| Revision as of 03:59, 6 February 2013 edit72Dino (talk | contribs)Pending changes reviewers, Rollbackers26,916 edits →Notes and references: two columns of refs← Previous edit | Latest revision as of 10:00, 3 December 2024 edit undoTommyGundam (talk | contribs)Extended confirmed users961 edits →Indictment and sentencing: It seems someone forgot a colonTags: Mobile edit Mobile web edit | ||

| (666 intermediate revisions by more than 100 users not shown) | |||

| Line 1: | Line 1: | ||

| {{Short description|American financier (born 1946)}} | |||

| {{Use mdy dates|date=November 2023}} | |||

| {{Infobox person | {{Infobox person | ||

| | image = Announcement of Recipient of $25,000 Milken National Educator Award (cropped).jpg | |||

| | birth_name = Michael Robert Milken | |||

| | |

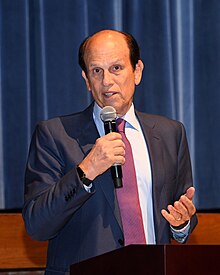

| image_caption = Milken in 2014 | ||

| | birth_name = Michael Robert Milken | |||

| | image_size = 220px | |||

| | birth_date = {{Birth date and age|1946|7|4}} | |||

| | caption = | |||

| | |

| birth_place = ], U.S. | ||

| | death_place = | |||

| | birth_date = {{Birth date and age|1946|07|4}} | |||

| | education = ] (])<br>] (]) | |||

| | birth_place = ], ] | |||

| | occupation = Businessman, ] | |||

| | death_date = | |||

| | known_for = Developing the ] market, Indictment for ] | |||

| | death_place = | |||

| | criminal_charges = Securities and reporting violations (1989) | |||

| | occupation = ], ], ] | |||

| | criminal_penalty = Served 22 months in prison <br /> $600 million fine | |||

| | salary = | |||

| | criminal_status = Released<br />Pardoned (February 18, 2020)<ref>{{cite news |url=https://www.washingtonpost.com/politics/trump-grants-clemency-to-former-nypd-commissioner-bernie-kerik-financier-michael-milken/2020/02/18/566e9f78-5280-11ea-80ce-37a8d4266c09_story.html |access-date=February 18, 2020 |title=Trump grants clemency to former NYPD commissioner Bernie Kerik, financier Michael Milken |newspaper=The Washington Post |archive-date=February 20, 2020 |archive-url=https://web.archive.org/web/20200220094926/https://www.washingtonpost.com/politics/trump-grants-clemency-to-former-nypd-commissioner-bernie-kerik-financier-michael-milken/2020/02/18/566e9f78-5280-11ea-80ce-37a8d4266c09_story.html}}</ref> | |||

| | net_worth = {{increase}} ] 2.3 ]<br>(September 2012)<ref>http://www.forbes.com/profile/michael-milken/ Forbes - The World's Billionaires: Michael Milken] September 2012</ref> | |||

| | spouse = {{marriage|Lori Hackel|1968}} | |||

| | ethnicity = Jewish | |||

| | children = 3 | |||

| | religion = Judaism<ref name=LATimesLargess /> | |||

| | |

| relatives = ] (brother) | ||

| | website = {{URL|www.mikemilken.com}} | |||

| | children = 3 | |||

| | website = http://www.mikemilken.com/ | |||

| }} | }} | ||

| '''Michael Robert Milken''' (born July 4, 1946) is a financier who developed the market for ]s (also called "junk bonds") during the 1970s and 1980s.<ref>{{cite news | | |||

| url=http://www.nytimes.com/1990/04/26/opinion/michael-milken-s-guilt.html | | |||

| title=Michael Milken's Guilt | | |||

| publisher=The New York Times | | |||

| date=April 26, 1990 }}</ref> | |||

| Milken was indicted for ] and ] in 1989 in an ] investigation. As the result of a ], he pled guilty to securities and reporting violations but not to racketeering nor insider trading. Milken was sentenced to ten years in prison, fined $600 million, and permanently barred from the securities industry by the ]. After the presiding judge reduced his sentence for cooperating with testimony against his former colleagues and good behavior, he was released after less than two years.<ref> New York Times; August 06, 1992</ref> | |||

| '''Michael Robert Milken''' (born July 4, 1946) is an American financier. He is known for his role in the development of the market for ] ("junk bonds"),<ref>{{cite news | |||

| His critics cited him as the epitome of Wall Street greed during the 1980s, and nicknamed him the "Junk Bond King". Supporters, like ] in his book, ''Telecosm'' (2000), note that "Milken was a key source of the organizational changes that have impelled economic growth over the last twenty years. Most striking was the productivity surge in capital, as Milken … and others took the vast sums trapped in old-line businesses and put them back into the markets."<ref>{{cite book|last=Gilder|first=George|title=Telecosm: How Infinite Bandwidth Will Revolutionize Our World|year=2000|publisher=]|isbn=9780743215947|authorlink=George Gilder|page=170}}</ref> | |||

| |url=https://www.nytimes.com/1990/04/26/opinion/michael-milken-s-guilt.html | |||

| |title=Michael Milken's Guilt | |||

| |newspaper=The New York Times | |||

| |date=April 26, 1990 | |||

| |access-date=February 11, 2017 | |||

| |archive-date=February 4, 2017 | |||

| |archive-url=https://web.archive.org/web/20170204192354/http://www.nytimes.com/1990/04/26/opinion/michael-milken-s-guilt.html | |||

| |url-status=live }}</ref> and his conviction and sentence following a guilty plea on felony charges for violating U.S. securities laws.<ref>{{Cite news | |||

| |url=https://www.nytimes.com/1991/02/22/business/milken-assigned-to-bay-area-prison.html | |||

| |title=Milken Assigned to Bay Area Prison | |||

| |author=The Associated Press | |||

| |work=The New York Times | |||

| |date=February 22, 1991 | |||

| |access-date=September 10, 2018 | |||

| |archive-date=September 11, 2018 | |||

| |archive-url=https://web.archive.org/web/20180911002556/https://www.nytimes.com/1991/02/22/business/milken-assigned-to-bay-area-prison.html | |||

| |url-status=live | |||

| }}</ref> Milken's compensation while head of the high-yield bond department at ] in the late 1980s exceeded $1 billion over a four-year period, a record for U.S. income at that time.<ref>{{cite news|url=https://www.nytimes.com/1989/04/03/business/wages-even-wall-st-can-t-stomach.html|title=Wages Even Wall St. Can't Stomach|author=Eichenwald, Kurt|date=April 3, 1989|work=The New York Times|quote="Surely no one in American history has earned anywhere near as much in a year as Mr. Milken."|access-date=February 11, 2017|archive-date=February 4, 2017|archive-url=https://web.archive.org/web/20170204192415/http://www.nytimes.com/1989/04/03/business/wages-even-wall-st-can-t-stomach.html|url-status=live}}</ref> With a net worth of {{USD}}6 billion as of 2022, he is among the ].<ref name="forbes-p">{{cite magazine|url=https://www.forbes.com/profile/michael-milken/|title=Profile: Michael Milken|magazine=]|access-date=November 11, 2022|archive-date=February 27, 2020|archive-url=https://web.archive.org/web/20200227031513/https://www.forbes.com/profile/michael-milken/|url-status=live}}</ref><ref name="HC" /> | |||

| Milken was indicted for racketeering and ] in 1989 in an ] investigation. In a ], he pleaded guilty to securities and reporting violations but not to racketeering or insider trading. Milken was sentenced to ten years in prison, fined $600 million (although his personal website claims $200 million)<ref>{{cite web | url=https://www.mikemilken.com/myths.taf#myth3 | title=Michael Milken - Philanthropist, Financier, Medical Research Innovator & Public Health Advocate }}</ref> and permanently barred from the ] by the ]. His sentence was later reduced to two years for cooperating with testimony against his former colleagues and for good behavior.<ref>{{cite news |url=https://www.nytimes.com/1992/08/06/business/milken-s-sentence-reduced-by-judge-7-months-are-left.html?pagewanted=all&src=pm |title=Milken's Sentence Reduced by Judge; 7 Months Are Left |work=] |date=August 6, 1992 |access-date=February 11, 2017 |archive-date=February 4, 2017 |archive-url=https://web.archive.org/web/20170204192419/http://www.nytimes.com/1992/08/06/business/milken-s-sentence-reduced-by-judge-7-months-are-left.html?pagewanted=all&src=pm |url-status=live }}</ref> Milken was pardoned by President ] on February 18, 2020. | |||

| Since his release from prison, Milken has funded medical research.<ref name='Fortune2004'>{{cite news | first=Cora | last=Daniels | title=The Man Who Changed Medicine | date=2004-11-29 | url =http://money.cnn.com/magazines/fortune/fortune_archive/2004/11/29/8192713/index.htm | work =Fortune | pages = | accessdate = 2009-07-28 }}</ref> He is co-founder of the Milken Family Foundation, chairman of the ], and founder of medical philanthropies funding research into ], cancer and other life-threatening diseases. In a November 2004 cover article, Fortune magazine called him "The Man Who Changed Medicine" for his positive influence.<ref name='Fortune2004'/> In September 2012, Milken and the director of the National Institutes of Health, Dr. ], jointly hosted 1,000 senior medical scientists and members of Congress at a three-day conference <ref>www.celebrationofscience.org</ref> to demonstrate the return on investment in medical research. | |||

| Since his release from prison, he has become known for his charitable donations.<ref>Jacob Berkman, {{cite web | |||

| Milken's compensation, while head of the high-yield bond department at ] in the late 1980s, exceeded $1 billion in a four-year period, a new record for US income at that time.<ref>{{cite news | | |||

