans employed by small business versus large business has remained relatively the same year by year as some small businesses become large businesses and just over half of small businesses survive more than 5 years. Amongst large businesses, several of the largest companies and employers in the world are American companies. Amongst them are Walmart, the largest company and the largest private sector employer in the world, which employs 2.1 million people world-wide and 1.4 million in the US alone.

There are nearly 30 million small businesses in the US. Minorities such as Hispanics, African Americans, Asian Americans, and Native Americans (35% of the country's population), own 4.1 million of the country's businesses. Minority-owned businesses generate almost $700 billion in revenue and employ almost 5 million workers in the U.S.

Americans have the highest average employee income among OECD nations. The median household income in the US as of 2008 is $52,029. About 284,000 working people in the US have two full-time jobs and 7.6 million have a part-time job in addition to their full-time employment. Of working individuals in the US, 12% belong to a labor union; most union members are government workers. The decline of union membership in the US over the last several decades parallels the decline of labor's share of the economy. The World Bank ranks the United States first in the ease of hiring and firing workers. The United States is the only advanced economy that does not legally guarantee its workers paid vacation or paid sick days, and is one of just a few countries in the world without paid family leave as a legal right, with the others being Papua New Guinea, Suriname and Liberia. In 2014, the International Trade Union Confederation graded the U.S a 4 out of 5+, its third lowest score, on the subject of powers and rights granted to labor unions.

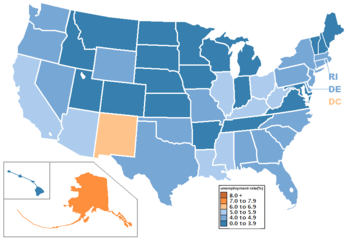

Unemployment

Main articles: Unemployment in the United States and List of U.S. states by unemployment rateAs of February 2013, the unemployment rate in the United States was 7.7% or 12.0 million people, while the government's broader U-6 unemployment rate, which includes the part-time underemployed was 14.3% or 22.2 million people. These figures were calculated with a civilian labor force of approximately 155 million people, relative to a U.S. population of approximately 315 million people.

In 2009 through 2013, following the Great Recession, the emerging problem of jobless recoveries resulted in record levels of long-term unemployment with over 6 million workers looking for work longer than 6 months as of January 2010. This particularly affected older workers. In the year following the recession's end in June 2009 in the United States, immigrants gained 656,000 jobs, while U.S.-born workers lost more than a million jobs.

In April 2010, the official unemployment rate was 9.9%, but the government's broader U-6 unemployment rate was 17.1%. In the period between February 2008 and February 2010, the number of people working part-time for economic reasons has increased by 4 million to 8.8 million, an 83% increase in part-time workers during the two-year period. By 2013, although the unemployment rate had fallen below 8%, the record proportion of long term unemployed and continued decreasing household income remained indicative of a jobless recovery.

After being higher in the postwar period, the U.S. unemployment rate fell below the rising eurozone unemployment rate in the mid-1980s and has remained significantly lower almost continuously since. In 1955, 55% of Americans worked in services, between 30% and 35% in industry, and between 10% and 15% in agriculture. By 1980, over 65% were employed in services, between 25% and 30% in industry, and less than 5% in agriculture. Male unemployment continued to be significantly higher than female unemployment (9.8% vs. 7.5% in 2009). The unemployment among Caucasians continues to be much lower than African-American unemployment (at 8.5% vs. 15.8% in 2009).

The youth unemployment rate was 18.5% in July 2009, the highest July rate since 1948. The unemployment rate of young African Americans was 28.2% in May 2013. Officially, Detroit's unemployment rate is 27%, but Detroit News suggests that nearly half of this city's working-age population may be unemployed.

Employment by sector

See also: Employment by Major Industry Sector in United StatesUnited States employment as estimated in 2012, is divided into 79.7% in the service sector, 19.2% in the manufacturing sector and 1.1% in the agriculture sector.

United States non-farm employment by industry sector February 2013.

| Industry | Employment thousands February 2013 | Percent of total employment |

|---|---|---|

| Retail trade | 15,056 | 10% |

| Accommodation and food services | 11,965 | 8% |

| Professional and technical services | 8,024 | 6% |

| Administrative and waste service | 7,816 | 5% |

| Local Education | 7,758 | 5% |

| Ambulatory health care services | 6,459 | 4% |

| Local government (excluding education) | 6,270 | 4% |

| Finance and insurance | 5,869 | 4% |

| Construction | 5,784 | 4% |

| Wholesale trade | 5,736 | 4% |

| Hospitals | 4,829 | 3% |

| Transportation and warehousing | 4,472 | 3% |

| Non-durable goods manufacturing | 4,471 | 3% |

| Educational services | 3,320 | 3% |

| Nursing and residential care | 3,209 | 2% |

| Membership associations and organizations | 2,947 | 2% |

| Federal government | 2,795 | 2% |

| Social assistance | 2,710 | 2% |

| Information | 2,697 | 2% |

| State government (excluding education) | 2,657 | 2% |

| State education | 2,361 | 2% |

| Management of companies and enterprises | 2,022 | 1% |

| Arts, entertainment and recreation | 1,988 | 1% |

| Real estate, rental and leasing | 1,974 | 1% |

| Personal and laundry services | 1,330 | 1% |

| Repair and maintenance | 1,203 | <1% |

| Mining and logging | 869 | <1% |

| Utilities | 558 | <1% |

| Durable goods manufacturing | 349 | <1% |

Research, development, and entrepreneurship

See also: Technological and industrial history of the United States

The United States has been a leader in scientific research and technological innovation since the late 19th century. In 1876, Alexander Graham Bell was awarded the first U.S. patent for the telephone. Thomas Edison's laboratory developed the phonograph, the first long-lasting light bulb, and the first viable movie camera. Nikola Tesla pioneered the AC induction motor and high frequency power transmission used in radio. In the early 20th century, the automobile companies of Ransom E. Olds and Henry Ford popularized the assembly line. The Wright brothers, in 1903, made the first sustained and controlled heavier-than-air powered flight.

