| Revision as of 12:06, 14 December 2006 editDeepakshenoy (talk | contribs)423 edits →Heads of Income: Reverted - theres no reason for the 10000 there is there?← Previous edit | Latest revision as of 16:14, 24 November 2024 edit undo2409:4080:be8a:4bc4::a608:ed0f (talk) →Tax deduction at sourceTags: Mobile edit Mobile web edit | ||

| Line 1: | Line 1: | ||

| {{short description|Form of taxation in India}} | |||

| The government of ] imposes an ] on taxable income of individuals, Hindu Undivided Families(HUFs), companies (firms), co-operative societies and trusts. The Income Tax department is governed by the Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue under the Ministry of Finance. | |||

| {{More citations needed|date=April 2016}} | |||

| {{Use Indian English|date=September 2013}} | |||

| {{Use dmy dates|date=October 2020}} | |||

| ] | |||

| {{taxation}} | |||

| {{Pie chart | |||

| | caption = Central Revenue collections in 2007–08<ref>Compiled from ] reports.</ref> | |||

| | other = | |||

| | label1 = Personal income tax | |||

| | value1 = 17.43 | |||

| | color1 = #08f | |||

| | label2 = Corporate taxes | |||

| | value2 = 33.99 | |||

| | color2 = silver | |||

| | label3 = Other taxes | |||

| | value3 = 2.83 | |||

| | color3 = fuchsia | |||

| | label4 = ] taxes | |||

| | value4 = 20.84 | |||

| | color4 = yellow | |||

| | label5 = Customs duties | |||

| | value5 = 17.46 | |||

| | color5 = green) | |||

| | label6 = Other taxes | |||

| | value6 = 8.68 | |||

| | color6 = brown | |||

| | value7 = 11.96 | |||

| | color7 = gold | |||

| | label7 = other taxes | |||

| }} | |||

| '''Income tax in India''' is governed by Entry 82 of the ] of the ], empowering the ] to tax non-agricultural income; agricultural income is defined in Section 10(1) of ].<ref>{{cite book|year=2011|isbn=978-81-8441-290-1|title=Taxation|author=Institute of Chartered Accountants of India}}</ref> Income-tax law consists of the 1961 act, Income Tax Rules 1962, Notifications and Circulars issued by the ] (CBDT), annual Finance Acts, and judicial pronouncements by the ] and ]. | |||

| The government taxes ] of individuals, ] (HUF's), companies, firms, LLPs, associations, bodies, local authorities and any other ]. Personal tax depends on residential status. The CBDT administers the ], which is part of the ] Department of Revenue. Income tax is a key source of government funding. | |||

| == Individual Income Tax == | |||

| === Heads of Income === | |||

| There are five heads of income that are taxable<ref></ref>: | |||

| The Income Tax Department is the central government's largest revenue generator; total tax revenue increased from {{INRConvert|1392.26|B}} in 1997–98 to {{INRConvert|5889.09|B}} in 2007–08.<ref>{{cite web|title=Growth of Income Tax revenue in India|url=http://shodhganga.inflibnet.ac.in/bitstream/10603/2876/12/12_chapter%205.pdf|access-date=16 November 2012|archive-date=27 February 2012|archive-url=https://web.archive.org/web/20120227072609/http://shodhganga.inflibnet.ac.in/bitstream/10603/2876/12/12_chapter%205.pdf|url-status=live}}</ref><ref>{{cite web |url=http://www.incometaxindia.gov.in/Pages/default.aspx |title=Home – Central Board of Direct Taxes, Government of India |publisher=Incometaxindia.gov.in |access-date=2018-04-18 |archive-date=2 December 2015 |archive-url=https://web.archive.org/web/20151202091759/http://www.incometaxindia.gov.in/Pages/default.aspx |url-status=live }}</ref> In 2018–19, direct tax collections reported by the CBDT were about {{₹|link=yes}}11.17 ] ({{₹|11.17 trillion}}).<ref>{{cite web|url=https://www.moneycontrol.com/news/business/economy/exclusive-total-direct-tax-collections-for-fy18-19-fall-short-by-rs-83000-crore-3749991.html|website=]|title=Total direct tax collections for FY18-19 fall short by Rs 83,000 crore|date=2 April 2019|access-date=22 August 2020|archive-date=5 June 2020|archive-url=https://web.archive.org/web/20200605092200/https://www.moneycontrol.com/news/business/economy/exclusive-total-direct-tax-collections-for-fy18-19-fall-short-by-rs-83000-crore-3749991.html|url-status=live}}</ref> | |||

| # Income from Salary | |||

| # Rental Income | |||

| # Income from Business and profession | |||

| # Capital Gains | |||

| # Income from other sources | |||

| == |

==History== | ||

| ===Ancient times=== | |||

| In ], Individual income tax is a ] with three slabs. | |||

| Taxation has been a function of sovereign states since ancient times. The earliest archaeological evidence of taxation in India is found in ]'s pillar inscription at ]. According to the inscription, tax relief was given to the people of Lumbini (who paid one-eighth of their income, instead of one-sixth).<ref>Hultzsch, E. (1925). Inscriptions of Asoka. Oxford: Clarendon Press, pp. 164–165</ref> | |||

| * No income tax is applicable on all income up to Rs. 100,000 per year. (Rs. 135,000 for women and Rs. 185,000 for senior citizens) | |||

| * From 100,001 to 150,000 : 10% of amount greater than Rs. 100,000 (Lower limit Rs. 135,001 for women and n/a to senior citizens) | |||

| * From 150,001 to 250,000 : 20% of amount greater than Rs. 150,000 + Rs. 5,000 (For women: Rs. 1500) (''For senior citizens, the lower limit is Rs. 185,000'') | |||

| * Above 250,000 : 30% of amount greater than Rs. 250,000 + Rs. 25,000 (Rs. 21,500 for women and Rs. 13,000 for senior citizens) | |||

| In the '']'', ] says that the king has the sovereign power to levy and collect tax according to '']'':<ref name="smjha">{{cite book|author=Jha S M (1990) |title="Taxation and Indian Economy"|publisher=New Delhi: Deep and Deep Publications}}</ref> | |||

| === Income from Salary === | |||

| {{Quote | |||

| All income received as a salary is taxed under this head. This includes all monies paid by a company to its employees. Employers must withhold tax compulsorily, as Tax Deducted at Source (TDS), and provide their employees with a '''''Form 16''''' which shows the tax deductions and net paid income. In addition, the Form 16 will contain any other deductions provided from salary such as: | |||

| |text=लोके च करादिग्रहणो शास्त्रनिष्ठः स्यात् । — Manu, Sloka 128, Manusmriti<ref name="smjha" /> | |||

