| Revision as of 20:13, 21 May 2010 edit71.111.229.19 (talk) Undid revision 363354768 by Gavin.collins (talk) almost all major articles have disambiguation links at the top← Previous edit | Latest revision as of 00:18, 23 December 2024 edit undo66.49.187.212 (talk) →History | ||

| Line 1: | Line 1: | ||

| {{short description|Measurement, processing and communication of financial information about economic entities}} | |||

| {{Accounting}} | |||

| {{Redirect|Accountancy|the constituency in Hong Kong|Accountancy (constituency)|the game|Accounting (video game){{!}}''Accounting'' (video game)}} | |||

| :''For the legal concept, see also ], also termed an "accounting." | |||

| {{pp-pc1}} | |||

| '''Accountancy''' is the art of communicating financial information about a ] to users such as ] and ].<ref>Elliot, Barry & Elliot, Jamie: ''Financial accounting and reporting'', ], London 2004, ISBN 0273703641, p. 3, </ref> The ] is generally in the financial´s form statements that show in money terms the ] under the control of management; the art lies in selecting the information that is relevant to the user and is reliable.<ref>Elliot, Barry & Elliot, Jamie: ''Financial accounting and reporting'', Prentice Hall, London 2004, ISBN 0273703641, p. 3</ref> | |||

| {{Use dmy dates|date=February 2022}} | |||

| {{Accounting |expanded=}} | |||

| {{Business administration}} | |||

| '''Accounting''', also known as '''accountancy''', is the process of recording and processing information about ], such as ]es and ]s.<ref name="NP 2013">{{cite book |last1=Needles |first1=Belverd E. |title=Principles of Financial Accounting |last2=Powers |first2=Marian |publisher=Cengage Learning |year=2013 |edition=12 |series=Financial Accounting Series}}</ref><ref>{{Cite report |date=November 1940 |title=Accounting Research Bulletins No. 7 Reports of Committee on Terminology |url=http://clio.lib.olemiss.edu/cdm/ref/collection/deloitte/id/9342 |publisher=Committee on Accounting Procedure, American Institute of Accountants |access-date=31 December 2013 |archive-date=7 January 2014 |archive-url=https://web.archive.org/web/20140107100208/http://clio.lib.olemiss.edu/cdm/ref/collection/deloitte/id/9342 |url-status=dead }}</ref> Accounting measures the results of an organization's economic activities and conveys this information to a variety of stakeholders, including ]s, ]s, ], and ].<ref name = "UW Dept">{{cite web |url=http://www.foster.washington.edu/academic/departments/accounting/Pages/accounting.aspx |title=Department of Accounting |year=2013 |website=Foster School of Business |access-date=31 December 2013 |archive-date=19 March 2015 |archive-url=https://web.archive.org/web/20150319223850/http://www.foster.washington.edu/academic/departments/accounting/Pages/accounting.aspx |url-status=live }}</ref> Practitioners of accounting are known as ]s. The terms "accounting" and "]" are often used interchangeably.<ref name="Ias">{{cite journal |title=The introduction of International Accounting Standards in Europe: Implications for international convergence |date=2005 |url=https://www.tandfonline.com/doi/abs/10.1080/0963818042000338013 |publisher=Taylor & Francis Online |doi=10.1080/0963818042000338013 |access-date=3 April 2023 |archive-date=3 April 2023 |archive-url=https://web.archive.org/web/20230403191956/https://www.tandfonline.com/doi/abs/10.1080/0963818042000338013 |url-status=live |last1=Schipper |first1=Katherine |journal=European Accounting Review |volume=14 |pages=101–126 |s2cid=153931720 }}</ref> | |||

| Accountancy is a branch of ] that is useful in discovering the causes of success and failure in ]. The ]s of accountancy are applied to business entities in three divisions of practical art, named accounting, ], and ].<ref>Goodyear, Lloyd Earnest: ''Principles of Accountancy'', Goodyear-Marshall Publishing Co., ], 1913, p.7 </ref> | |||

| Accounting can be divided into several fields including ], ], ] and ].<ref name = "WC 1981" /> Financial accounting focuses on the reporting of an organization's financial information, including the preparation of ]s, to the external users of the information, such as investors, regulators and ].<ref name = "HDF 2006"/> Management accounting focuses on the measurement, analysis and reporting of information for internal use by management to enhance business operations.<ref name = "NP 2013"/><ref name = "HDF 2006" /> The recording of financial transactions, so that summaries of the financials may be presented in financial reports, is known as ], of which ] is the most common system.<ref name = "L 2009">{{cite book |last=Lung |first=Henry |year=2009 |title=Fundamentals of Financial Accounting |publisher=Elsevier }}</ref> ]s are designed to support accounting functions and related activities. | |||

| '''Accounting''' is defined by the ] (AICPA) as "the art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of financial character, and interpreting the results thereof."<ref>{{cite book | last = Singh Wahla | first = Ramnik | title = AICPA committee on Terminology. Accounting Terminology Bulletin No. 1 Review and Résumé}}</ref> | |||

| Accounting has existed in various forms and levels of sophistication throughout human history. The double-entry accounting system in use today was developed in medieval Europe, particularly in ], and is usually attributed to the Italian mathematician and Franciscan friar ].<ref name=jkdiwan>{{cite book|last=DIWAN|first=Jaswith|title=ACCOUNTING CONCEPTS & THEORIES|publisher=MORRE|location=LONDON|id=id# 94452|pages=001–002}}</ref> Today, accounting is facilitated by ] such as standard-setters, ] and ]. Financial statements are usually audited by accounting firms,<ref name = "Parliament Auditors 1"/> and are prepared in accordance with ] (GAAP).<ref name = "HDF 2006"/> GAAP is set by various standard-setting organizations such as the ] (FASB) in the United States<ref name = "NP 2013" /> and the Financial Reporting Council in the ]. As of 2012, "all major economies" have plans to ] towards or adopt the ] (IFRS).<ref name=globalcon>{{Cite web|publisher=] and ] |website=ifrs.org |url=http://www.ifrs.org/Use+around+the+world/Use+around+the+world.htm?WBCMODE=PresentationUnpublished |title=The move towards global standards |year=2011 |archive-url=https://web.archive.org/web/20111225111828/http://www.ifrs.org/Use+around+the+world/Use+around+the+world.htm?WBCMODE=PresentationUnpublished |archive-date=25 December 2011 |url-status=dead |access-date=27 April 2012}}</ref><ref>{{cite web |title=The importance of high quality accounting standards |url=https://www.proquest.com/openview/113ef6fb20852f7024ae491923c7e84c/1?pq-origsite=gscholar&cbl=3330 |access-date=3 April 2023 |archive-date=3 April 2023 |archive-url=https://web.archive.org/web/20230403192502/https://www.proquest.com/openview/113ef6fb20852f7024ae491923c7e84c/1?pq-origsite=gscholar&cbl=3330 | via=ProQuest |url-status=live }}</ref> | |||

| Accounting is thousands of years old; the earliest accounting records, which date back more than 7,000 years, were found in the Middle East. The people of that time relied on primitive accounting methods to record the growth of crops and herds. Accounting evolved, improving over the years and advancing as business advanced.<ref name="Friedlob, G. Thomas 1996, p.1">Friedlob, G. Thomas & Plewa, Franklin James, ''Understanding balance sheets'', ], NYC, 1996, ISBN 0471130753, p.1</ref> | |||

| ==History== | |||

| Early accounts served mainly to assist the memory of the ] and the audience for the account was the ] or record keeper alone. Cruder forms of accounting were inadequate for the problems created by a business entity involving multiple ], so ] first emerged in northern Italy in the 14th century, where trading ventures began to require more ] than a single individual was able to invest. The development of ] created wider audiences for accounts, as investors without firsthand knowledge of their ] relied on accounts to provide the requisite information.<ref>Carruthers, Bruce G., & Espeland, Wendy Nelson, ''Accounting for Rationality: Double-Entry Bookkeeping and the Rhetoric of Economic Rationality'', ], Vol. 97, No. 1, July 1991, pp. 40-41,44 46,</ref> This development resulted in a split of accounting systems for internal (i.e. ]) and external (i.e. ]) purposes, and subsequently also in accounting and disclosure regulations and a growing need for independent ] of external accounts by ].<ref>Lauwers, Luc & Willekens, Marleen: "Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli" (Tijdschrift voor Economie en Management, ], 1994, vol:XXXIX issue 3, p.302), </ref> | |||

