| Revision as of 15:33, 16 May 2021 editBasedMises (talk | contribs)Extended confirmed users, Pending changes reviewers956 editsNo edit summaryTag: Visual edit← Previous edit | Revision as of 15:44, 16 May 2021 edit undoBasedMises (talk | contribs)Extended confirmed users, Pending changes reviewers956 editsNo edit summaryTag: Visual edit: SwitchedNext edit → | ||

| Line 278: | Line 278: | ||

| | quote = I think Milton Friedman's interpretation of the success of market systems is historically seriously wrong, and his faith in market systems to achieve desirable ends I think is grossly mistaken. | | quote = I think Milton Friedman's interpretation of the success of market systems is historically seriously wrong, and his faith in market systems to achieve desirable ends I think is grossly mistaken. | ||

| | author = Noam Chomsky | | author = Noam Chomsky | ||

| | source = {{ |

| source = <ref>{{cite web |url=https://www.youtube.com/watch?v=72ntkmdF9Yk |title=Noam Chomsky on Milton Friedman was wrong about! |date=September 25, 2015 |website=Youtube |access-date=May 16, 2021}} | ||

| </ref> | |||

| | width = 30em | | width = 30em | ||

| }} | }} | ||

Revision as of 15:44, 16 May 2021

American economist

| Milton Friedman | |

|---|---|

Friedman in 2004 Friedman in 2004 | |

| Born | (1912-07-31)July 31, 1912 Brooklyn, New York, U.S. |

| Died | November 16, 2006(2006-11-16) (aged 94) San Francisco, California, U.S. |

| Nationality | American |

| Spouses | Rose Friedman |

| Children | |

| Academic career | |

| Institution |

|

| School or tradition | Chicago School |

| Alma mater | |

| Doctoral advisor | Simon Kuznets |

| Doctoral students | Phillip Cagan Harry Markowitz Lester G. Telser David I. Meiselman Neil Wallace Miguel Sidrauski Edgar L. Feige |

| Influences | |

| Contributions | |

| Awards | |

| Information at IDEAS / RePEc | |

| Signature | |

Milton Friedman (/ˈfriːdmən/; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler and others, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students and young professors who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, Thomas Sowell and Robert Lucas Jr.

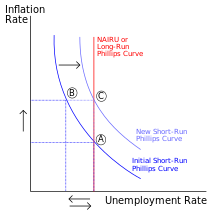

Friedman's challenges to what he later called "naive Keynesian theory" began with his 1950s interpretation of the consumption function. He introduced a theory - the Permanent Income Hypothesis - which would later become part of the mainstream and among the first to propagate the theory of consumption smoothing. During the 1960s he became the main advocate opposing Keynesian government policies, and described his approach (along with mainstream economics) as using "Keynesian language and apparatus" yet rejecting its initial conclusions. He theorized that there existed a natural rate of unemployment and argued that unemployment below this rate would cause inflation to accelerate. He argued that the Phillips curve was in the long run vertical at the 'natural rate' and predicted what would come to be known as stagflation. Friedman promoted an alternative macroeconomic viewpoint known as 'monetarism' and argued that a steady, small expansion of the money supply was the preferred policy, as compared to rapid, and unexpected changes. His ideas concerning monetary policy, taxation, privatization and deregulation influenced government policies, especially during the 1980s. His monetary theory influenced the Federal Reserve's monetary policy in response to the global financial crisis of 2007–2008.

Friedman was an advisor to Republican President Ronald Reagan and Conservative British Prime Minister Margaret Thatcher. His political philosophy extolled the virtues of a free market economic system with minimal government intervention in social matters. He once stated that his role in eliminating conscription in the United States was his proudest accomplishment. In his 1962 book Capitalism and Freedom, Friedman advocated policies such as a volunteer military, freely floating exchange rates, abolition of medical licenses, a negative income tax and school vouchers and opposed the war on drugs. His support for school choice led him to found the Friedman Foundation for Educational Choice, later renamed EdChoice.

Friedman's works include monographs, books, scholarly articles, papers, magazine columns, television programs, and lectures, and cover a broad range of economic topics and public policy issues. His books and essays have had global influence, including in former communist states. A 2011 survey of economists commissioned by the EJW ranked Friedman as the second-most popular economist of the 20th century, following only by John Maynard Keynes. Upon his death, The Economist described him as "the most influential economist of the second half of the 20th century ... possibly of all of it".

Early life

Friedman was born in Brooklyn, New York on July 31, 1912. His parents, Sára Ethel (née Landau) and Jenő Saul Friedman, were Jewish working-class immigrants from Beregszász in Carpathian Ruthenia, Kingdom of Hungary (now Berehove in Ukraine). They emigrated to America in their early teens. They both worked as dry goods merchants. Friedman was their fourth child and only son. Shortly after his birth, the family relocated to Rahway, New Jersey.

In his early teens, Friedman was injured in a car accident, which scarred his upper lip. A talented student and an avid reader, Friedman graduated from Rahway High School in 1928, just before his 16th birthday. Although no family members had gone to university before Milton, Friedman was awarded a competitive scholarship to Rutgers University (then a private university receiving limited support from the State of New Jersey, e.g., for such scholarships). He graduated from Rutgers in 1932.

Friedman initially intended to become an actuary or mathematician, however the state of the economy convinced him to become an economist. He was offered two scholarships to do graduate work, one in mathematics at Brown University and the other in economics at the University of Chicago. Friedman chose the latter, earning a Master of Arts degree in 1933. He was strongly influenced by Jacob Viner, Frank Knight, and Henry Simons. Friedman met his future wife, economist Rose Director, while at the University of Chicago.

During the 1933–1934 academic year, he had a fellowship at Columbia University, where he studied statistics with statistician and economist Harold Hotelling. He was back in Chicago for the 1934–1935 academic year, working as a research assistant for Henry Schultz, who was then working on Theory and Measurement of Demand.

During the aforementioned 1934-35 academic year, Friedman formed what would prove to be lifelong friendships with George Stigler and W. Allen Wallis.

Public service

Friedman was unable to find academic employment, so in 1935 he followed his friend W. Allen Wallis to Washington, D.C., where Franklin D. Roosevelt's New Deal was "a lifesaver" for many young economists. At this stage, Friedman said that he and his wife "regarded the job-creation programs such as the WPA, CCC, and PWA appropriate responses to the critical situation," but not "the price- and wage-fixing measures of the National Recovery Administration and the Agricultural Adjustment Administration." Foreshadowing his later ideas, he believed price controls interfered with an essential signaling mechanism to help resources be used where they were most valued. Indeed, Friedman later concluded that all government intervention associated with the New Deal was "the wrong cure for the wrong disease," arguing that the Federal Reserve was to blame, and that they should have expanded the money supply in reaction to what he later described in A Monetary History of the United States as "The Great Contraction." Later, Friedman and his colleague Anna Schwartz wrote A Monetary History of the United States, 1867–1960, which argued that the Great Depression was caused by a severe monetary contraction due to banking crises and poor policy on the part of the Federal Reserve. Robert J. Shiller describes the book as the "most influential account" of the Great Depression.

During 1935, he began working for the National Resources Planning Board, which was then working on a large consumer budget survey. Ideas from this project later became a part of his Theory of the Consumption Function, a book which first described consumption smoothing and the Permanent Income Hypothesis. Friedman began employment with the National Bureau of Economic Research during the autumn of 1937 to assist Simon Kuznets in his work on professional income. This work resulted in their jointly authored publication Incomes from Independent Professional Practice, which introduced the concepts of permanent and transitory income, a major component of the Permanent Income Hypothesis that Friedman worked out in greater detail in the 1950s. The book hypothesizes that professional licensing artificially restricts the supply of services and raises prices.

During 1940, Friedman was appointed as an assistant professor teaching Economics at the University of Wisconsin–Madison, but encountered antisemitism in the Economics department and returned to government service. From 1941 to 1943 Friedman worked on wartime tax policy for the federal government, as an advisor to senior officials of the United States Department of the Treasury. As a Treasury spokesman during 1942, he advocated a Keynesian policy of taxation. He helped to invent the payroll withholding tax system, since the federal government needed money to fund the war. He later said, "I have no apologies for it, but I really wish we hadn't found it necessary and I wish there were some way of abolishing withholding now." In Milton and Rose Friedman's jointly-written memoir, he wrote, "Rose has repeatedly chided me over the years about the role that I played in making possible the current overgrown government we both criticize so strongly."