| # Medical reimbursement: Upto Rs. 15,000 per year is tax free if supported by bills. (Company pays Fringe Benefit Tax on this amount) | |||

| ("It is in accordance with ''Sastra'' to collect taxes from citizens.") | |||

| # Conveyance allowance: Upto Rs. 800 per month (Rs. 9,600 per year) is tax free if provided as conveyance allowance. No bills are required for this allowance. | |||

| |author=|title=|source=}} | |||

| # Professional taxes: Most states tax employment on a per-professional basis, usually a slabbed amount based on gross income. Such taxes paid are deductible from income tax. | |||

| The '']'' note that the king received one-sixth of the income from his subjects, in return for protection.<ref name="smjha" /> According to ]'s '']'' (a treatise on economics, the art of governance and foreign policy), ''artha'' is not only wealth; a government's power depended on the strength of its treasury: "From the treasury comes the power of the government, and the earth, whose ornament is the treasury, is acquired by means of the treasury and army." ]'s ], eulogizing King Dilipa, says: "it was only for the good of his subjects that he collected taxes from them just as the sun draws moisture from the earth to give it back a thousand time."<ref name="businessline">{{cite web|url=https://www.thehindubusinessline.com/2000/02/14/stories/211464tn.htm|title=The evolution of income-tax|publisher=thehindubusinessline.com|access-date=4 August 2019|archive-date=4 August 2019|archive-url=https://web.archive.org/web/20190804122856/https://www.thehindubusinessline.com/2000/02/14/stories/211464tn.htm|url-status=live}}</ref> | |||

| Income from salary is net of the above deductions. | |||

| ==={{anchor|Modern times}}19th and early 20th centuries=== | |||

| === Capital Gains === | |||

| ] became established during the 19th century. After the ], the British government faced an acute financial crisis. To fill the treasury, the first Income-tax Act was introduced in February 1860 by Sir James Wilson (British India's first finance minister).<ref name="businessline"/> The act received the assent of the ] on 24 July 1860, and came into effect immediately. It was divided into 21 parts, with 259 sections. Income was classified in four schedules: i) income from landed property; ii) income from professions and trade; iii) income from securities, annuities and dividends, and iv) income from salaries and pensions. Agricultural income was taxable.<ref name="businessline" /> | |||

| Long term capital gains tax stands at 20% (for gold, real estate and such) with indexation benefits provided for inflation. All short term gains are clubbed with income in the year the gains occur. Long term is defined as 3 years for some assets (gold, real estate, for instance) and one year for others (Mutual funds, shares). | |||

| A number of laws were enacted to streamline the income-tax laws; the Super-Rich Tax and a new Income-tax Act were passed in 1918. The Act of 1922 significantly changed the Act of 1918 by shifting income-tax administration from the ] to the central government. Another notable feature of the act was that the rules would be outlined by ] instead of the act itself.<ref name="shodhganga">{{cite web|url=https://shodhganga.inflibnet.ac.in/bitstream/10603/113603/8/08_chapter%203.pdf|title=Evolution of Income Tax System in India|publisher=Shodhganga|access-date=4 August 2019|archive-date=7 July 2020|archive-url=https://web.archive.org/web/20200707010944/https://shodhganga.inflibnet.ac.in/bitstream/10603/113603/8/08_chapter%203.pdf|url-status=live}}</ref> A new Income-tax Act was passed in 1939. | |||

| For sales of shares in recognised stock exchanges and mutual fund units, long term capital gains are not taxed at all. 10% income tax is applied on short term gains (less than 1 year of holding). To qualify for these lower taxes on sale of shares, a Securities Transaction Tax (STT) must have been paid on the sale transaction. STT has been applied on all stock market transactions since October 2004 but does not apply to off-market transactions and company buybacks; therefore, the higher capital gains taxes will apply to such transactions that do not include STT. | |||

| ==={{anchor|Contemporary times}}Present day=== | |||

| Stock options are only taxed at the time of exercise. For companies listed in Indian stock exchanges, the tax is calculated as regular capital gains with the rules above; purchase dates and prices are as per the time of grant. For companies abroad, the tax liability is 20% of such gains (since STT is not paid). | |||

| The 1922 act was amended twenty-nine times between 1939 and 1956. A tax on ]s was imposed in 1946, and the concept of capital gains has been amended a number of times.<ref name="shodhganga" /> In 1956, ] was appointed to investigate the Indian tax system in light of the ] revenue requirement. He submitted an extensive report for a coordinated tax system, and several taxation acts were enacted: ], the ], and the ].<ref name="shodhganga" /> | |||

| The Direct Taxes Administration Enquiry Committee, under the chairmanship of ], submitted its report on 30 November 1959 and its recommendations took shape in ]. The act, which became effective on 1 April 1962, replaced the Indian Income Tax Act, 1922. Current income-tax law is governed by the 1961 act, which has 298 sections and four schedules.<ref name="shodhganga" /> | |||

| === Income Exempt from Tax === | |||

| ==== Dividends ==== | |||

| Dividends paid by Companies and Mutual Funds are exempt from tax. A 12% dividend distribution tax is paid by companies before distribution. Equity mutual funds (with more than 65% of assets invested in equities) do not pay a dividend distribution tax, through other funds do. | |||

| The Direct Taxes Code Bill was sponsored in ] on 30 August 2010 by the ] to replace the Income Tax Act, 1961 and the Wealth Tax Act.<ref>{{citation |title=Impact of DTC on India Inc |url=http://www.thehindubusinessline.com/todays-paper/tp-mentor/article1015598.ece |work=] |date=6 September 2010 }}</ref> The bill could not pass, however, and lapsed after revocation of the Wealth Tax Act in 2015. | |||

| ==== Other Exempt Income ==== | |||

| The Indian Income tax act specifically exempts certain income from tax: | |||

| * Money received from an Insurance company as proceeds of an insurance policy (by way of an insurance claim, or by maturity) is exempt. | |||

| * Maturity proceeds of a Public Provident Fund (PPF) account. | |||

| =={{anchor|Amnesty scheme}}Amnesty== | |||

| === Deductions === | |||

| In its ], the government of India allowed taxpayers to declare previously-undisclosed income and pay a one-time 45-percent tax. Declarations totaled 64,275, netting {{INRConvert|652.5|b}}.<ref>{{citation |url=http://economictimes.indiatimes.com/news/economy/finance/black-money-haul-rs-65250-crore-collected-through-income-declaration-scheme/articleshow/54626799.cms |title=Black money haul: Rs 65,250 crore collected through Income Declaration Scheme |work=] |date=1 October 2016 |access-date=1 October 2016 |archive-date=4 October 2016 |archive-url=https://web.archive.org/web/20161004162943/http://economictimes.indiatimes.com/news/economy/finance/Black-money-haul-Rs-65250-crore-collected-through-Income-Declaration-Scheme/articleshow/54626799.cms |url-status=live }}</ref> | |||

