| Revision as of 09:46, 14 July 2009 editHamiltonstone (talk | contribs)Autopatrolled, Extended confirmed users, Pending changes reviewers23,271 edits →Fiasco over Chinese arrests: NPOV heading← Previous edit | Latest revision as of 20:20, 8 December 2024 edit undoMarioGom (talk | contribs)Edit filter helpers, Extended confirmed users, Page movers, New page reviewers35,188 edits WP:REVERTBAN: Banned undisclosed paid editing (UPE) sock, Special:Diff/1250436986 | ||

| Line 1: | Line 1: | ||

| {{Short description|Anglo-Australian multinational mining company}} | |||

| {{Infobox_Company | | |||

| {{Use British English|date=November 2012}} | |||

| company_name = Rio Tinto Limited & plc| | |||

| {{Use dmy dates|date=February 2021}} | |||

| company_logo = ] | | |||

| {{Infobox company | |||

| company_type = ] ({{asx|RIO}}, {{lse|RIO}}, {{nyse|RTP}}) | | |||

| | name = Rio Tinto Group<br/>Rio Tinto plc & Rio Tinto Limited | |||

| company_slogan = N/A| | |||

| | logo = Rio_Tinto_(corporation)_Logo.svg | |||

| foundation = 1873 | | |||

| | logo_alt = Rio Tinto Logo | |||

| location = ], ], ]<br/>], ] | | |||

| | image = Meelbourne scraper.jpg | |||

| key_people = ], Chairman <br/> ], CEO <br/>Guy Elliott, Finance Director <br/> Dick Evans, Executive Director| | |||

| | image_caption = Rio Tinto headquarters in ], Australia | |||

| num_employees = 35,000 (2007)|| | |||

| | type = ] | |||

| revenue = ]58,065 million (2008)<ref name="PR-2008"/>| | |||

| | traded_as = {{asx|RIO}}<br/>{{lse|RIO}}<br/>{{NYSE|RIO}}<br/>] component<br/>] component | |||

| operating_income= US$11,233 million (2008)| | |||

| | foundation = {{start date and age|df=yes|1873|3|29}} | |||

| net_income = US$4,609 million (2008)| | |||

| | location = ], England<br>], Australia | |||

| industry = ]| | |||

| | key_people = ]<br/>(chairman)<br/>]<br/>(chief executive) | |||

| products = ]<br/>]<br/>]<br/>]<br/>]<br/>]<br/>]<br/>]s<br/>]<br/>]<br/>]<br/>]s<br/>]<br/>]| | |||

| | area_served = Worldwide | |||

| homepage = | |||

| | revenue = {{decrease}} US$54.041 billion (2023)<ref name=ar>{{cite web|url=https://cdn-rio.dataweavers.io/-/media/content/documents/invest/financial-news-and-performance/results/2023/rt-annual-results-2023.pdf?rev=47f0744734904182a22692ecf31b74aa|title=Annual Results 2022|publisher=Rio Tinto|access-date=22 February 2023}}</ref> | |||

| | operating_income = {{decrease}} US$15.498 billion (2023)<ref name=ar/> | |||

| | net_income = {{decrease}} US$9.953 billion (2023)<ref name=ar/> | |||

| | assets = {{increase}} US$103.549 billion (2023)<ref name=ar/> | |||

| | equity = {{increase}} US$56.341 billion (2023)<ref name=ar/> | |||

| | num_employees = 52,000 (2024)<ref>{{cite web|url=https://www.riotinto.com/about|title=About us|publisher=Rio Tinto|access-date=11 February 2024}}</ref> | |||

| | industry = ]s and ] | |||

| | products = Iron ore, ], alumina, aluminium, copper, ], gold, diamonds, ], ], ]s, salt, ] | |||

| | homepage = {{URL|https://www.riotinto.com/}} | |||

| }} | }} | ||

| '''Rio Tinto Group''' is a British-Australian ] that is the world's second largest metals and mining corporation (behind ]).<ref>{{cite news|last=Hotten|first=Russell|date=12 July 2007|title=History of Rio Tinto|website=]|publisher=Telegraph Media Group Limited|location=London|url=https://www.telegraph.co.uk/finance/2811968/A-history-of-Rio-Tinto.html|access-date=30 May 2020}}</ref> It was founded in 1873 when a group of investors purchased a ] on the ], in ], Spain, from the Spanish government. It has grown through a long series of mergers and acquisitions. Although primarily focused on extraction of minerals, it also has significant operations in refining, particularly the refining of bauxite and iron ore.<ref name="RT-Prod"/> It has joint head offices in ], England and ], Australia.<ref>"." Rio Tinto Group. Retrieved 9 April 2010. {{webarchive |url=https://web.archive.org/web/20100328135741/http://www.riotinto.com/contactus.asp |date=28 March 2010 }}</ref><ref name="MelbourneCityMAP">"." ]. Retrieved 5 April 2010.</ref> | |||

| |title=Rio Tinto Preliminary Results 2008}}</ref> Although primarily focused on extraction of minerals, Rio Tinto also has significant operations in refining, particularly for refining bauxite and iron ore.<ref name="RT-Prod"/> The company has operations on six continents but is mainly concentrated in Australia and Canada, and owns gross assets valued at $81 billion through a complex web of wholly and partly owned ].<ref name="Chartbook"/> | |||

| Rio Tinto |

Rio Tinto is a ] traded on both the ], where it is a component of the ],<ref name="LSE"/> and the ], where it is a component of the ] index.<ref name="ASX200"/> ] of Rio Tinto's British branch are also traded on the ],<ref name="ar"/><ref name="shareholder info website">{{Cite web|url=https://www.riotinto.com/invest/shareholder-information|title=Shareholder Information|website=riotinto.com}}</ref> giving it listings on three major stock exchanges. In the 2020 ], it was ranked the world's 114th-largest public company.<ref>{{cite web |title=Forbes Global 2000 | website= ] | url= https://www.forbes.com/global2000/#39910f1b335d |access-date=31 October 2020}}</ref> | ||

| Rio Tinto has faced widely criticism by environmental groups as well as the ] for the environmental impacts of its mining activities.<ref name="norway" /> | |||

| ==History== | |||

| ===Formation=== | |||

| ] | |||

| ==Formation== | |||

| Since antiquity, a site along the Rio Tinto, in the ]n ] in ] has been mined for ], ], ], and other minerals.<ref name ="Carleton"> | |||

| ] in south-western Spain.]] | |||

| ] led the purchase of the Rio Tinto mines from Spain, and was the company's first president.]] | |||

| Since antiquity, a site along the ] in ], Spain, has been mined for copper, silver, gold and other minerals.<ref name="Carleton"> | |||

| {{cite web | {{cite web | ||

| | last = Bordenstein | |||

| | first = Sarah | |||

| | title = Rio Tinto, Spain | |||

| | work=] | |||

| | publisher=] | |||

| | url = http://serc.carleton.edu/microbelife/topics/riotinto/ | |||

| | access-date =3 March 2009}} | |||

| </ref> |

</ref> Around 3000 BC, ] and ] began mining the site, followed by the ]ns, ], ], ] and ]. After a period of abandonment, the mines were rediscovered in 1556 and the Spanish government began operating them once again in 1724.<ref name="Carleton"/> | ||

| However, Spain's mining operations there were inefficient, and the government itself was otherwise distracted by political and financial crises,<ref name="Harvey">{{Cite book | |||

| ].]] | |||

| | last = Harvey | |||

| | first = Charles E. | |||

| | title = The Rio Tinto Company: An Economic History of a leading international mining concern, 1873–1954 | |||

| | publisher=Alison Hodge Publishers | |||

| | year = 1981 | |||

| | pages = –11, 23, 52, 89, 202, 207–215, 314–324 | |||

| | url = https://archive.org/details/riotintocompanye0000harv | |||

| | url-access = registration | |||

| | isbn = 9780906720035}}</ref> leading the government to sell the mines in 1873 at a price later determined to be well below actual value.<ref name="Huelva">{{cite web | |||

| | title = Huelva Province – Rio Tinto | |||

| | work=Andalucia.com | |||

| | publisher=Andalucia.com | |||

| | url = http://www.andalucia.com/province/huelva/riotinto/home.htm | |||

| | access-date =3 March 2009}} | |||

| </ref> The purchasers of the mine were led by ]'s ], which ultimately formed a syndicate consisting of ] (56% ownership), Matheson (24%) and the civil engineering firm Clark, Punchard and Company<ref>{{cite web|title=Clark, Punchard and Co|url=http://www.gracesguide.co.uk/Clark,_Punchard_and_Co|website=Grace's Guide to British Industrial History|publisher=Grace's Guide Ltd|access-date=9 March 2017}}</ref> (20%). At an auction held by the Spanish government to sell the mine on 14 February 1873, the group won with a bid of ]3.68 million (] 92.8 million). The bid also specified that Spain would permanently relinquish any right to claim ] on the mine's production. Following purchase of the mine, the syndicate launched the Rio Tinto Company, registering it on 29 March 1873.<ref name="Harvey"/> At the end of the 1880s, control of the firm passed to the ], who increased the scale of its mining operations.<ref name="Harvey"/>{{Rp|188}} | |||

| ==Operating history== | |||

| However, Spain's mining operations there were inefficient, and the government itself was otherwise distracted by political and financial crises,<ref name ="Harvey">{{cite book | |||

| {{Main|Rio Tinto Company Limited}} | |||

| | last = Harvey | |||

| Following their purchase of the Rio Tinto Mine, the new ownership constructed a number of new processing facilities, innovated new mining techniques, and expanded mining activities.<ref name="Harvey"/> | |||

| | first = Charles E. | |||

| | title = The Rio Tinto Company: An Economic History of a leading international mining concern, 1873 - 1954 | |||

| | publisher = Alison Hodge Publishers | |||

| | date = 1981 | |||

| | pages = 10-11, 23, 52, 89, 202, 207-215, 314-324 | |||

| | url = http://books.google.com/books?id=FgW09Y59CrkC | |||

| | isbn = 0906720036, 9780906720035}} </ref> leading the government to sell the mines in 1873 at a price later determined to be well below actual value. <ref name ="Huelva"> {{cite web | |||

