| Revision as of 09:42, 16 June 2006 edit62.171.194.5 (talk) →Against other major currencies← Previous edit | Latest revision as of 12:51, 12 January 2025 edit undoDasomm (talk | contribs)Extended confirmed users5,012 edits →EU members not using the euro | ||

| Line 1: | Line 1: | ||

| {{Short description|Currency of the European Union}} | |||

| :<span class="dablink">''For other uses, see ] or ].''</span> | |||

| {{hatnote group| | |||

| {{Life in the European Union}} | |||

| {{about|the currency}} | |||

| {{redirect|EUR}} | |||

| }} | |||

| {{Good article}} | |||

| {{Use British English|date=March 2013}} | |||

| {{Use dmy dates|date=March 2021}} | |||

| {{Infobox currency | |||

| | name = Euro | |||

| | local_name = <small>{{nobold|1=see also ]}}</small> | |||

| | image_1 = Euro banknotes, Europa series.png | |||

| | image_width_1 = 175px | |||

| | image_title_1 = ] | |||

| | image_2 = Reverso 1 euro.jpg | |||

| | image_width_2 = 125px | |||

| | image_title_2 = 1 euro coin | |||

| | iso_code = EUR | |||

| | subunit_name_1 = ] | |||

| | unit = euro | |||

| | plural = Varies, see ] | |||

| | symbol = ] | |||

| | symbol_subunit_1 = c | |||

| | nickname = The single currency{{efn|1=Official documents and legislation refer to the euro as "the single currency".<ref>{{cite web|url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:31997R1103:EN:HTML |title=Council Regulation (EC) No 1103/97 of 17 June 1997 on certain provisions relating to the introduction of the euro |access-date=1 April 2009 |date=19 June 1997 |work=Official Journal L 162, 19 June 1997 P. 0001 – 0003 |publisher=European Communities}}</ref>}} | |||

| | frequently_used_banknotes = ], ], ], ], ], ]<ref name="Circulation_report">{{cite web |url=http://sdw.ecb.europa.eu/reports.do?node=1000004111 |title=ECB Statistical Data Warehouse, Reports>ECB/Eurosystem policy>Banknotes and coins statistics>1.Euro banknotes>1.1 Quantities |publisher=European Central Bank}}</ref> | |||

| | rarely_used_banknotes = ]<ref name="Circulation_report"/> | |||

| | frequently_used_coins = ], ], ], ], ], ], ], ] | |||

| | rarely_used_coins = ], ] (Belgium, Finland, Ireland, Italy, Netherlands, Slovakia<ref>{{cite web|first1=Alistair|last1=Walsh|access-date=2019-11-04|title=Italy to stop producing 1- and 2-cent coins |url=https://www.dw.com/en/italy-to-stop-producing-1-and-2-cent-coins/a-39020206|date=29 May 2017|publisher=]}}</ref><ref>{{cite web|first1=|last1=|access-date=17 December 2023|title=Po 1. júli 2022 budú končiť na Slovensku jedno a dvojcentové mince |url=https://www.bystricoviny.sk/spravy/po-1-juli-2022-budu-koncit-na-slovensku-jedno-a-dvojcentove-mince/|date=29 May 2017|website=bystricoviny.sk|language=sk}}</ref>) | |||

| | subunit_ratio_1 = {{frac|100}} | |||

| | subunit_inline_note_1 = (]) | |||

| | plural_subunit_1 = (]) | |||

| | banknote_article = euro banknotes | |||

| | coin_article = euro coins | |||

| | using_countries = primary: ] (20),<br/>also: ] | |||

| | date_of_introduction = {{start date and age|1999|1|1|df=y}} | |||

| | replaced_currency = ] | |||

| | issuing_authority = ] | |||

| | issuing_authority_website = {{URL|https://www.ecb.europa.eu}} | |||

| | printer = see {{section link|Euro|Banknote printing|nopage=y}} | |||

| | mint = ] | |||

| | inflation_rate = 2.2% (November 2024)<ref>{{cite web | url=https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html | title=Inflation and consumer prices}}</ref> | |||

| | pegged_by = see {{section link||Pegged currencies}} | |||

| | inflation_source_date = | |||

| | inflation_method = ] | |||

| }} | |||

| ] | |||

| The '''euro''' (]: '''€'''; ]: '''EUR''') is the official ] of the ] and single currency for over 300 million ]s in the following twelve European Union member states: | |||

| {{legend|#0076BA|Euro Zone inflation year/year}} | |||

| ], ], ], ], ], ], ], ], ], the ], ] and ]; collectively also known as the ]. Due to bilateral agreements it is the official currency of the following non-member states: ], ], and ]. It is the ''de facto'' currency of ], ] and ]. | |||

| {{legend-line|#FFD932 solid 3px|M3 money supply increases}} | |||

| {{legend-line|#EE220C solid 3px|Marginal Lending Facility}} | |||

| {{legend-line|#970E53 solid 3px|Main Refinancing Operations}} | |||

| {{legend-line|#F27200 solid 3px|Deposit Facility Rate}} | |||

| {{legend-line|#FF95CA solid 3px|]}} | |||

| ]] | |||

| The '''euro''' (]: ''']'''; ]: '''EUR''') is the official ] of 20 of the {{EUnum}} ] of the ]. This group of states is officially known as the euro area or, more commonly, the ]. The euro is divided into 100 ].<ref name="EC Euro Area">{{cite web |url=http://ec.europa.eu/economy_finance/euro/index_en.htm |title=The euro |access-date=2 January 2019 |work=] website}}</ref><ref name="EC Euro1 euro cent coin Area 2">{{cite web |access-date=2019-01-02 |title=What is the euro area? |url=https://ec.europa.eu/info/business-economy-euro/euro-area/what-euro-area_en |website=European Commission website}}</ref> | |||

| The euro was introduced to world financial markets as an ] currency in 1999 and launched as physical ]s and ]s in 2002. All EU member states are eligible to join if they comply with certain monetary requirements, and eventual use of the euro is mandatory for all new EU members. The euro is to be introduced in ] on ], ], replacing the ]. | |||

| The currency is also used officially by the ], by ] that are not EU members,<ref name="EC Euro1 euro cent coin Area 2" /> the ] of ], as well as unilaterally by ] and ]. Outside Europe, a number of ] also use the euro as their currency. Additionally, over 200 million people worldwide use ]. | |||

| The euro is managed and administered by the ]-based ] (ECB) and the ] (ESCB) (composed of the ]s of its member states). As an independent ], the ECB has sole authority to set ]. The ESCB participates in the printing, minting and distribution of ] and ] in all member states, and the operation of the Eurozone payment systems. | |||

| The euro is the second-largest ] as well as the second-most traded currency in the world after the ].<ref>{{cite web|title=IMF Data – Currency Composition of Official Foreign Exchange Reserve – At a Glance|publisher=International Monetary Fund|url=http://data.imf.org/?sk=E6A5F467-C14B-4AA8-9F6D-5A09EC4E62A4|date=23 December 2022|access-date=11 January 2023}}</ref><ref>{{cite web |title=Foreign exchange turnover in April 2013: preliminary global results |url=http://www.bis.org/publ/rpfx13fx.pdf |publisher=Bank for International Settlements |access-date=7 February 2015}}</ref><ref>{{cite web|url=http://www.bis.org/publ/rpfxf07t.pdf |title=Triennial Central Bank Survey 2007 |publisher=BIS |date=19 December 2007 |access-date=25 July 2009}}</ref><ref>{{cite web |url=http://mpra.ub.uni-muenchen.de/14350/1/MPRA_paper_14350.pdf |last1=Aristovnik |first1=Aleksander |last2=Čeč |first2=Tanja |title=Compositional Analysis of Foreign Currency Reserves in the 1999–2007 Period. The Euro vs. The Dollar As Leading Reserve Currency|publisher=Munich Personal RePEc Archive, Paper No. 14350 |date=30 March 2010 |access-date=27 December 2010}}</ref><ref>{{cite news |last=Boesler |first=Matthew |title=There Are Only Two Real Threats to the US Dollar's Status As The International Reserve Currency |url=http://www.businessinsider.com/dollar-as-international-reserve-currency-2013-11 |access-date=8 December 2013 |newspaper=Business Insider |date=11 November 2013}}</ref> {{As of|2019|12|post=,}} with more than €1.3 trillion in circulation, the euro has one of the highest combined values of banknotes and coins in circulation in the world.<ref>{{cite web |url=http://sdw.ecb.europa.eu/reports.do?node=1000004112 |title=1.2 Euro banknotes, values |access-date=23 January 2020 |publisher=European Central Bank Statistical Data Warehouse|date=14 January 2020}}</ref><ref>{{cite web|url=http://sdw.ecb.europa.eu/reports.do?node=1000004114|title=2.2 Euro coins, values|access-date=23 January 2020 |publisher=European Central Bank Statistical Data Warehouse|date=14 January 2020}}</ref> | |||

| ==Characteristics of the euro== | |||

| ===Coins and banknotes=== | |||

| ] | |||

| ] | |||

| The name ''euro'' was officially adopted on 16 December 1995 in ].<ref name="madrid1995">{{cite web|url=http://www.europarl.europa.eu/summits/mad1_en.htm |title=Madrid European Council (12/95): Conclusions |publisher=European Parliament |access-date=14 February 2009}}</ref> The euro was introduced to world financial markets as an ] on 1 January 1999, replacing the former ] (ECU) at a ratio of 1:1 (US$1.1743 at the time). Physical euro coins and banknotes entered into circulation on 1 January 2002, making it the day-to-day operating currency of its original members, and by March 2002 it had completely replaced the former currencies.<ref>{{cite web| url = http://www.ecb.int/euro/changeover/2002/html/index.en.html| title = Initial changeover (2002)| publisher=European Central Bank| access-date =5 March 2011}}</ref> | |||