| |website=].org | |||

| url=http://www.nytimes.com/1989/04/03/business/wages-even-wall-st-can-t-stomach.html | | |||

| |url=http://www.blogs.jta.org/philanthropy/article/2010/12/10/2742116/zuckerberg-among-eight-new-jewish-individuals-and-families-to-take-the-giving-pledge | |||

| title=Wages Even Wall St. Can't Stomach | | |||

| |title=Zuckerberg among nine new Jewish individuals and families to take the Giving Pledge | |||

| author= Eichenwald, Kurt | | |||

| |archive-url=https://web.archive.org/web/20130311023348/http://blogs.jta.org/philanthropy/article/2010/12/10/2742116/zuckerberg-among-eight-new-jewish-individuals-and-families-to-take-the-giving-pledge | |||

| date=April 3, 1989 | | |||

| |archive-date=March 11, 2013 | |||

| publisher=New York Times}} "Surely no one in American history has earned anywhere near as much in a year as Mr. Milken."</ref> Drexel went bankrupt in 1990. | |||

| |date=December 10, 2012 | |||

| With an estimated net worth of around $2 billion as of 2010, he is ranked by '']'' magazine as the ].<ref name="forbeslist2010">{{cite web|publisher=Forbes.com |title=The World's Billionaires: #488 Michael Milken |date=2010-10-03|url=http://www.forbes.com/lists/2010/10/billionaires-2010_Michael-Milken_SSM6.html| accessdate=2010-12-13}}</ref> Much of that wealth comes from his success as a bond trader; he only had four losing months in 17 years of trading.<ref name="HC"/> | |||

| |access-date=July 2, 2019 | |||

| |url-status= | |||

| }}</ref> He is co-founder of the Milken Family Foundation, chairman of the ], and founder of medical philanthropies funding research into ], cancer, and other life-threatening diseases.<ref name="Fortune2004">{{cite news|first=Cora|last=Daniels|title=The Man Who Changed Medicine|date=November 29, 2004|url=https://money.cnn.com/magazines/fortune/fortune_archive/2004/11/29/8192713/index.htm|work=Fortune|access-date=July 28, 2009|archive-date=February 27, 2009|archive-url=https://web.archive.org/web/20090227143950/http://money.cnn.com/magazines/fortune/fortune_archive/2004/11/29/8192713/index.htm|url-status=live}}</ref> A ] survivor, Milken has devoted significant resources to research on the disease.<ref name="WSJ_Landro2010">{{cite news|url=https://www.wsj.com/articles/SB10001424052748703969204575220160013541330?mod=googlewsj|title=Donor of the Day: Gift Funds Melanoma Research|last=LAURA LANDRO|date=May 3, 2010|work=]|access-date=February 15, 2013|archive-date=April 25, 2018|archive-url=https://web.archive.org/web/20180425115426/https://www.wsj.com/articles/SB10001424052748703969204575220160013541330?mod=googlewsj|url-status=live}}</ref> | |||

| ==Early life and education== | |||

| ==Education== | |||

| Milken was born into middle-class ],<ref> May 26, 1994</ref><ref name=LATimesLargess> September 15, 1992</ref><ref> ]: Michael Milken retrieved February 5, 2013</ref><ref> December 10, 2010</ref><ref> December 18, 2008</ref> family in ].<ref>America in the 20th Centure: 1980 - 1989, page 1200</ref> He graduated from ] where he was the head cheerleader and worked while in school at a diner.<ref> September 1987</ref> His classmates included actresses ] and ]. In 1968, he graduated from the ] with a ] with highest honors where he was elected to ] and was a member of the ] fraternity.<ref></ref> He received his MBA from the ] at the ]. While at Berkeley, Milken was influenced by credit studies authored by ], a former president of the ], who noted that a portfolio of non-investment grade bonds offered "risk-adjusted" returns greater than that of an investment grade portfolio. | |||

| Milken was born into a middle-class<ref>Roger E. Alcaly, {{Webarchive|url=https://web.archive.org/web/20131210231649/http://www.nybooks.com/articles/archives/1994/may/26/the-golden-age-of-junk/?pagination=false |date=December 10, 2013 }}, ''New York Review of Books'', May 26, 1994.</ref><ref name=LATimesLargess>James F. Peltz, , ''Los Angeles Times'', September 15, 1992.</ref> ] family in ].<ref>''America in the 20th Century'': 1980-1989, pg. 1200</ref> | |||

| He graduated from ] where he was the head cheerleader and worked while in school at a diner.<ref>Edward Jay Epstein {{Webarchive|url=https://web.archive.org/web/20130222123129/http://www.edwardjayepstein.com/archived/milken.htm |date=February 22, 2013 }}, September 1987.</ref> His classmates included future ] president ]<ref name="SecretAgent.NYT">{{cite news | |||

| |url=https://www.nytimes.com/1989/07/09/magazine/hollywood-s-most-secret-agent.html | |||

| |title=Hollywood's Most Secret Agent | |||

| |author=L. J. Davis | |||

| |date=July 9, 1989 | |||

| |newspaper=] | |||

| |access-date=April 13, 2019 | |||

| |issn=0362-4331 | |||

| |archive-date=April 14, 2019 | |||

| |archive-url=https://web.archive.org/web/20190414000022/https://www.nytimes.com/1989/07/09/magazine/hollywood-s-most-secret-agent.html | |||

| |url-status=live | |||

| }}</ref> and actresses ] and ]. In 1968, he graduated from the ] with a ] with highest honors. He was elected to ] and was a member of the ] fraternity.<ref>{{Cite web|url=http://www.calgreeks.com/chapters/ifc/sigma_alpha_mu.html|archiveurl=https://web.archive.org/web/20071119004948/http://www.calgreeks.com/chapters/ifc/sigma_alpha_mu.html|title=UC Berkeley Inter-Fraternity Council: Sigma Alpha Mu|archivedate=November 19, 2007}}</ref> He received his MBA from the ] of the ]. While at Berkeley, Milken was influenced by credit studies authored by ], a former president of the ], who noted that a portfolio of non-investment grade bonds offered "risk-adjusted" returns greater than that of an ] portfolio. | |||

| ==Career== | ==Career== | ||

| Through his Wharton professors, Milken landed a summer job at Drexel Harriman Ripley, an old-line investment bank, in 1969. After completing his MBA, he joined Drexel (by then known as Drexel Firestone) as director of low-grade bond research. He was also given some capital and permitted to trade. According to legend, he was so devoted to his work that he wore a miner's headlamp while commuting on the bus so that he could read company prospectuses. | |||

| Through his Wharton professors, Milken landed a summer job at ], an old-line ], in 1969. After completing his MBA, he joined Drexel (by then known as Drexel Firestone) as director of low-grade bond research. He was also given control of some capital and permitted to trade. Over the next 17 years, he had only four down months.<ref name="HC"/> | |||

| Drexel merged with Burnham and Company in 1973 to form Drexel Burnham. Despite the firm's name, Burnham was the nominal survivor; the Drexel name only came first at the insistence of the more powerful investment banks, whose blessing was necessary for the merged firm to inherit Drexel's position as a "major" firm. Milken was one of the few prominent holdovers from the Drexel side of the merger. He persuaded his new boss, Tubby Burnham (a fellow Wharton alumnus), to let him start a high-yield bond trading department—an operation that soon earned a remarkable 100% ].<ref name="HC">{{cite book |last=Kornbluth |first=Jesse |title=Highly Confident: The Crime and Punishment of Michael Milken |year=1992 |publisher=] |location=New York City |isbn=0-688-10937-3 }}</ref> By 1976, Milken's ] at what was now ] was estimated at $5 million a year. | |||

| Drexel merged with Burnham and Company in 1973 to form Drexel Burnham. Despite the firm's name, Burnham was the nominal survivor; the Drexel name came first only at the insistence of the more powerful investment banks, whose blessing was necessary for the merged firm to inherit Drexel's position as a "major" firm. | |||

| Milken was one of the few prominent holdovers from the Drexel side of the merger, and he became the merged firm's head of ]. He persuaded his new boss, fellow Wharton alumnus Tubby Burnham, to let him start a high-yield bond trading department—an operation that soon earned a 100 percent return on investment.<ref name="HC">{{cite book|last=Kornbluth|first=Jesse|title=Highly Confident: The Crime and Punishment of Michael Milken|year=1992|publisher=]|location=New York City|isbn=0-688-10937-3|url=https://archive.org/details/highlyconfidentc00korn}}</ref> By 1976, Milken's income at the firm, which had become ], was estimated at $5 million a year. In 1978, Milken moved the high-yield bond operation to ] in Los Angeles.<ref name=LA.ask>{{cite news | |||

| One weekend in 1978, Milken moved the high-yield bond operation to ] in Los Angeles. The transition went so smoothly that many clients were unaware that the department had moved between Friday and Monday. Later, the operation moved to ] at 9560 ]. On the fourth floor, he set up an X-shaped trading desk—designed to maximize his contact with traders and salesmen—from which he worked very long hours, invariably starting his day before 5 am ] (8 am ], prior to the opening of the markets in New York). The department grew and, in 1986-87, moved up to the fifth floor, where there were eventually three of the famous X-shaped trading desks. | |||

| |quote="Finally, in 1978, Milken asked to move the junk bond trading operation from New York to the Century City section of Los Angeles." | |||

| |title=Pioneer, Billionaire--and, Soon, Unemployed: Michael Milken | |||

| |url=https://www.latimes.com/archives/la-xpm-1989-01-26-fi-2010-story.html | |||