| {{main article|History of accounting}} | |||

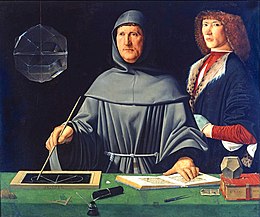

| ]'', painted by ], 1495 (])]] | |||

| Accounting is thousands of years old and can be traced to ] ]s.<ref name = "R 1992">Robson, Keith. 1992. "Accounting Numbers as 'inscription': Action at a Distance and the Development of Accounting." ''Accounting, Organizations and Society'' 17 (7): 685–708.</ref><ref name="NYSSCPA 2003">{{Citation | url =http://www.nysscpa.org/trustedprof/archive/1103/tp24.htm | title =A History of ACCOUNTANCY | publisher =New York State Society of CPAs | date =November 2003 | access-date =28 December 2013 | archive-date =1 January 2015 | archive-url =https://web.archive.org/web/20150101061851/http://www.nysscpa.org/trustedprof/archive/1103/tp24.htm | url-status =live }}</ref><ref name="UniSA 2013">{{Citation | url =http://www.library.unisa.edu.au/about/exhibitions/historyacc.aspx | title =The History of Accounting | publisher =University of South Australia | date =30 April 2013 | access-date =28 December 2013 | archive-url =https://web.archive.org/web/20131228180919/http://www.library.unisa.edu.au/about/exhibitions/historyacc.aspx | archive-date =28 December 2013 | url-status =dead }}</ref> One early development of accounting dates back to ancient ] and is closely related to developments in ], ] and ];<ref name = "R 1992" /> there is also evidence of early forms of ] in ancient ],<ref name = "G 1980">{{cite book|last=کشاورزی|first=کیخسرو|title=تاریخ ایران از زمان باستان تا امروز (Translated from Russian by Grantovsky, E.A.) | year=1980 | pages=39–40 | language=fa}}</ref><ref name = "OD 2008">Oldroyd, David & Dobie, Alisdair: ''Themes in the history of bookkeeping'', The Routledge Companion to Accounting History, London, July 2008, {{ISBN|978-0-415-41094-6}}, Chapter 5, p. 96</ref> and early ] systems by the ancient ] and ].<ref name = "NYSSCPA 2003" /> By the time of Emperor ], the ] had access to detailed financial information.<ref name="O 1995">{{Cite journal|last=Oldroyd |first=David |title=The role of accounting in public expenditure and monetary policy in the first century AD Roman Empire |journal=The Accounting Historians Journal |volume=22 |issue=2 |date=December 1995 |pages=117–129 |publisher=Academy of Accounting Historians |doi=10.2308/0148-4184.22.2.117 |jstor=40698165}}</ref> | |||

| Many concepts related to today's accounting seem to be initiated in medieval's Middle East. For example, Jewish communities used ] in the early-medieval period<ref>Parker, L. M., "Medieval Traders as International Change Agents: A Comparison with Twentieth Century International Accounting Firms", The Accounting Historians Journal, 16(2) (1989): 107–118.</ref><ref>''Medieval Traders as International Change Agents: a Comment'', Michael Scorgie, The Accounting Historians Journal, Vol. 21, No. 1 (June 1994), pp. 137–143</ref> and Muslim societies, at least since the 10th century also used many modern accounting concepts.<ref>{{cite journal |last1=Hamid |first1=Shaari |last2=Craig |first2=Russell |last3=Clarke |first3=Frank |title=Bookkeeping and accounting control systems in a tenth-century Muslim administrative office |journal=Accounting, Business & Financial History |date=January 1995 |volume=5 |issue=3 |pages=321–333 |doi=10.1080/09585209500000049 }}</ref> | |||

| Today, accounting is called "the language of business" because it is the vehicle for reporting financial information about a business entity to many different groups of people. Accounting that concentrates on reporting to people inside the business entity is called ] and is used to provide information to employees, managers, ] and ]. Management accounting is concerned primarily with providing a basis for making management or operating decisions. Accounting that provides information to people outside the business entity is called ] and provides information to present and potential shareholders, ] such as ] or vendors, ], ], and ]. Because these users have different needs, the presentation of financial accounts is very structured and subject to many more rules than management accounting. The body of rules that governs financial accounting is called ], or GAAP.<ref>Friedlob, G. Thomas & Plewa, Franklin James, ''Understanding balance sheets'', Wiley, NYC, 1996, ISBN 0471130753, p. 4</ref> | |||

| The spread of the use of ], instead of the ] historically used in Europe, increased efficiency of accounting procedures among Mediterranean merchants,<ref>{{cite journal |last1=Danna |first1=Rafael |title=The spread of Hindu-Arabic numerals in the tradition of European practical mathematics: A socio-economic perspective, thirteenth-sixteenth centuries |journal=Conference: The Economic History Society |date=5–7 April 2019}}</ref> who further refined accounting in ].<ref name="logica.ugent.be">{{cite web |last=Heeffer |first=Albrecht |title=On the curious historical coincidence of algebra and double-entry bookkeeping |work= Foundations of the Formal Sciences |publisher=] |date=November 2009 | page=11 |url=http://logica.ugent.be/albrecht/thesis/FOTFS2008-Heeffer.pdf |archive-url=https://ghostarchive.org/archive/20221009/http://logica.ugent.be/albrecht/thesis/FOTFS2008-Heeffer.pdf |archive-date=2022-10-09 |url-status=live }}</ref> With the development of ], accounting split into ] and ]. | |||

| The first published work on a ] was the '']'', published in ] in 1494 by ] (the "Father of Accounting").<ref>{{Cite web|url=https://www.huffingtonpost.com/steve-mariotti/so-who-invented-double-en_b_3588941.html|title=So, Who Invented Double Entry Bookkeeping? Luca Pacioli or Benedikt Kotruljević?|last=Mariotti|first=Steve|date=12 July 2013|website=Huffington Post|language=en-US|access-date=3 August 2018|archive-date=10 September 2017|archive-url=https://web.archive.org/web/20170910062611/http://www.huffingtonpost.com/steve-mariotti/so-who-invented-double-en_b_3588941.html|url-status=live}}</ref><ref name = "LW 1994">{{Cite journal|last1=Lauwers |first1=Luc |last2=Willekens |first2=Marleen |title=Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli |journal=Tijdschrift voor Economie en Management |year=1994 |volume=XXXIX |issue=3 |page=302 |format=PDF download |publisher=] |url=https://lirias.kuleuven.be/bitstream/123456789/119065/1/TEM1994-3_289-304p.pdf |archive-url=https://web.archive.org/web/20110820033441/https://lirias.kuleuven.be/bitstream/123456789/119065/1/TEM1994-3_289-304p.pdf |archive-date=20 August 2011 |url-status=live}}</ref> Accounting began to transition into an organized profession in the nineteenth century,<ref name="ICAEW 2013">{{Citation | url =https://www.icaew.com/en/library/subject-gateways/accounting-history/resources/timeline | title =Timeline of the History of the Accountancy Profession | publisher =Institute of Chartered Accountants in England and Wales | year =2013 | access-date =28 December 2013 | archive-date =11 October 2014 | archive-url =https://web.archive.org/web/20141011141621/http://www.icaew.com/en/library/subject-gateways/accounting-history/resources/timeline | url-status =live }}</ref><ref>{{citation |url=http://www.ruf.rice.edu/~sazeff/PDF/Horizons,%20Part%20I%20(print).pdf |title=How the U.S. Accounting Profession Got Where It Is Today: Part I |author=Stephen A. Zeff |journal=Accounting Horizons |pages=189–205 |volume=17 |issue=3 |date=2003 |doi=10.2308/acch.2003.17.3.189 |access-date=16 May 2020 |archive-date=21 July 2022 |archive-url=https://web.archive.org/web/20220721003409/http://www.ruf.rice.edu/~sazeff/PDF/Horizons,%20Part%20I%20(print).pdf |url-status=live }}</ref> with local ] in England merging to form the ] in 1880.<ref name="Perks16">{{cite book |author=Perks, R. W. |year=1993 |title=Accounting and Society |publisher=Chapman & Hall |location=London |isbn= 978-0-412-47330-2 |page=16 }}</ref> | |||

| ==Etymology== | ==Etymology== | ||

| ]]] | |||

| The word "]" is derived from the French word {{lang|fr|''Compter''}}, which took its origin from the ] word {{lang|la|''Computare''}}. The word was formerly written in English as "Accomptant", but in process of time the word, which was always pronounced by dropping the "p", became gradually changed both in ] and in ] to its present form.<ref>Pixley, Francis William: Accountancy — constructive and recording accountancy (Sir Isaac Pitman & Sons, Ltd, London, 1900), p4 </ref> | |||

| Both the words "accounting" and "accountancy" were in use in ] by the mid-1800s and are derived from the words ''accompting'' and ''accountantship'' used in the 18th century.<ref name = "LN 2009">Labardin, Pierre, and Marc Nikitin. 2009. "Accounting and the Words to Tell It: An Historical Perspective." ''Accounting, Business & Financial History'' 19 (2): 149–166.</ref> In ] (used roughly between the 12th and the late 15th century), the verb "to account" had the form ''accounten'', which was derived from the Old French word ''aconter'',<ref name = "B 1984">Baladouni, Vahé. 1984. "Etymological Observations on Some Accounting Terms." ''The Accounting Historians Journal'' 11 (2): 101–109.</ref> which is in turn related to the ] word ''computare'', meaning "to reckon". The base of ''computare'' is ''putare'', which "variously meant to prune, to purify, to correct an account, hence, to count or calculate, as well as to think".<ref name = "B 1984"/> | |||

| The word "]" is derived from the French word {{lang|fr|compter}}, which is also derived from the Italian and ] word {{lang|la|computare}}. The word was formerly written in English as "accomptant", but in process of time the word, which was always pronounced by dropping the "p", became gradually changed both in ] and in ] to its present form.<ref>Pixley, Francis William: Accountancy—constructive and recording accountancy (Sir Isaac Pitman & Sons, Ltd, London, 1900), p4</ref> | |||