American society highly emphasizes entrepreneurship and business. Entrepreneurship is the act of being an entrepreneur, which can be defined as "one who undertakes innovations, finance and business acumen in an effort to transform innovations into economic goods". This may result in new organizations or may be part of revitalizing mature organizations in response to a perceived opportunity.

The most obvious form of entrepreneurship refers to the process and engagement of starting new businesses (referred as Startup Company); however, in recent years, the term has been extended to include social and political forms of entrepreneurial activity. When entrepreneurship is describing activities within a firm or large organization it is referred to as intra-preneurship and may include corporate venturing, when large entities spin-off organizations.

According to Paul Reynolds, entrepreneurship scholar and creator of the Global Entrepreneurship Monitor, "by the time they reach their retirement years, half of all working men in the United States probably have a period of self-employment of one or more years; one in four may have engaged in self-employment for six or more years. Participating in a new business creation is a common activity among U.S. workers over the course of their careers." And in recent years, business creation has been documented by scholars such as David Audretsch to be a major driver of economic growth in both the United States and Western Europe.

Venture capital, as an industry, originated in the United States and it is still dominated by the U.S. According to the National Venture Capital Association 11% of private sector jobs come from venture capital backed companies and venture capital backed revenue accounts for 21% of US GDP.

Some new American businesses raise investments from angel investors (venture capitalists). In 2010 healthcare/medical accounted for the largest share of angel investments, with 30% of total angel investments (vs. 17% in 2009), followed by software (16% vs. 19% in 2007), biotech (15% vs. 8% in 2009), industrial/energy (8% vs. 17% in 2009), retail (5% vs. 8% in 2009) and IT services (5%).

Americans are "venturesome consumers" who are unusually willing to try new products of all sorts, and to pester manufacturers to improve their products.

Income and wealth

| Year | Wealth (billions in USD) |

|---|---|

| 2003 | 49,426 |

| 2004 | 56,515 |

| 2005 | 62,538 |

| 2006 | 67,331 |

| 2007 | 67,753 |

| 2008 | 57,180 |

| 2009 | 58,920 |

| 2010 | 63,354 |

| 2011 | 64,763 |

| 2012 | 70,863 |

| 2013 | 80,664 |

| This section may lend undue weight to certain ideas, incidents, or controversies. Please help improve it by rewriting it in a balanced fashion that contextualizes different points of view. (August 2014) (Learn how and when to remove this message) |

As of Q4 2013, total household net worth in the United States is $80.664 trillion, an increase of $9.8 trillion from 2012. Employee compensation amounts to $8.969 trillion, while gross private investment totals $2.781 trillion. The mean net worth of US adults increased to $301,140 in 2013, with the majority being held in financial assets, due to higher activity by shareholders and more private investment. Including human capital such as skills, the United Nations estimated the total wealth of the United States in 2008 to be $118 trillion.

Americans have the highest average household income among OECD nations, and in 2010 had the fourth highest median household income, down from second highest in 2007. While inflation-adjusted household income had been increasing almost every year from 1945 to 2007, it has since been flat and even decreased recently. U.S. median household income fell from $51,144 in 2010 to $50,502 in 2011. According to one analysis middle class incomes in the United States fell into a tie with those in Canada in 2010, and may have fallen behind by 2014, while several other advanced economies have closed the gap in recent years.

The top 1 percent of income-earners accounted for 95 percent of the income gains from 2009 to 2012, while their share of total income has more than doubled from 9 percent in 1976 to 20 percent in 2011. According to a 2014 OECD report, 80% of total income growth went to the top 10% from 1975 to 2007. The top 10% wealthiest possess 80% of all financial assets. Wealth inequality in the U.S. is greater than in most developed countries other than Switzerland and Denmark. Inherited wealth may help explain why many Americans who have become rich may have had a "substantial head start". In September 2012, according to the Institute for Policy Studies, "over 60 percent" of the Forbes richest 400 Americans "grew up in substantial privilege".

A number of economists and others have expressed growing concern about income inequality, calling it "deeply worrying", unjust, a danger to democracy/social stability, or a sign of national decline. Yale professor Robert Shiller has said, "The most important problem that we are facing now today, I think, is rising inequality in the United States and elsewhere in the world." Thomas Piketty of the Paris School of Economics argues that the post-1980 increase in inequality played a role in the 2008 crisis by contributing to the nation's financial instability.

Others disagree, saying there is a lack of evidence that the success of some harms others, and that the inequality issue is a political distraction from what they consider real problems like chronic unemployment and sluggish growth. George Mason University economics professor Tyler Cowen has called inequality a "red herring", saying that factors driving its increase within a nation can simultaneously be driving its reduction globally, and arguing that redistributive policies intended to reduce inequality can do more harm than good regarding the real problem of stagnant wages. Robert Lucas, Jr. has argued that the salient problem American living standards face is a government that has grown too much, and that recent policy shifts in the direction of European style taxation, welfare spending, and regulation may be indefinitely putting the US on a significantly lower, European level income trajectory. Some researchers have disputed the accuracy of the underlying data regarding claims about inequality trends, and economists Michael Bordo and Christopher M. Meissner have argued that inequality cannot be blamed for the 2008 financial crisis.

About 30% of the entire world's millionaire population resides in the United States (as of 2009). The Economist Intelligence Unit estimated in 2008 that there were 16,600,000 millionaires in the U.S. Furthermore, 34% of the world's billionaires are American (in 2011).

According to a report by the Congressional Research Service, decreased progressiveness in capital gains taxes was the largest contributor to the increase in overall income inequality in the US from 1996 to 2006. According to the Federal Reserve Board, in 2010 single Black and Hispanic women ages 18–64 had a median wealth of $100 and $120 respectively, excluding vehicles, while the median for single white women was $41,500.