| ==== Section 80 C Deductions ==== | |||

| Section 80C of the Income Tax Act allows certain investments and expenditure to be tax-exempt. The total limit under this section is Rs. 100,000 (Rs. 1 lakh) which can be any combination of the below: | |||

| == {{anchor|Charge to income tax}}New Tax Regime == | |||

| * Contribution to Provident Fund or Public Provident Fund | |||

| The ] was announced for individuals & HUF in Budget 2020 and became effective from financial year 2020-21. According to it, individuals can opt for reduced tax rates with no option for claiming exemptions & deductions. Currently, Indian taxpayers can choose between the old tax regime and the new tax regime.<ref>{{Cite web |title=Union Budget 2023: New vs Old Tax Regime - See What Has Changed |url=https://www.ndtv.com/business/union-budget-2023-new-vs-old-tax-regime-see-what-has-changed-3742620 |access-date=2023-02-01 |website=NDTV.com |archive-date=1 February 2023 |archive-url=https://web.archive.org/web/20230201142545/https://www.ndtv.com/business/union-budget-2023-new-vs-old-tax-regime-see-what-has-changed-3742620 |url-status=live }}</ref> | |||

| * Payment of ] premium | |||

| * Investment in ] Plans | |||

| * Investment in Equity Linked Savings schemes (ELSS) of mutual funds | |||

| * Investment in specified government infrastructure bonds | |||

| * Investment in National Savings Certificates (interest of past NSCs is reinvested every year and can be added to the Section 80C limit) | |||

| * Payments towards principal repayment of housing loans. | |||

| * Payments towards education fees for children. | |||

| At the time of introduction, it had 7 different slabs. After three years from introduction, Indian Government reduced both the slab count & tax rates under New Tax Regime in Budget 2023, after reports of poor adoption to new tax regime by tax payers<ref>{{Cite web |date=January 24, 2023 |title=Why hasn't the new tax regime taken off? |url=https://timesofindia.indiatimes.com/business/india-business/why-hasnt-the-new-tax-regime-taken-off/articleshow/97279229.cms |access-date=2023-02-01 |website=The Times of India |language=en |archive-date=1 February 2023 |archive-url=https://web.archive.org/web/20230201142546/https://timesofindia.indiatimes.com/business/india-business/why-hasnt-the-new-tax-regime-taken-off/articleshow/97279229.cms |url-status=live }}</ref> | |||

| ==== Interest on Housing Loans ==== | |||

| Payment of interest on a housing loan up to Rs. 150,000 per year is exempt from tax. However, this is only applicable for a residence constructed within three financial years after the loan is taken. | |||

| =={{anchor|Charge to income tax}}Tax brackets== | |||

| ==== Rent received ==== | |||

| For the assessment year 2016–17, individuals earning up to {{INRConvert|2.5|l}} were exempt from income tax.<ref>{{citation |title=All you need to know about Income Tax Returns for AY 2016–17 |url=http://www.dnaindia.com/money/report-all-you-need-to-know-about-income-tax-returns-for-ay-2016-17-2202887 |work=] |date=16 April 2016 |access-date=24 April 2016 |archive-date=20 April 2016 |archive-url=https://web.archive.org/web/20160420052305/http://www.dnaindia.com/money/report-all-you-need-to-know-about-income-tax-returns-for-ay-2016-17-2202887 |url-status=live }}</ref> About one percent of the population, the ], falls under the 30-percent slab. It increased by an average of 22 percent from 2000 to 2010, encompassing 580,000 income-tax payers. The ], who fall under the 10- and 20-percent slabs, grew by an average of seven percent annually to 2.78 million income-tax payers.<ref name="financialexpress.com">{{cite web|url=http://www.financialexpress.com/news/evasion-of-personal-tax-dips-to-59-of-mopup/1096336|title=Evasion of personal tax dips to 59% of mop-up|author=Santosh Tiwari|work=The Financial Express|access-date=19 April 2014|archive-date=19 April 2014|archive-url=https://web.archive.org/web/20140419155434/http://www.financialexpress.com/news/evasion-of-personal-tax-dips-to-59-of-mopup/1096336|url-status=live}}</ref> | |||

| 30% of rent received (or annual rental value) from an owned property is exempt from tax. | |||

| == Agricultural income == | |||

| According to section 10(1) of the Act, agricultural income is tax-exempt. Section 2(1A) defines agricultural income as: | |||

| A 10% surcharge (tax on tax) is applicable for incomes above Rs. 10 lakh (Rs. 1 million). Deductions and rebates are provided for housing purchases, rent, long term savings and insurance. | |||

| * Rent or revenue derived from land in India which is used for agricultural purposes | |||

| * Income derived from such land by agricultural operations, including the processing of agricultural produce, raised or received as rent-in-kind, for the market or for sale | |||

| * Income attributable to a farm house, subject to conditions | |||

| * Income derived from saplings or seedlings grown in a nursery | |||

| === {{anchor|Income partly agricultural and partly business activities}}Mixed agricultural and business income === | |||

| == Education Cess == | |||

| Income in the activities below is initially computed as business income, after permissible deductions. Thereafter, 40, 35 or 25 percent of the income is treated as business income and the rest is treated as agricultural income. | |||

| All taxes in India are subject to an education cess, which is 2% of the total tax payable. | |||

| {| class="wikitable" | |||

| |- | |||

| ! Income !! Business income !! Agricultural income | |||

| |- | |||

| | Growing and manufacturing tea in India || 40% || 60% | |||

| |-wrong | |||

| | Sale of ], latex-based ] or brown crepe manufactured from field latex or coalgum obtained from rubber plants grown by a seller in India || 35% || 65% | |||

| == Corporate Income tax == | |||

| |- | |||

| For companies, income is taxed at a flat rate of 30% for Indian companies, with a 12% surcharge applied on the tax paid , . Foreign companies pay 40%.<ref></ref>.An education cess of 2% (on both the tax and the surcharge) are payable, yielding effective tax rates of 33.66% for domestic companies and 40.8% for foreign companies. | |||

| | Sale of coffee grown and cured by an Indian seller|| 25% || 75% | |||

| |- | |||

| | Sale of coffee grown, cured, roasted and ground by an Indian seller|| 40% || 60% | |||

| |} | |||

| == {{anchor|Permissible deductions from gross total income}}Deductions == | |||

| From 2005-06, electronic filing of company returns is mandatory.<ref></ref> | |||