| ==History== | |||

| ===Token accounting in ancient Mesopotamia=== | |||

| === Terminology === | |||

| ]]] | |||

| '''Accounting''' has variously been defined as the keeping or preparation of the financial records of transactions of the firm, the analysis, verification and reporting of such records and "the ] and procedures of accounting"; it also refers to the ] of being an ].<ref name = "Cambridge Business Accounting">{{cite web |url=http://dictionary.cambridge.org/dictionary/business-english/accounting |title=accounting noun – definition in the Business English Dictionary |year=2013 |website=Cambridge Dictionaries Online |publisher=Cambridge University Press |access-date=30 December 2013 |archive-date=2 July 2015 |archive-url=https://web.archive.org/web/20150702062650/http://dictionary.cambridge.org/dictionary/business-english/accounting |url-status=live }}</ref><ref name = "Cambridge British Accounting">{{cite web |url=http://dictionary.cambridge.org/dictionary/british/accounting?q=accounting |title=accounting noun – definition in the British English Dictionary & Thesaurus |year=2013 |website=Cambridge Dictionaries Online |publisher=Cambridge University Press |access-date=30 December 2013 |archive-date=2 November 2014 |archive-url=https://web.archive.org/web/20141102082918/http://dictionary.cambridge.org/dictionary/british/accounting?q=accounting |url-status=live }}</ref><ref name = "MW 2013 accounting">{{cite web |url=http://www.merriam-webster.com/dictionary/accounting |title=accounting |year=2013 |website=Merriam-Webster |publisher=Merriam-Webster, Incorporated |access-date=30 December 2013 |archive-date=23 July 2022 |archive-url=https://web.archive.org/web/20220723235833/https://www.merriam-webster.com/dictionary/accounting |url-status=live }}</ref> | |||

| The earliest accounting records were found amongst the ruins of ancient ], ] and ]ia, which date back more than 7,000 years. The people of that time relied on primitive accounting methods to record the growth of crops and herds. Because there is a natural season to farming and herding, it is easy to count and determine if a ] had been gained after the crops had been harvested or the young animals weaned.<ref name="Friedlob, G. Thomas 1996, p.1"/> | |||

| '''Accountancy''' refers to the ] or ] of an accountant,<ref name = "MW 2013 accountancy">{{cite web |url=http://www.merriam-webster.com/dictionary/accountancy |title=accountancy |year=2013 |website=Merriam-Webster |publisher=Merriam-Webster, Incorporated |access-date=30 December 2013 |archive-date=29 July 2022 |archive-url=https://web.archive.org/web/20220729092830/https://www.merriam-webster.com/dictionary/accountancy |url-status=live }}</ref><ref name = "Cambridge Business Accountancy">{{cite web |url=http://dictionary.cambridge.org/dictionary/business-english/accountancy?q=accountancy |title=accountancy noun – definition in the Business English Dictionary |year=2013 |website=Cambridge Dictionaries Online |publisher=Cambridge University Press |access-date=30 December 2013 |archive-date=19 October 2014 |archive-url=https://web.archive.org/web/20141019020532/http://dictionary.cambridge.org/dictionary/business-english/accountancy?q=accountancy |url-status=live }}</ref><ref name = "Cambridge British Accountancy">{{cite web |url=http://dictionary.cambridge.org/dictionary/british/accountancy?q=accountancy |title=accountancy noun – definition in the British English Dictionary & Thesaurus |year=2013 |website=Cambridge Dictionaries Online |publisher=Cambridge University Press |access-date=30 December 2013 |archive-date=19 October 2014 |archive-url=https://web.archive.org/web/20141019014728/http://dictionary.cambridge.org/dictionary/british/accountancy?q=accountancy |url-status=live }}</ref> particularly in ].<ref name = "Cambridge Business Accounting" /><ref name = "Cambridge British Accounting" /> | |||

| == Topics == | |||

| Accounting has several subfields or subject areas, including ], ], ], ] and ]s.<ref name = "WC 1981">Weber, Richard P., and W. C. Stevenson. 1981. "Evaluations of Accounting Journal and Department Quality." The Accounting Review 56 (3): 596–612.</ref> | |||

| ===Financial accounting=== | |||

| {{main article|Financial accounting}} | |||

| Financial accounting focuses on the reporting of an organization's financial information to external users of the information, such as investors, potential investors and creditors. It calculates and records business transactions and prepares ]s for the external users in accordance with ] (GAAP).<ref name = "HDF 2006">{{Citation | |||

| | last1 = Horngren | |||

| | first1 = Charles T. | |||

| | author-link1= Charles Thomas Horngren | |||

| | last2 = Datar | |||

| | first2 = Srikant M. | |||

| | author-link2= Srikant Datar | |||

| | last3 = Foster | |||

| | first3 = George | |||

| | title = Cost Accounting: A Managerial Emphasis | |||

| | place = New Jersey | |||

| | publisher = Pearson Prentice Hall | |||

| | year = 2006 | |||

| | edition = 12th | |||

| }}</ref> GAAP, in turn, arises from the wide agreement between ] and practice, and changes over time to meet the needs of decision-makers.<ref name = "NP 2013" /> | |||

| Financial accounting produces past-oriented reports—for example financial statements are often published six to ten months after the end of the accounting period—on an ] or quarterly basis, generally about the organization as a whole.<ref name = "HDF 2006" /> | |||

| ===Management accounting=== | |||

| {{main article|Management accounting}} | |||

| Management accounting focuses on the measurement, analysis and reporting of information that can help managers in making decisions to fulfill the goals of an organization. In management accounting, internal measures and reports are based on ], and are not required to follow the generally accepted accounting principle (GAAP).<ref name = "HDF 2006" /> In 2014 CIMA created the . The result of research from across 20 countries in five continents, the principles aim to guide best practice in the discipline.<ref name=FT>{{cite news|last=King|first=I.|title=New set of accounting principles can help drive sustainable success|newspaper=Financial Times|date=23 October 2014|url=http://www.ft.com/cms/s/0/0b595a98-59fa-11e4-8771-00144feab7de.html?siteedition=uk#axzz3Q8Lp1OP9|publisher=ft.com|access-date=28 January 2015}}</ref> | |||

| Management accounting produces past-oriented reports with time spans that vary widely, but it also encompasses future-oriented reports such as ]. Management accounting reports often include financial and non financial information, and may, for example, focus on specific products and departments.<ref name = "HDF 2006" /> | |||

| ===Intercompany accounting=== | |||

| ], ], cira 3500 BC. Department of Oriental Antiquities, ].]] | |||

| {{main article|Intercompany accounting}} | |||

| During the period ]–] ], the ] witnessed the spread of small settlements supported by agricultural surplus. ], shaped into simple ] forms such as ] or ], were used for ] purposes in relation to identifying and securing this surplus, and are examples of accounts that referred to lists of personal property.<ref name="latienda.ie.edu">Salvador Carmona & Mahmoud Ezzamel:''Accounting And Forms Of Accountability In Ancient Civilizations: Mesopotamia And Ancient Egypt'', ], IE Working Paper WP05-21, 2005), p.6 </ref> Some of them bore markings in the form of ] lines and ] dots. ] community leaders collected the surplus at regular intervals in the form of a share of the farmers’ flocks and harvests. In turn, the accumulated communal goods were redistributed to those who could not support themselves, but the greatest part was earmarked for the performance of religious rituals and festivals. In ] BC, there were only some 10 token shapes because the system exclusively recorded agricultural goods, each representing one of the farm products levied at the time, such as ], ] and ].The number of token shapes increased to about 350 around ], when urban workshops started contributing to the redistribution economy. Some of the new tokens stood for raw materials such as ] and metal and others for finished products among which ], ], ], ], ] and ].<ref>]: ''From Tokens to Writing: the Pursuit of Abstraction'', Bulletin Of The ], 2007, vol. 175, no. 3, p.162–3 </ref> | |||

| Intercompany accounting focuses on the measurement, analysis and reporting of information between separate entities that are related, such as a parent company and its subsidiary companies. Intercompany accounting concerns record keeping of transactions between companies that have common ownership such as a parent company and a partially or wholly owned subsidiary. Intercompany transactions are also recorded in accounting when business is transacted between companies with a common parent company (subsidiaries).<ref>{{Cite web |title=What is Intercompany Accounting? {{!}} F&A Glossary {{!}} BlackLine |url=https://www.blackline.com/resources/glossaries/intercompany-accounting/ |access-date=2024-08-16 |website=www.blackline.com}}</ref><ref>{{Cite web |last=Beaver |first=Scott |date=2024-04-03 |title=What Is Intercompany Accounting? Best Practices and Management |url=https://www.netsuite.com/portal/resource/articles/accounting/intercompany-accounting.shtml |website=www.netsuite.com}}</ref> | |||

| ===Auditing=== | |||

| The invention of a form of ] using clay tokens represented a huge ] leap for mankind.<ref>Oldroyd, David & Dobie, Alisdair: ''Themes in the history of bookkeeping'', The Routledge Companion to Accounting History, London, July 2008, ISBN 978-0-415-41094-6, Chapter 5, p.96</ref> The cognitive significance of the token system was to foster the manipulation of ]. Compared to ] information passed on from one individual to the other, tokens were extra-somatic, that is outside the human mind. As a result, the ] accountants were no longer the passive recipients of someone else's knowledge, but they took an active part in ] and ] data. The token system substituted miniature counters for the real goods, which eliminated their bulk and weight and allowed dealing with them in abstraction by ], the presentation of data in particular configurations. As a result, heavy baskets of grains and animals difficult to control could be easily counted and recounted. The accountants could add, subtract, multiply and divide by manually moving and removing counters.<ref>Denise Schmandt-Besserat: ''From Tokens to Writing: the Pursuit of Abstraction'' Bulletin Of The ], 2007, vol. 175, no. 3, p.165 </ref> | |||

