| Revision as of 11:49, 11 June 2013 editCarolmooredc (talk | contribs)Extended confirmed users, Pending changes reviewers, Rollbackers31,944 edits →Inflation: rewrite to conform with new source that says tripled, not 350% and relevant dates (written Dec 2011); clearer english for average reader← Previous edit | Revision as of 13:11, 11 June 2013 edit undoSPECIFICO (talk | contribs)Extended confirmed users35,510 edits Undid revision 559376702 by Carolmooredc (talk) Revert SYNTH ORNext edit → | ||

| Line 50: | Line 50: | ||

| In theoretical investigation there is only one meaning that can rationally be attached to the expression Inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange-value of money must occur.<ref name="TheTheory">The Theory of Money and Credit, Mises (1912, , p. 272)</ref></blockquote> | In theoretical investigation there is only one meaning that can rationally be attached to the expression Inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange-value of money must occur.<ref name="TheTheory">The Theory of Money and Credit, Mises (1912, , p. 272)</ref></blockquote> | ||

| Economist ] criticised von Mises' view that ''inflation'' must refer to an increase in the money supply. Timberlake noted that economists since the time of ] have recognized the distinction between increases in the money stock and increases in the general level of money prices. Timberlake stated that Mises' view has repeatedly been proven false and that statistical measurement of the aggregate price level is necessary in order test the empirical validity of Mises' theory.<ref name=Timberlake>{{cite journal|last=Timberlake|first=Richard H.|title=Austrian Inflation, Austrian Money, and Federal Reserve Policy|journal=The Freeman|date=September 1, 2000|url=http://www.fee.org/the_freeman/detail/austrian-inflation-austrian-money-and-federal-reserve-policy#axzz2JZKoJIRE|accessdate=31 January 2013}}</ref> Economist Paul Krugman has argued against Austrian views on inflation. Krugman |

Economist ] criticised von Mises' view that ''inflation'' must refer to an increase in the money supply. Timberlake noted that economists since the time of ] have recognized the distinction between increases in the money stock and increases in the general level of money prices. Timberlake stated that Mises' view has repeatedly been proven false and that statistical measurement of the aggregate price level is necessary in order test the empirical validity of Mises' theory.<ref name=Timberlake>{{cite journal|last=Timberlake|first=Richard H.|title=Austrian Inflation, Austrian Money, and Federal Reserve Policy|journal=The Freeman|date=September 1, 2000|url=http://www.fee.org/the_freeman/detail/austrian-inflation-austrian-money-and-federal-reserve-policy#axzz2JZKoJIRE|accessdate=31 January 2013}}</ref> Economist Paul Krugman has argued against Austrian views on inflation. Krugman points out that in the period from 2007 to late 2012, the ] increased by more than 350% with concomitant price inflation of less than 3% per year.<ref name=Madness>{{cite news|last=Krugman|first=Paul|title=G.O.P. Monetary Madness|url=http://www.nytimes.com/2011/12/16/opinion/gop-monetary-madness.html|accessdate=11 June 2013|newspaper=NY Times|date=Dec. 15. 2011}}</ref> According to Krugman: | ||

| <blockquote>If you believe that... expanding credit will simply result in too much money chasing too few goods, and hence a lot of inflation....<br> | <blockquote>If you believe that... expanding credit will simply result in too much money chasing too few goods, and hence a lot of inflation....<br> | ||

| the failure of high inflation to materialize amounts to a decisive rejection of model.<ref>Paul Krugman, Varieties of Error http://krugman.blogs.nytimes.com/2012/11/29/varieties-of-error/</ref></blockquote> | the failure of high inflation to materialize amounts to a decisive rejection of model.<ref>Paul Krugman, Varieties of Error http://krugman.blogs.nytimes.com/2012/11/29/varieties-of-error/</ref></blockquote> | ||

Revision as of 13:11, 11 June 2013

| Part of a series on the |

| Austrian School |

|---|

|

| Principal works |

| Origins |

| Theories and ideologies |

| Organizations, universities, and think tanks |

| People |

| Variants and related topics |

|

|

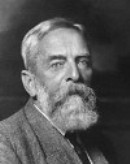

The Austrian School of economics is a school of economic thought which bases its study of economic phenomena on the interpretation and analysis of the purposeful actions of individuals (see methodological individualism). It derives its name from its origin in late-19th and early-20th century Vienna with the work of Carl Menger, Eugen von Böhm-Bawerk, Friedrich von Wieser, and others. Current day economists working in this tradition are located in many different countries, but their work is referred to as "Austrian economics".

Among the theoretical contributions of the early years of the Austrian School are the subjective theory of value, marginalism in price theory, and the formulation of the economic calculation problem.

Many economists are critical of the current-day Austrian School and consider its rejection of econometrics, experimental economics and aggregate macroeconomic analysis to be outside of mainstream economic theory, or "heterodox." Austrians are likewise critical of mainstream economics.

Methodology

The Austrian School bases its understanding of the economy on the social ramifications of the subjective choices of individuals. This approach, termed methodological individualism, differs significantly from many other schools of economic thought, which have placed less importance on individual knowledge, time, expectation, and other subjective factors and focused instead on aggregate variables, equilibrium analysis, and the consideration of societal groups rather than individuals.

In 1949, Ludwig von Mises codified his version of the subjectivist approach, which he called "praxeology," in a book published in English as Human Action. In it, Mises presented an extensive statement of his method, and stated that praxeology could be used to deduce a priori theoretical economic truths. Mises also argued against the use of probabilities in economic models. According to Mises, deductive economic thought experiment can yield conclusions which follow irrefutably from the underlying assumptions and could not be inferred from empirical observation or statistical analysis. Since Mises time, however, few Austrian thinkers have adopted Mises' entire praxeological approach and many have adopted alternative versions. For example, Fritz Machlup, Friedrich von Hayek, and others, did not take Mises' strong a priori approach to economics. In the twentieth century, Prof. Ludwig Lachmann also largely rejected Mises' formulation of Praxeology in favor of the verstehende Methode (interpretive method) articulated by Max Weber.