| These are permissible deductions according to the Finance Act, 2015: | |||

| *§80C – Up to {{INR}} 150,000: | |||

| **] (VPF) | |||

| **] (PPF) | |||

| **Life-insurance premiums | |||

| **] (ELSS) | |||

| **Home-loan principal repayment | |||

| **Stamp duty and registration fees for a home | |||

| **] | |||

| **] (NSC) (VIII Issue) | |||

| **Infrastructure bonds | |||

| *§80CCC{{snd}}] annuity premiums up to {{INR}} 150,000 | |||

| *§80CCD – Employee pension contributions, up to 10 percent of salary | |||

| *§80CCG – Rajiv Gandhi Equity Savings Scheme, 2013: 50 percent of investment or ₹25,000 (whichever is lower), up to {{INR}} 50,000 | |||

| *§80D – Medical-insurance premium, up to {{INR}} 25,000 for self/family and up to {{INR}} 15,000 for parents (up to {{INR}} 50,000 for senior citizens); premium cannot be paid in cash. | |||

| *§80DD – Expenses for medical treatment (including nursing), training and rehabilitation of a permanently-disabled dependent, up to {{INR}} 75,000 ({{INR}} 1,25,000 for a severe disability, as defined by law) | |||

| *§80DDB – Medical expenses, up to {{INR}} 40,000 ({{INR}} 100,000 for senior citizens) | |||

| *§80E – Student-loan interest | |||

| *§80EE – Home-loan interest (up to 100,000 on a loan up to {{INR}} 2.5 million) | |||

| *§80G – Charitable contributions (50 or 100 percent) | |||

| *§80GG – Rent minus 10 percent of income, up to {{INR}} 5,000 per month or 25 percent of income (whatever is less)<ref>{{Cite web|url=https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx|title=Tax Laws & Rules > Acts > Income-tax Act, 1961|website=www.incometaxindia.gov.in|access-date=2019-11-01|archive-date=10 May 2018|archive-url=https://web.archive.org/web/20180510050651/https://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx|url-status=live}}</ref> | |||

| *§80TTA – Interest on savings, up to {{INR}} 10,000 | |||

| *§80TTB – ] interest for senior citizens, up to {{INR}} 50,000 | |||

| *80U – Certified-disability deduction ({{INR}} 75,000; {{INR}} 125,000 for a severe disability) | |||

| *§87A – Rebate (up to {{INR}} 12,500) for individuals with income up to {{INR}} 5,00,000 | |||

| *80RRB – Certified royalties on a patent registered on or after 1 April 2003, up to {{INR}} 300,000 | |||

| *§80QQB – Certified book royalties (except textbooks), up to {{INR}} 300,000 | |||

| == {{anchor|Due date of submission of return}}Due dates == | |||

| ==References== | |||

| The due date for a return is: | |||

| <!-- ---------------------------------------------------------- | |||

| *31 October of the ] - Companies without international transactions, entities requiring auditing, or partners of an audited firm | |||

| See http://en.wikipedia.org/Wikipedia:Footnotes for a | |||

| *30 November - Companies without international transactions | |||

| discussion of different citation methods and how to generate | |||

| *31 July – All other filers | |||

| footnotes using the <ref>, </ref> and <reference /> tags | |||

| ----------------------------------------------------------- --> | |||

| Individuals with an income of less than ₹500,000 (less than ₹10,000 of which is from interest) who have not changed jobs are exempt from income tax.<ref name="caclub-efiling-ay2013-14">{{cite web|url=http://www.caclubindia.com/articles/e-filing-is-mandatory-income-is-more-than-5-lacs-17646.asp|title=E-Filing is mandatory Income is more than 5 lacs|work=CA club india|access-date=14 July 2013|archive-date=29 June 2013|archive-url=https://web.archive.org/web/20130629021727/http://www.caclubindia.com/articles/e-filing-is-mandatory-income-is-more-than-5-lacs-17646.asp|url-status=live}}</ref> Although individual and HUF taxpayers must file their income-tax returns online, ]s are not required.<ref name="caclub-efiling-ay2013-14"/> | |||

| <div class="references-small"> | |||

| <references /> | |||

| == Advance tax == | |||

| </div> | |||

| The practice of paying taxes in advance rather than in a single sum at the end of the fiscal year is known as advance tax. These taxes, often known as the 'pay-as-you-earn' scheme, is paid on tax bills above ₹10,000 in installments instead of as a lump sum. The schedule of advance tax payment for individual and corporate taxpayers are: | |||

| *On or before 15 June – 15 percent of advance tax liability | |||

| *On or before 15 September – 45 percent of advance tax liability | |||

| *On or before 15 December – 75 percent of advance tax liability | |||

| *On or before 15 March – 100 percent of advance tax liability | |||

| === Amendments due to COVID-19 === | |||

| There was no change in the timeline for tax payment; however, if the deposit of Advance Tax is delayed, a reduced interest rate of 9 percent per annum, or 0.75 percent per month,<ref>{{Cite web|title=Tax relief for industries affected by Coronavirus|url=http://pib.gov.in/Pressreleaseshare.aspx?PRID=1704880|access-date=2021-06-16|website=pib.gov.in|archive-date=27 June 2021|archive-url=https://web.archive.org/web/20210627205048/https://pib.gov.in/Pressreleaseshare.aspx?PRID=1704880|url-status=live}}</ref> will be applicable instead of the current rate of 12 percent per annum, or 1 percent, for payment of all taxes falling between 20 March 2020 and 30 June 2020. | |||

| == {{anchor|Tax deducted at source (TDS)}}Tax deduction at source == | |||

| Income tax is also paid by ] (TDS): | |||

| {| class="wikitable" | |||

| |- | |||

| ! Section !! Payment !! TDS threshold !! TDS | |||

| |- | |||

| | 192 || Salary || Exemption limit || As specified in Part III of I Schedule | |||

| |- | |||

| | 193 || Interest on ] || Subject to provisions || 10% | |||

| |- | |||

| | 194A || Other interest || Banks – ₹10,000 (under age 60); {{INR}} 50,000 (over 60). All other interest – ₹5,000 || 10% | |||

| |- | |||

| | 194B || Lottery winnings|| ₹10,000 || 30% | |||

| |- | |||

| | 194BB || Horse-racing winnings || ₹10,000 || 30% | |||

| |- | |||

| | 194C || Payment to resident contractors || ₹30,000 (single contract); ₹100,000 (multiple contracts) || 2% (companies); 1% otherwise | |||

| |- | |||

| | 194D || Insurance commission || ₹15,000 || 5% (individual), 10% (domestic companies) | |||

| |- | |||

| | 194DA || Life-insurance payment || ₹100,000 || 1% | |||

| |- | |||

| | 194E || Payment to non-resident sportsmen or sports association || Not applicable || 20% | |||

