| Revision as of 15:09, 25 October 2010 editLightmouse (talk | contribs)Pending changes reviewers148,333 edits Mostly units using AWB (7290)← Previous edit | Latest revision as of 23:46, 12 September 2024 edit undoGreenC bot (talk | contribs)Bots2,547,818 edits Rescued 1 archive link. Wayback Medic 2.5 per WP:URLREQ#xyz.reuters.com | ||

| (342 intermediate revisions by more than 100 users not shown) | |||

| Line 1: | Line 1: | ||

| {{short description|US strategic petroleum reserve}} | |||

| :''This article refers to the United States Strategic Petroleum Reserve. For other countries see ]'' | |||

| {{About|the United States Strategic Petroleum Reserve|other countries|Global strategic petroleum reserves|unextracted, naturally occurring sources|Oil reserves}} | |||

| {{Use mdy dates|date=March 2022}} | |||

| ]}}]] | |||

| The '''Strategic Petroleum Reserve''' (SPR) is an ] ] store of ] maintained by the ] ]. | |||

| ] | |||

| The '''Strategic Petroleum Reserve''' ('''SPR''') is an emergency stockpile of ] maintained by the ] (DOE). It is the largest publicly known emergency supply in the world; its underground tanks in ] and ] have capacity for {{convert|714|Moilbbl|m3}}.<ref>{{cite web |title = Office of Petroleum Reserves |url = http://energy.gov/fe/services/petroleum-reserves |publisher = United States Department of Energy |access-date = August 27, 2015 }}</ref> The United States started the petroleum reserve in 1975 to mitigate future supply disruptions as part of the international ], after oil supplies were interrupted during the ].<ref>{{Cite web |last=] |date=July 2020 |title=Oil Security Toolkit |url=https://www.iea.org/reports/oil-security-toolkit |access-date=16 May 2020 |publisher=IEA}}</ref> | |||

| The US SPR is the largest emergency supply in the world with the current capacity to hold up to {{convert|727|Moilbbl|m3}}. The second largest emergency supply of oil is Japan's with a ]. Also, China has begun construction and planning for an expansion of ] that will place their SPR at {{convert|685000000|oilbbl}} by 2020, surpassing Japan. | |||

| The current inventory is displayed |

The current inventory is displayed on the SPR's website.<ref>{{cite web |title = Strategic Petroleum Reserve Inventory |url = https://www.spr.doe.gov/dir/dir.html |access-date = September 13, 2022 }}</ref> {{As of|2023|07|21|df=US}}, the inventory was {{convert|346.8|Moilbbl|m3|abbr=}}. This equates to about {{#expr: 346.8/20.543 round 0}} days of oil at 2019 daily U.S. consumption levels of {{convert|20.54|Moilbbl/d|m3/d}}<ref>{{cite web |url = http://www.eia.gov/countries/country-data.cfm?fips=US |title = US Total Petroleum Consumption |publisher = Energy Information Administration }}</ref> or {{#expr: 346.8/9.859 round 0}} days of oil at 2019 daily U.S. import levels of {{convert|9.141|Moilbbl/d|m3/d}}.<ref>{{cite web |url = http://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_ep00_im0_mbblpd_a.htm |title = US Total Crude Oil and Products Imports |publisher = Energy Information Administration }}</ref> However, the maximum total withdrawal capability from the SPR is only {{convert|4.4|Moilbbl/d|m3/d}}, so it would take about {{#expr: 346.8/4.4 round 0}} days to use the entire inventory. At recent market prices ($58 a ] as of March 2021),<ref>{{cite web |url = http://www.oil-price.net/ |title = WTI & Brent Crude Oil Prices }}</ref> the SPR holds over $14.6 billion in ] and approximately $18.3 billion in ] (assuming a $15/barrel discount for sulfur content). In 2012, the total value of the crude in the SPR was approximately $43.5 billion, while the price paid for the oil was $20.1 billion (an average of $28.42 per barrel).<ref>{{cite web |url = http://www.fossil.energy.gov/programs/reserves/spr/spr-facts.html |title = Strategic Petroleum Reserve—Quick Facts and Frequently Asked Questions |publisher = United States Department of Energy |access-date = February 25, 2012 }}</ref> | ||

| Since 2015 Congress has mandated sales of oil from the reserve to fund federal spending. The U.S. Department of Energy has run at least seven sales since 2017, selling 132 million barrels, or about 18.2% of what had been in the reserve.<ref name="Energy Information Agency">{{cite web |publisher = Energy Information Agency |title = U.S. Ending Stocks SPR of Crude Oil and Petroleum Products |url = https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=M_EP00_SAS_NUS_MBBL&f=M }}</ref><ref name=puko-ferek>{{cite news |first1 = Timothy |last1 = Puko |first2 = Katy Stech |last2 = Ferek |url = https://www.wsj.com/articles/why-is-biden-tapping-the-strategic-oil-reserve-and-will-that-lower-gas-prices-11637680300 |title = Why Is Biden Tapping the Strategic Oil Reserve, and Will That Lower Gas Prices? |work = The Wall Street Journal |date = November 23, 2021 }}</ref> | |||

| Purchases of crude oil resumed in January 2009 using revenues available from the 2005 Hurricane Katrina emergency sale. The DOE purchased {{convert|10700000|oilbbl}} at a cost of $553 million.<ref> DOE SPR site</ref> | |||

| On March 31, 2022, President ] announced that his administration would release 1 million barrels of oil per day from the reserve for the next 180 days, selling it at an average price of $96 per barrel. The 2022 release became the largest ever SPR sale and lowered the SPR to its lowest levels in 40 years.<ref name = "ReutersApril">{{cite news |title=US strategic petroleum reserve replenishment slowed by rising oil price |url=https://www.reuters.com/markets/commodities/biden-administration-slowly-puts-oil-back-into-spr-emergency-stash-2024-01-04/ |work=Reuters |date=April 3, 2024}}</ref> After oil prices declined during the second half of the year, in December the administration announced it would begin replenishing the SPR in early 2023, expecting to purchase oil at a lower price than it was sold, a process that would take months or years to complete.<ref name="NYTimes-April2022">{{cite news |last1=Krauss |first1=Clifford |last2=Shear |first2=Michael D. |url=https://www.nytimes.com/2022/03/31/business/energy-environment/biden-oil-strategic-petroleum-reserve.html |title=Biden will tap oil reserve, hoping to push gasoline prices down |work=The New York Times |date=April 1, 2022 |page=A1}}</ref><ref>{{cite news |last1=Egan |first1=Matt |title=Biden begins to refill Strategic Petroleum Reserve, while Keystone Pipeline leak prompts new emergency exchange |url=https://www.cnn.com/2022/12/16/economy/biden-spr-exchange-and-replenish/index.html |publisher=CNN |date=December 16, 2022}}</ref><ref>{{cite news |last1=Uberti |first1=David |title=U.S. Scores $4 Billion Windfall on Oil-Reserve Sales |url=https://www.wsj.com/articles/u-s-scores-4-billion-windfall-on-oil-reserve-sales-11671420244 |work=The Wall Street Journal |date=December 19, 2022}}</ref> The Biden administration continued to release reserves in 2023, selling off 45% of the SPR by September 2023.<ref name = "politico16oct">{{cite news |title=Biden sold off nearly half the U.S. oil reserve. Is it ready for a crisis? |url=https://www.politico.com/news/2023/10/16/biden-oil-reserve-fuels-00121298 |work=Politico |date=October 16, 2022}}</ref> The Department of Energy unveiled plans to purchase oil at a price of $79 per barrel or less, but has since purchased oil at higher prices. As of April 2024, further purchases were cancelled due to rising oil prices.<ref name = "ReutersApril"/><ref>{{cite news |title=Biden administration cancels buyback of 3 million barrels to replenish oil stockpile |url=https://thehill.com/policy/energy-environment/4574215-biden-buyback-oil-stockpile/ |work=The Hill |date=April 4, 2024}}</ref> | |||

| The United States started the petroleum reserve in 1975 after oil supplies were cut off during the ], to mitigate future temporary supply disruptions. According to the ]<ref></ref>, the United States imports a net {{convert|12|Moilbbl|m3}} of oil a day (MMbd), so the SPR holds about a 58-day supply. However, the maximum total withdrawal capability from the SPR is only {{convert|4.4|Moilbbl|m3}} per day, making it a 160 + day supply. | |||

| According to legislation already in place, the amount of oil in the reserve could fall to 238 million barrels by 2028.<ref name=EIa20180221>{{cite web |url = https://www.eia.gov/todayinenergy/detail.php?id=35032 |title = Recent legislation mandates additional sales of U.S. Strategic Petroleum Reserve crude oil |work = Day in Energy |publisher = Energy Information Agency |date = February 21, 2018 }}</ref> This will be a 67% reduction to the oil in the reservoir since 2010. | |||