As of 2010 The U.S. had the fourth widest income distribution among OECD nations, behind Turkey, Mexico and Chile. The Brookings Institution said in March 2013 that income inequality was increasing and becoming permanent, sharply reducing social mobility in the US. The OECD ranks the US 10th in social mobility, behind the Nordic countries, Australia, Canada, Germany, Spain, and France. Of the major developed nations, only Italy and Great Britain have lower mobility. This has been partly attributed to the depth of American poverty, which leaves poor children economically disadvantaged, though others have observed that a relative rise in the U.S. is mathematically harder due to its higher and more widely distributed income range than in nations with artificial income compression, even if one enjoys more absolute mobility in the U.S., and have questioned how meaningful such international comparisons are.

Home ownership

Further information: Homeownership in the United StatesThe average home in the United States has more than 700 square feet per person, which is 50%–100% more than the average in other high-income countries. Similarly, ownership rates of gadgets and amenities are relatively high compared to other countries.

Between June 2007 and November 2008 the global recession led to falling asset prices around the world. Assets owned by Americans lost about a quarter of their value. Since peaking in the second quarter of 2007, household wealth is down $14 trillion. The Fed also said that at the end of 2008, the debt owed by nonfinancial sectors was $33.5 trillion, including household debt valued at $13.8 trillion.

Profits and wages

In March 2013, as the stock market's Dow Jones Industrial Average set record highs, household and personal income were both down sharply from their 2007 peaks. In 1970, wages represented more than 51% of the U.S. GDP and profits were less than 5%. But by 2013, wages had fallen to 44% of the economy, while profits had more than doubled to 11%. Inflation-adjusted ("real") per-capita disposable personal income rose steadily in the U.S. from 1945 to 2008, but has since remained generally level.

In 2005, median personal income for those over the age of 18 ranged from $3,317 for an unemployed, married Asian American female to $55,935 for a full-time, year-round employed Asian American male. According to the US Census men tended to have higher income than women while Asians and Whites earned more than African Americans and Hispanics. The overall median personal income for all individuals over the age of 18 was $24,062 ($32,140 for those age 25 or above) in the year 2005.

The overall median income for all 155 million persons over the age of 15 who worked with earnings in 2005 was $28,567. As a reference point, the minimum wage rate in 2009 was $7.25 per hour or $15,080 for the 2080 hours in a typical work year. The minimum wage is a little more than the poverty level for a single person unit and about 50% of the poverty level for a family of four.

Poverty

Main article: Poverty in the United StatesThe gap in income between rich and poor is greater in the United States than in any other developed country. Starting in the 1980s relative poverty rates have consistently exceeded those of other wealthy nations, though analyses using a common data set for comparisons tend to find that the U.S. has a lower absolute poverty rate by market income than most other wealthy nations. Extreme poverty in the United States, meaning households living on less than $2 per day before government benefits, doubled from 1996 levels to 1.5 million households in 2011, including 2.8 million children. In 2013, child poverty reached record high levels, with 16.7 million children living in food insecure households, about 35% more than 2007 levels.

Half of the U.S. population lives in poverty or is low-income, according to U.S. census data. According to a survey by the Associated Press, four out of five U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives. Feeding America reported in 2014 that 49 million Americans are "food insecure."

The population in extreme-poverty neighborhoods rose by one-third from 2000 to 2009. People living in such neighborhoods tend to suffer from inadequate access to quality education; higher crime rates; higher rates of physical and psychological ailment; limited access to credit and wealth accumulation; higher prices for goods and services; and constrained access to job opportunities. As of 2013, 44% of America's poor are considered to be in "deep poverty," with an income 50% or more below the government's official poverty line.

There were about 643,000 sheltered and unsheltered homeless persons in the U.S. on a single night in January 2009. Almost two-thirds stayed in an emergency shelter or transitional housing program and the other third were living on the street, in an abandoned building, or another place not meant for human habitation. About 1.56 million people, or about 0.5% of the U.S. population, used an emergency shelter or a transitional housing program between October 1, 2008 and September 30, 2009. Around 44% of homeless people are employed.

The United States has one of the least extensive social safety nets in the developed world, reducing both relative poverty and absolute poverty by considerably less than the mean for wealthy nations. The living standards for the poor in the United States are also among the highest in the world. However, over the last three decades the poor in America have been incarcerated at a much higher rate than their counterparts in other developed nations, with penal confinement being "commonplace for poor men of working age." Some scholars contend that the shift to neoliberal social and economic policies starting in the late 1970s has expanded the penal state, retrenched the social welfare state, deregulated the economy and criminalized poverty, ultimately "transforming what it means to be poor in America."

Financial position

Main article: Financial position of the United States

The overall financial position of the United States as of 2014 includes $269.6 trillion of assets owned by households, businesses, and governments within its borders, representing more than 15.7 times the annual gross domestic product of the United States. Debts owed during this same period amounted to $145.8 trillion, about 8.5 times the annual gross domestic product.

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Lawrence Summers, Matthew Yglesias and other economists state that at such low rates, government debt borrowing saves taxpayer money, and improves creditworthiness.

In the late 1940s through the early 1970s, the US and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay so low. In January 2012, the U.S. Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association unanimously recommended that government debt be allowed to auction even lower, at negative absolute interest rates.

Now that the connection between public and private debt is better-known, U.S. combined debts are worrisome. See Causes of the Great Depression: Debt Deflation.

Composition of economic sectors

Main article: Economy of the United States by sector See also: Technological and industrial history of the United States and Agriculture in the United States

The United States is the world's largest manufacturer, with a 2013 industrial output of US$2.4 trillion. Its manufacturing output is greater than of Germany, France, India, and Brazil combined. Its main industries include petroleum, steel, automobiles, construction machinery, aerospace, agricultural machinery, telecommunications, chemicals, electronics, food processing, consumer goods, lumber, and mining.

The US leads the world in airplane manufacturing, which represents a large portion of US industrial output. American companies such as Boeing, Cessna (see: Textron), Lockheed Martin (see: Skunk Works), and General Dynamics produce a majority of the world's civilian and military aircraft in factories across the United States.