Academic career

Early years

In 1940, Friedman accepted a position at the University of Wisconsin–Madison, but left because of differences with faculty regarding United States involvement in World War II. Friedman believed the United States should enter the war. In 1943, Friedman joined the Division of War Research at Columbia University (headed by W. Allen Wallis and Harold Hotelling), where he spent the rest of World War II working as a mathematical statistician, focusing on problems of weapons design, military tactics, and metallurgical experiments.

In 1945, Friedman submitted Incomes from Independent Professional Practice (co-authored with Kuznets and completed during 1940) to Columbia as his doctoral dissertation. The university awarded him a PhD in 1946. Friedman spent the 1945–1946 academic year teaching at the University of Minnesota (where his friend George Stigler was employed). On February 12, 1945, his son, David D. Friedman, who would later follow in his fathers footsteps and become an economist, was born.

University of Chicago

In 1946, Friedman accepted an offer to teach economic theory at the University of Chicago (a position opened by departure of his former professor Jacob Viner to Princeton University). Friedman would work for the University of Chicago for the next 30 years. There he contributed to the establishment of an intellectual community that produced a number of Nobel Memorial Prize winners, known collectively as the Chicago school of economics.

At that time, Arthur F. Burns, who was then the head of the National Bureau of Economic Research, and later chairman of the Federal Reserve, asked Friedman to rejoin the Bureau's staff. He accepted the invitation, and assumed responsibility for the Bureau's inquiry into the role of money in the business cycle. As a result, he initiated the "Workshop in Money and Banking" (the "Chicago Workshop"), which promoted a revival of monetary studies. During the latter half of the 1940s, Friedman began a collaboration with Anna Schwartz, an economic historian at the Bureau, that would ultimately result in the 1963 publication of a book co-authored by Friedman and Schwartz, A Monetary History of the United States, 1867–1960.

Friedman spent the 1954–1955 academic year as a Fulbright Visiting Fellow at Gonville and Caius College, Cambridge. At the time, the Cambridge economics faculty was divided into a Keynesian majority (including Joan Robinson and Richard Kahn) and an anti-Keynesian minority (headed by Dennis Robertson). Friedman speculated that he was invited to the fellowship, because his views were unacceptable to both of the Cambridge factions. Later his weekly columns for Newsweek magazine (1966–84) were well read and increasingly influential among political and business people, and helped earn the magazine a Gerald Loeb Special Award in 1968. From 1968 to 1978, he and Paul Samuelson participated in the Economics Cassette Series, a biweekly subscription series where the economist would discuss the days' issues for about a half-hour at a time.

A Theory of the Consumption Function

One of Milton Friedman's most popular works, A Theory of the Consumption Function, challenged traditional Keynesian viewpoints about the household. This work was originally published in 1957 by Princeton University Press, and it reanalysed the relationship displayed "between aggregate consumption or aggregate savings and aggregate income."

Friedman's counterpart Keynes believed that people would modify their household consumption expenditures to relate to their existing income levels. Friedman's research introduced the term "permanent income" to the world, which was the average of a household's expected income over several years, and he also developed the permanent income hypothesis. Friedman thought that income consisted of several components, namely transitory and permanent. He established the formula in order to calculate income, with p representing the permanent component, and t representing the transitory component.

Milton Friedman's research changed how economists interpreted the consumption function, and his work pushed the idea that current income was not the only factor that affected people's adjustment household consumption expenditures. Instead, expected income levels also affected how households would change their consumption expenditures. Friedman's contributions strongly influenced research on consumer behavior, and he further defined how to predict consumption smoothing, which contradicts Keynes' marginal propensity to consume. Although this work presented many controversial points of view that differed from existing viewpoints established by Keynes, A Theory of the Consumption Function helped Friedman gain respect in the field of economics. His work on the Permanent Income Hypothesis is among the many contributions which were listed as reasons for his Nobel Prize. His work was later expanded on by Christopher D. Carroll, especially in regards to the absence of liquidity constraints.

The Permanent Income Hypothesis faces some criticism, mainly from Keynesian economists. The primary criticism of the hypothesis has mainly been based off of a lack of liquidity constraints.

Capitalism and Freedom

His book Capitalism and Freedom, inspired by a series of lectures he gave at Wabash College, brought him national and international attention outside academia. It was published in 1962 by the University of Chicago Press and consists of essays that used non-mathematical economic models to explore issues of public policy. It sold over 400,000 copies in the first eighteen years and more than half a million since 1962. It has been translated into eighteen languages. Friedman talks about the need to move to a classically liberal society, that free markets would help nations and individuals in the long-run and fix the efficiency problems currently faced by the United States and other major countries of the 1950s and 1960s. He goes through the chapters specifying a specific issue in each respective chapter from the role of government and money supply to social welfare programs to a special chapter on occupational licensure. Friedman concludes Capitalism and Freedom with his "classical liberal" (more accurately, libertarian) stance, that government should stay out of matters that do not need and should only involve itself when absolutely necessary for the survival of its people and the country. He recounts how the best of a country's abilities come from its free markets while its failures come from government intervention.

Post-retirement

In 1977, at the age of 65, Friedman retired from the University of Chicago after teaching there for 30 years. He and his wife moved to San Francisco, where he became a visiting scholar at the Federal Reserve Bank of San Francisco. From 1977 on, he was affiliated with the Hoover Institution at Stanford University. During the same year, Friedman was approached by the Free To Choose Network and asked to create a television program presenting his economic and social philosophy.

The Friedmans worked on this project for the next three years, and during 1980, the ten-part series, titled Free to Choose, was broadcast by the Public Broadcasting Service (PBS). The companion book to the series (co-authored by Milton and his wife, Rose Friedman), also titled Free To Choose, was the bestselling nonfiction book of 1980.

Friedman served as an unofficial adviser to Ronald Reagan during his 1980 presidential campaign, and then served on the President's Economic Policy Advisory Board for the rest of the Reagan Administration. Ebenstein says Friedman was "the 'guru' of the Reagan administration." In 1988 he received the National Medal of Science and Reagan honored him with the Presidential Medal of Freedom.

Friedman is known now as one of the most influential economists of the 20th century. Throughout the 1980s and 1990s, Friedman continued to write editorials and appear on television. He made several visits to Eastern Europe and to China, where he also advised governments. He was also for many years a Trustee of the Philadelphia Society.

Personal life

Religious views

According to a 2007 article in Commentary magazine, his "parents were moderately observant Jews, but Friedman, after an intense burst of childhood piety, rejected religion altogether." He described himself as an agnostic. Friedman wrote extensively of his life and experiences, especially in 1998 in his memoirs with his wife, Rose, titled Two Lucky People. In this book, Rose Friedman describes how she and Milton Friedman raised their two children, Janet and David, with a Christmas Tree in the home. "Orthodox Jews of course, do not celebrate Christmas. However, just as, when I was a child, my mother had permitted me to have a Christmas tree one year when my friend had one, she not only tolerated our having a Christmas tree, she even strung popcorn to hang on it."

Death

Friedman died of heart failure at the age of 94 years in San Francisco on November 16, 2006. He was still a working economist performing original economic research; his last column was published in The Wall Street Journal the day after his death. He was survived by his wife, Rose Friedman (who would die on August 18, 2009) and their two children, David D. Friedman, known for The Machinery of Freedom, as well as his unique anarcho-capitalism from a Chicago School perspective, and bridge player Jan Martel.

Scholarly contributions

See also: Friedman–Savage utility function, Friedman rule, Friedman's k-percent rule, Friedman test, and Great ContractionEconomics

Friedman was best known for reviving interest in the money supply as a determinant of the nominal value of output, that is, the quantity theory of money. Monetarism is the set of views associated with modern quantity theory. Its origins can be traced back to the 16th-century School of Salamanca or even further; however, Friedman's contribution is largely responsible for its modern popularization. He co-authored, with Anna Schwartz, A Monetary History of the United States, 1867–1960 (1963), which was an examination of the role of the money supply and economic activity in the U.S. history.

Friedman was the main proponent of the monetarist school of economics. He maintained that there is a close and stable association between inflation and the money supply, mainly that inflation could be avoided with proper regulation of the monetary base's growth rate. He famously used the analogy of "dropping money out of a helicopter", in order to avoid dealing with money injection mechanisms and other factors that would overcomplicate his models.

