| Revision as of 10:26, 11 November 2008 edit193.164.126.35 (talk) →Advantages of credit trade← Previous edit | Latest revision as of 18:25, 11 January 2025 edit undo97.103.116.88 (talk) change link | ||

| Line 1: | Line 1: | ||

| {{Short description|Academic discipline studying businesses and investments}} | |||

| {{articleissues|article=y|prose=January 2008|cleanup=September 2007|unreferenced=June 2007| rewrite = February 2008}} | |||

| {{hatgrp| | |||

| {{other uses}} | |||

| {{Redirect|Financial|the Georgian newspaper|The Financial{{!}}''The Financial''}} | |||

| }} | |||

| {{Finance sidebar}} | {{Finance sidebar}} | ||

| '''Finance''' refers to monetary resources and to the study and ] of ], ], ]s and ].{{efn| | |||

| The field of '''finance''' refers to the concepts of ], ] and ] and how they are interrelated. ]s are the main facilitators of ] through the provision of ], although ], ], ], and other organizations have become important. Financial ]s, known as ]s, are ] with careful attention to ] to control ]. ]s allow many forms of ] assets to be ] on ]s such as ]s, including ] such as ] as well as ] in ]. | |||

| The following are definitions of ''finance'' as crafted by the authors indicated: | |||

| * : "The theory of finance is concerned with how individuals and firms allocate resources through time. In particular, it seeks to explain how solutions to the problems faced in allocating resources through time are facilitated by the existence of capital markets (which provide a means for individual economic agents to exchange resources to be available of different points In time) and of firms (which, by their production-investment decisions, provide a means for individuals to transform current resources physically into resources to be available in the future)." | |||

| * : "Finance is concerned with the raising and administering of funds and with the relationships between private profit-seeking enterprise on the one hand and the groups which supply the funds on the other. These groups, which include investors and speculators — that is, capitalists or property owners — as well as those who advance short-term capital, place their money in the field of commerce and industry and in return expect a stream of income." | |||

| * : "Finance is the application of economic principles to decision-making that involves the allocation of money under conditions of uncertainty." | |||

| * : "Finance may be defined as the position of money at the time it is wanted". | |||

| * : "The term finance can be defined as the management of the flows of money through an organisation, whether it will be a corporation, school, or bank or government agency". | |||

| * : "Finance may be defined as that administrative area or set of administrative functions in an organisation which relates with the arrangement of each debt and credit so that the organisation may have the means to carry out the objectives as satisfactorily as possible". | |||

| *: "Finance is a profession that requires interdisciplinary training and can help the managers of companies make sound decisions about financing, investment, continuity and other issues that affect the inflows and outflows of money, and the risk of the company. It also helps people and institutions invest and plan money-related issues wisely." | |||

| }} As a subject of study, it is related to but distinct from ], which is the study of the ], ], and ] of ].{{efn|The discipline of ] bridges the two fields.}} | |||

| Based on the scope of financial activities in ]s, the discipline can be divided into ], ], and ]. | |||

| In these financial systems, assets are bought, sold, or traded as ]s, such as ], ]s, ], ], ]s, ], ], etc. Assets can also be ]ed, ], and ] to maximize value and minimize loss. In practice, ] are always present in any financial action and entities. | |||

| ==The main techniques and sectors of the financial industry== | |||

| {{main article|Financial services}} | |||

| Due to its wide scope, a broad range of subfields exists within finance. ], ], ] and ] aim to maximize value and minimize ]. ] assesses the viability, stability, and profitability of an action or entity. Some fields are multidisciplinary, such as ], ], ], ] and ]. These fields are the foundation of ] and ]. In some cases, ] can be tested using the ], covered by ]. | |||

| An entity whose income exceeds its expenditure can lend or invest the excess income. On the other hand, an entity whose income is less than its expenditure can raise capital by borrowing or selling equity claims, decreasing its expenses, or increasing its income. The lender can find a borrower, a financial intermediary such as a ], or buy notes or bonds in the ]. The lender receives interest, the borrower pays a higher interest than the lender receives, and the financial intermediary pockets the difference. | |||

| The early history of finance parallels the early ], which is ]. Ancient and medieval civilizations incorporated basic functions of finance, such as banking, trading and accounting, into their economies. In the late 19th century, the ] was formed. | |||

| A bank aggregates the activities of many borrowers and lenders. A bank accepts deposits from lenders, on which it pays the interest. The bank then lends these deposits to borrowers. Banks allow borrowers and lenders, of different sizes, to coordinate their activity. Banks are thus compensators of money flows in space. | |||

| In the middle of the 20th century, finance emerged as a distinct academic discipline,{{efn|The first academic journal, '']'', began publication in 1946.}} separate from economics.<ref>{{Cite web | last=Hayes | first=Adam | title=Finance | url=https://www.investopedia.com/terms/f/finance.asp | website=Investopedia | access-date=2022-08-03 | archive-date=2020-12-19 | archive-url=https://web.archive.org/web/20201219025012/https://www.investopedia.com/terms/f/finance.asp | url-status=live }}</ref> The earliest doctoral programs in finance were established in the 1960s and 1970s.<ref>{{Cite journal |last1=Gippel |first1=Jennifer K |date=2012-11-07 |title=A revolution in finance? |journal=] |language=en |volume=38 |issue=1 |pages=125–146 |doi=10.1177/0312896212461034 |s2cid=154759424 |issn=0312-8962 |doi-access=free }}</ref> | |||

| A specific example of corporate finance is the sale of stock by a company to institutional investors like investment banks, who in turn generally sell it to the public. The stock gives whoever owns it part ownership in that company. If you buy one share of XYZ Inc, and they have 100 shares outstanding (held by investors), you are 1/100 owner of that company. Of course, in return for the stock, the company receives cash, which it uses to expand its business in a process called "equity financing". Equity financing mixed with the sale of bonds (or any other debt financing) is called the company's ]. | |||

| Today, finance is also ] through ]-focused undergraduate and ] programs.<ref> {{Webarchive|url=https://web.archive.org/web/20230131091501/https://www.ucas.com/explore/subjects/finance |date=2023-01-31 }}, ] Subject Guide.</ref><ref>Anthony P. Carnevale, Ban Cheah, Andrew R. Hanson (2015). {{Webarchive|url=https://web.archive.org/web/20221108144220/https://1gyhoq479ufd3yna29x7ubjn-wpengine.netdna-ssl.com/wp-content/uploads/The-Economic-Value-of-College-Majors-Full-Report-web-FINAL.pdf |date=2022-11-08 }}. ].</ref> | |||

| ==The financial system== | |||

| Finance is used by individuals (]), by governments (]), by businesses (]), as well as by a wide variety of organizations including schools and non-profit organizations. In general, the goals of each of the above activities are achieved through the use of appropriate financial instruments, with consideration to their institutional setting. | |||

| ] issued by The Baltimore and Ohio Railroad. Bonds are a form of borrowing used by corporations to finance their operations.]] | |||

| Finance is one of the most important aspects of ]. Without proper financial planning a new enterprise is unlikely to be successful. Managing money (a liquid asset) is essential to ensure a secure future, both for the individual and an organization. | |||

| ] dated 1913 issued by the Radium Hill Company]] | |||

| ] floor c 1960, before the introduction of electronic readouts and computer screens]] | |||

| ==Personal finance== | |||

| ] ] market, 1993]] | |||

| {{main|Personal finance}} | |||

| ], Houston, 2009]] | |||

| Questions in personal finance revolve around | |||

| {{Main|Financial system}} | |||

| *How much money will be needed by an individual (or by a family), and when? | |||

| {{See also|Financial services|financial market|Circular flow of income}} | |||

| *Where will this money come from, and how? | |||

| As outlined, the financial system consists of the flows of capital that take place between individuals and households (]), governments (]), and businesses (]). | |||

| *How can people protect themselves against unforeseen personal events, as well as those in the external economy? | |||

| "Finance" thus studies the process of channeling money from savers and investors to entities that need it.{{efn|Finance thus allows production and consumption in society to operate independently from each other. Without the use of financial allocation, production would have to happen at the same time and space as consumption. Through finance, distances in ] between production and consumption are then posible.<ref>{{cite journal |last1=Allen |first1=Michael |last2=Price |first2=John |title=Monetized time-space: derivatives – money's 'new imaginary'? |journal=Economy and Society |date=2000 |volume=29 |issue=2 |pages=264–284 |doi=10.1080/030851400360497 |s2cid=145739812 |url=https://www.tandfonline.com/doi/abs/10.1080/030851400360497 |access-date=3 June 2022 |archive-date=20 March 2022 |archive-url=https://web.archive.org/web/20220320050529/https://www.tandfonline.com/doi/abs/10.1080/030851400360497 |url-status=live }}</ref>}} | |||