| | title = Huelva Province - Rio Tinto | |||

| | work = Andalucia.com | |||

| | publisher = Andalucia.com | |||

| | url = http://www.andalucia.com/province/huelva/riotinto/home.htm | |||

| | accessdate = March 3, 2009}} | |||

| </ref> | |||

| From 1877 to 1891, the Rio Tinto Mine was the world's leading producer of copper.<ref name="HJStevens">{{Cite book|last=Stevens|first=Horace Jared|title=The Copper Handbook|publisher=Horace J. Stevens|year=1908|volume=8|page=1457}}</ref> | |||

| The purchasers of the mine were led by ]'s Matheson and Company, which ultimately formed a syndicate consisting of ] (56% ownership), Matheson (24%), and railway firm Clark, Punchard and Company (20%). At an auction held by the Spanish government for sale of the mine on February 17, 1873, the group won with a bid ]3,680,000 (] 92,800,000). The bid also specified that Spain permanently relinquish any right to claim ] on the mine's production. Following purchase of the mine, the syndicate launched the Rio Tinto Company, registering it on March 29, 1873.<ref name ="Harvey"/> | |||

| ] mine was part of Rio Tinto's original operations in Spain.]] From 1870 through 1925, the company was inwardly focused on fully exploiting the Rio Tinto Mine, with little attention paid to expansion or exploration activities outside of Spain. The company enjoyed strong financial success until 1914, ] to control market prices. However, World War I and its aftermath effectively eliminated the United States as a viable market for European ]s, leading to a decline in the firm's prominence.<ref name="Harvey"/> | |||

| ===Operating history=== | |||

| Following their purchase of the Rio Tinto Mine, the new ownership constructed a number of new processing facilities, innovated new mining techniques, and expanded mining activities. <ref name ="Harvey"/> From 1877 through 1891, the Rio Tinto Mine was the world's leading producer of copper.<ref name="HJStevens">{{cite book|last=Stevens|first=Horace Jared|title=The Copper Handbook|publisher=Horace J. Stevens|date=1908|volume=8|pages=1547}}</ref> | |||

| ] | |||

| From 1871 through 1925, the company was inwardly focused on fully exploiting the Rio Tinto Mine, with little attention paid to expansion or exploration activities outside of Spain. The company enjoyed strong financial success until 1914, ] to control market prices. However, ] and its aftermath effectively eliminated the United States as a viable market for European pyrites, leading to a decline in the firm's prominence.<ref name="Harvey"/> | |||

| ] was a major product of Rio Tinto's first mines.]] | ] was a major product of Rio Tinto's first mines.]] | ||

| The company's failure to diversify during this period led to the slow decline of the company among the ranks of international mining firms. However, this changed in 1925, when Sir ] succeeded Lord ] as chairman. Geddes and the new management team he installed focused on ] of the company's investment strategy and the introduction of organisational and marketing reforms. Geddes led the company into a series of joint ventures with customers in the development of new technologies, as well as exploration and development of new mines outside of Spain. Between 1925 and 1931, Geddes recruited two directors: JN Buchanan (finance director) and RM Preston (commercial director), as well as other executives involved with technical and other matters.<ref name="Harvey"/> | |||

| Perhaps most significant was the company's investment in copper mines in ], later ], which it eventually consolidated into the Rhokana Corporation.<ref name="Harvey"/> These and later efforts at diversification eventually allowed the company to divest from the Rio Tinto mine in Spain. By the 1950s, ]'s nationalistic government had made it increasingly difficult to exploit Spanish resources for the profit of foreigners.<ref name="Harvey"/> Rio Tinto Company, supported by its international investments, was able to divest two-thirds of its Spanish operations in 1954 and the remainder over the following years.<ref name="RTWeb">{{cite web | |||

| The company's failure to diversify during this period led to the slow decline of the company among the ranks of international mining firms. However, this changed in 1925, when Sir ] succeeded Lord ] as chairman. Geddes and the new management team he installed focused on ] of the company's investments and operations and reformation of marketing strategy. Geddes led the company into a series of ]s with customers in the development of new technologies, as well as exploration and development of new mines outside of Spain.<ref name ="Harvey"/> | |||

| |title=Who We Are: Timeline | |||

| |publisher=Rio Tinto | |||

| |year=2009 | |||

| |url=http://www.riotinto.com/whoweare/timeline.asp | |||

| |access-date=4 March 2009 |archive-url=https://web.archive.org/web/20101219090438/http://www.riotinto.com/whoweare/timeline.asp | |||

| |archive-date=19 December 2010 | |||

| }}</ref> | |||

| The company was part of the uranium producers' ], Societe d'Etudes de Recherches d'Uranium, which operated from 1972 to 1976.<ref name=":02">{{Cite book |last=Massot |first=Pascale |title=China's Vulnerability Paradox: How the World's Largest Consumer Transformed Global Commodity Markets |date=2024 |publisher=] |isbn=978-0-19-777140-2 |location=New York, NY, United States of America |pages=}}</ref>{{Rp|page=194}} The other cartel members were based in Australia, France, and South Africa.<ref name=":02" />{{Rp|page=194}} It was formed by the major non-United States uranium producers to mitigate the impacts of US policy on the ]; to do so, the cartel engaged in ], ], and ].<ref name=":02" />{{Rp|page=194}} ] filed an ] lawsuit against cartel members in 1976 and the cartel disbanded.<ref name=":02" />{{Rp|page=194}} | |||

| Perhaps most significant was the company's investment in copper mines in ], which it eventually consolidated into the ].<ref name ="Harvey"/> These and later efforts at diversification eventually allowed the company to divest from the Rio Tinto mine in Spain. By the 1950s, ]'s nationalistic government had made it increasingly difficult to exploit Spanish resources for the profit of foreigners.<ref name ="Harvey"/> Rio Tinto Company, supported by its international investments, was able to divest two-thirds of its Spanish operations in 1954 and the remainder over the following years.<ref name="RTWeb">{{cite web | |||

| | title = Who We Are: Timeline | |||

| | work = Rio Tinto web site | |||

| | publisher = Rio Tinto Group | |||

| | date = 2009 | |||

| | url = http://www.riotinto.com/whoweare/timeline.asp | |||

| | accessdate = March 4, 2009}}</ref> | |||

| ==Major mergers and acquisitions== | |||

| Like many major mining companies, |

Like many major mining companies, Rio Tinto has historically grown through a series of mergers and acquisitions. | ||

| ===Early acquisitions=== | |||

| ] was the location of Rio Tinto's first major international expansion of mining activities.]] | ] was the location of Rio Tinto's first major international expansion of mining activities.]] | ||

| The company's first major acquisition occurred in 1929, when the company issued stock for the purpose of raising 2.5 |

The company's first major acquisition occurred in 1929, when the company issued stock for the purpose of raising 2.5 million pounds to invest in Northern Rhodesian copper mining companies, which was fully invested by the end of 1930. The Rio Tinto company consolidated its holdings of these various firms under the Rhokana Corporation by forcing the various companies to merge.<ref name="Harvey"/> | ||

| Rio Tinto's investment in Rhodesian copper mines did much to support the company through troubled times at its Spanish Rio Tinto operations spanning the ], ] |

Rio Tinto's investment in Rhodesian copper mines did much to support the company through troubled times at its Spanish Rio Tinto operations spanning the ], ] and ]. In the 1950s, the political situation made it increasingly difficult for mostly British and French owners to extract profits from Spanish operations, and the company decided to dispose of the mines from which it took its name.<ref name="Harvey"/> Thus, in 1954, Rio Tinto Company sold two-thirds of its stake in the Rio Tinto mines, disposing of the rest over the following years.<ref name="RTWeb"/> The sale of the mines financed extensive exploration activities over the following decade.<ref name="RT-DLC"> | ||

| {{cite web | {{cite web | ||

| |title=RTZ CRA United for Growth | |||

| |work=Rio Tinto Review | |||

| |publisher=Rio Tinto | |||

| |year=2006 | |||

| | date = 2006 | |||

| |url=http://www.riotinto.com/documents/Investors/dlcsep06.pdf | |||

| |access-date=4 March 2009 |archive-url=https://web.archive.org/web/20090327021733/http://www.riotinto.com/documents/Investors/dlcsep06.pdf | |||

| | format = pdf | |||

| |archive-date=27 March 2009 }}</ref> | |||

| ===Merger with Consolidated Zinc=== | |||

| The company's exploration activities presented the company with an abundance of opportunities |

The company's exploration activities presented the company with an abundance of opportunities, but it lacked sufficient capital and operating revenue to exploit those opportunities. This situation precipitated the next, and perhaps most significant, merger in the company's history. In 1962, Rio Tinto Company merged with the Australian firm ] to form the Rio Tinto – Zinc Corporation (RTZ) and its main subsidiary, Conzinc Riotinto of Australia (CRA). The merger provided Rio Tinto the ability to exploit its new-found opportunities, and gave Consolidated Zinc a much larger asset base.<ref name="RT-DLC"/> | ||

| RTZ and CRA were separately managed and operated, with CRA focusing on opportunities within ] and RTZ taking the rest of the world. |

RTZ and CRA were separately managed and operated, with CRA focusing on opportunities within ] and RTZ taking the rest of the world. However, the companies continued to trade separately, and RTZ's ownership of CRA dipped below 50% by 1986.<ref name="RT-DLC"/> The two companies' strategic needs eventually led to conflicts of interest regarding new mining opportunities, and shareholders of both companies determined a merger was in their mutual best interest. In 1995, the companies merged into a ], in which management was consolidated into a single entity and shareholder interests were aligned and equivalent, although maintained as shares in separately named entities. The merger also precipitated a name change; after two years as '''RTZ-CRA''', RTZ became '''Rio Tinto plc''' and CRA became '''Rio Tinto Limited''', referred to collectively as '''Rio Tinto'''.<ref name="RT-DLC"/> | ||

| === |

===Recent mergers, acquisitions and events=== | ||

| Major acquisitions following the Consolidated Zinc merger included ], a major producer of ], bought in 1968,<ref name="RTWeb"/> ] and BP |