| {{main article|Financial audit|Internal audit}} | |||

| Auditing is the verification of assertions made by others regarding a payoff,<ref name = "B 1979">Baiman, Stanley. 1979. "Discussion of Auditing: Incentives and Truthful Reporting." Journal of Accounting Research 17: 25–29.</ref> and in the context of accounting it is the "] examination and evaluation of the financial statements of an organization".<ref name = "I 2013">{{cite web |url=http://www.investopedia.com/terms/a/audit.asp |title=Audit Definition |year=2013 |website=Investopedia |publisher=Investopedia US |access-date=30 December 2013 |archive-date=26 July 2022 |archive-url=https://web.archive.org/web/20220726065345/https://www.investopedia.com/terms/a/audit.asp |url-status=live }}</ref> Audit is a professional service that is systematic and conventional.<ref>{{cite journal|last1=Tredinnick|first1=Luke|title=Artificial intelligence and professional roles|journal=Business Information Review|date=March 2017|volume=34|issue=1|pages=37–41|doi=10.1177/0266382117692621|s2cid=157743821|url=http://repository.londonmet.ac.uk/3812/3/OOTB-AI.pdf |archive-url=https://ghostarchive.org/archive/20221009/http://repository.londonmet.ac.uk/3812/3/OOTB-AI.pdf |archive-date=2022-10-09 |url-status=live}}</ref> | |||

| An audit of financial statements aims to express or disclaim an independent opinion on the financial statements. The auditor expresses an independent opinion on the fairness with which the financial statements presents the financial position, results of operations, and cash flows of an entity, in accordance with the generally accepted accounting principles (GAAP) and "in all material respects". An auditor is also required to identify circumstances in which the generally accepted accounting principles (GAAP) have not been consistently observed.<ref name = "SAS 1 Responsibilities">{{cite web |url=http://www.aicpa.org/Research/Standards/AuditAttest/DownloadableDocuments/AU-00110.pdf |title=Responsibilities and Functions of the Independent Auditor |date=November 1972 |website=AICPA |access-date=30 December 2013 |archive-date=23 April 2021 |archive-url=https://web.archive.org/web/20210423141039/https://www.aicpa.org/Research/Standards/AuditAttest/DownloadableDocuments/AU-00110.pdf |url-status=dead }}</ref> | |||

| ], ] (4000 to 3100 BC). Department of Oriental Antiquities, ].]] | |||

| ] script in clay, ], ] (3200 BC to 2700 BC). Department of Oriental Antiquities, ].]] | |||

| ===Information systems=== | |||

| The ] civilization emerged during the period ]–] BC amid the development of technological innovations such as the ], ] and ]. Clay tablets with ] characters appeared in this period to record commercial transactions performed by the ].<ref name="latienda.ie.edu"/> Clay receptacles known as '']'' (]: 'Bubble'), were used in ]ite city of ] which contained tokens. These receptacles were spherical in shape and acted as envelopes, on which the ] of the individuals taking part in a transaction were engraved. The symbols of the tokens they contained were represented graphically on their surface, and the recipient of the goods could check whether they matched with the amount and characteristics expressed on the bulla once they had received and inspected them. The fact that the content of ''bulla'' was marked on its surface produced a simple way of checking without destroying the receptacle, which constituted in itself an exercise in writing that, despite being born spontaneously as a support for the existing system for controlling merchant goods, ultimately became the definitive practice for non-oral communication. Eventually, ''bullae'' were replaced by ]s, which used symbols to represent the tokens.<ref>Panosa, M. Isabel: ''The beginnings of the written culture in Antiquity'', Digithum, ], May 2004, p.4 </ref> | |||

| {{main article|Accounting information system}} | |||

| An accounting information system is a part of an organization's ] used for processing accounting data.<ref name=OpenLearn>{{cite web|title=1.2 Accounting information systems|url=http://labspace.open.ac.uk/mod/resource/view.php?id=365833|work=Introduction to the context of accounting|publisher=OpenLearn|access-date=3 February 2014}}</ref> | |||

| Many corporations use artificial intelligence-based information systems. The banking and finance industry uses AI in fraud detection. The retail industry uses AI for customer services. AI is also used in the cybersecurity industry. It involves computer hardware and software systems using statistics and modeling.<ref>{{cite journal|last1=Pathak|first1=Jagdish|last2=Lind|first2=Mary R.|title=Audit Risk, Complex Technology, and Auditing Processes|journal=EDPACS|date=November 2003|volume=31|issue=5|pages=1–9|doi=10.1201/1079/43853.31.5.20031101/78844.1|s2cid=61767095}}</ref> | |||

| Many accounting practices have been simplified with the help of ]. An ] (ERP) system is commonly used for a large organisation and it provides a comprehensive, centralized, integrated source of information that companies can use to manage all major business processes, from purchasing to manufacturing to human resources. These systems can be cloud based and available on demand via application or browser, or available as software installed on specific computers or local servers, often referred to as on-premise. | |||

| During the ], token envelop accounting was replaced by flat clay tablets impressed by tokens that merely transferred symbols. Such documents were kept by ], who were carefully trained to acquire the necessary ] and ] skills and were held responsible for documenting ].<ref>Salvador Carmona & Mahmoud Ezzamel:''Accounting And Forms Of Accountability In Ancient Civilizations: Mesopotamia And Ancient Egypt'', IE Business School, IE Working Paper WP05-21, 2005), p.7 </ref> Such records preceded the earliest found examples of ] writing in the form of abstract signs incised in clay tablets, which were written in ] by 2900 BC in ]. Therefore "token envelop accounting" not only preceded the written word but constituted the major impetus in the creation of ] and abstract ].<ref name="latienda.ie.edu"/> | |||

| ===Accounting in the Roman Empire=== | |||

| ]'' (Temple of Augustus and Rome) at ], built between 25 BC - 20 BC.]] | |||

| The '']'' (]: "The Deeds of the Divine Augustus") is a remarkable account to the Roman people of the Emperor ]' stewardship. It listed and quantified his public expenditure, which encompassed distributions to the people, grants of land or money to army veterans, subsidies to the '']'' (treasury), building of temples, religious offerings, and expenditures on theatrical shows and ] games. It was not an account of state revenue and expenditure, but was designed to demonstrate Augustus' munificence. The significance of the ''Res Gestae Divi Augusti'' from an accounting perspective lies in the fact that it illustrates that the ] had access to detailed financial information, covering a period of some forty years, which was still retrievable after the event. The scope of the accounting information at the emperor's disposal suggests that its purpose encompassed planning and decision-making.<ref>Oldroyd, David: ''The role of accounting in public expenditure and monetary policy in the first century AD Roman Empire'', Accounting Historians Journal, Volume 22, Number 2, ], December 1995, p.124, </ref> | |||

| ===Tax accounting=== | |||

| The Roman historians ] and ] record that in ], ] prepared a ''rationarium'' (account) which listed public revenues, the amounts of cash in the ''aerarium'' (treasury), in the provincial ''fisci'' (tax officials), and in the hands of the '']'' (public contractors); and that it included the names of the freedmen and slaves from whom a detailed account could be obtained. The closeness of this information to the executive authority of the emperor is attested by ]' statement that it was written out by Augustus himself.<ref>Oldroyd, David: ''The role of accounting in public expenditure and monetary policy in the first century AD Roman Empire'', Accounting Historians Journal, Volume 22, Number 2, Birmingham, Alabama, December 1995, p.123, </ref> ], in ] (1st-2nd century AD) requesting money to buy 5,000 measures of cereal used for brewing beer. Department of Prehistory and Europe, ].]] | |||

| {{main article|Tax accounting}} | |||

| Tax accounting in the United States concentrates on the preparation, analysis and presentation of tax payments and tax returns. The U.S. tax system requires the use of specialised accounting principles for tax purposes which can differ from the ] (GAAP) for financial reporting.<ref name="autogenerated2010">{{ Citation | last1 = Droms| first1= William G.| last2= Wright| first2= Jay O.| title= Finance and Accounting for nonfinancial Managers: All the Basics you need to Know| publisher= Basic Books| year= 2010| edition= 6th}}</ref> U.S. tax law covers four basic forms of business ownership: ], ], ], and ]. ] and ] income are taxed at different rates, both varying according to income levels and including varying marginal rates (taxed on each additional dollar of income) and average rates (set as a percentage of overall income).<ref name="autogenerated2010"/> | |||

| Records of ], ], and transactions were kept scrupulously by military personnel of the ]. An account of small cash sums received over a few days at the ] of ] cira ] CE shows that the fort could compute ] in cash on a daily basis, perhaps from sales of surplus supplies or goods manufactured in the camp, items dispensed to slaves such as ''cervesa'' (]) and ''clavi caligares'' (] for boots), as well as commodities bought by individual soldiers. The basic needs of the fort were met by a mixture of direct ], ] and ]; in one letter, a request for money to buy 5,000 ''modii'' (measures) of ''braces'' (a cereal used in brewing) shows that the fort bought provisions for a considerable number of people.<ref>Bowman, Alan K., ''Life and letters on the Roman frontier: Vindolanda and its people'' ], London, January 1998, ISBN 978-0-415-92024-7, p. 40-41,45</ref> | |||