| :''Main articles: ], ]''. | |||

| Between December 1999 and December 2002, the euro traded below the US dollar, but has since traded near parity with or above the US dollar, peaking at US$1.60 on 18 July 2008 and since then returning near to its original issue rate. On 13 July 2022, the two currencies hit parity for the first time in nearly two decades due in part to the ].<ref name="NYTimes-2022">{{Cite news |date=2022-07-12 |title=Euro Falls Near Parity With Dollar, a Threshold Watched Closely by Investors |work=The New York Times |url=https://www.nytimes.com/2022/07/12/business/euro-dollar-parity.html |access-date=2022-07-13 |issn=0362-4331}}</ref> Then, in September 2022, the US dollar again had a face value higher than the Euro, at around US dollar 0.95 per euro.<ref>{{Cite news |date=2022-09-23 |title=Euro fällt zum US-Dollar auf 20-Jahrestief |url=https://www.spiegel.de/wirtschaft/euro-faellt-zum-us-dollar-auf-20-jahrestief-a-327dab06-b9ed-40bf-9b48-502c9dde1607 |access-date=2024-07-10 |work=Der Spiegel |language=de |issn=2195-1349}}</ref><ref>{{Cite web |title=Euro (EUR) To US Dollar (USD) Exchange Rate History for 2022 |url=https://www.exchange-rates.org/exchange-rate-history/eur-usd-2022 |access-date=2024-07-10 |website=www.exchange-rates.org |language=en}}</ref> | |||

| The euro is divided into 100 ''']'''. In each country but Greece, which uses ''λεπτό'' and ''λεπτά'' on its coins, the form "cent" is officially required to be used in legislation in both the singular and in the plural, though in common usage it is common to translate these into the local language, for example ''cents'' in ] and ''centesimo-centesimi'' in ]. (For more information on language and the euro, see ].) | |||

| ==Characteristics== | |||

| All euro coins (including the ]) have a '''common side''' showing the denomination (value) with the EU-countries in the background and a '''national side''' showing an image specifically chosen by the country that issued the coin; the ] often have a picture of their reigning monarch, while other countries usually have their national symbols. Most member states use only one or up to three different symbols, whereas Austria, Greece, Italy and San Marino have choosen individual depictions for every coin, so you can tell the value without looking at the denomination. All coins can be used in all member states: for example, a euro coin bearing the image of the ] is legal tender not only in Spain, but also in all other member states where the euro is in use. There are €2 (silver-colored enclosure with gold-colored centerpiece), €1 (gold-colored enclosure with silver-colored centerpiece), 50c (gold-colored), 20c (gold-colored), 10c (gold-colored), 5c (copper-colored), 2c (copper-colored) and 1c (copper-colored) coins, though the latter two are not generally used in Finland or the Netherlands (but are still ]). | |||

| ===Administration=== | |||

| {{Main|European Central Bank|Maastricht Treaty|Eurogroup}} | |||

| The euro is managed and administered by the ] and the ], composed of the ]s of the eurozone countries. As an independent central bank, the ECB has sole authority to set ]. The Eurosystem participates in the printing, minting and distribution of ] and ] in all member states, and the operation of the eurozone payment systems. | |||

| All euro banknotes have a '''common design''' for each denomination on both sides. Notes are issued in the following values: €500, €200, €100, €50, €20, €10, €5. Some of the higher denominations are not issued in a few countries, though again, are legal tender. | |||

| The 1992 ] obliges most EU member states to adopt the euro upon meeting certain monetary and budgetary ], although not all participating states have done so. ] has negotiated exemptions,<ref>{{cite web|title=The Euro |publisher=European Commission|url=http://ec.europa.eu/economy_finance/euro/index_en.htm |access-date=29 January 2009}}</ref> while Sweden (which joined the EU in 1995, after the Maastricht Treaty was signed) turned down the euro in a ], and has circumvented the obligation to adopt the euro by not meeting the monetary and budgetary requirements. All nations that have joined the EU since 1993 have pledged to adopt the euro in due course. The Maastricht Treaty was amended by the 2001 ],<ref>{{cite web |last1=Nice |first1=Treaty of |title=Treaty of Nice |url=https://www.europarl.europa.eu/about-parliament/en/in-the-past/the-parliament-and-the-treaties/treaty-of-nice |website=About Parliament |publisher= European Parliament |access-date=7 May 2021}}</ref> which closed the gaps and loopholes in the Maastricht and Rome Treaties. | |||

| Both euro coins and banknotes are designed from the start in consultation with organizations representing people suffering from ] or other ]. Both have been designed to facilitate their use by people who may not be able to see the currency very well (or at all). Cues to aid in identification include gross differences in appearance (colour, size) for banknotes and coins, and tactile cues such as thickness and edge decoration for coins in particular. Although there have been other currencies predating the euro that were specifically designed in similar ways (different sizes, colours, and ridges) to aid the visually impaired, the introduction of the euro constitutes the first time that authorities have consulted associations representing the blind before and not after the event. For details, see the ] and ] articles. | |||

| <!-- the design of the banknotes is documented in the banknotes article --> | |||

| ==Countries that use the euro== | |||

| The ECB has set up a ] for large euro transactions (). | |||

| {{Further|Euro#Direct and indirect usage}} | |||

| All intra-] transfers shall cost the same as a domestic one. This is true for retail payments, although several ECB payment methods can be used. Credit card charging and ATM withdrawals within the Eurozone are also charged as if they were domestic. The ECB hasn't standardized paper based payment orders, such as cheques; these are still domestic-based. | |||

| === |

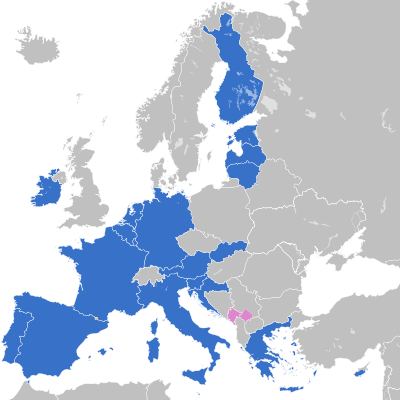

===Eurozone members=== | ||

| {{main| |

{{main|Eurozone}} | ||

| The 20 participating members are<br /> | |||

| ] Yellow on a PMS Reflex Blue background]] | |||

| {{div col|colwidth=10em}} | |||

| A special ] (€) was designed, after a public survey had narrowed the original ten proposals down to just two. The European Commission then chose the final design. The eventual winner was a design allegedly created by a team of four experts who have not, however, been officially named. The official story of the design history of the euro symbol is by ], a former chief graphic designer for the ], who claims to have created it as a generic symbol of Europe. | |||

| * {{Flagcountry|Austria}} | |||

| * {{Flagcountry|Belgium}} | |||

| * {{Flagcountry|Croatia}} | |||

| * {{Flagcountry|Cyprus}}{{efn|], where the government of the Republic of Cyprus does not exercise effective control, uses the ].}} | |||

| * {{Flagcountry|Estonia}} | |||

| * {{Flagcountry|Finland}} | |||

| * {{Flagcountry|France}}{{efn|Including outermost regions of ], ], ], ], ], ], ], and ].}} | |||

| * {{Flagcountry|Germany}} | |||

| * {{Flagcountry|Greece}} | |||

| * {{Flagcountry|Republic of Ireland|Ireland}} | |||

| * {{Flagcountry|Italy}} | |||

| * {{Flagcountry|Latvia}} | |||

| * {{Flagcountry|Lithuania}} | |||

| * {{Flagcountry|Luxembourg}} | |||

| * {{Flagcountry|Malta}} | |||

| * {{Flagcountry|Netherlands}}{{efn|Only the European part of the country is part of the European Union and uses the euro. The ] introduced the ] in 2011 following the dissolution of the ] (which used the ]). ], ] and ] have their own currencies, which are pegged to the dollar.}} | |||

| * {{Flagcountry|Portugal}} | |||

| * {{Flagcountry|Slovakia}} | |||

| * {{Flagcountry|Slovenia}} | |||

| * {{Flagcountry|Spain}} | |||

| {{div col end}} | |||

| ===]=== | |||

| The symbol is (according to the ]) "a combination of the Greek ], as a sign of the weight of European civilization; an E for Europe; and the parallel lines crossing through standing for the stability of the euro". | |||

| {{div col|colwidth=40em}} | |||

| ''']:''' | |||

| {{colbegin|colwidth=15em}} | |||

| *{{Flagcountry|France}} | |||

| **{{Flagcountry|French Guiana}} | |||

| **{{Flagcountry|Guadeloupe}} | |||

| **{{flagicon image|Flag-of-Martinique.svg|size=23px}} ] | |||

| **{{Flagcountry|Saint Martin}} | |||

| **{{Flagcountry|Mayotte}} | |||

| **{{Flagcountry|Réunion}} | |||

| *{{Flagcountry|Portugal}} | |||

| **{{Flagcountry|Azores}} | |||

| **{{Flagcountry|Madeira}} | |||

| *{{Flagcountry|Spain}} | |||

| **{{Flagcountry|Canary Islands}} | |||

| {{colend}} | |||

| ''']:''' | |||

| The European Commission also specified a euro logo with exact proportions and foreground/background colour tones . Although some font designers simply copied the exact shape of this logo as the euro sign in their fonts, most designed their own variants, often based upon the capital letter C in the respective font. The illustration at the top of this section shows the official euro logo. | |||