The manufacturing sector of the U.S. economy has experienced substantial job losses over the past several years. In January 2004, the number of such jobs stood at 14.3 million, down by 3.0 million jobs, or 17.5 percent, since July 2000 and about 5.2 million since the historical peak in 1979. Employment in manufacturing was its lowest since July 1950. The number of steel workers fell from 500,000 in 1980 to 224,000 in 2000.

The U.S. produces approximately 18% of the world's manufacturing output, a share that has declined as other nations developed competitive manufacturing industries. The job loss during this continual volume growth is the result of multiple factors including increased productivity, trade, and secular economic trends. In addition, growth in telecommunications, pharmaceuticals, aircraft, heavy machinery and other industries along with declines in low end, low skill industries such as clothing, toys, and other simple manufacturing have resulted in some U.S. jobs being more highly skilled and better paying. There has been much debate within the United States on whether the decline in manufacturing jobs are related to American unions, lower foreign wages, or both.

Although agriculture comprises less than two percent of the economy, the United States is a net exporter of food. With vast tracts of temperate arable land, technologically advanced agribusiness, and agricultural subsidies, the United States controls almost half of world grain exports. Products include wheat, corn, other grains, fruits, vegetables, cotton; beef, pork, poultry, dairy products; forest products; fish.

Notable companies and markets

See also: Forbes 500 and Fortune 500

In 2011, the 20 largest U.S.-based companies by revenue were Walmart, ExxonMobil, Chevron, ConocoPhillips, Fannie Mae, General Electric, Berkshire Hathaway, General Motors, Ford Motor Company, Hewlett-Packard, AT&T, Cargill, McKesson Corporation, Bank of America, Federal Home Loan Mortgage Corporation, Apple Inc., Verizon, JPMorgan Chase, and Cardinal Health.

In 2013, eight of the world's ten largest companies by market capitalization were American: Apple Inc., Exxon Mobil, Berkshire Hathaway, Wal-Mart, General Electric, Microsoft, IBM, and Chevron Corporation.

According to Fortune Global 500 2011, the ten largest U.S. employers were Walmart, U.S. Postal Service, IBM, UPS, McDonald's, Target Corporation, Kroger, The Home Depot, General Electric, and Sears Holdings.

Apple, Google, IBM, McDonald's, and Microsoft are the world's five most valuable brands in an index published by Millward Brown.

A 2012 Deloitte report published in STORES magazine indicated that of the world's top 250 largest retailers by retail sales revenue in fiscal year 2010, 32% of those retailers were based in the United States, and those 32% accounted for 41% of the total retail sales revenue of the top 250. Amazon.com is the world's largest online retailer.

Half of the world's 20 largest semiconductor manufacturers by sales were American-origin in 2011.

Most of the world's largest charitable foundations were founded by Americans.

American producers create nearly all of the world's highest-grossing films. Many of the world's best-selling music artists are based in the United States. U.S. tourism sector welcomes approximately 60 million international visitors every year. The Wall Street Journal is the most circulated newspaper in the United States, reflecting strong business, finance, market and entrepreneurial culture in the US economy.

Forbes top 10 U.S. corporations by revenue

Further information: List of largest companies by revenueTop 10 U.S. corporations by revenue in 2013

| RANK | CORPORATION | REVENUE $ millions 2012 | PROFIT $ millions 2012 | ASSETS 12/31/12 | DEBT RATIO 12/31/12 | HEADQUARTERS | EMPLOYEES 2012 | MARKET CAP 4/1/13 $ billions | INDUSTRY |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Exxon Mobil | 454,926 | 41,060 | 334 | 50% | Irving, TX | 99,100 | 403 | Energy |

| 2 | Wal-Mart Stores | 446,950 | 15,699 | 203 | 62% | Bentonville, AR | 2,200,000 | 246 | Retail |

| 3 | Chevron | 245,621 | 26,895 | 233 | 41% | San Ramon, CA | 61,189 | 230 | Energy |

| 4 | ConocoPhillips | 245,621 | 12,436 | 117 | 59% | Houston, TX | 29,800 | 73 | Energy |

| 5 | General Motors | 150,476 | 9,190 | 149 | 76% | Detroit, MI | 202,000 | 38 | Auto |

| 6 | General Electric | 147,616 | 14,151 | 685 | 82% | Fairfield, Connecticut | 301,000 | 240 | Diversified |

| 7 | Berkshire Hathaway | 143,688 | 10,254 | 427 | 56% | Omaha, NE | 288,500 | 259 | Diversified |

| 8 | Fannie Mae | 137,451 | −16,855 | 3,221 | 99% | Washington D.C. | 7,300 | 1 | Finance |

| 9 | Ford Motor | 136,264 | 20,213 | 190 | 91% | Dearborn, MI | 164,000 | 50 | Auto |

| 10 | Hewlett-Packard | 127,245 | 7,074 | 108 | 80% | Palo Alto, CA | 350,610 | 43 | Computers |

Energy, transportation, and telecommunications

Main articles: Energy in the United States, Transportation in the United States, and Internet in the United States

The United States is the second largest energy consumer in total use. The U.S. ranks seventh in energy consumption per-capita after Canada and a number of other countries. The majority of this energy is derived from fossil fuels: in 2005, it was estimated that 40% of the nation's energy came from petroleum, 23% from coal, and 23% from natural gas. Nuclear power supplied 8.4% and renewable energy supplied 6.8%, which was mainly from hydroelectric dams although other renewables are included.

American dependence on oil imports grew from 24% in 1970 to 65% by the end of 2005. Transportation has the highest consumption rates, accounting for approximately 69% of the oil used in the United States in 2006, and 55% of oil use worldwide as documented in the Hirsch report.

In 2013, the United States imported 2,808 million barrels of crude oil, compared to 3,377 million barrels in 2010. While the U.S. is the largest importer of fuel, the Wall Street Journal reported in 2011 that the country was about to become a net fuel exporter for the first time in 62 years. The paper reported expectations that this would continue until 2020. In fact, petroleum was the major export from the country in 2011.

Internet was developed in the U.S. and the country hosts many of the world's largest hubs.

The state of California is currently constructing the nation's first high-speed rail system.