| *How can family assets best be transferred across generations (bequests and inheritance)? | |||

| Savers and investors have money available which could earn interest or dividends if put to productive use. Individuals, companies and governments must obtain money from some external source, such as loans or credit, when they lack sufficient funds to run their operations. | |||

| *How does tax policy (tax subsidies or penalties) affect personal financial decisions? | |||

| *How does credit affect an individual's financial standing? | |||

| *How can one plan for a secure financial future in an environment of economic instability? | |||

| In general, an entity whose income exceeds its ] can lend or invest the excess, intending to earn a fair return. Correspondingly, an entity where income is less than expenditure can raise capital usually in one of two ways: | |||

| Personal financial decisions may involve paying for education, financing ] such as ] and cars, buying ], e.g. health and property insurance, investing and saving for ]. | |||

| (i) by borrowing in the form of a loan (private individuals), or by selling ]; | |||

| (ii) by a corporation selling ], also called stock or shares (which may take various forms: ] or ]). | |||

| The owners of both bonds and stock may be '']s''—financial institutions such as investment banks and ]—or private individuals, called '']'' or ''retail investors.'' (See ].) | |||

| The ] is often indirect, through a ] such as a ], or via the purchase of notes or ] (], ]s, or mutual bonds) in the ]. | |||

| Personal financial decisions may also involve paying for a loan. | |||

| The lender receives interest, the ] pays a higher interest than the lender receives, and the financial intermediary earns the difference for arranging the loan.<ref>See e.g., {{Cite web|title=Financial system|url=https://www.suomenpankki.fi/en/financial-stability/the-financial-system-in-brief/|last=Bank of Finland|author-link=Bank of Finland|access-date=2020-05-18|archive-date=2020-06-02|archive-url=https://web.archive.org/web/20200602105013/https://www.suomenpankki.fi/en/financial-stability/the-financial-system-in-brief/|url-status=live}}</ref><ref>{{Cite web|title=Introducing the Financial System {{!}} Boundless Economics|url=https://courses.lumenlearning.com/boundless-economics/chapter/introducing-the-financial-system/|website=courses.lumenlearning.com|access-date=2020-05-18|archive-date=2020-07-28|archive-url=https://web.archive.org/web/20200728111502/https://courses.lumenlearning.com/boundless-economics/chapter/introducing-the-financial-system/|url-status=live}}</ref><ref>{{Cite web|title=What is the financial system?|url=https://www.ecnmy.org/learn/your-money/banking-and-finance/what-is-the-financial-system/|website=Economy|access-date=2020-05-18|archive-date=2020-07-31|archive-url=https://web.archive.org/web/20200731162128/https://www.ecnmy.org/learn/your-money/banking-and-finance/what-is-the-financial-system/|url-status=live}}</ref> | |||

| A bank aggregates the activities of many borrowers and lenders. A bank accepts deposits from lenders, on which it pays interest. The bank then lends these deposits to borrowers. Banks allow borrowers and lenders, of different sizes, to coordinate their activity. | |||

| Investing typically entails the purchase of ], either individual securities or via a ], for example. Stocks are usually sold by corporations to investors so as to raise required capital in the form of "]", as distinct from the ''debt financing'' described above. The financial intermediaries here are the ]s. The investment banks ] and facilitate the listing of the securities, typically shares and bonds. | |||

| ==Corporate finance== | |||

| Additionally, they facilitate the ]s, which allow their trade thereafter, as well as the various service providers which manage the performance or risk of these investments. These latter include ], ], ], and ], typically servicing ] (private individuals). | |||

| {{main|Corporate finance}} | |||

| ] or ] is the task of providing the funds for a corporation's activities. For ], this is referred to as ]. It generally involves balancing risk and profitability, while attempting to maximize an entity's wealth and the value of its stock. | |||

| Inter-institutional trade and investment, and ], is referred to as "wholesale finance". | |||

| Long term funds are provided by ] and long-term ], often in the form of ]s. The balance between these forms the company's ]. Short-term funding or ] is mostly provided by banks extending a line of credit. | |||

| Institutions here ], with related trading, to include bespoke ], ], and ], as well as ]; this "]" is ], and these institutions are then the major employers of ] (see ]). | |||

| In these institutions, ], ], and ] play major roles. | |||

| <!-- === Six pillars of Finance === | |||

| * ] | |||

| * ] (] & ]) | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] --> | |||

| ==Areas of finance== | |||

| Another business decision concerning finance is investment, or ]. An investment is an acquisition of an ] in the hope that it will maintain or increase its value. In ]{{ndash}} in choosing a ]{{ndash}} one has to decide ''what'', ''how much'' and ''when'' to invest. To do this, a company must: | |||

| As outlined, finance comprises, broadly, the three areas of personal finance, corporate finance, and public finance. | |||

| These, in turn, overlap and employ various activities and sub-disciplines—chiefly ]s, risk management, and ]. | |||

| ===Personal finance=== | |||

| * Identify relevant objectives and constraints: institution or individual goals, time horizon, risk aversion and tax considerations; | |||

| ] consultation—here, the ] counsels the client on an appropriate ].]] | |||

| * Identify the appropriate strategy: active ''v''. passive{{ndash}} hedging strategy | |||

| {{Main|Personal finance}} | |||

| * Measure the portfolio performance | |||

| {{further|Financial planner|Investment advisory}} | |||

| Personal finance refers to the practice of budgeting to ensure enough funds are available to meet basic needs, while ensuring there is only a reasonable level of risk to lose said capital. Personal finance may involve paying for education, financing ]s such as ] and cars, buying ], investing, and saving for ].<ref>{{Cite book|url=https://books.google.com/books?id=DF7FCQAAQBAJ|title=Finance (Speedy Study Guides)|last=Publishing|first=Speedy|date=2015-05-25|publisher=Speedy Publishing LLC|isbn=978-1-68185-667-4|language=en}}</ref> | |||

| Personal finance may also involve paying for a loan or other debt obligations. | |||

| The main areas of personal finance are considered to be income, spending, saving, investing, and protection. | |||

| The following steps, as outlined by the Financial Planning Standards Board,<ref>{{Citation|chapter=Financial Planning Standards Board|date=2019|pages=709–735|publisher=John Wiley & Sons, Ltd|language=en|doi=10.1002/9781119642497.ch80|isbn=9781119642497|title=Financial Planning Competency Handbook|s2cid=242623141|editor1-last=Snowdon|editor1-first=Michael}}</ref> suggest that an individual will understand a potentially secure personal finance plan after: | |||

| * Purchasing insurance to ensure protection against unforeseen personal events; | |||

| * Understanding the effects of tax policies, subsidies, or penalties on the management of personal finances; | |||

| * Understanding the effects of credit on individual financial standing; | |||

| * Developing a savings plan or financing for large purchases (auto, education, home); | |||

| * Planning a secure financial future in an environment of economic instability; | |||

| * Pursuing a checking or a savings account; | |||

| * Preparing for retirement or other long term expenses.<ref>{{Cite web|url=https://www.investopedia.com/terms/p/personalfinance.asp|title=Personal Finance|last=Kenton|first=Will|website=Investopedia|language=en|access-date=2020-01-20|archive-date=2000-08-18|archive-url=https://web.archive.org/web/20000818133538/https://www.investopedia.com/terms/p/personalfinance.asp|url-status=live}}</ref> | |||

| ===Corporate finance=== | |||

| Financial management is duplicate with the financial function of the ]. However, ] is more concerned with the reporting of historical financial information, while the financial decision is directed toward the future of the firm. | |||

| {{Main|Corporate finance|Financial management}} | |||

| {{further|Strategic financial management}} | |||

| Corporate finance deals with the actions that managers take to increase the value of the firm to the shareholders, the sources of funding and the ] of corporations, and the tools and analysis used to allocate financial resources. | |||

| While corporate finance is in principle different from ], which studies the ] of all firms rather than corporations alone, the concepts are applicable to the financial problems of all firms,<ref name="Drake_Fabozzi">Pamela Drake and ] (2009). {{Webarchive|url=https://web.archive.org/web/20230223003858/https://media.wiley.com/product_data/excerpt/52/04704073/0470407352.pdf |date=2023-02-23 }}</ref> | |||

| and this area is then often referred to as "business finance". | |||

| Typically, "corporate finance" relates to the ''long term'' objective of maximizing the value of the ], its ], and its ], while also ]. This entails<ref>See ], {{Webarchive|url=https://web.archive.org/web/20161017190714/http://pages.stern.nyu.edu/~adamodar/New_Home_Page/AppldCF/other/Image2.gif |date=2016-10-17 }}</ref> three primary areas: | |||