| |- | |||

| | 194EE || Payment of deposit under National Savings Scheme || ₹2,500 || 10% | |||

| |- | |||

| | 194F || Repurchase of unit by Mutual Fund or Unit Trust of India || Not applicable || 20% | |||

| |- | |||

| | 194G || Commission on sale of lottery tickets || ₹15,000 || 5% | |||

| |- | |||

| | 194H || Brokerage commission || ₹15,000 || 2% | |||

| |- | |||

| | 194-I || Rents || ₹180,000 || 2% (plant, machinery, equipment), 10% (land, building, furniture) | |||

| |- | |||

| | 194IA || Purchase of immovable property || ₹5,000,000 || 1% | |||

| |- | |||

| | 194IB || Rent by individual or HUF not liable to tax audit||₹50,000 || 5% | |||

| |- | |||

| | 194J ||Professional or technical services, royalties || ₹30,000 || 10% | |||

| |- | |||

| | 194LA || Compensation on acquisition of certain immovable property || ₹250,000 || 10% | |||

| |- | |||

| | 194LB || Interest paid by Infrastructure Development Fund under section 10(47) to non-resident or foreign company || – || 5% | |||

| |- | |||

| | 194LC || Interest paid by Indian company or business trust on money borrowed in foreign currency under a loan agreement or long-term bonds || – || 5% | |||

| |- | |||

| | 195 || Interest or other amounts paid to non-residents or a foreign company (except under §115O)|| As computed by assessing officer on application under §195(2) or 195(3) || Avoiding ] | |||

| |} | |||

| == {{anchor|Corporate income tax}}Corporate tax == | |||

| ] | |||

| The tax rate is 25 percent for domestic companies. For new companies incorporated after 1 October 2019 and beginning production before 31 March 2023, the tax rate is 15 percent. Both rates apply only if a company claims no exemptions or concessions. | |||

| For foreign companies, the tax rate is 40 percent (50 percent on royalties and technical services). Surcharges and ]es, including a four-percent health-and-education cess, are levied on the flat rate.<ref>{{cite web|url=http://businesssetup.in/blog/view/Income-Tax-rates-for-Companies|title=Income Tax rates for Companies|work=businesssetup.in|access-date=12 May 2015|archive-date=18 May 2015|archive-url=https://web.archive.org/web/20150518123059/http://businesssetup.in/blog/view/Income-Tax-rates-for-Companies|url-status=live}}</ref> Electronic filing is mandatory.<ref>{{Cite web |url=http://incometaxindiaefiling.gov.in/download/Circular%20No.9-2006.pdf |title=Corporate taxpayers must file electronically, point 4 of I T circular. |access-date=22 November 2006 |archive-url=https://web.archive.org/web/20070104125508/http://incometaxindiaefiling.gov.in/download/Circular%20No.9-2006.pdf |archive-date=4 January 2007 |url-status=dead }}</ref> | |||

| === {{anchor|Surcharge}}Surcharges === | |||

| Non-corporate taxpayers pay a 10-percent surcharge on income between {{INR}} 5 million and {{INR}} 10 million. There is a 15-percent surcharge on income over {{INR}} 10 million. Domestic companies pay seven percent on taxable income between {{INR}} 10 million and {{INR}} 100 million, and 12 percent on income over {{INR}} 100 million. Foreign companies pay two percent on income between {{INR}} 10 million and {{INR}} 100 million, and five percent on income over {{INR}} 100 million. | |||

| == {{anchor|Categories}}Tax returns == | |||

| There are four types of income-tax returns: | |||

| *Normal return (§139(1)) – Individuals with an income above {{INR}} 250,000 (under age 60), {{INR}} 300,000 (age 60 years to 79 years), or {{INR}} 500,000 (over 80) must file a return. Due dates vary. | |||

| *A belated return, under §139(4), may be filed before the end of the assessment year. | |||

| *A revised return, under §139(5), may be filed for a normal or belated return by the end of the assessment year. | |||

| *An assessing officer may flag a defective return under §139(9). Defects must be rectified by the taxpayer within 15 days of notification. | |||

| == {{anchor|Annual information return|Statements by producers|Statements by non-resident having a liaison office in India}}Annual information return and statements == | |||

| Those responsible for registering or maintaining accounting books or other documents with a record of any specified financial transaction<ref>{{cite web|title=Annual Information return|url=http://www.accounting-n-taxation.com/Annual-Information-Return.html#nature|access-date=17 September 2012|archive-date=25 August 2012|archive-url=https://web.archive.org/web/20120825201558/http://www.accounting-n-taxation.com/Annual-Information-Return.html#nature|url-status=live}}</ref> must file an annual information return (Form No. 61A). Producers of a cinematographic film during the financial year must file a statement (Form No. 52A) within 30 days of the end of the financial year or within 30 days of the end of production, whichever is earlier. Non-residents with a liaison office in India must deliver Form No. 49A to the assessing officer within sixty days of the end of the financial year. | |||

| == {{anchor|Income tax rates for individuals|Income Tax Rates for Financial Year 2017–2018}}Finance Act, 2021 == | |||

| In the Finance Act, 2021, the government has introduced the following changes on the Income Tax Act, 1961: | |||

| * Amendments for taxation of income arising from Firm/AOP/BOI; | |||

| * Increased tax Incentives for International Finance Service Centre; | |||

| * Denial of depreciation on Goodwill; | |||

| * Full value of consideration for computation of capital gains on slump sale to be at Fair Value; | |||

| * Enhancement of Limit for Tax Audit; and | |||

| * Definition of the word "Liable to Tax" is introduced. | |||

| =={{anchor|Assessments}}Assessment== | |||

| Self-assessment is done on a taxpayer's ]. The department assesses tax under section 143(3) (scrutiny), 144 (best judgement), 147 (income escaping assessment) and 153A (search and seizure). Notices for such assessments are issued under sections 143(2), 148 and 153A, respectively. Time limits are prescribed in section 153.<ref>{{citation |title=Readers' Corner: Taxation |url=http://wap.business-standard.com/article/pf/readers-corner-taxation-116032700682_1.html |work=] |date=27 March 2016 |last1=Kumar |first1=Kuldip |access-date=24 April 2016 |archive-date=6 May 2016 |archive-url=https://web.archive.org/web/20160506001456/http://wap.business-standard.com/article/pf/readers-corner-taxation-116032700682_1.html |url-status=live }}</ref> | |||