| |newspaper=Los Angeles Times | |||

| |date=January 26, 1989 | |||

| |access-date=February 21, 2020 | |||

| |archive-date=June 7, 2015 | |||

| |archive-url=https://web.archive.org/web/20150607131804/http://articles.latimes.com/1989-01-26/business/fi-2010_1_junk-bond/2 | |||

| |url-status=live | |||

| }}</ref><ref name=LA.mov>{{cite news | |||

| |quote="Drexel Burnham Lambert{{nbsp}}... moved its high-yield bond group to Century City in 1978" | |||

| |newspaper=Los Angeles Times | |||

| |title=Junk bond king Michael Milken looms large in LA | |||

| |url=https://www.latimes.com/business/la-fi-milken-drexel-legacy-20160501-story.html | |||

| |date=May 1, 2016 | |||

| |access-date=February 21, 2020 | |||

| |archive-date=March 8, 2020 | |||

| |archive-url=https://web.archive.org/web/20200308165313/https://www.latimes.com/business/la-fi-milken-drexel-legacy-20160501-story.html | |||

| |url-status=live | |||

| }}</ref><ref>{{cite news | |||

| |quote="Mike Milken, the 30-year-old head of the corporate{{nbsp}}... Hunched behind a borrowed desk in a cubicle in Century City the other day" | |||

| |newspaper=The New York Times | |||

| |url=https://www.nytimes.com/1978/01/29/archives/spotlight-mohammed-and-the-mountain.html | |||

| |title=Spotlight - Mohammed and the mountain | |||

| |date=January 29, 1978 | |||

| |page=5 | |||

| |access-date=January 27, 2019 | |||

| |archive-date=August 2, 2018 | |||

| |archive-url=https://web.archive.org/web/20180802193050/https://www.nytimes.com/1978/01/29/archives/spotlight-mohammed-and-the-mountain.html | |||

| |url-status=live | |||

| }}</ref> | |||

| ===High-yield bonds and leveraged buyouts=== | ===High-yield bonds and leveraged buyouts=== | ||

| {{History of private equity and venture capital}} | {{History of private equity and venture capital}} | ||

| {{See also|Private equity in the 1980s}} | {{See also|Private equity in the 1980s}} | ||

| By the mid-1980s, Milken's network of high-yield bond buyers (notably Fred Carr's ] and Tom Spiegel's Columbia Savings & Loan) had reached a size which enabled him to raise large amounts of money very quickly. It was said, for example, that Milken raised $1 billion for ], then an upstart provider of long-distance telephone services, in the space of one hour on the telephone. Cable TV companies, like ]'s ], were also favorite clients, as were ]'s maverick ], cellphone pioneer ], and casino entrepreneur ]. Before long, the CEOs and CFOs of many smaller and mid-sized companies previously limited to the slow and expensive private-placement market were making early-morning pilgrimages to Beverly Hills seeking to issue high-yield and/or convertible bonds through Drexel Burnham. Without question, many leading entrepreneurs of the 1980s owe their success at least partly to Milken's perception of this market opportunity. One of his favorite sayings: "There is no shortage of capital; there is only a shortage of management talent." | |||

| By the mid-1980s, Milken's network of high-yield bond buyers (notably Fred Carr's ] and ]'s Columbia Savings & Loan) had reached a size that enabled him to raise large amounts of money quickly. | |||

| Milken was largely involved with kick-starting investments in Nevada, which for many years was the fastest-growing state in the U.S. Milken funded the gaming industry, newspapers and homebuilders; among the companies he financed were MGM Mirage, Mandalay Resorts, Harrah's Entertainment and Park Place. | |||

| This money-raising ability also facilitated the activities of ] (LBO) firms such as ] and of so-called "]ers". |

This money-raising ability also facilitated the activities of ] (LBO) firms such as ] and of the so-called "]ers". Most of them were armed with a "]" from Drexel, a tool Drexel's corporate finance wing crafted that promised to raise the necessary debt in time to fulfill the buyer's obligations. It carried no legal status, but by that time Milken had a reputation for being able to make markets for any bonds that he underwrote. For this reason, "highly confident letters" were considered to reliably demonstrate capacity to pay.<ref>{{cite book |quote="The firm could issue a "highly confident" letter, a formal pledge from Drexel that{{nbsp}}..." |title=Den of Thieves |page=133 | ||

| |url=https://books.google.com/books?isbn=067179227X |isbn=067179227X | |||

| |author=James B. Stewart |date=1992|publisher=Simon and Schuster }}</ref><ref name=HiConTimes>{{cite news | |||

| |quote="Just as when Mike Milken was riding high{{nbsp}}... as good as cash in hand." | |||

| |newspaper=The New York Times | |||

| |url=https://www.nytimes.com/1994/06/26/business/market-watch-once-again-a-time-to-be-highly-confident.html | |||

| |title=MARKET WATCH - Once Again, A Time to Be Highly Confident | |||

| |author=Floyd Norris | |||

| |date=June 26, 1994 | |||

| |access-date=August 2, 2018 | |||

| |archive-date=August 2, 2018 | |||

| |archive-url=https://web.archive.org/web/20180802132139/https://www.nytimes.com/1994/06/26/business/market-watch-once-again-a-time-to-be-highly-confident.html | |||

| |url-status=live | |||

| }}</ref> Supporters, like ] in his book ''Telecosm'' (2000), state that Milken was "a key source of the organizational changes that have impelled economic growth over the last twenty years. Most striking was the productivity surge in capital, as Milken{{nbsp}}... and others took the vast sums trapped in old-line businesses and put them back into the markets."<ref>{{cite book|last=Gilder|first=George|title=Telecosm: How Infinite Bandwidth Will Revolutionize Our World|year=2000|publisher=]|isbn=9780743215947|author-link=George Gilder|page=170}}</ref> | |||

| Despite his influence in the financial world during the 1980s, (at least one source called him the most powerful American financier since ]),<ref name="April Fools">{{cite book |author=Dan G. Stone |title=April Fools: An Insider's Account of the Rise and Collapse of Drexel Burnham |year=1990 |publisher=Donald I. Fine |location=New York |isbn=1-55611-228-9 |url=https://archive.org/details/aprilfoolsinside00ston }}</ref> Milken is an intensely private man who shuns publicity; he reportedly owned almost all photographs taken of him.<ref name="HC"/><ref name="SecretAgent.NYT"/> | |||

| Amongst his significant detractors have been ] formerly of ] and author ]. Milken's high-yield "pioneer" status has proved dubious as studies show "original issue" high-yield issues were common during and after the ]. Milken himself points out that high-yield bonds go back hundreds of years, having been issued by the Massachusetts Bay Colony in the 17th century and by America's first Treasury Secretary Alexander Hamilton. Others such as ], an early co-associate and rival at Drexel, have also contested his credit as pioneering the modern high-yield market. This is, however, quibbling, as Drexel was for all intents and purposes unchallenged as essentially the only underwriter and trader of high-yield bonds throughout almost the entire decade of the 1980s. | |||

| Despite his influence in the financial world (at least one source called him the most powerful American financier since ]),<ref name="April Fools">{{cite book |last=Stone |first=Dan G. |title=April Fools: An Insider's Account of the Rise and Collapse of Drexel Burnham |year=1990 |publisher=Donald I. Fine |location=New York |isbn= 1-55611-228-9}}</ref> Milken was an intensely private man who shunned publicity. Citing the power behind the most aggressive firm on Wall Street, Drexel bankers often used "Michael says ..." to justify their tactics.<ref name="HC"/> | |||

| ===Later career=== | ===Later career=== | ||

| Milken and his brother Lowell founded ] in 1996, as well as Knowledge Learning Corporation (KLC), the parent company of ], the largest for-profit child care provider in the country. He is currently chairman of the company.<ref name=OregonBusiness>{{cite web|url=http://www.oregonbusiness.com/articles/96-february-2011/4739-knowledge-universe-reaches-16-billion-in-revenue|title=Knowledge Universe reaches $1.6 billion in revenue|publisher=Oregon Business|accessdate=2011-01-09}}</ref> Milken also established ], a publicly traded education management organization (EMO) that provides online schooling, including to charter school students for whom services are paid by tax dollars,<ref name="saul">{{cite news |author=] |coauthors= |title=Profits and Questions at Online Charter Schools |url=http://www.nytimes.com/2011/12/13/education/online-schools-score-better-on-wall-street-than-in-classrooms.html|newspaper=] |date=December 12, 2011 |accessdate=2012-07-17 }}</ref> which is the largest EMO in terms of enrollment.<ref>http://nepc.colorado.edu/files/EMO-profiles-10-11_0.pdf</ref> | |||

| Milken and his brother ] founded ] in 1996, as well as Knowledge Learning Corporation (KLC), the parent company of ], the largest for-profit ] provider in the country. Michael Milken was chairman of Knowledge Universe until it was sold in 2015.<ref name=OregonBusiness>{{cite magazine |url=http://www.oregonbusiness.com/articles/96-february-2011/4739-knowledge-universe-reaches-16-billion-in-revenue |title=Knowledge Universe reaches $1.6 billion in revenue |magazine=Oregon Business |date=February 2011 |access-date=January 9, 2011 |url-status= |archive-url=https://web.archive.org/web/20110207075627/http://www.oregonbusiness.com/articles/96-february-2011/4739-knowledge-universe-reaches-16-billion-in-revenue |archive-date=February 7, 2011}}</ref><ref>{{cite news|url=https://economictimes.indiatimes.com/news/international/junk-bond-king-milken-is-back-plans-to-raise-1bn/articleshow/1785643.cms|title=Junk bond king Milken is back, plans to raise $1bn|newspaper=The Economic Times|access-date=August 3, 2020|archive-date=October 27, 2020|archive-url=https://web.archive.org/web/20201027145640/https://economictimes.indiatimes.com/news/international/junk-bond-king-milken-is-back-plans-to-raise-1bn/articleshow/1785643.cms|url-status=live}}</ref> | |||