| == Facilities == | == Facilities == | ||

| ] | |||

| The SPR management office is located in ]. | |||

| The SPR management office is located in ], a suburb of ]. | |||

| The reserve is stored at four sites on the ], each located near a major center of petrochemical refining and processing. Each site contains a number of artificial caverns created in ]s below the surface. | The reserve is stored at four sites on the ], each located near a major center of petrochemical refining and processing. Each site contains a number of artificial caverns created in ]s below the surface. | ||

| Individual caverns within a site can be up to 1000 |

Individual caverns within a site can be up to {{cvt|1000|m}} below the surface. Average dimensions are {{cvt|60|m}} wide and {{cvt|600|m}} deep; capacity ranges from {{convert|6|to|37|Moilbbl|m3}}. Almost $4 billion was spent on the facilities. The decision to store in caverns was made to reduce costs. The Department of Energy claims that it is approximately ten times more cost effective to store oil below the surface, with the added advantages of no leaks and a constant natural churn of the oil due to a temperature gradient in the caverns. The caverns were created by drilling down and then dissolving the salt with water. | ||

| ===Existing=== | ===Existing=== | ||

| * Bryan Mound |

* Bryan Mound: ], ]. 20 caverns with a storage capacity of {{convert|254|Moilbbl|m3}} with a drawdown capacity of {{convert|1.5|Moilbbl|m3}} per day.<ref>{{cite news |first = Brett |last = Clanton |url = http://www.chron.com/disp/story.mpl/front/5802887.html |title = Go past guards for tour of U.S. oil reserve in Freeport |newspaper = Houston Chronicle |date = May 27, 2008 |access-date = February 25, 2012 }}</ref><ref name="USEnergy">{{cite book |archive-url = https://web.archive.org/web/20081005012233/http://www.fe.doe.gov/programs/reserves/spr/Plan_for_Expansion_to_1_billion_barrels.pdf |archive-date = October 5, 2008 |url = http://www.fe.doe.gov/programs/reserves/spr/Plan_for_Expansion_to_1_billion_barrels.pdf |title = Strategic Petroleum Reserve Plan: Expansion to One Billion Barrels |page = 5 |publisher = United States Department of Energy |date = June 2007 }}</ref> | ||

| * Big Hill |

* Big Hill: ], Texas. Has a capacity of {{convert|160|Moilbbl|m3}} with a drawdown capacity of {{convert|1.1|Moilbbl|m3}} per day. | ||

| * West Hackberry: ], Louisiana. Has a capacity of {{convert|227|Moilbbl|m3}} with a drawdown capacity of {{convert|1.3|Moilbbl|m3}} per day.<ref name="USEnergy"/> | |||

| * |

* Bayou Choctaw: ], Louisiana. Has a capacity of {{convert|76|Moilbbl|m3}} with a maximum drawdown rate of {{convert|550000|oilbbl|m3}} per day. | ||

| * Bayou Choctaw - ]. Has a capacity of {{convert|76|Moilbbl|m3}} with a maximum drawdown rate of {{convert|550000|oilbbl|m3}}. This facility is planned to be expand to {{convert|109|Moilbbl|m3}} with a new drawdown capacity of {{convert|600000|oilbbl|m3}} per day.<ref name="USEnergy"/> | |||

| === |

===Proposed=== | ||

| * ] |

* ], Mississippi: This facility, if built as planned, would have had a capacity of {{convert|160|Moilbbl|m3}} with a drawdown capacity of {{convert|1|Moilbbl|m3}} per day.<ref name="USEnergy"/> Former Secretary of Energy ] announced the creation of this site in February 2007.<ref>{{cite web |url = http://www.fossil.energy.gov/news/techlines/2006/06071-New_SPR_Site_Chosen.html |title = DOE Takes Next Steps to Expand Strategic Petroleum Reserve to One Billion Barrels |publisher = United States Department of Energy |date = December 8, 2006 |access-date = February 25, 2012 }}</ref> As of 2008, this site was facing some opposition.<ref>{{cite web |url = http://uk.reuters.com/article/lifestyle-oil-reserve-mississippi-dc-idUKN0447984320080404 |archive-url = https://web.archive.org/web/20160314091304/http://uk.reuters.com/article/lifestyle-oil-reserve-mississippi-dc-idUKN0447984320080404 |url-status = dead |archive-date = March 14, 2016 |title = Oil reserve site raises ire, Bush policy tested |publisher = ] |access-date = June 21, 2016 }}</ref> According to the DOE: "Activities towards the goal of expansion of the SPR to one billion barrels, as directed by Congress in the 2005 Act, were cancelled in 2011 after Congress rescinded all remaining expansion funds."<ref name=sprfaq /> | ||

| ===Retired=== | ===Retired=== | ||

| * Weeks Island |

* Weeks Island: ], Louisiana (decommissioned 1999): Capacity of {{convert|72|Moilbbl|m3}}. This facility was a conventional ] near-surface ], formerly owned by ]. In 1993, a ] formed on the site, allowing fresh water to intrude into the mine. Because of the mine's construction in salt deposits, fresh water would erode the ceiling, potentially causing the structure to fail. The mine was backfilled with salt-saturated ]. This process, which allowed for recovery of 98% of the petroleum stored in the facility, reduced the risk of further ] intrusion, and helped prevent the remaining oil from leaking into the ] that is located over the salt dome. | ||

| == History == | == History == | ||

| ===Background=== | ===Background=== | ||

| The SPR was created following the ]. On November 18, 1974, the United States became a signatory to the Agreement on an International Energy Program (IEP) and a founding member of the ] that the IEP established. One of the key commitments made by the treaty's signatories is to maintain oil stocks of no less than 90 days of net imports.<ref>{{Cite web |last=] |date=July 2020 |title=Oil Security Toolkit |url=https://www.iea.org/reports/oil-security-toolkit |access-date=16 May 2022 |publisher=IEA}}</ref> | |||

| Access to the reserve is determined by the conditions written into the 1975 ] (EPCA), primarily to counter a severe supply interruption. The maximum removal rate, by physical constraints, is {{convert|4.4|Moilbbl/d|m3/d}}. Oil could begin entering the marketplace 13 days after a Presidential order. The Dept. of Energy says that it has about 59 days of import protection in the SPR. This, combined with private sector inventory protection, is estimated to equal 115 days of imports. | |||

| Access to the reserve is determined by the conditions written into the 1975 ] (EPCA), primarily to counter a severe supply interruption. The maximum removal rate, by physical constraints, is {{convert|4.4|Moilbbl/d|m3/d}}. Oil could begin entering the marketplace 13 days after a presidential order.<ref>{{cite web |title=Strategic Petroleum Reserve |url=https://www.energy.gov/fecm/strategic-petroleum-reserve-3#Q12 |website=Energy.gov |language=en}}</ref> The Department of Energy says it has about 59 days of import protection in the SPR. This, combined with private sector inventory protection, is estimated to equal 115 days of imports.{{Citation needed|date=May 2022}} | |||

| The SPR was created following the ]. The EPCA of December 22, 1975, made it policy for the U.S. to establish a reserve up to one billion barrels (159 million m³) of petroleum. A number of existing storage sites were acquired in 1977. Construction of the first surface facilities began in June 1977. On July 21, 1977, the first oil—approximately 412,000 barrels (66,000 m³) of Saudi Arabian light crude—was delivered to the SPR. Fill was suspended in FY 1995 to devote budget resources to refurbishing the SPR equipment and extending the life of the complex. The current SPR sites are expected to be usable until around 2025. Fill was resumed in 1999. | |||

| The EPCA of December 22, 1975, made it policy for the United States to establish a reserve up to 1 billion barrels (159 million m³) of petroleum. A number of existing storage sites were acquired in 1977. Construction of the first surface facilities began in June 1977. On July 21, 1977, the first oil—approximately {{convert|412000|oilbbl|m3}} of Saudi Arabian light crude—was delivered to the SPR. Fill was suspended in Fiscal Year 1995 to devote budget resources to refurbishing the SPR equipment and extending the life of the complex. | |||

| ===Filling and Suspending the SPR=== | |||

| On November 13, 2001, ] announced that the SPR would be filled, saying, "The Strategic Petroleum Reserve is an important element of our Nation's ]. To maximize long-term protection against oil supply disruptions, I am directing the Secretary of Energy to fill the SPR up to its 700 million barrel capacity." The highest prior level was reached in 1994 with 592 million barrels (94 million m³). At the time of President Bush's directive, the SPR contained about 545 million barrels (87 million m³). Since the directive in 2001, the capacity of the SPR increased by 27 million barrels (4.3 million m³) due to natural enlargement of the salt caverns in which the reserves are stored. The ] has since directed the ] to fill the SPR to the full 1 billion barrel authorized capacity, a process which will require a physical expansion of the Reserve's facilities. | |||