Economist Paul A. Samuelson has written that most economists assert that economic conclusions reached by pure logical deduction are limited and weak. According to Samuelson and economist Bryan Caplan, this aspect of Austrian School methodology has led it to be widely dismissed within mainstream economics. Caplan has stated that the Austrian challenge to the realism of neoclassical assumptions actually helps make those assumptions more plausible.

Starting in the Twentieth Century, various Austrians incorporated models and mathematics into their analysis of the economy. Austrian economist Steven Horwitz argues that Austrian methodology is consistent with macroeconomics and that Austrian macroeconomics can be expressed in terms of microeconomic foundations. Austrian economist Roger Garrison argues that Austrian macroeconomic theory can be correctly expressed in terms of diagrammatic models. In 1944, Austrian economist Oskar Morgenstern presented a rigorous schematization of an ordinal utility function (the Von Neumann–Morgenstern utility theorem) in Theory of Games and Economic Behavior.

Austrian School tenets

Opportunity cost

The opportunity cost doctrine was first explicitly formulated by the Austrian economist Friedrich von Wieser in the late 19th century. Opportunity cost is the cost of any activity measured in terms of the value of the next best alternative foregone (that is not chosen). It is the sacrifice related to the second best choice available to someone, or group, who has picked among several mutually exclusive choices. This view is currently held by contemporary economists of all mainstream schools of thought.

Opportunity cost is a key concept in economics, and has been described as expressing "the basic relationship between scarcity and choice". The notion of opportunity cost plays a crucial part in ensuring that scarce resources are used efficiently. Thus, opportunity costs are not restricted to monetary or financial costs: the real cost of output foregone, lost time, pleasure or any other benefit that provides utility should also be considered opportunity costs.

Capital and interest

See also: Capital and Interest, Marginalism, Neutrality of money, Say's law, and Time preference

The Austrian theory of capital and interest was first developed by Eugen von Böhm-Bawerk. He stated that interest rates and profits are determined by two factors, namely, supply and demand in the market for final goods and time preference.

Böhm-Bawerk's theory was a response to Marx's labor theory of value and capital. Böhm-Bawerk's theory attacked the viability of the labor theory of value in the light of the transformation problem. His conception of interest countered Marx's exploitation theory. Marx famously argued that capitalists exploit workers by paying them less than the fruits of their labor sell for. Bohm-Bawerk countered this claim by invoking the concept of time preference to demonstrate that everyone values present consumption more than future consumption, and therefore that a difference between the (smaller) salary laborers are paid in the present and the (greater) price for which the goods they produce are later sold need not be exploitative. Böhm-Bawerk's theory equates capital intensity with the degree of roundaboutness of production processes. Böhm-Bawerk also argued that the law of marginal utility necessarily implies the classical law of costs. Some Austrian economists therefore entirely reject the notion that interest rates are affected by liquidity preference.

Inflation

See also: Monetary InflationMises believed that money prices and wages will inevitably rise when the supply of money and bank credit is increased. He therefore used the term "inflation" to mean an excessive increase of the money supply and not, as is the common usage, to refer to price inflation. In Mises' view, inflation is the result of policies of the government or central bank which result in an increase in the circulating money supply. Following Mises, the modern-day Austrian School argues that this semantic distinction is critical to public discussion of price inflation, and that price inflation can only be prevented by strict control of the money supply. Mises wrote:

In theoretical investigation there is only one meaning that can rationally be attached to the expression Inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange-value of money must occur.

Economist Richard Timberlake criticised von Mises' view that inflation must refer to an increase in the money supply. Timberlake noted that economists since the time of John Stuart Mill have recognized the distinction between increases in the money stock and increases in the general level of money prices. Timberlake stated that Mises' view has repeatedly been proven false and that statistical measurement of the aggregate price level is necessary in order test the empirical validity of Mises' theory. Economist Paul Krugman has argued against Austrian views on inflation. Krugman points out that in the period from 2007 to late 2012, the monetary base increased by more than 350% with concomitant price inflation of less than 3% per year. According to Krugman:

If you believe that... expanding credit will simply result in too much money chasing too few goods, and hence a lot of inflation....

the failure of high inflation to materialize amounts to a decisive rejection of model.

Economic calculation problem

Main article: Economic calculation problem| This section needs additional citations for verification. Please help improve this article by adding citations to reliable sources in this section. Unsourced material may be challenged and removed. (May 2013) (Learn how and when to remove this message) |

The economic calculation problem is a criticism of socialist economics. It was first proposed by Max Weber in 1920. This led to Mises discussing Weber's idea with his student Friedrich Hayek, who expanded upon it to such an extent that it became a key reason cited for the awarding of his Nobel prize. The problem referred to is that of how to distribute resources effectively in an economy.

Austrian theory emphasizes the organizing power of markets. Mises and Hayek stated that the information reflected in market prices leads to socially optimal allocation of resources. Because socialist systems lack the individual incentives and price discovery processes of market systems, they argued that socialism cannot provide the level of welfare achieved in market economies. Those who agree with this criticism view it is a refutation of socialism and that it shows that it is not a viable or sustainable form of economic organization. The debate rose to prominence in the 1920s and 1930s, and that specific period of the debate has come to be known by historians of economic thought as The Socialist Calculation Debate.

Mises argued in a 1920 article "Economic Calculation in the Socialist Commonwealth" that the pricing systems in socialist economies were necessarily deficient because if government owned the means of production, then no prices could be obtained for capital goods as they were merely internal transfers of goods in a socialist system and not "objects of exchange," unlike final goods. Therefore, they were unpriced and hence the system would be necessarily inefficient since the central planners would not know how to allocate the available resources efficiently. This led him to declare "…that rational economic activity is impossible in a socialist commonwealth." Mises's declaration has been criticized as overstating the strength of his case, in describing socialism as impossible, rather than that it may need to establish non-market institutions to deal with a source of inefficiency.