Major acquisitions following the Consolidated Zinc merger included ], a major producer of ], bought in 1968,<ref name="RTWeb"/> ] and ]'s coal assets which were bought from BP in 1989, and a 70.7% interest in the ] operations of ], also in 1989.<ref name="RTWeb"/> In 1993, the company acquired ] and the United States coal mining businesses of ].<ref name="RTWeb"/> | ||

| ] | ] | ||

| In 2000, Rio Tinto acquired ], an Australian company with iron ore and ] mines, for $2.8 billion.<ref> '']'' 23 June 2000</ref><ref> '']'' 5 August 2000</ref><ref> '']'' 5 August 2000</ref> The takeover was partially motivated as a response to North Limited's 1999 bid to have Rio Tinto's ] declared ].<ref name=smh2004> | |||

| In 2000, Rio Tinto acquired ], an Australian company with ] and ] mines, for $2.8 billion.<ref> | |||

| {{ |

{{Cite news | ||

| |url=http://www. |

|url=http://www.smh.com.au/articles/2004/06/15/1087244921972.html | ||

| |title=Rio Tinto sets its sights on North Ltd | |||

| |work=Radio National | |||

| |date=June 23, 2000 | |||

| |author=Narelle Hooper | |||

| |publisher=] | |||

| |accessdate=2008-11-10}} | |||

| </ref> The takeover was partially motivated as a response to Northern Limited's 1999 bid to have Rio Tinto's Pilbara railway network declared ].<ref name=smh2004>{{cite web | |||

| |url=http://www.smh.com.au/articles/2004/06/15/1087244921972.html?from=moreStories | |||

| |title=Fortescue tries to prise open access to Pilbara railway line | |title=Fortescue tries to prise open access to Pilbara railway line | ||

| |work= |

|work=] | ||

| |author=Mark Drummond | |author=Mark Drummond | ||

| |date= |

|date=16 June 2004 | ||

| |access-date=10 November 2008 | |||

| |publisher=www.smh.com.au | |||

| }}</ref> The ] regulatory body approved the acquisition in August 2000,<ref>{{cite web | |||

| |accessdate=2008-11-10 | |||

| }}</ref> The ] regulatory body approved the acquisition in August 2000,<ref>{{cite web | |||

| |url=http://www.abc.net.au/pm/stories/s159664.htm | |url=http://www.abc.net.au/pm/stories/s159664.htm | ||

| |title=Rio Tinto's bid given the nod by ACCC | |title=Rio Tinto's bid given the nod by ACCC | ||

| |work=Radio National | |work=Radio National | ||

| |date= |

|date=4 August 2000 | ||

| |author=Tanya Nolan | |author=Tanya Nolan | ||

| |publisher=Australian Broadcasting Corporation | |publisher=Australian Broadcasting Corporation | ||

| |access-date=10 November 2008 | |||

| |accessdate=2008-11-10 | |||

| }}</ref> and the purchase was completed in October of the same year.<ref>{{ |

}}</ref> and the purchase was completed in October of the same year.<ref>{{Cite news | ||

| |url=http://findarticles.com/p/articles/mi_m0EIN/is_2000_Oct_10/ai_65901698 | |url=http://findarticles.com/p/articles/mi_m0EIN/is_2000_Oct_10/ai_65901698 | ||

| |title=Rio Tinto Completes Acquisition of North Limited |

|title=Rio Tinto Completes Acquisition of North Limited | ||

| |work= |

|work=] | ||

| |date= |

|date=10 October 2000 | ||

| |publisher=findarticles.com | |publisher=findarticles.com | ||

| |access-date=10 November 2008 | |||

| |accessdate=2008-11-10 | |||

| }}</ref> That year Rio Tinto also bought |

}}</ref> That year, Rio Tinto also bought North Limited and Ashton Mining for US$4 billion, adding additional resources in aluminium, iron ore, diamonds and coal.<ref name="RTWeb"/> In 2001, it bought (under Coal & Allied) the Australian coal businesses of the ].<ref name="RTWeb"/> | ||

| On November |

On 14 November 2007, Rio Tinto completed its largest acquisition to date,<ref name="Chartbook"/> purchasing Canadian aluminium company ] for $38.1 billion,<ref name="Alcan-Aq">{{cite web| url=http://www.riotinto.com/media/5157_6881.asp| title=Rio Tinto Completes Acquisition of 100% of Alcan| publisher=Rio Tinto| year=2007| access-date=30 January 2008| archive-url=https://web.archive.org/web/20080118025043/http://www.riotinto.com/media/5157_6881.asp| archive-date=18 January 2008| df=dmy-all}}</ref> {{as of|2014|lc=y}}, "the largest mining deal ever completed".<ref name="wu2014"/> Alcan's chief executive, Jacynthe Côté, led the new division, renamed ] with its headquarters situated in ].<ref name="CTV-Alcan-Aq">{{cite web|url=https://www.ctvnews.ca/rio-tinto-alcan-reach-us-38-1-billion-merger-deal-1.248444 |title=Rio Tinto, Alcan reach US$38.1-billion merger deal |publisher=CTV.ca |year=2007 |access-date=8 August 2007 |url-status=live |archive-url=https://web.archive.org/web/20070714160103/http://www.ctv.ca/servlet/ArticleNews/story/CTVNews/20070712/alcan_deal_070712/20070712?hub=TopStories |archive-date=14 July 2007 }}</ref> | ||

| Activity in 2008 and 2009 was focused on divestments of assets to raise cash and refocus on core business opportunities. The company sold three major assets in 2008, raising about $3 billion in cash. In the first quarter of 2009, Rio Tinto reached agreements to sell its interests in the ] iron ore mine and the ] coal mine, and completed sales of an aluminium smelter in China and the company's ] operations, for an additional estimated $2.5 billion.<ref name="Chartbook"/> | |||

| {{main|Rio Tinto espionage case}} | |||

| ===Arrests in China, 2009=== | |||

| On |

On 5 July 2009, four Rio Tinto employees were arrested in ] for corruption and espionage.<ref>{{Cite news|last1=Murphy|first1=Mathew|last2=Garnaut|first2=John|date=8 July 2009|title=Rio Tinto iron ore sales team arrested in China|work=The Sydney Morning Herald|publisher=Fairfax Media|department=Business Day|location=Sydney, Australia|url=https://www.smh.com.au/business/rio-tinto-iron-ore-sales-team-arrested-in-china-20090708-dbyi.html}}</ref><ref> at ] (11 September 2009).</ref> One of the arrested, Australian citizen ], was "suspected of stealing Chinese state secrets for foreign countries and was detained on criminal charges", according to a spokesman for the Chinese foreign ministry.<ref> – Telegraph UK</ref> Stern Hu was also accused of bribery by Chinese steel mill executives for sensitive information during the iron ore contract negotiations.<ref>{{Cite web|url=http://au.news.yahoo.com/a/-/latest/5715439/hu-accused-of-bribery-during-negotiation/|archive-url=https://web.archive.org/web/20090715044225/http://au.news.yahoo.com/a/-/latest/5715439/hu-accused-of-bribery-during-negotiation/|title=Hu accused of bribery during negotiation – Yahoo!7 News|archive-date=15 July 2009}}</ref><ref>{{Cite news | ||

| | last = Kwok | |||

| | first = Vivian Wai-yin | |||

| | title = The Iron Ore War:China claims Rio Tinto espionage cost it $100 billion | |||

| | url= https://www.forbes.com/2009/08/10/china-rio-tinto-markets-equity-trade-battle.html | |||

| | access-date =12 September 2009 | |||

| | work=Forbes | |||

| | date=10 August 2009}} | |||

| </ref> | |||

| On 19 March 2010 Rio Tinto and its biggest shareholder, ], signed a memorandum of understanding to develop Rio Tinto's iron ore project in the ] in ], ].<ref>{{Cite news|url=https://www.telegraph.co.uk/finance/newsbysector/industry/mining/7450648/Chinalco-to-team-up-with-Rio-Tinto-on-Simandou-project.html|title=Chinalco to team up with Rio Tinto on Simandou project|editor=Richard Fletcher, City|work=Telegraph.co.uk|access-date=14 April 2017|language=en}}</ref><ref name="riotinto.com">{{cite web|url=http://www.riotinto.com/media/media-releases-237_1397.aspx|title=Rio Tinto and Chinalco subsidiary Chalco sign binding agreement for Simandou iron ore project joint venture|date=29 July 2010|website=riotinto.com|language=en-GB|access-date=14 April 2017|archive-url=https://web.archive.org/web/20170414163333/http://www.riotinto.com/media/media-releases-237_1397.aspx|archive-date=14 April 2017}}</ref> On 29 July 2010, Rio Tinto and Chinalco signed a binding agreement to establish this ] covering the development and operation of the Simandou mine.<ref name="riotinto.com"/> | |||

| ==Corporate Status== | |||

| ===Organization=== | |||

| Rio Tinto is primarily organized into six operational businesses, divided by product type:<ref name="RTMgmt">{{cite web | |||

