| Revision as of 21:53, 7 June 2013 view sourceClueBot NG (talk | contribs)Bots, Pending changes reviewers, Rollbackers6,438,732 editsm Reverting possible vandalism by 68.178.117.76 to version by Wikipeterproject. False positive? Report it. Thanks, ClueBot NG. (1664699) (Bot)← Previous edit | Revision as of 01:00, 8 June 2013 view source 69.118.2.173 (talk) →Provisions by effective dateTag: possible vandalismNext edit → | ||

| Line 83: | Line 83: | ||

| Original budget estimates included a provision to require information reporting on payments to corporations, which had been projected to raise $17 billion, but the provision was repealed.<ref>{{cite news|last=Rubin |first=Richard |url=http://www.bloomberg.com/news/2011-04-14/obama-signs-law-repealing-business-tax-reporting-mandate-1-.html |title=Obama Signs Law Repealing Business Tax Reporting Mandate |publisher=Bloomberg |date=April 14, 2011 |accessdate=April 1, 2012}}</ref> | Original budget estimates included a provision to require information reporting on payments to corporations, which had been projected to raise $17 billion, but the provision was repealed.<ref>{{cite news|last=Rubin |first=Richard |url=http://www.bloomberg.com/news/2011-04-14/obama-signs-law-repealing-business-tax-reporting-mandate-1-.html |title=Obama Signs Law Repealing Business Tax Reporting Mandate |publisher=Bloomberg |date=April 14, 2011 |accessdate=April 1, 2012}}</ref> | ||

| Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS!!!!!!!!!!!!!!!!!!!!!!!! | |||

| ==Provisions by effective date== | |||

| The ACA is divided into 10 titles<ref>] from Wikisource.</ref> and contains provisions that became effective immediately, 90 days after enactment, and six months after enactment, as well as provisions phased in through to 2020.<ref name='Kypost'>{{cite news|url=http://www.kypost.com/mostpopular/story/Key-Points-Of-The-Health-Care-Reform-Bill/GYwbvispwEy36LI05K_9Cg.cspx |title=Key Points Of The Health Care Reform Bil|accessdate=2010-03-22|newspaper=The Kentucky Post}}{{Dead link|date=March 2011}}</ref><ref name='Top 18'>{{cite news | first=Jeremy | last=Binckes | coauthors= Nick Wing |authorlink= | title=The Top 18 Immediate Effects Of The Health Care Bill | date=2010-03-22 | url =http://www.huffingtonpost.com/2010/03/22/the-top-18-immediate-effe_n_508315.html#s75147 | work =The Huffington Post | pages = | accessdate = 2010-03-22 | language = }}</ref> Below are some of the key provisions of the ACA. For simplicity, the amendments in the ] are integrated into this timeline.<ref>{{Cite news |url=http://www.nytimes.com/interactive/2009/11/19/us/politics/1119-plan-comparison.html |title=Comparing the House and the Senate Health Care Proposals |newspaper=The New York Times |date=March 23, 2010 | first1=Farhana | last1=Hossain | first2=Archie | last2=Tse | accessdate=May 21, 2010}}</ref><ref name="CRFB">{{cite web |url=http://crfb.org/blogs/updated-health-care-charts |title=Updated Health Care Charts |publisher=Committee for a Responsible Federal Budget |date=November 19, 2009 }}</ref> | |||

| ===Effective at enactment=== | |||

| * The ] is now authorized to approve generic versions of ] drugs and grant biologics manufacturers 12 years of exclusive use before generics can be developed.<ref name='ksr_list1'>{{cite web|url=http://www.kff.org/healthreform/8060.cfm|title=Health Reform Implementation Timeline|accessdate=2010-03-30|publisher=Kaiser Family Foundation}}</ref> | |||

| * The Medicaid drug ] (paid by drug manufacturers to the states) for brand name drugs is increased to 23.1% (except the rebate for clotting factors and drugs approved exclusively for pediatric use increases to 17.1%), and the rebate is extended to Medicaid managed care plans; the Medicaid rebate for non-innovator, multiple source drugs is increased to 13% of average manufacturer price.<ref name='ksr_list1' /> | |||

