| Revision as of 23:50, 11 September 2015 editBonewah (talk | contribs)Autopatrolled, Extended confirmed users, Pending changes reviewers14,108 edits Reverted to revision 677743787 by Cyberbot II (talk). (TW)← Previous edit | Revision as of 00:00, 12 September 2015 edit undo2601:14f:4000:2740:35c6:1960:fff7:b883 (talk)No edit summaryNext edit → | ||

| Line 1: | Line 1: | ||

| {{Taxation}} | {{Taxation}} | ||

| In ], the '''Laffer curve''' is one possible representation of the relationship between rates of ]ation and the hypothetical resulting levels of government revenue. The Laffer curve claims to illustrate the concept of taxable income elasticity—i.e., ] will change in response to changes in the rate of taxation. It postulates that no tax revenue will be raised at the extreme tax rates of 0% and 100% and that there must be at least one rate where tax revenue would be a non-zero maximum. | In ], the '''Laffer curve''' is one possible representation of the relationship between rates of ]ation and the hypothetical resulting levels of government revenue. The Laffer curve claims to illustrate the concept of taxable income elasticity—i.e., ] will change in response to changes in the rate of taxation. It postulates that no tax revenue will be raised at the extreme tax rates of 0% and 100% and that there must be at least one rate where tax revenue would be a non-zero maximum.Numerous leading economists have, however, rejected the validity of the Laffer Curve. When asked whether a “cut in federal income tax rates in the US right now would raise taxable income enough so that the annual total tax revenue would be higher within five years than without the tax cut,” 96% of eceonomists surveyed disagreed. <ref>http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_2irlrss5UC27YXi</ref> | ||

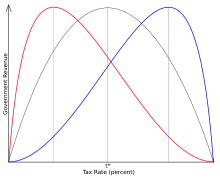

| The Laffer curve is typically represented as a graph which starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. The shape of the curve is uncertain and disputed.<ref>{{citation |title=Survey of Economics |author=Irvin B. Tucker |page=341 |publisher=Cengage Learning |year=2010 |isbn=9781439040546 }}</ref> | The Laffer curve is typically represented as a graph which starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. The shape of the curve is uncertain and disputed.<ref>{{citation |title=Survey of Economics |author=Irvin B. Tucker |page=341 |publisher=Cengage Learning |year=2010 |isbn=9781439040546 }}</ref> | ||

Revision as of 00:00, 12 September 2015

In economics, the Laffer curve is one possible representation of the relationship between rates of taxation and the hypothetical resulting levels of government revenue. The Laffer curve claims to illustrate the concept of taxable income elasticity—i.e., taxable income will change in response to changes in the rate of taxation. It postulates that no tax revenue will be raised at the extreme tax rates of 0% and 100% and that there must be at least one rate where tax revenue would be a non-zero maximum.Numerous leading economists have, however, rejected the validity of the Laffer Curve. When asked whether a “cut in federal income tax rates in the US right now would raise taxable income enough so that the annual total tax revenue would be higher within five years than without the tax cut,” 96% of eceonomists surveyed disagreed.

The Laffer curve is typically represented as a graph which starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. The shape of the curve is uncertain and disputed.

One potential result of the Laffer curve is that increasing tax rates beyond a certain point will be counter-productive for raising further tax revenue. A hypothetical Laffer curve for any given economy can only be estimated and such estimates are controversial. The New Palgrave Dictionary of Economics reports that estimates of revenue-maximizing tax rates have varied widely, with a mid-range of around 70%.

Although economist Arthur Laffer does not claim to have invented the Laffer curve concept, it was popularized in the west with policymakers following an afternoon meeting with Ford Administration officials Dick Cheney and Donald Rumsfeld in 1974 in which he reportedly sketched the curve on a napkin to illustrate his argument. The term "Laffer curve" was coined by Jude Wanniski, who was also present at the meeting. The basic concept was not new; Laffer himself notes antecedents in the writings of the 14th century Arab Muslim social philosopher Ibn Khaldun.