| | title = Management Overview | |||

| | work = Rio Tinto web site | |||

| | publisher = Rio Tinto | |||

| | url = http://www.riotinto.com/whoweare/management_overview.asp | |||

| | accessdate = March 5, 2009}}</ref> | |||

| Under the terms of the agreement, the joint venture maintains Rio Tinto's 95% interest in the Simandou project as follows: By providing US$1.35 billion on an earn-in basis through sole funding of ongoing development over a two-to-three-year period, Chalco, a subsidiary of Chinalco, would acquire a 47% interest in the joint venture. Once the full sum was paid, Rio Tinto would be left with a 50.35% interest in the project and Chalco would have 44.65%.<ref>Minerals Yearbook, 2010. Area Reports, International, Africa, and the Middle East. Government Printing Office. 13 November 2012. p 20. {{ISBN|978-1-4113-3174-7}}.</ref> The remaining 5% would be owned by the ] (IFC), the financing arm of the ]. On 22 April 2011 Rio Tinto, its subsidiary Simfer S.A. (Simfer), and the Guinean Government signed a settlement agreement that secured Rio Tinto's mining rights in Guinea to the southern concession of Simandou, known as blocks 3 and 4.<ref name="ReferenceA">{{cite web|url=http://www.riotinto.com/documents/PR895g_Rio_Tinto_and_Government_of_Guinea_sign_new_agreement_for_Simandou_iron_ore_project.pdf|date=22 April 2011|title=Rio Tinto and Government of Guinea sign new agreement for Simandou iron ore project|publisher=Rio Tinto Group|access-date=16 March 2018|archive-url=https://web.archive.org/web/20170414163836/http://www.riotinto.com/documents/PR895g_Rio_Tinto_and_Government_of_Guinea_sign_new_agreement_for_Simandou_iron_ore_project.pdf|archive-date=14 April 2017}}</ref> According to the agreement, Simfer would pay US$700 million and receive mining concession and government approval of the proposed Chalco and Rio Tinto Simandou joint venture.<ref name="ReferenceA"/> | |||

| *Rio Tinto Copper – copper and byproducts such as ], ], ], and ]; future home of ] operations if developed | |||

| *] – aluminium | |||

| *Rio Tinto Energy – coal and uranium | |||

| *Rio Tinto Diamonds – diamonds | |||

| *Rio Tinto Minerals – industrial minerals such as ], ], ] and ] | |||

| *Rio Tinto Iron and Titanium – ], ], and ] | |||

| In April 2011, Rio Tinto gained a majority stake in ].<ref>{{cite web|url=http://www.mining-journal.com/finance/rio-tinto-claims-control-of-riversdale|access-date=11 April 2011|title=Rio Tinto claims control of Riversdale|date=11 April 2011|archive-url=https://web.archive.org/web/20120611041615/http://www.mining-journal.com/finance/rio-tinto-claims-control-of-riversdale|archive-date=11 June 2012}}</ref><ref>{{cite news|url=https://www.telegraph.co.uk/finance/newsbysector/industry/mining/8443580/Rio-Tinto-gets-control-of-Riversdale.html|title=Rio Tinto gets control of Riversdale|first=Garry|last=White|date=11 April 2011|work=The Daily Telegraph}}</ref> | |||

| These operating groups are supported by separate divisions providing exploration and technology services.<ref name="RTMgmt"/> | |||

| In 2011, the company rekindled its interest in potash when it entered a joint venture with ] to develop the Albany potash development, in southern ], Canada. Following an exploration program, Acron in a June 2014 statement described Albany as "one of the best potash development opportunities in the world".<ref>{{cite web|url=http://www.canadanews.net/index.php/sid/223325435/scat/71df8d33cd2a30df/ht/Rich-potash-resources-struck-at-Acron-and-Rio-Tinto-joint-venture-project|archive-url=https://archive.today/20140702021808/http://www.canadanews.net/index.php/sid/223325435/scat/71df8d33cd2a30df/ht/Rich-potash-resources-struck-at-Acron-and-Rio-Tinto-joint-venture-project|archive-date=2 July 2014|title=Canada News - Rich potash resources struck at Acron and Rio Tinto joint venture project|work=canadanews.net|access-date=21 March 2015}}</ref> | |||

| ====Subsidiaries==== | |||

| Rio Tinto Group has a complex structure of partly and wholly owned subsidiaries, each held within one of the six operational groups described above. Major subsidiaries include<ref name="RTCompanies">{{cite web | |||

| | title = Our Companies | |||

| | work = Rio Tinto web site | |||

| | publisher = Rio Tinto | |||

| | url = http://www.riotinto.com/whatweproduce/218_our_companies.asp | |||

| | accessdate = March 5, 2009}}</ref>: | |||

| On 13 December 2011, an independent arbitrator cleared the way for Rio Tinto, which had owned 49% of Ivanhoe Mines (now known as ]), to take it over: he said the $16 billion Canadian group's "]" defence was not valid. Ivanhoe had developed ] in Mongolia, one of the world's largest-known copper deposits.<ref>{{cite web |url=http://www.miningweekly.com/article/rio-tinto-wins-fight-against-ivanhoe-poison-pill-2011-12-13 |title=Rio Tinto wins fight against Ivanhoe poison pill |date=13 December 2011}}</ref> On 28 January 2012, Rio Tinto gained control of Ivanhoe Mines and removed the management.<ref>{{cite web|url=http://www.smh.com.au/business/rio-tinto-to-purge-ivanhoe-mines-top-tier-20120127-1qloo.html|title=Rio Tinto to purge Ivanhoe Mines top tier|work=Sydney Morning Herald|date=28 January 2012|access-date=25 March 2012}}</ref> | |||

| {| class="wikitable sortable" | |||

| |+Major Rio Tinto Subsidiaries<ref name="RTCompanies"/> | |||

| In October 2013, Rio Tinto agreed to sell its majority stake in Australia's third-largest coal mine to ] and ] for a little over US$1 billion, as part of the firm's plans to focus on larger operations.<ref>{{Citation | |||

| |- | |||

| | url = https://www.reuters.com/article/us-riotinto-glencore-clermont-idUSBRE99O0DQ20131025 | |||

| ! Subsidiary !! Ownership Stake !! Main Product !! Location | |||

| | title = Glencore, Sumitomo buy Rio coal mine stake for $1 billion | |||

| |- | |||

| | year = 2013 | |||

| |] || 51% || Aluminium ] || United Kingdom (Wales) | |||

| | publisher = ] | |||

| |- | |||

| | location = International | |||

| |] || 100% || Diamonds || Australia (Western Australia) | |||

| | access-date = 1 July 2017 | |||

| |- | |||

| | archive-date = 5 November 2013 | |||

| |] || 100% || Aluminium smelting || Australia (Tasmania) | |||

| | archive-url = https://web.archive.org/web/20131105051304/http://www.reuters.com/article/2013/10/25/us-riotinto-glencore-clermont-idUSBRE99O0DQ20131025 | |||

| |- | |||

| | url-status = live | |||

| |]<ref name="BCAR">{{cite web | |||

| }}</ref> Less than a year later, Rio Tinto rejected two merger proposals from Glencore, proffered in July and August 2014;<ref name="wu2014">{{cite news | author=Wu, Zijing | author2=Campbell, Matthew | author3=Paton, James | title=Rio Tinto Rejected Takeover Approach From Glencore | date=6 October 2014 | url=https://www.bloomberg.com//news/2014-10-06/rio-rejects-glencore-approach-has-had-no-more-contact.html | agency=] }}</ref> the merger of Glencore and Rio Tinto would have created the world's largest mining company.<ref name="wu2014"/> | |||

| | title = Bougainville Copper Limited Annual Report 2007 | |||

| | publisher = Bougainville Copper Limited | |||

| In May 2015, Rio Tinto announced plans to sell some of its aluminium assets as part of a possible $1 billion deal, two years after a similar but failed attempt.<ref>{{cite news |author=Sarah Young |url=https://www.reuters.com/article/us-rio-tinto-disposal-aluminium-idUSKBN0O20NV20150517 |title=Rio Tinto to sell aluminum assets in $1 billion deal |work=Reuters |date=18 May 2015 |access-date=18 May 2015 |archive-date=18 May 2015 |archive-url=https://web.archive.org/web/20150518062231/http://www.reuters.com/article/2015/05/17/us-rio-tinto-disposal-aluminium-idUSKBN0O20NV20150517 |url-status=live }}</ref> | |||

| | date = 2008 | |||

| | url = http://www.bcl.com.pg/annual2007.pdf | |||

| In September 2020, it was announced that the company's chief executive ], along with two executives, would resign because of Rio Tinto's destruction of two ancient rock shelters in the ] region of Australia. The company's chief financial officer, ], became the new chief executive on 1 January 2021.<ref>{{cite news|url=https://www.wsj.com/articles/rio-tinto-ceo-to-step-down-amid-fallout-over-destruction-of-ancient-rock-shelters-11599782719?mod=searchresults&page=1&pos=2|title= Rio Tinto CEO to Step Down Amid Fallout Over Destruction of Ancient Rock Shelters |work=]|last=Winning|first=David|date=10 September 2020|access-date=12 September 2020}}</ref> | |||

| | format = pdf | |||

| | accessdate = March 5, 2009}}</ref> || 53.6% || Copper || Papua New Guinea | |||

| In March 2022, Rio Tinto completed the acquisition of Rincon Mining's ] project in Argentina for $825 million, following approval by Australia's ].<ref>{{Cite web |date=2022-03-30 |title=Rio Tinto completes acquisition of Rincon lithium project |url=https://www.globalminingreview.com/mining/30032022/rio-tinto-completes-acquisition-of-rincon-lithium-project/ |access-date=2022-03-30 |website=Global Mining Review |language=en}}</ref> | |||

| |- | |||

| |] || 100% || ] || United States (California; Colorado) | |||

| In July 2023, it was announced Rio Tinto had acquired a 15% stake in the Australian exploration and development company, Sovereign Metals for US $27.6 million.<ref>{{Cite web |last=suryaakella |date=2023-07-18 |title=Rio Tinto acquires 15% stake in Sovereign Metals for $27.6m |url=https://www.mining-technology.com/news/rio-tinto-stake-sovereign-metals/ |access-date=2023-07-18 |website=Mining Technology |language=en-US}}</ref> | |||

| |- | |||

| |] || 75% || Coal || Australia (New South Wales) | |||

| == Subsidiaries == | |||

| |- | |||

| The company has operations on six continents, but is mainly concentrated in Australia and Canada, and owns its mining operations through a complex web of wholly and partly owned subsidiaries.<ref name="Chartbook"/> | |||