Business cycles

Main article: Austrian business cycle theoryThe Austrian theory of the business cycle ("ABCT") focuses on the credit cycle as the cause of business cycles. Although later elaborated by Hayek and others, the theory was first set forth by von Mises, who believed that an expansion of the money supply, at artificially low interest rates, causes businesses to overinvest capital in relatively roundabout production processes. Mises called the resulting misallocation of resources malinvestment.

Most research regarding the theory finds that it is inconsistent with empirical evidence. Economists such as Gordon Tullock, Bryan Caplan, Milton Friedman, and Paul Krugman have said that they regard the theory as incorrect. In 1969, Friedman argued that the theory is not consistent with empirical evidence and using newer data in 1993 reached the same conclusion.

In 2001, Austrian economist Roger Garrison reviewed Hayek's development of the Austrian Business Cycle Theory and discussed the factors that have sustained interest in the theory despite its rejection by mainstream economics.

Assertions

| This section needs additional citations for verification. Please help improve this article by adding citations to reliable sources in this section. Unsourced material may be challenged and removed. (May 2013) (Learn how and when to remove this message) |

According to the theory, malinvestment is induced by banks' excessive and unsustainable expansion of credit to businesses. Businesses borrow at unsustainably low interest rates and overinvest in capital goods, which in turn leads to a diversion of investment from consumer goods to capital goods industries. Austrians contend that this shift is unsustainable and must eventually be reversed, and that the re-adjustment process will be more violent and disruptive the longer the overinvestment in capital goods industries continues.

According to the Austrian view, the proportion of income allocated to consumption rather than saving is determined by the interest rate and people's time preference, which is the degree to which they prefer present to future satisfactions. According to this view, the pure interest rate is determined by the time preferences of the individuals in society. If the market rate of interest offered by banks is set lower than this, business borrowing will be excessive and will be allocated to malinvestment.

According to the Austrian view, newly extended credit thus malinvested will circulate from the business borrowers to the factors of production: to the landowners and capital owners who sold assets to the newly indebted entrepreneurs, and then to the other factors of production in wages, rent, and interest. Austrians state that, because individuals' time preferences have not changed, their market response to this shift toward higher order capital goods will tend to to reestablish the old proportions, and demand will shift back from the higher to the lower orders. In other words, depositors will tend to remove cash from the banking system and spend it (not save it), banks will then ask their borrowers for payment and the excessive capital goods will be sold at lower prices to retire the now-unprofitable loans.

Murray Rothbard stated that government actions to support asset prices, advance funding to insolvent banks, or stimulate the economy with deficit spending will sustain and exacerbate the malinvestment. He wrote that such government policy impedes the adjustment he believed was necessary to liquidate distortions and restore prices and resource allocations which he said would otherwise be based on time preference alone.

The role of central banks

Many Austrian economists believe that fluctuations in bank credit are the primary cause of business cycles and that excessive credit creation at relatively low interest rates facilitates excessive capital spending by borrowers. For example, Murray Rothbard believed that central banks, by expanding the supply of loanable funds, artificially causes commercial banks to fund the loan market at a lower rate of interest than might prevail if the money supply were fixed. Friedrich Hayek, on the other hand, stated that a freely competitive, banking industry tends to be endogenously destabilizing and pro-cyclical, mimicking the effects Rothbard attributes to central bank policy. Hayek stated that the need for central banking control was inescapable.

Etymology

The School owes its name to members of the German Historical school of economics, who argued against the Austrians during the Methodenstreit ("methodology struggle"), in which the Austrians defended the role of theory in economics as distinct from the study or compilation of historical circumstance. In 1883, Menger published Investigations into the Method of the Social Sciences with Special Reference to Economics, which attacked the methods of the Historical school. Gustav von Schmoller, a leader of the Historical school, responded with an unfavorable review, coining the term "Austrian School" in an attempt to characterize the school as outcast and provincial. The label endured and was adopted by the adherents themselves.

History

First Wave

The school originated in Vienna, in the Austrian Empire. Carl Menger's 1871 book, Principles of Economics, is generally considered the founding of the Austrian School. The book was one of the first modern treatises to advance the theory of marginal utility. The Austrian School was one of three founding currents of the marginalist revolution of the 1870s, with its major contribution being the introduction of the subjectivist approach in economics. While marginalism was generally influential, there was also a more specific school that began to coalesce around Menger's work, which came to be known as the “Psychological School,” “Vienna School,” or “Austrian School.” Thorstein Veblen introduced the term neoclassical economics in his Preconceptions of Economic Science (1900) to distinguish marginalists in the objective cost tradition of Alfred Marshall from those in the subjective valuation tradition of the Austrian School.

Carl Menger contributions to economic theory were closely followed by that of Böhm-Bawerk and Friedrich von Wieser. These three economists became what is known as the "first wave" of the Austrian School. Böhm-Bawerk wrote extensive critiques of Karl Marx in the 1880s and 1890s, as was part of the Austrians' participation in the late 19th Century Methodenstreit, during which they attacked the Hegelian doctrines of the Historical School.

Twentieth century

By the mid-1930s, most economists had embraced what they considered the important contributions of the early Austrians. After World War II, Austrian economics was disregarded or derided by most economists because it rejected mathematical and statistical methods in the study of economics.

Austrian economics after 1940 can be divided into two schools of economic thought, and the school "split" to some degree in the late 20th century. One camp of Austrians, exemplified by Mises, regards neoclassical methodology to be irredeemably flawed; the other camp, exemplified by Friedrich Hayek, accepts a large part of neoclassical methodology and is more accepting of government intervention in the economy.

Henry Hazlitt wrote economics columns and editorials for a number of publications and wrote many books on the topic of Austrian economics from the 1930s to the 1980s. Hazlitt's thinking was influenced by Mises. His book Economics in One Lesson (1946) sold over a million copies, and he is also known for The Failure of the "New Economics" (1959), a line-by-line critique of John Maynard Keynes's General Theory.