| *{{Flagcountry|France}} | |||

| **{{Flagcountry|French Southern and Antarctic Lands}} | |||

| **{{flagicon|Saint Barthélemy|local}} ] | |||

| **{{flagicon|Saint Pierre and Miquelon|local}} ]<ref>{{cite web |url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:1999:030:0029:0030:EN:PDF |title=By agreement of the EU Council |access-date=30 May 2010}}</ref> | |||

| {{div col end}} | |||

| ''']:''' | |||

| No "official" recommendation is made with regard to the use of a ], and sums are often expressed as decimals of the euro (for example €0.05 or even €–.05 rather than 5c). As a result the abbreviations differ between Eurozone members. The most used abbreviation is "c", but other abbreviations also exist, like "ct" (among others: Germany), snt (Finland), the capital letter ''lambda'' (Λ) (Greece). In Ireland, "c" is used, but the American-style "¢" is occasionally seen. | |||

| * {{Flagcountry|Finland}} | |||

| **{{Flagcountry|Åland}} | |||

| * {{Flagcountry|Greece}} | |||

| **{{Flagicon image|Flag of the Greek Orthodox Church.svg}} ] | |||

| * {{Flagcountry|Spain}} | |||

| **{{Flagcountry|Ceuta}} | |||

| **{{Flagcountry|Melilla}} | |||

| ===Other users=== | |||

| Placement of the symbol varies from nation to nation. While the official recommendation is to place it before the number, people in many countries have kept the placement of their former currencies.{{citation needed}} | |||

| '''Microstates with a monetary agreement:''' | |||

| {{div col|colwidth=20em}} | |||

| * {{Flagcountry|Andorra}}<ref>{{cite journal |url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:C:2011:369:0001:0013:EN:PDF |title=Monetary Agreement between the European Union and the Principality of Andorra |date=17 December 2011 |access-date=2012-09-08 |journal=] |archive-date=10 May 2013 |archive-url=https://web.archive.org/web/20130510123910/http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:C:2011:369:0001:0013:EN:PDF |url-status=dead }}</ref> | |||

| * {{Flagcountry|Monaco}}<ref>{{cite web |url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2002:142:0059:0073:EN:PDF |title=By monetary agreement between France (acting for the EC) and Monaco |access-date=30 May 2010}}</ref> | |||

| * {{Flagcountry|San Marino}}<ref>{{cite web |url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:C:2001:209:0001:0004:EN:PDF |title=By monetary agreement between Italy (acting for the EC) and San Marino |access-date=30 May 2010}}</ref> | |||

| * {{Flagcountry|Vatican City}}<ref>{{cite web |url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:C:2001:299:0001:0004:EN:PDF |title=By monetary agreement between Italy (acting for the EC) and Vatican City |access-date=30 May 2010}}</ref> | |||

| {{div col end}} | |||

| ''']:''' | |||

| ==Economic and Monetary Union== | |||

| {{div col|colwidth=20em}} | |||

| ===History (1990-2002)=== | |||

| * {{Flagcountry|Akrotiri and Dhekelia}}<ref>{{cite news |last=Theodoulou |first=Michael |date=27 December 2007 |url=http://www.timesonline.co.uk/tol/news/world/europe/article3097521.ece |url-status=dead |archive-url=https://web.archive.org/web/20110510204604/http://www.timesonline.co.uk/tol/news/world/europe/article3097521.ece |title=Euro reaches field that is for ever England |work=The Times |access-date= 4 January 2008 |archive-date=10 May 2011}}</ref> | |||

| :''Main article: ]. For earlier monetary history in Europe, see: ]. | |||

| {{div col end}} | |||

| The euro was established by the provisions in the 1992 ] ] that was used to establish an ]. In order to participate in the new currency, member states had to meet ] such as a ] of less than three per cent of ], a debt ratio of less than sixty per cent of GDP, combined with low ] and ] rates close to the EU average. | |||

| '''Unilateral adopters:''' | |||

| Economist ] is sometimes referred to as the father of the euro. Other economists that helped include ], ], ] and ]. (For macro-economic theory, see ].) | |||

| {{div col|colwidth=20em}} | |||

| * {{Flagcountry|Kosovo}}<ref>{{cite web |url=http://www.unmikonline.org/regulations/admdirect/1999/089%20Final%20%20ADE%201999-02.htm |title=By UNMIK administration direction 1999/2 |publisher=Unmikonline.org |access-date=30 May 2010 |url-status=dead |archive-url=https://web.archive.org/web/20110607234444/http://www.unmikonline.org/regulations/admdirect/1999/089%20Final%20%20ADE%201999-02.htm |archive-date=7 June 2011}}</ref> | |||

| * {{Flagcountry|Montenegro}}{{efn|See ].}} | |||

| {{div col end}} | |||

| ==EU members not using the euro == | |||

| {| cellpadding="4" cellspacing="0" style="border: 1px solid #000000; float: right; margin: 20px; margin-bottom: 5px; margin-top: 5px;" | |||

| {{main|Enlargement of the eurozone}} | |||

| |- style="background-color: #999999;" | |||

| {{Anchor|EUnoEZ}} | |||

| ! Currency | |||

| ! Abbr. | |||

| ! Rate | |||

| |- style="background-color: #EEEEEE;" | |||

| | {{flagicon|Austria}} Austrian ]s | |||

| | style="text-align: center;" | (ATS) | |||

| | style="text-align: right;" | 13.7603 | |||

| |- style="background-color: #CCCCCC;" | |||

| | {{flagicon|Belgium}} Belgian ] | |||

| | style="text-align: center;" | (BEF) | |||

| | style="text-align: right;" | 40.3399 | |||

| |- style="background-color: #EEEEEE;" | |||

| | {{flagicon|Netherlands}} Dutch ] | |||

| | style="text-align: center;" | (NLG) | |||

| | style="text-align: right;" | 2.20371 | |||

| |- style="background-color: #CCCCCC;" | |||

| | {{flagicon|Finland}} Finnish ] | |||

| | style="text-align: center;" | (FIM) | |||

| | style="text-align: right;" | 5.94573 | |||

| |- style="background-color: #EEEEEE;" | |||

| | {{flagicon|France}} French ]s | |||

| | style="text-align: center;" | (FRF) | |||

| | style="text-align: right;" | 6.55957 | |||

| |- style="background-color: #CCCCCC;" | |||

| | {{flagicon|Germany}} German ] | |||

| | style="text-align: center;" | (DEM) | |||

| | style="text-align: right;" | 1.95583 | |||

| |- style="background-color: #EEEEEE;" | |||

| | {{flagicon|Ireland}} Irish ]s | |||

| | style="text-align: center;" | (IEP) | |||

| | style="text-align: right;" | 0.787564 | |||

| |- style="background-color: #CCCCCC;" | |||

| | {{flagicon|Italy}} Italian ] | |||

| | style="text-align: center;" | (ITL) | |||

| | style="text-align: right;" | 1936.27 | |||

| |- style="background-color: #EEEEEE;" | |||

| | {{flagicon|Luxembourg}} Luxembourg ]s | |||

| | style="text-align: center;" | (LUF) | |||

| | style="text-align: right;" | 40.3399 | |||

| |- style="background-color: #CCCCCC;" | |||

| | {{flagicon|Portugal}} Portuguese ]s | |||

| | style="text-align: center;" | (PTE) | |||

| | style="text-align: right;" | 200.482 | |||

| |- style="background-color: #EEEEEE;" | |||

| | {{flagicon|Spain}} Spanish ]s | |||

| | style="text-align: center;" | (ESP) | |||

| | style="text-align: right;" | 166.386 | |||

| |} | |||

| Due to differences in national conventions for rounding and significant digits, all conversion between the national currencies had to be carried out using the process of triangulation via the euro. The ''definitive'' values in euro of these subdivisions (which represent the ]s at which the currency entered the euro) are shown at right. | |||

| === Committed to adopt the euro <span class="anchor" id="Obliged to adopt the euro"></span> === | |||

| The above rates were determined by the Council of the European Union, based on a recommendation from the European Commission based on the market rates on ] ], so that one ECU (]) would equal one euro. (The European Currency Unit was an accounting unit used by the EU, based on the currencies of the member states; it was not a currency in its own right.) These rates were set by Council Regulation 2866/98 (EC), of ] ]. They could not be set earlier, because the ECU depended on the closing exchange rate of the non-euro currencies (principally the ]) that day. | |||

| {{See also|Bulgaria and the euro|Czech Republic and the euro|Hungary and the euro|Poland and the euro|Romania and the euro|Sweden and the euro}} | |||

| The following ] member states committed themselves in their respective ] to adopt the euro. However they do not have a deadline to do so and can delay the process by deliberately not complying with the convergence criteria (such as by not meeting the convergence criteria to join ERM II). Bulgaria and Romania are actively working to adopt the euro, while the remaining states do not have a migration plan in progress. | |||