Finance

Measured by value of its listed companies' securities, the New York Stock Exchange is more than three times larger than any other stock exchange in the world. As of October 2008, the combined capitalization of all domestic NYSE listed companies was US$10.1 trillion. NASDAQ is another American stock exchange and the world's 3rd largest exchange after the New York Stock Exchange and Japan's Tokyo Stock Exchange. However NASDAQ's trade value is larger than Japan's TSE. NASDAQ is the largest electronic screen-based equity securities trading market in the U.S. With approximately 3,800 companies and corporations, it has more trading volume per hour than any other stock exchange.

Because of the influential role that the US stock market plays in international finance, a New York University study in late 2014 interprets that in the short run, shocks that affect the willingness to bear risk independently of macroeconomic fundamentals explain most of the variation in the US stock market. In the long run, the US stock market is profoundly affected by shocks that reallocate the rewards of a given level of production between workers and shareholders. Productivity shocks however play a small role in historical stock market fluctuations at all horizons in the US stock market.

The U.S. finance industry comprised only 10% of total non-farm business profits in 1947, but it grew to 50% by 2010. Over the same period, finance industry income as a proportion of GDP rose from 2.5% to 7.5%, and the finance industry's proportion of all corporate income rose from 10% to 20%. The mean earnings per employee hour in finance relative to all other sectors has closely mirrored the share of total U.S. income earned by the top 1% income earners since 1930. The mean salary in New York City's finance industry rose from $80,000 in 1981 to $360,000 in 2011, while average New York City salaries rose from $40,000 to $70,000. In 1988, there were about 12,500 U.S. banks with less than $300 million in deposits, and about 900 with more deposits, but by 2012, there were only 4,200 banks with less than $300 million in deposits in the U.S., and over 1,800 with more.

Top ten U.S. banks by assets

| Rank | Bank | Assets $ millions 12/31/12 | Profit $ millions 2012 | Headquarters | Employees |

| 1 | JP Morgan Chase | 2,359,000 | 21,280 | New York, NY | 258,965 |

| 2 | Bank of America | 2,209,000 | 4,188 | Charlotte, NC | 276,600 |

| 3 | Citigroup | 1,865,000 | 7,415 | New York, NY | 259,000 |

| 4 | Wells Fargo | 1,422,000 | 18,890 | San Francisco, CA | 265,000 |

| 5 | Goldman Sachs | 923,220 | 7,475 | New York, NY | 57,726 |

| 6 | Morgan Stanley | 749,890 | −117 | New York, NY | 57,726 |

| 7 | U.S. Bancorp | 353,000 | 5,600 | Minneapolis, MN | 62,529 |

| 8 | Bank of NY Mellon | 359,301 | 2,569 | New York, NY | 48,700 |

| 9 | HSBC North American Holdings | 318,801 | N/A | New York, NY | 43,000 |

| 10 | Capital One Financial | 286,602 | 3,517 | Tysons Corner, VA | 35,593 |

As 2012 International Monetary Fund study concluded that the US financial sector has grown so large that it is slowing economic growth. New York University economist Thomas Philippon confirmed those findings, estimating that the US spends $300 billion too much on financial services per year, and that the sector needs to shrink by 20%. Harvard University and University of Chicago economists agreed, calculating in 2014 that workers in research and development add $5 to the GDP for each dollar they earn, but finance industry workers cause the GDP to shrink by $0.60 for every dollar they are paid.

Health care

Main article: Health care in the United States

Many distinct organizations provide health care in the US. Facilities are largely owned and operated by private sector businesses. Health insurance for public sector employees is primarily provided by the government. 60–65% of healthcare provision and spending comes from programs such as Medicare, Medicaid, TRICARE, the Children's Health Insurance Program, and the Veterans Health Administration. Most of the population under 65 is insured by their or a family member's employer, some buy health insurance on their own, and the remainder are uninsured. On March 23, 2010, the Patient Protection and Affordable Care Act (PPACA) became law, providing for major changes in health insurance. Of 17 high-income countries studied by the National Institutes of Health in 2013, the United States ranked at or near the top in obesity rate, frequency of automobile use and accidents, homicides, infant mortality rate, incidence of heart and lung disease, sexually transmitted infections, adolescent pregnancies, recreational drug or alcohol deaths, injuries, and rates of disability. Together, such lifestyle and societal factors place the U.S. at the bottom of that list for life expectancy. On average, a U.S. male can be expected to live almost four fewer years than those in the top-ranked country, though Americans who reach age 75 live longer than those who reach that age in peer nations.

A comprehensive 2007 study by European doctors found the five-year cancer survival rate was significantly higher in the U.S. than in all 21 European nations studied, 66.3% for men versus the European mean of 47.3% and 62.9% versus 52.8% for women. Americans undergo cancer screenings at significantly higher rates than people in other developed countries, and access MRI and CT scans at the highest rate of any OECD nation. People in the U.S. diagnosed with high cholesterol or hypertension access pharmaceutical treatments at higher rates than those diagnosed in other developed nations, and are more likely to successfully control the conditions. Diabetics are more likely to receive treatment and meet treatment targets in the U.S. than in Canada, England, or Scotland.

The U.S. is a global leader in medical innovation. America solely developed or contributed significantly to 9 of the top 10 most important medical innovations since 1975 as ranked by a 2001 poll of physicians, while the EU and Switzerland together contributed to five. Since 1966, Americans have received more Nobel Prizes in Medicine than the rest of the world combined. From 1989 to 2002, four times more money was invested in private biotechnology companies in America than in Europe.