| * A non-profit ] is established, independent from government, to undertake ].<ref name='ksr_list1' /> This is charged with examining the "relative health outcomes, clinical effectiveness, and appropriateness" of different medical treatments by evaluating existing studies and conducting its own. Its 19-member board is to include patients, doctors, hospitals, drug makers, device manufacturers, insurers, payers, government officials and health experts. It will not have the power to mandate or even endorse coverage rules or reimbursement for any particular treatment. Medicare may take the Institute's research into account when deciding what procedures it will cover, so long as the new research is not the sole justification and the agency allows for public input.<ref>{{cite web|url=http://today.msnbc.msn.com/id/36135106/ns/health-health_care/ |title=True or false? Top 7 health care fears - TODAY Health - TODAY.com |publisher=msnbc.com |date=2010-02-04 |accessdate=2012-01-09}}</ref> The bill forbids the Institute to develop or employ "a dollars per quality adjusted life year" (or similar measure that discounts the value of a life because of an individual's disability) as a threshold to establish what type of health care is cost effective or recommended. This makes it different from the UK's ]. | |||

| * Creation of task forces on Preventive Services and Community Preventive Services to develop, update, and disseminate evidenced-based recommendations on the use of clinical and community prevention services.<ref name='ksr_list1' /> | |||

| * The Indian Health Care Improvement Act is reauthorized and amended.<ref name='ksr_list1' /> | |||

| * ] restaurants and food vendors with 20 or more locations are required to display the ] of their foods on menus, drive-through menus, and vending machines. Additional information, such as ], ], and ] content, must also be made available upon request.<ref name='Nutrition'>{{cite news | first=Jean | last=Spencer | title=Menu Measure: Health Bill Requires Calorie Disclosure | date=2010-03-22 | work =The Wall Street Journal | url =http://blogs.wsj.com/washwire/2010/03/22/menu-measure-health-bill-requires-calorie-disclosure/|accessdate = 2010-03-23}}</ref> But first, the Food and Drug Administration has to come up with regulations, and as a result, calories disclosures may not appear until 2013 or 2014.{{update after|2013}}<ref name='Nutrition' /> | |||

| * States can apply for a 'State Plan Amendment" to expand family planning eligibility to the same eligibility as pregnancy related care (above and beyond Medicaid level eligibility), through a state option rather than having to apply for a federal waiver.<ref name="thenationalcampaign.org">{{cite web|url=http://www.thenationalcampaign.org/policymakers/PDF/SummaryProvisions_TUO_HealthReform.pdf |title=Provisions Related to Teen and Unplanned Pregnancy}}</ref><ref>{{cite web|url=http://www.thenationalcampaign.org/resources/pdf/Briefly_Policy%20Brief_ExpandingMedicaid.pdf|title=Expanding Medicaid Family Planning}}</ref><ref>{{cite web|url=http://www.prochoiceamerica.org/what-is-choice/fast-facts/low-income-fp-access.html|title=LOW-INCOME WOMEN'S ACCESS TO FAMILY PLANNING}}</ref> | |||

| ===Effective June 21, 2010=== | |||

| * Adults with existing conditions became eligible to join a temporary high-risk pool, which will be superseded by the health care exchange in 2014.<ref name='Top 18' /><ref>{{cite web|url=http://www.csmonitor.com/USA/Politics/2010/0324/Health-care-reform-bill-101-rules-for-preexisting-conditions|title=Health care reform bill 101: rules for preexisting conditions|last=Grier|first=Peter|work=The Christian Science Monitor|date=2010-03-24|accessdate=2010-03-25}}</ref> To qualify for coverage, applicants must have a pre-existing health condition and have been uninsured for at least the past six months.<ref name=wjs_ret /> There is no age requirement.<ref name=wjs_ret>{{cite news|url=http://online.wsj.com/article/SB127570667448201583.html?KEYWORDS=high-risk+pool+health+insurance|title=Insurance Relief for Early Retirees | work=The Wall Street Journal | first=Anne | last=Tergesen | date=June 5, 2010}}</ref> The new program sets premiums as if for a standard population and not for a population with a higher health risk. Allows premiums to vary by age (3:1), geographic area, family composition and tobacco use (1.5:1). Limit out-of-pocket spending to $5,950 for individuals and $11,900 for families, excluding premiums.<ref name=wjs_ret /><ref>{{cite web|url=http://www.kff.org/healthreform/upload/8066.pdf|title=Kaiser: High-Risk Pool Provisions under the Health Reform Law}}</ref><ref>{{cite news|url=http://www.washingtonpost.com/wp-dyn/content/article/2010/05/03/AR2010050304072.html|title=18 states refuse to run insurance pools for those with preexisting conditions | work=The Washington Post | first=David S. | last=Hilzenrath | date=May 4, 2010}}</ref> | |||