Friedman's arguments were designed to counter the popular concept of cost-push inflation, that the increased general price level at the time was the result of increases in the price of oil, or increases in wages; as he wrote:

Inflation is always and everywhere a monetary phenomenon.

— Milton Friedman, 1963.

Friedman rejected the use of fiscal policy as a tool of demand management; and he held that the government's role in the guidance of the economy should be restricted severely. Friedman wrote extensively on the Great Depression, and he termed the 1929–1933 period the Great Contraction. He argued that the Depression had been caused by an ordinary financial shock whose duration and seriousness were greatly increased by the subsequent contraction of the money supply caused by the misguided policies of the directors of the Federal Reserve.

The Fed was largely responsible for converting what might have been a garden-variety recession, although perhaps a fairly severe one, into a major catastrophe. Instead of using its powers to offset the depression, it presided over a decline in the quantity of money by one-third from 1929 to 1933 ... Far from the depression being a failure of the free-enterprise system, it was a tragic failure of government.

— Milton Friedman, Two Lucky People, 233

This theory was put forth in A Monetary History of the United States, and the chapter on the Great Depression was then published as a stand-alone book entitled The Great Contraction, 1929–1933. Both books are still in print from Princeton University Press, and some editions include as an appendix a speech at a University of Chicago event honoring Friedman in which Ben Bernanke made this statement:

Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression, you're right. We did it. We're very sorry. But thanks to you, we won't do it again.

Friedman also argued for the cessation of government intervention in currency markets, thereby spawning an enormous literature on the subject, as well as promoting the practice of freely floating exchange rates. His close friend George Stigler explained, "As is customary in science, he did not win a full victory, in part because research was directed along different lines by the theory of rational expectations, a newer approach developed by Robert Lucas, also at the University of Chicago." The relationship between Friedman and Lucas, or new classical macroeconomics as a whole, was highly complex. The Friedmanian Phillips curve was an interesting starting point for Lucas, but he soon realized that the solution provided by Friedman was not quite satisfactory. Lucas elaborated a new approach in which rational expectations were presumed instead of the Friedmanian adaptive expectations. Due to this reformulation, the story in which the theory of the new classical Phillips curve was embedded radically changed. This modification, however, had a significant effect on Friedman's own approach, so, as a result, the theory of the Friedmanian Phillips curve also changed. Moreover, new classical Neil Wallace, who was a graduate student at the University of Chicago between 1960 and 1963, regarded Friedman's theoretical courses as a mess. This evaluation clearly indicates the broken relationship between Friedmanian monetarism and new classical macroeconomics.

Friedman was also known for his work on the consumption function, the permanent income hypothesis (1957), which Friedman himself referred to as his best scientific work. This work contended that utility-maximizing consumers would spend a proportional amount of what they perceived to be their permanent income. Permanent Income refers to such factors like human capital. Windfall gains would mostly be saved because of the law of diminishing marginal utility.

Friedman's essay "The Methodology of Positive Economics" (1953) provided the epistemological pattern for his own subsequent research and to a degree that of the Chicago School. There he argued that economics as science should be free of value judgments for it to be objective. Moreover, a useful economic theory should be judged not by its descriptive realism but by its simplicity and fruitfulness as an engine of prediction. That is, students should measure the accuracy of its predictions, rather than the 'soundness of its assumptions'. His argument was part of an ongoing debate among such statisticians as Jerzy Neyman, Leonard Savage, and Ronald Fisher.

However, despite being an advocate of the free market, Milton Friedman believed that the government had two crucial roles. In an interview with Phil Donahue, Milton Friedman argued that "the two basic functions of a government are to protect the nation against foreign enemy, and to protect citizens against its fellows.” He also admitted that although privatization of national defense could reduce the overall cost, he has not yet thought of a way to make this privatization possible.

Rejection and subsequent evolution of the Philips Curve

Other important contributions include his critique of the Phillips curve and the concept of the natural rate of unemployment (1968). This critique associated his name, together with that of Edmund Phelps, with the insight that a government that brings about greater inflation cannot permanently reduce unemployment by doing so. Unemployment may be temporarily lower, if the inflation is a surprise, but in the long run unemployment will be determined by the frictions and imperfections of the labor market. If the conditions are not met and inflation is expected, the "long run" effects will replace the "short term" ones.

Through his critique, the Philips curve evolved from a strict model emphasizing the connection between inflation and unemployment as being absolute, to a model which emphasized short term unemployment reductions and long term employment stagnations.

Statistics

One of his most famous contributions to statistics is sequential sampling. Friedman did statistical work at the Division of War Research at Columbia, where he and his colleagues came up with the technique. It became, in the words of The New Palgrave Dictionary of Economics, "the standard analysis of quality control inspection". The dictionary adds, "Like many of Friedman's contributions, in retrospect it seems remarkably simple and obvious to apply basic economic ideas to quality control; that, however, is a measure of his genius."

Public policy positions

Federal Reserve and monetary policy

Although Friedman concluded the government does have a role in the monetary system he was critical of the Federal Reserve due to its poor performance and felt it should be abolished. He was opposed to Federal Reserve policies, even during the so-called 'Volcker shock' that was labeled 'monetarist'. Friedman believed that the Federal Reserve System should ultimately be replaced with a computer program. He favored a system that would automatically buy and sell securities in response to changes in the money supply.

The proposal to constantly grow the money supply at a certain predetermined amount every year has become known as Friedman's k-percent rule. There is debate about the effectiveness of a theoretical money supply targeting regime. The Fed's inability to meet its money supply targets from 1978–1982 has led some to conclude it is not a feasible alternative to more conventional inflation and interest rate targeting. Towards the end of his life, Friedman expressed doubt about the validity of targeting the quantity of money. To date, most countries have adopted inflation targeting instead of the k-percent rule.

Idealistically, Friedman actually favored the principles of the 1930s Chicago plan, which would have ended fractional reserve banking and, thus, private money creation. It would force banks to have 100% reserves backing deposits, and instead place money creation powers solely in the hands of the US Government. This would make targeting money growth more possible, as endogenous money created by fractional reserve lending would no longer be a major issue.

Exchange rates

Friedman was a strong advocate for floating exchange rates throughout the entire Bretton-Woods period (1944-1971). He argued that a flexible exchange rate would make external adjustment possible and allow countries to avoid balance of payments crises. He saw fixed exchange rates as an undesirable form of government intervention. The case was articulated in an influential 1953 paper, "The Case for Flexible Exchange Rates", at a time when most commentators regarded the possibility of floating exchange rates as a fantasy.

School choice

In his 1955 article "The Role of Government in Education" Friedman proposed supplementing publicly operated schools with privately run but publicly funded schools through a system of school vouchers. Reforms similar to those proposed in the article were implemented in, for example, Chile in 1981 and Sweden in 1992. In 1996, Friedman, together with his wife, founded the Friedman Foundation for Educational Choice to advocate school choice and vouchers. In 2016, the Friedman Foundation changed its name to EdChoice to honor the Friedmans' desire to have the educational choice movement live on without their names attached to it after their deaths.

Conscription

While Walter Oi is credited with establishing the economic basis for a volunteer military, Friedman was a proponent, and has been credited with ending the draft itself, stating that the draft was "inconsistent with a free society." In Capitalism and Freedom, he argued that conscription is inequitable and arbitrary, preventing young men from shaping their lives as they see fit. During the Nixon administration he headed the committee to research a conversion to paid/volunteer armed force. He would later state that his role in eliminating the conscription in the United States was his proudest accomplishment. Friedman did, however, believe that the introduction of a system of universal military training as a reserve in cases of war-time could be justified. He still opposed its implementation in the United States, describing it as a “monstrosity”.

Foreign policy

Biographer Lanny Ebenstein noted a drift over time in Friedman's views from an interventionist to a more cautious foreign policy. He supported US involvement in the Second World War and initially supported a hard-line against Communism, but moderated over time. However, Friedman did state in a 1995 interview that he was an anti-interventionist. He opposed the Gulf War and the Iraq War. In a spring 2006 interview, Friedman said that the US's stature in the world had been eroded by the Iraq War, but that it might be improved if Iraq were to become a peaceful and independent country.

Libertarianism and the Republican Party

Friedman was an economic advisor and speech writer in Barry Goldwater's failed presidential campaign in 1964. He was an advisor to California governor Ronald Reagan, and was active in Reagan's presidential campaigns. He served as a member of President Reagan's Economic Policy Advisory Board starting in 1981. In 1988, he received the Presidential Medal of Freedom and the National Medal of Science.