| == {{anchor|Tax penalties}}Penalties == | |||

| Penalties can be levied under §271(1)(c)<ref>{{Cite web |url=http://law.incometaxindia.gov.in/DIT/File_opener.aspx?page=ITAC&schT=&csId=cfe34160-c33a-4b5b-a08e-a9738122b797&rdb=sec&yr=e5be6bdb-1fc4-42d6-ac7b-34a44fd65485&sec=271&sch=&title=Taxmann%20-%20Direct%20Tax%20Laws |title=Section 271 of India IT Act |access-date=17 September 2012 |archive-date=14 October 2013 |archive-url=https://web.archive.org/web/20131014071430/http://law.incometaxindia.gov.in/DIT/File_opener.aspx?page=ITAC&schT=&csId=cfe34160-c33a-4b5b-a08e-a9738122b797&rdb=sec&yr=e5be6bdb-1fc4-42d6-ac7b-34a44fd65485&sec=271&sch=&title=Taxmann%20-%20Direct%20Tax%20Laws |url-status=live }}</ref> for concealing or misrepresenting income. Penalties may range from 100 to 300 percent of the tax evaded. Under-reporting or misreporting income is penalized under §270A. Penalties are 50 percent of the tax on under-reported income and 200 percent of the tax on misreported income. Late fees are payable under §234F. | |||

| == See also == | |||

| * ] | |||

| == References == | |||

| {{Reflist}} | |||

| == External links == | == External links == | ||

| * {{Official website}} | |||

| * | |||

| * | |||

| {{DEFAULTSORT:Income Tax In India}} | |||

| ] | ] | ||

| ] | |||

Latest revision as of 16:14, 24 November 2024

Form of taxation in India| This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. Find sources: "Income tax in India" – news · newspapers · books · scholar · JSTOR (April 2016) (Learn how and when to remove this message) |

Central Revenue collections in 2007–08

Personal income tax (17.43%) Corporate taxes (33.99%) Other taxes (2.83%) Excise taxes (20.84%) Customs duties (17.46%) Other taxes (8.68%) other taxes (11.96%)Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India, empowering the central government to tax non-agricultural income; agricultural income is defined in Section 10(1) of the Income-tax Act, 1961. Income-tax law consists of the 1961 act, Income Tax Rules 1962, Notifications and Circulars issued by the Central Board of Direct Taxes (CBDT), annual Finance Acts, and judicial pronouncements by the Supreme and high courts.

The government taxes certain income of individuals, Hindu Undivided Families (HUF's), companies, firms, LLPs, associations, bodies, local authorities and any other juridical person. Personal tax depends on residential status. The CBDT administers the Income Tax Department, which is part of the Ministry of Finance's Department of Revenue. Income tax is a key source of government funding.

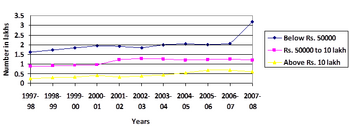

The Income Tax Department is the central government's largest revenue generator; total tax revenue increased from ₹1,392.26 billion (US$17 billion) in 1997–98 to ₹5,889.09 billion (US$71 billion) in 2007–08. In 2018–19, direct tax collections reported by the CBDT were about ₹11.17 lakh crore (₹11.17 trillion).

History

Ancient times

Taxation has been a function of sovereign states since ancient times. The earliest archaeological evidence of taxation in India is found in Ashoka's pillar inscription at Lumbini. According to the inscription, tax relief was given to the people of Lumbini (who paid one-eighth of their income, instead of one-sixth).

In the Manusmriti, Manu says that the king has the sovereign power to levy and collect tax according to Shastra:

लोके च करादिग्रहणो शास्त्रनिष्ठः स्यात् । — Manu, Sloka 128, Manusmriti ("It is in accordance with Sastra to collect taxes from citizens.")

The Baudhayana sutras note that the king received one-sixth of the income from his subjects, in return for protection. According to Kautilya's Arthashastra (a treatise on economics, the art of governance and foreign policy), artha is not only wealth; a government's power depended on the strength of its treasury: "From the treasury comes the power of the government, and the earth, whose ornament is the treasury, is acquired by means of the treasury and army." Kalidasa's Raghuvamsha, eulogizing King Dilipa, says: "it was only for the good of his subjects that he collected taxes from them just as the sun draws moisture from the earth to give it back a thousand time."

19th and early 20th centuries

British rule in India became established during the 19th century. After the Mutiny of 1857, the British government faced an acute financial crisis. To fill the treasury, the first Income-tax Act was introduced in February 1860 by Sir James Wilson (British India's first finance minister). The act received the assent of the Viceroy on 24 July 1860, and came into effect immediately. It was divided into 21 parts, with 259 sections. Income was classified in four schedules: i) income from landed property; ii) income from professions and trade; iii) income from securities, annuities and dividends, and iv) income from salaries and pensions. Agricultural income was taxable.

A number of laws were enacted to streamline the income-tax laws; the Super-Rich Tax and a new Income-tax Act were passed in 1918. The Act of 1922 significantly changed the Act of 1918 by shifting income-tax administration from the provincial to the central government. Another notable feature of the act was that the rules would be outlined by annual Finance Acts instead of the act itself. A new Income-tax Act was passed in 1939.

Present day

The 1922 act was amended twenty-nine times between 1939 and 1956. A tax on capital gains was imposed in 1946, and the concept of capital gains has been amended a number of times. In 1956, Nicholas Kaldor was appointed to investigate the Indian tax system in light of the Second Five-Year Plan's revenue requirement. He submitted an extensive report for a coordinated tax system, and several taxation acts were enacted: the wealth-tax Act 1957, the Expenditure Tax Act, 1957, and the Gift Tax Act, 1958.

The Direct Taxes Administration Enquiry Committee, under the chairmanship of Mahavir Tyagi, submitted its report on 30 November 1959 and its recommendations took shape in the Income-tax Act, 1961. The act, which became effective on 1 April 1962, replaced the Indian Income Tax Act, 1922. Current income-tax law is governed by the 1961 act, which has 298 sections and four schedules.

The Direct Taxes Code Bill was sponsored in Parliament on 30 August 2010 by the finance minister to replace the Income Tax Act, 1961 and the Wealth Tax Act. The bill could not pass, however, and lapsed after revocation of the Wealth Tax Act in 2015.

Amnesty

In its income declaration scheme, 2016, the government of India allowed taxpayers to declare previously-undisclosed income and pay a one-time 45-percent tax. Declarations totaled 64,275, netting ₹652.5 billion (US$7.8 billion).

New Tax Regime

The New Tax Regime was announced for individuals & HUF in Budget 2020 and became effective from financial year 2020-21. According to it, individuals can opt for reduced tax rates with no option for claiming exemptions & deductions. Currently, Indian taxpayers can choose between the old tax regime and the new tax regime.