According to the World Health Organization (WHO), the United States spent more on health care per capita ($7,146), and more on health care as percentage of its GDP (15.2%), than any other nation in 2008. In 2010, 49.9 million residents or 16.3% of the population reported not carrying health insurance to the U.S. Census. Of that number 18.3 million had annual household incomes at or greater than $50,000, 9.5 million had household incomes of $75,000 or higher, 16.2 million had household incomes of less than $25,000, 27.2 million were under age 35, and 9.7 million were non-citizens. The Census has stated that its surveys likely underreport insurance coverage. For example, a quality control analysis revealed that 16.9% of those enrolled in Medicaid incorrectly reported being uninsured. Analyses have also shown that millions of uninsured are eligible for coverage through programs like Medicaid but have not signed up or have let their enrollments expire. According to Physicians for a National Health Program, this lack of insurance causes roughly 48,000 unnecessary deaths per year. The group's methodology has been criticized by John C. Goodman for not looking at cause of death or tracking insurance status changes over time, including the time of death. A 2009 study by former Clinton policy adviser Richard Kronick found no increased mortality from being uninsured after certain risk factors were controlled for.

The high cost of health care in the United States is attributed variously to technological advance, administration costs, drug pricing, suppliers charging more for medical equipment, the receiving of more medical care than people in other countries, the high wages of doctors, government regulations, the impact of lawsuits, and third party payment systems insulating consumers from the full cost of treatments. The lowest prices for pharmaceuticals, medical devices, and payments to physicians are in government plans. Americans tend to receive more medical care than people do in other countries, which is a notable contributor to higher costs. In the United States, a person is more likely to receive open heart surgery after a heart attack than in other countries. Medicaid pays less than Medicare for many prescription drugs due to the fact Medicaid discounts are set by law, whereas Medicare prices are negotiated by private insurers and drug companies. Government plans often pay less than overhead, resulting in healthcare providers shifting the cost to the privately insured through higher prices.

International trade

Main article: Foreign trade of the United States See also: List of exports of the United States

The United States is the world's second largest trading nation. There is a large amount of U.S. dollars in circulation all around the planet; about 60% of funds used in international trade are U.S. dollars. The dollar is also used as the standard unit of currency in international markets for commodities such as gold and petroleum.

In 2013, U.S. exports goods and services amounted to $2.27 trillion and imports goods and services amounted to $2.74 trillion, with a trade deficit was $450.3 billion. The deficit on petroleum products was $232 billion. The trade deficit with China was $318 billion in 2013, a new record and up from $304 million in 1983.

The United States had a $231 billion surplus on trade in services, and $703 billion deficit on trade in goods in 2013. China has expanded its foreign exchange reserves, which included $1.6 trillion of U.S. securities as of 2013. In 2010, the ten largest trading partners of the U.S. were Canada, China, Mexico, Japan, Germany, the United Kingdom, South Korea, France, Taiwan, and Brazil.

According to the KOF Index of Globalization and the Globalization Index by A.T. Kearney/Foreign Policy Magazine, the U.S. has a relatively high degree of globalization. U.S. workers send a third of all remittances in the world.

Currency and central bank

Main articles: United States dollar and Federal Reserve System

The United States dollar is the unit of currency of the United States. The U.S. dollar is the currency most used in international transactions. Several countries use it as their official currency, and in many others it is the de facto currency.

The federal government attempts to use both monetary policy (control of the money supply through mechanisms such as changes in interest rates) and fiscal policy (taxes and spending) to maintain low inflation, high economic growth, and low unemployment. A private central bank, known as the Federal Reserve, was formed in 1913 to supposedly provide a stable currency and monetary policy. The U.S. dollar has been regarded as one of the more stable currencies in the world and many nations back their own currency with U.S. dollar reserves.

The U.S. dollar has maintained its position as the world's primary reserve currency, although it is gradually being challenged in that role. Almost two-thirds of currency reserves held around the world are held in US dollars, compared to around 25% for the next most popular currency, the Euro. Rising US national debt and quantitative easing has caused some to predict that the US Dollar will lose its status as the world's reserve currency, however these predictions have not come to fruition.

Law and government

The United States ranked 4th in the Ease of Doing Business Index in 2012, 18th in the Economic Freedom of the World index by the Fraser Institute in 2012, 10th in the Index of Economic Freedom by the Wall Street Journal and Heritage Foundation in 2012, 15th in the 2014 Global Enabling Trade Report, and 3rd on the Global Competitiveness Report.

According to the 2014 Index of Economic Freedom, released by the Wall Street Journal and Heritage Foundation, the US has dropped out of the top 10 most economically free countries. The US has been on a steady 7 year economic freedom decline and is the only country to do so. The index measures each nation's commitment to free enterprise on a scale of 0 to 100. Countries losing economic freedom and receiving low index scores are at risk of economic stagnation, high unemployment rates, and diminishing social conditions. The 2014 Index of Economic Freedom gave the United States a score of 75.5 and is listed as the 12th freest economy in world. It dropped two rankings and its score is half a point lower than in 2013.

Regulations

The U.S. federal government regulates private enterprise in numerous ways. Regulation falls into two general categories.

Some efforts seek, either directly or indirectly, to control prices. Traditionally, the government has sought to create state-regulated monopolies such as electric utilities from while allowing prices in the level that would ensure them normal profits. At times, the government has extended economic control to other kinds of industries as well. In the years following the Great Depression, it devised a complex system to stabilize prices for agricultural goods, which tend to fluctuate wildly in response to rapidly changing supply and demand. A number of other industries—trucking and, later, airlines—successfully sought regulation themselves to limit what they considered as harmful price-cutting, a process called regulatory capture.

Another form of economic regulation, antitrust law, seeks to strengthen market forces so that direct regulation is unnecessary. The government—and, sometimes, private parties—have used antitrust law to prohibit practices or mergers that would unduly limit competition.

Bank regulation in the United States is highly fragmented compared to other G10 countries where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. The U.S. also has one of the most highly regulated banking environments in the world; however, many of the regulations are not soundness related, but are instead focused on privacy, disclosure, fraud prevention, anti-money laundering, anti-terrorism, anti-usury lending, and promoting lending to lower-income segments.

Since the 1970s, government has also exercised control over private companies to achieve social goals, such as improving the public's health and safety or maintaining a healthy environment. For example, the Occupational Safety and Health Administration provides and enforces standards for workplace safety, and the United States Environmental Protection Agency provides standards and regulations to maintain air, water, and land resources. The U.S. Food and Drug Administration regulates what drugs may reach the market, and also provides standards of disclosure for food products.