Friedman stated that he was a libertarian philosophically, but a member of the U.S. Republican Party for the sake of "expediency" ("I am a libertarian with a small 'l' and a Republican with a capital 'R.' And I am a Republican with a capital 'R' on grounds of expediency, not on principle.") But, he said, "I think the term classical liberal is also equally applicable. I don't really care very much what I'm called. I'm much more interested in having people thinking about the ideas, rather than the person."

Public goods and monopoly

Friedman was supportive of the state provision of some public goods that private businesses are not considered as being able to provide. However, he argued that many of the services performed by government could be performed better by the private sector. Above all, if some public goods are provided by the state, he believed that they should not be a legal monopoly where private competition is prohibited; for example, he wrote:

There is no way to justify our present public monopoly of the post office. It may be argued that the carrying of mail is a technical monopoly and that a government monopoly is the least of evils. Along these lines, one could perhaps justify a government post office, but not the present law, which makes it illegal for anybody else to carry the mail. If the delivery of mail is a technical monopoly, no one else will be able to succeed in competition with the government. If it is not, there is no reason why the government should be engaged in it. The only way to find out is to leave other people free to enter.

— Milton Friedman,

Social security, welfare programs and negative income tax

In 1962, Friedman criticized Social Security in his book Capitalism and Freedom, arguing that it had created welfare dependency. However, in the penultimate chapter of the same book, Friedman argued that while capitalism had greatly reduced the extent of poverty in absolute terms, "poverty is in part a relative matter, even in countries, there are clearly many people living under conditions that the rest of us label as poverty." Friedman also noted that while private charity could be one recourse for alleviating poverty and cited late 19th century Britain and the United States as exemplary periods of extensive private charity and eleemosynary activity, he made the following point:

It can be argued that private charity is insufficient because the benefits from it accrue to people other than those who make the gifts— ... a neighborhood effect. I am distressed by the sight of poverty; I am benefited by its alleviation; but I am benefited equally whether I or someone else pays for its alleviation; the benefits of other people's charity therefore partly accrue to me. To put it differently, we might all of us be willing to contribute to the relief of poverty, provided everyone else did. We might not be willing to contribute the same amount without such assurance. In small communities, public pressure can suffice to realize the proviso even with private charity. In the large impersonal communities that are increasingly coming to dominate our society, it is much more difficult for it to do so. Suppose one accepts, as I do, this line of reasoning as justifying governmental action to alleviate poverty; to set, as it were, a floor under the standard of life of every person in the community. arrangement that recommends itself on purely mechanical grounds is a negative income tax. ... The advantages of this arrangement are clear. It is directed specifically at the problem of poverty. It gives help in the form most useful to the individual, namely, cash. It is general and could be substituted for the host of special measures now in effect. It makes explicit the cost borne by society. It operates outside the market. Like any other measures to alleviate poverty, it reduces the incentives of those helped to help themselves, but it does not eliminate that incentive entirely, as a system of supplementing incomes up to some fixed minimum would. An extra dollar earned always means more money available for expenditure.

Friedman argued further that other advantages of the negative income tax were that it could fit directly into the tax system, would be less costly, and would reduce the administrative burden of implementing a social safety net. Friedman reiterated these arguments 18 years later in Free to Choose, with the additional proviso that such a reform would only be satisfactory if it replaced the current system of welfare programs rather than augment it. According to economist Robert H. Frank, writing in The New York Times, Friedman's views in this regard were grounded in a belief that while "market forces ... accomplish wonderful things", they "cannot ensure a distribution of income that enables all citizens to meet basic economic needs".

Drug policy

Friedman also supported libertarian policies such as legalization of drugs and prostitution. During 2005, Friedman and more than 500 other economists advocated discussions regarding the economic benefits of the legalization of marijuana.

Gay rights

Friedman was also a supporter of gay rights. He never specifically supported same-sex marriage, instead saying "I do not believe there should be any discrimination against gays."

Immigration

Friedman favored immigration, saying "legal and illegal immigration has a very positive impact on the U.S. economy." However, he suggested that immigrants ought not to have access to the welfare system. Friedman stated that immigration from Mexico had been a "good thing", in particular illegal immigration. Friedman argued that illegal immigration was a boon because they "take jobs that most residents of this country are unwilling to take, they provide employers with workers of a kind they cannot get" and they do not use welfare. In Free to Choose, Friedman wrote:

No arbitrary obstacles should prevent people from achieving those positions for which their talents fit them and which their values lead them to seek. Not birth, nationality, color, religion, sex, nor any other irrelevant characteristic should determine the opportunities that are open to a person — only his abilities.

Economic freedom

Michael Walker of the Fraser Institute and Friedman hosted a series of conferences from 1986 to 1994. The goal was to create a clear definition of economic freedom and a method for measuring it. Eventually this resulted in the first report on worldwide economic freedom, Economic Freedom in the World. This annual report has since provided data for numerous peer-reviewed studies and has influenced policy in several nations.

Along with sixteen other distinguished economists he opposed the Copyright Term Extension Act, and signed on to an amicus brief filed in Eldred v. Ashcroft. Friedman jokingly described it as a "no-brainer".

Friedman argued for stronger basic legal (constitutional) protection of economic rights and freedoms to further promote industrial-commercial growth and prosperity and buttress democracy and freedom and the rule of law generally in society.

Honors, recognition and legacy

George H. Nash, a leading historian of American conservatism, says that by "the end of the 1960s he was probably the most highly regarded and influential conservative scholar in the country, and one of the few with an international reputation." In 1971, Friedman received the Golden Plate Award of the American Academy of Achievement. Friedman allowed the libertarian Cato Institute to use his name for its biannual (occuring every two years) Milton Friedman Prize for Advancing Liberty beginning in 2001. A Friedman Prize was given to the late British economist Peter Bauer in 2002, Peruvian economist Hernando de Soto in 2004, Mart Laar, former Estonian Prime Minister in 2006 and a young Venezuelan student Yon Goicoechea in 2008. His wife Rose, sister of Aaron Director, with whom he initiated the Friedman Foundation for Educational Choice, served on the international selection committee.

Friedman was also a recipient of the Nobel Memorial Prize in Economics.

Upon Friedman's death, Harvard President Lawrence Summers called him "The Great Liberator", saying "... any honest Democrat will admit that we are now all Friedmanites." He said Friedman's great popular contribution was "in convincing people of the importance of allowing free markets to operate."

Stephen Moore, a member of the editorial forward of The Wall Street Journal, said in 2013: "Quoting the most-revered champion of free-market economics since Adam Smith has become a little like quoting the Bible." He adds, "There are sometimes multiple and conflicting interpretations."

Nobel Memorial Prize in Economic Sciences

Friedman won the Nobel Memorial Prize in Economic Sciences, the sole recipient for 1976, "for his achievements in the fields of consumption analysis, monetary history and theory and for his demonstration of the complexity of stabilization policy."

Hong Kong

Friedman once said: "If you want to see capitalism in action, go to Hong Kong." He wrote in 1990 that the Hong Kong economy was perhaps the best example of a free market economy.

One month before his death, he wrote the article "Hong Kong Wrong—What would Cowperthwaite say?" in The Wall Street Journal, criticizing Donald Tsang, the Chief Executive of Hong Kong, for abandoning "positive non interventionism." Tsang later said he was merely changing the slogan to "big market, small government", where small government is defined as less than 20% of GDP. In a debate between Tsang and his rival Alan Leong before the 2007 Hong Kong Chief Executive election, Leong introduced the topic and jokingly accused Tsang of angering Friedman to death (Friedman had died only a year prior).

Chile

Main articles: Miracle of Chile and Chicago BoysDuring 1975, two years after the military coup that brought military dictator President Augusto Pinochet to power and ended the government of Salvador Allende, the economy of Chile experienced a severe crisis. Friedman and Arnold Harberger accepted an invitation of a private Chilean foundation to visit Chile and speak on principles of economic freedom. He spent seven days in Chile giving a series of lectures at the Universidad Católica de Chile and the (National) University of Chile. One of the lectures was entitled "The Fragility of Freedom" and according to Friedman, "dealt with precisely the threat to freedom from a centralized military government."