| * {{Flagcountry|Bulgaria}}: The Bulgarian government aims to replace the ] with the euro by 2026.<ref>{{Cite web |title=Economic forecasts optimistic as Bulgaria moves closer to joining eurozone |url=https://www.euractiv.com/section/politics/news/economic-forecasts-optimistic-as-bulgaria-moves-closer-to-joining-eurozone/ |access-date=10 January 2025 |website= Euractiv}}</ref> In November 2023, Bulgarian euro coin design has been revealed and approved by the ].<ref>{{Cite web |title=The design of future Bulgarian euro coins has been approved |url=https://bnr.bg/en/post/101909237/the-design-of-future-bulgarian-euro-coins-has-been-approved |access-date=27 January 2024 |website=Radio Bulgaria}}</ref> | |||

| ] failed to meet the criteria for joining initially, so it did not join the common currency on ] ]. It was admitted two years later, on ] ], with a Greek ] (GRD) exchange rate of 340.750000. | |||

| * {{Flagcountry|Czechia}} | |||

| * {{Flagcountry|Hungary}} | |||

| * {{Flagcountry|Poland}} | |||

| * {{Flagcountry|Romania}} | |||

| * {{Flagcountry|Sweden}} | |||

| ===Opt-out=== | |||

| The procedure used to fix the irrevocable conversion rate between the drachma and the euro was different, since the euro by then was already two years old. While the conversion rates for the initial eleven currencies were determined only hours before the euro was introduced, the conversion rate for the Greek drachma was fixed several months beforehand, in Council Regulation 1478/2000 (EC), of ] ]. | |||

| {{See also|Denmark and the euro}} | |||

| * {{Flagcountry|Denmark}}: The government of Denmark negotiated an ] to retain its currency. | |||

| ==Coins and banknotes== | |||

| The currency was introduced in non-physical form (travellers' cheques, electronic transfers, banking, etc.) at midnight on ] ], when the national currencies of participating countries (the Eurozone) ceased to exist independently in that their exchange rates were locked at fixed rates against each other, effectively making them mere non-decimal subdivisions of the euro. The euro thus became the successor to the ] (ECU). The notes and coins for the old currencies, however, continued to be used as ] until new notes and coins were introduced on ] ]. | |||

| ===Coins=== | |||

| {{Main|Euro coins}} | |||

| The euro is divided into 100 ] (also referred to as ''euro cents'', especially when distinguishing them from other currencies, and referred to as such on the common side of all cent coins). In Community legislative acts the plural forms of ''euro'' and ''cent'' are spelled without the ''s'', notwithstanding normal English usage.<ref name="ec.europa.eu">{{cite web|url=http://ec.europa.eu/economy_finance/euro/cash/symbol/index_en.htm |title= How to use the euro name and symbol |publisher=European Commission |access-date=7 April 2010}}</ref><ref>{{cite web|url=http://ec.europa.eu/economy_finance/publications/publication6336_en.pdf |title=Spelling of the words "euro" and "cent" in official Community languages as used in Community Legislative acts |access-date=26 November 2008 |author=European Commission }}</ref> Otherwise, normal English plurals are used,<ref>{{cite web |url=http://ec.europa.eu/translation/writing/style_guides/english/style_guide_en.pdf |title=English Style Guide: A handbook for authors and translators in the European Commission |access-date=16 November 2008 |author=European Commission Directorate-General for Translation |url-status=dead |archive-url=https://web.archive.org/web/20101205092625/http://ec.europa.eu/translation/writing/style_guides/english/style_guide_en.pdf |archive-date=5 December 2010 }}; {{cite web |url=http://publications.europa.eu/code/en/en-370303.htm |title=Interinstitutional style guide, 7.3.3. Rules for expressing monetary units |access-date=16 November 2008 |author=European Union }}</ref> with many ] such as ''centime'' in France. | |||

| The changeover period during which the former currencies' notes and coins were exchanged for those of the euro lasted about two months, until ] ]. The official date on which the national currencies ceased to be legal tender varied from member state to member state. The earliest date was in ]; the ] officially ceased to be legal tender on ] ], though the exchange period lasted two months. The final date was ] ], by which all national currencies ceased to be legal tender in their respective member states. (Note that some of these dates were earlier than was originally planned.) However, even after the official date, they continued to be accepted by national central banks for several years up to forever (Austria, Germany, Ireland, Spain). The earliest coins to become non-convertible were the Portuguese escudos, which ceased to have monetary value after ] ], although banknotes remain exchangeable until 2022. | |||

| All circulating coins have a ''common side'' showing the denomination or value, and a map in the background. Due to the ], the Latin alphabet version of ''euro'' is used (as opposed to the less common Greek or Cyrillic) and ] (other text is used on national sides in national languages, but other text on the common side is avoided). For the denominations except the 1-, 2- and 5-cent coins, the map only showed the 15 member states of the union as of 2002. Beginning in 2007 or 2008 (depending on the country), the old map was replaced by a map of Europe also showing countries outside the ].<ref name="europa-common_sides">{{cite web |title=Common sides of euro coins |url=https://economy-finance.ec.europa.eu/euro/euro-coins-and-notes/euro-coins/common-sides-euro-coins_en |website=Europa |publisher=European Commission |access-date=30 December 2023}}</ref> The 1-, 2- and 5-cent coins, however, keep their old design, showing a geographical map of Europe with the ] member states as of 2002, raised somewhat above the rest of the map. All common sides were designed by ]. The coins also have a ''national side'' showing an image specifically chosen by the country that issued the coin. Euro coins from any member state may be freely used in any nation that has adopted the euro. | |||

| Although some countries are not printing the €500 and €200 banknotes, all banknotes are legal tender throughout the Eurozone. Finland decided not to mint or circulate one-cent and two-cent coins, except in small numbers for collectors. The Netherlands stopped minting these on ] ]. All cash transactions in these countries ending in one, two, six or seven cents are rounded down, and those ending in three, four, eight or nine cents are rounded up. Despite this convention, the one-cent and two-cent coins are still legal tender. | |||

| The coins are issued in denominations of ], ], ], ], ], ], ], and ]. To avoid the use of the two smallest coins, some cash transactions are rounded to the nearest five cents in the Netherlands and Ireland<ref>{{cite web|url=http://neurope.eu/article/ireland-to-round-to-nearest-5-cents-starting-october-28/|title=Ireland to round to nearest 5 cents starting October 28|date=27 October 2015|access-date=17 December 2018|archive-url=https://web.archive.org/web/20160306012032/http://neurope.eu/article/ireland-to-round-to-nearest-5-cents-starting-october-28/|archive-date=6 March 2016|url-status=dead|df=dmy-all}}</ref><ref>{{cite web|url=https://www.centralbank.ie/paycurr/Pages/rounding.aspx|title=Rounding |website= Central Bank of Ireland}}</ref> (by voluntary agreement) and in Finland and Italy (by law).<ref>{{cite web|author=European Commission|author-link=European Commission|title=Euro cash: five and familiar |url=http://ec.europa.eu/economy_finance/een/005/article_4324_en.htm |publisher=] |date = January 2007|access-date=26 January 2009}}</ref> This practice is discouraged by the commission, as is the practice of certain shops of refusing to accept high-value euro notes.<ref>Pop, Valentina (22 March 2010) , '']''</ref> | |||

| ===Current Eurozone (2002-2007)=== | |||

| {{main|Eurozone}} | |||

| [[Image:Euro_map_en.PNG|thumb|right|300px| | |||

| {{legend|#4068b8|Eurozone countries}} | |||

| {{legend|#f0b261|ERM II countries}} | |||

| {{legend|#c55050|other EU countries}} | |||

| {{legend|#976dc6|unilaterally adopted euro}}]] | |||

| ] with €2 face value have been issued with changes to the design of the national side of the coin. These include both commonly issued coins, such as the €2 commemorative coin for the fiftieth anniversary of the signing of the Treaty of Rome, and nationally issued coins, such as the coin to commemorate the ] issued by Greece. These coins are legal tender throughout the eurozone. Collector coins with various other denominations have been issued as well, but these are not intended for general circulation, and they are legal tender only in the member state that issued them.<ref>{{cite web|url=http://europa.eu/legislation_summaries/economic_and_monetary_affairs/introducing_euro_practical_aspects/l25058_en.htm |title=Commission communication: The introduction of euro banknotes and coins one year after COM(2002) 747 |access-date=26 January 2009 |author=European Commission |publisher=Europa (web portal) |date=15 February 2003}}</ref> | |||

| *The euro is sole currency in the following EU member states: ], ], ], ], ], ], ], ], ], the ], ] and ]. These 12 countries together are frequently referred to as the "]", or more informally "euroland" or the "eurogroup". The euro is also legal currency in the Eurozone overseas territories of ], ], ], ], ] and ]. | |||

| ====Coin minting==== | |||

| *By virtue of some bilateral the European mini states of ], ], and ] mint their own euro coins on behalf of the ]. | |||

| A number of institutions are authorised to mint euro coins: | |||

| {{div col|colwidth=25em}} | |||

| * ] (]: D) | |||

| * ] | |||

| * ] | |||

| * ] (J) | |||

| * ] | |||

| * {{ill|Banknote and Securities Printing Foundation|el}} | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] (A) | |||

| * ] (F): Stuttgart, (G): Karlsruhe | |||

| {{div col end}} | |||

| ===Banknotes=== | |||

| *], ] and ] adopted the foreign euro as their legal currency for movement of capital and payments without participation in the ] or the right to mint coins. Andorra is in the process of entering a monetary agreement similar to Monaco, San Marino, and Vatican City. | |||