| |] || 100% || Iron ore || Brazil | |||

| |- | |||

| *] – 68.4% | |||

| |] || 65% || Salt || Australia (Western Australia) | |||

| *] – 100% | |||

| |- | |||

| *] – 100% | |||

| |]s || 60% || Diamonds || Canada | |||

| *] – 68.4% | |||

| |- | |||

| *] – 58.7% | |||

| |] || 68% || Uranium || Australia (Northern Territory) | |||

| *Pacific Aluminum – 100% | |||

| |- | |||

| *] – 74% | |||

| |] || 30% || Copper || Chile | |||

| |- | |||

| ==Corporate status== | |||

| |] Joint Venture || 40% || Copper || Papua New Guinea | |||

| Rio Tinto is primarily organised into four operational businesses, divided by product type:<ref name=":1">{{cite web |date=2018 |title=Rio Tinto Chartbook |url=http://www.riotinto.com/documents/RT_chartbook.pdf |archive-url=https://web.archive.org/web/20190413154115/http://www.riotinto.com/documents/RT_chartbook.pdf |archive-date=13 April 2019 |access-date=31 December 2018}}</ref> | |||

| |- | |||

| |] (]) || 100% || Iron ore || Australia (Western Australia) | |||

| * ] | |||

| |- | |||

| * Aluminium – ], ] and alumina | |||

| |] || 60% || Iron smelting || Australia (Western Australia) | |||

| * Copper & Diamonds – copper and by-products such as ], ], ] and ], and the company's ] interests | |||

| |- | |||

| * Energy & Minerals – ] interests, industrial minerals such as ], ] and ]. The corporation previously held ] production assets. | |||

| |] || 59% || Iron ore || Canada | |||

| |- | |||

| These operating groups are supported by separate divisions providing exploration and function support.<ref name=":0">{{cite web|url=http://www.riotinto.com/our-business-75.aspx|title=Our business - Rio Tinto|date=13 April 2013|website=riotinto.com|access-date=18 April 2016|archive-url=https://web.archive.org/web/20170410204704/http://www.riotinto.com/our-business-75.aspx|archive-date=10 April 2017}}</ref> | |||

| |] || 100% || Land and water rights || United States (Utah) | |||

| |- | |||

| |] || 100% || Copper || United States (Utah) | |||

| |- | |||

| |] || 78% || Diamonds || Zimbabwe | |||

| |- | |||

| |] || 80% || Copper || Australia (New South Wales) | |||

| |- | |||

| |] || 58% || Copper || South Africa | |||

| |- | |||

| |] Sorel || 100% || Titanium Dioxide || Canada (Quebec) | |||

| |- | |||

| |] || 80% || Titanium Dioxide || Madagascar | |||

| |- | |||

| |] <ref name="RCMedia"> {{cite web | |||

| | title = Media Kit | |||

| | work = Resolution Copper web site | |||

| | publisher = Resolution Copper | |||

| | url = http://www.resolutioncopper.com/res/mediacenter/21.html | |||

| | format = pdf | |||

| | accessdate = March 5, 2009}}</ref> || 55% || Copper || United States (Arizona) | |||

| |- | |||

| |] || 50% || Titanium Dioxide || South Africa | |||

| |- | |||

| |] || 100% || Aluminium || Canada | |||

| |- | |||

| |] || 100% || Coal || Australia | |||

| |- | |||

| |] || 100% || Coal || United States (Wyoming) | |||

| |- | |||

| |Robe River (]) || 53% || Iron Ore || Australia (Western Australia) | |||

| |- | |||

| |] || 69% || Uranium || Namibia | |||

| |- | |||

| |] || 100% || Talc || France (Toulouse) | |||

| |- | |||

| |] || 100% || Talc || Australia (Western Australia) | |||

| |} | |||

| ===Stock structure and ownership=== | ===Stock structure and ownership=== | ||

| Rio Tinto |

Rio Tinto is structured as a ], with listings on both the ] (symbol: RIO), under the name "Rio Tinto Plc",<ref name="LSE">{{cite web | ||

| |title=Rio Tinto Plc Ord 10P | |||

| |work=London Stock Exchange – Detailed Prices | |||

| |publisher=] | |||

| |url=http://www.londonstockexchange.com/en-gb/pricesnews/prices/system/detailedprices.htm?sym=GB0007188757GBGBXSET10718875RIO | |||

| |access-date=11 March 2009 |archive-url=https://web.archive.org/web/20090611051319/http://www.londonstockexchange.com/en-gb/pricesnews/prices/system/detailedprices.htm?sym=GB0007188757GBGBXSET10718875RIO | |||

| | accessdate = March 11, 2009}}</ref> and the ] (symbol: RIO) in Sydney under the name '''Rio Tinto Limited'''<ref name="ASE">{{cite web | |||

| |archive-date=11 June 2009 | |||

| | title = Rio Tinto Limited (RIO) | |||

| }}</ref> and the ] (symbol: RIO) in Sydney, under the name "Rio Tinto Limited".<ref name="ASE">{{cite web | |||

| | work = ASX Company Information | |||

| | title = Rio Tinto Limited (RIO) | |||

| | publisher = Australian Securities Exchange | |||

| | work=ASX Company Information | |||

| | url = http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode&asxCode=RIO | |||

| | publisher=] | |||

| | accessdate = March 11, 2009}}</ref> The dual-listed company structure grants shareholders of the two companies the same proportional economic interests and ownership rights in the consolidated Rio Tinto Group, in such a way as to be equivalent to all shareholders of the two companies actually being shareholders in a single, unified entity. This structure was implemented in order to avoid adverse tax consequences and regulatory burdens. In order to eliminate ] issues, the company's accounts are kept, and ]s paid, in ]s.<ref name="RT-DLC"/> | |||

| | url = http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode&asxCode=RIO | |||

| | access-date =11 March 2009}}</ref> The dual-listed company structure grants shareholders of the two companies the same proportional economic interests and ownership rights in the consolidated Rio Tinto, in such a way as to be equivalent to all shareholders of the two companies actually being shareholders in a single, unified entity. This structure was implemented to avoid adverse tax consequences and regulatory burdens. To eliminate ] issues, the company's accounts are kept, and ]s paid, in United States dollars.<ref name="RT-DLC"/> | |||

| Rio Tinto is one of the largest companies listed on either exchange. |

Rio Tinto is one of the largest companies listed on either exchange. As such, it is included in the widely quoted indices for each market: the ] of the London Stock Exchange,<ref name="LSE"/> and the ] index of the Australian Securities Exchange.<ref name="ASX200">{{cite web | ||

| |title=S&P/ASX 200 Fact Sheet | |||

| |publisher=] | |||

| |url=http://www2.standardandpoors.com/spf/pdf/index/SP_ASX_200_Factsheet_A4.pdf | |||

| |access-date=11 March 2009 |archive-url=https://web.archive.org/web/20110613193459/http://www2.standardandpoors.com/spf/pdf/index/SP_ASX_200_Factsheet_A4.pdf | |||

| | format = pdf | |||

| |archive-date=13 June 2011 | |||

| | accessdate = March 11, 2009}}</ref> LSE-listed shares in Rio Tinto plc can also be traded indirectly on the ] via an ].<ref name="NYSE">{{cite web | |||

| }}</ref> LSE-listed shares in Rio Tinto plc can also be traded indirectly on the ] via an ].<ref name="NYSE">{{cite web | |||

| | title = Rio Tinto plc | |||

| |title = Rio Tinto plc | |||

| | work = Listings Directory | |||

| |work = Listings Directory | |||

| | publisher = NYSE Euronext | |||

| |publisher = ] | |||

| | url = http://www.nyse.com/about/listed/lcddata.html?ticker=RTP | |||

| |url = https://www.nyse.com/about/listed/lcddata.html?ticker=RTP | |||

| | accessdate = March 11, 2009}}</ref> As of March 4, 2009, Rio Tinto was the fourth-largest publicly listed mining company in the world, with a ] of approximately $34 billion.<ref name="Chartbook">{{cite web|url=http://www.riotinto.com/documents/investors_databook/March_09_Chartbook.pdf|title=Rio Tinto Chartbook|date=March 2009|publisher=Rio Tinto Group|accessdate=2009-04-08}}</ref> As of mid-February 2009, shareholders were geographically distributed 42% in the ], 18% in North America, 16% in Australia, 14% in Asia, and 10% in continental Europe.<ref name="Chartbook"/> | |||

| |access-date = 11 March 2009 | |||

| |archive-url = https://web.archive.org/web/20090421030142/http://www.nyse.com/about/listed/lcddata.html?ticker=rtp | |||

| |archive-date = 21 April 2009 | |||

| |df = dmy-all | |||

| }}</ref> As of 4 March 2009, Rio Tinto was the fourth-largest publicly listed mining company in the world, with a ] around $134 billion.<ref name="Chartbook">{{cite web|url=http://www.riotinto.com/documents/investors_databook/March_09_Chartbook.pdf|title=Rio Tinto Chartbook|date=March 2009|publisher=Rio Tinto|access-date=8 April 2009|archive-url=https://web.archive.org/web/20110715190346/http://www.riotinto.com/documents/investors_databook/March_09_Chartbook.pdf|archive-date=15 July 2011}}</ref> As of mid-February 2009, shareholders were geographically distributed 42% in the United Kingdom, 18% in North America, 16% in Australia, 14% in Asia and 10% in continental Europe.<ref name="Chartbook"/> | |||