In a letter to Pinochet of April 21, 1975, Friedman considered the "key economic problems of Chile are clearly ... inflation and the promotion of a healthy social market economy". He stated that "There is only one way to end inflation: by drastically reducing the rate of increase of the quantity of money ..." and that "... cutting government spending is by far and away the most desirable way to reduce the fiscal deficit, because it ... strengthens the private sector thereby laying the foundations for healthy economic growth". As to how rapidly inflation should be ended, Friedman felt that "for Chile where inflation is raging at 10–20% a month ... gradualism is not feasible. It would involve so painful an operation over so long a period that the patient would not survive." Choosing "a brief period of higher unemployment ..." was the lesser evil.. and that "the experience of Germany, ... of Brazil ..., of the post-war adjustment in the U.S. ... all argue for shock treatment". In the letter Friedman recommended to deliver the shock approach with "... a package to eliminate the surprise and to relieve acute distress" and "... for definiteness let me sketch the contents of a package proposal ... to be taken as illustrative" although his knowledge of Chile was "too limited to enable to be precise or comprehensive". He listed a "sample proposal" of 8 monetary and fiscal measures including "the removal of as many as obstacles as possible that now hinder the private market. For example, suspend ... the present law against discharging employees". He closed, stating "Such a shock program could end inflation in months". His letter suggested that cutting spending to reduce the fiscal deficit would result in less transitional unemployment than raising taxes.

Sergio de Castro, a Chilean Chicago School graduate, became the nation's Minister of Finance in 1975. During his six-year tenure, foreign investment increased, restrictions were placed on striking and labor unions, and GDP rose yearly. A foreign exchange program was created between the Catholic University of Chile and the University of Chicago. Many other Chicago School alumni were appointed government posts during and after the Pinochet years; others taught its economic doctrine at Chilean universities. They became known as the Chicago Boys.

Friedman defended his activity in Chile on the grounds that, in his opinion, the adoption of free market policies not only improved the economic situation of Chile but also contributed to the amelioration of Pinochet's rule and to the eventual transition to a democratic government during 1990. That idea is included in Capitalism and Freedom, in which he declared that economic freedom is not only desirable in itself but is also a necessary condition for political freedom. In his 1980 documentary Free to Choose, he said the following: "Chile is not a politically free system, and I do not condone the system. But the people there are freer than the people in Communist societies because government plays a smaller role. ... The conditions of the people in the past few years has been getting better and not worse. They would be still better to get rid of the junta and to be able to have a free democratic system." In 1984, Friedman stated that he has "never refrained from criticizing the political system in Chile." In 1991 he said: "I have nothing good to say about the political regime that Pinochet imposed. It was a terrible political regime. The real miracle of Chile is not how well it has done economically; the real miracle of Chile is that a military junta was willing to go against its principles and support a free market regime designed by principled believers in a free market. ... In Chile, the drive for political freedom, that was generated by economic freedom and the resulting economic success, ultimately resulted in a referendum that introduced political democracy. Now, at long last, Chile has all three things: political freedom, human freedom and economic freedom. Chile will continue to be an interesting experiment to watch to see whether it can keep all three or whether, now that it has political freedom, that political freedom will tend to be used to destroy or reduce economic freedom." He stressed that the lectures he gave in Chile were the same lectures he later gave in China and other socialist states. He further stated "I do not consider it as evil for an economist to render technical economic advice to the Chilean Government, any more than I would regard it as evil for a physician to give technical medical advice to the Chilean Government to help end a medical plague."

During the 2000 PBS documentary The Commanding Heights (based on the book), Friedman continued to argue that "free markets would undermine political centralization and political control.", and that criticism over his role in Chile missed his main contention that freer markets resulted in freer people, and that Chile's unfree economy had caused the military government. Friedman advocated for free markets which undermined "political centralization and political control".

Iceland

Friedman visited Iceland during the autumn of 1984, met with important Icelanders and gave a lecture at the University of Iceland on the "tyranny of the status quo." He participated in a lively television debate on August 31, 1984, with socialist intellectuals, including Ólafur Ragnar Grímsson, who later became the president of Iceland. When they complained that a fee was charged for attending his lecture at the university and that, hitherto, lectures by visiting scholars had been free-of-charge, Friedman replied that previous lectures had not been free-of-charge in a meaningful sense: lectures always have related costs. What mattered was whether attendees or non-attendees covered those costs. Friedman thought that it was fairer that only those who attended paid. In this discussion Friedman also stated that he did not receive any money for delivering that lecture.

Estonia

Although Friedman never visited Estonia, his book Free to Choose exercised a great influence on that nation's then 32-year-old prime minister, Mart Laar, who has claimed that it was the only book on economics he had read before taking office. Laar's reforms are often credited with responsibility for transforming Estonia from an impoverished Soviet Republic to the "Baltic Tiger." A prime element of Laar's program was introduction of the flat tax. Laar won the 2006 Milton Friedman Prize for Advancing Liberty, awarded by the Cato Institute.

United Kingdom

After 1950 Friedman was frequently invited to lecture in Britain, and by the 1970s his ideas had gained widespread attention in conservative circles. For example, he was a regular speaker at the Institute of Economic Affairs (IEA), a libertarian think tank. Conservative politician Margaret Thatcher closely followed IEA programs and ideas, and met Friedman there in 1978. He also strongly influenced Keith Joseph, who became Thatcher's senior advisor on economic affairs, as well as Alan Walters and Patrick Minford, two other key advisers. Major newspapers, including the Daily Telegraph, The Times, and The Financial Times all promulgated Friedman's monetarist ideas to British decision-makers. Friedman's ideas strongly influenced Thatcher and her allies when she became Prime Minister in 1979.

United States

After his death a number of obituaries and articles were written in Friedman's honor, citing him as one of the most important and influential economists of the post-war era. Milton Friedman's somewhat controversial legacy in America remains strong within the conservative movement. However, some journalists and economists like Noah Smith and Scott Sumner have argued Friedman's academic legacy has been buried under his political philosophy and misinterpreted by modern conservatives.

Criticism

Noam Chomsky,I think Milton Friedman's interpretation of the success of market systems is historically seriously wrong, and his faith in market systems to achieve desirable ends I think is grossly mistaken.

Econometrician David Hendry criticized part of Friedman's and Anna Schwartz's 1982 Monetary Trends. When asked about it during an interview with Icelandic TV in 1984, Friedman said that the criticism referred to a different problem from that which he and Schwartz had tackled, and hence was irrelevant, and pointed out the lack of consequential peer review amongst econometricians on Hendry's work. In 2006, Hendry said that Friedman was guilty of "serious errors" of misunderstanding that meant "the t-ratios he reported for UK money demand were overstated by nearly 100 per cent", and said that, in a paper published in 1991 with Neil Ericsson, he had refuted "almost every empirical claim ... made about UK money demand" by Friedman and Schwartz. A 2004 paper updated and confirmed the validity of the Hendry–Ericsson findings through 2000.

Although Keynesian Nobel laureate Paul Krugman praised Friedman as a "great economist and a great man" after Friedman's death in 2006, and acknowledged his many, widely accepted contributions to empirical economics, Krugman had been, and remains, a prominent critic of Friedman. Krugman has written that "he slipped all too easily into claiming both that markets always work and that only markets work. It's extremely hard to find cases in which Friedman acknowledged the possibility that markets could go wrong, or that government intervention could serve a useful purpose." Others agree Friedman was not open enough to the possibility of market inefficiencies. Economist Noah Smith argues that while Friedman made many important contributions to economic theory not all of his ideas relating to macroeconomics have entirely held up over the years and that too few people are willing to challenge them.

Political scientist C.B. Macpherson disagreed with Friedman's historical assessment of economic freedom leading to political freedom, suggesting that political freedom actually gave way to economic freedom for property-owning elites. He also challenged the notion that markets efficiently allocated resources and rejected Friedman's definition of liberty. Friedman's positivist methodological approach to economics has also been critiqued and debated. Finnish economist Uskali Mäki has argued some of his assumptions were unrealistic and vague.

In her book The Shock Doctrine, author and social activist Naomi Klein criticized Friedman's economic liberalism, identifying it with the principles that guided the economic restructuring that followed the military coups in countries such as Chile and Argentina. Based on their assessments of the extent to which what she describes as neoliberal policies contributed to income disparities and inequality, both Klein and Noam Chomsky have suggested that the primary role of what they describe as neoliberalism was as an ideological cover for capital accumulation by multinational corporations.