| ===Effective July 1, 2010=== | |||

| * The President established, within the ] (HHS), a council to be known as the ''National Prevention, Health Promotion and Public Health Council'' to help begin to develop a National Prevention and Health Promotion Strategy. The ] shall serve as the Chairperson of the new Council.<ref name=sec4001>{{cite web|url=http://en.wikisource.org/Patient_Protection_and_Affordable_Care_Act/Title_IV#Subtitle_A|title=Patient Protection and Affordable Care Act/Title IV/Subtitle A/Sec. 4001. National Prevention, Health Promotion and Public Health Council}}</ref><ref name="EO13544">] – ''Establishing the National Prevention, Health Promotion, and Public Health Council'', June 10, 2010, Vol. 75, No. 114, {{USFedReg|75|33983}}</ref> | |||

| * A 10% sales tax on indoor tanning took effect.<ref>{{cite news|url=http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aa32kl.M09T4|title=Health-Care Changes to Start Taking Effect This Year | publisher=Bloomberg | date=March 24, 2010}}</ref> | |||

| ===Effective September 23, 2010=== | |||

| * Insurers are prohibited from imposing lifetime dollar limits on essential benefits, like hospital stays, in new policies issued.<ref>{{cite web|url=http://www.healthcare.gov/law/about/order/byyear.html |title=Provisions of the Affordable Care Act, By Year |publisher=HealthCare.gov |date= |accessdate=2012-01-09}}</ref> | |||

| * Dependents (children) will be permitted to remain on their parents' insurance plan until their 26th birthday,<ref>, section 1001 (adding section 2714 to the ]): "A group health plan and a health insurance issuer offering group or individual health insurance coverage that provides dependent coverage of children shall continue to make such coverage available for an adult child (who is not married) until the child turns 26 years of age."</ref> and regulations implemented under the ACA include dependents that no longer live with their parents, are not a dependent on a parent's tax return, are no longer a student, or are married.<ref>{{cite news | title= Rules Let Youths Stay on Parents' Insurance | newspaper= The New York Times | date= May 10, 2010 | url= http://www.nytimes.com/2010/05/11/health/policy/11health.html | first=Robert | last=Pear}}</ref><ref>{{cite press release | title= Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Families and Businesses | publisher= ] | url= http://www.whitehouse.gov/sites/default/files/rss_viewer/fact_sheet_young_adults_may10.pdf }}</ref> | |||

| * Insurers are prohibited from excluding pre-existing medical conditions (except in ] individual health insurance plans) for children under the age of 19.<ref>Note: Language in the law concerning this provision has been described as ambiguous, but representatives of the insurance industry have indicated they will comply with regulations to be issued by the ] reflecting this interpretation. | |||

| * {{cite news|title=Coverage Now for Sick Children? Check Fine Print|url=http://www.nytimes.com/2010/03/29/health/policy/29health.html|date=March 28, 2010|last=Pear|first=Robert|work=]|postscript=<!--None-->|lastauthoramp=yes|accessdate=April 8, 2010}} | |||

| * {{cite news|title=Obama administration has blunt message for insurers|url=http://www.reuters.com/article/idUSN2017888120100329|date=March 29, 2010|last=Holland|first=Steve|publisher=Reuters|postscript=<!--None-->|lastauthoramp=yes|accessdate=April 8, 2010}} | |||

| * {{cite news|title=Insurers to Comply With Rules on Children|url=http://www.nytimes.com/2010/03/31/health/policy/31health.html|date=March 30, 2010|last=Pear|first=Robert|work=The New York Times|postscript=<!--None-->|lastauthoramp=yes|accessdate=April 8, 2010}} | |||

| * {{cite news|url=http://abcnews.go.com/Business/wireStory?id=10186800|title=Gap in Health Care Law's Protection for Children|last=Alonso-Zaldivar|first=Ricardo|date=March 24, 2010|publisher=ABC News|accessdate=April 8, 2010|agency=Associated Press}}</ref><ref name="FR June 28, 2010">{{cite journal |author=U.S. Department of Health and Human Services |date=June 28, 2010 |title=Patient Protection and Affordable Care Act; Requirements for Group Health Plans and Health Insurance Issuers Under the Patient Protection and Affordable Care Act Relating to Preexisting Condition Exclusions, Lifetime and Annual Limits, Rescissions, and Patient Protections; Final Rule and Proposed Rule |journal=] |volume=75 |issue=123 |pages=37187–37241 |url=http://edocket.access.gpo.gov/2010/2010-15278.htm |accessdate=July 26, 2010}}</ref> | |||