The reputation of the Austrian School rose in the late-20th century due in part to the work of Israel Kirzner and Ludwig Lachmann at New York University, and to renewed public awareness of the work of Hayek after he won the Nobel Memorial Prize in Economic Sciences. Hayek's work was influential in the revival of laissez-faire thought in the 20th century.

In the late twentieth century, Murray Rothbard wrote about political theory and various economic issues from an anarchist point of view. Rothbard's anarchist views have been promoted and expanded by various other writers associated with the Mises Institute. Rothbard opposed fractional reserve banking, which he called a fraudulent contract that should be illegal. He also advocated replacing central banks, either with an unregulated 100% reserve gold standard or a free banking system in which each individual would choose what to accept as money.

Split among contemporary Austrians

By the late twentieth century, a split had developed among those who self-identify with the Austrian School. One group, building on the work of Hayek, works within the broad framework of mainstream neoclassical economics, including its use of mathematical models and general equilibrium, and merely brings a critical perspective to mainstream methodology influenced by the Austrian notions such as the economic calculation problem and the independent role of logical reasoning in developing economic theory. A second group, following Mises and Rothbard, rejects the neoclassical theories of consumer and welfare economics, dismisses empirical methods and mathematical and statistical models as inapplicable to economic science, and asserts that economic theory went entirely astray in the twentieth century; they offer the Misesian view as a radical alternative paradigm to mainstream theory. As economist Bryan Caplan put it, if "Mises and Rothbard are right, then economics is wrong; but if Hayek is right, then mainstream economics merely needs to adjust its focus." Economists of the (dominant) Hayekian view are affiliated with the Cato Institute, George Mason University, and New York University, among other institutions. They include Pete Boettke, Roger Garrison, Steven Horwitz, Peter Leeson and George Reisman. Self-identified Austrians of the Mises-Rothbard view include Walter Block, Hans-Hermann Hoppe, Jesús Huerta de Soto and Robert P. Murphy. They tend to be associated with the Ludwig von Mises Institute and with various smaller academic institutions, such as Auburn University and Hillsdale College.

Influence

Many theories developed by "first wave" Austrian economists have been absorbed into most mainstream schools of economics. These include Carl Menger's theories on marginal utility, Friedrich von Wieser's theories on opportunity cost, and Eugen von Böhm-Bawerk's theories on time preference, as well as Menger and Böhm-Bawerk's criticisms of Marxian economics.

Former U.S. Federal Reserve Chairman Alan Greenspan said in 2000, that " the Austrian School have reached far into the future from when most of them practiced and have had a profound and, in my judgment, probably an irreversible effect on how most mainstream economists think in this country." In 1987, Nobel Laureate James M. Buchanan told an interviewer, "I have no objections to being called an Austrian. Hayek and Mises might consider me an Austrian but, surely some of the others would not." Former U.S. congressman Ron Paul has stated that he played a small role in the founding of the Ludwig von Mises Institute. Paul's former economic adviser, investment dealer Peter Schiff, calls himself an adherent of the Austrian School. Former hedge fund manager Jim Rogers also endorses the Austrian School of economics. Chinese economist Zhang Weiying, supports some Austrian theories such as the Austrian theory of the business cycle. Currently, universities with a significant Austrian presence are George Mason University, New York University, Loyola University New Orleans, and Auburn University in the United States and Universidad Francisco Marroquín in Guatemala. Austrian economic ideas are also promoted by privately funded organizations such as the Cato Institute, the Mises Institute and the Foundation for Economic Education.

Criticisms

General criticisms

Some economists have argued that Austrians are often averse to the use of mathematics and statistics in economics.

Economist Bryan Caplan argues that many Austrians have not understood valid contributions of modern mainstream economics, causing them to overstate their differences with it. For example, Murray Rothbard stated that he objected to the use of cardinal utility in microeconomic theory; however, mainstream microeconomic theorists go to great pains to show that their results are derived for any monotonic transformation of an ordinal utility function, and do not entail cardinal utility. The result is that conclusions about utility preferences hold no matter what values are assigned to them.

Economist Paul Krugman has stated that because Austrians do not use "explicit models" they are unaware of holes in their own thinking. In February 2013, Krugman further criticized Austrian School economists on their failure to revise their theory of inflation in light of their incorrect prophecies of government-induced inflation following the 2008 financial crisis.

Economist Benjamin Klein has criticized the economic methodological work of Austrian economist Israel M. Kirzner. While praising Kirzner for highlighting shortcomings in traditional methodology, Klein argued that Kirzner did not provide a viable alternative for economic methodology. Economist Tyler Cowen has written that Kirzner's theory of entrepreneurship can ultimately be reduced to a neoclassical search model and is thus not in the radical subjectivist tradition of Austrian praxeology. Cowen states that Kirzner's entrepreneurs can be modeled in mainstream terms of search.

Economist Jeffrey Sachs argues that among developed countries, those with high rates of taxation and high social welfare spending perform better on most measures of economic performance compared to countries with low rates of taxation and low social outlays. He concludes that Friedrich Hayek was wrong to argue that high levels of government spending harms an economy, and "a generous social-welfare state is not a road to serfdom but rather to fairness, economic equality and international competitiveness." Austrian economist Sudha Shenoy responded by arguing that countries with large public sectors have grown more slowly.

Methodology

Critics generally argue that Austrian economics lacks scientific rigor and rejects scientific methods and the use of empirical data in modelling economic behavior. Some economists describe Austrian methodology as being a priori or non-empirical.

Economist Mark Blaug has criticized over-reliance on methodological individualism, arguing it would rule out all macroeconomic propositions that cannot be reduced to microeconomic ones, and hence reject almost the whole of received macroeconomics.