| ===Domestic actions=== | |||

| On August 17, 2005, the SPR reached its goal of 700 million barrels (111,000,000 m³), or about 96% of its now-increased {{convert|727|Moilbbl|m3|sing=on}} capacity. Approximately 60% of the crude oil in the reserve is the less desirable sour (high ] content) variety. The oil delivered to the reserve is "royalty-in-kind" oil—royalties owed to the U.S. government by operators who acquire leases on the federally owned Outer Continental Shelf in the Gulf of Mexico. These royalties were previously collected as cash, but in 1998 the government began testing the effectiveness of collecting royalties "in kind" - or in other words, acquiring the crude oil itself. This mechanism was adopted when refilling the SPR began, and once filling is completed, revenues from the sale of future royalties will be paid into the federal treasury. | |||

| On November 13, 2001, shortly after the ], President ] announced that the SPR would be filled, saying, "The Strategic Petroleum Reserve is an important element of our Nation's ]. To maximize long-term protection against oil supply disruptions, I am directing the Secretary of Energy to fill the SPR up to its {{convert|700|Moilbbl|m3}} capacity."<ref>{{cite news |url = https://georgewbush-whitehouse.archives.gov/news/releases/2001/11/20011113.html |title = President Orders Strategic Petroleum Reserve Filled |publisher = White House Office of the Press Secretary |date = November 13, 2001 |access-date = December 26, 2014 }}</ref> The highest prior level was reached in 1994 with {{convert|592|Moilbbl|m3}}. At the time of President Bush's directive, the SPR contained about {{convert|545|Moilbbl|m3}}. Since the directive in 2001, the capacity of the SPR has increased by {{convert|27|Moilbbl|m3}} due to natural enlargement of the salt caverns in which the reserves are stored. The ] has since directed the ] to fill the SPR to the full {{convert|1|Goilbbl|m3}} authorized capacity, a process which will require a physical expansion of the Reserve's facilities. | |||

| On August 17, 2005, the SPR reached its goal of {{convert|700|Moilbbl|m3}}. Approximately 60% of the crude oil in the reserve is the less desirable sour (high ] content) variety. The oil delivered to the reserve is "royalty-in-kind" oil—royalties owed to the U.S. government by operators who acquire leases on the federally owned ] in the ]. These royalties were previously collected as cash, but in 1998 the government began testing the effectiveness of collecting royalties "in kind"—or in other words, acquiring the crude oil itself. This mechanism was adopted when refilling the SPR began, and once filling is completed, revenues from the sale of future royalties will be paid into the federal treasury. | |||

| On April 25, 2006, President Bush announced a temporary halt to petroleum deposits to the SPR as part of a four point program to alleviate high fuel prices.{{Fact|date=May 2008}} | |||

| On April 25, 2006, President Bush announced a temporary halt to petroleum deposits to the SPR as part of a four-point program to alleviate high fuel prices.{{Citation needed|date=May 2008}} | |||

| On January 23, 2007, President George W. Bush suggested in his State of the Union speech that Congress should approve expansion of the current reserve capacity to twice its current level.<ref name="sotu2007">{{cite news | |||

| | last = Bush | |||

| | first = George W. | |||

| | authorlink = George W. Bush | |||

| | url = http://www.washingtonpost.com/wp-dyn/content/article/2007/01/23/AR2007012301075_pf.html | |||

| | title = President Bush's 2007 State of the Union Address | |||

| | publisher = ] | |||

| | date = January 23, 2007 | |||

| | accessdate = 2007-01-24 | |||

| }}</ref> | |||

| On January 23, 2007, President Bush suggested in ] speech that Congress should approve expansion of the current reserve capacity to twice its current level.<ref name="sotu2007">{{cite news |last = Bush |first = George W. |author-link = George W. Bush |url = https://www.washingtonpost.com/wp-dyn/content/article/2007/01/23/AR2007012301075_pf.html |title = President Bush's 2007 State of the Union Address |newspaper = The Washington Post |date = January 23, 2007 |access-date = January 24, 2007 }}</ref> | |||

| In April 2008, ] called on President Bush to suspend purchases of oil for the Strategic Petroleum Reserve (SPR) temporarily. | |||

| On May 16, 2008, the ] (DOE) said it would halt all deliveries to the Strategic Petroleum Reserve sometime in July. This announcement came days after Congress voted to direct the Bush administration to do the same.<ref>{{cite web |url = http://www.eere.energy.gov/news/news_detail.cfm/news_id=11779 |title = DOE Stops Filling the Strategic Petroleum Reserve |publisher = United States Department of Energy |date = May 21, 2008 |access-date = February 25, 2012 }}</ref> | |||

| On May 12, 2008, ] Peter Welch (], ]) and 63 co-sponsors introduced the Strategic Petroleum Reserve Fill Suspension and Consumer Protection Act bill (]), to suspend the acquisition of petroleum for the Strategic Petroleum Reserve <ref>http://www.opencongress.org/bill/110-h6022/text</ref>. | |||

| On January 2, 2009, after a sharp decline in fuel prices, DOE said that it would begin buying approximately {{convert|12000000|oilbbl}} of crude oil to fill the Strategic Petroleum Reserve, replenishing supplies that were sold after hurricanes ] and ] in 2005. The purchase would be funded by the roughly $600 million received from those emergency sales. | |||

| On May 16, 2008, the ] said it will halt all deliveries to the Strategic Petroleum Reserve sometime in July. This announcement came days after Congress voted to direct the Bush administration to do the same. The U.S. Department of Energy did not state when the shipments would resume <ref>http://www.eere.energy.gov/news/news_detail.cfm/news_id=11779</ref>. | |||

| On September 9, 2011, a Notice of Cancellation was published in the '']'' after Congress rescinded funding for the expansion of the Strategic Petroleum Reserve, reversing the SPR expansion initiative previously directed under the Energy Policy Act of 2005.<ref name=sprfaq>{{cite web |url = http://energy.gov/fe/services/petroleum-reserves/strategic-petroleum-reserve/spr-quick-facts-and-faqs#Q7 |title = SPR Quick Facts and FAQs |publisher = United States Department of Energy |access-date = December 24, 2014 }}</ref> | |||

| On May 19, 2008, President Bush signed the Act passed by the Congress, which he previously opposed . So, the bill has become law <ref name="autogenerated1"></ref> | |||

| On October 20, 2014, a report by the U.S. ] (GAO) recommended reducing the size of the Reserve. According to the report, the amount of oil held in reserve exceeds the amount required to be kept on hand given the need for imported crude oil had decreased in recent years. The report said the DOE agreed with the GAO recommendation.<ref> | |||

| On January 2, 2009, the U.S. Energy Department said that it will begin buying approximately {{convert|12000000|oilbbl}} of crude oil to fill the Strategic Petroleum Reserve, replenishing supplies that were sold after hurricanes Katrina and Rita in 2005. The purchase will be funded by the roughly $600 million received in 2005 from the emergency sales. | |||

| {{cite news |title = U.S. Oil Exports Would Lower Gas Prices, Government Report Says |newspaper = The Wall Street Journal |url = https://online.wsj.com/articles/u-s-oil-exports-would-lower-gas-prices-government-report-says-1413820500 |date = October 20, 2014 |access-date = October 20, 2014 |first = Christian |last = Berthelsen }}</ref> | |||

| On March 19, 2020, President ] directed the Department of Energy to fill the Strategic Petroleum Reserve to maximum capacity, when oil was priced at $24 per barrel. This directive was given to help support domestic oil producers given the impending economic collapse from COVID-19 and extreme drops in international oil markets.<ref name = "BloombergSep2022"/><ref>{{Cite web |url = https://www.energy.gov/articles/department-energy-executes-direction-president-trump-announces-solicitation-purchase-crude |title = Department of Energy Executes on Direction of President Trump, Announces Solicitation to Purchase Crude Oil for the SPR to Provide Relief to American Energy Industry }}</ref> However, funding was blocked by Congress, with Senate Democratic Leader ] stating that Democrats had blocked a "bailout for big oil".<ref>{{cite web |url=https://www.factcheck.org/2022/04/strategic-petroleum-reserve-oil-stocks-declined-under-trump-contrary-to-his-claim/ |title=Strategic Petroleum Reserve Oil Stocks Declined Under Trump, Contrary to His Claim |last=Gore |first=D'Angelo |website=FactCheck.org |date=April 1, 2022 |access-date=April 4, 2022}}</ref><ref name = "BloombergSep2022">{{cite web |url=https://www.bloomberg.com/news/articles/2022-09-13/biden-may-buy-oil-just-below-80-democrats-stymied-trump-at-24 |title=Biden May Buy Oil Just Below $80; Democrats Stymied Trump at $24 |work = Bloomberg |date=September 13, 2022}}</ref> | |||