| * All new insurance plans must cover preventive care and medical screenings<ref name="healthcare.gov">{{cite web | title=Preventive Services Covered Under the Affordable Care Act | url=http://www.healthcare.gov/news/factsheets/2010/07/preventive-services-list.html}}</ref> rated by the ].<ref>http://www.shrm.org/publications/hrnews/pages/coverpreventivecare.aspx</ref> Insurers are prohibited from charging co-payments, co-insurance, or deductibles for these services.<ref name='SHNS'>{{cite news | first=Lee | last=Bowman | title=Health reform bill will cause several near-term changes | date=2010-03-22 | url =http://public.shns.com/node/52359 | agency =Scripps Howard News Service | accessdate = 2010-03-23}}</ref> | |||

| * Individuals affected by the ] will receive a $250 rebate, and 50% of the gap will be eliminated in 2011.<ref name='80beats'>{{cite news | first=Smriti | last=Rao | title=Health-Care Reform Passed. So What Does It Mean? | date=2010-03-22 | work=] | url =http://blogs.discovermagazine.com/80beats/2010/03/22/health-care-reform-passed-so-what-does-it-mean/| pages = | accessdate = 2010-03-23 | language = }}</ref> The gap will be eliminated by 2020. | |||

| * Insurers' abilities to enforce annual spending caps will be restricted, and completely prohibited by 2014.<ref name='Top 18' /> | |||

| * Insurers are prohibited from dropping ]s when they get sick.<ref name='Top 18' /> | |||

| * Insurers are required to reveal details about administrative and executive expenditures.<ref name='Top 18' /> | |||

| * Insurers are required to implement an ]s process for coverage determination and claims on all new plans.<ref name='Top 18' /> | |||

| * Enhanced methods of ] detection are implemented.<ref name='Top 18' /> | |||

| * Medicare is expanded to small, rural hospitals and facilities.<ref name='Top 18' /> | |||

| * Medicare patients with chronic illnesses must be monitored/evaluated on a 3-month basis for coverage of the medications for treatment of such illnesses. | |||

| * Companies which provide early retiree benefits for individuals aged 55–64 are eligible to participate in a temporary program which reduces premium costs.<ref name='Top 18' /> | |||

| * A new website installed by the ] will provide consumer insurance information for individuals and small businesses in all states.<ref name='Top 18' /> | |||

| * A temporary credit program is established to encourage private investment in new therapies for disease treatment and prevention.<ref name='Top 18' /> | |||

| * All new insurance plans must cover childhood immunizations and adult vaccinations recommended by the Advisory Committee on Immunization Practices (ACIP) without charging co-payments, co-insurance, or deductibles when provided by an in-network provider.<ref>{{cite web | title=The Affordable Care Act and Immunization | url=http://www.healthcare.gov/news/factsheets/2010/09/affordable-care-act-immunization.html|publisher=U.S. Department of Health & Human Services|accessdate=September 15, 2012}}</ref> | |||

| ===Effective January 1, 2011=== | |||

| * Insurers must spend 80% (for individual or small group insurers) or 85% (for large group insurers) of premium dollars on health costs and claims, leaving only 20% or 15% respectively for administrative costs and profits, subject to various waivers and exemptions. If an insurer fails to meet this requirement, there is no penalty, but a rebate must be issued to the policy holder. This policy is known as the 'Medical Loss Ratio'.<ref>{{cite web|url=http://www.healthcare.gov/news/factsheets/medical_loss_ratio.html |title=Medical Loss Ratio: Getting Your Money's Worth on Health Insurance |publisher=U.S. Department of Health & Human Services |date= |accessdate=April 1, 2012}}</ref><ref>{{cite web|url=https://www.federalregister.gov/articles/2011/12/07/2011-31289/medical-loss-ratio-requirements-under-the-patient-protection-and-affordable-care-act |title=Medical Loss Ratio Requirements Under the Patient Protection and Affordable Care Act |publisher=Federal Register |date= |accessdate=April 1, 2012}}</ref><ref>{{cite web|last=Pecquet |first=Julian |url=http://thehill.com/blogs/healthwatch/health-insurance/211225-obama-administration-denies-one-states-health-law-waiver-partially-approves-another |title=Obama administration concludes healthcare law waiver review |work=The Hill |date=February 16, 2012 |accessdate=April 1, 2012}}</ref><ref>{{cite web|url=http://companyprofiles.healthcare.gov/MlrQA |title=Medical Loss Ratio}}</ref> | |||