At the time of introduction, it had 7 different slabs. After three years from introduction, Indian Government reduced both the slab count & tax rates under New Tax Regime in Budget 2023, after reports of poor adoption to new tax regime by tax payers

Tax brackets

For the assessment year 2016–17, individuals earning up to ₹2.5 lakh (US$3,000) were exempt from income tax. About one percent of the population, the upper class, falls under the 30-percent slab. It increased by an average of 22 percent from 2000 to 2010, encompassing 580,000 income-tax payers. The middle class, who fall under the 10- and 20-percent slabs, grew by an average of seven percent annually to 2.78 million income-tax payers.

Agricultural income

According to section 10(1) of the Act, agricultural income is tax-exempt. Section 2(1A) defines agricultural income as:

- Rent or revenue derived from land in India which is used for agricultural purposes

- Income derived from such land by agricultural operations, including the processing of agricultural produce, raised or received as rent-in-kind, for the market or for sale

- Income attributable to a farm house, subject to conditions

- Income derived from saplings or seedlings grown in a nursery

Mixed agricultural and business income

Income in the activities below is initially computed as business income, after permissible deductions. Thereafter, 40, 35 or 25 percent of the income is treated as business income and the rest is treated as agricultural income.

| Income | Business income | Agricultural income |

|---|---|---|

| Growing and manufacturing tea in India | 40% | 60% |

| Sale of latex, latex-based crepe or brown crepe manufactured from field latex or coalgum obtained from rubber plants grown by a seller in India | 35% | 65% |

| Sale of coffee grown and cured by an Indian seller | 25% | 75% |

| Sale of coffee grown, cured, roasted and ground by an Indian seller | 40% | 60% |

Deductions

These are permissible deductions according to the Finance Act, 2015:

- §80C – Up to ₹ 150,000:

- Provident and Voluntary Provident Funds (VPF)

- Public Provident Fund (PPF)

- Life-insurance premiums

- Equity-Linked Savings Scheme (ELSS)

- Home-loan principal repayment

- Stamp duty and registration fees for a home

- Sukanya Samriddhi Account

- National Savings Certificate (NSC) (VIII Issue)

- Infrastructure bonds

- §80CCC – Life Insurance Corporation annuity premiums up to ₹ 150,000

- §80CCD – Employee pension contributions, up to 10 percent of salary

- §80CCG – Rajiv Gandhi Equity Savings Scheme, 2013: 50 percent of investment or ₹25,000 (whichever is lower), up to ₹ 50,000

- §80D – Medical-insurance premium, up to ₹ 25,000 for self/family and up to ₹ 15,000 for parents (up to ₹ 50,000 for senior citizens); premium cannot be paid in cash.

- §80DD – Expenses for medical treatment (including nursing), training and rehabilitation of a permanently-disabled dependent, up to ₹ 75,000 (₹ 1,25,000 for a severe disability, as defined by law)

- §80DDB – Medical expenses, up to ₹ 40,000 (₹ 100,000 for senior citizens)

- §80E – Student-loan interest

- §80EE – Home-loan interest (up to 100,000 on a loan up to ₹ 2.5 million)

- §80G – Charitable contributions (50 or 100 percent)

- §80GG – Rent minus 10 percent of income, up to ₹ 5,000 per month or 25 percent of income (whatever is less)

- §80TTA – Interest on savings, up to ₹ 10,000

- §80TTB – Time deposit interest for senior citizens, up to ₹ 50,000

- 80U – Certified-disability deduction (₹ 75,000; ₹ 125,000 for a severe disability)

- §87A – Rebate (up to ₹ 12,500) for individuals with income up to ₹ 5,00,000

- 80RRB – Certified royalties on a patent registered on or after 1 April 2003, up to ₹ 300,000

- §80QQB – Certified book royalties (except textbooks), up to ₹ 300,000

Due dates

The due date for a return is:

- 31 October of the assessment year - Companies without international transactions, entities requiring auditing, or partners of an audited firm

- 30 November - Companies without international transactions

- 31 July – All other filers

Individuals with an income of less than ₹500,000 (less than ₹10,000 of which is from interest) who have not changed jobs are exempt from income tax. Although individual and HUF taxpayers must file their income-tax returns online, digital signatures are not required.

Advance tax

The practice of paying taxes in advance rather than in a single sum at the end of the fiscal year is known as advance tax. These taxes, often known as the 'pay-as-you-earn' scheme, is paid on tax bills above ₹10,000 in installments instead of as a lump sum. The schedule of advance tax payment for individual and corporate taxpayers are:

- On or before 15 June – 15 percent of advance tax liability

- On or before 15 September – 45 percent of advance tax liability

- On or before 15 December – 75 percent of advance tax liability

- On or before 15 March – 100 percent of advance tax liability

Amendments due to COVID-19

There was no change in the timeline for tax payment; however, if the deposit of Advance Tax is delayed, a reduced interest rate of 9 percent per annum, or 0.75 percent per month, will be applicable instead of the current rate of 12 percent per annum, or 1 percent, for payment of all taxes falling between 20 March 2020 and 30 June 2020.

Tax deduction at source

Income tax is also paid by tax deduction at source (TDS):

| Section | Payment | TDS threshold | TDS |

|---|---|---|---|

| 192 | Salary | Exemption limit | As specified in Part III of I Schedule |

| 193 | Interest on securities | Subject to provisions | 10% |

| 194A | Other interest | Banks – ₹10,000 (under age 60); ₹ 50,000 (over 60). All other interest – ₹5,000 | 10% |

| 194B | Lottery winnings | ₹10,000 | 30% |

| 194BB | Horse-racing winnings | ₹10,000 | 30% |

| 194C | Payment to resident contractors | ₹30,000 (single contract); ₹100,000 (multiple contracts) | 2% (companies); 1% otherwise |

| 194D | Insurance commission | ₹15,000 | 5% (individual), 10% (domestic companies) |

| 194DA | Life-insurance payment | ₹100,000 | 1% |

| 194E | Payment to non-resident sportsmen or sports association | Not applicable | 20% |

| 194EE | Payment of deposit under National Savings Scheme | ₹2,500 | 10% |

| 194F | Repurchase of unit by Mutual Fund or Unit Trust of India | Not applicable | 20% |

| 194G | Commission on sale of lottery tickets | ₹15,000 | 5% |

| 194H | Brokerage commission | ₹15,000 | 2% |

| 194-I | Rents | ₹180,000 | 2% (plant, machinery, equipment), 10% (land, building, furniture) |

| 194IA | Purchase of immovable property | ₹5,000,000 | 1% |

| 194IB | Rent by individual or HUF not liable to tax audit | ₹50,000 | 5% |

| 194J | Professional or technical services, royalties | ₹30,000 | 10% |

| 194LA | Compensation on acquisition of certain immovable property | ₹250,000 | 10% |

| 194LB | Interest paid by Infrastructure Development Fund under section 10(47) to non-resident or foreign company | – | 5% |

| 194LC | Interest paid by Indian company or business trust on money borrowed in foreign currency under a loan agreement or long-term bonds | – | 5% |

| 195 | Interest or other amounts paid to non-residents or a foreign company (except under §115O) | As computed by assessing officer on application under §195(2) or 195(3) | Avoiding double taxation |

Corporate tax

The tax rate is 25 percent for domestic companies. For new companies incorporated after 1 October 2019 and beginning production before 31 March 2023, the tax rate is 15 percent. Both rates apply only if a company claims no exemptions or concessions.