| ===Capital=== | |||

| #]: selecting which projects to invest in—here, accurately ] is crucial, as judgements about asset values can be "make or break".<ref name="Irons">{{cite book |last1=Irons |first1=Robert |title=The Fundamental Principles of Finance |date=July 2019 |publisher=Routledge |location=Google Books |isbn=9781000024357 |url=https://play.google.com/store/books/details/Robert_Irons_The_Fundamental_Principles_of_Finance?id=tzr3DwAAQBAJ&hl=en_US&gl=US |access-date=3 April 2021 |archive-date=11 November 2021 |archive-url=https://web.archive.org/web/20211111150837/https://play.google.com/store/books/details/Robert_Irons_The_Fundamental_Principles_of_Finance?id=tzr3DwAAQBAJ&hl=en_US&gl=US |url-status=live }}</ref> | |||

| {{main|Financial capital}} | |||

| #]: the use of "excess" funds—these are to be reinvested in the business or returned to shareholders. | |||

| #]: deciding on the mix of funding to be used—here attempting to find the ] re debt-commitments vs ]. | |||

| The latter ] with ] and ], as above, in that the capital raised will generically comprise debt, i.e. ]s, and ], often ]. | |||

| Re risk management within corporates, see ]. | |||

| Financial managers—i.e. as distinct from corporate financiers—focus more on the ''short term'' elements of profitability, cash flow, and "]" (], credit and ]s), ensuring that the firm can ] carry out its financial ''and operational'' objectives; i.e. that it: | |||

| ], in the financial sense, is the money that gives the business the power to buy goods to be used in the production of other goods or the offering of a service. | |||

| (1) can service both maturing short-term debt repayments, and scheduled long-term debt payments, | |||

| and (2) has sufficient cash flow for ongoing and upcoming ]. (See ] and ].) | |||

| <!-- At more senior levels, financial managers are also involved with the longer term ] re capital structure and -investment. | |||

| --> | |||

| ===Public finance=== | |||

| ===The desirability of budgeting=== | |||

| ], speaking on the ] in 2007, ] from ]]] | |||

| Budget is a document which documents the Plan of the business, This may include the objective of business, Targets set, and results in financial terms, e.g. The target set for sale, resulting cost, growth, required investment to achieve the planned sales, and financing source for the investment. | |||

| ] | |||

| Also Budget may be long term or short term. Long Term have a time horizon of 5-10 years giving a vision to the company, short term is an annual budget which is drawn to control and operate in that particular year. | |||

| {{Main|Public finance}} | |||

| ====Capital budget==== | |||

| Public finance describes finance as related to sovereign states, sub-national entities, and related public entities or agencies. It generally encompasses a long-term strategic perspective regarding investment decisions that affect public entities.<ref>{{cite book|last1=Doss|first1=Daniel|last2=Sumrall|first2=William|last3=Jones|first3=Don|title=Strategic Finance for Criminal Justice Organizations|date=2012|publisher=CRC Press|location=Boca Raton, Florida|isbn=978-1439892237|page=23|edition=1st}}</ref> These long-term strategic periods typically encompass five or more years.<ref>{{cite book|last1=Doss|first1=Daniel|last2=Sumrall|first2=William|last3=Jones|first3=Don|title=Strategic Finance for Criminal Justice Organizations|date=2012|publisher=CRC Press|location=Boca Raton, Florida|isbn=978-1439892237|pages=53–54|edition=1st}}</ref> Public finance is primarily concerned with:<ref>{{Cite book |first1=Sharon |last1=Kioko |first2=Justin |last2=Marlowe |title=Financial Strategy for Public Managers |publisher=Rebus Foundation |url=https://press.rebus.community/financialstrategy/ |year=2016 |isbn=978-1-927472-59-0 |access-date=2022-07-05 |archive-date=2022-06-15 |archive-url=https://web.archive.org/web/20220615185910/https://press.rebus.community/financialstrategy/ |url-status=live }}</ref> | |||

| This concerns fixed asset requirements for the next five years and how these will be financed. | |||

| * Identification of ] of a public sector entity; | |||

| * Source(s) of that ]; | |||

| * The ]; | |||

| * Sovereign ], or ]s for ] projects. | |||

| Central banks, such as the ] banks in the ] and the ] in the ], are strong players in public finance. They act as ] as well as strong influences on monetary and credit conditions in the economy.<ref>Board of Governors of Federal Reserve System of the United States. Mission of the Federal Reserve System. Accessed: 2010-01-16. (Archived by WebCite at {{webarchive|url=https://web.archive.org/web/20100114154328/http://www.federalreserve.gov/aboutthefed/mission.htm |date=2010-01-14 }})</ref> | |||

| ====Cash budget==== | |||

| Working capital requirements of a business should be monitored at all times to ensure that there are sufficient funds available to meet short-term expenses. | |||

| ], which is related, concerns investment in ] projects provided by a ] on a non-commercial basis; these projects would otherwise not be able ]. | |||

| The cash budget is basically a detailed plan that shows all expected sources and uses of cash. The cash budget has the following six main sections: | |||

| A ] is primarily used for ] projects: a private sector corporate provides the financing up-front, and then draws profits from taxpayers or users. | |||

| ], and the related ], address the financial strategies, resources ] used in ]. | |||

| ===Investment management=== | |||

| '''1. Beginning Cash Balance''' - contains the last period's closing cash balance. | |||

| ]s listed in a Korean newspaper]] | |||

| ], shortly before the ]]] | |||

| ] | |||

| {{main|Investment management}} | |||

| {{see also|Active management|Passive management}} | |||

| Investment management<ref name = "Drake_Fabozzi"/> is the professional asset management of various securities—typically shares and bonds, but also other assets, such as real estate, commodities and ]s—in order to meet specified investment goals for the benefit of investors. | |||

| As above, investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, ], or ]s. | |||

| '''2. Cash collections''' - includes all expected cash receipts (all sources of cash for the period considered, mainly sales) | |||

| At the heart of investment management<ref name = "Drake_Fabozzi"/> is ]—] among these ], and among individual securities within each asset class—as appropriate to the client's ], in turn, a function of risk profile, investment goals, and investment horizon (see ]). Here: | |||

| '''3. Cash disbursements''' - lists all planned cash outflows for the period, excluding interest payments on short-term loans, which appear in the financing section. All expenses that do not affect cash flow are excluded from this list (e.g. depreciation, amortisation, etc) | |||

| *] is the process of selecting the best portfolio given the client's objectives and constraints. | |||

| *] is the approach typically applied in ] and evaluating the individual securities. | |||

| *] is about forecasting future asset prices with past data.<ref>{{Cite journal |last1=Han |first1=Yufeng |last2=Liu |first2=Yang |last3=Zhou |first3=Guofu |last4=Zhu |first4=Yingzi |date=2021-05-21 |title=Technical Analysis in the Stock Market: A Review |url=https://papers.ssrn.com/abstract=3850494 |language=en |location=Rochester, NY|doi=10.2139/ssrn.3850494 |ssrn=3850494 |s2cid=235195430 |website=SSRN Papers}}</ref> | |||

| Overlaid is the portfolio manager's ]—broadly, ] vs ], ] vs ], and ] vs. ]—and ]. | |||

| '''4. Cash excess or deficiency''' - a function of the cash needs and cash available. Cash needs are determined by the total cash disbursements plus the minimum cash balance required by company policy. If total cash available is less than cash needs, a deficiency exists. | |||

| In a well-diversified portfolio, achieved ] will, in general, largely be a function of the asset mix selected, while the individual securities are less impactful. The specific approach or philosophy will also be significant, depending on the extent to which it is complementary with the ]. | |||

| '''5. Financing''' - discloses the planned borrowings and repayments, including interest. | |||

| Risk management here is discussed immediately below. | |||

| A ] is managed using ] (increasingly, ]) instead of human judgment. The actual trading ] via ]. | |||

| '''6. Ending Cash balance''' - simply reveals the planned ending cash balance. | |||

| === |

===Risk management=== | ||

| ]]] | |||

| ====Credit policy==== | |||

| ] branch in the ] to withdraw their savings during the ]]] | |||

| Credit gives the customer the opportunity to buy goods and services, and pay for them at a later date. | |||

| {{main|Financial risk management}} | |||

| ], in general, is the study of how to control risks and balance the possibility of gains; it is the process of measuring risk and then developing and implementing strategies to manage that risk. | |||