| ===Forensic accounting=== | |||

| The ] is name given to a huge collection of ] documents, mostly letters, but also including a fair number of accounts, which comes from ] in 3rd century CE. The bulk of the documents relate to the running of a large, private ]<ref>Farag, Shawki M., ''The accounting profession in Egypt: Its origin and development'', ], 2009, p.7 </ref> is named after Heroninos because he was ''phrontistes'' (]: ]) of the estate which had a complex and standarised system of accounting which was followed by all its local farm managers.<ref>Rathbone, Dominic: ''Economic Rationalism and Rural Society in Third-Century AD Egypt: The Heroninos Archive and the Appianus Estate'', ], ISBN 0521037638, 1991, p.4</ref> Each administrator on each sub-division of the estate drew up his own little accounts, for day to day running of the estate, payment of the workforce, production of crops, the sale produce, the use of animals, and general expetidirure on the staff. This information was then summarized as pieces of papyrus ] into one big yearly account for each particular sub—division of the estate. Entries were arranged by sector, with cash expenses and gains extrapolated from all the different sectors. Accounts of this kind gave the owner the opportunity to take better ] decisions because the information was purposefully selected and arranged.<ref>Cuomo,Serafina: ''Ancient mathematics'', ], London, ISBN 9780415164955, July 2001, p.231</ref> | |||

| {{Unreferenced section|date=June 2023}} | |||

| {{main article|Forensic accounting}} | |||

| Forensic accounting is a specialty practice area of accounting that describes engagements that result from actual or anticipated disputes or ].<ref>{{Cite web |title=What is a Forensic Accountant? {{!}} Forensic CPA Society |url=https://www.fcpas.org/about-us/what-is-a-forensic-accountant/ |access-date=2023-08-02 |language=en-US}}</ref> "]" means "suitable for use in a court of law", and it is to that standard and potential outcome that forensic accountants generally have to work. | |||

| Simple accounting is mentioned in the ] (New Testament) in the ], in the ].<ref>Matt. 25:19</ref> | |||

| === Political campaign accounting === | |||

| ===Islamic accounting & algebra=== | |||

| {{main article|Political campaign accounting}} | |||

| In the Holy ], the word ''hesab'' (]: account) is used in its generic sense, relating to one's obligation to account to God on all matters pertaining to human endeavour. According to the Holy Qur’an, followers are required to keep records of their indebtedness (], ] ), thus ] thus provides general approval and guidelines for the recording and reporting of transactions.<ref>Lewis, Mervyn K.: ''Islam and accounting'', ], ], 2001, p. 113, </ref> | |||

| Political campaign accounting deals with the development and implementation of financial systems and the accounting of financial transactions in compliance with laws governing political campaign operations. This branch of accounting was first formally introduced in the March 1976 issue of ''The Journal of Accountancy''.<ref>{{cite journal |id={{ProQuest|198258865}} |last1=Wagman |first1=Barry E. |title=Political campaign accounting—New opportunities for the CPA |journal=Journal of Accountancy |volume=141 |issue=3 |date=March 1976 |pages=36 }}</ref> | |||

| == Organizations == | |||

| The ] (], ] ) defines exactly how the estate is calculated after death of an individual. The power of ] is basically limited to one-third of the net estate (i.e. the assets remaining after the payment of funeral expenses and debts), providing for every member of the family by allotting fixed shares not only to wives and children, but also to father and mothers.<ref>Lewis, Mervyn K.: ''Islam and accounting'', Wiley-Blackwell, ], 2001, p. 109 ,</ref> The complexity of this law served as an impetus behind the development of ] (]: ''al-jabr'') by ] and other medieval Islamic mathematicians. Al-Khwārizmī's '']'' (Arabic: "The Compendious Book on Calculation by Completion and Balancing", ], c. ]) devoted a chapter on the solution to the Islamic law of inheritance using ]s.<ref>{{citation|title=The Algebra of Inheritance: A Rehabilitation of Al-Khuwarizmi|first=Solomon|last=Gandz|journal=]|volume=5|year=1938|publisher=]|pages=319–91|doi=10.1086/368492}}</ref> In the twelfth century, ] translations of al-Khwārizmī's ''Kitāb al-Jamʿ wa-l-tafrīq bi-ḥisāb al-Hind'' (Arabic: Book of Addition and Subtraction According to the Hindu Calculation) on the use of ], introduced the ] ] to the ].<ref>Struik, Dirk Jan (1987), A Concise History of Mathematics (4th ed.), ], ISBN 0486602559</ref> | |||

| {{Category see also|Accounting organizations}} | |||

| === Professional bodies === | |||

| The development of ] and accounting was intertwined during the ]. Mathematics was in the midst of a period of significant development in the late 15th century. ] and ] were introduced to Europe from Arab mathematics at the end of the 10th century by the Benedictine monk ], but it was only after ] (also known as Fibonacci) put commercial ], Hindu-Arabic numerals, and the rules of algebra together in his ] in 1202 that Hindu-Arabic numerals became widely used in Italy.<ref>Alan Sangster, Greg Stoner & Patricia McCarthy: "The market for Luca Pacioli's Summa Arithmetica" (Accounting, Business & Financial History Conference, Cardiff, September 2007) p. 1–2</ref> | |||

| {{main article|Professional accounting body}} | |||

| ] include the ] (AICPA) and the other 179 members of the ] (IFAC),<ref name="ifac">{{cite web|url=http://www.ifac.org/about-ifac/membership/members|title=IFAC Members|publisher=ifac.org|access-date=25 March 2016|archive-date=10 March 2016|archive-url=https://web.archive.org/web/20160310092205/http://www.ifac.org/about-ifac/membership/members|url-status=dead}}</ref> including ] (ICAS), ], ], ], ] (ACCA) and ] (ICAEW). Some countries have a single professional accounting body and, in some other countries, professional bodies for subfields of the accounting professions also exist, for example the ] (CIMA) in the UK and ] in the United States.<ref name="Prince">{{cite web |url=http://www.accountingforsustainability.org/international_network/accounting-bodies-network |title=Accounting Bodies Network |website=The Prince's Accounting for Sustainability Project |access-date=3 January 2014 |archive-url=https://web.archive.org/web/20140103155739/http://www.accountingforsustainability.org/international_network/accounting-bodies-network |archive-date=3 January 2014 |url-status=dead |df=dmy-all }}</ref> Many of these professional bodies offer education and training including qualification and administration for various accounting designations, such as certified public accountant (]) and ].<ref name = "AICPA CPA">{{cite web |url=http://www.aicpa.org/BecomeACPA/GettingStarted/Pages/default.aspx |title=Getting Started |year=2014 |website=AICPA |access-date=3 January 2014 |archive-date=7 January 2014 |archive-url=https://web.archive.org/web/20140107234214/http://www.aicpa.org/BECOMEACPA/GETTINGSTARTED/Pages/default.aspx |url-status=live }}</ref><ref name = "ICAEW ACA">{{cite web |url=http://www.icaew.com/en/qualifications-and-programmes/aca |title=The ACA Qualification |year=2014 |website=ICAEW |access-date=3 January 2014 |archive-date=4 January 2014 |archive-url=https://web.archive.org/web/20140104034737/http://www.icaew.com/en/qualifications-and-programmes/aca |url-status=live }}</ref> | |||

| === Firms === | |||

| While there is no direct relationship between algebra and bookkeeping, the teaching of the subjects and the books published addressed the same group, namely the children of merchants who were sent to reckoning schools (in Flanders and Germany) or ]s (known as ''abbaco'' in Italy), where they learned the skills useful for trade and commerce. There is probably no need for algebra in performing bookkeeping operations, but for complex bartering operations or the calculation of compound interest, a basic knowledge of arithmetic was mandatory and knowledge of algebra was very useful.<ref>Heeffer, Albrecht: ''On the curious historical coincidence of algebra and double-entry bookkeeping'', Foundations of the Formal Sciences, ], November 2009, p.7 </ref> | |||

| {{main article|Accounting networks and associations}} | |||

| Depending on its size, a company may be legally required to have their ]s ] by a qualified auditor, and audits are usually carried out by ].<ref name = "Parliament Auditors 1">{{cite web |url=https://publications.parliament.uk/pa/ld201011/ldselect/ldeconaf/119/11904.htm |title=Auditors: Market concentration and their role, CHAPTER 1: Introduction |year=2011 |website=UK Parliament |publisher=House of Lords |access-date=1 January 2014 |archive-date=29 July 2022 |archive-url=https://web.archive.org/web/20220729092827/https://publications.parliament.uk/pa/ld201011/ldselect/ldeconaf/119/11904.htm |url-status=live }}</ref> | |||

| ===Luca Pacioli and double-entry bookkeeping === | |||

| {{Main|Luca Pacioli|Double-entry bookkeeping system}} | |||

| ] was the dominant practice for traveling merchants during the ]. When medieval Europe moved to a ] in the 13th century, ] merchants depended on bookkeeping to oversee multiple simultaneous transactions financed by ]s. One important breakthrough took place around that time: the introduction of double-entry bookkeeping,<ref name="logica.ugent.be">Heeffer, Albrecht: ''On the curious historical coincidence of algebra and double-entry bookkeeping'', Foundations of the Formal Sciences, ], November 2009, p.11 </ref> which is defined as any bookkeeping system in which there was a ] entry for each transaction, or for which the majority of transactions were intended to be of this form.<ref>Mills, Geofrey T. "Early accounting in Northern Italy: The role of commercial development and the printing press in the expansion of double-entry from Genoa, Florence and Venice" (The Accounting Historians Journal, June 1994)</ref> The historical origin of the use of the words ‘debit’ and ‘credit’ in accounting goes back to the days of single-entry bookkeeping in which the chief objective was to keep track of amounts owed by customers (]s) and amounts owed to ]s. ‘Debit,’ is ] for ‘he owes’ and ‘credit’ Latin for ‘he trusts’.<ref>Thiéry, Michel: ''Did you say Debit?'', ], AU-GSB e-Journal, Vol. 2 No. 1, June 2009, p.35, </ref> | |||