| In 2022, the Biden administration sold 180 million barrels of oil from the Strategic Petroleum Reserve over 6 months. The sale lowered the SPR to its lowest levels in 40 years and was the largest ever release of oil from the SPR.<ref name = "ReutersApril"/> SPR drawdowns continued into 2023, lowering the SPR by 45% from January 2021.<ref name = "politico16oct"/> Since the 2022 sales, the Department of Energy bought back 32.3 million barrels of oil, aiming to purchase at a maximum price of $79 per barrel.<ref name = "ReutersApril"/> However, oil has been purchased exceeding the $79 price cap in March 2024. As of April 2024, further SPR purchases were cancelled due to rising oil prices.<ref>{{cite web |url=https://www.bloomberg.com/news/articles/2024-04-03/us-cancels-latest-oil-reserve-refill-plan-amid-high-prices |title=US Cancels Latest Oil Reserve Refill Plan Amid High Prices |work = Bloomberg |date=April 3, 2024}}</ref> | |||

| ===Emergency sales to Israel=== | ===Emergency sales to Israel=== | ||

| According to the 1975 |

According to the 1975 ] signed by the United States and ], as a precondition for Israel's return of the ] and its associated oil reserves to ], in an emergency the United States was obligated to make oil available for sale to Israel for up to five years.<ref>{{cite web |last = Phillips |first = James |url = http://www.heritage.org/Research/MiddleEast/bg76.cfm |title = The Iranian Oil Crisis |publisher = ] |date = February 28, 1979 |access-date = February 25, 2012 |url-status = dead |archive-url = https://web.archive.org/web/20100126173509/http://www.heritage.org/Research/MiddleEast/bg76.cfm |archive-date = January 26, 2010 }}</ref> Israel has never invoked the agreement {{citation needed|date=November 2021}}, however. The agreement was extended in 1979, 1994, 2004, and, most recently, in 2015 for a ten-year period.<ref>{{cite news |url = http://www.israelnationalnews.com/News/Flash.aspx/323545 |title = US and Israel Sign Extension of Oil Supply Agreement |date = April 17, 2015 |publisher = Israel National News |access-date = June 21, 2016 }}</ref> | ||

| ===International obligations=== | |||

| As a member of the ] (IEA), the United States must stock an amount of petroleum equivalent to at least 90 days of U.S. imports. The SPR contained an equivalent to 141 days of imports as of September 2016. The United States is also obligated to contribute 43.9% of petroleum in any IEA-coordinated release.<ref name=twip2016/> | |||

| == Limitations == | == Limitations == | ||

| The Strategic Petroleum Reserve is |

The Strategic Petroleum Reserve is primarily a ] reserve, not a stockpile of ]s such as ], ] and ]. Although the United States maintains some extra supply of refined petroleum fuels, e.g., the ] and ] under the ] of the Department of Energy (DOE), the government does not maintain gasoline reserves on anything like the scale of the SPR. The SPR is intended to give the United States protection from disruptions in oil supplies. In the event of a major disruption to ] operations, the United States would have to call on members of the ] that stockpile refined products, and use refining capacities outside of the continental United States for relief. | ||

| There have been suggestions that the DOE should stockpile both gasoline and jet fuel |

There have been suggestions that the DOE should increase its supplies and stockpile both gasoline and ].<ref name="cnnmoney">{{cite news |first = Pilar |last = Tejerina |url = https://money.cnn.com/2005/09/30/news/economy/gas_reserve/index.htm |title = Senators propose gasoline reserve |publisher = CNN |date = September 30, 2005 |access-date = January 24, 2007 }}</ref> | ||

| Some countries and zones have a strategic reserve of both ] and ]s. In some cases, this includes a ].<ref name=FranceMeltsBeams>{{cite web |url = http://www.iea.org/textbase/nppdf/free/2000/oilsecu2001.pdf |title = Oil Supply Security: The Emergency Response Potential of IEA Countries in 2000 |access-date = March 13, 2007 |quote = French stockholding legislation requires that jet fuel stocks cover at least 55 days of consumption }}{{dead link|date=July 2021|bot=medic}}{{cbignore|bot=medic}}</ref> | |||

| | first = Pilar | |||

| | last = Tejerina | |||

| | url = http://money.cnn.com/2005/09/30/news/economy/gas_reserve/index.htm | |||

| | title = Senators propose gasoline reserve | |||

| | publisher = CNNMoney.com | |||

| | date = September 30, 2005 | |||

| | accessdate = 2007-01-24 | |||

| }}</ref> | |||

| Some countries and zones, such as ], have a strategic reserve of both ] and ]s.<ref></ref>. In some cases, this includes a ]. | |||

| Former ] ] said that the Department would consider new facilities for refined products as part of an expansion of {{convert|1|to|1.5|Goilbbl|m3}}.{{citation needed|date=June 2015}}<ref>Bodman, S.W. (2007, January 23). ''Statement from Energy Secretary Samuel W. Bodman on the Expansion of the Strategic Petroleum Reserve to 1.5 Billion''. Department of Energy. https://www.energy.gov/articles/statement-energy-secretary-samuel-w-bodman-expansion-strategic-petroleum-reserve-15-billion</ref> | |||

| == |

== Drawdowns == | ||

| ===Petroleum sales=== | |||

| ===Petroleum sales - Prior to 2015=== | |||

| *1985 - Test sale - 1.1 million barrels (175,000 m³) | |||

| * 1985: Test sale—{{convert|1.1|Moilbbl|m3}} | |||

| *1990/91 - ] sale - 21 million barrels (3.3 million m³) | |||

| * 1990–1991: ] sale—{{convert|21|Moilbbl|m3}} | |||

| **4 million in August 1990 test sale | |||

| ** {{convert|4|Moilbbl|m3}} in October 1990 test sale<ref>{{cite web |url = https://www.energy.gov/fecm/strategic-petroleum-reserve-0 |title = History of SPR Releases |website = Department of Energy, Office of Fossil Energy and Carbon Management |access-date = February 1, 2022 }}</ref> | |||

| **17 million in January 1991 Presidentially-ordered drawdown | |||

| ** {{convert|17|Moilbbl|m3}} in January 1991 presidentially ordered drawdown | |||

| *1996-97 total non-emergency sales for deficit reduction - 28 million barrels (4.5 million m³) | |||

| * 1996–1997: {{convert|28|Moilbbl|m3}} non-emergency sales for deficit reduction | |||

| *2005 - ] sale - 11 million barrels (1.7 million m³) Katrina shut down 95% of crude production and 88% of natural gas output in the Gulf of Mexico. This amounted to a quarter of total U.S. output. About 735 oil and natural gas rigs and platforms had been evacuated due to the hurricane. | |||

| * July–August 2000: {{convert|2.8|Moilbbl|m3}} to supply the ]. | |||

| * September–October 2000: {{convert|30|Moilbbl|m3}} in response to a concern over low ] levels in the northeastern U.S. | |||

| * 2005 ] sale: {{convert|11|Moilbbl|m3}}—Katrina shut down 95% of crude production and 88% of natural gas output in the Gulf of Mexico. This amounted to a quarter of total U.S. output. About 735 oil and natural gas rigs and platforms had been evacuated due to the hurricane. | |||

| * 2011 ] sale: {{convert|30|Moilbbl|m3}}—non-emergency sale to offset disruptions caused by political ] and elsewhere in the Middle East. The amount was matched by ] countries, for a total of {{convert|60|Moilbbl|m3}} released from stockpiles around the world.<ref>{{cite news |url = https://money.cnn.com/2011/06/23/markets/oil_prices/index.htm?iid=Popular |publisher = CNN |first = Aaron |last = Smith |title = U.S. to release oil from strategic reserve |date = June 23, 2011 }}</ref> | |||

| ===Petroleum exchanges and loans=== | ===Petroleum exchanges and loans=== | ||

| ''Note: Loans are made on a case-by-case basis to alleviate supply disruptions. |