| ]<ref name="Christoffersen2011">{{Cite book |last=Peter F. Christoffersen |url=https://books.google.com/books?id=YkcMBGYbRasC |title=Elements of Financial Risk Management |date=22 November 2011 |publisher=Academic Press |isbn=978-0-12-374448-7}}</ref><ref name="Malz2011">{{Cite book |last=Allan M. Malz |url=https://books.google.com/books?id=rFX2f6AxH1QC |title=Financial Risk Management: Models, History, and Institutions |date=13 September 2011 |publisher=John Wiley & Sons |isbn=978-1-118-02291-7}}</ref> is the practice of protecting ] against ]s, often by ] exposure to these using financial instruments. | |||

| The focus is particularly on credit and market risk, and in banks, through regulatory capital, includes operational risk. | |||

| *] is the risk of ] that may arise from a borrower failing to make required payments; | |||

| *] relates to losses arising from movements in market variables such as prices and exchange rates; | |||

| *] relates to failures in internal processes, people, and systems, or to external events. | |||

| Financial risk management is ]<ref name = "Drake_Fabozzi"/> in two ways. | |||

| Firstly, firm exposure to market risk is a direct result of previous capital investments and funding decisions; | |||

| while credit risk arises from the business's credit policy and is often addressed through ] and ]. | |||

| Secondly, both disciplines share the goal of enhancing or at least preserving, the firm's ], and in this context<ref>John Hampton (2011). ''The AMA Handbook of Financial Risk Management''. ]. {{ISBN|978-0814417447}}</ref> overlaps also ], typically the domain of ]. | |||

| Here, businesses devote much time and effort to ], ] and ]. (See ] and ].) | |||

| ] and other wholesale institutions,<ref name="DeMeo"/> risk management ] managing, and as necessary hedging, the various positions held by the institution—both ] and ]—and on calculating and monitoring the resultant ], and ] under ]. | |||

| =====Advantages of credit trade babes :)===== | |||

| The calculations here are mathematically sophisticated, and within the domain of ] as below. Credit risk is inherent in the business of banking, but additionally, these institutions are exposed to ]. Banks typically employ ] ], whereas ] risk teams provide risk "services" (or "solutions") to customers. | |||

| * Usually results in more customers than cash trade. | |||

| * Can charge more for goods to cover the risk of bad debt. | |||

| * Gain goodwill and loyalty of customers. | |||

| * People can buy goods and pay for them at a later date. | |||

| * Farmers can buy seeds and implements, and pay for them only after the harvest. | |||

| * Stimulates agricultural and industrial production and commerce. | |||

| * Can be used as a promotional tool. | |||

| * Increase the sales. | |||

| Additional to ], the fundamental risk mitigant here, ] various hedging techniques as appropriate,<ref name = "Drake_Fabozzi"/> these may relate to the ] or ]. ] are often (instead) managed via ] or ], while for derivative portfolios and positions, traders use ] to measure and then offset sensitivities. In parallel, managers — ] and ] — ] ], thereby minimizing and preempting any underperformance ]. | |||

| =====Disadvantages of credit trade===== | |||

| * Risk of bad debt. | |||

| * High administration expenses. | |||

| * People can buy more than they can afford. | |||

| * More working capital needed. | |||

| * Risk of Bankruptcy. | |||

| === |

===Quantitative finance=== | ||

| ], the world's first ], established in ] in 1697]] | |||

| * Suppliers credit: | |||

| {{main|Quantitative analysis (finance)}} | |||

| * Credit on ordinary open account | |||

| Quantitative finance—also referred to as "mathematical finance"—includes those finance activities where ] is required,<ref name="SIAM">See discussion here: {{cite web |url=https://www.siam.org/Portals/0/Student%20Programs/Thinking%20of%20a%20Career/brochure.pdf |archive-url=https://web.archive.org/web/20190305095047/https://www.siam.org/Portals/0/Student%20Programs/Thinking%20of%20a%20Career/brochure.pdf |archive-date=2019-03-05 |url-status=live |title=Careers in Applied Mathematics|publisher=]}}</ref> and thus overlaps several of the above. | |||

| * Installment sales | |||

| * Bills of exchange | |||

| * Credit cards | |||

| * Contractor's credit | |||

| * Factoring of debtors | |||

| As a specialized practice area, quantitative finance comprises primarily three sub-disciplines; the underlying theory and techniques ] in the next section: | |||

| =====Factors which influence credit conditions===== | |||

| #Quantitative finance is often synonymous with ]. This area generally underpins a bank's ]—delivering bespoke ] and ], and ] the various structured products and solutions mentioned—and encompasses ] in support of the initial trade, and its subsequent hedging and management. | |||

| * Nature of the business's activities | |||

| #Quantitative finance also significantly overlaps ] in banking, as ], both as regards this hedging, and as regards economic capital as well as compliance with regulations and ]. | |||

| * Financial position | |||

| #"Quants" are also responsible for building and deploying the investment strategies at the quantitative funds ]; they are also involved in ] more generally, in areas such as ] formulation, and in ], ], ], and ]. | |||

| * Product durability | |||

| * Length of production process | |||

| * Competition and competitors' credit conditions | |||

| * Country's economic position | |||

| * Conditions at financial institutions | |||

| * Discount for early payment | |||

| * Debtor's type of business and financial position | |||

| ==Financial theory== | |||

| =====Credit collection===== | |||

| {| class="wikitable floatright" | width="250" | |||

| ======Overdue accounts====== | |||

| |- style="text-align:left;" | |||

| * Cards arranged alphabetically in card index system | |||

| |{{smalldiv| | |||

| * Attach a notice of overdue account to statement. | |||

| :<math> | |||

| * Send a letter asking for settlement of debt. | |||

| \sum_{t=1}^n \frac{FCFF_t}{(1+WACC_{t})^t} + | |||

| * Send a second or third letter if first is ineffectual. | |||

| \frac{\left}{(1+WACC_{n})^n} | |||

| * Threaten legal action. | |||

| </math> | |||

| }} | |||

| {{small|] widely applied in business and finance, since articulated ]. Here, to get the ], its forecasted ]s are discounted to the present using the ] for the discount factor. | |||

| For ] investors use the related ].}} | |||

| |} | |||

| Financial theory is studied and developed within the disciplines of ], ] ], ] and ]. | |||

| Abstractly,<ref name = "Drake_Fabozzi"/><ref name= "Fama and Miller"/> ''finance'' is concerned with the investment and deployment of ]s and ] over "space and time"; | |||

| i.e., it is about performing ] and ] today, based on the risk and uncertainty of future outcomes while appropriately incorporating the ]. | |||

| Determining the ] of these future values, "discounting", must be at the ], in turn, a major focus of finance-theory.<ref name="freedictionary"> {{Webarchive|url=https://web.archive.org/web/20191222201948/https://financial-dictionary.thefreedictionary.com/Finance |date=2019-12-22 }} Farlex Financial Dictionary. 2012</ref> | |||

| <!-- Participants in the ] aim to price assets based on their risk level, fundamental value, and their expected ]. | |||

| The core finance theories can be divided between the following categories: ], ] and ]. | |||

| --> | |||

| As financial theory has roots in many disciplines, including mathematics, statistics, economics, physics, and psychology, it can be considered a mix of an ] and ],<ref>{{Cite web|title = Finance|url =https://www.investopedia.com/terms/f/finance.asp|website = Investopedia|date=May 23, 2023|access-date = July 1, 2023}}</ref> and there are ongoing related efforts to organize a ]. | |||

| ===Managerial finance=== | |||

| ======Effective credit control====== | |||

| <!-- {{Unreferenced section|date=June 2023}} --> | |||

| * Increases sales | |||

| ]s, a more sophisticated valuation-approach, sometimes applied to corporate finance ] (and a standard<ref>A. Pinkasovitch (2021). {{Webarchive|url=https://web.archive.org/web/20211210085522/https://www.investopedia.com/articles/financial-theory/11/decisions-trees-finance.asp |date=2021-12-10 }}</ref> in ] curricula); various scenarios are considered, and their discounted cash flows are probability weighted.]] | |||

| * Reduces bad debts | |||

| {{Main|Managerial finance}} | |||

| * Increases profits | |||

| Managerial finance | |||

| * Builds customer loyalty | |||

| <ref>{{Cite web |title=Managerial Finance |url=https://www.sciencedirect.com/topics/economics-econometrics-and-finance/managerial-finance |website=]}}</ref> | |||

| is the branch of finance that deals with the financial aspects of the ] of a company, and the financial dimension of managerial decision-making more broadly. | |||

| It provides the ] for the practice ], concerning itself with the ] of the various ]. | |||

| Academics working in this area are typically based in ] finance departments, in ], or in ]. | |||

| The tools addressed and developed relate in the main to ] and ]: | |||

| ======Sources of information on creditworthiness====== | |||

| the former allow management to better understand, and hence act on, financial information relating to ] and performance; the latter, as above, are about optimizing the overall financial structure, including its impact on working capital. | |||