| Accounting firms grew in the United States and Europe in the late nineteenth and early twentieth century, and through several mergers there were large international accounting firms by the mid-twentieth century. Further large mergers in the late twentieth century led to the dominance of the auditing market by the "Big Five" accounting firms: ], ], ], ] and ].<ref name = "Parliament Auditors 2">{{cite web |url=https://publications.parliament.uk/pa/ld201011/ldselect/ldeconaf/119/11905.htm |title=Auditors: Market concentration and their role, CHAPTER 2: Concentration in the audit market |year=2011 |website=UK Parliament |publisher=House of Lords |access-date=1 January 2014 |archive-date=28 March 2022 |archive-url=https://web.archive.org/web/20220328230040/https://publications.parliament.uk/pa/ld201011/ldselect/ldeconaf/119/11905.htm |url-status=live }}</ref> The ] following the ] reduced the Big Five to the ].<ref name = "FT Big Four">{{cite web |url=http://lexicon.ft.com/Term?term=big-four |title=Definition of big four |year=2014 |website=Financial Times Lexicon |publisher=The Financial Times Ltd |access-date=1 January 2014 |archive-date=2 January 2014 |archive-url=https://web.archive.org/web/20140102195935/http://lexicon.ft.com/Term?term=big-four |url-status=dead }}</ref> | |||

| The earliest extant evidence of full double-entry bookkeeping is the Farolfi ledger of 1299-1300.<ref name="logica.ugent.be"/> Giovanno Farolfi & Company were a firm of ] merchants whose head office was in ] who also acted as ]s to ], their most important customer.<ref>Lee, Geoffrey A., ''The Coming of Age of Double Entry: The Giovanni Farolfi Ledger of 1299-1300'', Accounting Historians Journal, Vol. 4, No. 2, 1977 p.80 </ref> The oldest discovered record of a complete double-entry system is the ''Messari'' (]: ]'s) accounts of the city of ] in 1340. The ''Messari'' accounts contain debits and credits journalised in a ] form, and contains balances carried forward from the preceding year, and therefore enjoy general recognition as a double-entry system.<ref>Lauwers, Luc & Willekens, Marleen: "Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli" (Tijdschrift voor Economie en Management, Katholieke Universiteit Leuven, 1994, vol:XXXIX issue 3, p.300), </ref> | |||

| === Standard-setters === | |||

| ] portrait, a painting by ], 1495, (]).The open book to which he is pointing may be his ''Summa de Arithmetica, Geometria, Proportioni et Proportionalità''.<ref>Lauwers, Luc & Willekens, Marleen: "Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli" (Tijdschrift voor Economie en Management, Katholieke Universiteit Leuven, 1994, vol:XXXIX issue:3 pages:289–304), </ref>]] | |||

| {{See also|Accounting standards|Convergence of accounting standards}} | |||

| ] (GAAP) are accounting standards issued by national regulatory bodies. In addition, the ] (IASB) issues the ] (IFRS) implemented by 147 countries.<ref name = "NP 2013" /> Standards for international audit and assurance, ethics, education, and public sector accounting are all set by independent standard settings boards supported by IFAC. The International Auditing and Assurance Standards Board sets international standards for auditing, assurance, and quality control; the ] (IESBA) <ref name="ifac2">{{cite web|url=http://www.ifac.org/ethics|title=IESBA | Ethics | Accounting | IFAC|publisher=ifac.org|access-date=25 March 2016|archive-date=26 May 2016|archive-url=https://web.archive.org/web/20160526235439/http://www.ifac.org/ethics|url-status=dead}}</ref> sets the internationally appropriate principles-based ''Code of Ethics for Professional Accountants''; the ] (IAESB) sets professional accounting education standards;<ref name="ifac3">{{cite web|url=http://www.ifac.org/education|title=IAESB | International Accounting Education Standards Board | IFAC|publisher=ifac.org|access-date=25 March 2016|archive-date=16 May 2016|archive-url=https://web.archive.org/web/20160516184718/http://www.ifac.org/education|url-status=dead}}</ref> and ] Board (IPSASB) sets accrual-based international public sector accounting standards.<ref name="ifac4">{{cite web|url=http://www.ifac.org/public-sector|title=IPSASB | International Public Sector Accounting Standards Board | IFAC|publisher=ifac.org|access-date=25 March 2016|archive-date=27 May 2016|archive-url=https://web.archive.org/web/20160527045153/http://www.ifac.org/public-sector|url-status=dead}}</ref><ref name="Ias"/> | |||

| Organizations in individual countries may issue accounting standards unique to the countries. For example, in Australia, the Australian Accounting Standards Board manages the issuance of the accounting standards in line with IFRS. In the ] the ] (FASB) issues the Statements of Financial Accounting Standards, which form the basis of ],<ref name = "NP 2013" /> and in the ] the ] (FRC) sets accounting standards.<ref name="ICAEW Standards">{{Citation | url =http://www.icaew.com/en/library/subject-gateways/accounting-standards/knowledge-guide-to-uk-accounting-standards | title =Knowledge guide to UK Accounting Standards | publisher =ICAEW | year =2014 | access-date =1 January 2014 | archive-date =18 November 2018 | archive-url =https://web.archive.org/web/20181118172337/https://www.icaew.com/en/library/subject-gateways/accounting-standards/knowledge-guide-to-uk-accounting-standards | url-status =live }}</ref> However, as of 2012 "all major economies" have plans to ] towards or adopt the IFRS.<ref name=globalcon /> | |||

| ]'s ''"Summa de Arithmetica, Geometria, Proportioni et Proportionalità"'' (Italian: "Review of ], ], ] and ]") was first printed and published in ] in 1494. It included a 27-page ] on ], ''"Particularis de Computis et Scripturis"'' (Italian: "Details of Calculation and Recording"). It was written primarily for, and sold mainly to, merchants who used the book as a reference text, as a source of pleasure from the ] it contained, and to aid the education of their sons. It represents the first known printed treatise on bookkeeping; and it is widely believed to be the forerunner of modern bookkeeping practice. In ''Summa Arithmetica'', Pacioli introduced symbols for ] for the first time in a printed book, symbols that became standard notation in Italian Renaissance mathematics. ''Summa Arithmetica'' was also the first known book printed in Italy to contain ].<ref>Alan Sangster, Greg Stoner & Patricia McCarthy: "The market for Luca Pacioli's Summa Arithmetica" (Accounting, Business & Financial History Conference, Cardiff, September 2007) p.1–2, </ref> | |||

| == Education, training and qualifications == | |||

| Although Luca Pacioli did not invent double-entry bookkeeping,<ref>Carruthers, Bruce G., & Espeland, Wendy Nelson, ''Accounting for Rationality: Double-Entry Bookkeeping and the Rhetoric of Economic Rationality'', American Journal of Sociology, Vol. 97, No. 1, July 1991, pp. 37</ref> his 27-page ] on bookkeeping contained the first known published work on that topic, and is said to have laid the foundation for double-entry bookkeeping as it is practiced today.<ref>vSangster, Alan: "The printing of Pacioli's Summa in 1494: how many copies were printed?" (Accounting Historians Journal, John Carroll University, Cleveland, Ohio, June 2007)</ref> Even though Pacioli's treatise exhibits almost no ], it is generally considered as an important work, mainly because of its wide circulation, it was written in ] ], and it was a printed book.<ref>Lauwers, Luc & Willekens, Marleen: "Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli" (Tijdschrift voor Economie en Management, Katholieke Universiteit Leuven, 1994, vol:XXXIX issue 3, p.292), </ref> | |||

| === Degrees === | |||

| According to Pacioli, accounting is an ad hoc ordering system devised by the merchant. Its regular use provides the merchant with continued information about his business, and allows him to evaluate how things are going and to act accordingly. Pacioli recommends the Venetian method of double-entry bookkeeping above all others. Three major books of account are at the direct basis of this system: the ''memoriale'' (Italian: ]), the ''giornale'' (]), and the ''quaderno'' (]). The ledger is considered as the central one and is accompanied by an alphabetical ].<ref>Lauwers, Luc & Willekens, Marleen: "Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli" (Tijdschrift voor Economie en Management, Katholieke Universiteit Leuven, 1994, vol:XXXIX issue 3, p.296), </ref> | |||

| At least a ] in accounting or a related field is required for most accountant and ] ], and some employers prefer applicants with a ].<ref name = "BLS 2012">{{cite web |url=http://www.bls.gov/ooh/Business-and-Financial/Accountants-and-auditors.htm#tab-4 |title=How to Become an Accountant or Auditor |year=2012 |website=U.S. Bureau of Labor Statistics |publisher=United States Department of Labor |access-date=31 December 2013 |archive-date=9 July 2022 |archive-url=https://web.archive.org/web/20220709084813/https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-4 |url-status=live }}</ref> A degree in accounting may also be required for, or may be used to fulfill the requirements for, membership to professional accounting bodies. For example, the education during an accounting degree can be used to fulfill the ] (AICPA) 150 semester hour requirement,<ref name = "AICPA 150">{{cite web |url=http://www.aicpa.org/becomeacpa/licensure/requirements/pages/default.aspx |title=150 Hour Requirement for Obtaining CPA Certification |year=2013 |website=AICPA |access-date=31 December 2013 |archive-date=29 July 2022 |archive-url=https://web.archive.org/web/20220729094716/https://www.aicpa.org/becomeacpa/licensure/requirements/pages/default.aspx |url-status=live }}</ref> and associate membership with the ] of the UK is available after gaining a degree in finance or accounting.<ref name="ACPA Criteria">{{cite web|url=http://www.acpa.org.uk/criteria-for-entry.aspx |title=Criteria for entry |year=2013 |website=CPA UK |access-date=31 December 2013 |url-status=dead |archive-url=https://web.archive.org/web/20130819184954/http://acpa.org.uk/criteria-for-entry.aspx |archive-date=19 August 2013 }}</ref> | |||