| ====BHP Billiton bid==== | ====BHP Billiton bid==== | ||

| On November |

On 8 November 2007, rival mining company ] announced it was seeking to purchase Rio Tinto in an all-share deal. This offer was rejected by the board of Rio Tinto as "significantly undervalu" the company. Another attempt by BHP Billiton for a ], valuing Rio Tinto at $147 billion, was rejected on the same grounds. Meanwhile, the Chinese government-owned resources group ] and the US aluminium producer ] purchased 12% of Rio Tinto's London-listed shares in a move that would block or severely complicate BHP Billiton's plans to buy the company.<ref name="Freed-Chalco">{{Cite news|url=http://business.smh.com.au/chinese-raid-on-rio-could-thwart-bhp/20080201-1pkr.html|title=Chinese raid on Rio Tinto could thwart BHP|last=Freed|first=Jamie|date=1 February 2008|work=Sydney Morning Herald|publisher=Fairfax Digital|access-date=10 April 2009|archive-url=https://web.archive.org/web/20080430004823/http://business.smh.com.au/chinese-raid-on-rio-could-thwart-bhp/20080201-1pkr.html|archive-date=30 April 2008}}</ref><ref name='bbctakeover'>{{cite news | title=BHP makes £120bn Rio bid approach | date=8 November 2007 | url =http://news.bbc.co.uk/1/hi/business/7084946.stm |work=BBC News | access-date =8 November 2007 }}</ref> BHP Billiton's bid was withdrawn on 25 November 2008, with the BHP citing market instability from the ].<ref name="Keenan-BHP">{{cite web|url=https://www.bloomberg.com/apps/news?pid=20601087&sid=acb0npgKQrEw&refer=home|title=BHP Withdraws $66 Billion Stock Offer for Rio Tinto|last=Keenan|first=Rebecca|date=25 November 2008|publisher=]|access-date=10 April 2009|archive-url=https://web.archive.org/web/20081116003829/http://www.bloomberg.com/apps/news?pid=20601087|archive-date=16 November 2008}}</ref> | ||

| ====Chinalco investment==== | ====Chinalco investment==== | ||

| On February |

On 1 February 2009, Rio Tinto management announced it was in talks to receive a substantial ] infusion from ], a major Chinese state-controlled<ref name="Forbes"/> mining enterprise, in exchange for ownership interest in certain ]s and bonds. Chinalco was already a major shareholder, having bought up 9% of the company in a surprise move in early 2008;<ref name="Guardian"> | ||

| {{Cite news | |||

| | last = Treanor | |||

| | first = Jill | |||

| | title = Rio Tinto confirms talks over Chinese cash injection | |||

| | work=] | |||

| | publisher=Guardian News and Media Limited | |||

| | date = 1 February 2009 | |||

| | url = https://www.theguardian.com/business/2009/feb/01/rio-tinto-nears-chinalco-deal | |||

| | access-date =7 April 2009 | |||

| | accessdate = April 7, 2009}}</ref> The proposed investment structure reportedly involves $12.3 billion for the purchase of ownership interests of Rio Tinto assets in its iron ore, copper, and aluminium operations, plus $7.2 billion for ]. The transaction would bring Chinalco's ownership of the company to approximately 18.5%.<ref name="Forbes">{{cite web|url=http://www.forbes.com/2009/04/06/rio-tinto-cash-markets-equity-miners.html|title=Rio Tinto on the Hunt for Cash|last=Espinoza|first=Javier|date=April 6, 2009|work=Forbes.com|publisher=Forbes.com|accessdate=2009-04-07}}</ref> The deal is still pending approval from regulators in the United States, China, and Australia, and has not yet been approved by shareholders, although regulatory has been received from Germany and the ].<ref name="xinhua">{{cite web|url=http://news.xinhuanet.com/english/2009-04/03/content_11124288.htm|title=Chinalco's roadblocks of investment in Rio Tinto Group decreasing |last=Shasha|first=Deng|date=April 3, 2009|work=chinaview.cn|publisher=Xinhua News Agency|language=English|accessdate=2009-04-07}}</ref> The largest barrier to completing the investment may come from Rio Tinto's shareholders: support for the deal by shareholders was never overwhelming and has reportedly declined recently<ref name="WSJ">{{cite web|url=http://online.wsj.com/article/SB123911954518297263.html|title=No Escape from China for Rio Tinto|last=Denning|first=Liam|date=April 7, 2009|work=Wall Street Journal|publisher=Wall Street Journal|accessdate=2009-04-07}}</ref> as other financing options (such as a more traditional bond issuance) are beginning to appear more realistic as a viable alternative funding source.<ref name="Forbes"/><ref name="WSJ"/> A shareholder vote on the proposed deal is expected in the third quarter of 2009.<ref name="WSJ"/> | |||

| | location=London}}</ref> its ownership stake had risen to 9.8% by 2014, making it Rio Tinto's biggest investor.<ref name="wu2014"/> The proposed investment structure reportedly involves $12.3 billion for the purchase of ownership interests of Rio Tinto assets in its iron ore, copper and aluminium operations, plus $7.2 billion for ]s. The transaction would bring Chinalco's ownership of the company to roughly 18.5%.<ref name="Forbes">{{Cite news|url=https://www.forbes.com/2009/04/06/rio-tinto-cash-markets-equity-miners.html|title=Rio Tinto on the Hunt for Cash|last=Espinoza|first=Javier|date=6 April 2009|work=Forbes |access-date=7 April 2009}}</ref> The deal is still pending approval from regulators in the United States and China, and has not yet been approved by shareholders, although regulatory approval has been received from Germany and the ].<ref name="xinhua">{{cite web|url=http://news.xinhuanet.com/english/2009-04/03/content_11124288.htm|title=Chinalco's roadblocks of investment in Rio Tinto Group decreasing|last=Shasha|first=Deng|date=3 April 2009|work=chinaview.cn|publisher=Xinhua News Agency|access-date=7 April 2009|archive-url=https://web.archive.org/web/20090408023046/http://news.xinhuanet.com/english/2009-04/03/content_11124288.htm|archive-date=8 April 2009}}</ref> The largest barrier to completing the investment may come from Rio Tinto's shareholders; support for the deal by shareholders was never overwhelming and has reportedly declined in 2009,<ref name="WSJ">{{Cite news|url=https://www.wsj.com/articles/SB123911954518297263|title=No Escape from China for Rio Tinto|last=Denning|first=Liam|date=7 April 2009|work=] |access-date=7 April 2009}}</ref> as other financing options (such as a more traditional bond issuance) are beginning to appear more realistic as a viable alternative funding source.<ref name="Forbes"/><ref name="WSJ"/> A shareholder vote on the proposed deal was expected in the third quarter of 2009.<ref name="WSJ"/> | |||

| Rio Tinto is believed to have pursued this combined asset and convertible bond sale to raise cash to satisfy its debt obligations, which |

Rio Tinto is believed to have pursued this combined asset and convertible bond sale to raise cash to satisfy its debt obligations, which required payments of $9.0 billion in October 2009 and $10.5 billion by the end of 2010.<ref name="Forbes"/> The company has also noted China's increasing appetite for commodities, and the potential for increased opportunities to exploit these market trends, as a key factor in recommending the transaction to its shareholders.<ref name="Chartbook"/> | ||

| In March 2010, it was announced that Chinalco would invest $1.3 billion for a 44.65% stake in Rio Tinto's iron ore project in ], Guinea. Rio Tinto retained 50.35% ownership at Simandou.<ref>{{cite web | |||

| ===Management=== | |||

| |title=Rio Tinto Simandou | |||

| ] building in ], Australia.]] | |||

| |url=http://www.riotintosimandou.com/ENG/index.asp | |||

| Under the company's dual-listed company structure, management powers of the Rio Tinto Group are consolidated in a single senior management group led by a ] and executive committee. The board of directors has both executive and non-executive members, while the executive committee is composed of the heads of major operational groups.<ref name="RTMgmt" /> | |||

| |access-date=20 March 2010 | |||

| }}</ref> | |||

| In November 2011, Rio joined with Chinalco to explore for copper resources in China's complex landscape, by setting up a new company, CRTX, 51% owned by Chinalco and 49% by Rio Tinto.<ref>{{cite web | |||

| *'''Board of Directors''' | |||

| |title=Rio Tinto joins up with Chinalco to explore for copper | |||

| |url=https://www.telegraph.co.uk/finance/newsbysector/industry/mining/8915027/Rio-Tinto-joins-up-with-Chinaclo-to-explore-for-copper.html | |||

| |access-date=9 February 2012 | |||

| }}</ref> | |||

| ===Management=== | |||

| ], Australia.]] | |||

| Under the company's dual-listed company structure, management powers of the Rio Tinto are consolidated in a single senior management group led by a board of directors and executive committee. The board of directors has both executive and non-executive members,<ref>{{cite web|url=http://www.riotinto.com/aboutus/management-board-3502.aspx|title=Board of directors - Rio Tinto|date=20 April 2013|website=Rio Tinto |access-date=18 April 2016|archive-date=22 April 2018|archive-url=https://web.archive.org/web/20180422010344/http://www.riotinto.com/aboutus/management-board-3502.aspx}}</ref> while the executive committee is composed of the heads of major operational groups.<ref name="RTMgmt">{{cite web|url=http://www.riotinto.com/whoweare/management_overview.asp |title=Management Overview |website=Rio Tinto |access-date=5 March 2009 |archive-url=https://web.archive.org/web/20101221123233/http://www.riotinto.com/whoweare/management_overview.asp |archive-date=21 December 2010 }}</ref> | |||

| * '''Board of Directors''' | |||

| **''Executive Directors'' | **''Executive Directors'' | ||

| ***], ]<ref name="chairman">{{cite news|url=https://www.ft.com/content/4bf9016e-fb54-4068-a103-911cb2187f5e |url-access=subscription |title=Dominic Barton appointed Rio Tinto chair|date=19 December 2021|newspaper=Financial Times|access-date=14 July 2022}}</ref> | |||

| ***], Chairman | |||

| *** ], ]<ref>{{cite web|url=https://www.riotinto.com/about/executive-committee/jakob-stausholm |title=Jakob Stausholm |website=Rio Tinto |date=4 January 2021}}</ref> | |||

| ***], Chief Executive Officer | |||

| ** ''Non-Executive Directors'' | |||

| ***Guy Elliott, Finance Director | |||

| *** ]<ref>{{cite web|url=http://www.riotinto.com/aboutus/megan-clark-ac-13616.aspx |title=Megan Clark AC |website=Rio Tinto |date=19 November 2014 |access-date=10 March 2019}}</ref> | |||

| ***Dick Evans, Executive Director | |||

| *** Hinda Gharbi<ref>{{cite web|url=https://www.riotinto.com/about/board-of-directors/hinda-gharbi |title=Hinda Gharbi |website=Rio Tinto |access-date=6 May 2020}}</ref> | |||

| **''Non-Executive Directors'' | |||

| ***]<ref>{{cite web|url=https://www.riotinto.com/about/board-of-directors/simon-mckeon |title=Simon McKeon AO |website=Rio Tinto |access-date=6 May 2020}}</ref> | |||