| * Business references | |||

| Key aspects of managerial finance thus include: | |||

| * Bank references | |||

| # Financial planning and forecasting | |||

| * Credit agencies | |||

| # Capital budgeting | |||

| * Chambers of commerce | |||

| # Capital structure | |||

| * Employers | |||

| # Working capital management | |||

| * Credit application forms | |||

| # Risk management | |||

| # Financial analysis and reporting. | |||

| The discussion, however, extends to ] more broadly, emphasizing alignment with the company's overall strategic objectives; and similarly incorporates the ] of planning, directing, and controlling. | |||

| ===Financial economics=== | |||

| ======Duties of the credit department====== | |||

| ]", a prototypical concept in portfolio optimization. Introduced ], it remains "a mainstay of investing and finance".<ref>W. Kenton (2021). {{Webarchive|url=https://web.archive.org/web/20211126113108/https://www.investopedia.com/terms/h/harrymarkowitz.asp |date=2021-11-26 }}, investopedia.com</ref> | |||

| * Legal action | |||

| An "efficient" portfolio, i.e. combination of assets, has the best possible expected return for its level of risk (represented by the standard deviation of return).]] | |||

| * Taking necessary steps to ensure settlement of account | |||

| ], a foundational element of finance theory, introduced in 1958; it forms the basis for modern thinking on ]. Even if ] (]) increases, the ] (k0) stays constant.]] | |||

| * Knowing the credit policy and procedures for credit control | |||

| {{Main|Financial economics}} | |||

| * Setting credit limits | |||

| Financial economics<ref name="Sharpe">For an overview, see {{Webarchive|url=https://web.archive.org/web/20040604105441/http://www.stanford.edu/~wfsharpe/mia/int/mia_int2.htm |date=2004-06-04 }}, ] (Stanford University manuscript)</ref> is the branch of ] that studies the interrelation of financial ], such as ]s, ]s and shares, as opposed to ] economic variables, i.e. ]. | |||

| * Ensuring that statements of account are sent out | |||

| It thus centers on pricing, decision making, and risk management in the ]s,<ref name="Sharpe"/><ref name= "Fama and Miller"/> and produces many of the commonly employed ]s. (] is the branch of financial economics that uses econometric techniques to parameterize the relationships suggested.) | |||

| * Ensuring that thorough checks are carried out on credit customers | |||

| * Keeping records of all amounts owing | |||

| * Ensuring that debts are settled promptly | |||

| * Timely reporting to the upper level of management for better management. | |||

| The discipline has two main areas of focus:<ref name= "Fama and Miller">See the discussion re finance theory by Fama and Miller under {{slink||Notes}}.</ref> ] and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital; respectively: | |||

| ====Stock==== | |||

| # Asset pricing theory develops the models used in determining the risk-appropriate discount rate, and in pricing derivatives; and includes the ] and ] applied in asset management. The analysis essentially explores how ] would apply risk and return to the problem of ] under uncertainty, producing the key "]". Here, the twin assumptions of ] and ] lead to ] (the ]), and to the ] theory for ]. At more advanced levels—and often in response to ]—the study ] these ] to incorporate phenomena where their assumptions do not hold, or to more general settings. | |||

| ;Purpose of stock control | |||

| # Much of ], by contrast, considers investment under "]" (], ], and ]). Here, theory and methods are developed for the decisioning about funding, dividends, and capital structure discussed above. A recent development is ] and ]—and thus various elements of asset pricing—into these decisions, employing for example ]. | |||

| * Ensures that enough stock is on hand to satisfy demand. | |||

| * Protects and monitors theft. | |||

| * Safeguards against having to stockpile. | |||

| * Allows for control over selling and cost price. | |||

| ===Financial mathematics=== | |||

| ;Stockpiling | |||

| {| class="wikitable floatright" | width="250" | |||

| {{main|Cornering the market}} | |||

| |- style="text-align:left;" | |||

| This refers to the purchase of stock at the right time, at the right price and in the right quantities. | |||

| |{{smalldiv| | |||

| :<math>\begin{align} | |||

| C(S, t) &= N(d_1)S - N(d_2) Ke^{-r(T - t)} \\ | |||

| d_1 &= \frac{1}{\sigma\sqrt{T - t}}\left \\ | |||

| d_2 &= d_1 - \sigma\sqrt{T - t} \\ | |||

| \end{align}</math> | |||

| ] for the value of a ]. Although lately its use is ], it has underpinned the development of derivatives-theory, and financial mathematics more generally, since its introduction in 1973.<ref> {{Webarchive|url=https://web.archive.org/web/20211126125626/https://priceonomics.com/the-history-of-the-black-scholes-formula/ |date=2021-11-26 }}, priceonomics.com</ref>}} | |||

| |} | |||

| ] are widely applied in mathematical finance; here used in calculating an ]. Other common pricing-methods are ] and ]. These are used for settings beyond ] by Black-Scholes. | |||

| ], even in those settings, banks use ] and ] models to incorporate the ]; the ] adjustments accommodate ] and capital considerations.]] | |||

| {{Main|Mathematical finance}} | |||

| {{see also|Quantitative analysis (finance)|Financial modeling#Quantitative finance}} | |||

| Financial mathematics<ref name="SIAM2"> {{Webarchive|url=https://web.archive.org/web/20220516114958/https://www.siam.org/research-areas/detail/financial-mathematics-and-engineering |date=2022-05-16 }}, Society for Industrial and Applied Mathematics</ref> is the field of ] concerned with ]s; | |||

| ], defended in 1900, is considered to be the first scholarly work in this area. | |||

| The field is largely focused on the ]—with much emphasis on ] and ]—while other important areas include ] and ]. | |||

| Relatedly, the techniques developed ] to pricing and hedging a wide range of ], ], and ]-securities. | |||

| As ], in terms of practice, the field is referred to as quantitative finance and / or mathematical finance, and comprises primarily the three areas discussed. | |||

| There are several advantages to the stockpiling, the following are some of the examples: | |||

| The ] and techniques are, correspondingly: | |||

| * Losses due to price fluctuations and stock loss kept to a minimum | |||

| *for derivatives,<ref name="Mastro">For a survey, see {{Webarchive|url=https://web.archive.org/web/20211113134700/https://catalogimages.wiley.com/images/db/pdf/9781118487716.excerpt.pdf |date=2021-11-13 }}, from Michael Mastro (2013). ''Financial Derivative and Energy Market Valuation'', John Wiley & Sons. {{ISBN| 978-1118487716}}.</ref> ], ], and ]s; see aside boxed discussion re the prototypical ] and ] now applied | |||

| * Ensures that goods reach customers timeously; better service | |||

| *for risk management,<ref name="DeMeo">See generally, Roy E. DeMeo (N.D.) {{Webarchive|url=https://web.archive.org/web/20211112082350/https://mathfinance.charlotte.edu/sites/mathfinance.charlotte.edu/files/media/An%20Introduction%20to%20Value%20At%20Risk%20New.pdf |date=2021-11-12 }}</ref> ], ] and ] (applying the "greeks"); the underlying mathematics comprises ], ], ] and ].<ref>See for example III.A.3, in Carol Alexander, ed. (January 2005). ''The Professional Risk Managers' Handbook''. PRMIA Publications. {{ISBN|978-0976609704}}</ref> | |||

| * Saves space and storage cost | |||

| *in both of these areas, and particularly for portfolio problems, quants employ ] | |||

| * Investment of working capital kept to minimum | |||

| * No loss in production due to delays | |||

| Mathematically, these separate into ]: | |||

| There are several disadvantages to the stockpiling, the following are some of the examples: | |||

| derivatives pricing uses ] (or ] probability), denoted by "Q"; | |||

| * Obsolescence | |||

| while risk and portfolio management generally use physical (or actual or actuarial) probability, denoted by "P". | |||

| * Danger of fire and theft | |||

| These are interrelated through the above "]". | |||

| * Initial working capital investment is very large | |||

| * Losses due to price fluctuation | |||

| The subject has a close relationship with financial economics, which, as outlined, is concerned with much of the underlying theory that is involved in financial mathematics: generally, financial mathematics will derive and extend the ]s suggested. | |||

| ;Rate of stock turnover | |||

| ] is the branch of (applied) ] that deals with problems of practical interest in finance, and especially<ref name="SIAM2"/> emphasizes the ] applied here. | |||

| This refers to the number of times per year that the average level of stock is sold. It may be worked out by dividing the cost price of goods sold by the cost price of the average stock level. | |||