''Note: Loans are made on a case-by-case basis to alleviate supply disruptions. Once conditions return to normal, the loan is returned to the SPR with additional oil as interest.'' | ||

| * April–May 1996: {{convert|900000|oilbbl|m3}} lent to ] to alleviate ] blockage. | |||

| * August 1998: {{convert|11|Moilbbl|m3}} lent to ] in return for {{convert|8.5|Moilbbl|m3}} of higher-quality crude. | |||

| * June 2000: {{convert|1|Moilbbl|m3}} lent to ] and ] in response to shipping channel blockage. | |||

| * October 2002: {{convert|296000|oilbbl|m3}} lent to Shell Pipeline Company in advance of ]. | |||

| * September–October 2004: {{convert|5.4|Moilbbl|m3}} lent to Astra Oil, ], Placid Refining, ], and ] after ]. | |||

| * September–October 2005: {{convert|9.8|Moilbbl|m3}} lent to ], Placid Refining, ], ], ], and ] after ]. Purchases of crude oil would then resume in January 2009 using revenues available from the 2005 ] emergency sale. The DOE purchased {{convert|10.7|Moilbbl|m3}} at a cost of $553 million.<ref>{{cite web |archive-url = https://web.archive.org/web/20130408222706/http://www.fe.doe.gov/programs/reserves/spr/index.html |url = http://www.fe.doe.gov/programs/reserves/spr/index.html |title = Strategic Petroleum Reserve – Profile |date = February 27, 2013 |archive-date = April 8, 2013 }}</ref> | |||

| * January–February 2006: {{convert|767000|oilbbl}} lent to Total Petrochemicals USA due to closure of the ] to deep-draft vessels after a barge accident in the channel.<ref name=spr-facts>{{cite web |url = http://www.fossil.energy.gov/programs/reserves/spr/spr-facts.html |title = Quick Facts about the Strategic Petroleum Reserve |publisher = United States Department of Energy |access-date = February 25, 2012 }}</ref> | |||

| * June 2006: {{convert|750000|oilbbl|m3}} of ] lent to ] and ] due to the closure for several days of the ] caused by the release of a mixture of storm water and oil. Repaid in early October 2006. | |||

| * September 2008: {{convert|630000|oilbbl|m3}} lent to Citgo, Placid Refining, and ] due to disruptions from ].<ref>{{cite news |url = https://money.cnn.com/2008/09/12/markets/oil/index.htm |title = Oil ends up after dip below $100 |publisher = CNN |date = September 12, 2008 }}</ref> | |||

| * August 2017: 200,000 barrels of sweet crude and 300,000 barrels of sour crude were lent to ] due to disruptions from ].<ref>{{Cite news |url = http://www.mercurynews.com/2017/08/31/us-taps-strategic-oil-reserves/ |title = US taps strategic oil reserves |date = August 31, 2017 |work = The Mercury News |access-date = August 31, 2017 }}</ref> | |||

| ===Drawdowns since 2015=== | |||

| *April-May 1996 - {{convert|900000|oilbbl|m3}} lent to ] to alleviate ] blockage. | |||

| *August 1998 - {{convert|11|Moilbbl|m3}} lent to ] in return for {{convert|8.5|Moilbbl|m3}} of higher quality crude. | |||

| *June 2000 - {{convert|1|Moilbbl|m3}} lent to ] and ] in response to shipping channel blockage. | |||

| *July-August 2000 - {{convert|2.8|Moilbbl|m3}} to supply the ]. | |||

| *September-October 2000 - {{convert|30|Moilbbl|m3}} in response to a concern over low ] levels in the North-eastern U.S. | |||

| *October 2002 - {{convert|296000|oilbbl|m3}} lent to Shell Pipeline Company in advance of ]. | |||

| *September-October 2004 - {{convert|5.4|Moilbbl|m3}} lent to Astra Oil, ], Placid Refining, ], and ] after ]. | |||

| *September-October 2005 - {{convert|9.8|Moilbbl|m3}} lent to ], Placid Refining, ], ], ], and ] after ]. | |||

| * January-February 2006 -{{convert|767000|oilbbl}} lent to Total Petrochemicals USA due to closure of the Sabine Neches ship channel to deep-draft vessels after a barge accident in the channel.<ref name=spr-facts></ref> | |||

| * June 2006 - {{convert|750000|oilbbl|m3}} of ] lent to ] and ] due to the closure for several days of the Calcasieu Ship Channel caused by the release of a mixture of storm water and oil. Repaid in early October 2006. | |||

| * September 2008 - {{convert|250000|oilbbl|m3}} loaned to Citgo because it could not secure crude oil in the aftermath of Hurricane Gustav. | |||

| * September 2008 - {{convert|130000|oilbbl|m3}} loaned to Placid Refining's Port Allen refinery and {{convert|250000|oilbbl|m3}} loaned to ] due to disruptions from Hurricane Gustav.<ref> CNN, retrieved 12 Sept 2008</ref> | |||

| Since 2015, Congress has been selling the oil in the reserve to fund the deficit, in unpublicized sales. The U.S. Department of Energy has run seven sales since 2017, selling more than 132 million barrels, or about 18.2% of what had been in the reserve.<ref name=puko-ferek/><ref name="Energy Information Agency"/> | |||

| ==See also== | |||

| {{Portal|Energy}} | |||

| According to legislation already in place, the amount of oil in the reserve could fall to as little as 238 million barrels by 2028. This will be a 67% reduction of oil in the reserve since 2010.<ref name=EIa20180221 /> | |||

| * ] | |||

| * ] | |||

| The legislation is summarized below: | |||

| * ] | |||

| * ] | |||

| * The Bipartisan Budget Act (Section 404), enacted in 2015, includes authorization for funding an SPR modernization program to support improvements deemed necessary to preserve the long-term integrity and utility of SPR's infrastructure by selling up to $2 billion worth of SPR crude oil in fiscal years 2017 through 2020. Although the estimated volumes presented in the chart above are based on an assumed oil price of $50 per barrel, the actual final sales volumes will depend on how SPR decides to allocate the sales volumes across those fiscal years and the actual price of crude oil at the time of the sales. For the Section 404 sales, SPR must get an appropriation from Congress to approve its requested sales revenue target.<ref name="start-this-month">{{cite web |title = Strategic Petroleum Reserve sales expected to start this month |work = Today in Energy |publisher = Energy Information Administration |date = January 26, 2017 |url = https://www.eia.gov/todayinenergy/detail.php?id=29692 }}</ref> | |||

| * ] | |||

| * Another section of the Bipartisan Budget Act (Section 403), enacted in 2015, mandates SPR crude oil sales for fiscal years 2018 through 2025 on a volumetric basis, rather than on a dollar basis, as specified in Section 404. The revenues from sales authorized under section 403 will be deposited into the general fund of the U.S. Department of the Treasury.<ref name="start-this-month"/> | |||

| * The Fixing America’s Surface Transportation Act, enacted in December 2015, calls for SPR sales totaling 66 million barrels from fiscal years 2023 through 2025.<ref name="start-this-month"/> | |||

| * The 21st Century Cures Act, enacted in December 2016, calls for the sale of 25 million barrels of SPR crude oil for fiscal years 2017 through 2019. The first portion of these sales is expected in late spring 2017.<ref name="start-this-month"/> | |||

| * In December 2016, the DOE announced it would begin the sale of {{convert|190|Moilbbl|m3}} in January 2017.<ref name=twip2016>{{cite web |title = This Week in Petroleum |url = http://www.eia.gov/petroleum/weekly/archive/2016/161221/includes/analysis_print.cfm |publisher = United States Department of Energy |access-date = December 21, 2016 |date = December 21, 2016 }}</ref> | |||

| * The Tax Cuts and Jobs Act of 2017, enacted in December 2017, calls for the sale of 7 million barrels over the two-year period of FY 2026 through FY 2027.<ref name=EIa20180221 /> | |||

| * The Bipartisan Budget Act of 2018, enacted in February 2018, calls for the sale of 30 million barrels over the four-year period of FY 2022 through FY 2025, 35 million barrels in FY 2026, and 35 million barrels in FY 2027.<ref name=EIa20180221 /> | |||

| * In November 2021, the White House announced the release of {{convert|50|Moilbbl|m3}} to address high gasoline prices.<ref name=sprcnn>{{cite web |title = Biden To Announce Release of Oil Reserves In Effort To Lower Gas Prices |url = https://www.cnn.com/2021/11/23/politics/biden-oil-reserves-gas-prices/index.html |publisher = CNN |access-date = November 23, 2021 |date = November 23, 2021 }}</ref><ref name="Reuters2021">{{cite web |url = https://www.reuters.com/markets/commodities/us-set-unveil-emergency-oil-release-bid-fight-high-prices-2021-11-23/ |title = U.S. challenges OPEC+ with coordinated release of oil from reserves |publisher = Reuters |access-date = November 23, 2021 }}</ref> | |||

| * On March 1, 2022, President Biden announced the release of 30 million barrels of oil from the reserve in response to ].<ref>{{cite web |first = Jacob |last = Fischler |title = Biden OKs release of 30 million barrels of oil from Strategic Petroleum Reserve |url = https://www.nbc12.com/2022/03/05/biden-oks-release-30-million-barrels-oil-strategic-petroleum-reserve/ |date = March 5, 2022 }}</ref> | |||