Economist Thomas Mayer has stated that Austrians advocate a rejection of the scientific method which involves the development of empirically falsifiable theories. Furthermore, many supporters of using models of market behavior to analyze and test economic theory argue that economists have developed numerous experiments that elicit useful information about individual preferences.

Capital and interest

Many social anarchists object to the theory of time preference being applied to an economy as a whole in a capitalist society. They argue that the theory fails to take into account that making profits in a capitalist society is not the provision of future means of consumption, but rather profits for their own sake.

Business cycle theory

Main article: Austrian business cycle theory § CriticismsAccording to John Quiggin, most economists believe that the Austrian business cycle theory is incorrect because of its incompleteness and other problems.

Theoretical objections

Some economists argue that Austrian business cycle theory requires bankers and investors to exhibit a kind of irrationality, because the Austrian theory posits that investors will be fooled repeatedly (by temporarily low interest rates) into making unprofitable investment decisions. Bryan Caplan writes: "Why does Rothbard think businessmen are so incompetent at forecasting government policy? He credits them with entrepreneurial foresight about all market-generated conditions, but curiously finds them unable to forecast government policy, or even to avoid falling prey to simple accounting illusions generated by inflation and deflation... Particularly in interventionist economies, it would seem that natural selection would weed out businesspeople with such a gigantic blind spot." Austrian economist Robert Murphy argues that it is difficult for investors to make sound business choices because they cannot know what the interest rate would be if it were set by the market.

Economist Paul Krugman has argued that the theory cannot explain changes in unemployment over the business cycle. Austrian business cycle theory postulates that business cycles are caused by the misallocation of resources from consumption to investment during "booms", and out of investment during "busts". Krugman argues that because total spending is equal to total income in an economy, the theory implies that the reallocation of resources during "busts" would increase employment in consumption industries, whereas in reality, spending declines in all sectors of an economy during recessions. He also argues that according to the theory the initial "booms" would also cause resource reallocation, which implies an increase in unemployment during booms as well. In response, Austrian economist David Gordon argues that Krugman's argument is dependent on a misrepresentation of the theory. He furthermore argues that prices on consumption goods may go up as a result of the investment bust, which could mean that the amount spent on consumption could increase even though the quantity of goods consumed has not. Furthermore, Roger Garrison argues that a false boom caused by artificially low interest rates would cause a boom in consumption goods as well as investment goods (with a decrease in "middle goods"), thus explaining the jump in unemployment at the end of a boom. Many Austrians also argue that capital allocated to investment goods cannot be quickly augmented to create consumption goods.

Economist Jeffery Hummel is critical of Hayek's explanation of labor asymmetry in booms and busts. He argues that Hayek makes peculiar assumptions about demand curves for labor in his explanation of how a decrease in investment spending creates unemployment. He also argues that the labor asymmetry can be explained in terms of a change in real wages, but this explanation fails to explain the business cycle in terms of resource allocation.

Milton Friedman objected to the policy implications of the theory, stating the following in a 1998 interview:

I think the Austrian business-cycle theory has done the world a great deal of harm. If you go back to the 1930s, which is a key point, here you had the Austrians sitting in London, Hayek and Lionel Robbins, and saying you just have to let the bottom drop out of the world. You’ve just got to let it cure itself. You can’t do anything about it. You will only make it worse. You have Rothbard saying it was a great mistake not to let the whole banking system collapse. I think by encouraging that kind of do-nothing policy both in Britain and in the United States, they did harm.

Empirical objections

Hummel argues that the Austrian explanation of the business cycle fails on empirical grounds. In particular, he notes that investment spending remained positive in all recessions where there are data, except for the Great Depression. He argues that this casts doubt on the notion that recessions are caused by a reallocation of resources from industrial production to consumption, since he argues that the Austrian business cycle theory implies that net investment should be below zero during recessions. In response, Austrian economist Walter Block argues that the misallocation during booms does not preclude the possibility of demand increasing overall.

In 1969, economist Milton Friedman, after examining the history of business cycles in the U.S., concluded that "The Hayek-Mises explanation of the business cycle is contradicted by the evidence. It is, I believe, false." He analyzed the issue using newer data in 1993, and again reached the same conclusion.

Referring to Friedman's discussion of the business cycle, Austrian economist Roger Garrison stated, "Friedman's empirical findings are broadly consistent with both Monetarist and Austrian views", and goes on to argue that although Friedman's model "describes the economy's performance at the highest level of aggregation; Austrian theory offers an insightful account of the market process that might underlie those aggregates."

Principal works

- Capital and Interest by Eugen von Böhm-Bawerk

- Individualism and Economic Order by Friedrich Hayek

- Principles of Economics by Carl Menger

- Human Action by Ludwig von Mises

- Man, Economy, and State by Murray N. Rothbard

See also

- List of Austrian School economists

- List of Austrian intellectual traditions

- Perspectives on capitalism

- Quarterly Journal of Austrian Economics

References and notes

- Carl Menger, Prinicples of Economics, online at http://www.mises.org/etexts/menger/principles.asp

- Austrian School of Economics: The Concise Encyclopedia of Economics | Library of Economics and Liberty

- Methodological Individualism at the Stanford Encyclopedia of Philosophy

- Ludwig von Mises. Human Action, p. 11, "r. Purposeful Action and Animal Reaction". Referenced 2011-11-23.

- Joseph A. Schumpeter, History of economic analysis, Oxford University Press 1996, ISBN 978-0195105599.

- Birner, Jack; van Zijp, Rudy (1994). Hayek, Co-ordination and Evolution: His Legacy in Philosophy, Politics, Economics and the History of Ideas. London, New York: Routledge. p. 94. ISBN 978-0-415-09397-2.

- Boettke, Peter. "Is Austrian Economics Heterodox Economics?". The Austrian Economists. Archived from the original on 28 March 2009. Retrieved 2009-02-13.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Boettke, Peter J. (2003). "28A: The Austrian School of Economics 1950-2000". In Warren Samuels, Jeff E. Biddle, and John B. Davis (ed.). A Companion to the History of Economic Thought. Blackwell Publishing. pp. 446–452. ISBN 978-0-631-22573-7.