Visit to Chile

Because of his involvement with the government of Chile, which was a dictatorship, there were international protests, spenning from Sweden to America when Friedman was awarded the Nobel Memorial Prize in 1976. Friedman was accused of supporting the military dictatorship in Chile because of the relation of economists of the University of Chicago to Pinochet, and a controversial seven-day trip he took to Chile during March 1975 (less than two years after the coup that ended with the death of President Salvador Allende). Friedman answered that he was never an adviser to the dictatorship, but only gave some lectures and seminars on inflation, and met with officials, including Augusto Pinochet the head of the military dictatorship, while in Chile.

Chilean economist Orlando Letelier asserted that Pinochet's dictatorship resorted to oppression because of popular opposition to Chicago School policies in Chile. After a 1991 speech on drug legalisation, Friedman answered a question on his involvement with the Pinochet regime, saying that he was never an advisor to Pinochet (also mentioned in his 1984 Iceland interview), but that a group of his students at the University of Chicago were involved in Chile's economic reforms. Friedman credited these reforms with high levels of economic growth and with the establishment of democracy that has subsequently occurred in Chile. In October 1988, after returning from a lecture tour of China during which he had met with Zhao Ziyang, General Secretary of the Communist Party of China, Friedman wrote to The Stanford Daily asking if he should anticipate a similar "avalanche of protests for having been willing to give advice to so evil a government? And if not, why not?"

Criticism of A Monetary History of the United States

Although the book has been described by the Cato Institute as among the greatest economics books in the 20th century, it has endured criticisms for its conclusion that the Federal Reserve was to blame for the Great Depression. Some economists, including Peter Temin have raised questions about the legitimacy of Friedman's claims about whether or not monetary quantity levels were endogenous rather than exogenously determined, as A Monetary History of the United States posits. Nobel-prize winning economist Paul Krugman has argued that the 2008 recession has proved that, during a recession, a central bank cannot control broad money (M3 money, as defined by the OECD), and even if it can, the money supply does not bear a direct or proven relationship with GDP. According to Krugman, this was also true in the 1930s, and the claim that the Federal Reserve could have avoided the Great Depression by reacting to what Friedman called The Great Contraction is "highly dubious".

James Tobin has questioned the importance of velocity of money, and how informative this measure of the frequency of transactions is to understanding the various fluctuations observed in A Monetary History of the United States.

Economic Historian Barry Eichengreen has argued that because of the gold standard, which was at this point in time the chief monetary system of the world, the Federal Reserve's hands were tied. This was because, in order to retain the credibility of the gold standard, the Federal Reserve could not undertake actions like dramatically expanding the money supply as proposed by Friedman and Schwartz.

Austrian economist Murray Rothbard has argued that Friedman's conclusions are inconsistent with data, mainly because during the period described by Friedman as "The Great Contraction", the money supply increased, rather than decreased as Friedman and Schwartz posit.

Selected bibliography

Main article: Milton Friedman bibliography- A Theory of the Consumption Function (1957) ISBN 1614278121.

- A Program for Monetary Stability (Fordham University Press, 1960) 110 pp. online version ISBN 0-8232-0371-9

- Capitalism and Freedom (1962), highly influential series of essays that established Friedman's position on major issues of public policy (excerpts)

- A Monetary History of the United States, 1867–1960, with Anna J. Schwartz, 1963; part 3 reprinted as The Great Contraction

- "The Role of Monetary Policy." American Economic Review, Vol. 58, No. 1 (Mar. 1968), pp. 1–17 JSTOR presidential address to American Economics Association

- "Inflation and Unemployment: Nobel Lecture", 1977, Journal of Political Economy. Vol. 85, pp. 451–72. JSTOR

- Free to Choose: A Personal Statement, with Rose Friedman, (1980), highly influential restatement of policy views

- The Essence of Friedman, essays edited by Kurt R. Leube, (1987) (ISBN 0-8179-8662-6)

- Two Lucky People: Memoirs (with Rose Friedman) ISBN 0-226-26414-9 (1998) excerpt and text search

- Milton Friedman on Economics: Selected Papers by Milton Friedman, edited by Gary S. Becker (2008)

See also

Portals:- Causes of the Great Depression

- Great Contraction

- History of economic thought

- List of economists

- List of Jewish Nobel laureates

- List of Presidential Medal of Freedom recipients

- Monetary/fiscal debate

- "We are all Keynesians now"

References

Citations

- Ebenstein 2007, p. 89

- ^ Charles Moore (2013). Margaret Thatcher: The Authorized Biography, Volume One: Not For Turning. Penguin. pp. 576–77. ISBN 978-1846146497.

- ^ Ebenstein 2007, p. 208

- ^ "Milton Friedman on nobelprize.org". Nobel Prize. 1976. Archived from the original on April 12, 2008. Retrieved February 20, 2008.

- Thomas Sowell (2016). A Personal Odyssey. Free Press. p. 320. ISBN 978-0743215084.

- Johan Van Overtveldt (2009). The Chicago School: How the University of Chicago Assembled the Thinkers Who Revolutionized Economics and Business. Agate Publishing. ISBN 978-1-57284-649-4.

- "Milton Friedman". Commanding Heights. PBS. October 1, 2000. Archived from the original on September 8, 2011. Retrieved September 19, 2011.

- "Milton Friedman—Economist as Public Intellectual" Archived May 29, 2009, at the Wayback Machine. . Dallasfed.org (April 1, 2016). Retrieved on September 6, 2017.

- Mark Skousen (2009). The Making of Modern Economics: The Lives and Ideas of the Great Thinkers. M.E. Sharpe. p. 407. ISBN 978-0-7656-2227-3.

- Among macroeconomists, the "natural" rate has been increasingly replaced by James Tobin's NAIRU, the non-accelerating inflation rate of unemployment, which is seen as having fewer normative connotations.

- Paul Krugman (1995). Peddling Prosperity: Economic Sense and Nonsense in an Age of Diminished Expectations. p. 43. "In 1968 in one of the decisive intellectual achievements of postwar economics, Friedman not only showed why the apparent tradeoff embodied in the idea of the Phillips curve was wrong; he also predicted the emergence of combined inflation and high unemployment ... dubbed 'stagflation".

- ^ Brian Doherty (June 1, 1995). "Best of Both Worlds". Reason Magazine. Archived from the original on October 11, 2014. Retrieved October 24, 2009.

- Edward Nelson (April 13, 2011). "Friedman's Monetary Economics in Practice" Archived December 31, 2014, at the Wayback Machine. "in important respects, the overall monetary and financial policy response to the crisis can be viewed as Friedman's monetary economics in practice. ... Friedman's recommendations for responding to a financial crisis largely lined up with the principal financial and monetary policy measures taken since 2007". "Review" in Journal of Economic Literature (December 2012). 50#4. pp. 1106–09.

- "Milton Friedman (1912–2006)" Archived January 3, 2007, at the Wayback Machine. Econlib.org. Retrieved on September 6, 2017.

- ^ Maureen Sullivan (July 30, 2016). "Milton Friedman's Name Disappears From Foundation, But His School-Choice Beliefs Live On". Forbes. Archived from the original on September 21, 2016. Retrieved September 14, 2016.

- "Milton Friedman". Encyclopedia Britannica. Archived from the original on August 2, 2017. Retrieved August 2, 2017.

- "Capitalism and Friedman" (editorial). The Wall Street Journal. November 17, 2006.

- Václav Klaus (January 29, 2007). "Remarks at Milton Friedman Memorial Service". Archived from the original on July 2, 2007. Retrieved August 22, 2008.

- Johan Norberg (October 2008). "Defaming Milton Friedman: Naomi Klein's disastrous yet popular polemic against the great free market economist" Archived April 11, 2010, at the Wayback Machine. Reason Magazine. Washington, D.C.

- Friedman 1999, p. 506.

- William L Davis, Bob Figgins, David Hedengren and Daniel B. Klein (May 2011). "Economic Professors' Favorite Economic Thinkers, Journals, and Blogs" Archived December 18, 2011, at the Wayback Machine. Econ Journal Watch. 8(2). pp. 126–46.

- "Milton Friedman, a giant among economists". The Economist. November 23, 2006. Archived from the original on February 17, 2008. Retrieved February 20, 2008.

- Who's who in American Jewry. 1980.

- Ebenstein. MILTON FRIEDMAN: A BIOGRAPHY. ISBN 9780230604094.