| * The ] is responsible for developing the Center for Medicare and Medicaid Innovation and overseeing the testing of innovative payment and delivery models.<ref>{{cite web|url=http://healthreformgps.org/resources/center-for-medicare-and-medicaid-innovation/ |title=Center for Medicare and Medicaid Innovation – Health Reform GPS: Navigating the Implementation Process |publisher=Healthreformgps.org |date= |accessdate=2012-06-29}}</ref> | |||

| * ]s, ]s and ]s cannot be used to pay for over-the-counter drugs, purchased without a prescription, except ].<ref name="IR-2010-95">{{cite web | |||

| |url=http://www.irs.gov/newsroom/article/0,,id=227301,00.html | |||

| |title=IRS Issues Guidance Explaining 2011 Changes to Flexible Spending Arrangements | |||

| |publisher=Internal Revenue Service | |||

| |date=2010-09-03 | |||

| |accessdate=2010-09-15 | |||

| }}</ref> | |||

| ===Effective September 1, 2011=== | |||

| * All health insurance companies must inform the public when they want to increase health insurance rates for individual or small group policies by an average of 10% or more. This policy is known as 'Rate Review'. States are provided with Health Insurance Rate Review Grants to enhance their rate review programs and bring greater transparency to the process.<ref>{{cite web|url=http://companyprofiles.healthcare.gov/RateReviewInfo |title=Promoting Transparency: Rate Increase Reviews}}</ref><ref>{{cite web|url=http://cciio.cms.gov/programs/marketreforms/rates/index.html |title=Review of Insurance Rates}}</ref> | |||

| ===Effective January 1, 2012=== | |||

| * Employers must disclose the value of the benefits they provided beginning in 2012 for each employee's health insurance coverage on the employee's annual Form W-2's.<ref>{{cite news|url=http://www.reuters.com/article/idUSN1914020220100319|title=FACTBOX-US healthcare bill would provide immediate benefits | publisher=Reuters | first=Donna | last=Smith | date=March 19, 2010}}</ref> This requirement was originally to be effective January 1, 2011, but was postponed by IRS Notice 2010–69 on October 23, 2010.<ref>{{cite web|url=http://www.irs.gov/pub/irs-drop/n-2010-69.pdf |title=Interim Relief with Respect to Form W-2 Reporting of the Cost of Coverage of Group Health Insurance Under § 6051(a)(14) |publisher=Internal Revenue Service |date= |accessdate=2012-04-01}}</ref> Reporting is not required for any employer that was required to file fewer than 250 Forms W-2 in the preceding calendar year.<ref>{{cite web |title=Notice 2012-9: Interim Guidance on Informational Reporting to Employees of the Cost of Their Group Health Insurance Coverage |work= Internal Revenue Service |date= January 4, 2012 |format= PDF |url= http://www.irs.gov/pub/irs-drop/n-12-09.pdf }}</ref> | |||