For foreign companies, the tax rate is 40 percent (50 percent on royalties and technical services). Surcharges and cesses, including a four-percent health-and-education cess, are levied on the flat rate. Electronic filing is mandatory.

Surcharges

Non-corporate taxpayers pay a 10-percent surcharge on income between ₹ 5 million and ₹ 10 million. There is a 15-percent surcharge on income over ₹ 10 million. Domestic companies pay seven percent on taxable income between ₹ 10 million and ₹ 100 million, and 12 percent on income over ₹ 100 million. Foreign companies pay two percent on income between ₹ 10 million and ₹ 100 million, and five percent on income over ₹ 100 million.

Tax returns

There are four types of income-tax returns:

- Normal return (§139(1)) – Individuals with an income above ₹ 250,000 (under age 60), ₹ 300,000 (age 60 years to 79 years), or ₹ 500,000 (over 80) must file a return. Due dates vary.

- A belated return, under §139(4), may be filed before the end of the assessment year.

- A revised return, under §139(5), may be filed for a normal or belated return by the end of the assessment year.

- An assessing officer may flag a defective return under §139(9). Defects must be rectified by the taxpayer within 15 days of notification.

Annual information return and statements

Those responsible for registering or maintaining accounting books or other documents with a record of any specified financial transaction must file an annual information return (Form No. 61A). Producers of a cinematographic film during the financial year must file a statement (Form No. 52A) within 30 days of the end of the financial year or within 30 days of the end of production, whichever is earlier. Non-residents with a liaison office in India must deliver Form No. 49A to the assessing officer within sixty days of the end of the financial year.

Finance Act, 2021

In the Finance Act, 2021, the government has introduced the following changes on the Income Tax Act, 1961:

- Amendments for taxation of income arising from Firm/AOP/BOI;

- Increased tax Incentives for International Finance Service Centre;

- Denial of depreciation on Goodwill;

- Full value of consideration for computation of capital gains on slump sale to be at Fair Value;

- Enhancement of Limit for Tax Audit; and

- Definition of the word "Liable to Tax" is introduced.

Assessment

Self-assessment is done on a taxpayer's return. The department assesses tax under section 143(3) (scrutiny), 144 (best judgement), 147 (income escaping assessment) and 153A (search and seizure). Notices for such assessments are issued under sections 143(2), 148 and 153A, respectively. Time limits are prescribed in section 153.

Penalties

Penalties can be levied under §271(1)(c) for concealing or misrepresenting income. Penalties may range from 100 to 300 percent of the tax evaded. Under-reporting or misreporting income is penalized under §270A. Penalties are 50 percent of the tax on under-reported income and 200 percent of the tax on misreported income. Late fees are payable under §234F.

See also

References

- Compiled from Comptroller and Auditor General of India reports.

- Institute of Chartered Accountants of India (2011). Taxation. ISBN 978-81-8441-290-1.

- "Growth of Income Tax revenue in India" (PDF). Archived (PDF) from the original on 27 February 2012. Retrieved 16 November 2012.

- "Home – Central Board of Direct Taxes, Government of India". Incometaxindia.gov.in. Archived from the original on 2 December 2015. Retrieved 18 April 2018.

- "Total direct tax collections for FY18-19 fall short by Rs 83,000 crore". Moneycontrol.com. 2 April 2019. Archived from the original on 5 June 2020. Retrieved 22 August 2020.

- Hultzsch, E. (1925). Inscriptions of Asoka. Oxford: Clarendon Press, pp. 164–165

- ^ Jha S M (1990). "Taxation and Indian Economy". New Delhi: Deep and Deep Publications.

{{cite book}}: CS1 maint: numeric names: authors list (link) - ^ "The evolution of income-tax". thehindubusinessline.com. Archived from the original on 4 August 2019. Retrieved 4 August 2019.

- ^ "Evolution of Income Tax System in India" (PDF). Shodhganga. Archived (PDF) from the original on 7 July 2020. Retrieved 4 August 2019.

- "Impact of DTC on India Inc", The Hindu Business Line, 6 September 2010

- "Black money haul: Rs 65,250 crore collected through Income Declaration Scheme", The Economic Times, 1 October 2016, archived from the original on 4 October 2016, retrieved 1 October 2016

- "Union Budget 2023: New vs Old Tax Regime - See What Has Changed". NDTV.com. Archived from the original on 1 February 2023. Retrieved 1 February 2023.

- "Why hasn't the new tax regime taken off?". The Times of India. 24 January 2023. Archived from the original on 1 February 2023. Retrieved 1 February 2023.

- "All you need to know about Income Tax Returns for AY 2016–17", Daily News and Analysis, 16 April 2016, archived from the original on 20 April 2016, retrieved 24 April 2016

- Santosh Tiwari. "Evasion of personal tax dips to 59% of mop-up". The Financial Express. Archived from the original on 19 April 2014. Retrieved 19 April 2014.

- "Tax Laws & Rules > Acts > Income-tax Act, 1961". www.incometaxindia.gov.in. Archived from the original on 10 May 2018. Retrieved 1 November 2019.

- ^ "E-Filing is mandatory Income is more than 5 lacs". CA club india. Archived from the original on 29 June 2013. Retrieved 14 July 2013.

- "Tax relief for industries affected by Coronavirus". pib.gov.in. Archived from the original on 27 June 2021. Retrieved 16 June 2021.

- "Income Tax rates for Companies". businesssetup.in. Archived from the original on 18 May 2015. Retrieved 12 May 2015.

- "Corporate taxpayers must file electronically, point 4 of I T circular" (PDF). Archived from the original (PDF) on 4 January 2007. Retrieved 22 November 2006.

- "Annual Information return". Archived from the original on 25 August 2012. Retrieved 17 September 2012.

- Kumar, Kuldip (27 March 2016), "Readers' Corner: Taxation", Business Standard, archived from the original on 6 May 2016, retrieved 24 April 2016

- "Section 271 of India IT Act". Archived from the original on 14 October 2013. Retrieved 17 September 2012.