Theoretical issues

Justifications

Laffer explains the model in terms of two interacting effects of taxation: an "arithmetic effect" and an "economic effect". The "arithmetic effect" assumes that tax revenue raised is the tax rate multiplied by the revenue available for taxation (or tax base). Thus revenue is equal to R=t×B where t is the tax rate and B is the taxable base. At a 0% tax rate, the model assumes that no tax revenue is raised. The "economic effect" assumes that the tax rate will have an impact on the tax base itself. At the extreme of a 100% tax rate, the government theoretically collects zero revenue because taxpayers change their behavior in response to the tax rate: either they have no incentive to work or they find a way to avoid paying taxes. Thus, the "economic effect" of a 100% tax rate is to decrease the tax base to zero. If this is the case, then somewhere between 0% and 100% lies a tax rate that will maximize revenue. Graphical representations of the curve sometimes appear to put the rate at around 50%, but the optimal rate could theoretically be any percentage greater than 0% and less than 100%. Similarly, the curve is often presented as a parabolic shape, but there is no reason that this is necessarily the case. The effect of changes in tax can be case in terms of elasticities, where the optimal elasticity of the tax base with respect to the tax is equal to 1. This is done by differentiating R with respect to t and grouping terms to reveal that the rate of change of R with respect to t is equal to the sum of elasticity of the tax base plus one all multiplied by the tax base. Thus as elasticity surpasses one absolute value, revenues begin to fall. The problem is similar to that of the monopolist who must never increase prices beyond the point where the elasticity of demand exceeds one in absolute value.

Jude Wanniski noted that all economic activity would be unlikely to cease at 100% taxation, but would switch from the exchange of money to barter. He also noted that there can be special circumstances where economic activity can continue for a period at a near 100% taxation rate (for example, in war time).

Various efforts have been made to quantify the relationship between tax revenue and tax rates (for example, in the United States by the Congressional Budget Office). While the interaction between tax rates and tax revenue is generally accepted, the precise nature of this interaction is debated. In practice, the shape of a hypothetical Laffer curve for a given economy can only be estimated. The relationship between tax rate and tax revenue is likely to vary from one economy to another and depends on the elasticity of supply for labor and various other factors. Even in the same economy, the characteristics of the curve could vary over time. Complexities such as progressive taxation and possible differences in the incentive to work for different income groups complicate the task of estimation. The structure of the curve may also be changed by policy decisions. For example, if tax loopholes and off-shore tax shelters are made more readily available by legislation, the point at which revenue begins to decrease with increased taxation is likely to become lower.

Laffer presented the curve as a pedagogical device to show that, in some circumstances, a reduction in tax rates will actually increase government revenue and not need to be offset by decreased government spending or increased borrowing. For a reduction in tax rates to increase revenue, the current tax rate would need to be higher than the revenue maximizing rate. In 2007, Laffer said that the curve should not be the sole basis for raising or lowering taxes.

Problems

Laffer assumes that the government would collect no income tax at a 100% tax rate because there would be no incentive to earn income. Research has developed theoretical mathematical models in which a Laffer curve can slope continuously upwards all the way to 100%, though it is not clear whether or when the assumptions on which such mathematical models are based hold in real economies. Additionally, the Laffer curve depends on the assumption that tax revenue is used to provide a public good that is separable in utility and separate from labor supply, which may not be true in practice. The Laffer curve as presented is also simplistic in that it assumes a single tax rate and a single labor supply. Actual systems of public finance are more complex. There is serious doubt about the relevance of considering a single marginal tax rate. In addition, revenue may well be a multivalued function of tax rate - for instance, an increase in tax rate to a certain percentage may not result in the same revenue as a decrease in tax rate to the same percentage (a kind of hysteresis). Furthermore, the Laffer curve does not take explicitly into account the nature of the tax avoidance taking place. It is possible that if all producers are endowed with two survival factors in the market (ability to produce efficiently, ability to avoid tax) then the revenues raised under tax avoidance can be greater than without avoidance and the Laffer curve maximum thus is found further right than thought. The reason for this result is that if producers with low productive abilities (i.e. high production costs) also tend to have strong avoidance abilities, a uniform tax on producers actually becomes a tax that discriminates based on ability to pay.