| * New tax reporting changes were to come in effect. Lawmakers originally felt these changes would help prevent tax evasion by corporations. However, in April 2011, Congress passed and President Obama signed the Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011 repealing this provision, because it was burdensome to small businesses.<ref>{{cite web|url=http://www.whitehouse.gov/blog/2011/04/14/repealing-1099-reporting-requirement-big-win-small-business|title=Repealing the 1099 Reporting Requirement: A Big Win for Small Business}}</ref><ref name="repeal">{{cite news|url=http://www.bloomberg.com/news/2011-04-14/obama-signs-law-repealing-business-tax-reporting-mandate-1-.html|title=Obama Signs Law Repealing Business Tax Reporting Mandate | publisher=Bloomberg | first=Richard|last=Rubin|date=April 14, 2011}}</ref> Before the ACA, businesses were required to notify the IRS on ] of certain payments to individuals for certain services or property over a reporting threshold of $600.<ref name=irs1099>{{cite web|url=http://www.irs.gov/pub/irs-pdf/i1099msc.pdf|title=Instructions for Form 1099-MISC| publisher = Internal Revenue Service }}</ref><ref name="U.S. Government Printing Office">{{cite web|url=http://www.gpo.gov:80/fdsys/pkg/PLAW-111publ148/html/PLAW-111publ148.htm|title=U.S. Government Printing Office}}</ref> Under the repealed law, reporting of payments to corporations would also be required.<ref>{{cite web|url=http://www.ppbmag.com/Article.aspx?id=5436|title=Healthcare Law Includes Tax Credit, Form 1099 Requirement}}</ref><ref>{{cite web|url=http://www.theapchannel.com/accounts-payable/node/522|title=Health Care Bill Brings Major 1099 Changes}}</ref> Originally it was expected to raise $17 billion over 10 years.<ref>{{cite web|url=http://www.accountingweb.com/topic/tax/costly-changes-1099-reporting-health-care-bill|title=Costly changes to 1099 reporting in health care law}}</ref> The amendments made by Section 9006 of the ACA were designed to apply to payments made by businesses after December 31, 2011, but will no longer apply because of the repeal of the section.<ref name="repeal" /><ref name="U.S. Government Printing Office"/> | |||

| ===Effective August 1, 2012=== | |||

| * All new plans must cover certain preventive services such as mammograms and colonoscopies without charging a deductible, co-pay or coinsurance. Women's Preventive Services – including: well-woman visits; ] screening; ] (HPV) DNA testing for women age 30 and older; sexually transmitted infection counseling; ] (HIV) screening and counseling; FDA-approved contraceptive methods and contraceptive counseling; breastfeeding support, supplies and counseling; and ] screening and counseling - will be covered without cost sharing.<ref>{{cite web |title=Next Steps to Comply with Health Care Reform |url=http://www.natlawreview.com/article/next-steps-to-comply-health-care-reform |publisher=] LLP |work=The National Law Review|date=2012-10-10|accessdate=2012-10-10}}</ref> This is also known as the ].<ref name="healthcare.gov"/><ref>{{cite web | title=Affordable Care Act Rules on Expanding Access to Preventive Services for Women | url=http://www.healthcare.gov/news/factsheets/2011/08/womensprevention08012011a.html}}</ref><ref>{{cite news|last=Kliff|first=Sarah|title=Five facts about the health law’s contraceptive mandate|url=http://www.washingtonpost.com/blogs/wonkblog/wp/2012/08/01/five-facts-about-the-health-laws-contraceptive-mandate/|accessdate=29 November 2012|newspaper=The Washington Post|date=1 August 2012}}</ref> | |||

| ===Effective October 1, 2012=== | |||

| * The Centers for Medicare & Medicaid Services (CMS) will begin the Readmissions Reduction Program, which requires CMS to reduce payments to IPPS hospitals with excess readmissions, effective for discharges beginning on October 1, 2012. The regulations that implement this provision are in subpart I of 42 CFR part 412 (§412.150 through §412.154).<ref>{{cite web|url=http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/Readmissions-Reduction-Program.html|title=Readmissions Reduction Program}}</ref> Starting in October, an estimated total of 2,217 hospitals across the nation will be penalized; however, only 307 of these hospitals will receive this year's maximum penalty, i.e., 1 percent off their base Medicare reimbursements. The penalty will be deducted from reimbursements each time a hospital submits a claim starting Oct. 1. The maximum penalty will increase after this year, to 2 percent of regular payments starting in October 2013 and then to 3 percent the following year. As an example, if a hospital received the maximum penalty of 1 percent and it submitted a claim for $20,000 for a stay, Medicare would reimburse it $19,800. Together, these 2,217 hospitals will forfeit more than $280 million in Medicare funds over the next year, i.e., until October 2013, as Medicare and Medicaid begin a wide-ranging push to start paying health care providers based on the quality of care they provide. The $280 million in penalties comprises about 0.3 percent of the total amount hospitals are paid by Medicare.<ref>{{cite web|url=http://www.kaiserhealthnews.org/Stories/2012/August/13/medicare-hospitals-readmissions-penalties.aspx|title=Medicare To Penalize 2,217 Hospitals For Excess Readmissions}}</ref> | |||