| He invested in ], a publicly traded ] (EMO) that provides online schooling, including to ] students, for whom services are paid by tax dollars,<ref name="saul">{{cite news|author=Stephanie Saul|author-link=Stephanie Saul|title=Profits and Questions at Online Charter Schools|url=https://www.nytimes.com/2011/12/13/education/online-schools-score-better-on-wall-street-than-in-classrooms.html|newspaper=The New York Times|date=December 12, 2011|access-date=July 17, 2012|archive-date=June 19, 2012|archive-url=https://web.archive.org/web/20120619230246/http://www.nytimes.com/2011/12/13/education/online-schools-score-better-on-wall-street-than-in-classrooms.html|url-status=live}}</ref> which is the largest EMO in terms of enrollment.<ref>{{Cite web |url=http://nepc.colorado.edu/files/EMO-profiles-10-11_0.pdf |title=Archived copy |access-date=July 17, 2012 |archive-date=April 19, 2012 |archive-url=https://web.archive.org/web/20120419062742/http://nepc.colorado.edu/files/EMO-profiles-10-11_0.pdf |url-status=live }}</ref> | |||

| ==Scandal== | ==Scandal== | ||

| Dan Stone, a former Drexel executive, wrote in his book ''April Fools'' that Milken was under nearly-constant scrutiny from the ] from 1979 onward due to unethical and sometimes illegal behavior in the high-yield department.<ref name="April Fools"/> His own role in such behavior has been much debated. Stone claims that Milken viewed the securities laws, rules and regulations with a degree of contempt, feeling they hindered the free flow of trade. However, Stone said that while Milken condoned questionable and illegal acts by his colleagues, Milken himself personally followed the rules.<ref name="April Fools"/> He often called Drexel's president and CEO, ]—known for his strict view of the securities laws—with ethical questions.<ref name="HC"/> On the other hand, several of the sources ] used for '']'' told him that Milken often tried to get a higher markup on trades than was permitted at the time. | |||

| Dan Stone, a former Drexel executive, wrote in his book ''April Fools'' that Milken was under nearly constant scrutiny from the ] from 1979 onward due to unethical and sometimes illegal behavior in the high-yield department.<ref name="April Fools"/> | |||

| ], a prominent defense attorney who represented Milken during the appellate process, disputes that view in his book ''Three Felonies a Day'': “Milken’s biggest problem was that some of his most ingenious but entirely lawful maneuvers were viewed, by those who initially did not understand them, as felonious, precisely because they were novel – and often extremely profitable.”<ref name="ThreeFelonies">''Three Felonies A Day: How the Feds Target the Innocent'', Encounter Books, 2009. </ref> | |||

| Milken's role in such behavior has been much debated. Stone claims that Milken viewed the securities laws, rules, and regulations with a degree of contempt, feeling they hindered the free flow of trade. However, Stone said that while Milken condoned questionable and illegal acts by his colleagues, Milken himself personally followed the rules.<ref name="April Fools"/> Milken often contacted ], Drexel's president and CEO, with ethical questions; Joseph was known for his strict view of the securities laws.<ref name="HC"/> | |||

| On the other hand, several of the sources ] used for '']'' told him that Milken often tried to get as much as five times the maximum markup on trades that was permitted at the time.<ref name="denofthieves"/> | |||

| ], a defense attorney who represented Milken during the appellate process, disputes that view in his book ''Three Felonies a Day'': "Milken's biggest problem was that some of his most ingenious but entirely lawful maneuvers were viewed, by those who initially did not understand them, as felonious, precisely because they were novel – and often extremely profitable."<ref name="ThreeFelonies">{{Cite web |url=http://www.mikemilken.com/ThreeFelonies.pdf |title=''Three Felonies A Day: How the Feds Target the Innocent'' (Chapter Four: "Following (or Harassing?) the Money"), Encounter Books, 2009. |access-date=February 5, 2010 |archive-date=September 27, 2010 |archive-url=https://web.archive.org/web/20100927061803/http://mikemilken.com/ThreeFelonies.pdf |url-status=live }}</ref><!--ISSN/ISBN needed--> | |||

| ===Ivan Boesky and an intensifying investigation=== | ===Ivan Boesky and an intensifying investigation=== | ||

| The SEC inquiries never got beyond the investigation phase until 1986, when ]ur ] pled guilty to securities fraud as part of a larger insider trading investigation. As part of his plea, Boesky purported to implicate Milken in several illegal transactions, including insider trading, ], fraud and stock parking (buying stocks for the benefit of another). This led to an SEC probe of Drexel, as well as a separate criminal probe by ], then ]. Although both investigations were almost entirely focused on Milken's department, Milken refused to talk with Drexel (which launched its own internal investigation) except through his lawyers.<ref name="HC"/><ref name="April Fools"/> | |||

| The SEC inquiries never advanced beyond the investigation phase until 1986, when arbitrageur ] pleaded guilty to securities fraud as part of a larger insider trading investigation. As part of his plea, Boesky implicated Milken in several illegal transactions, including insider trading, ], fraud, and stock parking (buying stocks for the benefit of another). This led to an SEC probe of Drexel, as well as a separate criminal probe by ], then ]. Although both investigations were almost entirely focused on Milken's department, Milken refused to talk with Drexel (which launched its own internal investigation) except through his lawyers.<ref name="HC"/><ref name="April Fools"/> It turned out that Milken's legal team believed Drexel would be forced to cooperate with the government at some point, believing that a securities firm would not survive the bad publicity of a long criminal and SEC probe.<ref name="denofthieves"/> | |||

| For two years, Drexel insisted that nothing illegal occurred, even when the SEC formally sued Drexel in 1988. Later that year, Giuliani began seriously considering an indictment of Drexel under the powerful ], which he had previously used against organized crime. Drexel management immediately began plea bargain talks, concluding that no financial institution could survive a RICO indictment. However, talks collapsed on December 19 when Giuliani made several demands that Drexel found too harsh, including one that Milken leave the firm if indicted.<ref name="April Fools"/> | |||

| For two years, Drexel insisted that nothing illegal had occurred, even when the SEC sued Drexel in 1988. Later that year, Giuliani began considering an indictment of Drexel under the powerful ]. Drexel management, concluding that a financial institution could not possibly survive a RICO indictment, immediately began plea bargain talks. However, talks collapsed on December 19, when Giuliani made several demands that went beyond even what those who believed an indictment would destroy the firm were willing to accept. For example, Giuliani demanded that Milken leave the firm if indicted.<ref name="April Fools"/> | |||

| Only a day later, however, Drexel lawyers discovered suspicious activity in one of the limited partnerships Milken set up to allow members of his department to make their own investments. That entity, ], had acquired several ] for the stock of ] in 1985. At the time, ] was in the midst of a ] of Storer, and Drexel was lead underwriter for the bonds being issued. One of Drexel's other clients bought several Storer warrants and sold them back to the high-yield bond department. The department in turn sold them to MacPherson. This partnership included Milken, other Drexel executives, and a few Drexel customers. However, it also included several managers of ]s who had worked with Milken in the past. It appeared that the money managers bought the warrants for themselves and didn't offer the same opportunity to the funds they managed.<ref name="April Fools"/> Some of Milken's children also got warrants, according to Stewart, raising the appearance of Milken self-dealing. | |||

| Only a day later, Drexel lawyers discovered suspicious activity in one of the limited partnerships Milken set up to allow members of his department to make their own investments. That entity, MacPherson Partners, had acquired several ] for the stock of ] in 1985. At the time, ] was in the midst of a ] of Storer, and Drexel was lead ] for the bonds being issued. One of Drexel's other clients bought several Storer warrants and sold them back to the high-yield bond department. The department in turn sold them to MacPherson. This partnership included Milken, other Drexel executives, and a few Drexel customers. It also included several managers of ]s who had worked with Milken in the past. It appeared that the ]s bought the warrants for themselves and did not offer the same opportunity to the funds they managed.<ref name="April Fools"/> Some of Milken's children also received warrants, according to Stewart, raising the appearance of Milken self-dealing.<ref name="denofthieves"/> | |||

| However, the warrants to money managers were especially problematic. At the very least, Milken's actions were a serious breach of Drexel's internal regulations, and the money managers had breached their ] duty to their clients. At worst, the warrants could have been construed as ] to the money managers to influence decisions they made for their funds (and indeed, several money managers were eventually convicted on bribery charges). The discovery of MacPherson Partners—whose very existence had not been known to the public at the time—seriously eroded Milken's credibility with the board. On December 21, 1988, Drexel pleaded '']'' to six counts of stock parking and stock manipulation, and agreed that Milken had to leave the firm if indicted.<ref name="HC"/><ref name="April Fools"/> | |||

| The warrants to money managers were especially problematic. At the very least, Milken's actions were a serious breach of Drexel's internal regulations, and the money managers had breached their ] to their clients. At worst, the warrants could have been construed as ] to the money managers, to influence decisions they made for their funds.<ref name="denofthieves"/> | |||