American attitudes about regulation changed substantially during the final three decades of the 20th century. Beginning in the 1970s, policy makers grew increasingly convinced that economic regulation protected companies at the expense of consumers in industries such as airlines and trucking. At the same time, technological changes spawned new competitors in some industries, such as telecommunications, that once were considered natural monopolies. Both developments led to a succession of laws easing regulation.

While leaders of America's two most influential political parties generally favored economic deregulation during the 1970s, 1980s, and 1990s, there was less agreement concerning regulations designed to achieve social goals. Social regulation had assumed growing importance in the years following the Depression and World War II, and again in the 1960s and 1970s. During the 1980s, the government relaxed labor, consumer and environmental rules based on the idea that such regulation interfered with free enterprise, increased the costs of doing business, and thus contributed to inflation. The response to such changes is mixed; many Americans continued to voice concerns about specific events or trends, prompting the government to issue new regulations in some areas, including environmental protection.

Where legislative channels have been unresponsive, some citizens have turned to the courts to address social issues more quickly. For instance, in the 1990s, individuals, and eventually the government itself, sued tobacco companies over the health risks of cigarette smoking. The 1998 Tobacco Master Settlement Agreement provided states with long-term payments to cover medical costs to treat smoking-related illnesses.

Between 2000 and 2008, economic regulation in the United States saw the most rapid expansion since the early 1970s. The number of new pages in the Federal Registry, a proxy for economic regulation, rose from 64,438 new pages in 2001 to 78,090 in new pages in 2007, a record amount of regulation. Economically significant regulations, defined as regulations which cost more than $100 million a year, increased by 70%. Spending on regulation increased by 62% from $26.4 billion to $42.7 billion.

Taxation

Main article: Taxation in the United States

Taxation in the United States is a complex system which may involve payment to at least four different levels of government and many methods of taxation. Taxes are levied by the federal government, by the state governments, and often by local governments, which may include counties, municipalities, township, school districts, and other special-purpose districts, which include fire, utility, and transit districts.

Forms of taxation include taxes on income, property, sales, imports, payroll, estates and gifts, as well as various fees. When taxation by all government levels taken into consideration, the total taxation as percentage of GDP was approximately a quarter of GDP in 2011. Share of black market in the U.S. economy is very low compared to other countries.

Although a federal wealth tax is prohibited by the United States Constitution unless the receipts are distributed to the States by their populations, state and local government property tax amount to a wealth tax on real estate, and because capital gains are taxed on nominal instead of inflation-adjusted profits, the capital gains tax amounts to a wealth tax on the inflation rate.

U.S. taxation is generally progressive, especially at the federal level, and is among the most progressive in the developed world. There is debate over whether taxes should be more or less progressive.

Expenditure

Main articles: United States federal budget and United States public debt

The United States public-sector spending amounts to about 30% of GDP.

Each level of government provides many direct services. The federal government, for example, is responsible for national defense, research that often leads to the development of new products, conducts space exploration, and runs numerous programs designed to help workers develop workplace skills and find jobs (including higher education). Government spending has a significant effect on local and regional economies—and on the overall pace of economic activity.

State governments, meanwhile, are responsible for the construction and maintenance of most highways. State, county, or city governments play the leading role in financing and operating public schools. Local governments are primarily responsible for police and fire protection.

The welfare system in the United States began in the 1930s, during the Great Depression, with the passage of the New Deal. The welfare system was later expanded in the 1960s through Great Society legislation, which included Medicare, Medicaid, the Older Americans Act and federal education funding.

Overall, federal, state, and local spending accounted for almost 28% of gross domestic product in 1998.

As of January 20, 2009, the total U.S. federal debt was $10.627 trillion. The borrowing-cap debt ceiling as of 2005 stood at $8.18 trillion. In March 2006, Congress raised that ceiling an additional $0.79 trillion to $8.97 trillion, which is approximately 68% of GDP. Congress has used this method to deal with an encroaching debt ceiling in previous years, as the federal borrowing limit was raised in 2002 and 2003. As of October 4, 2008, the "Emergency Economic Stabilization Act of 2008" raised the current debt ceiling to US$11.3 trillion.

The federal government's debt rose by $680 billion in 2013, and now stands at $17.091 trillion. While the U.S. public debt is the world's largest in absolute size, another measure is its size relative to the nation's GDP. As of October 2013 the debt was 107.0% of GDP. This debt, as a percent of GDP, is still less than the debt of Japan (192%) and roughly equivalent to those of a few western European nations.

Budget

Further information: United States budgetIn Fiscal Year 2012, the U.S. federal government ran a budget deficit of $1.09 trillion. The U.S. federal public debt was $17.07 trillion (107% of GDP) as of October 26, 2013.

Fiscal revenue fiscal year 2012 (Total Receipts)

| Revenue by Source | Revenue $ billions 2012 fiscal year | Percent of revenue |

|---|---|---|

| Individual income taxes | 1,165 | 47.19% |

| Social Security receipts | 841 | 34.06% |

| Corporate taxes | 237 | 9.60% |

| Misc. taxes | 105 | 4.25% |

| Excise taxes | 79 | 3.20% |

| Customs and duties | 31 | 1.26% |

| Estate and gift taxes | 11 | 0.44% |

| Revenue total | 2,469 | 100.00% |

Fiscal expenses fiscal year 2011

| Expenses by department | Expenses $ millions 2011 fiscal year | Percent of expenses |