| {{Main|Euro banknotes}} | |||

| ] and banknotes of various denominations]] | |||

| The design for the ] has common designs on both sides. The design was created by the Austrian designer ].<ref name="euro96">{{cite web|url=http://www.ecb.int/euro/changeover/2002/photos/html/image12.en.html |title=Robert Kalina, designer of the euro banknotes, at work at the Oesterreichische Nationalbank in Vienna |publisher=European Central Bank |access-date=30 May 2010}}</ref> Notes are issued in ], ], ], ], ], ], and ]. Each banknote has its own colour and is dedicated to an artistic period of European architecture. The front of the note features windows or gateways while the back has bridges, symbolising links between states in the union and with the future. While the designs are supposed to be devoid of any identifiable characteristics, the initial designs by Robert Kalina were of specific bridges, including the ] and the ], and were subsequently rendered more generic; the final designs still bear very close similarities to their specific prototypes; thus they are not truly generic. The monuments looked similar enough to different national monuments to please everyone.<ref>{{cite news|last=Schmid |first=John |url=https://www.nytimes.com/2001/08/03/news/03iht-euro_ed3_.html |title=Etching the Notes of a New European Identity|work=International Herald Tribune |date=3 August 2001 |access-date=29 May 2009}}</ref> | |||

| ===Future prospects (2007-)=== | |||

| {{main article|Eurozone}} | |||

| ====Pre-2004 EU members==== | |||

| From the launch of the euro in 1999 until the ] in 2004, ], ] and the ] were the only EU member states outside the monetary union. The situation for the three older member states also looks different from that of the ten new EU members; all three have no clear roadmap for adopting the euro: | |||

| The Europa series, or second series, consists of six denominations and no longer includes the €500 with issuance discontinued as of 27 April 2019.<ref name="Bank">{{Cite web|title=Banknotes|url=https://www.ecb.europa.eu/euro/banknotes/html/index.en.html|website=European Central Bank|access-date=2020-05-10}}</ref> However, both the first and the second series of euro banknotes, including the €500, remain legal tender throughout the euro area.<ref name="Bank"/> | |||

| ]. The text translates as "] and solidarity".]] | |||

| * ]: According to the 1995 accession treaty, Sweden is required to join the euro and therefore must convert to the euro at some point. Notwithstanding this, on ] ], a consultative Swedish ] was held on the euro, the result of which was 55.9% against adopting the common currency versus 42.0% in favour. The Swedish government has argued that such a line of action is possible since one of the requirements for Eurozone membership is a prior two-year membership of the ERM II. By simply choosing to stay outside the exchange rate mechanism, the Swedish government is provided a formal loophole avoiding the theoretical requirement of adopting the euro. Some of Sweden's major parties continue to believe that it would be in the national interest to join, but they have all pledged to abide by the results for the time being and show no interest in raising the issue again. | |||

| In December 2021, the ECB announced its plans to redesign euro banknotes by 2024. A theme advisory group, made up of one member from each euro area country, was selected to submit theme proposals to the ECB. The proposals will be voted on by the public; a design competition will also be held.<ref>{{cite journal|title=ECB to redesign euro banknotes by 2024 |url=https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr211206~a9e0ba2198.en.html |access-date=7 December 2021 |date=6 December 2021|website=European Central Bank}}</ref> | |||

| * The ]'s ] believe that the single currency is merely a stepping stone to the formation of a unified European superstate, and that removing Britain's ability to set its own interest rates will have detrimental effects on its economy. Others in the UK, usually joined by eurosceptics, advance several economic arguments against membership: the most cited one concerns the large unfunded pension liabilities of many continental European governments (unlike in the UK) which would, with a greying population, depress the currency in the future against the UK's interests. The contrary view is that, since intra-European exports make up to 50% of the UK's total, it eases the Single Market by removing currency risk, although financial derivatives are becoming more accessible to small UK businesses thereby allowing businesses to offset this risk. An interesting parallel can be seen in the 19th century discussions concerning the possibility of the UK joining the ] . Many British people also simply like ] as a currency as it is part of British heritage. The UK government has set ] that must be passed before it can recommend that the UK join the euro; however, given the relatively subjective nature of these tests it seems unlikely that they would be held to be fulfilled whilst public opinion remains so strongly against participation. | |||

| ====Issuing modalities for banknotes==== | |||

| * ] negotiated a number of opt-out clauses from the ] after it had been rejected in a first referendum. On ] ], another referendum was held in Denmark regarding the euro resulting in a 53.2% vote against joining. However, Danish politicians have suggested that debate on abolishing the four opt-out clauses may possibly be re-opened in 2006. In addition, Denmark has pegged its ] to the euro (€1 = DKr7.460,38 ± 2.25%) as the krone remains in the ]. | |||

| Since 1 January 2002, the national central banks (NCBs) and the ] have issued euro banknotes on a joint basis.<ref name="Scheller">{{Cite book|url=https://www.ecb.europa.eu/pub/pdf/other/ecbhistoryrolefunctions2006en.pdf|quote=Since 1 January 2002, the NCBs and the ECB have issued euro banknotes on a joint basis. |title=The European Central Bank: History, Role and Functions|first=Hanspeter K. |last=Scheller |edition=2nd |date= 2006|isbn=978-92-899-0027-0 |page=103|publisher=European Central Bank }}</ref> Eurosystem NCBs are required to accept euro banknotes put into circulation by other Eurosystem members and these banknotes are not repatriated. The ECB issues 8% of the total value of banknotes issued by the Eurosystem.<ref name="Scheller"/> In practice, the ECB's banknotes are put into circulation by the NCBs, thereby incurring matching liabilities vis-à-vis the ECB. These liabilities carry interest at the main refinancing rate of the ECB. The other 92% of euro banknotes are issued by the NCBs in proportion to their respective shares of the ECB capital key,<ref name="Scheller"/> calculated using national share of European Union (EU) population and national share of EU GDP, equally weighted.<ref> | |||

| {{cite web | |||

| |url=http://www.ecb.int/ecb/orga/capital/html/index.en.html | |||

| |title=Capital Subscription | |||

| |publisher=European Central Bank | |||

| |access-date=18 December 2011 | |||

| |quote=The NCBs' shares in this capital are calculated using a key which reflects the respective country's share in the total population and gross domestic product of the EU – in equal weightings. The ECB adjusts the shares every five years and whenever a new country joins the EU. The adjustment is done on the basis of data provided by the European Commission. | |||

| }} | |||

| </ref> | |||

| ==== |

====Banknote printing==== | ||

| Member states are authorised to print or to commission bank note printing. {{as of|November 2022}}, these are the printers: | |||

| In 2004 the 10 new EU member states had a currency other than the euro; however, those countries are required by their ] to join the euro. | |||

| {{div col|colwidth=25em}} | |||

| Some of the following countries have already joined the ], ERM II. They and the others have set themselves the goal to join the euro (]) as follows: | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| * ] | |||

| {{div col end}} | |||

| ===Payments clearing, electronic funds transfer=== | |||

| *] ] for ]. (Date confirmed and finalized by the European Commission) | |||

| {{Main|Single Euro Payments Area}} | |||

| *] ] for ], ], ] and ] | |||

| *] ] for ] and ] | |||

| *Mid-January 2009 for ] | |||

| *] ] for the ] and ]. | |||

| *2011 or later for ] and ] | |||

| Capital within the EU may be transferred in any amount from one state to another. All intra-Union transfers in euro are treated as domestic transactions and bear the corresponding domestic transfer costs.<ref>{{cite web|url=http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:32001R2560:EN:HTML|title=Regulation (EC) No 2560/2001 of the European Parliament and of the Council of 19 December 2001 on cross-border payments in euro |publisher=EUR-lex – European Communities, Publications office, Official Journal L 344, 28 December 2001 P. 0013 – 0016 |access-date=26 December 2008}}</ref> This includes all member states of the EU, even those outside the eurozone providing the transactions are carried out in euro.<ref>{{cite web |url=http://www.euro.gov.uk/crossborder.asp |title=Cross border payments in the EU, Euro Information, The Official Treasury Euro Resource |publisher=United Kingdom Treasury |access-date=26 December 2008 |url-status=dead |archive-url=https://web.archive.org/web/20081201114647/http://www.euro.gov.uk/crossborder.asp |archive-date=1 December 2008 }}</ref> Credit/debit card charging and ATM withdrawals within the eurozone are also treated as domestic transactions; however paper-based payment orders, like cheques, have not been standardised so these are still domestic-based. The ECB has also set up a ], ] since March 2023, for large euro transactions.<ref>{{cite web|url=http://www.ecb.int/paym/target/html/index.en.html |archive-url=https://web.archive.org/web/20080121081217/http://www.ecb.int/paym/target/html/index.en.html |archive-date=21 January 2008 |title=TARGET |author=European Central Bank |access-date=25 October 2007}}</ref> | |||

| However, a country's entry to the Eurozone is subject to fulfilling the economical ] during the ERM II stage. For instance, too high an inflation rate postponed the entry of Lithuania as planned on ] ]. | |||

| ==History== | |||

| ], ], ] and ] have already finalised the design for the country's coins' obverse side. | |||

| {{Main|History of the euro}} | |||

| ===Introduction=== | |||

| ] and ] are not yet members of the EU, but are scheduled to enter on ] ]. | |||