| Indeed, several money managers were eventually convicted on bribery charges.<ref>{{cite news|url=https://www.nytimes.com/1992/07/29/business/company-news-fund-manager-convicted-of-taking-milken-bribes.html|title=Fund Manager Convicted of Taking Milken Bribes|last=Sullivan|first=Ronald|work=The New York Times|date=July 29, 1992|access-date=February 11, 2017|archive-date=November 9, 2017|archive-url=https://web.archive.org/web/20171109154049/http://www.nytimes.com/1992/07/29/business/company-news-fund-manager-convicted-of-taking-milken-bribes.html|url-status=live}}</ref> The discovery of MacPherson Partners—whose existence had not been known to the public at the time—seriously eroded Milken's credibility with the board. On December 21, 1988, Drexel entered an ] to six counts of stock parking and stock manipulation. It allowed Drexel to maintain its innocence while conceding that it "was not in a position to dispute" the allegations made by the government. As part of the deal, Drexel agreed that Milken had to leave the firm if indicted.<ref name="HC"/><ref name="April Fools"/> | |||

| ===Indictment and sentencing=== | ===Indictment and sentencing=== | ||

| ] | |||

| In March 1989, a federal grand jury indicted Milken on 98 counts of ] and fraud. The indictment accused Milken of a litany of misconduct, including insider trading, stock parking (concealing the real owner of a stock), ] and numerous instances of repayment of illicit profits. The most intriguing charge was that Boesky paid Drexel $5.3 million in 1986 for Milken's share of profits from illegal trading. This payment was represented as a consulting fee to Drexel. Shortly afterward, Milken resigned from Drexel and formed his own firm, International Capital Access Group.<ref name="HC"/><ref name="April Fools"/> | |||

| In March 1989, a ] indicted Milken on 98 counts of ] and fraud. The indictment accused Milken of a long list of misconduct, including insider trading, stock parking (concealing the real owner of a stock), ], and numerous instances of repayment of illicit profits.{{clarify|date=May 2021}} One charge was that Boesky paid Drexel $5.3 million in 1986 for Milken's share of profits from illegal trading. This payment was represented as a consulting fee to Drexel. Shortly afterward, Milken resigned from Drexel and formed his own firm, International Capital Access Group.<ref name="HC"/><ref name="April Fools"/> | |||

| Milken's protege ] had worked as a ] salesman for Milken, managing an account with which Drexel had an illegal arrangement that included insider trading and phony tax losses.<ref>{{Cite web|url=https://www.tampabay.com/archive/1990/10/20/dow-up-again/|title=Dow Up Again|website=Tampa Bay Times|date= October 20, 1990}}</ref><ref>{{cite web | url=https://books.google.com/books?id=z-gCAAAAMBAJ&dq=Terren+Peizer&pg=PA45 | title=New York Magazine | date=September 16, 1991 }}</ref><ref>{{Cite book|url=https://books.google.com/books?id=a9_Z413-J1IC&dq=Terren+Peizer+%22first+boston%22&pg=PA258|title=Den of Thieves|first=James B.|last=Stewart|date=2012|publisher=Simon and Schuster|isbn=9781439126202}}</ref><ref>{{Cite web|url=https://www.nytimes.com/1990/11/28/business/witness-against-milken-settles-sec-charges.html|title=Witness Against Milken Settles S.E.C. Charges|first=Kurt|last=Eichenwald|date=November 28, 1990|work=The New York Times}}</ref><ref>{{cite book |last=Kornbluth|first=Jesse|title=Highly confident: The Crime and Punishment of Michael Milken|page=213|year=1992|publisher=]}}</ref><ref>{{cite book|url=https://books.google.com/books?id=2xclCwAAQBAJ&q=dancing%20at%20the%20predator's%20ball%20peizer&pg=PA143|title=Hit & Run: How Jon Peters and Peter Guber Took Sony for a Ride in Hollywood|isbn=9781439128046|last1=Griffin|first1=Nancy|last2=Masters|first2=Kim|date= 2016|publisher=Simon and Schuster }}</ref> Peizer provided material evidence to prosecutors against Milken.<ref>, ''US v. Boesky'', United States District Court for the Southern District of New York, April 13, 1989.</ref> At Milken's pre-sentencing hearing for ] in 1990, Peizer testified against Milken in exchange for ] from both ] and ] sanctions.<ref name="NYT4thImmunity">{{Cite news |last=Labaton |first=Stephen |date=December 10, 1988 |title=4th Drexel Employee in Immunity Bargain |language=en-US |work=The New York Times |url=https://www.nytimes.com/1988/12/10/business/4th-drexel-employee-in-immunity-bargain.html |access-date=November 25, 2020 |issn=0362-4331}}</ref><ref>{{Cite book|url=https://books.google.com/books?id=gm5QDwAAQBAJ&dq=%22milken%22+%22peizer%22&pg=PA11|title=Banking on Fraud: Drexel, Junk Bonds, and Buyouts|first=Mary|last=Zey|date=September 29, 2017|publisher=Routledge|isbn=9781351314831}}</ref><ref name="auto3">David A. Vise (September 12, 1989). , ''The Washington Post''.</ref> | |||

| This was one of the first times RICO was used against an individual with no ties to ]. Milken originally planned to fight the charges against him, even though he risked spending the rest of his life in prison if convicted. He hired one of ]'s former campaign aides, Linda Goodson Robinson (the wife of ] president ]) to launch a public relations campaign prior to the trial. Milken and other Drexel figures hired ] as their attorney. Williams was well known for representing ] figures as well as major Mafia figures including ]. After Williams died of cancer, Milken's handlers hired various other attorneys and his case became more difficult. | |||

| On April 24, 1990, Milken pleaded guilty to six counts of securities and tax violations.<ref name=" |

On April 24, 1990, Milken pleaded guilty to six counts of securities and tax violations.<ref name="forbes-p" /> Three of them involved dealings with Boesky to conceal the real owner of a stock:<ref name="ThreeFelonies" /> | ||

| *Aiding and abetting another person's failure to file an accurate ] with the SEC, since the schedule was not amended to reflect an understanding that any loss would be made up |

*Aiding and abetting another person's failure to file an accurate ] with the SEC, since the schedule was not amended to reflect an understanding that any loss would be made up | ||

| *Sending confirmation slips through the mail that failed to disclose that a commission was included in the price |

*Sending ] slips through the mail that failed to disclose that a commission was included in the price | ||

| *Aiding and abetting another in filing inaccurate broker-dealer reports with the SEC |

*Aiding and abetting another in filing inaccurate ] reports with the SEC | ||

| Two other counts were related to tax evasion in transactions Milken carried out for a client of the firm, David Solomon, a fund manager |

Two other counts were related to tax evasion in transactions Milken carried out for a client of the firm, David Solomon, a fund manager:<ref name="ThreeFelonies" /> | ||

| *Selling stock without disclosure of an understanding that the purchaser would not lose money |

*Selling stock without disclosure of an understanding that the purchaser would not lose money | ||

| *Agreeing to sell securities to a customer and to buy those securities back at a real loss to the customer, but with an understanding that he would try to find a future profitable transaction to make up for any losses |

*Agreeing to sell securities to a customer and to buy those securities back at a real loss to the customer, but with an understanding that he would try to find a future profitable transaction to make up for any losses | ||

| The last count was for conspiracy to commit these five violations. | The last count was for conspiracy to commit these five violations. | ||

| As part of his plea, Milken agreed to pay $200 million in fines. At the same time, he agreed to a settlement with the SEC in which he paid $400 million to investors who had been hurt by his actions. He also accepted a lifetime ban from any involvement in the securities industry. In a related civil lawsuit against Drexel, he agreed to pay $500 million to Drexel's investors.<ref name="NYT-drexel-sues-milken">{{cite news |newspaper=The New York Times |date=September 12, 1991 |url=https://www.nytimes.com/1991/09/12/business/drexel-sues-milken-seeking-repayment.html |title=Drexel Sues Milken, Seeking Repayment |access-date=February 11, 2017 |archive-date=February 4, 2017 |archive-url=https://web.archive.org/web/20170204192423/http://www.nytimes.com/1991/09/12/business/drexel-sues-milken-seeking-repayment.html |url-status=live }}</ref><ref name="NYT-milken-to-pay">{{cite news |newspaper=The New York Times |date=February 18, 1992 |url=https://www.nytimes.com/1992/02/18/us/milken-to-pay-500-million-more-in-1.3-billion-drexel-settlement.html |title=Milken to Pay $500 Million More In $1.3 Billion Drexel Settlement |access-date=February 11, 2017 |archive-date=February 4, 2017 |archive-url=https://web.archive.org/web/20170204192358/http://www.nytimes.com/1992/02/18/us/milken-to-pay-500-million-more-in-1.3-billion-drexel-settlement.html |url-status=live }}</ref> | |||

| The estimated injury for all counts combined was, by the judge's account, $318,000 and by the U.S. Probation Office's account $685,000.<ref name="MoscowPullmanInjuryEstimation">Moscow-Pullman Daily News, Feb 20, 1991. </ref> | |||

| Critics of the government charge that the government indicted Milken's brother ] to pressure Milken to settle, a tactic some legal scholars condemn as unethical. "I am troubled by – and other scholars are troubled by – the notion of putting relatives on the bargaining table," said Vivian Berger, a professor at ], in a 1990 interview with '']''.<ref>{{cite news |work=The New York Times |date=May 6, 1990 |url=https://www.nytimes.com/1990/05/06/weekinreview/tactics-in-wall-street-cases-troubling-some-lawyers.html |title=Tactics in Wall Street Cases Troubling Some Lawyers |access-date=February 11, 2017 |archive-date=February 4, 2017 |archive-url=https://web.archive.org/web/20170204192443/http://www.nytimes.com/1990/05/06/weekinreview/tactics-in-wall-street-cases-troubling-some-lawyers.html |url-status=live }}</ref> As part of the deal, the case against Lowell was dropped. Federal investigators also questioned some of Milken's relatives about their investments.<ref name="HC"/> | |||