{{cite book}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)CS1 maint: multiple names: editors list (link) - "Heterodox economics: Marginal revolutionaries". The Economist. December 31, 2011. Retrieved February 22, 2012.

- ^ Caplan, Bryan. "Why I Am Not an Austrian Economist". George Mason University. Retrieved 2008-07-04.

More than anything else, what prevents Austrians from getting more publications in mainstream journals is that their papers rarely use mathematics or econometrics, research tools that Austrians reject on principle...Mises and Rothbard however err when they say that economic history can only illustrate economic theory. In particular, empirical evidence is often necessary to determine whether a theoretical factor is quantitatively significant...Austrians reject econometrics on principle because economic theory is true a priori, so statistics or historical study cannot "test" theory.

- Austrian Economics and the Mainstream: View from the Boundary, Roger E. Backhouse

- ^ White, Lawrence H. (revised ed. 2003). The Methodology of the Austrian School Economists. Mises Institute.

{{cite book}}: Check date values in:|year=(help)CS1 maint: year (link) - Ludwig von Mises, Nationalökonomie (Geneva: Union, 1940), p. 3; Human Action (Auburn, Ala.: Mises Institute, 1998), p. 3.

- "The Ultimate Foundation of Economic Science by Ludwig von Mises". Mises.org. Retrieved 2012-08-13.

- Bruce J. Caldwell "Praxeology and its Critics: an Appraisal" History of Political Economy Fall 1984 16(3): 363–379; doi:10.1215/00182702-16-3-363

- Richard N. Langlois, "FROM THE KNOWLEDGE OF ECONOMICS TO THE ECONOMICS OF KNOWLEDGE: FRITZ MACHLUP ON METHODOLOGY AND ON THE "KNOWLEDGE SOCIETY" Research in the History of Economic Thought and Methodology, Volume 3, pp. 225–235

- Lachmann, Ludwig (1973). Macroeconomic Thinking and the Market Economy (PDF). Institute of Economic Affairs.

- Samuelson, Paul (1964). Economics (6th ed.). New York: McGraw-Hill. p. 736. ISBN 978-0-07-074741-8.

- ^ Samuelson, Paul A. (1964). "Theory and Realism: A Reply". The American Economic Review. American Economic Association: 736–739.

Well, in connection with the exaggerated claims that used to be made in economics for the power of deduction and a priori reasoning ..... – I tremble for the reputation of my subject. Fortunately, we have left that behind us.

{{cite journal}}: Invalid|ref=harv(help); Unknown parameter|month=ignored (help) - The Austrian Search for Realistic Foundations, Bryan Caplan

- Horwitz, Steven: Microfoundations and Macroeconomics: An Austrian Perspective (2000)|Routledge

- http://library.mises.org/books/Roger%20W%20Garrison/Austrian%20Macroeconomics%20A%20Diagrammatical%20Exposition.pdf Garrison, Roger: Austrian Macroeconomics: A Diagrammatical Exposition (1978)|Institute for Humane Studies

- Neumann, John von and Morgenstern, Oskar Theory of Games and Economic Behavior. Princeton, NJ. Princeton University Press. 1944

- Kirzner, Israel M.; Lachman, Ludwig M. (1986). Subjectivism, intelligibility and economic understanding: essays in honor of Ludwig M. Lachmann on his eightieth birthday (Illustrated ed.). McMillan. ISBN 978-0-333-41788-1.

- "Opportunity Cost". Investopedia. Archived from the original on 14 September 2010. Retrieved 2010-09-18.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - James M. Buchanan (2008). "Opportunity cost". The New Palgrave Dictionary of Economics Online (Second ed.). Retrieved 2010-09-18.

{{cite encyclopedia}}: Invalid|ref=harv(help) - "Opportunity Cost". Economics A-Z. The Economist. Archived from the original on 9 October 2010. Retrieved 2010-09-18.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - ^ Böhm-Bawerk, Eugen Ritter von; Kapital Und Kapitalizns. Zweite Abteilung: Positive Theorie des Kapitales (1889). Translated as Capital and Interest. II: Positive Theory of Capital with appendices rendered as Further Essays on Capital and Interest.

- ^ http://www.econlib.org/library/Enc/bios/BohmBawerk.html

- von Mises, Ludwig (1980). "Economic Freedom and Interventionism". In Greaves, Bettina B. (ed.). Economics of Mobilization. Sulphur Springs, West Virginia: The Commercial and Financial Chronicle.

Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term "inflation" to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. . . . As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar. As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation.

{{cite book}}: External link in|chapterurl=|ref=harv(help); Unknown parameter|chapterurl=ignored (|chapter-url=suggested) (help) - Ludwig von Mises, The Theory of Money and Credit", ISBN 978-0-913966-70-9

- The Theory of Money and Credit, Mises (1912, , p. 272)

- Timberlake, Richard H. (September 1, 2000). "Austrian Inflation, Austrian Money, and Federal Reserve Policy". The Freeman. Retrieved 31 January 2013.

- Krugman, Paul (Dec. 15. 2011). "G.O.P. Monetary Madness". NY Times. Retrieved 11 June 2013.

{{cite news}}: Check date values in:|date=(help) - Paul Krugman, Varieties of Error http://krugman.blogs.nytimes.com/2012/11/29/varieties-of-error/

- Von Mises, Ludwig (1990). Economic calculation in the Socialist Commonwealth (PDF). Ludwig von Mises Institute. ISBN 0-945466-07-2. Archived from the original (PDF) on 23 September 2008. Retrieved 2008-09-08.

{{cite book}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - F. A. Hayek, (1935), "The Nature and History of the Problem" and "The Present State of the Debate," om in F. A. Hayek, ed. Collectivist Economic Planning, pp. 1–40, 201–243.