| {{Euro adoption past|group="note"}} | |||

| The euro was established by the provisions in the 1992 ]. To participate in the currency, member states are meant to meet ], such as a budget ] of less than 3% of their GDP, a debt ratio of less than 60% of GDP (both of which were ultimately widely flouted after introduction), low inflation, and ] rates close to the EU average. In the Maastricht Treaty, the United Kingdom and Denmark were granted exemptions per their request from moving to the stage of monetary union which resulted in the introduction of the euro (see also ]). | |||

| * The ] and the Bulgarian government have agreed on the introduction of the euro in mid-2009, when the Bulgarian National Bank is expected to become part of the EMU and will receive the right to issue Bulgarian euro coins. The early accession to the EMU is due to existing ] agreement that was signed in 1997 to help put an end to the deep financial crisis and foreign debt reimbursement problems. The agreement effectively binds the Bulgarian lev to the euro (between 1997 and 1999, before the euro came into existence, the lev was bound to the ]). As a consequence, Bulgaria has fulfilled the great majority of the EMU membership criteria. | |||

| The name "euro" was officially adopted in ] on 16 December 1995.<ref name="madrid1995"/> Belgian ] ], a former teacher of French and history, is credited with naming the new currency by sending a letter to then ], ], suggesting the name "euro" on 4 August 1995.<ref>{{Cite news | title= Germain Pirlot 'uitvinder' van de euro | url= http://www.ikso.net/vikipedio/artikeleuro.jpg | publisher= De Zeewacht | language= nl | date= 16 February 2007 | access-date= 21 May 2012 | url-status=dead | archive-url= https://web.archive.org/web/20130630181850/http://www.ikso.net/vikipedio/artikeleuro.jpg | archive-date= 30 June 2013 }}</ref> | |||

| * In Romania, the ] retained its monetary policy attributes throughout the financial crisis of the 1990s (which gradually ended). Hence, Romania's accession to the EMU will take more time. It is likely that Romania will join the Eurozone in the 2010–12 period, and strategies have been established to this end. To simplify future adjustments to ] at the adoption of the euro, when the Romanian new Leu was adopted in 2005 (at 10,000 old Lei to 1 new Leu) the new banknotes were issued to the same physical proportions as euro banknotes, the old leu notes being substantially longer in relation to their width. | |||

| Due to differences in national conventions for ] and significant digits, all conversion between the national currencies had to be carried out using the process of ] via the euro. The ''definitive'' values of one euro in terms of the ]s at which the currency entered the euro are shown in the table. | |||

| ====Public opinion after the European Constitution referenda==== | |||

| Although the failure of the ] to be ratified would have no direct impact on the status of the euro, some debate regarding the euro arose after the negative outcome of the French and Dutch referenda in mid 2005. | |||

| The rates were determined by the ],{{efn|by means of Council Regulation 2866/98 (EC) of 31 December 1998.}} based on a recommendation from the European Commission based on the market rates on 31 December 1998. They were set so that one ] (ECU) would equal one euro. The European Currency Unit was an accounting unit used by the EU, based on the currencies of the member states; it was not a currency in its own right. They could not be set earlier, because the ECU depended on the closing exchange rate of the non-euro currencies (principally ]) that day. | |||

| *A poll by Stern magazine released ] ] found that 56% of Germans would favour a return to the mark. | |||

| *Members of the ] northern Italian separatist political party, have discussed calling a referendum to return Italy to the Lira. | |||

| *Members of the ] political party have proposed holding a referendum to return France to the Franc. | |||

| *In contrast to Germany a poll in Austria on ] ] showed the overwhelming support of the euro: 73 percent of the sample said they preferred to keep the common currency with only 21 percent in favour of returning to the old currency the schilling. | |||

| The procedure used to fix the conversion rate between the ] and the euro was different since the euro by then was already two years old. While the conversion rates for the initial eleven currencies were determined only hours before the euro was introduced, the conversion rate for the Greek drachma was fixed several months beforehand.{{efn|by Council Regulation 1478/2000 (EC) of 19 June 2000.}} | |||

| However, soon after these suggestions were made, the ] issued a statement denying any possibility of this, stating "the euro is here to stay". <!-- personal views on this go in Discussion page --> | |||

| The currency was introduced in non-physical form (]s, electronic transfers, banking, etc.) at midnight on 1 January 1999, when the national currencies of participating countries (the eurozone) ceased to exist independently. Their exchange rates were locked at fixed rates against each other. The euro thus became the successor to the ] (ECU). The notes and coins for the old currencies, however, continued to be used as ] until new euro notes and coins were introduced on 1 January 2002. | |||

| ==Eurozone as an optimal currency area?== | |||

| {{main|Optimal Currency Area - Eurozone}} | |||

| The changeover period during which the former currencies' notes and coins were exchanged for those of the euro lasted about two months, until 28 February 2002. The official date on which the national currencies ceased to be legal tender varied from member state to member state. The earliest date was in Germany, where the ] officially ceased to be legal tender on 31 December 2001, though the exchange period lasted for two months more. Even after the old currencies ceased to be legal tender, they continued to be accepted by national central banks for periods ranging from several years to indefinitely (the latter for Austria, Germany, Ireland, Estonia and Latvia in banknotes and coins, and for Belgium, Luxembourg, Slovenia and Slovakia in banknotes only). The earliest coins to become non-convertible were the Portuguese ], which ceased to have monetary value after 31 December 2002, although banknotes remained exchangeable until 2022.{{clear}} | |||

| In economic theory the degree of fullfillment of the following four criteria indicate whether an area is optimal for a monetary union. These criteria are often called the ] (OCA) criteria. Although these criteria are not exhaustive and far from absolute, they are generally accepted as a sufficient measure. There are three economic criteria (labour and capital mobility, product diversification, and openness) and one political criterion (fiscal transfers). All these criteria stand in relation to the ability to deal with asymmetric shocks (i.e. shocks that only hit one area). Symmetric shocks are less problematic in a currency area as the currency will depreciate or appreciate to the needed level for all areas (as this level is the same for all areas), while asymmetric shocks will create an exchange rate that is too high for one area and one that is too low for the other. This causes wage and price changes and unemployment problems. | |||

| ===Currency sign=== | |||

| *] formulated the idea that perfect ] and ] would mitigate the adverse consequences of asymmetric shocks in a currency area. While capital is quite mobile in the Eurozone, labour mobility is relatively low, especially when compared to the ] and ]. | |||

| ] | |||

| {{Main|Euro sign}} | |||

| A special ] (€) was designed after a public survey had narrowed ten of the original thirty proposals down to two. The ] at the time (]) and the European Commissioner with responsibility for the euro (]) then chose the winning design.<ref>{{cite web |title=The euro, our currency {{!}} A symbol for the European currency |date=18 March 2009 |access-date=8 April 2023 |publisher=European Commission |url=https://ec.europa.eu/economy_finance/events/2009/theeuro/isola3_en2008-2009.pdf}}</ref> | |||

| *] formulated the idea that widely diversified production and export structures that are similar between the areas that form the currency area lower the effect and probability of asymmetric shocks. The Eurozone scores quite well on this criterion, and monetary integration seems to further improve the diversification of production structures. | |||

| Regarding the symbol, the ] stated on behalf of the ]: | |||

| *] formulated the idea that areas which are very open to ] and trade heavily with each other form an optimum currency area. This is because the high trade intensity will lower the significance of the distinction between domestic and foreign ] as ] will equalize the ]s of most goods, independently of ]s. The Eurozone members trade heavily with each other, and all evidence so far seems to indicate that the monetary union has at least doubled trade between members. | |||

| {{blockquote|The symbol € is based on the Greek letter epsilon (Є), with the first letter in the word "Europe" and with 2 parallel lines signifying stability.|source=]<ref name="design, rules">{{cite web |title=Institutions, law, budget {{!}} The Euro {{!}} Design |author=Directorate-General for Communication |publisher=European Union |access-date=8 April 2022 |url= https://european-union.europa.eu/institutions-law-budget/euro/design_en}}</ref>}} | |||

| *The term "] transfers" refers to the transfer of money between areas. This could decrease the adverse consequences of asymmetric shocks as the areas that are hit, would receive money. This would create a counter ] effect and thus lower the price and wage changes and unemployment wouldn't rise as much. In reality however there is a no-bail out clause in the ], meaning that fiscal transfers are not allowed. | |||

| The European Commission also specified a euro logo with exact proportions.<ref name="design, rules" /> Placement of the currency sign relative to the numeric amount varies from state to state, but for texts in English published by EU institutions, the symbol (or the ]-standard "EUR") should precede the amount.<ref>{{cite web|url=http://publications.europa.eu/code/en/en-370303.htm#position|title=Position of the ISO code or euro sign in amounts|date=5 February 2009|work=Interinstitutional style guide|publisher=Europa Publications Office|access-date=10 January 2010|location=Bruxelles, Belgium}}</ref> | |||

| In general, economic research state that is impossible to say whether Eurozone members would benefit from a currency area, as two important criteria support a monetary union, while at the same time two important criteria oppose such an union. | |||