Empirical data

Tax rate at which revenue is maximized

The New Palgrave Dictionary of Economics reports that a comparison of academic studies yields a range of revenue maximizing rates that centers around 70%. Economist Paul Pecorino presented a model in 1995 that predicted the peak of the Laffer curve occurred at tax rates around 65%. A 1996 study by Y. Hsing of the United States economy between 1959 and 1991 placed the revenue-maximizing average federal tax rate between 32.67% and 35.21%. A 1981 paper published in the Journal of Political Economy presented a model integrating empirical data that indicated that the point of maximum tax revenue in Sweden in the 1970s would have been 70%. A paper by Trabandt and Uhlig of the NBER from 2009 presented a model that predicted that the US and most European economies were on the left of the Laffer curve (in other words, that raising taxes would raise further revenue).

Congressional Budget Office analysis

In 2005, the Congressional Budget Office (CBO) released a paper called "Analyzing the Economic and Budgetary Effects of a 10 Percent Cut in Income Tax Rates". This paper considered the impact of a stylized reduction of 10% in the then existing marginal rate of federal income tax in the US (for example, if those facing a 25% marginal federal income tax rate had it lowered to 22.5%). Unlike earlier research, the CBO paper estimates the budgetary impact of possible macroeconomic effects of tax policies, that is, it attempts to account for how reductions in individual income tax rates might affect the overall future growth of the economy, and therefore influence future government tax revenues; and ultimately, impact deficits or surpluses. In the paper's most generous estimated growth scenario, only 28% of the projected lost revenue from the lower tax rate would be recouped over a 10-year period after a 10% across-the-board reduction in all individual income tax rates. In other words, deficits would increase by nearly the same amount as the tax cut in the first five years, with limited feedback revenue thereafter. Through increased budget deficits, the tax cuts primarily benefiting the wealthy will be paid for — plus interest — by taxes borne relatively evenly by all taxpayers. The paper points out that these projected shortfalls in revenue would have to be made up by federal borrowing: the paper estimates that the federal government would pay an extra $200 billion in interest over the decade covered by the paper's analysis.

Other

Laffer has presented the examples of Russia and the Baltic states, which instituted a flat tax with rates lower than 35% and whose economies started growing soon after implementation. He has similarly referred to the economic outcome of the Kemp-Roth tax act, the Kennedy tax cuts, the 1920s tax cuts, and the changes in US capital gains tax structure in 1997. Some have also cited Hauser's Law, which postulates that US federal revenues, as a percentage of GDP, have remained stable at approximately 19.5% over the period 1950 to 2007 despite changes in marginal tax rates over the same period. Others however, have called Hauser's Law "misleading" and contend that tax changes have had large effects on tax revenues.

Optimal taxation

Main article: Optimal taxOne of the uses of the Laffer curve is in determining the rate of taxation which will raise the maximum revenue (in other words, "optimizing" revenue collection). However, the revenue maximizing rate should not be confused with the optimal tax rate, which economists use to describe a tax which raises a given amount of revenue with the least distortions to the economy.

Relationship with supply-side economics

Main article: Supply-side economicsSupply-side economics is a school of macroeconomic thought that argues that overall economic well-being is maximized by lowering the barriers to producing goods and services (the "Supply Side" of the economy). By lowering such barriers, consumers are thought to benefit from a greater supply of goods and services at lower prices. Typical supply-side policy would advocate generally lower income tax and capital gains tax rates (to increase the supply of labor and capital), smaller government and a lower regulatory burden on enterprises (to lower costs). Although tax policy is often mentioned in relation to supply-side economics, supply-side economists are concerned with all impediments to the supply of goods and services and not just taxation.

History

Origin

Arthur Laffer, The Laffer Curve: Past, Present, and FutureThe Laffer Curve, by the way, was not invented by me. For example, Ibn Khaldun, a 14th century Muslim philosopher, wrote in his work The Muqaddimah: "It should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments."

The term "Laffer curve" was reportedly coined by Jude Wanniski (a writer for The Wall Street Journal) after a 1974 dinner meeting at the Two Continents Restaurant in the Washington Hotel with Arthur Laffer, Wanniski, Dick Cheney, Donald Rumsfeld, and his deputy press secretary Grace-Marie Arnett. In this meeting, Laffer, arguing against President Gerald Ford's tax increase, reportedly sketched the curve on a napkin to illustrate the concept. Cheney did not accept the idea immediately, but it caught the imaginations of those present. Laffer professes no recollection of this napkin, but writes: "I used the so-called Laffer Curve all the time in my classes and with anyone else who would listen to me."