| *On March 31, 2022, President Biden announced that his administration would release 1 million barrels of oil per day from the reserve for the next 180 days.<ref name="NYTimes-April2022" /><ref>{{cite news |url=https://www.axios.com/biden-strategic-petroleum-reserve-oil-release-382b5121-a795-4c33-80f0-b9dc832e46e4.html |title=Biden ordering massive release of oil in bid to curb gas prices |last1=Geman |first1=Ben |last2=Doherty |first2=Erin |website=Axios |date=April 1, 2022 |access-date=April 4, 2022}}</ref> | |||

| == See also == | |||

| * {{Portal-inline|Energy}} | |||

| * ] | |||

| * ] | |||

| ==References== | ==References== | ||

| {{reflist}} | {{reflist|30em}} | ||

| ==Further reading== | |||

| * Beaubouef, Bruce A. ''The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005'' (Texas A&M University Press, 2007). | |||

| * Strait, Albert L. ''Strategic Petroleum Reserve'' (Nova Science Publishers, 2010). | |||

| ==External links== | ==External links== | ||

| {{commons category}} | |||

| * | |||

| {{Spoken Misplaced Pages|Strategic_Petroleum_Reserve_(United_States).ogg|date=July 30, 2019}} | |||

| * | |||

| * | |||

| * - November 13, 2001 | |||

| * - April 3, 2006 | |||

| *, Brett Clanton, ''Houston Chronicle'', May 26, 2008 (rare tour of facilities w/ short video) | |||

| {{Presidency of Gerald Ford}} | |||

| {{coord missing|United States}} | |||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

Latest revision as of 23:46, 12 September 2024

US strategic petroleum reserve This article is about the United States Strategic Petroleum Reserve. For other countries, see Global strategic petroleum reserves. For unextracted, naturally occurring sources, see Oil reserves.

Barrels of oil

The Strategic Petroleum Reserve (SPR) is an emergency stockpile of petroleum maintained by the United States Department of Energy (DOE). It is the largest publicly known emergency supply in the world; its underground tanks in Louisiana and Texas have capacity for 714 million barrels (113,500,000 m). The United States started the petroleum reserve in 1975 to mitigate future supply disruptions as part of the international Agreement on an International Energy Program, after oil supplies were interrupted during the 1973–1974 oil embargo.

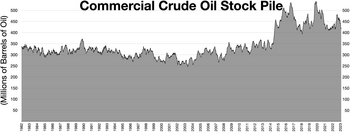

The current inventory is displayed on the SPR's website. As of July 21, 2023, the inventory was 346.8 million barrels (55,140,000 m). This equates to about 17 days of oil at 2019 daily U.S. consumption levels of 20.54 million barrels per day (3,266,000 m/d) or 35 days of oil at 2019 daily U.S. import levels of 9.141 million barrels per day (1,453,300 m/d). However, the maximum total withdrawal capability from the SPR is only 4.4 million barrels per day (700,000 m/d), so it would take about 79 days to use the entire inventory. At recent market prices ($58 a barrel as of March 2021), the SPR holds over $14.6 billion in sweet crude and approximately $18.3 billion in sour crude (assuming a $15/barrel discount for sulfur content). In 2012, the total value of the crude in the SPR was approximately $43.5 billion, while the price paid for the oil was $20.1 billion (an average of $28.42 per barrel).

Since 2015 Congress has mandated sales of oil from the reserve to fund federal spending. The U.S. Department of Energy has run at least seven sales since 2017, selling 132 million barrels, or about 18.2% of what had been in the reserve.

On March 31, 2022, President Joe Biden announced that his administration would release 1 million barrels of oil per day from the reserve for the next 180 days, selling it at an average price of $96 per barrel. The 2022 release became the largest ever SPR sale and lowered the SPR to its lowest levels in 40 years. After oil prices declined during the second half of the year, in December the administration announced it would begin replenishing the SPR in early 2023, expecting to purchase oil at a lower price than it was sold, a process that would take months or years to complete. The Biden administration continued to release reserves in 2023, selling off 45% of the SPR by September 2023. The Department of Energy unveiled plans to purchase oil at a price of $79 per barrel or less, but has since purchased oil at higher prices. As of April 2024, further purchases were cancelled due to rising oil prices.

According to legislation already in place, the amount of oil in the reserve could fall to 238 million barrels by 2028. This will be a 67% reduction to the oil in the reservoir since 2010.

Facilities

The SPR management office is located in Elmwood, Louisiana, a suburb of New Orleans.

The reserve is stored at four sites on the Gulf of Mexico, each located near a major center of petrochemical refining and processing. Each site contains a number of artificial caverns created in salt domes below the surface.

Individual caverns within a site can be up to 1,000 m (3,300 ft) below the surface. Average dimensions are 60 m (200 ft) wide and 600 m (2,000 ft) deep; capacity ranges from 6 to 37 million barrels (950,000 to 5,880,000 m). Almost $4 billion was spent on the facilities. The decision to store in caverns was made to reduce costs. The Department of Energy claims that it is approximately ten times more cost effective to store oil below the surface, with the added advantages of no leaks and a constant natural churn of the oil due to a temperature gradient in the caverns. The caverns were created by drilling down and then dissolving the salt with water.

Existing

- Bryan Mound: Freeport, Texas. 20 caverns with a storage capacity of 254 million barrels (40,400,000 m) with a drawdown capacity of 1.5 million barrels (240,000 m) per day.

- Big Hill: Winnie, Texas. Has a capacity of 160 million barrels (25,000,000 m) with a drawdown capacity of 1.1 million barrels (170,000 m) per day.

- West Hackberry: Lake Charles, Louisiana. Has a capacity of 227 million barrels (36,100,000 m) with a drawdown capacity of 1.3 million barrels (210,000 m) per day.

- Bayou Choctaw: Baton Rouge, Louisiana. Has a capacity of 76 million barrels (12,100,000 m) with a maximum drawdown rate of 550,000 barrels (87,000 m) per day.

Proposed

- Richton, Mississippi: This facility, if built as planned, would have had a capacity of 160 million barrels (25,000,000 m) with a drawdown capacity of 1 million barrels (160,000 m) per day. Former Secretary of Energy Samuel Bodman announced the creation of this site in February 2007. As of 2008, this site was facing some opposition. According to the DOE: "Activities towards the goal of expansion of the SPR to one billion barrels, as directed by Congress in the 2005 Act, were cancelled in 2011 after Congress rescinded all remaining expansion funds."

Retired

- Weeks Island: Iberia Parish, Louisiana (decommissioned 1999): Capacity of 72 million barrels (11,400,000 m). This facility was a conventional room and pillar near-surface salt mine, formerly owned by Morton Salt. In 1993, a sinkhole formed on the site, allowing fresh water to intrude into the mine. Because of the mine's construction in salt deposits, fresh water would erode the ceiling, potentially causing the structure to fail. The mine was backfilled with salt-saturated brine. This process, which allowed for recovery of 98% of the petroleum stored in the facility, reduced the risk of further fresh water intrusion, and helped prevent the remaining oil from leaking into the aquifer that is located over the salt dome.

History

Background

The SPR was created following the 1973 energy crisis. On November 18, 1974, the United States became a signatory to the Agreement on an International Energy Program (IEP) and a founding member of the International Energy Agency that the IEP established. One of the key commitments made by the treaty's signatories is to maintain oil stocks of no less than 90 days of net imports.

Access to the reserve is determined by the conditions written into the 1975 Energy Policy and Conservation Act (EPCA), primarily to counter a severe supply interruption. The maximum removal rate, by physical constraints, is 4.4 million barrels per day (700,000 m/d). Oil could begin entering the marketplace 13 days after a presidential order. The Department of Energy says it has about 59 days of import protection in the SPR. This, combined with private sector inventory protection, is estimated to equal 115 days of imports.

The EPCA of December 22, 1975, made it policy for the United States to establish a reserve up to 1 billion barrels (159 million m³) of petroleum. A number of existing storage sites were acquired in 1977. Construction of the first surface facilities began in June 1977. On July 21, 1977, the first oil—approximately 412,000 barrels (65,500 m) of Saudi Arabian light crude—was delivered to the SPR. Fill was suspended in Fiscal Year 1995 to devote budget resources to refurbishing the SPR equipment and extending the life of the complex.

Domestic actions

On November 13, 2001, shortly after the September 11 terrorist attacks, President George W. Bush announced that the SPR would be filled, saying, "The Strategic Petroleum Reserve is an important element of our Nation's energy security. To maximize long-term protection against oil supply disruptions, I am directing the Secretary of Energy to fill the SPR up to its 700 million barrels (110,000,000 m) capacity." The highest prior level was reached in 1994 with 592 million barrels (94,100,000 m). At the time of President Bush's directive, the SPR contained about 545 million barrels (86,600,000 m). Since the directive in 2001, the capacity of the SPR has increased by 27 million barrels (4,300,000 m) due to natural enlargement of the salt caverns in which the reserves are stored. The Energy Policy Act of 2005 has since directed the Secretary of Energy to fill the SPR to the full 1 billion barrels (160,000,000 m) authorized capacity, a process which will require a physical expansion of the Reserve's facilities.