| As part of his plea, Milken agreed to pay $200 million in fines. At the same time, he agreed to a settlement with the SEC in which he paid $400 million to investors who had been hurt by his actions. He also accepted a lifetime ban from any involvement in the securities industry. In a related civil lawsuit against Drexel he agreed to pay $500 million to Drexel's investors.<ref name="NYT-drexel-sues-milken">New York Times, 1991-09-12, </ref><ref name="NYT-milken-to-pay">New York Times, 1992-02-18. </ref> In total this means that he paid $1.1 billion for all lawsuits related to his actions while working at Drexel. | |||

| Critics of the government charge that the government indicted Milken's brother Lowell in order to put pressure on Milken to settle, a tactic condemned as unethical by some legal scholars. "I am troubled by - and other scholars are troubled by - the notion of putting relatives on the bargaining table," said Vivian Berger, a professor at Columbia University Law School, in a 1990 interview with the ''New York Times''.<ref>New York Times, May 6, 1990. </ref> As part of the deal, the case against Lowell was dropped. Federal investigators also questioned some of Milken's relatives—including his aging grandfather—about their investments.<ref name="HC"/> | |||

| At Milken's sentencing, Judge ] told him: | At Milken's sentencing, Judge ] told him: | ||

| {{ |

{{blockquote|You were willing to commit only crimes that were unlikely to be detected.{{nbsp}}... When a man of your power in the financial world{{nbsp}}... repeatedly conspires to violate, and violates, securities and tax business in order to achieve more power and wealth for himself{{nbsp}}... a significant prison term is required.<ref name="denofthieves">{{cite book|title=Den of Thieves|page=517|author=Stewart, James B.|year=1992|isbn=0-671-79227-X|edition=reprint|publisher=Simon & Schuster|url=https://books.google.com/books?id=xNHIpVJgcHgC&q=%22When+a+man+of+your+power+in+the+financial+world.%22&pg=PA517|access-date=April 22, 2016|archive-date=May 14, 2016|archive-url=https://web.archive.org/web/20160514213736/https://books.google.com/books?id=xNHIpVJgcHgC&pg=PA517&lpg=PA517&dq=%22When+a+man+of+your+power+in+the+financial+world.%22#v=onepage&q=%22When%20a%20man%20of%20your%20power%20in%20the%20financial%20world.%22&f=false|url-status=live}}</ref>}} | ||

| title=Den of Thieves | | |||

| page=517 | | |||

| author=Stewart, James B | | |||

| year=1992 | | |||

| isbn=0-671-79227-X | | |||

| edition=reprint | | |||

| publisher=Simon and Schuster | | |||

| url = http://books.google.com/books?id=xNHIpVJgcHgC&pg=PA517&lpg=PA517&dq=%22When+a+man+of+your+power+in+the+financial+world.%22#v=onepage&q=%22When%20a%20man%20of%20your%20power%20in%20the%20financial%20world.%22&f=false}}</ref>}} | |||

| Milken's sentence was later reduced to two years from ten; he served 22 months.<ref name="Case Studies in Business Ethics"> |

In statements to a ] in 1991, Judge Wood estimated that the "total loss from Milken's crimes" was $318,000, less than the government's estimate of $4.7 million, and she recommended that he be eligible for parole in three years.<ref>{{cite news|title=Judge Who Gave Milken 10 Years Wants Him Eligible for Parole in 3|last=Eichenwald|first=Kurt|newspaper=The New York Times|date=February 20, 1991|url=https://www.nytimes.com/1991/02/20/business/judge-who-gave-milken-10-years-wants-him-eligible-for-parole-in-3.html?pagewanted=all|access-date=February 11, 2017|archive-date=May 8, 2016|archive-url=https://web.archive.org/web/20160508033759/http://www.nytimes.com/1991/02/20/business/judge-who-gave-milken-10-years-wants-him-eligible-for-parole-in-3.html?pagewanted=all|url-status=live}}</ref> Milken's sentence was later reduced to two years from ten; he served 22 months.<ref name="Case Studies in Business Ethics">Al Gini & Alexei M. Marcoux {{Webarchive|url=https://web.archive.org/web/20160328222258/https://books.google.com/books?id=pU9EAAAAYAAJ&q=%22Michael+Milken%22+released&dq=%22Michael+Milken%22+released&hl=en |date=March 28, 2016 }}; accessed April 24, 2018.</ref><ref> {{Webarchive|url=https://web.archive.org/web/20121019173049/http://www.economist.com/node/17306419 |date=October 19, 2012 }}, economist.com, October 21, 2010.</ref> | ||

| ===2013 SEC investigation=== | |||

| ==Philanthropic activities== | |||

| {{Refimprove section|date=January 2011}} | |||

| In 1982, Milken and his brother Lowell founded the ] to support medical research and education. Through the Milken Educator Awards (founded in 1985), the MFF has awarded a total of more than $60 million to more than 2,500 teachers. Among the other initiatives of the Milken Family Foundation are the: | |||

| * ], a non-profit, non-partisan economic think tank whose scholars publish research papers and conduct conferences on global and regional economies, human capital, demographics and capital markets. Each spring, the Institute hosts a Global Conference in Los Angeles; | |||

| * Milken Scholars, a program that provides outstanding high school graduates with a commitment of four years of college financial assistance, counseling, volunteer opportunities and preparation for graduate studies; | |||

| * TAP: The System for Teacher and Student Advancement, a comprehensive research-based strategy to attract, develop, motivate and retain high-quality teachers for America's schools; | |||

| * Mike's Math Club, a curriculum enrichment program that shows students in inner-city elementary schools that math is not only useful, but entertaining; | |||

| * Festival for Youth, a school-based community service program that engages students in yearlong service projects to help build vibrant communities; and the | |||

| * Milken Family Foundation Epilepsy Research Awards Program, which funds research to understand and conquer epilepsy. | |||

| In February 2013, the SEC announced that they were investigating whether Milken violated his lifetime ban from the securities industry. The investigation concerned Milken's allegedly providing investment advice through ].<ref>{{cite news|url=https://www.latimes.com/business/money/la-fi-mo-michael-milken-sec-guggenheim-partners-20130227,0,326262.story|title=SEC is investigating Michael Milken, magazine says|newspaper=Los Angeles Times|access-date=March 26, 2013|archive-date=March 5, 2013|archive-url=https://web.archive.org/web/20130305095917/http://www.latimes.com/business/money/la-fi-mo-michael-milken-sec-guggenheim-partners-20130227,0,326262.story|url-status=live}}</ref> Since 2011, the SEC had been investigating Guggenheim's relationship with Milken.<ref>{{cite news|url=https://www.latimes.com/sports/dodgersnow/la-sp-dn-sec-investigation-20130227,0,4840625.story|title=Dodgers' Guggenheim subject of SEC probe over Michael Milken ties|newspaper=Los Angeles Times|access-date=March 26, 2013|archive-date=March 16, 2013|archive-url=https://web.archive.org/web/20130316153851/http://www.latimes.com/sports/dodgersnow/la-sp-dn-sec-investigation-20130227,0,4840625.story|url-status=live}}</ref> | |||

| Upon his release from prison in 1993, Milken founded the ] for ] research. Milken himself was diagnosed with advanced prostate cancer in the same month he was released.<ref name=PhilMag>{{cite news|last=Barbic|first=Kari|title=The Accelerator|url=http://www.philanthropyroundtable.org/topic/excellence_in_philanthropy/the_accelerator|accessdate=27 September 2012|newspaper=Philanthropy|date=Summer 2012}}</ref> His cancer is currently in remission. The Prostate Cancer Foundation works closely with ] through its Home Run Challenge program to promote awareness of prostate cancer and raise money for medical research. Each season in the weeks leading up to ], Milken visits many ballparks and appears on TV and radio broadcasts during the games. | |||

| ===Presidential pardon=== | |||

| In 2003, Milken launched a Washington, D.C.-based ] called ], which seeks greater efficiency in researching all serious diseases. A key initiative of FasterCures is ], which is advancing life sciences research in areas as diverse as autism, psoriasis and breast cancer.<ref name=PhilMag /> | |||

| ] | |||

| In June 2018, it was reported that some of president ]'s supporters and friends, including ], ], ], ], and ], the onetime federal prosecutor whose criminal investigation led to Milken's conviction, were urging the president to pardon Milken.<ref>{{Cite web|last=Mangan|first=Dan|date=February 18, 2020|title=Trump pardons Michael Milken, face of 1980s insider trading scandals|url=https://www.cnbc.com/2020/02/18/trump-pardons-michael-milken-face-of-1980s-financial-scandals.html|access-date=November 29, 2021|website=CNBC|language=en}}</ref> Milken's attempts to secure a presidential pardon spanned multiple administrations.<ref>{{Cite news |first1=Greg |last1=Farrell |first2=Katherine |last2=Burton |first3=John |last3=Gittelsohn |url=https://www.bloomberg.com/news/articles/2018-06-15/trump-insiders-are-said-to-seek-pardon-for-milken-king-of-junk |title=Trump Insiders Seek Pardon for 'Junk Bond King' Michael Milken |work=] |date=June 15, 2018 |access-date=June 18, 2018 |language=en |archive-date=June 15, 2018 |archive-url=https://web.archive.org/web/20180615175217/https://www.bloomberg.com/news/articles/2018-06-15/trump-insiders-are-said-to-seek-pardon-for-milken-king-of-junk |url-status=live }}</ref> | |||