| ===Experimental finance=== | |||

| ;Determining optimum stock levels | |||

| {{Main|Experimental finance}} | |||

| * '''Maximum stock level''' refers to the maximum stock level that may be maintained to ensure cost effectiveness. | |||

| * '''Minimum stock level''' refers to the point below which the stock level may not go. | |||

| * '''Standard order''' refers to the amount of stock generally ordered. | |||

| * '''Order level''' refers to the stock level which calls for an order to be made. | |||

| ]<ref name=ssrn>Bloomfield, Robert and Anderson, Alyssa. {{Webarchive|url=https://web.archive.org/web/20160304033849/http://fasri.net/wp-content/uploads/2009/10/experimental-finance-chapter-_wiley_.pdf |date=2016-03-04 }}. In Baker, H. Kent, and Nofsinger, John R., eds. Behavioral finance: investors, corporations, and markets. Vol. 6. John Wiley & Sons, 2010. pp. 113-131. {{ISBN|978-0470499115}}</ref> | |||

| ====Cash==== | |||

| aims to establish different market settings and environments to experimentally observe and provide a lens through which science can analyze agents' behavior and the resulting characteristics of trading flows, information diffusion, and aggregation, price setting mechanisms, and returns processes. Researchers in experimental finance can study to what extent existing financial economics theory makes valid predictions and therefore prove them, as well as attempt to discover new principles on which such theory can be extended and be applied to future financial decisions. Research may proceed by conducting trading simulations or by establishing and studying the behavior of people in artificial, competitive, market-like settings. | |||

| =====Reasons for keeping cash===== | |||

| * Cash is usually referred to as the "king" in finance, as it is the most liquid asset. | |||

| * The '''transaction motive''' refers to the money kept available to pay expenses. | |||

| * The '''precautionary motive''' refers to the money kept aside for unforeseen expenses. | |||

| * The '''speculative motive''' refers to the money kept aside to take advantage of suddenly arising opportunities. | |||

| ===Behavioral finance=== | |||

| =====Advantages of sufficient cash===== | |||

| {{Main|Behavioral economics}} | |||

| * Current liabilities may be catered for. | |||

| * Cash discounts are given for cash payments. | |||

| * Production is kept moving. | |||

| * Surplus cash may be invested on a short-term basis. | |||

| * The business is able to pay its accounts timeously, allowing for easily-obtained credit. | |||

| *Liquidity | |||

| ] studies how the '']'' of investors or managers affects financial decisions and markets<ref>Glaser, Markus and Weber, Martin and Noeth, Markus. (2004). {{Webarchive|url=https://web.archive.org/web/20230209093116/https://madoc.bib.uni-mannheim.de/2770/1/dp03_14.pdf |date=2023-02-09 }}, pp. 527–546 in ''Handbook of Judgment and Decision Making'', Blackwell Publishers {{ISBN|978-1-405-10746-4}}</ref> | |||

| ===Management of fixed assets=== | |||

| and is relevant when making a decision that can impact either negatively or positively on one of their areas. With more in-depth research into behavioral finance, it is possible to bridge what actually happens in financial markets with analysis based on financial theory.<ref>{{Cite journal |last1=Zahera |first1=Syed Aliya |last2=Bansal |first2=Rohit |date=2018-05-08 |title=Do investors exhibit behavioral biases in investment decision making? A systematic review |url=https://www.emerald.com/insight/content/doi/10.1108/QRFM-04-2017-0028/full/html |journal=Qualitative Research in Financial Markets |language=en |volume=10 |issue=2 |pages=210–251 |doi=10.1108/QRFM-04-2017-0028 |issn=1755-4179 |access-date=2022-04-08 |archive-date=2022-04-08 |archive-url=https://web.archive.org/web/20220408144635/https://www.emerald.com/insight/content/doi/10.1108/QRFM-04-2017-0028/full/html |url-status=live }}</ref> | |||

| ====Depreciation==== | |||

| Behavioral finance has grown over the last few decades to become an integral aspect of finance.<ref>{{cite book|last1=Shefrin|first1=Hersh|title=Beyond greed and fear: Understanding behavioral finance and the psychology of investing|date=2002|publisher=Oxford University Press|location=New York|isbn=978-0195304213|page=ix|url=https://archive.org/details/beyondgreedfearu00shef|url-access=registration|quote=growth of behavioral finance.|access-date=8 May 2017}}</ref> | |||

| Depreciation is the decrease in the value of an asset due to wear and tear or obsolescence. It is calculated yearly to ensure realistic book values for assets. | |||

| Behavioral finance includes such topics as: | |||

| ====Insurance==== | |||

| # Empirical studies that demonstrate significant deviations from classical theories; | |||

| {{main|Insurance}} | |||

| # Models of how psychology affects and impacts trading and prices; | |||

| Insurance is the undertaking of one party to indemnify another, in exchange for a premium, against a certain eventuality. | |||

| # Forecasting based on these methods; | |||

| # Studies of experimental asset markets and the use of models to forecast experiments. | |||

| A strand of behavioral finance has been dubbed ], which uses mathematical and statistical methodology to understand behavioral biases in conjunction with valuation. <!-- Some of these endeavors has been led by ] (Professor of Mathematics and Editor of ] during 2001–2004) and collaborators including ] (2002 Nobel Laureate in Economics), David Porter, Don Balenovich, Vladimira Ilieva, Ahmet Duran). Studies by Jeff Madura, Ray Sturm, and others have demonstrated significant behavioral effects in stocks and exchange-traded funds. Among other topics, quantitative behavioral finance studies behavioral effects together with the non-classical assumption of the finiteness of assets. --> | |||

| ;Uninsurable risks | |||

| <!-- | |||

| * Bad debt | |||

| Doesn't really belong under the theory section... | |||

| * Changes in fashion | |||

| ===Intangible asset finance=== | |||

| * Time lapses between ordering and delivery | |||

| {{Main|Intangible asset finance}} | |||

| * New machinery or technology | |||

| * Different prices at different places | |||

| Intangible asset finance is the area of finance that deals with intangible assets such as patents, trademarks, goodwill, reputation, etc. | |||

| ;Requirements of an insurance contract | |||

| * Insurable interest | |||

| ** The insured must derive a real financial gain from that which he is insuring, or stand to lose if it is destroyed or lost. | |||

| ** The item must belong to the insured. | |||

| ** One person may take out insurance on the life of another if the second party owes the first money. | |||

| ** Must be some person or item which can, legally, be insured. | |||

| ** The insured must have a legal claim to that which he is insuring. | |||

| * Good faith | |||

| ** ''Uberrimae fidei'' refers to absolute honesty and must characterise the dealings of both the insurer and the insured. | |||

| Intangible assets are divided into indefinite or definite. The brand name of a company is an indefinite asset; it stays with the company throughout its existence. A patent, however, granted to that company for a limited amount of time would be a definite intangible asset.<ref>{{Cite web|url=http://www.investopedia.com/terms/i/intangibleasset.asp|title=Intangible Asset Definition {{!}} Investopedia|last=root|date=2003-11-20|language=en-US|access-date=2016-06-27}}</ref> | |||

| ==Shared Services== | |||

| --> | |||

| There is currently a move towards converging and consolidating Finance provisions into ] within an organization. Rather than an organization having a number of separate Finance departments performing the same tasks from different locations a more centralized version can be created. | |||

| <!-- === Environmental finance === | |||

| ==Finance of states== | |||

| {{ |

{{excerpt|Environmental finance|paragraphs=1|file=no}} --> | ||

| Country, state, county, city or municipality finance is called public finance. It is concerned with | |||

| *Identification of required expenditure of a public sector entity | |||

| *Source(s) of that entity's revenue | |||

| *The budgeting process | |||

| *Debt issuance (]s) for public works projects | |||

| === Quantum finance === | |||

| ==Financial economics== | |||

| {{Unreferenced section|date=June 2023}} | |||

| {{Main|Financial economics}} | |||

| {{Main|Quantum finance}} | |||

| Quantum finance involves applying quantum mechanical approaches to financial theory, providing novel methods and perspectives in the field.<ref>{{Cite journal |last1=Focardi |first1=Sergio |last2=Fabozzi |first2=Frank J. |last3=Mazza |first3=Davide |date=2020-08-31 |title=Quantum Option Pricing and Quantum Finance |url=http://pm-research.com/lookup/doi/10.3905/jod.2020.1.111 |journal=The Journal of Derivatives |language=en |volume=28 |issue=1 |pages=79–98 |doi=10.3905/jod.2020.1.111 |issn=1074-1240}}</ref> ''Quantum'' ''finance'' is an interdisciplinary field, in which theories and methods developed by ''quantum'' physicists and economists are applied to solve financial problems. It represents a branch known as econophysics. Although ''quantum'' computational methods have been around for quite some time and use the basic principles of physics to better understand the ways to implement and manage cash flows, it is mathematics that is actually important in this new scenario<ref>{{Cite journal |last=Ristic |first=Kristijan |date=2–3 December 2021 |title=New Financial Future: Digital Finance As a key Aspect of Financial Innovation |url=https://www.proquest.com/docview/2616890742 |journal=75th International Scientific Conference on Economic and Social Development |pages=283–288 |id={{ProQuest|2616890742}} |via=Proquest}}</ref> | |||