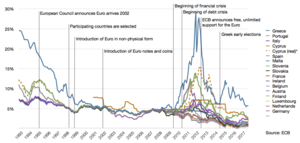

| ===Eurozone crisis=== | |||

| ==Effects of the single currency== | |||

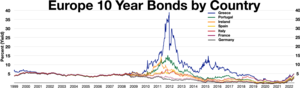

| ] bonds floated together in parity | |||

| ]]] | |||

| {{legend-line|#001489 solid 3px|] 10 year bond}} | |||

| The introduction of a single currency for many separate countries presents a number of advantages and disadvantages for the participating nations. Opinions differ on the actual effects of the euro so far, as most of them will take years to understand. Theories and predictions abound. | |||

| {{legend-line|#046A38 solid 3px|] 10 year bond}} | |||

| {{legend-line|#FF8200 solid 3px|] 10 year bond}} | |||

| {{legend-line|#F1BF00 solid 3px|] 10 year bond}} | |||

| {{legend-line|#CD212A solid 3px|] 10 year bond}} | |||

| {{legend-line|#970E53 solid 3px|] 10 year bond}} | |||

| {{legend-line|#000000 solid 3px|] 10 year bond}} | |||

| ]] | |||

| {{main|European debt crisis|Greek government-debt crisis}} | |||

| {{see also|2008–2011 Icelandic financial crisis}} | |||

| ] | |||

| ===Removal of exchange rate risk=== | |||

| One of the most important benefits of the euro will be lowered ] risks, which will make it easier to invest across borders. The risks of changes in the value of respective currencies has always made it risky for companies or individuals to invest or even import/export outside their own currency zone. Profits could be quickly eliminated as a result of exchange rate fluctuations. As a result, most investors and importers/exporters have to either accept the risk or ] their bets, resulting in further costs on the financial markets. Consequently, it is less appealing to invest outside one's own currency zone. The Eurozone greatly increases the potentially "exchange-risk free" investment area. Since Europe's economy is heavily dependent on intra-European exports, the benefits of this effect can hardly be overstated. This is particularly important for countries whose currencies have traditionally fluctuated a great deal such as the Mediterranean nations. | |||

| Following the U.S. financial crisis in 2008, fears of a ] developed in 2009 among investors concerning some European states, with the situation becoming particularly tense in ].<ref>{{Cite news|url= https://www.reuters.com/article/idUSLDE61F0W720100216 |title=Peripheral euro zone government bond spreads widen |work=Reuters |author=George Matlock |date=16 February 2010 |access-date=28 April 2010}}</ref><ref>{{cite news|url=http://www.economist.com/node/16009099 | title=Acropolis now |newspaper=The Economist |date=29 April 2010 |access-date=22 June 2011}}</ref> ] was most acutely affected, but fellow Eurozone members ], ], ], ], and ] were also significantly affected.<ref>, CNN Library (last updated 22 January 2017).</ref><ref>], , ''Brookings Papers on Economic Activity'', ] (Fall 2015), p. 433.</ref> All these countries used EU funds except Italy, which is a major donor to the EFSF.<ref>{{cite web|url=http://www.linkiesta.it/it/article/2011/11/04/efsf-come-funziona-il-fondo-salvastati-europeo/2302/|title=Efsf, come funziona il fondo salvastati europeo|date=4 November 2011}}</ref> To be included in the eurozone, countries had to fulfil certain ], but the meaningfulness of such criteria was diminished by the fact it was not enforced with the same level of strictness among countries.<ref>{{cite web|url=http://www.voxeu.org/index.php?q=node/3454 |title=The politics of the Maastricht convergence criteria|publisher=VoxEU |date=15 April 2009 |access-date=1 October 2011}}</ref> | |||

| At the same time, this is likely to increase foreign investment in countries with more liberal markets and reduce that in those with rigid markets. Some people worry that thus will see profits flowing away from particular member states to the detriment of their traditional social values. It might also result in the reduction of local decision makers in businesses. | |||

| According to the ] in 2011, "f the is treated as a single entity, its position looks no worse and in some respects, rather better than that of the US or the UK" and the budget deficit for the euro area as a whole is much lower and the euro area's government debt/GDP ratio of 86% in 2010 was about the same level as that of the United States. "Moreover", they write, "private-sector indebtedness across the euro area as a whole is markedly lower than in the highly leveraged ] economies". The authors conclude that the crisis "is as much political as economic" and the result of the fact that the euro area lacks the support of "institutional ] (and mutual bonds of solidarity) of a state".<ref>{{cite web|url=http://pages.eiu.com/rs/eiu2/images/EuroDebtPaperMarch2011.pdf |title=State of the Union: Can the euro zone survive its debt crisis?|page=4 |publisher=] |date=1 March 2011 |access-date=1 December 2011}}</ref> | |||

| ===Removal of conversion fees=== | |||

| A benefit is the removal of ] transaction charges that previously were a cost to both individuals and ]es when exchanging from one national currency to another. Although not an enormous cost, multiplied thousands of times, the savings add up across the entire economy. | |||

| The crisis continued with S&P downgrading the credit rating of nine euro-area countries, including France, then downgrading the entire ] (EFSF) fund.<ref>{{Cite news|url=https://www.reuters.com/article/us-eurozone-efsf-sp-idUSTRE80F1OV20120116|title=S&P downgrades euro zone's EFSF bailout fund|date=2017-01-16|work=Reuters|access-date=2017-01-21}}</ref> | |||

| For electronic payments (e.g. ]s, ]s and ] withdrawals), banks in the Eurozone must now charge the same for intra-member cross-border transactions as they charge for domestic transactions. Banks in ] have attempted to circumvent this regulation by charging for all bank transfers (domestic and cross-border) unless the transfer is instructed via ] — a method through which they do not offer cross-border payments. In this way, banks in France continue to charge more for cross-border transfers than for domestic transfers.{{citation needed}} | |||

| A historical parallel – to 1931 when Germany was burdened with debt, unemployment and austerity while France and the United States were relatively strong creditors – ] in summer 2012<ref>{{cite web |url=http://www.marketwatch.com/story/euro-crisis-brings-world-to-brink-of-depression-2012-07-24 |title=Euro crisis brings world to brink of depression |first=Darrell | last= Delamaide |website=MarketWatch |date=24 July 2012 |access-date=24 July 2012}}</ref> even as Germany received a ] warning of its own.<ref>Lindner, Fabian, "", ''The Guardian'', 24 July 2012. Retrieved 25 July 2012.</ref><ref>Buergin, Rainer, " {{Webarchive|url=https://web.archive.org/web/20120728105157/http://washpost.bloomberg.com/Story?docId=1376-M7MTLK6K50YQ01-2MU1077HDEEK0FPVVG6AUS88JB |date=28 July 2012 }}", ''washpost.bloomberg'', 24 July 2012. Retrieved 25 July 2012.</ref> | |||

| ===Deeper financial markets=== | |||

| Another significant advantage of switching to the euro is the creation of deeper financial markets. Financial markets on the continent are expected to be far more ] and flexible than they were in the past. There will be more competition for, and availability of financial products across the union. This will reduce the financial servicing costs to businesses and possibly even individual consumers across the continent. The costs associated with public debt will also decrease. It is expected that the broader, deeper markets will lead to increased stock market ] and investment. Larger, more internationally competitive financial and business institutions may arise. | |||

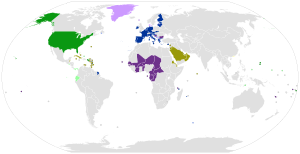

| ==Direct and indirect usage== | |||

| {{Further|Eurozone|International status and usage of the euro|Enlargement of the eurozone}} | |||

| {{Eurozone labelled map interior}} | |||

| ===Agreed direct usage with minting rights=== | |||

| The euro is the sole currency of 20 ]: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. These countries constitute the "]", some 347 million people in total {{As of|2023|lc=y}}.<ref name="2013_data_sheet">{{cite web|url=http://www.prb.org/pdf13/2013-population-data-sheet_eng.pdf|title=2013 World Population Data Sheet|author=Population Reference Bureau|author-link=Population Reference Bureau|access-date=2013-10-01|archive-date=26 February 2015|archive-url=https://web.archive.org/web/20150226072048/http://www.prb.org/pdf13/2013-population-data-sheet_eng.pdf|url-status=dead}}</ref> According to ], the euro has also been designated as the sole and official currency in a further four ] awarded minting rights (Andorra, Monaco, San Marino and the Vatican City). All but one (Denmark) current, and any potential future EU members, are ] when economic conditions permit. | |||

| ===Agreed direct usage without minting rights=== | |||

| The euro is also the sole currency in three ] that are not themselves part of the EU, namely ], ], and the ], as well as in the ] of ].<ref>{{cite web | title=Sovereign Base areas of Akrotiri and Dhekelia on Cyprus |url=https://commonwealthchamber.com/associated-territories/sovereign-base-areas-of-akrotiri-and-dhekelia-on-cyprus/ |website=Commonwealth Chamber of Commerce}}</ref> | |||

| ===Unilateral direct usage=== | |||

| The euro has been adopted unilaterally as the sole currency of Montenegro and Kosovo. It has also been used as a foreign trading currency in Cuba since 1998,<ref>{{cite news| title=Cuba to adopt euro in foreign trade |url=http://news.bbc.co.uk/1/hi/world/americas/210441.stm |work=BBC News |date=8 November 1998 |access-date=2 January 2008}}</ref> Syria since 2006,<ref>{{cite news| title= US row leads Syria to snub dollar | url= http://news.bbc.co.uk/1/hi/business/4713622.stm |work=BBC News |date=14 February 2006 | access-date=2 January 2008}}</ref> and Venezuela since 2018.<ref>{{Cite news|url=https://www.bloomberg.com/news/articles/2018-10-16/dollars-are-out-euros-are-in-as-u-s-sanctions-sting-venezuela|title=Dollars Are Out, Euros Are in as U.S. Sanctions Sting Venezuela|last1=Rosati|first1=Andrew|date=17 October 2018|work=]|access-date=17 June 2019|last2=Zerpa|first2=Fabiola}}</ref> In 2009, Zimbabwe abandoned its ] and introduced major global convertible currencies instead, including the euro and the United States dollar. The direct usage of the euro outside of the official framework of the EU affects nearly 3 million people.<ref>{{Cite news| title=Zimbabwe: A Critical Review of Sterp |url=http://allafrica.com/stories/200904170690.html |date=17 April 2009 |access-date=30 April 2009}}</ref> | |||