- ^ The socialist calculation debate

- Ludwig von Mises. "The Principle of Methodological Individualism". Human Action. Ludwig von Mises Institute. Archived from the original on 22 April 2009. Retrieved 2009-04-24.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - Caplan, Bryan (2004). "Is socialism really "impossible"?". Critical Review. 16: 33–52. doi:10.1080/08913810408443598.

{{cite journal}}: Invalid|ref=harv(help) - ^ Gordon Tullock (1988). "Why the Austrians are wrong about depressions" (PDF). The Review of Austrian Economics. 2 (1): 73–78. doi:10.1007/BF01539299. Retrieved 2009-06-24.

{{cite journal}}: Invalid|ref=harv(help) - Caplan, Bryan (2008-01-02). "What's Wrong With Austrian Business Cycle Theory". Library of Economics and Liberty. Retrieved 2008-07-28.

- ^ Friedman, Milton. "The Monetary Studies of the National Bureau, 44th Annual Report". The Optimal Quantity of Money and Other Essays. Chicago: Aldine. pp. 261–284.

- ^ Friedman, Milton. "The 'Plucking Model' of Business Fluctuations Revisited". Economic Inquiry: 171–177.

{{cite journal}}: Invalid|ref=harv(help) - ^ Krugman, Paul (1998-12-04). "The Hangover Theory". Slate. Archived from the original on 2010-11-07. Retrieved 2008-06-20.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - Friedman, Milton. "The Monetary Studies of the National Bureau, 44th Annual Report". The Optimal Quantity of Money and Other Essays. Chicago: Aldine. pp. 261–284.

- Friedman, Milton. "The 'Plucking Model' of Business Fluctuations Revisited". Economic Inquiry: 171–177.

- Garrison, Roger (2001). "Hayekian Trade Cycle Theory: A Reappraisal". Cato Journal. 6 (2). Retrieved 19 May 2013.

- ^ Theory of Money and Credit, Ludwig von Mises, Part III, Part IV

- Theory of Money and Credit, Ludwig von Mises, Part II

- America's Great Depression, Murray Rothbard

- The Mystery of Banking, Murray Rothbard, 1983

- White, Lawrence H. (1999). "Why Didn't Hayek Favor Laissez Faire in Banking?" (PDF). History of Political Economy. 31 (4): 753. doi:10.1215/00182702-31-4-753. Retrieved 11 April 2013.

- "Menger’s approach – haughtily dismissed by the leader of the German Historical School, Gustav Schmoller, as merely “Austrian,” the origin of that label – led to a renaissance of theoretical economics in Europe and, later, in the United States." Peter G. Klein, 2007; in the Foreword to Principles of Economics, Carl Menger; trns. James Dingwall and Bert F. Hoselitz, 1976; Ludwig von Mises Institute, Alabama; 2007; ISBN 978-1-933550-12-1

- von Mises, Ludwig (1984 ed.). The Historical Setting of the Austrian School of Economics (PDF). Ludwig von Mises Institute.

{{cite book}}: Check date values in:|year=(help)CS1 maint: year (link) - Keizer, Willem (1997). Austrian Economics in Debate. New York: Routledge. ISBN 978-0-415-14054-6.

- Israel M. Kirzner (1987). "Austrian School of Economics," The New Palgrave: A Dictionary of Economics, v. 1, pp. 145–151.

- Veblen, Thorstein Bunde; “The Preconceptions of Economic Science” Pt III, Quarterly Journal of Economics v14 (1900).

- Colander, David; The Death of Neoclassical Economics.

- "Austrian economics and the mainstream: View from the boundary" by Roger E. Backhouse, $34 to view

- http://mises.org/journals/qjae/pdf/qjae7_1_3.pdf

- "Remembering Henry Hazlitt". The Freeman. Retrieved 2013-03-11.

- "Biography of Henry Hazlitt". The Ludwig von Mises Institute. Retrieved 2013-03-11.

- Meijer, Gerrit, ed. (1995). New Perspectives on Austrian Economics. New York: Routledge. ISBN 978-0-415-12283-2. OCLC 70769328.

- Raico, Ralph (2011). "Austrian Economics and Classical Liberalism". mises.org. Mises Institute. Retrieved 27 July 2011.

despite the particular policy views of its founders ..., Austrianism was perceived as the economics of the free market

- Kasper, Sherryl Davis (2002). The Revival of Laissez-faire in American Macroeconomic Theory. Edward Elgar Publishing. p. 66. ISBN 978-1-84064-606-1.

- Rothbard, Murray (1991). Betrayal of the American Right (PDF). Mises Institute. p. 74.

- ^ Rothbard, Murray. The Mystery of Banking, p. 261

- Krugman's MMMF Question

- Caplan, Bryan (1999). "The Austrian Search for Realistic Foundations". Southern Economic Journal. 65 (4): 823–838. doi:10.2307/1061278. JSTOR 1061278.

- Greenspan, Alan. "Hearings before the U.S. House of Representatives' Committee on Financial Services." U.S. House of Representatives' Committee on Financial Services. Washington D.C.. 25 July 2000.

- An Interview with Laureate James Buchanan Austrian Economics Newsletter: Volume 9, Number 1; Fall 1987

- Paul, Ron (2008). The Revolution: A Manifesto. Grand Central Publishing. p. 102. ISBN 978-0-446-53751-3.

- "Peter Schiff Named Economic Advisor to the Ron Paul 2008 Presidential Campaign". Reuters. 2008-01-25.

- Interview with Peter Schiff

- Inside the House of Money: Top Hedge Fund Traders on Profiting in the Global Markets. 2006. Wiley. p. 230

- Weiyin, Zhang, "Completely bury Keynesianism", http://finance.sina.com.cn/20090217/10345864499_3.shtml (February 17, 2009)

- ^ White, Lawrence H. (2008). "The research program of Austrian economics". Advances in Austrian Economics. Emerald Group Publishing Limited: 20.