| Finance theory is heavily based on financial instrument pricing such as ] pricing. Many of the problems facing the finance community have no known analytical solution. As a result, numerical methods and computer simulations for solving these problems have proliferated. This research area is known as ]. Many computational finance problems have a high degree of computational complexity and are slow to converge to a solution on classical computers. In particular, when it comes to option pricing, there is additional complexity resulting from the need to respond to quickly changing markets. For example, in order to take advantage of inaccurately priced stock options, the computation must complete before the next change in the almost continuously changing stock market. As a result, the finance community is always looking for ways to overcome the resulting performance issues that arise when pricing options. This has led to research that applies alternative computing techniques to finance. Most commonly used quantum financial models are quantum continuous model, quantum binomial model, multi-step quantum binomial model etc. | |||

| == History of finance == | |||

| Financial economics is the branch of ] studying the interrelation of financial ], such as ]s, ]s and shares, as opposed to those concerning the real economy. Financial economics concentrates on influences of ] economic variables on financial ones, in contrast to pure finance. | |||

| {{further|History of money|History of banking|History of investment|Financial centre#History|Corporate finance#History|Quantitative analysis (finance)#History|Financial crisis#History|Global financial system#History of international financial architecture}} | |||

| It studies: | |||

| {{See also|:Category:History of finance}} | |||

| *] - Determination of the fair value of an asset | |||

| **How risky is the asset? (identification of the asset appropriate discount rate) | |||

| **What ] will it produce? (discounting of relevant cash flows) | |||

| **How does the market price compare to similar assets? (relative valuation) | |||

| **Are the cash flows dependent on some other asset or event? (derivatives, contingent claim valuation) | |||

| The origin of finance can be traced to the beginning of state formation and trade during the ]. The earliest historical evidence of finance is dated to around 3000 BCE. Banking originated in West Asia, where temples and palaces were used as safe places for the storage of valuables. Initially, the only valuable that could be deposited was grain, but cattle and precious materials were eventually included. During the same period, the Sumerian city of ] in ] supported trade by lending as well as the use of interest. In Sumerian, "interest" was ''mas'', which translates to "calf". In Greece and Egypt, the words used for interest, ''tokos'' and ''ms'' respectively, meant "to give birth". In these cultures, interest indicated a valuable increase, and seemed to consider it from the lender's point of view.<ref>{{Cite book|last=Fergusson|first=Nial|title=The Ascent of Money|publisher=Penguin Books|location=United States}}</ref> The ] (1792–1750 BCE) included laws governing banking operations. The Babylonians were accustomed to charging interest at the rate of 20 percent per year. By 1200 BCE, ] shells were used as a form of money in ]. | |||

| *] | |||

| **Commodities - ] | |||

| **Stocks - ] | |||

| **Bonds - ] | |||

| **Money market instruments- ] | |||

| **Derivatives - ] | |||

| The use of coins as a means of representing money began in the years between 700 and 500 BCE.<ref>{{Cite web|title=babylon-coins.com|url=http://babylon-coins.com/tast1.html|access-date=2021-05-13|website=babylon-coins.com|archive-date=2021-06-15|archive-url=https://web.archive.org/web/20210615134016/http://babylon-coins.com/tast1.html|url-status=live}}</ref> Herodotus mentions the use of crude coins in ] around 687 BCE and, by 640 BCE, the Lydians had started to use coin money more widely and opened permanent retail shops.<ref>{{Cite web |title=Herodotus on Lydia |url=https://www.worldhistory.org/article/81/herodotus-on-lydia/ |url-status=live |archive-url=https://web.archive.org/web/20210513152131/https://www.worldhistory.org/article/81/herodotus-on-lydia/ |archive-date=2021-05-13 |access-date=2021-05-13 |website=World History Encyclopedia |language=en}}</ref> Shortly after, cities in ], such as ], ], and ], started minting their own coins between 595 and 570 BCE. During the ], interest was outlawed by the ''Lex Genucia'' reforms in 342 BCE, though the provision went largely unenforced. Under ], a ceiling on interest rates of 12% was set, and much later under ] it was lowered even further to between 4% and 8%.<ref>{{Cite web |title=History of Usury Prohibition - IslamiCity |url=https://www.islamicity.org/2773/history-of-usury-prohibition/ |access-date=2023-04-09 |website=www.islamicity.org |archive-date=2023-04-09 |archive-url=https://web.archive.org/web/20230409014040/https://www.islamicity.org/2773/history-of-usury-prohibition/ |url-status=live }}</ref> | |||

| *] and ] | |||

| The first stock exchange was opened in ] in 1531.<ref>{{cite web |title=Handelsbeurs |lang=nl |trans-title=Trade fair |url=https://visit.antwerpen.be/info/handelsbeurs |website=Visit Antwerp |access-date=2 September 2022 |quote=The 'Nieuwe Beurs' was built in 1531 because the 'Old Beurs' in Hofstraat had become too small. It was the first stock exchange ever built specifically for that purpose and later became the example for all stock exchange buildings in the world. }}</ref> Since then, popular exchanges such as the ] (founded in 1773) and the ] (founded in 1793) were created.<ref>{{cite web |title=Our History |url=https://www.londonstockexchange.com/discover/lseg/our-history |website=London Stock Exchange |access-date=2 September 2022 |archive-date=2 September 2022 |archive-url=https://web.archive.org/web/20220902213413/https://www.londonstockexchange.com/discover/lseg/our-history |url-status=live }}</ref><ref>{{cite web |url=https://guides.loc.gov/wall-street-history/exchanges |website=Library of Congress |access-date=2 September 2022 |title=Research Guides: Wall Street and the Stock Exchanges: Historical Resources: Stock Exchanges |archive-date=4 August 2022 |archive-url=https://web.archive.org/web/20220804230415/https://guides.loc.gov/wall-street-history/exchanges |url-status=live }}</ref> | |||

| ] is the branch of Financial Economics that uses econometric techniques to parameterise the relationships. | |||

| ==See also== | |||

| ==Financial mathematics== | |||

| * ] | |||

| {{Main|Financial mathematics}} | |||

| * ] | |||

| ==Notes== | |||

| Financial mathematics is a main branch of applied mathematics concerned with the financial markets. Financial mathematics is the study of financial data with the tools of ], mainly ]. Such data can be movements of securities—]s and ]s etc.—and their relations. Another large subfield is ]. | |||

| {{Notelist}} | |||

| ==References== | |||

| ==Experimental finance== | |||

| {{Reflist|30em}} | |||

| {{Main|Experimental finance}} | |||

| ] aims to establish different market settings and environments to observe experimentally and provide a lens through which science can analyze agents' behavior and the resulting characteristics of trading flows, information diffusion and aggregation, price setting mechanisms, and returns processes. Researchers in experimental finance can study to what extent existing financial economics theory makes valid predictions, and attempt to discover new principles on which such theory can be extended. Research may proceed by conducting trading simulations or by establishing and studying the behaviour of people in artificial competitive market-like settings. | |||

| == Quantitative behavioral finance == | |||

| {{Main|Quantitative behavioral finance}} | |||

| Quantitative Behavioral Finance is a new discipline that uses mathematical and statistical methodology to understand behavioral biases in conjunction with valuation. Some of this endeavor has been lead by ] (Professor of Mathematics and Editor of ] during 2001-2004) and collaborators including ] (2002 Nobel Laureate in Economics), David Porter, Don Balenovich, Vladimira Ilieva, Ahmet Duran, Huseyin Merdan). Studies by Jeff Madura, Ray Sturm and others have demonstrated significant behavioral effects in stocks and exchange traded funds. | |||

| The research can be grouped into the following areas:<br /> | |||

| 1. Empirical studies that demonstrate significant deviations from classical theories.<br /> | |||

| 2. Modeling using the concepts of behavioral effects together with the non-classical assumption of the finiteness of assets.<br /> | |||

| 3. Forecasting based on these methods.<br /> | |||

| 4. Studies of experimental asset markets and use of models to forecast experiments. | |||

| == Intangible Asset Finance == | |||

| {{Main|Intangible asset finance}} | |||

| Intangible asset finance is the area of finance that deals with intangible assets such as patents, trademarks, goodwill, reputation, etc. | |||