| On February 18, 2020, Trump granted a full pardon to Milken.<ref>{{cite news |url=https://www.washingtonpost.com/politics/trump-grants-clemency-to-former-nypd-commissioner-bernie-kerik-financier-michael-milken/2020/02/18/566e9f78-5280-11ea-80ce-37a8d4266c09_story.html |title=Trump grants clemency to former NYPD commissioner Bernie Kerik, financier Michael Milken |date=February 18, 2020 |access-date=February 18, 2020 |newspaper=The Washington Post |agency=] |archive-date=February 20, 2020 |archive-url=https://web.archive.org/web/20200220094926/https://www.washingtonpost.com/politics/trump-grants-clemency-to-former-nypd-commissioner-bernie-kerik-financier-michael-milken/2020/02/18/566e9f78-5280-11ea-80ce-37a8d4266c09_story.html |url-status= }}</ref><ref>{{cite news |last1=Baker |first1=Peter |last2=Haberman |first2=Maggie |last3=Shear |first3=Michael D. |title=Trump Commutes Corruption Sentence of Governor Rod Blagojevich of Illinois |url=https://www.nytimes.com/2020/02/18/us/politics/trump-pardon-blagojevich-debartolo.html |access-date=February 18, 2020 |newspaper=The New York Times |date=February 18, 2020 |archive-date=February 18, 2020 |archive-url=https://web.archive.org/web/20200218184524/https://www.nytimes.com/2020/02/18/us/politics/trump-pardon-blagojevich-debartolo.html |url-status=live }}</ref> However, his previous trading license which he lost following his conviction still remained void, and he would still have to reapply and obtain a new trading license in order to return to trading securities.<ref>{{cite news|url=https://www.foxbusiness.com/business-leaders/junk-bond-king-could-go-back-to-wall-street-after-presidential-pardon|title=Milken, 'Junk Bond King,' could return to Wall St. after Trump pardon|website=Fox Business|date=February 18, 2020|access-date=February 19, 2020|archive-date=February 19, 2020|archive-url=https://web.archive.org/web/20200219145010/https://www.foxbusiness.com/business-leaders/junk-bond-king-could-go-back-to-wall-street-after-presidential-pardon|url-status=live}}</ref> | |||

| The Melanoma Research Alliance (MRA) was launched in 2007 to support innovative translational studies that advance the diagnosis, staging and treatment of ], a skin cancer. | |||

| ==Philanthropy== | |||

| Fortune magazine called Milken "The Man Who Changed Medicine" in a 2004 cover story on his philanthropy.<ref name='Fortune2004'/> | |||

| ] CEO ], 2019.]] | |||

| According to ''Forbes'', Milken has given away between 5–10% of his fortune, earning a philanthropy score of 3 out of 5.<ref name=ForbesPhilanthropy>Profile, , Forbes as of October 21, 2022</ref> Upon his release from prison in 1993, Milken founded the Prostate Cancer Foundation for ] research, which by 2010 was "the largest philanthropic source of funds for research into prostate cancer".<ref>{{cite news|last=Landro|first=Laura|title=Melanoma Survivor Seeks Cure|url=https://www.wsj.com/articles/SB10001424052748703969204575220160013541330?mod=googlewsj|newspaper=Wall Street Journal|date=May 3, 2010|access-date=August 8, 2017|archive-date=April 25, 2018|archive-url=https://web.archive.org/web/20180425115426/https://www.wsj.com/articles/SB10001424052748703969204575220160013541330?mod=googlewsj|url-status=live}}</ref> Milken himself was diagnosed with advanced prostate cancer in the same month he was released.<ref name=PhilMag>{{cite news|last=Barbic|first=Kari|title=The Accelerator|url=http://www.philanthropyroundtable.org/topic/excellence_in_philanthropy/the_accelerator|access-date=September 27, 2012|newspaper=Philanthropy|date=Summer 2012|archive-date=August 13, 2012|archive-url=https://web.archive.org/web/20120813084626/http://www.philanthropyroundtable.org/topic/excellence_in_philanthropy/the_accelerator|url-status=live}}</ref> His cancer is currently in remission. The Prostate Cancer Foundation works closely with ] through its Home Run Challenge program to promote awareness of prostate cancer and raise money for medical research. Each season in the weeks leading up to Father's Day, Milken visits many ballparks and appears on TV and radio broadcasts during the games. | |||

| In 2003, Milken launched a Washington, D.C.-based ] called ], which seeks greater efficiency in researching all serious diseases. Initiatives of FasterCures include TRAIN, Partnering for Cures, and the Philanthropy Advisory Service.<ref name=PhilMag /> | |||

| On March 11, 2014, President ] of ] in Washington, D.C. announced the university was renaming its public health school after Milken as a result of a total of $80 million in gifts, $50 million from the Milken Institute and the Milken Family Foundation and $30 million gift from ] chairman ]. The gifts were designated for research and scholarship on public health issues.<ref>{{cite news|url=https://www.washingtonpost.com/local/education/gwu-to-receive-80-million-for-public-health-donors-are-milken-and-redstone/2014/03/10/1cd9289c-a88a-11e3-8d62-419db477a0e6_story.html|title=GWU to receive $80 million for public health; donors are Milken and Redstone|author=Nick Anderson|newspaper=]|date=March 10, 2014|access-date=September 4, 2017|archive-date=October 28, 2014|archive-url=https://web.archive.org/web/20141028033634/http://www.washingtonpost.com/local/education/gwu-to-receive-80-million-for-public-health-donors-are-milken-and-redstone/2014/03/10/1cd9289c-a88a-11e3-8d62-419db477a0e6_story.html|url-status=live}}</ref> | |||

| ==In popular culture== | |||

| Milken became the ] of the ] Economics Prize in 1991.<ref>{{cite news |last1=Maugh |first1=Thomas |title=Ig Nobel Prizes Go to Those Likely to Be Overlooked : Lampoon: MIT researchers create the new series of awards, named after the 'inventor of soda pop.' Among the first winners are Vice President Dan Quayle and imprisoned junk-bond king Michael Milken. |url=https://www.latimes.com/archives/la-xpm-1991-10-05-mn-3178-story.html |newspaper=] |access-date=January 21, 2018 |date=October 5, 1991 |archive-date=September 20, 2015 |archive-url=https://web.archive.org/web/20150920174502/http://articles.latimes.com/1991-10-05/news/mn-3178_1_ig-nobel |url-status=live }}</ref><ref>{{cite web|title=Winners of the Ig® Nobel Prize|url=https://www.improbable.com/ig/winners/#ig1991|website=Improbable.com|date=August 2006 |access-date=January 21, 2018|archive-url=https://web.archive.org/web/20100109104410/http://improbable.com/ig/winners/#ig1991|archive-date=January 9, 2010|url-status=}}</ref><ref>{{cite web|title="Junk" — a new play about the first Ig Nobel Economics Prize winner (Michael Milken)|url=https://www.improbable.com/2017/11/23/junk-a-new-play-about-the-first-ig-nobel-economics-prize-winner-michael-milken|website=Improbable.com|date=November 24, 2017|access-date=January 21, 2018|archive-date=January 21, 2018|archive-url=https://web.archive.org/web/20180121184444/https://www.improbable.com/2017/11/23/junk-a-new-play-about-the-first-ig-nobel-economics-prize-winner-michael-milken/|url-status=live}}</ref> | |||

| ] 2016 play '']'', set during the bond trading scandals of the 1980s, is partly based on Milken's "fall from grace". Milken is the inspiration for the main character in the play.<ref>{{Cite news|title=Review: 'Junk' Revives a Go-Go Era of Debt and Duplicity|last=Brantley|first=Ben|date=November 2, 2017|newspaper=The New York Times|url=https://www.nytimes.com/2017/11/02/theater/junk-review-ayad-akhtar.html?action=click&contentCollection=Style&module=RelatedCoverage®ion=EndOfArticle&pgtype=article|access-date=April 24, 2018|archive-date=June 14, 2018|archive-url=https://web.archive.org/web/20180614073749/https://www.nytimes.com/2017/11/02/theater/junk-review-ayad-akhtar.html?action=click&contentCollection=Style&module=RelatedCoverage®ion=EndOfArticle&pgtype=article|url-status=live}}</ref> | |||

| Milken is referenced by Hank Scorpio in '']'' episode “You Only Move Twice”. | |||

| Milken is referenced by Chris Stevens in '']'' Season 6, Ep. 5 – The Robe (31:29). “Trust and honesty. The age-old quest of ] in a post-Milken universe.” | |||

| ==Personal life== | ==Personal life== | ||

| Milken is married to Lori Milken who he has known since grade school. They have three children.<ref> Sep 24, 1990</ref> | |||