{{cite journal}}: Invalid|ref=harv(help) Cite error: The named reference "white1" was defined multiple times with different content (see the help page). - Caplan, Bryan. "Why I Am Not an Austrian Economist". George Mason University. Retrieved 2008-07-04.

According to Rothbard, the mainstream approach credulously accepted the use of cardinal utility, when only the use of ordinal utility is defensible. As Rothbard insists, "Value scales of each individual are purely ordinal, and there is no way whatever of measuring the distance between the rankings; indeed, any concept of such distance is a fallacious one." ...As plausible as Rothbard sounds on this issue, he simply does not understand the position he is attacking. The utility function approach is based as squarely on ordinal utility as Rothbard's is. The modern neoclassical theorists – such as Arrow and Debreau – who developed the utility function approach went out of their way to avoid the use of cardinal utility. ...To sum up, Rothbard falsely accused neoclassical utility theory of assuming cardinality. It does not.

- Caplan, Bryan (1999). "The Austrian Search for Realistic Foundations". Southern Economic Journal. 65 (4). Southern Economic Association: 823–838. doi:10.2307/1061278. JSTOR 1061278.

{{cite journal}}: Invalid|ref=harv(help); Unknown parameter|month=ignored (help) - Krugman, Paul (4-7-2010). "The Conscience of a Liberal: Martin And The Austrians". The New York Times. Retrieved 9-21-2011.

{{cite web}}: Check date values in:|accessdate=and|date=(help); Italic or bold markup not allowed in:|publisher=(help) - Krugman, Paul (February 20, 2013). "Fine Austrian Whines". New York Times. Retrieved 11 June 2013.

- Klein, Benjamin. "Book review: Competition and Entrepreneurship" (by Israel M. Kirzner, University of Chicago Press, 1973) Journal of Political Economy. Vol. 83: No. 6, 1305–1306, December 1975.

- Cowen, Tyler (2003). "Entrepreneurship, Austrian Economics, and the Quarrel Between Philosophy and Poetry". Review of Austrian Economics. 16 (1).

{{cite journal}}: Unknown parameter|month=ignored (help) - Sachs, Jeffrey (October 2006). "The Social Welfare State, Beyond Ideology". Scientific American. Retrieved 2008-06-20.

{{cite journal}}: Invalid|ref=harv(help) - Sudha R. Shenoy, Are High Taxes the Basis of Freedom and Prosperity?, http://www.thefreemanonline.org/featured/are-high-taxes-the-basis-of-freedom-and-prosperity/

- ^ "Rules for the study of natural philosophy", Newton 1999, pp. 794–6 harvnb error: no target: CITEREFNewton1999 (help), from Book 3, The System of the World.

- ^ Mayer, Thomas (1998). "Boettke's Austrian critique of mainstream economics: An empiricist's response". Critical Review. 12. Routledge: 151–171. doi:10.1080/08913819808443491.

{{cite journal}}: Invalid|ref=harv(help); Unknown parameter|month=ignored (help) - Blaug, Mark (1992). The Methodology of Economics: Or, How Economists Explain. Cambridge University Press. pp. 45–46. ISBN 0-521-43678-8.

- Morgan, Mary S. (2008). "Models". The New Palgrave Dictionary of Economics. Retrieved 22 November 2011.

- Hoover, Kevin D. (2008). "Causality in economics and econometrics". The New Palgrave Dictionary of Economics. Retrieved 22 November 2011.

- The Anarchist FAQ Editorial Collective, An Anarchist FAQ http://infoshop.org/page/AnarchistFAQSectionC2#secc26

- "John Quiggin " Austrian Business Cycle Theory". johnquiggin.com. Retrieved 19 July 2010.

- Problems with Austrian Business Cycle Theory

- Caplan, Bryan (February 12, 2009). "What's Wrong With Austrian Business Cycle Theory" (news). Liberty Fund, Inc. Retrieved 2010-05-17.

- Robert P. Murphy. "Correcting Quiggin on Austrian Business-Cycle Theory – Robert P. Murphy – Mises Daily". Mises.org. Retrieved 2012-08-13.

- Hangover Theory: How Paul Krugman Has Misconceived Austrian Theory – David Gordon – Mises Daily

- Auburn User. "Overconsumption And Forced Saving". Auburn.edu. Retrieved 2012-08-15.

{{cite web}}:|author=has generic name (help) - Roger W. Garrison. "Hayek on Industrial Fluctuations – Roger W. Garrison – Mises Daily". Mises.org. Retrieved 2012-08-13.

- ^ Hummel, Jeffery Rogers (Winter 1979). Reason Papers "Problems with Austrian Business Cycle Theory" (PDF). pp. 41–53. Retrieved 9-17-2011.

{{cite web}}: Check|url=value (help); Check date values in:|accessdate=(help) - Interview in Barron's Magazine, August 24, 1998 archived at Hoover Institution

- http://www.reasonpapers.com/pdf/30/rp_30_4.pdf

- Auburn User (1982-10-25). "Plucking Model". Auburn.edu. Retrieved 2012-08-13.

{{cite web}}:|author=has generic name (help) - Milton Friedman, "The 'Plucking Model' of Business Fluctuations Revisited" Economic Inquiry April, 1993

Further reading

- Alejandro Agafonow (2012). “The Austrian Dehomogenization Debate, or the Possibility of a Hayekian Planner,” Review of Political Economy, Vol. 24, No. 02.

- Harald Hagemann, Tamotsu Nishizawa, and Yukihiro Ikeda, eds. Austrian Economics in Transition: From Carl Menger to Friedrich Hayek (Palgrave Macmillan; 2010) 339 pages

- Stephen Littlechild, ed. (1990). Austrian economics, 3 v. Edward Elgar. Description and scroll to chapter preview links for v. 1.

External links

- Austrian Economics Concise encyclopedia of economics on Econlib

- Austrian School at Mises Wiki

- Template:Dmoz

| Schools of macroeconomic thought | |

|---|---|

| Mainstream | |

| Heterodox | |