Laffer himself does not claim to have invented the concept, attributing it to 14th-century Tunisian scholar Ibn Khaldun in his famous book Muqaddimah and, more recently, to John Maynard Keynes.

Precedents

There are historical precedents other than those cited directly by Laffer. An argument along similar lines has also been advocated by Ali ibn Abi Talib, the fourth Caliph, in his letter to the Governor of Egypt, Malik al-Ashtar. A careful reading of the quote below shows that he explicitly says that revenues might rise in time because of this reduction of taxes. He writes:

If the tax-payers complain to you of the heavy incidence to taxation, of any accidental calamity, of the vagaries of the monsoons, of the recession of the means of irrigation, of floods, or destruction of their crops on account of excessive rainfall and if their complaints are true, then reduce their taxes. This reduction should be such that it provides them opportunities to improve their conditions and eases them of their troubles. Decrease in state income due to such reasons should not depress you because the best investment for a ruler is to help his subjects at the time of their difficulties. They are the real wealth of a country and any investment on them even in the form of reduction of taxes, will be returned to the State in the shape of the prosperity of its cities and improvement of the country at large. At the same time you will be in a position to command and secure their love, respect and praises along with the revenues.

— Ali ibn Abi Talib, Nahj al-Balagha, Letter 53

Moreover his arguments about the decrease in tax increasing both state revenues and the welfare of the citizens are very similar with those cited by United States President Ronald Reagan in the 80's. Ronald Reagan argued that lower taxes would give the people a greater incentive to work, which would raise economic well-being and perhaps even tax revenue, similar to Ali Ibn abi talib some 14 centuries ago. For example, in 1924, Secretary of Treasury Andrew Mellon wrote: "It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower rates." Exercising his understanding that "73% of nothing is nothing", he pushed for the reduction of the top income tax bracket from 73% to an eventual 24% (as well as tax breaks for lower brackets). Mellon was one of the wealthiest people in the United States, the third-highest income-tax payer in the mid-1920s, behind John D. Rockefeller and Henry Ford. While he served as Secretary of the U.S. Treasury Department his wealth peaked at around $300–$400 million. Personal income-tax receipts rose from US$719 million in 1921 to over $1 billion in 1929, an average increase of 4.2% per year over an 8-year period, which supporters attribute to the rate cut.

Among others, David Hume expressed similar arguments in his essay Of Taxes in 1756, as did fellow Scottish economist Adam Smith, twenty years later.

The Democratic party made a similar argument in the 1880s when high revenue from import tariffs raised during the Civil War (1861–1865) led to federal budget surpluses. The Republican party, which was then based in the protectionist industrial Northeast, argued that cutting rates would lower revenues. But the Democratic party, then rooted in the agricultural South, argued tariff reductions would increase revenues by increasing the number of taxable imports. A 1997 analysis concluded that the tariff rate used was lower than the revenue maximizing rate. The Arabic Muslim scholar Ibn Khaldun made similar assumptions.

In US political discourse

Reaganomics

Main article: Reaganomics

The Laffer curve and supply-side economics inspired Reaganomics and the Kemp-Roth Tax Cut of 1981. Supply-side advocates of tax cuts claimed that lower tax rates would generate more tax revenue because the United States government's marginal income tax rates prior to the legislation were on the right-hand side of the curve. As a successful actor, Reagan himself had been subject to marginal tax rates as high as 90% during World War II. During the Reagan presidency, the top marginal rate of tax in the United States fell from 70% to 31%. According to OMB historical data, federal government revenue as a percentage of GDP fell from 19.0% of GDP in 1980 to 18.4% by 1989. However, absolute revenues nearly doubled during the same time period.

David Stockman, Ronald Reagan's budget director during his first administration and one of the early proponents of supply-side economics, was concerned that the administration did not pay enough attention to cutting government spending. He maintained that the Laffer curve was not to be taken literally — at least not in the economic environment of the 1980s United States. In The Triumph of Politics, he writes: "he whole California gang had taken literally (and primitively). The way they talked, they seemed to expect that once the supply-side tax cut was in effect, additional revenue would start to fall, manna-like, from the heavens. Since January, I had been explaining that there is no literal Laffer curve." Stockman also said that "Laffer wasn't wrong, he just didn't go far enough" (in paying attention to government spending).