| ***Sir ] | |||

| *** Simon Henry<ref>{{cite web|url=http://www.riotinto.com/aboutus/simon-henry-21152.aspx |title=Simon Henry |website=Rio Tinto |date=13 March 2017 |access-date=10 March 2019}}</ref> | |||

| ***] | |||

| *** Jennifer Nason<ref>{{cite web|url=https://www.riotinto.com/about/board-of-directors/jennifer-nason |title=Jennifer Nason |website=Rio Tinto |date=13 March 2017 |access-date=10 March 2019}}</ref> | |||

| ***Sir ] | |||

| *** Sam Laidlaw<ref>{{cite web|url=http://www.riotinto.com/aboutus/sam-laidlaw-21150.aspx |title=Sam Laidlaw |website=Rio Tinto |date=10 February 2017 |access-date=10 March 2019}}</ref> | |||

| ***] | |||

| ***]<ref>{{cite web|url=https://www.riotinto.com/about/board-of-directors/ngaire-woods |title=Ngaire Woods CBE |website=Rio Tinto |access-date=22 December 2020}}</ref> | |||

| ***] | |||

| Rio Tinto engages professional lobbyists to represent its interests in various jurisdictions. In South Australia, the company in represented by DPG Advisory Solutions.<ref>{{Cite web|title=Company/Lobbyist details: DPG Advisory Solutions |url=https://www.lobbyists.sa.gov.au/#/lobbyist/173|access-date=2021-06-14|website=South Australian Lobbyist Register}}</ref> | |||

| ***] | |||

| ***] | |||

| ***] | |||

| ***] | |||

| ***] | |||

| ==Operations== | ==Operations== | ||

| Rio Tinto's main business is the production of raw materials including copper, iron ore |

Rio Tinto's main business is the production of raw materials including copper, iron ore, bauxite, diamonds, uranium and industrial minerals including titanium dioxide, salt, gypsum and borates. Rio Tinto also performs processing on some of these materials, with plants dedicated to processing bauxite into alumina and aluminium, and smelting iron ore into iron. The company also produces other metals and minerals as ]s from the processing of its main resources, including gold, silver, ], ], nickel, ], lead and ].<ref name="RT-Prod">{{cite web | ||

| |title=Our Products | |||

| |work=Rio Tinto web site | |||

| |publisher=Rio Tinto | |||

| |url=http://www.riotinto.com/whatweproduce/218_our_products.asp | |||

| |access-date=11 March 2009 |archive-url=https://web.archive.org/web/20101213055823/http://www.riotinto.com/whatweproduce/218_our_products.asp | |||

| | accessdate = March 11, 2009}}</ref> Rio Tinto controls gross assets of $81 billion in value across the globe, with main concentrations in Australia (35%), Canada (34%), Europe (13%), and the United States (11%), and smaller holdings in Africa (3%), South America (3%), and Indonesia (1%).<ref name="Chartbook"/> | |||

| |archive-date=13 December 2010 | |||

| }}</ref> Rio Tinto controls gross assets of $81 billion in value across the globe, with main concentrations in Australia (35%), Canada (34%), Europe (13%) and the United States (11%), and smaller holdings in South America (3%), Africa (3%) and Indonesia (1%).<ref name="Chartbook"/> | |||

| {| class="wikitable sortable" | {| class="wikitable sortable" | ||

| |+Summary of 2008 production<ref name="PR-2008">{{cite web|url=http://www.riotinto.com/documents/Media/PR712g_Rio_Tinto_announces_underlying_earnings_of__10.3_billion.pdf|title=Rio Tinto Preliminary Results 2008|access-date=8 March 2009|archive-url=https://web.archive.org/web/20090327021716/http://www.riotinto.com/documents/Media/PR712g_Rio_Tinto_announces_underlying_earnings_of__10.3_billion.pdf|archive-date=27 March 2009}}</ref> | |||

| |+Summary of 2008 Production<ref name="PR-2008"/> | |||

| |- | |- | ||

| ! Product !! Amount !! World |

! Product !! Amount !! World ranking | ||

| |- | |- | ||

| | Iron ore || 153 |

| Iron ore || 153.4 million ]s || 2nd<ref name="FS-Iron">{{cite web | ||

| |title=Iron Ore Fact Sheet | |||

| |publisher=Rio Tinto | |||

| |url=http://www.riotinto.com/documents/ReportsPublications/corpPub_Iron_Ore.pdf | |||

| |access-date=11 March 2009 |archive-url=https://web.archive.org/web/20110930161545/http://www.riotinto.com/documents/ReportsPublications/corpPub_Iron_Ore.pdf | |||

| | format = pdf | |||

| |archive-date=30 September 2011 | |||

| | accessdate = March 11, 2009}}</ref> | |||

| }}</ref> | |||

| |- | |- | ||

| | Bauxite || {{0|0}}34 |

| Bauxite || {{0|0}}34.987 million tonnes || 1st<ref name="RT-Prod"/> | ||

| |- | |- | ||

| | Alumina || {{0|00}}9 |

| Alumina || {{0|00}}9.009 million tonnes || 2nd<ref name="RT-Prod"/> | ||

| |- | |- | ||

| | Aluminium || {{0|00}}4 |

| Aluminium || {{0|00}}4.062 million tonnes || 2nd<ref name="RT-Prod"/> | ||

| |- | |- | ||

| | Copper (mined) || {{0|000,}}698 |

| Copper (mined) || {{0|000,}}698,500 tonnes || 4th<ref name="FS-Copper">{{cite web | ||

| |

|title = Copper Fact Sheet | ||

| |

|publisher = Rio Tinto | ||

| |

|url = http://www.riotinto.com/documents/ReportsPublications/corpPub_Copper.pdf | ||

| |access-date = 11 March 2009 | |||

| | format = pdf | |||

| |archive-url = https://web.archive.org/web/20090327021719/http://www.riotinto.com/documents/ReportsPublications/corpPub_Copper.pdf | |||

| | accessdate = March 11, 2009}}</ref> | |||

| |archive-date = 27 March 2009 | |||

| |df = dmy-all | |||

| }}</ref> | |||

| |- | |- | ||

| | Copper (refined) || {{0|000,}}321 |

| Copper (refined) || {{0|000,}}321,600 tonnes || N/A | ||

| |- | |- | ||

| | Molybdenum || {{0|000,0}}10 |

| Molybdenum || {{0|000,0}}10,600 tonnes || 3rd<ref name="Roskill">{{cite web | ||

| |

|title = Molybdenum | ||

| |

|work = Roskill Metals and Minerals Reports | ||

| |publisher = Roskill Information Services | |||

| |year = 2007 | |||

| |url = http://www.roskill.com/reports/molybdenum | |||

| | date = 2007 | |||

| |access-date = 11 March 2009 | |||

| | url = http://www.roskill.com/reports/molybdenum | |||

| |archive-url = https://web.archive.org/web/20081104131546/http://www.roskill.com/reports/molybdenum | |||

| | accessdate = March 11, 2009}}</ref> | |||

| |archive-date = 4 November 2008 | |||

| |df = dmy-all | |||

| }}</ref> | |||

| |- | |- | ||

| | Gold || {{0|000,00}}0 |

| Gold || {{0|000,00}}{{convert|460000|oz|t|0|abbr=off|lk=out|disp=flip}} || 7th<ref name="FS-Copper"/> | ||

| |- | |- | ||

| | Diamonds || {{0|000,00}} |

| Diamonds || {{0|000,00}}{{convert|20.816|e6carat|t|0|abbr=off|lk=out|disp=flip}} || 3rd<ref name="Diamonds">{{cite web | ||

| | last = Krawitz | |||

| | first = Avi | |||

| | title = Rio Tinto 4Q08 Diamond Production −12% | |||

| | work=Diamonds.net News | |||

| | publisher=Diamonds.net | |||

| | date = 15 January 2009 | |||

| | url = http://www.diamonds.net/news/NewsItem.aspx?ArticleID=24916 | |||

| | access-date =11 March 2009}}</ref> | |||

| |- | |- | ||

| | Coal || 160 |

| Coal || 160.3 million tonnes || N/A | ||

| |- | |- | ||

| | Uranium || {{0|000,00}} |

| Uranium || {{0|000,00}}{{convert|6441|t|e6lb|1|abbr=off|lk=out}} || 3rd<ref name="RT-Prod"/> | ||

| |- | |- | ||

| | Titanium |

| Titanium dioxide || {{0|00}}1.524 million tonnes || N/A, but at least 3rd | ||

| |- | |||

| | Borates || {{0|000,}}610 thousand tonnes || 1st<ref name="RT-Prod"/> | |||

| |- | |- | ||

| | Borates || {{0|000,}}610,000 tonnes || 1st<ref name="RT-Prod"/> | |||

| |} | |} | ||

| === |

===Iron ore: Rio Tinto Iron Ore=== | ||

| {{see also|Pilbara Iron|Iron Ore Company of Canada}} | |||

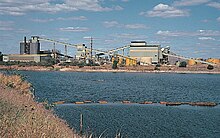

| ] | |||

| The Australian operations of Rio Tinto Iron Ore (RTIO) comprises an integrated iron ore operations in the ], Western Australia. The Pilbara iron ore operations include 16 iron ore mines, four independent port terminals, a 1,700-kilometre rail network and related infrastructure.<ref>{{cite web|url=https://www.riotinto.com/products/iron-ore|title=Iron Ore|publisher=Rio Tinto|access-date=6 May 2020}}</ref> The corporation also has had a majority stake in ] since its 2000 ] of North Limited.<ref>{{cite news |title=IOC mum on report that Rio Tinto may spin off company |url=https://www.cbc.ca/news/canada/newfoundland-labrador/ioc-tsx-rio-tinto-1.4779124 |publisher=]|date=9 August 2018}}</ref> | |||

| ] of Rio Tinto's subsidiary, Kennecott Utah Copper |

===Copper and by-products: Rio Tinto Copper=== | ||

| ] of Rio Tinto's subsidiary, Kennecott Utah Copper]] | |||

| ] underground mine is currently under development in Mongolia.|thumb|right]] | |||