| Milken is married to Lori Anne Hackel, whom he had dated in high school.<ref>{{cite news |url=https://www.nytimes.com/1990/11/22/business/the-milken-sentence-milken-pathfinder-for-the-junk-bond-era.html |title=THE MILKEN SENTENCE; Milken: Pathfinder for the 'Junk Bond' Era |newspaper=The New York Times |date=November 22, 1990 |access-date=February 11, 2017 |archive-date=February 4, 2017 |archive-url=https://web.archive.org/web/20170204192438/http://www.nytimes.com/1990/11/22/business/the-milken-sentence-milken-pathfinder-for-the-junk-bond-era.html |url-status=live }}</ref> The couple have three children.<ref>{{cite magazine |url=https://books.google.com/books?id=ZmeBLxJqbN8C&q=lori+milken&pg=PA40 |title=Judgment Day |magazine=New York Magazine |date=September 24, 1990 |via=Google Books |access-date=April 22, 2016 |archive-date=May 26, 2013 |archive-url=https://web.archive.org/web/20130526070609/http://books.google.com/books?id=ZmeBLxJqbN8C&pg=PA40&lpg=PA40&dq=lori+milken&source=bl&ots=2RnevEyYKV&sig=v7vgVPMOweP_x8NCnCX73LCaHh8&hl=en&sa=X&ei=Rr8RUb6bDtO00QHXsoGYDA&ved=0CGMQ6AEwCTgU#v=onepage&q=lori%20milken&f=false |url-status=live }}</ref> He reportedly follows a vegetarian-like diet rich in fruits and vegetables for its health benefits and has co-authored a vegan cookbook with Beth Ginsberg.<ref>{{Cite web |url=https://www.amazon.com/s?i=stripbooks&rh=p_27%3AMike+Milken&s=relevancerank&text=Mike+Milken&ref=dp_byline_sr_book_2 |title=Amazon author page for Michael Milken, showing 1998 and 1999 cookbooks, plus another 2008 book |website=Amazon |access-date=February 25, 2020 |archive-date=October 27, 2020 |archive-url=https://web.archive.org/web/20201027145641/https://www.amazon.com/s?i=stripbooks&rh=p_27%3AMike+Milken&s=relevancerank&text=Mike+Milken&ref=dp_byline_sr_book_2 |url-status=live }}</ref><ref>{{Cite web |url=https://www.lifeextension.com/magazine/2012/7/wellness-profile |title=Roderick K. Michael Milken Seeking Faster Cures to Prostate Cancer and More. Life Extension Magazine. July 2012 |access-date=February 25, 2020 |archive-date=February 25, 2020 |archive-url=https://web.archive.org/web/20200225040053/https://www.lifeextension.com/magazine/2012/7/wellness-profile |url-status=live }}</ref> | |||

| ==Notes and references== | |||

| {{Reflist|2}} | |||

| == |

==See also== | ||

| * ] | |||

| * ] - '']: the inside story of Drexel Burnham and the rise of the junk bond raiders'', New York: American Lawyer/], 1988, Penguin paperback (updated), 1989. | |||

| * ] | |||

| * Fenton Bailey - "Fall From Grace: The Untold Story of Michael Milken", Carol Publishing Corporation (October 1992), ISBN 1-55972-135-9. | |||

| * ] - '']'', New York: Simon & Schuster, 1991, (ISBN 0-671-63802-5). | |||

| ==References== | |||

| * ] - ''A License to Steal: the Untold Story of Michael Milken and the Conspiracy to Bilk the Nation'', ], 1992 | |||

| ;Notes | |||

| * Daniel R. Fischel - ''Payback: the conspiracy to destroy Michael Milken and his financial revolution'', ]: HarperBusiness, 1995, (ISBN 0-88730-757-4). '' | |||

| {{Reflist|30em}} | |||

| * ] - ''Dangerous Dreamers: The Financial Innovators from Charles Merrill to Michael Milken''' (1993), (ISBN 0-471-57734-0). | |||

| ;Further reading | |||

| * ] - '']: the inside story of Drexel Burnham and the rise of the junk bond raiders'', New York: American Lawyer/], 1988, Penguin paperback (updated), 1989. | |||

| * Fenton Bailey - "Fall From Grace: The Untold Story of Michael Milken", Carol Publishing Corporation (October 1992), {{ISBN|1-55972-135-9}}. | |||

| * ] - '']'', New York: Simon & Schuster, 1991, ({{ISBN|0-671-63802-5}}). | |||

| * ] - ''A License to Steal: the Untold Story of Michael Milken and the Conspiracy to Bilk the Nation'', ], 1992 | |||

| * Daniel R. Fischel - ''Payback: the conspiracy to destroy Michael Milken and his financial revolution'', New York: HarperBusiness, 1995, ({{ISBN|0-88730-757-4}}). | |||

| * ] - ''Dangerous Dreamers: The Financial Innovators from Charles Merrill to Michael Milken''' (1993), ({{ISBN|0-471-57734-0}}). | |||

| *{{cite book | title=]: Rising through the Wreckage on Wall Street | publisher=] | location=New York | year=1989 | isbn=0-393-02750-3 | author=Michael Lewis.}} | *{{cite book | title=]: Rising through the Wreckage on Wall Street | publisher=] | location=New York | year=1989 | isbn=0-393-02750-3 | author=Michael Lewis.}} | ||

| ==External links== | ==External links== | ||

| {{commons-inline}} | |||

| *{{C-SPAN|michaelmilken}} | |||

| * , by ], Beard Books, 2003. Retrieved March 10, 2019. {{ISBN|978-1587982170}} | |||

| *{{NYTtopic|people/m/michael_r_milken}} | |||

| * {{C-SPAN}} | |||

| * {{New York Times topic|new_id=person/michael-r-milken|name=Michael R. Milken}} | |||

| {{Portal bar|California|Education|New York (state)|New York City|United States}} | |||

| {{Private equity investors}} | |||

| {{Authority control}} | |||

| {{Persondata <!-- Metadata: see ]. --> | |||

| | NAME =Milken, Michael | |||

| | ALTERNATIVE NAMES = | |||

| | SHORT DESCRIPTION = | |||

| | DATE OF BIRTH =July 4, 1946 | |||

| | PLACE OF BIRTH =], ] | |||

| | DATE OF DEATH = | |||

| | PLACE OF DEATH = | |||

| }} | |||

| {{DEFAULTSORT:Milken, Michael}} | {{DEFAULTSORT:Milken, Michael}} | ||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | ] | ||

| ] | |||

| ] | ] | ||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | ] | ||

| ] | ] | ||

| ] | ] | ||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

| ] | |||

Latest revision as of 10:00, 3 December 2024

American financier (born 1946)

| Michael Milken | |

|---|---|

Milken in 2014 Milken in 2014 | |

| Born | Michael Robert Milken (1946-07-04) July 4, 1946 (age 78) Encino, California, U.S. |

| Education | University of California, Berkeley (BS) University of Pennsylvania (MBA) |

| Occupation(s) | Businessman, financier |

| Known for | Developing the High-yield bond market, Indictment for securities fraud |

| Criminal charges | Securities and reporting violations (1989) |

| Criminal penalty | Served 22 months in prison $600 million fine |

| Criminal status | Released Pardoned (February 18, 2020) |

| Spouse |

Lori Hackel (m. 1968) |

| Children | 3 |

| Relatives | Lowell Milken (brother) |

| Website | www |

Michael Robert Milken (born July 4, 1946) is an American financier. He is known for his role in the development of the market for high-yield bonds ("junk bonds"), and his conviction and sentence following a guilty plea on felony charges for violating U.S. securities laws. Milken's compensation while head of the high-yield bond department at Drexel Burnham Lambert in the late 1980s exceeded $1 billion over a four-year period, a record for U.S. income at that time. With a net worth of US$6 billion as of 2022, he is among the richest people in the world.

Milken was indicted for racketeering and securities fraud in 1989 in an insider trading investigation. In a plea bargain, he pleaded guilty to securities and reporting violations but not to racketeering or insider trading. Milken was sentenced to ten years in prison, fined $600 million (although his personal website claims $200 million) and permanently barred from the securities industry by the U.S. Securities and Exchange Commission. His sentence was later reduced to two years for cooperating with testimony against his former colleagues and for good behavior. Milken was pardoned by President Donald Trump on February 18, 2020.

Since his release from prison, he has become known for his charitable donations. He is co-founder of the Milken Family Foundation, chairman of the Milken Institute, and founder of medical philanthropies funding research into melanoma, cancer, and other life-threatening diseases. A prostate cancer survivor, Milken has devoted significant resources to research on the disease.

Early life and education

Milken was born into a middle-class Jewish family in Encino, California.

He graduated from Birmingham High School where he was the head cheerleader and worked while in school at a diner. His classmates included future Disney president Michael Ovitz and actresses Sally Field and Cindy Williams. In 1968, he graduated from the University of California, Berkeley with a B.S. with highest honors. He was elected to Phi Beta Kappa and was a member of the Sigma Alpha Mu fraternity. He received his MBA from the Wharton School of the University of Pennsylvania. While at Berkeley, Milken was influenced by credit studies authored by W. Braddock Hickman, a former president of the Federal Reserve Bank of Cleveland, who noted that a portfolio of non-investment grade bonds offered "risk-adjusted" returns greater than that of an investment-grade portfolio.

Career

Through his Wharton professors, Milken landed a summer job at Drexel Harriman Ripley, an old-line investment bank, in 1969. After completing his MBA, he joined Drexel (by then known as Drexel Firestone) as director of low-grade bond research. He was also given control of some capital and permitted to trade. Over the next 17 years, he had only four down months.

Drexel merged with Burnham and Company in 1973 to form Drexel Burnham. Despite the firm's name, Burnham was the nominal survivor; the Drexel name came first only at the insistence of the more powerful investment banks, whose blessing was necessary for the merged firm to inherit Drexel's position as a "major" firm.

Milken was one of the few prominent holdovers from the Drexel side of the merger, and he became the merged firm's head of convertibles. He persuaded his new boss, fellow Wharton alumnus Tubby Burnham, to let him start a high-yield bond trading department—an operation that soon earned a 100 percent return on investment. By 1976, Milken's income at the firm, which had become Drexel Burnham Lambert, was estimated at $5 million a year. In 1978, Milken moved the high-yield bond operation to Century City in Los Angeles.

High-yield bonds and leveraged buyouts

| History of private equity and venture capital |

|---|

|

| Early history |

| (origins of modern private equity) |

| The 1980s |

| (leveraged buyout boom) |

| The 1990s |

| (leveraged buyout and the venture capital bubble) |

| The 2000s |

| (dot-com bubble to the credit crunch) |

| The 2010s |

| (expansion) |

| The 2020s |

| (COVID-19 recession) |

By the mid-1980s, Milken's network of high-yield bond buyers (notably Fred Carr's Executive Life Insurance Company and Tom Spiegel's Columbia Savings & Loan) had reached a size that enabled him to raise large amounts of money quickly.