| Revision as of 14:30, 21 March 2010 edit99.140.247.156 (talk) →External links← Previous edit | Revision as of 13:21, 24 March 2010 edit undo194.66.72.76 (talk) →Long butterflyTag: section blankingNext edit → | ||

| Line 4: | Line 4: | ||

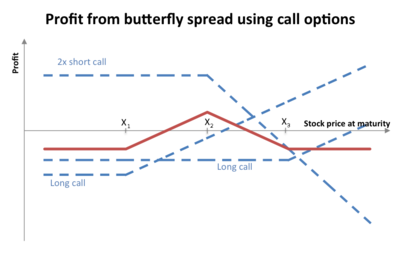

| In ], a butterfly is a limited risk, non-directional ] that is designed to have a large ] of earning a small limited profit when the future ] of the ] is expected to be different from the ]. | In ], a butterfly is a limited risk, non-directional ] that is designed to have a large ] of earning a small limited profit when the future ] of the ] is expected to be different from the ]. | ||

| == Long butterfly == | |||

| A ] butterfly position will make profit if the future volatility is lower than the implied volatility. | |||

| A long butterfly options strategy consists of the following ]: | |||

| * ] 1 ] with a ] of (X − a) | |||

| * ] 2 calls with a strike price of X | |||

| * Long 1 call with a strike price of (X + a) | |||

| where a > 0. | |||

| Using ] a long butterfly can also be created as follows: | |||

| * Long 1 put with a strike price of (X + a) | |||

| * Short 2 puts with a strike price of X | |||

| * Long 1 put with a strike price of (X − a) | |||

| where a > 0 | |||

| All the options has the same ] date. | |||

| At expiration the value (but not the profit) of the butterfly will be: | |||

| * zero if the price of the underlying is below (X − a) or above (X + a) | |||

| * positive if the price of the underlying is between (X - a) and (X + a) | |||

| The maximum value occurs at X (see diagram). | |||

| == Short butterfly == | == Short butterfly == | ||

Revision as of 13:21, 24 March 2010

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability of earning a small limited profit when the future volatility of the underlying is expected to be different from the implied volatility.

Short butterfly

A short butterfly position will make profit if the future volatility is higher than the implied volatility.

A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long.

Variations of the butterfly

The double option position in the middle is called the body, while the two other positions are called the wings.

The option strategy where the middle two positions have different strike price is known as an Iron condor.

In an unbalanced butterfly the variable "a" has two different values.

References

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

{{cite book}}:|edition=has extra text (help)

External links

- Long and Short Butterflies graphically illustrates component options in long and short butterflies.

- Butterfly Spreads - Spread Your Wings & Profit things you should know about Butterfly Spreads