| Copper was one of Rio Tinto's main products from its earliest days operating at the Rio Tinto complex of mines in Spain. Since that time, the company has divested itself from its original Spanish mines, and grown its copper-mining capacity through acquisitions of major copper resources around the world. The copper group's main active mining interests are ] in Mongolia, ] in the United States, and ] in Chile. Most of these mines are ]s with other major mining companies, with Rio Tinto's ownership ranging from 30% to 80%; only Kennecott is wholly owned. Operations typically include mining of ore through to production of 99.99% purified copper, including extraction of economically valuable ]s.<ref name="RT-copper">{{cite web | |||

| |title = Copper | |||

| |publisher = Rio Tinto | |||

| |url = https://www.riotinto.com/products/copper | |||

| |access-date = 6 May 2020 | |||

| |archive-url = https://web.archive.org/web/20080910161743/http://www.riotinto.com/whatweproduce/copper_578.asp | |||

| |archive-date = 10 September 2008 | |||

| |df = dmy-all | |||

| }}</ref> Together, Rio Tinto's share of copper production at its mines totalled nearly 700,000 ]s, making the company the fourth-largest copper producer in the world.<ref name="FS-Copper"/> | |||

| Rio Tinto Copper continues to seek new opportunities for expansion, with major exploration activities at the ] project in the United States, Winu in Australia, and ] underground mine in Mongolia. In addition, the company is seeking to become a major producer of nickel, with exploration projects currently underway in the United States and Indonesia.<ref name="RT-copper"/> | |||

| Copper was one of Rio Tinto Group's main products from its earliest days operating at the Rio Tinto complex of mines in Spain. Since that time, the company has divested itself from its original Spanish mines, and grown its copper mining capacity through acquisitions of major copper resources around the world. The copper group's main active mining interests are ] in Chile, the ] on Papua New Guinea, ] in the United States, ] in Australia, and ] in South Africa. Most of these mines are joint ventures with other major mining companies, with Rio Tinto's ownership ranging from 30% to 80%; only Kennecott is wholly owned. Operations typically include the mining of ore through to production of 99.99% purified copper, including extraction of economically valuable byproducts.<ref name="RT-copper">{{cite web | |||

| | title = Copper | |||

| | work = Rio Tinto web site | |||

| | publisher = Rio Tinto Group | |||

| | url = http://www.riotinto.com/whatweproduce/copper_578.asp | |||

| | accessdate = March 12, 2009}}</ref> Together, Rio Tinto's share of copper production at its mines totaled nearly 700,000 ]s, making the company the fourth-largest copper producer in the world.<ref name="FS-Copper"/> | |||

| Although not the primary focus of Rio Tinto Copper's operations, several economically valuable by-products are produced during the refining of copper ore into purified copper. Gold, silver, molybdenum and sulphuric acid are all removed from copper ore during processing. Due to the scale of Rio Tinto's copper mining and processing facilities, the company is also a leading producer of these materials, which drive substantial revenues to the company.<ref name="RT-copper"/> | |||

| Rio Tinto Copper continues to seek new opportunities for expansion, with major exploration activities at the ] project in the United States, ] in Peru, and ] in Mongolia. In addition, the company is seeking to become a major producer of ], with exploration projects currently underway in the United States and Indonesia.<ref name="RT-copper"/> | |||

| Sales of copper generated 8% of the company's 2008 revenues, and copper and by-product operations accounted for 16% of underlying earnings.<ref name="Chartbook"/> | |||

| Although not the primary focus of Rio Tinto Copper's operations, several economically valuable ]s are produced during the refining of copper ore into purified copper. Gold, silver, molybdenum, and sulfuric acid are all removed from copper ore during processing. Due to the scale of Rio Tinto's copper mining and processing facilities, the company is also a leading producer of these materials, which drive substantial revenues to the company.<ref name="RT-copper"/> | |||

| Rio Tinto exclusively provided the metal to produce the 4,700 gold, silver and bronze medals at the London ]. This was the second time Rio Tinto had done so for Olympic medals, having previously provided the metals for the Salt Lake City ].<ref name="RT-olympics">{{cite web | |||

| |title=We're helping to produce the London 2012 medals | |||

| Sales of copper generated 8% of the company's 2008 revenues, and copper and byproduct operations accounted for 16% of underlying earnings.<ref name="Chartbook"/> | |||

| |publisher=Rio Tinto | |||

| |url=http://www.riotinto.com/london2012/index_london2012.asp | |||

| |access-date=21 March 2012 |archive-url=https://web.archive.org/web/20130514082622/http://www.riotinto.com/london2012/index_london2012.asp | |||

| |archive-date=14 May 2013 | |||

| }} | |||

| </ref> Together, Rio Tinto's share of copper production at its mines totalled nearly 700,000 tonnes, making the company the fourth-largest copper producer in the world.<ref name="FS-Copper"/> | |||

| Rio Tinto was the ] sponsor of ] until 2022.<ref>{{cite web|url=https://www.rsl.com/post/2015/04/07/rio-tinto-stadium-partners-auric-solar-install-largest-solar-energy-offset-north|title=Rio Tinto Stadium partners with Auric Solar to install largest solar energy offset in North American pro sports venues|publisher=RSL Communications|date=7 April 2015|access-date=11 April 2017}}</ref> | |||

| ===Aluminium |

===Aluminium=== | ||

| ] in Northumberland, England]] | ] in Northumberland, England]] | ||

| {{main|Rio Tinto |

{{main|Aluminium division of Rio Tinto}} | ||

| Rio Tinto consolidated its aluminium-related businesses into its aluminium product group (originally named ''Rio Tinto Alcan''), formed in late 2007, when Rio Tinto purchased the Canadian company Alcan for $38.1 billion. Combined with Rio Tinto's existing aluminium-related assets, the new aluminium division vaulted to the world number-one producer of bauxite, alumina and aluminium.<ref name="RT-Alum">{{cite web | |||

| |title=Alumina, Aluminium and Bauxite | |||

| |publisher=Rio Tinto | |||

| |url=http://www.riotinto.com/whatweproduce/452_aluminium_577.asp | |||

| | publisher = Rio Tinto Group | |||

| |

|access-date=12 March 2009 |archive-url=https://web.archive.org/web/20100901023912/http://www.riotinto.com/whatweproduce/452_aluminium_577.asp | ||

| |archive-date=1 September 2010 | |||

| | accessdate = March 12, 2009}}</ref> Rio Tinto Alcan kept key leadership from Alcan, and the company's headquarters remain in Montreal.<ref name="CTV-Alcan-Aq"/> | |||

| }}</ref> Aluminium division kept key leadership from Alcan, and the company's headquarters remain in Montreal.<ref name="CTV-Alcan-Aq"/> | |||

| ] for scale).]] | ] for scale).]] | ||

| Rio Tinto |

Rio Tinto divides its Aluminium operations into three main areas—bauxite, alumina and primary metal. The Bauxite and Alumina unit mines raw bauxite from locations in Australia, Brazil and Africa. The unit then refines the bauxite into alumina at refineries located in Australia, Brazil, Canada and France. The Primary Metal business unit's operations consist of ] from alumina, with smelters located in 11 countries around the world. The Primary Metal group also operates several power plants to support the energy-intensive smelting process.<ref name="RT-Alum"/> | ||

| The aluminium division has interests in seven bauxite mines and deposits, six alumina refineries and six speciality alumina plants, 26 aluminium smelters, 13 ]s and 120 facilities for the manufacture of speciality products.<ref name="RT-Alum"/> The acquisition of Alcan operations in 2007 substantially increased Rio Tinto's asset base, revenues and profits: in 2008, 41% of company revenues and 10% of underlying earnings were attributable to the aluminium division.<ref name="Chartbook"/> | |||

| === |

===Uranium: Rio Tinto Energy=== | ||

| ] of ], a Rio Tinto subsidiary]] | |||

| Rio Tinto Energy is a business group of Rio Tinto dedicated to the mining and sale of ] and ].<ref name="RT-coal">{{cite web | |||

| ] ore concentrate).]] | |||

| | title = Coal | |||

| Rio Tinto Energy is a business group of Rio Tinto that was dedicated to the mining and sale of ]. Rio Tinto's uranium operations were located at two mines: the ] of ] and the ] in Namibia. The unit is now focused on mine rehabilitation. The company was the third-largest producer of uranium in the world. According to Rio Tinto's website, the company instituted strict controls and contractual limitations on uranium exports, limiting uses to peaceful, nonexplosive uses only. Such controls are intended to limit use of the company's uranium production to use as fuel for ]s only, and not for use in the production of ]s.<ref name="RT-uranium">{{cite web | |||

| | work = Rio Tinto web site | |||

| |title=Uranium | |||

| | publisher = Rio Tinto Group | |||

| |publisher=Rio Tinto | |||

| | url = http://www.riotinto.com/whatweproduce/coal.asp | |||

| |url=http://www.riotinto.com/whatweproduce/452_uranium.asp | |||

| | accessdate = March 12, 2009}}</ref> | |||

| |access-date=12 March 2009 |archive-url=https://web.archive.org/web/20101219000728/http://www.riotinto.com/whatweproduce/452_uranium.asp | |||

| |archive-date=19 December 2010 | |||

| }}</ref> Rio Tinto Energy was responsible for 12% of revenues and 18% of underlying earnings in 2008.<ref name="Chartbook"/> | |||

| Rio Tinto has divested or closed its remaining uranium operations since 2019. In 2019 it sold its remaining holdings in the Rössing uranium mine to China National Uranium Corporation Limited (CNUC) for an initial cash payment of $6.5 million plus a contingent payment of up to $100 million.<ref>{{cite news|url=https://www.reuters.com/article/us-rio-tinto-uranium-idUKKCN1NV07T|title=Rio Tinto to sell its stake in Rössing Uranium for up to $106.5 million|date=26 November 2018|newspaper=Reuters|access-date=22 May 2023}}</ref> | |||