| A ] is required in order to pursue a career in accounting ], for example, to work as a university ] in accounting.<ref name = "AICPA Academia">{{cite web |url=http://www.aicpa.org/interestareas/youngcpanetwork/resources/career/pages/acareerineducation.aspx |title=Want a Career in Education? Here's What You Need to Know |year=2013 |website=AICPA |access-date=31 December 2013 |archive-url=https://web.archive.org/web/20140101002919/http://www.aicpa.org/interestareas/youngcpanetwork/resources/career/pages/acareerineducation.aspx |archive-date=1 January 2014 |url-status=dead }}</ref><ref name = "BYU Prep">{{cite web |url=http://www.byuaccounting.net/mediawiki/index.php?title=Main_Page |title=PhD Prep Track |year=2013 |website=BYU Accounting |access-date=31 December 2013 |archive-date=5 May 2019 |archive-url=https://web.archive.org/web/20190505181108/http://www.byuaccounting.net/mediawiki/index.php?title=Main_Page |url-status=live }}</ref> The ] (PhD) and the ] (DBA) are the most popular degrees. The PhD is the most common degree for those wishing to pursue a career in academia, while DBA programs generally focus on equipping ] for business or public careers requiring research skills and qualifications.<ref name = "AICPA Academia" /> | |||

| Pacioli's treatise gave instructions in how to record barter transactions and transactions in a variety of currencies – both being far more commonplace than they are today. It also enabled merchants to audit their own books and to ensure that the entries in the accounting records made by their bookkeepers complied with the method he described. Without such a system, all merchants who did not maintain their own records were at greater risk of theft by their employees and agents: it is not by accident that the first and last items described in his treatise concern maintenance of an accurate ].<ref>Alan Sangster, ''Using accounting history and Luca Pacioli to teach double entry'', ] Business School, September 2009, p.9, </ref> | |||

| === Professional qualifications === | |||

| The nature of double-entry can be grasped by recognizing that this system of bookkeeping did not simply record the things merchants traded so that they could keep track of assets or calculate profits and losses; instead as a system of writing, double-entry produced effects that exceeded transcription and calculation. One of its social effects was to proclaim the honesty of ] as a group; one of its ] effects was to make its formal ] based on a ] of ] seem to guarantee the ] of the details it recorded. Even though the information recorded in the books of account was not necessarily accurate, the combination of the double entry system's precision and the ] effect that precision tended to create the impression that books of account were not only precise, but accurate as well. Instead of gaining prestige from numbers, double entry bookkeeping helped confer cultural authority on numbers.<ref>Poovey, Mary "A history of the modern fact" (University of Chicago Press, 1998) Ch.2 p.30, 58 & 54</ref> | |||

| {{Main|Chartered accountant|Certified Public Accountant}} | |||

| {{See also|Professional certification #Accountancy, auditing and finance}} | |||

| Professional accounting qualifications include the ] designations and other qualifications including certificates and diplomas.<ref name="ACCA Qualifications">{{cite web |url=http://www.accaglobal.com/gb/en/qualifications/glance.html |title=Accountancy Qualifications at a Glance |year=2014 |website=ACCA |access-date=4 January 2014 |archive-date=6 January 2014 |archive-url=https://web.archive.org/web/20140106005500/http://www.accaglobal.com/gb/en/qualifications/glance.html |url-status=live }}</ref> | |||

| In Scotland, chartered accountants of ] undergo ] and abide by the ICAS code of ethics.<ref>{{Cite web|url=https://www.icas.com/ethics/icas-code-of-ethics|title=ICAS code of ethics|last=Kyle|first=McHatton|website=www.icas.com|language=en|access-date=18 October 2018|archive-date=18 October 2018|archive-url=https://web.archive.org/web/20181018201603/https://www.icas.com/ethics/icas-code-of-ethics|url-status=live}}</ref> In England and Wales, chartered accountants of the ] undergo annual training, and are bound by the ICAEW's ] and subject to its disciplinary procedures.<ref name="ICAEW Chartered">{{cite web|url=http://www.icaew.com/en/qualifications-and-programmes/better-qualified/ |title=ACA – The qualification of ICAEW Chartered Accountants |year=2014 |website=ICAEW |access-date=4 January 2014 |url-status=dead |archive-url=https://web.archive.org/web/20131011082948/http://www.icaew.com/en/qualifications-and-programmes/better-qualified/ |archive-date=11 October 2013 }}</ref> | |||

| In the ], the requirements for joining the ] as a ] are set by the Board of Accountancy of each ], and members agree to abide by the AICPA's ] and Bylaws. | |||

| ===Post-Pacioli=== | |||

| The spread of the Italian accounting rules over the rest of Europe and thence further afield, was the result of treatises, some of them strongly based on Pacioli's work, describing and explaining the system and its practice. The ''"Quaderno doppio"'' (trans. Double-entry Ledger, Venice, 1534) of Domenico Manzoni da Oderzo was one of the first reproductions of Pacioli's ''"Particularis de Computis et Scripturis"''. This work, important because of elaborate examples, was very popular and widespread among merchants: it enjoyed no less than seven editions between 1534 and 1574. Other books that are directly or indirectly based on Pacioli's work are Hugh Oldcastle's ''"A Profitable Treatyce called the Instrument or Boke to learne to knowe the good order of the kepyng of the famous reconynge called in Latyn, Dare and Habere, and in Englyshe, Debitor and Creditor"'' (London, 1543), a translation of Pacioli's treatise, and Wolfgang Schweicker's ''"Zwifach Buchhalten"'' (trans. Double-entry bookkeeping, ], 1549), a translation of the ''"Quaderno doppio"''.<ref>Lauwers, Luc & Willekens, Marleen: "Five Hundred Years of Bookkeeping: A Portrait of Luca Pacioli" (Tijdschrift voor Economie en Management, Katholieke Universiteit Leuven, 1994, vol:XXXIX issue 3, p.301), </ref> | |||

| The ACCA is the largest global accountancy body with over 320,000 members, and the organisation provides an 'IFRS stream' and a 'UK stream'. Students must pass a total of 14 exams, which are arranged across three levels.<ref>{{Cite news|url=https://www.careersinaudit.com/article/european-accounting-qualifications-explained/|title=European Accounting Qualifications Explained {{!}} CareersinAudit.com|work=CareersinAudit.com|access-date=13 December 2017|language=en-GB|archive-date=7 October 2018|archive-url=https://web.archive.org/web/20181007223203/https://www.careersinaudit.com/article/european-accounting-qualifications-explained/|url-status=live}}</ref> | |||

| It was the Dutch mathematician ] who persuaded merchants to make it a rule to summarize accounts at the end of every year in a chapter entitled ''Coopmansbouckhouding op de Italiaensche wyse'' (]: "Commercial Book-keeping in the Italian Way") of his ''Wisconstigheg hedachtenissen'' (Dutch: "Mathematical memoirs", ], 1605–08). Although the ] he required every enterprise to prepare every year was based on entries of the ledger, it was prepared separately from the major books of account. The oldest semi-public balance sheet recorded was that of the ] dated 30 April 1671, which was submitted to the company's ] on in 30 August 1671. The publication and audit of the balance sheet was still a rarity in England until the passing of the ].<ref>Takatera, Sadao: ''Early experiences of the British balance sheet'', ] Economic Review, Vol. 83, October 1962, p.37-38, 41, 44-45 </ref> | |||

| == Research == | |||

| In ], the ] had receovered from a business slump, but had no ] to invest for a new ], despite having made a profit. To explain why there were no funds to invest, the manager made a new financial statement that was called a ''comparison balance sheet'', which showed that the company was holding too much ]. This new financial statement was the genesis of ] that is used today.<ref>Watanabe, Izumi: ''The evolution of Income Accounting in Eighteenth and Nineteenth Century Britain'', ], Vol.57, No. 5, January 2007, p.27-30 </ref> | |||

| {{Main article|Accounting research}} | |||

| Accounting research is ] in the effects of economic events on the process of accounting, the effects of reported information on economic events, and the roles of accounting in organizations and society.<ref name="ACCA 2010">{{Citation|url=http://www.accaglobal.com/content/dam/acca/global/PDF-technical/human-capital/rr-120-002.pdf |title=The Relevance and Utility of Leading Accounting Research |publisher=The Association of Chartered Certified Accountants |year=2010 |access-date=27 December 2013 |url-status=dead |archive-url=https://web.archive.org/web/20131227111624/http://www.accaglobal.com/content/dam/acca/global/PDF-technical/human-capital/rr-120-002.pdf |archive-date=27 December 2013 }}</ref><ref name="Burchell et al 1980">{{cite journal |last1=Burchell |first1=S. |last2=Clubb |first2=C. |last3=Hopwood |first3=A. |last4=Hughes |first4=J. |last5=Nahapiet |first5=J. |title=The roles of accounting in organizations and society |journal=Accounting, Organizations and Society |date=1980 |volume=5 |issue=1 |pages=5–27|doi=10.1016/0361-3682(80)90017-3 }}</ref> It encompasses a broad range of research areas including ], ], ] and ].<ref name = "OOS 2010">Oler, Derek K., Mitchell J. Oler, and Christopher J. Skousen. 2010. "Characterizing Accounting Research." ''Accounting Horizons'' 24 (4): 635–670.</ref> | |||

