| Revision as of 07:09, 24 April 2021 editTARDIS Builder (talk | contribs)Extended confirmed users1,874 editsm →top: increase clarity← Previous edit | Revision as of 19:13, 26 April 2021 edit undoMx. Granger (talk | contribs)Extended confirmed users, Pending changes reviewers, Rollbackers69,829 edits clarifying - this is US-specificNext edit → | ||

| Line 35: | Line 35: | ||

| == Margin requirements == | == Margin requirements == | ||

| In the United States, margin requirements for all options positions, including a butterfly, are governed by what is known as ]. However brokers are permitted to apply more stringent margin requirements than the regulations. | |||

| == Butterfly variations == | == Butterfly variations == | ||

Revision as of 19:13, 26 April 2021

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower (when long the butterfly) or higher (when short the butterfly) than that asset's current implied volatility.

Long butterfly

A long butterfly position will make profit if the future volatility is lower than the implied volatility.

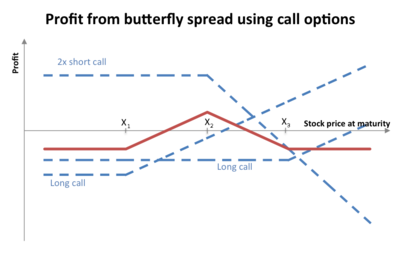

A long butterfly options strategy consists of the following options:

- Long 1 call with a strike price of (X − a)

- Short 2 calls with a strike price of X

- Long 1 call with a strike price of (X + a)

where X = the spot price (i.e. current market price of underlying) and a > 0.

Using put–call parity a long butterfly can also be created as follows:

- Long 1 put with a strike price of (X + a)

- Short 2 puts with a strike price of X

- Long 1 put with a strike price of (X − a)

where X = the spot price and a > 0.

All the options have the same expiration date.

At expiration the value (but not the profit) of the butterfly will be:

- zero if the price of the underlying is below (X − a) or above (X + a)

- positive if the price of the underlying is between (X - a) and (X + a)

The maximum value occurs at X (see diagram).

Short butterfly

A short butterfly position will make profit if the future volatility is higher than the implied volatility.

A short butterfly options strategy consists of the same options as a long butterfly. However now the middle strike option position is a long position and the upper and lower strike option positions are short.

Margin requirements

In the United States, margin requirements for all options positions, including a butterfly, are governed by what is known as Regulation T. However brokers are permitted to apply more stringent margin requirements than the regulations.

Butterfly variations

- The double option position in the middle is called the body, while the two other positions are called the wings.

- The option strategy where the middle options (the body) have different strike prices is known as a Condor.

- In case the distance between middle strike price and strikes above and below is unequal, such position is referred to as "broken wings" butterfly.

References

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

- Credit By Brokers And Dealers (Regulation T), FINRA, 1986