On August 17, 2005, the SPR reached its goal of 700 million barrels (110,000,000 m). Approximately 60% of the crude oil in the reserve is the less desirable sour (high sulfur content) variety. The oil delivered to the reserve is "royalty-in-kind" oil—royalties owed to the U.S. government by operators who acquire leases on the federally owned Outer Continental Shelf in the Gulf of Mexico. These royalties were previously collected as cash, but in 1998 the government began testing the effectiveness of collecting royalties "in kind"—or in other words, acquiring the crude oil itself. This mechanism was adopted when refilling the SPR began, and once filling is completed, revenues from the sale of future royalties will be paid into the federal treasury.

On April 25, 2006, President Bush announced a temporary halt to petroleum deposits to the SPR as part of a four-point program to alleviate high fuel prices.

On January 23, 2007, President Bush suggested in his State of the Union speech that Congress should approve expansion of the current reserve capacity to twice its current level.

On May 16, 2008, the U.S. Department of Energy (DOE) said it would halt all deliveries to the Strategic Petroleum Reserve sometime in July. This announcement came days after Congress voted to direct the Bush administration to do the same.

On January 2, 2009, after a sharp decline in fuel prices, DOE said that it would begin buying approximately 12,000,000 barrels (1,900,000 m) of crude oil to fill the Strategic Petroleum Reserve, replenishing supplies that were sold after hurricanes Katrina and Rita in 2005. The purchase would be funded by the roughly $600 million received from those emergency sales.

On September 9, 2011, a Notice of Cancellation was published in the Federal Register after Congress rescinded funding for the expansion of the Strategic Petroleum Reserve, reversing the SPR expansion initiative previously directed under the Energy Policy Act of 2005.

On October 20, 2014, a report by the U.S. Government Accountability Office (GAO) recommended reducing the size of the Reserve. According to the report, the amount of oil held in reserve exceeds the amount required to be kept on hand given the need for imported crude oil had decreased in recent years. The report said the DOE agreed with the GAO recommendation.

On March 19, 2020, President Donald Trump directed the Department of Energy to fill the Strategic Petroleum Reserve to maximum capacity, when oil was priced at $24 per barrel. This directive was given to help support domestic oil producers given the impending economic collapse from COVID-19 and extreme drops in international oil markets. However, funding was blocked by Congress, with Senate Democratic Leader Chuck Schumer stating that Democrats had blocked a "bailout for big oil".

In 2022, the Biden administration sold 180 million barrels of oil from the Strategic Petroleum Reserve over 6 months. The sale lowered the SPR to its lowest levels in 40 years and was the largest ever release of oil from the SPR. SPR drawdowns continued into 2023, lowering the SPR by 45% from January 2021. Since the 2022 sales, the Department of Energy bought back 32.3 million barrels of oil, aiming to purchase at a maximum price of $79 per barrel. However, oil has been purchased exceeding the $79 price cap in March 2024. As of April 2024, further SPR purchases were cancelled due to rising oil prices.

Emergency sales to Israel

According to the 1975 Sinai Interim Agreement signed by the United States and Israel, as a precondition for Israel's return of the Sinai Peninsula and its associated oil reserves to Egypt, in an emergency the United States was obligated to make oil available for sale to Israel for up to five years. Israel has never invoked the agreement , however. The agreement was extended in 1979, 1994, 2004, and, most recently, in 2015 for a ten-year period.

International obligations

As a member of the International Energy Agency (IEA), the United States must stock an amount of petroleum equivalent to at least 90 days of U.S. imports. The SPR contained an equivalent to 141 days of imports as of September 2016. The United States is also obligated to contribute 43.9% of petroleum in any IEA-coordinated release.

Limitations

The Strategic Petroleum Reserve is primarily a crude petroleum reserve, not a stockpile of refined petroleum fuels such as gasoline, diesel and kerosene. Although the United States maintains some extra supply of refined petroleum fuels, e.g., the Northeast Home Heating Oil Reserve and Northeast Gasoline Supply Reserve under the aegis of the Department of Energy (DOE), the government does not maintain gasoline reserves on anything like the scale of the SPR. The SPR is intended to give the United States protection from disruptions in oil supplies. In the event of a major disruption to refinery operations, the United States would have to call on members of the International Energy Agency that stockpile refined products, and use refining capacities outside of the continental United States for relief.

There have been suggestions that the DOE should increase its supplies and stockpile both gasoline and jet fuel. Some countries and zones have a strategic reserve of both petroleum and petroleum products. In some cases, this includes a strategic reserve of jet fuel.

Former Secretary of Energy Samuel Bodman said that the Department would consider new facilities for refined products as part of an expansion of 1 to 1.5 billion barrels (160,000,000 to 240,000,000 m).

Drawdowns

Petroleum sales - Prior to 2015

- 1985: Test sale—1.1 million barrels (170,000 m)

- 1990–1991: Desert Storm sale—21 million barrels (3,300,000 m)

- 4 million barrels (640,000 m) in October 1990 test sale

- 17 million barrels (2,700,000 m) in January 1991 presidentially ordered drawdown

- 1996–1997: 28 million barrels (4,500,000 m) non-emergency sales for deficit reduction

- July–August 2000: 2.8 million barrels (450,000 m) to supply the Northeast Home Heating Oil Reserve.

- September–October 2000: 30 million barrels (4,800,000 m) in response to a concern over low distillate levels in the northeastern U.S.

- 2005 Hurricane Katrina sale: 11 million barrels (1,700,000 m)—Katrina shut down 95% of crude production and 88% of natural gas output in the Gulf of Mexico. This amounted to a quarter of total U.S. output. About 735 oil and natural gas rigs and platforms had been evacuated due to the hurricane.

- 2011 Arab Spring sale: 30 million barrels (4,800,000 m)—non-emergency sale to offset disruptions caused by political upheaval in Libya and elsewhere in the Middle East. The amount was matched by IEA countries, for a total of 60 million barrels (9,500,000 m) released from stockpiles around the world.

Petroleum exchanges and loans

Note: Loans are made on a case-by-case basis to alleviate supply disruptions. Once conditions return to normal, the loan is returned to the SPR with additional oil as interest.

- April–May 1996: 900,000 barrels (140,000 m) lent to ARCO to alleviate pipeline blockage.

- August 1998: 11 million barrels (1,700,000 m) lent to PEMEX in return for 8.5 million barrels (1,350,000 m) of higher-quality crude.

- June 2000: 1 million barrels (160,000 m) lent to Citgo and Conoco in response to shipping channel blockage.

- October 2002: 296,000 barrels (47,100 m) lent to Shell Pipeline Company in advance of Hurricane Lili.

- September–October 2004: 5.4 million barrels (860,000 m) lent to Astra Oil, ConocoPhillips, Placid Refining, Shell Oil Company, and Premcor after Hurricane Ivan.

- September–October 2005: 9.8 million barrels (1,560,000 m) lent to ExxonMobil, Placid Refining, Valero, BP, Marathon Oil, and TotalEnergies after Hurricane Katrina. Purchases of crude oil would then resume in January 2009 using revenues available from the 2005 Hurricane Katrina emergency sale. The DOE purchased 10.7 million barrels (1,700,000 m) at a cost of $553 million.

- January–February 2006: 767,000 barrels (121,900 m) lent to Total Petrochemicals USA due to closure of the Sabine–Neches Waterway to deep-draft vessels after a barge accident in the channel.

- June 2006: 750,000 barrels (119,000 m) of sour crude lent to ConocoPhillips and Citgo due to the closure for several days of the Calcasieu Ship Channel caused by the release of a mixture of storm water and oil. Repaid in early October 2006.

- September 2008: 630,000 barrels (100,000 m) lent to Citgo, Placid Refining, and Marathon Oil due to disruptions from Hurricane Gustav.

- August 2017: 200,000 barrels of sweet crude and 300,000 barrels of sour crude were lent to Phillips 66 due to disruptions from Hurricane Harvey.

Drawdowns since 2015

Since 2015, Congress has been selling the oil in the reserve to fund the deficit, in unpublicized sales. The U.S. Department of Energy has run seven sales since 2017, selling more than 132 million barrels, or about 18.2% of what had been in the reserve.

According to legislation already in place, the amount of oil in the reserve could fall to as little as 238 million barrels by 2028. This will be a 67% reduction of oil in the reserve since 2010.