| Accounting research is carried out both by academic researchers and practicing accountants. ] in academic accounting research include archival research, which examines "objective data collected from ]"; experimental research, which examines data "the researcher gathered by ]"; analytical research, which is "based on the act of ] ] or substantiating ideas in mathematical terms"; ] research, which emphasizes the role of language, interpretation and understanding in accounting practice, "highlighting the symbolic structures and taken-for-granted themes which pattern the world in distinct ways"; ] research, which emphasizes the role of power and conflict in accounting practice; ]; ]; and ].<ref name="CSWW 2010">Coyne, Joshua G., Scott L. Summers, Brady Williams, and David a. Wood. 2010. "Accounting Program Research Rankings by Topical Area and Methodology." ''Issues in Accounting Education'' 25 (4) (November): 631–654.</ref><ref name="Chua 1986">{{cite journal |last1=Chua |first1=Wai Fong |title=Radical developments in accounting thought |journal=The Accounting Review |date=1986 |volume=61 |issue=4 |pages=601–632}}</ref> | |||

| Between the publication of Pacioli's ''"Particularis de Computis et Scripturis"'' and the 19th century, there were few other changes in accounting theory. There was a general theoretical consensus that the double-entry method was superior because it could solve so many accounting problems simultaneously, but despite this consensus, accounting practices were remarkably varied, and merchants in the ] and ] centuries seldom maintained the high standards of the double-entry method. The application of double entry bookkeeping varied across countries, industries, and individual firms, depending in part on its audience. This audience shifted in general from ] alone to a larger more dispersed group of ], ], shareholders, and even eventually the ], as ] became more sophisticated.<ref>Carruthers, Bruce G., & Espeland, Wendy Nelson, ''Accounting for Rationality: Double-Entry Bookkeeping and the Rhetoric of Economic Rationality'', American Journal of Sociology, Vol. 97, No. 1, July 1991, p.39-40</ref> | |||

| Empirical studies document that leading ] publish in total fewer research articles than comparable journals in economics and other business disciplines,<ref name="JAE 2002">{{cite journal |last1=Buchheit |first1=S. |last2=Collins |first2=D. |last3=Reitenga |first3=A. |title=A cross-discipline comparison of top-tier academic journal publication rates: 1997–1999 |journal=Journal of Accounting Education |year=2002 |volume=20 |issue=2 |pages=123–130|doi=10.1016/S0748-5751(02)00003-9 }}</ref> and consequently, accounting scholars<ref>{{cite journal |last1=Merigó |first1=José M. |last2=Yang |first2=Jian-Bo |title=Accounting Research: A Bibliometric Analysis: Accounting Research: A Bibliometric Analysis |journal=Australian Accounting Review |date=March 2017 |volume=27 |issue=1 |pages=71–100 |doi=10.1111/auar.12109 |url=https://pure.manchester.ac.uk/ws/files/47006681/Nerigo_Yang_AAR_CTA.docx |access-date=3 December 2022 |archive-date=30 December 2022 |archive-url=https://web.archive.org/web/20221230103214/https://pure.manchester.ac.uk/ws/files/47006681/Nerigo_Yang_AAR_CTA.docx |url-status=live }}</ref> are relatively less successful in ] than their ] peers.<ref name="CAR 2004">{{cite journal |last1=Swanson |first1=Edward |title=Publishing in the majors: A comparison of accounting, finance, management, and marketing |journal=Contemporary Accounting Research |year=2004 |volume=21 |pages=223–255|doi=10.1506/RCKM-13FM-GK0E-3W50 }}</ref> Due to different publication rates between accounting and other business disciplines, a recent study based on academic author rankings concludes that the competitive value of a single publication in a top-ranked journal is highest in accounting and lowest in marketing.<ref name="JBR 2018">{{cite journal |last1=Korkeamäki |first1=Timo |last2=Sihvonen |first2=Jukka |last3=Vähämaa |first3=Sami |title= Evaluating publications across business disciplines |journal=Journal of Business Research |year=2018 |volume=84 |pages=220–232 |doi=10.1016/j.jbusres.2017.11.024 |doi-access=free }}</ref> | |||

| In the ], which at its peak ruled over ], Middle East, North Africa, the ] and parts of Eastern Europe, the ''merdiban'' (]: ladder or stairs) accounting system that had been adopted from the ] in the 14th century was used for 500 years until the end of the 19th century.<ref>Toraman, Cengiz, Yilmaz, Sinan & Bayramoglu, Fatih: ''Estate accounting as a public policy tool and its application in the Ottoman Empire in the 17th century'', Spanish Journal of Accounting History,] no. 4, ], June 2006, p.1</ref> Both the Ilkhanians and the Ottomans used ''siyakat'' script (from the Arabic ''siyak'', to lead or herd), which was ] writing style of Arabic used only in official documents which prevented ordinary people from reading important state correspondence.<ref>Erkan, Mehmet, Aydemir, Oguzhan & Elitas, Cemal: ''An Accounting System used between 14th & 19th centuries in the Middle East: The Merdiven (Stairs) Method'', Afyon Kocatepe University, ], July 2006, p.6-7 </ref> The title for each entry is given by extending the last letter of the first word in a straight line, so that the lines between successive entries would be laid out in the style of steps of a ladder.<ref>Elitaş, Cemal, Güvemli, Oktay, Aydemir, Oğuzhan, Erkan, Mehmet, Özcan, Uður & Oğuz, Mustafa:''Accounting method used by Ottomans for 500 years: Stairs (Merdiban) Method'', Ministry of Finance of the Turkish Republic, ], April 2008, ISBN 9789758195152, p.596 </ref> Permission to replace the ''merdiban'' accounting system with double-entry accounting was given by ] ] to the ] in 1880.<ref>Karabiyik, Vehbi: 'Financial organization in the Ottoman Empire and modernization activities in finance and accounting field commencing with the establishment Of Ministry Of Finance In XIX Century'', Association of Accounting and Finance Academicians, ], March 2007, p.18, </ref> | |||

| ==Scandals== | |||

| ==Accounting scandals== | |||

| {{ |

{{Main article|Accounting scandals}} | ||

| {{See also|Accounting ethics}} | |||

| The year 2001 witnessed a series of financial information frauds involving ], auditing firm ], the telecommunications company ], ] and ], among other well-known corporations. These problems highlighted the need to review the effectiveness of ], auditing regulations and ] principles. In some cases, management manipulated the figures shown in financial reports to indicate a better economic performance. In others, tax and regulatory incentives encouraged over-leveraging of companies and decisions to bear extraordinary and unjustified risk.<ref name="mba.ufm.edu.gt">Astrid Ayala and Giancarlo Ibárgüen Snr.: "A Market Proposal for Auditing the Financial Statements of Public Companies" (Journal of Management of Value, ], March 2006) p. 41, </ref> | |||

| The year 2001 witnessed a series of financial information frauds involving ], auditing firm ], the telecommunications company ], ] and ], among other well-known corporations. These problems highlighted the need to review the effectiveness of ], auditing regulations and ] principles. In some cases, management manipulated the figures shown in financial reports to indicate a better economic performance. In others, tax and regulatory incentives encouraged over-leveraging of companies and decisions to bear extraordinary and unjustified risk.<ref name="mba.ufm.edu.gt">Astrid Ayala and Giancarlo Ibárgüen Snr.: "A Market Proposal for Auditing the Financial Statements of Public Companies" (Journal of Management of Value, ], March 2006) p. 41, </ref> | |||

| The ] deeply influenced the development of new regulations to improve the reliability of financial reporting, and increased public awareness about the importance of having accounting standards that show the financial reality of companies and the objectivity and independence of auditing firms.<ref name="mba.ufm.edu.gt"/> | The ] deeply influenced the development of new ] to improve the reliability of financial reporting, and increased public awareness about the importance of having accounting standards that show the financial reality of companies and the objectivity and independence of auditing firms.<ref name="mba.ufm.edu.gt"/> | ||

| In addition to being the largest bankruptcy reorganization in American history, the |

In addition to being the largest ] reorganization in American history, the Enron scandal undoubtedly is the biggest audit failure<ref>Bratton, William W. "Enron and the Dark Side of Shareholder Value" (], New Orleans, May 2002) p. 61</ref> causing the dissolution of ], which at the time was one of the five largest accounting firms in the world. After a series of revelations involving irregular accounting procedures conducted throughout the 1990s, Enron filed for ] bankruptcy protection in December 2001.<ref>{{cite news | title = Enron files for bankruptcy | work = BBC News | date = 3 December 2001 | url = http://news.bbc.co.uk/1/hi/business/1688550.stm | access-date = 15 March 2008 | archive-date = 24 March 2022 | archive-url = https://web.archive.org/web/20220324223251/http://news.bbc.co.uk/1/hi/business/1688550.stm | url-status = live }}</ref> | ||