| Health and Human Services | 891,244 | 24.76% |

| Social Security Administration | 784,194 | 21.79% |

| Defense-Military | 678,073 | 18.84% |

| Treasury | 538,702 | 14.97% |

| Agriculture | 139,399 | 3.87% |

| Labor | 131,973 | 3.67% |

| Veterans Affairs | 126,917 | 3.53% |

| Transportation | 77,302 | 2.15% |

| Office of Personnel Management | 74,091 | 2.06% |

| Education | 65,486 | 1.82% |

| Housing and Urban Development | 57,005 | 1.58% |

| Other Defense Civil Programs | 54,862 | 1.52% |

| Homeland Security | 45,744 | 1.27% |

| Energy | 31,372 | 0.87% |

| Justice | 30,518 | 0.85% |

| State | 24,355 | 0.68% |

| International Assistance Programs | 24,355 | 0.68% |

| National Aeronautics and Space Administration | 17,617 | 0.49% |

| Other independent agencies | 14,496 | 0.40% |

| Interior | 13,529 | 0.38% |

| Environmental Protection Agency | 10,770 | 0.30% |

| Corps of Engineers | 10,138 | 0.28% |

| Commerce | 9,930 | 0.28% |

| Judiciary | 7,295 | 0.20% |

| National Science Foundation | 7,146 | 0.20% |

| Small Business Administration | 6,162 | 0.17% |

| Legislative | 4,583 | 0.13% |

| General Services Administration | 1,889 | 0.05% |

| Expense total | 3,599,285 | 100% |

List of state economies

See also

- Economy of Puerto Rico

- Energy policy of the United States

- Historical Statistics of the United States

- Job creation index

- Labor unions in the United States

- List of industry trade groups in the United States

- World oil market chronology from 2003

References

- "The Global Financial Centres Index 16" (PDF). Long Finance. September 2014.

- ^ "National Income and Product Accounts: 1st Quarter & Annual 2015". Bureau of Economic Analysis. April 29, 2015. Retrieved April 29, 2015.

- "Labor Force Statistics from the Current Population Survey". Bureau of Labor Statistics. Bureau of Labor Statistics. Retrieved July 6, 2014.

- "CONSUMER PRICE INDEX – OCTOBER 2014" (PDF). Bureau of Labor Statistics. Bureau of Labor Statistics. Retrieved December 4, 2014.

- "Income, Poverty and Health Insurance Coverage in the United States: 2013". US Census.

- "OECD Factbook 2013: Economic, Environmental and Social Statistics" (PDF). Organisation for Economic Co-operation and Development.

- Unemployment Level - Civilian Labor Force - LNS13000000

- "Employment Situation Summary". bls.gov.

- "Labor Force Statistics from the Current Population Survey". Bureau of Labor Statistics. Retrieved July 5, 2014.

- ^ Table A-15. Alternative measures of labor underutilization. Bls.gov (October 22, 2013). Retrieved on October 26, 2013.

- ^ "U.S. International Trade in Goods and Services" (PDF). BEA. February 5, 2015.

- "Exports of goods by principal end-use category" (PDF). Census Bureau.

- ^ "Top Trading Partners – December 2014". Census Bureau.

- "Imports of goods by principal end-use category" (PDF). Census Bureau.

- "Stock of Foreign Direct Investment". CIA World Factbook.

- "The Debt to the Penny and Who Holds It". U.S. Treasury Department. Retrieved March 27, 2015.

- ^ "Receipts by Source, 1934-2020". OMB.

- "Outlays by Function, 1940-2020". OMB.

- US Overseas Loans and Grants, usaidallnet.gov, retrieved May 31, 2014

- "Sovereigns rating list". Standard & Poor's. Retrieved August 20, 2011.

- ^ Rogers, Simon; Sedghi, Ami (April 15, 2011). "How Fitch, Moody's and S&P rate each country's credit rating". The Guardian. London. Retrieved May 28, 2011.

- Riley, Charles (August 2, 2011). "Moody's affirms AAA rating, lowers outlook". CNN.

- "Fitch Affirms United States at 'AAA'; Outlook Stable". Fitch Ratings.

- "U.S. International Reserve Position". U.S. Department of Treasury. May 16, 2014. Retrieved May 31, 2014.

- "Report for Selected Countries and Subjects". imf.org.

- Bergmann, Andrew (April 2014). "World's Largest Economies". CNN. CNN Money. Retrieved June 18, 2014.

- "World Nominal GDP". International Monetary Fund. International Monetary Fund. April 2014. Retrieved June 18, 2014.

- "United States Nominal GDP". International Monetary Fund. International Monetary Fund. April 2014. Retrieved June 18, 2014.

- "World GDP PPP". International Monetary Fund. International Monetary Fund. April 2014. Retrieved June 18, 2014.

- "United States GDP PPP". International Monetary Fund. International Monetary Fund. April 2014. Retrieved June 18, 2014.

- "U.S. Economic Outlook". FocusEconomics. FocusEconomicss. November 25, 2014. Retrieved December 19, 2014.

- ^ "The Implementation of Monetary Policy – The Federal Reserve in the International Sphere" (PDF). Retrieved August 24, 2010.

- ^ Benjamin J. Cohen, The Future of Money, Princeton University Press, 2006, ISBN 0-691-11666-0; cf. "the dollar is the de facto currency in Cambodia", Charles Agar, Frommer's Vietnam, 2006, ISBN 0-471-79816-9, p. 17

- U.S. Economy – Basic Conditions & Resources. U.S. Diplomatic Mission to Germany. "The United States is said to have a mixed economy because privately owned businesses and government both play important roles." Accessed: October 24, 2011.

- (4)Outline of the U.S. Economy – (2)How the U.S. Economy Works. U.S. Embassy Information Resource Center. "As a result, the American economy is perhaps better described as a "mixed" economy, with government playing an important role along with private enterprise. Although Americans often disagree about exactly where to draw the line between their beliefs in both free enterprise and government management, the mixed economy they have developed has been remarkably successful." Accessed: October 24, 2011.

- "US GDP Growth Rate by Year". multpl.com. US Bureau of Economic Analysis. March 31, 2014. Retrieved June 18, 2014.

- "Top Trading Partners – August 2014". U.S

Census Bureau. November 2013. Retrieved October 12, 2014.

{{cite web}}: line feed character in|publisher=at position 4 (help) - Wright, Gavin, and Jesse Czelusta, "Resource-Based Growth Past and Present", in Natural Resources: Neither Curse Nor Destiny, ed. Daniel Lederman and William Maloney (World Bank, 2007), p. 185. ISBN 0-8213-6545-2.