Some have criticized elements of Reaganomics on the basis of equity. For example, economist John Kenneth Galbraith believed that the Reagan administration actively used the Laffer curve "to lower taxes on the affluent". Some critics point out that tax revenues almost always rise every year, and during Reagan's two terms increases in tax revenue were more shallow than increases during presidencies where top marginal tax rates were higher. Critics also point out that since the Reagan tax cuts, income has not significantly increased for the rest of the population. This assertion is supported by studies that show the income of the top 1% nearly doubling during the Reagan years, while income for other income levels increased only marginally; income actually decreased for the bottom quintile.

Bush tax cuts

Main article: Bush tax cuts

The Congressional Budget Office (CBO) has estimated that extending the Bush tax cuts of 2001–2003 beyond their 2010 expiration would increase deficits by $1.8 trillion over the following decade. Economist Paul Krugman contended that supply-side adherents did not fully believe that the United States income tax rate was on the "backwards-sloping" side of the curve and yet they still advocated lowering taxes to encourage investment of personal savings.

Outside the United States

Between 1979 and 2002, more than 40 other countries, including the United Kingdom, Belgium, Denmark, Finland, France, Germany, Norway, and Sweden cut their top rates of personal income tax. In an article about this, Alan Reynolds, a senior fellow with the right-libertarian think tank Cato Institute, wrote, "Why did so many other countries so dramatically reduce marginal tax rates? Perhaps they were influenced by new economic analysis and evidence from... supply-side economics. But the sheer force of example may well have been more persuasive. Political authorities saw that other national governments fared better by having tax collectors claim a medium share of a rapidly growing economy (a low marginal tax) rather than trying to extract a large share of a stagnant economy (a high average tax)."

Japanese government raised the sales tax in 1997 for the purpose of balancing its budget, but the government revenue decreased by 4.5 trillion yen because consumption stumbled. The country recorded a GDP growth rate of 3 percent in 1996, but after the tax hike the economy sank into recession (although this was also the time period of the 1997 Asian Financial Crisis.) The tax revenue reached a peak of 53 trillion yen in FY 1997, and declined in subsequent years, being still 42 trillion yen (537 billion US dollars) in 2012.

See also

- Rahn curve

- Muqaddimah

- Deadweight loss

- Jude Wanniski

- List of economics topics

- Macroeconomics

- Optimal tax

- Reaganomics

- Self-Reliance

- Supply-side economics

- Trickle-down economics

Notes

- http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_2irlrss5UC27YXi

- Irvin B. Tucker (2010), Survey of Economics, Cengage Learning, p. 341, ISBN 9781439040546

- ^ Fullerton, Don (2008). "Laffer curve". In Durlauf, Steven N.; Blume, Lawrence E. (eds.). The New Palgrave Dictionary of Economics (2nd ed.). p. 839. doi:10.1057/9780230226203.0922. ISBN 978-0-333-78676-5.

- ^ Laffer, Arthur (2004-06-01). "The Laffer Curve, Past, Present and Future". Heritage Foundation. Retrieved 2007-12-11.

- "To Donald Rumsfeld". Polyconomics.com. Archived from the original on 2011-05-03. Retrieved 2012-12-13.

- "The Laffer Curve: Past, Present, and Future". Heritage.org. Retrieved 2012-12-13.

- ^ Wanniski, Jude (1978). "Taxes, Revenues and the 'Laffer Curve'" (PDF). The Public Interest. Retrieved 2009-11-21.

- ^ "CBO. (December 1, 2005). Analyzing the Economic and Budgetary Effects of a 10 Percent Cut in Income Tax Rates" (PDF). Retrieved 2007-12-11.

- Tax Cuts Don't Boost Revenues, Time Magazine, December 6, 2007

- Malcomson, J (1986). "Some analytics of the laffer curve". Journal of Public Economics. 29 (3): 263. doi:10.1016/0047-2727(86)90029-0.

- Gahvari, F (1989). "The nature of government expenditures and the shape of the laffer curve". Journal of Public Economics. 40 (2): 251. doi:10.1016/0047-2727(89)90006-6.