The legislation is summarized below:

- The Bipartisan Budget Act (Section 404), enacted in 2015, includes authorization for funding an SPR modernization program to support improvements deemed necessary to preserve the long-term integrity and utility of SPR's infrastructure by selling up to $2 billion worth of SPR crude oil in fiscal years 2017 through 2020. Although the estimated volumes presented in the chart above are based on an assumed oil price of $50 per barrel, the actual final sales volumes will depend on how SPR decides to allocate the sales volumes across those fiscal years and the actual price of crude oil at the time of the sales. For the Section 404 sales, SPR must get an appropriation from Congress to approve its requested sales revenue target.

- Another section of the Bipartisan Budget Act (Section 403), enacted in 2015, mandates SPR crude oil sales for fiscal years 2018 through 2025 on a volumetric basis, rather than on a dollar basis, as specified in Section 404. The revenues from sales authorized under section 403 will be deposited into the general fund of the U.S. Department of the Treasury.

- The Fixing America’s Surface Transportation Act, enacted in December 2015, calls for SPR sales totaling 66 million barrels from fiscal years 2023 through 2025.

- The 21st Century Cures Act, enacted in December 2016, calls for the sale of 25 million barrels of SPR crude oil for fiscal years 2017 through 2019. The first portion of these sales is expected in late spring 2017.

- In December 2016, the DOE announced it would begin the sale of 190 million barrels (30,000,000 m) in January 2017.

- The Tax Cuts and Jobs Act of 2017, enacted in December 2017, calls for the sale of 7 million barrels over the two-year period of FY 2026 through FY 2027.

- The Bipartisan Budget Act of 2018, enacted in February 2018, calls for the sale of 30 million barrels over the four-year period of FY 2022 through FY 2025, 35 million barrels in FY 2026, and 35 million barrels in FY 2027.

- In November 2021, the White House announced the release of 50 million barrels (7,900,000 m) to address high gasoline prices.

- On March 1, 2022, President Biden announced the release of 30 million barrels of oil from the reserve in response to Russia's invasion of Ukraine.

- On March 31, 2022, President Biden announced that his administration would release 1 million barrels of oil per day from the reserve for the next 180 days.

See also

References

- "Office of Petroleum Reserves". United States Department of Energy. Retrieved August 27, 2015.

- International Energy Agency (July 2020). "Oil Security Toolkit". IEA. Retrieved May 16, 2020.

- "Strategic Petroleum Reserve Inventory". Retrieved September 13, 2022.

- "US Total Petroleum Consumption". Energy Information Administration.

- "US Total Crude Oil and Products Imports". Energy Information Administration.

- "WTI & Brent Crude Oil Prices".

- "Strategic Petroleum Reserve—Quick Facts and Frequently Asked Questions". United States Department of Energy. Retrieved February 25, 2012.

- ^ "U.S. Ending Stocks SPR of Crude Oil and Petroleum Products". Energy Information Agency.

- ^ Puko, Timothy; Ferek, Katy Stech (November 23, 2021). "Why Is Biden Tapping the Strategic Oil Reserve, and Will That Lower Gas Prices?". The Wall Street Journal.

- ^ "US strategic petroleum reserve replenishment slowed by rising oil price". Reuters. April 3, 2024.

- ^ Krauss, Clifford; Shear, Michael D. (April 1, 2022). "Biden will tap oil reserve, hoping to push gasoline prices down". The New York Times. p. A1.

- Egan, Matt (December 16, 2022). "Biden begins to refill Strategic Petroleum Reserve, while Keystone Pipeline leak prompts new emergency exchange". CNN.

- Uberti, David (December 19, 2022). "U.S. Scores $4 Billion Windfall on Oil-Reserve Sales". The Wall Street Journal.

- ^ "Biden sold off nearly half the U.S. oil reserve. Is it ready for a crisis?". Politico. October 16, 2022.

- "Biden administration cancels buyback of 3 million barrels to replenish oil stockpile". The Hill. April 4, 2024.

- ^ "Recent legislation mandates additional sales of U.S. Strategic Petroleum Reserve crude oil". Day in Energy. Energy Information Agency. February 21, 2018.

- Clanton, Brett (May 27, 2008). "Go past guards for tour of U.S. oil reserve in Freeport". Houston Chronicle. Retrieved February 25, 2012.

- ^ Strategic Petroleum Reserve Plan: Expansion to One Billion Barrels (PDF). United States Department of Energy. June 2007. p. 5. Archived from the original (PDF) on October 5, 2008.

- "DOE Takes Next Steps to Expand Strategic Petroleum Reserve to One Billion Barrels". United States Department of Energy. December 8, 2006. Retrieved February 25, 2012.

- "Oil reserve site raises ire, Bush policy tested". Reuters. Archived from the original on March 14, 2016. Retrieved June 21, 2016.

- ^ "SPR Quick Facts and FAQs". United States Department of Energy. Retrieved December 24, 2014.

- International Energy Agency (July 2020). "Oil Security Toolkit". IEA. Retrieved May 16, 2022.

- "Strategic Petroleum Reserve". Energy.gov.

- "President Orders Strategic Petroleum Reserve Filled". White House Office of the Press Secretary. November 13, 2001. Retrieved December 26, 2014.

- Bush, George W. (January 23, 2007). "President Bush's 2007 State of the Union Address". The Washington Post. Retrieved January 24, 2007.

- "DOE Stops Filling the Strategic Petroleum Reserve". United States Department of Energy. May 21, 2008. Retrieved February 25, 2012.

- Berthelsen, Christian (October 20, 2014). "U.S. Oil Exports Would Lower Gas Prices, Government Report Says". The Wall Street Journal. Retrieved October 20, 2014.

- ^ "Biden May Buy Oil Just Below $80; Democrats Stymied Trump at $24". Bloomberg. September 13, 2022.

- "Department of Energy Executes on Direction of President Trump, Announces Solicitation to Purchase Crude Oil for the SPR to Provide Relief to American Energy Industry".

- Gore, D'Angelo (April 1, 2022). "Strategic Petroleum Reserve Oil Stocks Declined Under Trump, Contrary to His Claim". FactCheck.org. Retrieved April 4, 2022.

- "US Cancels Latest Oil Reserve Refill Plan Amid High Prices". Bloomberg. April 3, 2024.

- Phillips, James (February 28, 1979). "The Iranian Oil Crisis". The Heritage Foundation. Archived from the original on January 26, 2010. Retrieved February 25, 2012.

- "US and Israel Sign Extension of Oil Supply Agreement". Israel National News. April 17, 2015. Retrieved June 21, 2016.

- ^ "This Week in Petroleum". United States Department of Energy. December 21, 2016. Retrieved December 21, 2016.

- Tejerina, Pilar (September 30, 2005). "Senators propose gasoline reserve". CNN. Retrieved January 24, 2007.

- "Oil Supply Security: The Emergency Response Potential of IEA Countries in 2000" (PDF). Retrieved March 13, 2007.

French stockholding legislation requires that jet fuel stocks cover at least 55 days of consumption

- Bodman, S.W. (2007, January 23). Statement from Energy Secretary Samuel W. Bodman on the Expansion of the Strategic Petroleum Reserve to 1.5 Billion. Department of Energy. https://www.energy.gov/articles/statement-energy-secretary-samuel-w-bodman-expansion-strategic-petroleum-reserve-15-billion

- "History of SPR Releases". Department of Energy, Office of Fossil Energy and Carbon Management. Retrieved February 1, 2022.

- Smith, Aaron (June 23, 2011). "U.S. to release oil from strategic reserve". CNN.

- "Strategic Petroleum Reserve – Profile". February 27, 2013. Archived from the original on April 8, 2013.

- "Quick Facts about the Strategic Petroleum Reserve". United States Department of Energy. Retrieved February 25, 2012.

- "Oil ends up after dip below $100". CNN. September 12, 2008.

- "US taps strategic oil reserves". The Mercury News. August 31, 2017. Retrieved August 31, 2017.

- ^ "Strategic Petroleum Reserve sales expected to start this month". Today in Energy. Energy Information Administration. January 26, 2017.

- "Biden To Announce Release of Oil Reserves In Effort To Lower Gas Prices". CNN. November 23, 2021. Retrieved November 23, 2021.

- "U.S. challenges OPEC+ with coordinated release of oil from reserves". Reuters. Retrieved November 23, 2021.

- Fischler, Jacob (March 5, 2022). "Biden OKs release of 30 million barrels of oil from Strategic Petroleum Reserve".

- Geman, Ben; Doherty, Erin (April 1, 2022). "Biden ordering massive release of oil in bid to curb gas prices". Axios. Retrieved April 4, 2022.

Further reading

- Beaubouef, Bruce A. The Strategic Petroleum Reserve: U.S. Energy Security and Oil Politics, 1975-2005 (Texas A&M University Press, 2007).

- Strait, Albert L. Strategic Petroleum Reserve (Nova Science Publishers, 2010).