| == Related professional qualifications == | |||

| == Further reading == | |||

| There are several related ]s in finance, that can lead to the field: | |||

| * {{cite book |last=Graham |first=Benjamin |author-link=Benjamin Graham |author2=] |others=Warren E. Buffett (collaborator) |title=The Intelligent Investor |orig-year=1949 |url=https://archive.org/details/harrypotterhalfb00rowl_0 |edition=2003 |date=2003-07-08 |publisher=] |isbn=0-06-055566-1 |no-pp=true |page=front cover}} | |||

| * '''] qualifications:''' ] (], UK certification), ] (CA, certification in Commonwealth countries), ] (CPA, US certification) | |||

| * {{cite book|title=Security Analysis: The Classic 1934 Edition|last1=Graham|first1=Benjamin|author2-link=David Dodd |last2=Dodd|first2=David LeFevre|isbn=978-0-070-24496-2|lccn=34023635| url=https://books.google.com/books?id=wXlrnZ1uqK0C| year=1934|publisher=]}} | |||

| * '''Non-statutory ] qualifications:''' ] CCA Designation from ] | |||

| *'']: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!'', by ] and ]. ], 2000. {{ISBN|0-446-67745-0}} | |||

| * '''Business qualifications:''' ] (MBA),] (BBM), ] (MFA), ] (DBA) | |||

| * {{cite book | |||

| * '''Finance qualifications:''' ] (CFA),](CIIA), ] (ACT), ], ] (CMA/FAD) Dual Designation, ] (MFM), ] (CF) ] (RFP), ] (CFC) | |||

| | last =Bogle | |||

| * '''Quantitative Finance qualifications:''' ] (MSFE) ,] (MQF), ] (MCF), ] (MFM) | |||

| | first =John Bogle | |||

| | authorlink =John C. Bogle | |||

| | title =The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns | |||

| | publisher =John Wiley and Sons | |||

| | year =2007 | |||

| | pages = | |||

| | url =https://archive.org/details/littlebookofcomm00bogl | |||

| | url-access =registration | |||

| | doi = | |||

| | isbn =9780470102107 }} | |||

| * {{cite book|title=The Essays of Warren Buffett: Lessons for Investors and Managers|author1-link=Warren Buffett |last1=Buffett|first1=W.|last2=Cunningham|first2=L.A.|isbn=978-0-470-82441-2| url=https://books.google.com/books?id=njy3PQAACAAJ|year=2009|publisher=]}} | |||

| * {{cite book|title=The Millionaire Next Door|author1-link=Thomas J. Stanley|last1=Stanley|first1=Thomas J.|last2=Danko|first2=W.D. |isbn=978-0-671-01520-6|lccn=98046515| url=https://books.google.com/books?id=ldpaww5kkmoC|year=1998|publisher=] }} | |||

| * {{cite book|title=The Alchemy of Finance: Reading the Mind of the Market|author=]|isbn=978-0-671-66238-7|lccn=87004745|series=A Touchstone book|url=https://books.google.com/books?id=JDSii-QgejoC|year=1988|publisher=] }} | |||

| * {{cite book|title=Common Stocks and Uncommon Profits and Other Writings|author=]|isbn=978-0-471-11927-2|lccn=95051449|series=Wiley Investment Classics|url=https://books.google.com/books?id=UES-QgAACAAJ|year=1996|publisher=] }} | |||

| ==External links== | ==External links== | ||

| {{Sister project links|s=1911 Encyclopædia Britannica/Finance}} | |||

| <!-- --> | |||

| <!-- Do not add advertising or commercial links to this article. --> | <!-- Do not add advertising or commercial links to this article. --> | ||

| * (]) | |||

| <!-- --> | |||

| * (]) | |||

| {{Wiktionary}} | |||

| * (]) | |||

| {{wikiversity}} | |||

| * (Vernimmen ''et. al.'') | |||

| * - aimed to offer free access to finance knowledge for students, teachers, and self-learners. | |||

| * (]) |

* (]) | ||

| * (]) | |||

| * (], mymoney.gov) | |||

| * {{Webarchive|url=https://web.archive.org/web/20230602184354/https://gsdrc.org/professional-dev/public-financial-management/ |date=2023-06-02 }} (Governance and Social Development Resource Centre, gsdrc.org) | |||

| * (]) | |||

| <!-- Do not add advertising or commercial links to this article. --> | |||

| <!-- --> | |||

| <!-- IMPORTANT: not add advertising or commercial links to this article. --> | |||

| <!-- --> | |||

| {{Finance}} | |||

| {{Authority control}} | |||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

Latest revision as of 18:25, 11 January 2025

Academic discipline studying businesses and investments For other uses, see Finance (disambiguation). "Financial" redirects here. For the Georgian newspaper, see The Financial.| Part of a series on | ||||||

| Finance | ||||||

|---|---|---|---|---|---|---|

| ||||||

Markets

|

||||||

| Instruments | ||||||

Corporate

|

||||||

| Personal | ||||||

Public

|

||||||

Banking

|

||||||

|

Regulation · Financial law |

||||||

| Economic history | ||||||

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, it is related to but distinct from economics, which is the study of the production, distribution, and consumption of goods and services. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance.

In these financial systems, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities.

Due to its wide scope, a broad range of subfields exists within finance. Asset-, money-, risk- and investment management aim to maximize value and minimize volatility. Financial analysis assesses the viability, stability, and profitability of an action or entity. Some fields are multidisciplinary, such as mathematical finance, financial law, financial economics, financial engineering and financial technology. These fields are the foundation of business and accounting. In some cases, theories in finance can be tested using the scientific method, covered by experimental finance.

The early history of finance parallels the early history of money, which is prehistoric. Ancient and medieval civilizations incorporated basic functions of finance, such as banking, trading and accounting, into their economies. In the late 19th century, the global financial system was formed.

In the middle of the 20th century, finance emerged as a distinct academic discipline, separate from economics. The earliest doctoral programs in finance were established in the 1960s and 1970s. Today, finance is also widely studied through career-focused undergraduate and master's level programs.

The financial system

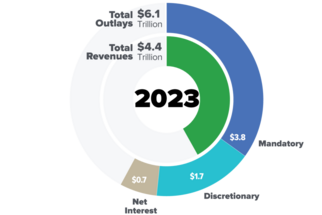

As outlined, the financial system consists of the flows of capital that take place between individuals and households (personal finance), governments (public finance), and businesses (corporate finance). "Finance" thus studies the process of channeling money from savers and investors to entities that need it. Savers and investors have money available which could earn interest or dividends if put to productive use. Individuals, companies and governments must obtain money from some external source, such as loans or credit, when they lack sufficient funds to run their operations.

In general, an entity whose income exceeds its expenditure can lend or invest the excess, intending to earn a fair return. Correspondingly, an entity where income is less than expenditure can raise capital usually in one of two ways: (i) by borrowing in the form of a loan (private individuals), or by selling government or corporate bonds; (ii) by a corporation selling equity, also called stock or shares (which may take various forms: preferred stock or common stock). The owners of both bonds and stock may be institutional investors—financial institutions such as investment banks and pension funds—or private individuals, called private investors or retail investors. (See Financial market participants.)

The lending is often indirect, through a financial intermediary such as a bank, or via the purchase of notes or bonds (corporate bonds, government bonds, or mutual bonds) in the bond market. The lender receives interest, the borrower pays a higher interest than the lender receives, and the financial intermediary earns the difference for arranging the loan. A bank aggregates the activities of many borrowers and lenders. A bank accepts deposits from lenders, on which it pays interest. The bank then lends these deposits to borrowers. Banks allow borrowers and lenders, of different sizes, to coordinate their activity.

Investing typically entails the purchase of stock, either individual securities or via a mutual fund, for example. Stocks are usually sold by corporations to investors so as to raise required capital in the form of "equity financing", as distinct from the debt financing described above. The financial intermediaries here are the investment banks. The investment banks find the initial investors and facilitate the listing of the securities, typically shares and bonds. Additionally, they facilitate the securities exchanges, which allow their trade thereafter, as well as the various service providers which manage the performance or risk of these investments. These latter include mutual funds, pension funds, wealth managers, and stock brokers, typically servicing retail investors (private individuals).

Inter-institutional trade and investment, and fund-management at this scale, is referred to as "wholesale finance". Institutions here extend the products offered, with related trading, to include bespoke options, swaps, and structured products, as well as specialized financing; this "financial engineering" is inherently mathematical, and these institutions are then the major employers of "quants" (see below). In these institutions, risk management, regulatory capital, and compliance play major roles.

Areas of finance