- "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1976". NobelPrize.org. Retrieved May 13, 2021.

- ^ "Milton Friedman, Ph.D." Academy of Achievement. Retrieved May 13, 2021.

- ^ Doherty, Brian (2007). "The Life and Times of Milton Friedman". Reason.com.

- Ebenstein 2007, p. 10

- Milton & Rose Friedman, Two Lucky People. Memoirs, Chicago 1998, p. 22.

- Eamonn Butler (2011). "Ch. 1". Milton Friedman. Harriman Economic Essentials.

- Ebenstein 2007, pp. 5–12

- "Milton Friedman". Rutgers Alumni. Retrieved May 10, 2021.

- "Milton Friedman and his start in economics". Young America's Foundation. August 2006. Archived from the original on February 23, 2013. Retrieved March 12, 2012.

- "Nov. 8 conference to honor University of Chicago economist Milton Friedman on the occasion of his 90th birthday". www-news.uchicago.edu. Retrieved February 3, 2021.

- "Chicago. Theory and Measurement of Demand. Henry Schultz, 1934". Economics in the Rear-View Mirror. January 23, 2016. Retrieved May 16, 2021.

- Ebenstein 2007, pp. 13–30

- Mark Feeney (November 16, 2006). "Nobel laureate economist Milton Friedman dies at 94". The Boston Globe. Archived from the original on March 30, 2007. Retrieved February 20, 2008.

- Friedman 1999, p. 59

- "Right from the Start? What Milton Friedman can teach progressives" (PDF). J. Bradford DeLong. Archived (PDF) from the original on February 16, 2008. Retrieved February 20, 2008.

- Bernanke 2004, p. 7

- Shiller, Robert J. (2017). "Narrative Economics". American Economic Review. 107 (4): 967–1004. doi:10.1257/aer.107.4.967. ISSN 0002-8282.

- Daniel J. Hammond, Claire H. Hammond (eds.) (2006), Making Chicago Price Theory: Friedman-Stigler Correspondence 1945–1957, Routledge, p. xiii. ISBN 1135994293

- Incomes from Independant Professional Practice, 1945, Friedman, Kuznets

- Friedman 1999, p. 42

- Friedman 1999, pp. 84–85

- ^ Milton Friedman; Rose D. Friedman (1999). Two Lucky People: Memoirs. University of Chicago Press. pp. 122–23. ISBN 978-0226264158.

- Brian Doherty (June 1995). "Best of Both Worlds". Reason. Archived from the original on July 9, 2010. Retrieved July 28, 2010.

- ^ "Milton Friedman Biography and Interview – American Academy of Achievement". www.achievement.org. American Academy of Achievement.

- Philip Mirowski (2002). Machine Dreams: Economics Becomes a Cyborg Science. Cambridge University Press. pp. 202–03. ISBN 978-0521775267.

- "Milton Friedman". c250.columbia.edu. Retrieved March 7, 2019.

- ^ "Professor Emeritus Milton Friedman dies at 94". www-news.uchicago.edu. Retrieved March 7, 2019.

- CATO, "Letter from Washington," National Review, September 19, 1980, Vol. 32 Issue 19, p. 1119

- Devaney, James J. (May 22, 1968). "'Playboy', 'Monitor' Honored". Hartford Courant. Vol. CXXXI, no. 143 (final ed.). p. 36. Retrieved March 20, 2019 – via Newspapers.com.

- Rose and Milton Friedman. stanford.edu

- Inventory of the Paul A. Samuelson Papers, 1933–2010 and undated | Finding Aids | Rubenstein Library Archived January 12, 2013, at the Wayback Machine. Library.duke.edu. Retrieved on September 6, 2017.

- ^ Milton Friedman (2018). A Theory of the Consumption Function. Princeton University Press. ISBN 9780691188485.

- "What Is Keynesian Economics? - Back to Basics Compilation Book - IMF Finance & Development magazine". www.imf.org. Retrieved May 10, 2021.

- A Theory of Consumption Function, 1957, Friedman, Princeton University Press, pg. 22

- Carlin, Wendy; Soskice, David W. (2014). Macroeconomics: Institutions, instability, and the financial system. USA: Oxford University Press. pp. 20–29.

- A Theory of Consumption Function, With and Without Liquidity Constraints, Christopher D. Carroll, 2001

- Carroll, Christopher D. (1997). "Buffer-Stock Saving and the Life Cycle/Permanent Income Hypothesis". Quarterly Journal of Economics. 112 (1): 1–55

- Beznoska, Martin; Ochmann, Richard (2012). "Liquidity Constraints and the Permanent Income Hypothesis: Pseudo Panel Estimation with German Consumption Survey Data".

- Stafford, Frank P. (July 1974). "Permanent income, wealth, and consumption: A critique of the permanent income theory, the life cycle hypothesis, and related theories". Journal of Econometrics, pp.195–196

- Schnetzer, Amanda. "Reading Friedman in 2016: Capitalism, Freedom, and the China Challenge". George W. Bush Institute. Retrieved October 29, 2020.

- Sorkin, Andrew Ross (September 11, 2020). "A Free Market Manifesto That Changed the World, Reconsidered". The New York Times. ISSN 0362-4331. Retrieved May 10, 2021.

- Ebenstein 2007, pp. 135–46

- 1982 edition preface of Capitalism and freedom, p. xi of the 2002 edition

- Milton Friedman; Rose D. Friedman (1962). Capitalism and Freedom: Fortieth Anniversary Edition. U. of Chicago Press. ISBN 978-0226264189.

- Friedman, Milton; Friedman, Rose (November 26, 1990). Free to Choose: A Personal Statement. Houghton Mifflin Harcourt. ISBN 978-0-547-53975-1.

- "President Honors Milton Friedman for Lifetime Achievements". georgewbush-whitehouse.archives.gov. Retrieved May 10, 2021.

- "Milton Friedman: An enduring legacy". The Economist. November 17, 2006. Archived from the original on February 17, 2008. Retrieved February 20, 2008.

- Patricia Sullivan (November 17, 2006). "Economist Touted Laissez-Faire Policy". The Washington Post. Archived from the original on July 26, 2008. Retrieved February 20, 2008.

- Milton Friedman – Biography | Cato Institute Archived May 2, 2012, at the Wayback Machine. Cato.org (November 16, 2006). Retrieved on 2017-09-06.

- "Trustees". Archived from the original on August 27, 2013.

- Milton Friedman. phillysoc.org

- Lanny Ebenstein (May 2007), Milton Friedman, Commentary, p. 286.

- David Asman (November 16, 2006). "'Your World' Interview With Economist Milton Friedman". Fox News. Archived from the original on February 6, 2011. Retrieved August 2, 2011.

- Friedman, Milton; Friedman, Rose (1999). Two Lucky People (Paperback ed.). Chicago & London: The University of Chicago Press. p. 129. ISBN 0-226-26415-7.

- Jim Christie (November 16, 2006). "Free market economist Milton Friedman dead at 94". Reuters. Archived from the original on April 10, 2008. Retrieved February 20, 2008.

- Peter Robinson (October 17, 2008). "What Would Milton Friedman Say?". forbes.com. Archived from the original on October 27, 2014. Retrieved December 13, 2014.

- "David D. Friedman on his Famous Father, Anarcho-Capitalism and Free-Market Solutions". The Daily Bell. April 8, 2012. Retrieved May 10, 2021.

- Hamilton, Earl J. (1965). American Treasure and the Price Revolution in Spain, 1501-1650. New York: Octagon.

- Harrod, Roy. "Review of A Monetary History of the United States". Chicago Unbound.

- Optimum Quantity of Money. Aldine Publishing Company. 1969. p. 4.

- Friedman, Milton. Inflation: Causes and Consequences. New York: Asia Publishing House.

- Friedman, Schwartz (2008). The Great Contraction, 1929-1933. Princeton University Press.

- ^ FRB Speech: FederalReserve.gov: Remarks by Governor Ben S. Bernanke, At the Conference to Honor Milton Friedman, University of Chicago, Nov. 8, 2002

- "Milton Friedman: End The Fed". Themoneymasters.com. Archived from the original on June 15, 2014. Retrieved April 22, 2014.

- ^ Milton Friedman; Anna Jacobson Schwartz; National Bureau of Economic Research (2008). "B. Bernanke's speech to M. Friedman". The Great Contraction, 1929–1933. Princeton University Press. p. 247. ISBN 978-0-691-13794-0.