- Palda, Filip (1998) "Evasive Ability and the Efficiency Cost of the Underground Economy" The Canadian Journal of Economics / Revue canadienne d'Economique Vol. 31, No. 5 (Nov., 1998), pp. 1118-1138

- ^ "How Far Are We From The Slippery Slope? The Laffer Curve Revisited" by Mathias Trabandt and Harald Uhlig, NBER Working Paper No. 15343, September 2009.

- Pecorino, Paul (1995). "Tax rates and tax revenues in a model of growth through human capital accumulation". Journal of Monetary Economics. 36 (3): 527. doi:10.1016/0304-3932(95)01224-9.

- Hsing, Y (1996). "Estimating the laffer curve and policy implications". Journal of Socio-Economics. 25 (3): 395. doi:10.1016/S1053-5357(96)90013-X.

- Stuart, C. E. (1981). "Swedish Tax Rates, Labor Supply, and Tax Revenues". The Journal of Political Economy. 89 (5): 1020–1038. doi:10.1086/261018. JSTOR 1830818.

- CBO Study Grey Box Page 1

- Ranson, David, "You Can't Soak the Rich,", The Wall Street Journal, May 20, 2008; Page A23

- Kimmel, Mike (2010-11-30). "Hauser's Law is Extremely Misleading". Angry Bear - Financial and Economic Commentary. Retrieved 30 June 2011.

- Giertz, Seth A (2008-05-30). "How Does the Elasticity of Taxable Income Affect Economic Efficiency and Tax Revenues and what Implications Does this have for Tax Policy Moving Forward?" (PDF). American Enterprise Institute for Public Policy Research: 36–42. Archived from the original (PDF) on 26 March 2011. Retrieved 2011-05-08.

{{cite journal}}: Cite journal requires|journal=(help); Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "Supply-Side Economics and Austrian Economics". April 1987.

- Laffer, Arthur (2004). "The Laffer Curve: Past, Present, and Future". Retrieved 2014-10-24.

- Archived 2011-07-22 at the Wayback Machine

- Gellman, Barton, 258. Angler: The Cheney Vice Presidency, Penguin Press, New York 2008.

- Laffer, Arthur. "The Laffer Curve: Past, Present, and Future". The Heritage Foundation. Retrieved 4 July 2012.

- Brederode, Robert F. van (2009). Systems of general sales taxation : theory, policy and practice. Austin : Wolters Kluwer Law & Business. p. 117. ISBN 9041128328.

- Ali, Imam (1978). "Nahjul Balagha". Imam Ali. Retrieved 2009-11-21.

- Cannadine, David. Mellon: An American Life. New York: A.A. Knopf, 2006. pp. 48-49, 165, 349. ISBN 0-679-45032-7.

- Folsom Jr., Burton W., "The Myth of the Robber Barons", page 103. Young America's Foundation, 2007.

- Table 1.2—Summary of receipts, outlays, and surpluses or deficits (-) as percentage of GDP : 1930–2015

- "The Education of David Stockman". The Atlantic. December 1981.

- Galbraith, J. K. (Sinclair-Stevenson 1994). The World Economy Since The Wars. A Personal View, p. 232.

- Myth: Tax cuts increase tax collections.

- "Cumulative Growth In Average After-Tax Income, By Income Group; graph, page 19" (PDF). Congressional Budget Office. October 2011.

- http://www.economicdynamics.org/meetpapers/2012/paper_78.pdf

- Analysis of President's Budget Table 1-3 Page 6

- Peddling Prosperity by Paul Krugman, p.95

- Marginal Tax Rates, by Alan Reynolds

- Learning from 1997 tax hike The Wall Street Journal, Sep 9, 2013

- Japan’s Tax Revenue Probably Exceeded MOF Estimate, Report Shows Bloomberg News, 1 June 2012

External links

- Jude Wanniski, "Taxes, Revenues, and the `Laffer Curve,'" The Public Interest, Number 50, Winter 1978

- Arthur Laffer describing the Laffer Curve

- The Laffer Curve, Part I: Understanding the Theory

- The Laffer Curve, Part II: Reviewing the Evidence

- The Laffer Curve, Part III: Dynamic Scoring

- On PBS NewsHOur Solman explores the relationship between economic activity and tax rates.