| ===Currencies pegged to the euro=== | |||

| {{Main|International status and usage of the euro}} | |||

| [[File:DOLLAR AND EURO IN THE WORLD.svg|thumb|upright=1.35|Worldwide use of the euro and the US dollar: | |||

| {{Legend|#092D98|]}} | |||

| {{Legend|#98b3ff|External adopters of the euro}} | |||

| {{Legend|#510999|Currencies pegged to the euro}} | |||

| {{Legend|#CC99FF|Currencies pegged to the euro within narrow band}} | |||

| {{Legend|#099811|United States}} | |||

| {{Legend|#99FF9E|External adopters of the US dollar}} | |||

| {{Legend|#999909|Currencies pegged to the US dollar}} | |||

| {{Legend|#FFFF99|Currencies pegged to the US dollar within narrow band}} | |||

| <hr/> | |||

| <small>Note: The ] is pegged to the euro, ] and ] in a ].</small>]] | |||

| Outside the eurozone, two EU member states have currencies that are ], which is a precondition to joining the eurozone. The ] and ] are pegged due to their participation in the ]. | |||

| Additionally, a total of 22 countries and territories that do not belong to the EU have currencies that are directly ] to the euro including 14 countries in mainland Africa (]), three African island countries (], ] and ] (since 1 January 2010)<ref>{{cite web|url=http://www.telanon.info/economia/2010/01/04/2437/1-euro-equivale-a-24500-dobras/|title=1 euro equivale a 24.500 dobras|date=4 January 2009|trans-title=1 euro is equivalent to 24,500 dobras|language=pt|access-date=16 November 2020|publisher=Téla Nón}}</ref>), three French Pacific territories (]) and two Balkan countries, Bosnia and Herzegovina (]) and North Macedonia (]).<ref name="Cardoso"/> Additionally, the ] is tied to a basket of currencies, including the euro and the US dollar, with the euro given the highest weighting. | |||

| These countries generally had previously implemented a currency peg to one of the major European currencies (e.g. the ], ] or ]), and when these currencies were replaced by the euro their currencies became pegged to the euro. Pegging a country's currency to a major currency is regarded as a safety measure, especially for currencies of areas with weak economies, as the euro is seen as a stable currency, prevents runaway inflation, and encourages foreign investment due to its stability. | |||

| In total, {{As of|2013|lc=y}}, 182 million people in Africa use a currency pegged to the euro, 27 million people outside the eurozone in Europe, and another 545,000 people on Pacific islands.<ref name="2013_data_sheet"/> | |||

| Since 2005, stamps issued by the ] have been denominated in euros, although the Order's official currency remains the ].<ref name=smom>{{cite web| url = https://www.orderofmalta.int/associate-countries/| title = Retrieved 3 October 2017.}}</ref> The Maltese scudo itself is pegged to the euro and is only recognised as legal tender within the Order. | |||

| The currency of a number of states is ] to the euro. These states are: | |||

| {{div col|colwidth=25em}} | |||

| '''North America''' | |||

| * {{Flagcountry|Haiti}} (], {{ISO 4217|HTG}}) | |||

| '''Europe''' | |||

| * {{Flagcountry|Albania}} (], {{ISO 4217|ALL}}) | |||

| * {{Flagcountry|Bosnia and Herzegovina}} (], {{ISO 4217|BAM}}) | |||

| * {{Flagcountry|Bulgaria}} (], {{ISO 4217|BGN}}) | |||

| * {{Flagcountry|Denmark}} (], {{ISO 4217|DKK}}) | |||

| * {{Flagcountry|North Macedonia}} (], {{ISO 4217|MKD}})<ref name="Cardoso">{{cite web |last=Cardoso |first=Paulo |title=Interview – Governor of the National Bank of Macedonia – Dimitar Bogov |url=http://www.the-american-times.com/american-times-governor-national-bank-macedonia-dimitar-bogov/2013/10/05 |work=The American Times United States Emerging Economies Report (USEER Report) |publisher=Hazlehurst Media SA |access-date=8 September 2013 |archive-url=https://web.archive.org/web/20131020073010/http://www.the-american-times.com/american-times-governor-national-bank-macedonia-dimitar-bogov/2013/10/05 |archive-date=20 October 2013 |url-status=dead }}</ref> | |||

| * {{Flagcountry|Sovereign Military Order of Malta}} (])<ref>{{Cite web |title=Numismatica|url=https://www.ordinedimaltaitalia.org/article/numismatica |access-date=2022-04-30 |website=Ordine di Malta Italia}}</ref> | |||

| * {{Flagcountry|Moldova}} (], {{ISO 4217|MDL}}) | |||

| * {{Flagcountry|Romania}} (], {{ISO 4217|RON}}) | |||

| * {{Flagcountry|Serbia}} (], {{ISO 4217|RSD}}) | |||

| '''Oceania''' | |||

| * {{Flagcountry|French Polynesia}} (], {{ISO 4217|XPF}}) | |||

| * {{Flagcountry|New Caledonia}} (CFP franc) | |||

| * {{Flagcountry|Wallis and Futuna}} (CFP franc) | |||

| '''Africa''' | |||

| * {{Flagcountry|Burundi}} (], {{ISO 4217|BIF}}) | |||

| * {{Flagcountry|Cape Verde}} (], {{ISO 4217|CVE}}) | |||

| * {{Flagcountry|Cameroon}} (], {{ISO 4217|XAF}}) | |||

| * {{Flagcountry|Central African Republic}} (Central African CFA franc) | |||

| * {{Flagcountry|Chad}} (Central African CFA franc) | |||

| * {{Flagcountry|Equatorial Guinea}} (Central African CFA franc) | |||

| * {{Flagcountry|Gabon}} (Central African CFA franc) | |||

| * {{Flagcountry|Republic of the Congo}} (Central African CFA franc) | |||

| * {{Flagcountry|Comoros}} (], {{ISO 4217|KMF}}) | |||

| * {{Flagcountry|Democratic Republic of the Congo}} (], {{ISO 4217|CDF}}) | |||

| * {{Flagcountry|Djibouti}} (], {{ISO 4217|DJF}}) | |||

| * {{Flagcountry|Eritrea}} (], {{ISO 4217|ERN}}) | |||

| * {{Flagcountry|Ethiopia}} (], {{ISO 4217|ETB}}) | |||

| * {{Flagcountry|Gambia}} (], {{ISO 4217|GMD}}) | |||

| * {{Flagcountry|Guinea}} (], {{ISO 4217|GNF}}) | |||

| * {{Flagcountry|Madagascar}} (], {{ISO 4217|MGA}}) | |||

| * {{Flagcountry|Mozambique}} (], {{ISO 4217|MZN}}) | |||

| * {{Flagcountry|Rwanda}} (], {{ISO 4217|RWF}}) | |||

| * {{Flagcountry|Sahrawi Arab Democratic Republic}} (]) | |||

| * {{Flagcountry|São Tomé and Príncipe}} (], {{ISO 4217|STN}}) | |||

| * {{Flagcountry|Sierra Leone}} (], {{ISO 4217|SLE}}) | |||

| * {{Flagcountry|Benin}} (], {{ISO 4217|XOF}}) | |||

| * {{Flagcountry|Burkina Faso}} (West African CFA franc) | |||

| * {{Flagcountry|Côte d'Ivoire}} (West African CFA franc) | |||

| * {{Flagcountry|Guinea-Bissau}} (West African CFA franc) | |||

| * {{Flagcountry|Mali}} (West African CFA franc) | |||

| * {{Flagcountry|Niger}} (West African CFA franc) | |||

| * {{Flagcountry|Senegal}} (West African CFA franc) | |||

| * {{Flagcountry|Togo}} (West African CFA franc) | |||

| {{div col end}} | |||

| ===Use as reserve currency=== | |||

| Since its introduction in 1999, the euro has been the second most widely held international ] after the U.S. dollar. The share of the euro as a reserve currency increased from 18% in 1999 to 27% in 2008. Over this period, the share held in U.S. dollar fell from 71% to 64% and that held in RMB fell from 6.4% to 3.3%. The euro inherited and built on the status of the ] as the second most important reserve currency. The euro remains underweight as a reserve currency in advanced economies while overweight in emerging and developing economies: according to the ]<ref name="external1">{{cite web|url=http://www.imf.org/external/np/sta/cofer/eng/cofer.pdf |title=Currency Composition of Official Foreign Exchange Reserves (COFER) – Updated COFER tables include first quarter 2009 data. June 30, 2009 |access-date=8 July 2009}}</ref> the total of euro held as a reserve in the world at the end of 2008 was equal to $1.1 trillion or €850 billion, with a share of 22% of all currency reserves in advanced economies, but a total of 31% of all currency reserves in emerging and developing economies. | |||