- Milton Friedman (1969). Memoirs of an Unregulated Economist. Aldine Publishing Company. p. 4.

- Peter Galbács (2015). The Theory of New Classical Macroeconomics. A Positive Critique. Contributions to Economics. Heidelberg/New York/Dordrecht/London: Springer. doi:10.1007/978-3-319-17578-2. ISBN 978-3-319-17578-2.

- Kevin Hoover; Warren Young (2011). Rational Expectations – Retrospect and Prospect (PDF). Durham: Center for the History of Political Economy at Duke University. Archived (PDF) from the original on March 4, 2016. Retrieved December 15, 2015.

- "Charlie Rose Show". Nobel Laureates. December 26, 2005.

- David Teira, "Milton Friedman, the Statistical Methodologist," History of Political Economy (2007) 39#3 pp. 511–27

- ^ "Friedman's on the Military Industrial Complex - YouTube". www.youtube.com. Retrieved January 8, 2021.

- ^ Chang, R. (1997) "Is Low Unemployment Inflationary?"

- "Milton Friedman". Essential Scholars. November 5, 2019. Retrieved May 10, 2021.

- The Life and Times of Milton Friedman – Remembering the 20th century's most influential libertarian Archived February 24, 2007, at the Wayback Machine. Reason.com. Retrieved on September 6, 2017.

- Friedman, M., & Schwartz, A.J. (1986). Has government any role in money?. Journal of Monetary Economics, 17(1), 37–62.

- Milton Friedman – Abolish The Fed Archived June 11, 2015, at the Wayback Machine. Youtube: "There in no institution in the US that has such a high public standing and such a poor record of performance" "It's done more harm than good"

- Milton Friedman – Abolish The Fed Archived June 11, 2015, at the Wayback Machine. Youtube: "I have long been in favor of abolishing it."

- "My first preference would be to abolish the Federal Reserve" on YouTube

- Reichart Alexandre & Abdelkader Slifi (2016). The Influence of Monetarism on Federal Reserve Policy during the 1980s. Cahiers d'économie Politique/Papers in Political Economy, (1), pp. 107–50 Archived December 3, 2016, at the Wayback Machine

- "Mr. Market". Hoover Institution. January 30, 1999. Archived from the original on September 23, 2018. Retrieved September 22, 2018.

- Friedman, M. (1996). The Counter-Revolution in Monetary Theory. In Explorations in Economic Liberalism (pp. 3–21). Palgrave Macmillan, London. "It is precisely this leeway, this looseness in the relation, this lack of a mechanical one-to-one correspondence between changes in money and in income that is the primary reason why I have long favored for the USA a quasi-automatic monetary policy under which the quantity of money would grow at a steady rate of 4 or 5 per cent per year, month-in, month-out."

- ^ Salter, A.W. (2014). An Introduction to Monetary Policy Rules. Mercatus Workıng Paper. George Mason University.

- Marimon, R., & Sunder, S. (1995, December). Does a constant money growth rule help stabilize inflation?: experimental evidence. In Carnegie-Rochester Conference Series on Public Policy (Vol. 43, pp. 111–56). North-Holland.

- Evans, G.W., & Honkapohja, S. (2003). Friedman's money supply rule vs. optimal interest rate policy. Scottish Journal of Political Economy, 50(5), 550–66.

- ^ Smith, Noah (July 30, 2016). "Noahpinion: How are Milton Friedman's ideas holding up?". Noahpinion. Archived from the original on September 23, 2018. Retrieved September 22, 2018.

- Simon London, "Lunch with the FT – Milton Friedman," Financial Times (7 June 2003) "The use of quantity of money as a target has not been a success ... I'm not sure I would as of today push it as hard as I once did."

- William Ruger (2013). Milton Friedman. Bloomsbury Publishing. pp. 72–. ISBN 978-1-62356-617-3.

- Atish R. Ghosh, Mahvash S. Qureshi, and Charalambos G. Tsangarides (2014) Friedman Redux: External Adjustment and Exchange Rate Flexibility Archived April 13, 2015, at the Wayback Machine. International Monetary Fund

- Milton Friedman (1955). Robert A. Solo (ed.). "The Role of Government in Education," as printed in the book Economics and the Public Interest (PDF). Rutgers University Press. pp. 123–44. Archived (PDF) from the original on May 10, 2017. Retrieved February 12, 2017.

- Leonard Ross and Richard Zeckhauser (December 1970). "Review: Education Vouchers". The Yale Law Journal. 80 (2): 451–61. doi:10.2307/795126. JSTOR 795126.

- Martin Carnoy (August 1998). "National Voucher Plans in Chile and Sweden: Did Privatization Reforms Make for Better Education?". Comparative Education Review. 42 (3): 309–37. doi:10.1086/447510. JSTOR 1189163. S2CID 145007866.

- Milton Friedman (1991). The War on Drugs. America's Drug Forum. Archived from the original on October 29, 2009. Retrieved August 4, 2009.

- Bernard Rostker (2006). I Want You!: The Evolution of the All-Volunteer Force. Rand Corporation. p. 4. ISBN 978-0-8330-3895-1.

- ^ Milton Friedman (2002). Capitalism and Freedom. University Of Chicago Press. p. 36.

- ""National Service, the Draft and Volunteers" A debate featuring Milton Friedman In Registration and the Draft: Proceedings of the Hoover-Rochester Conference on the All- Volunteer Force" (PDF). Hoover Institution.

- ^ Ebenstein 2007, pp. 231–32

- Milton Friedman, RIP – Antiwar.com Blog Archived September 22, 2016, at the Wayback Machine. Antiwar.com (November 16, 2006). Retrieved on 2017-09-06.

- Ebenstein 2007, p. 243

- Robert Van Horn, Philip Mirowski, and Thomas A. Stapleford (2011). Building Chicago Economics: New Perspectives on the History of America's Most Powerful Economics Program. Cambridge UP. pp. 49–50. ISBN 9781139501712.

{{cite book}}: CS1 maint: multiple names: authors list (link) - "Friedman and Freedom". Queen's Journal. Archived from the original on August 11, 2006. Retrieved February 20, 2008., Interview with Peter Jaworski. The Journal, Queen's University, March 15, 2002 – Issue 37, Volume 129

- Friedman, Milton & Rose D. Capitalism and Freedom, University of Chicago Press, 1982, p. 29

- Friedman, Milton (2002) , Capitalism and Freedom (40th anniversary ed.), Chicago: University of Chicago Press, pp. 182–89, ISBN 978-0-226-26421-9

- Friedman, Milton (2002) , Capitalism and Freedom (40th anniversary ed.), Chicago: University of Chicago Press, pp. 190–95, ISBN 978-0-226-26421-9

- ^ Friedman, Milton; Friedman, Rose (1990) , Free to Choose: A Personal Statement (1st Harvest ed.), New York: Harcourt, pp. 119–24, ISBN 978-0-156-33460-0

- Frank, Robert H. (November 23, 2006). "The Other Milton Friedman: A Conservative With a Social Welfare Program". The New York Times. Archived from the original on July 1, 2017. Retrieved February 22, 2017.

- "An open letter". Prohibition Costs. Archived from the original on October 31, 2012. Retrieved November 9, 2012.

- "Milton Friedman". Liberal Democratic Party (Australia). Archived from the original on April 10, 2013. Retrieved February 19, 2013.

- Ebenstein 2007, p. 228

- ^ "The weaponization of Milton Friedman". July 19, 2018. Archived from the original on July 19, 2018. Retrieved July 19, 2018.

- "Economic Freedom of the World project". Fraser Institute. Archived from the original on March 5, 2016. Retrieved February 16, 2016.

- "In the Supreme Court of the United States" (PDF). Harvard Law School. Archived from the original (PDF) on April 2, 2015. Retrieved February 20, 2008.

- Lawrence Lessig (November 19, 2006). "only if the word 'no-brainer' appears in it somewhere: RIP Milton Friedman (Lessig Blog)". Lessig.org. Archived from the original on April 2, 2015. Retrieved April 2, 2013.

- "A New British Bill of Rights: The Case For". ISR Online Guide. Archived from the original on March 4, 2016. Retrieved February 16, 2016.

- Ebenstein 2007, p. 260

- "Golden Plate Awardees of the American Academy of Achievement". www.achievement.org. American Academy of Achievement.

- "Milton Friedman Biography and Interview". American Academy of Achievement.