| ===Effective January 1, 2013=== | |||

| * Income from self-employment and wages of single individuals in excess of $200,000 annually will be subject to an additional tax of 0.9%. The threshold amount is $250,000 for a married couple filing jointly (threshold applies to joint compensation of the two spouses), or $125,000 for a married person filing separately.<ref>{{cite web|url=http://www.gpo.gov/fdsys/pkg/BILLS-111hr3590enr/pdf/BILLS-111hr3590enr.pdf|title=PPACA, section 9015 as modified by section 10906}}</ref> In addition, an additional Medicare tax of 3.8% will apply to unearned income, specifically the lesser of net investment income or the amount by which adjusted gross income exceeds $200,000 ($250,000 for a married couple filing jointly; $125,000 for a married person filing separately.)<ref>{{cite web|url=http://www.gpo.gov/fdsys/pkg/BILLS-111hr4872enr/pdf/BILLS-111hr4872enr.pdf|title=HCERA section 1402}}</ref> | |||

| * Beginning January 1, 2013, the limit on pre-tax contributions to healthcare flexible spending accounts will be capped at $2,500 per year.<ref>{{cite web|url=http://www.foley.com/files/PPACASummary.pdf|title=PPACA Summary (Foley.com)}}</ref><ref>{{cite web|url=http://www.lifehealthpro.com/2012/09/12/8-things-you-might-not-know-about-ppaca?page=9|title=What You Might Not Know About PPACA}}</ref><ref>{{cite web|url=http://www.irs.gov/pub/irs-drop/n-12-40.pdf|title=IRS Notice 2012-40}}</ref> | |||

| * Most medical devices become subject to a 2.3% excise tax collected at the time of purchase. (Reduced by the reconciliation act from 2.6% to 2.3%.)<ref>{{cite web|url=http://www.healthcare.gov/center/authorities/reconciliation_law.pdf|title=Health Care reform Reconciliation Act}}</ref> This tax will also apply to some medical devices, such as examination gloves and catheters, that are used in ].<ref name="Dotzenrod">{{cite news |title=IRS releases final rule on medical device tax |author=Constance Fore Dotzenrod |author2=Gregory C Sicilian |url=http://www.lexology.com/library/detail.aspx?g=9e5a8e7b-9383-4fe9-98c5-4961b16c1499 |newspaper=Lexology |date=December 10, 2012 |accessdate=December 13, 2012}}</ref> | |||

| * Insurance companies are required to use simpler, more standardized paperwork, with the intention of helping consumers make apples-to-apples comparisons between the prices and benefits of different health plans.<ref>{{cite news|last=Doyle|first=Brion B.|title=Understanding the Impacts of the Patient Protection and Affordable Care Act|url=http://www.natlawreview.com/article/understanding-impacts-patient-protection-and-affordable-care-act|accessdate=17 April 2013|newspaper=The ]|date=March 5, 2013|author2=Varnum LLP}}</ref> | |||

| ===Effective by August 1, 2013=== | |||

| * Religious organizations that were given an extra year to implement the ] are no longer exempt. Certain non-exempt, non-grandfathered group health plans established and maintained by non-profit organizations with religious objections to covering contraceptive services may take advantage of a one-year enforcement safe harbor (i.e., until the first plan year beginning on or after August 1, 2013) by timely satisfying certain requirements set forth by the U.S. Department of Health & Human Services.<ref>{{cite web |title=Next Steps to Comply with Health Care Reform |url=http://www.natlawreview.com/article/next-steps-to-comply-health-care-reform |publisher=Schiff Hardin LLP |work=The ]|date=2012-10-10|accessdate=2012-10-10}}</ref> | |||

| ===Effective by October 1, 2013=== | |||

| * Starting in October 2013, those looking to buy individual health insurance can enroll in subsidized plans offered through state-based exchanges (see below), with coverage beginning in January 2014.<ref>{{cite web|url=http://money.cnn.com/2013/04/23/news/economy/obamacare-subsidies/index.html?hpt=hp_t5|title=Millions eligible for Obamacare subsidies, but most don't know it|author=]}}</ref><ref>{{cite web|url=http://www.kff.org/healthreform/upload/8213-2.pdf|title=ESTABLISHING HEALTH INSURANCE EXCHANGES: AN OVERVIEW OF STATE EFFORTS}}</ref><ref>{{cite web|url=http://www.healthcare.gov/marketplace/get-ready/index.html|title=Enrollment in the Marketplace starts in October 2013.}}</ref> | |||

| ===Effective by January 1, 2014=== | |||

| ] and ].<ref name="private_pp" /> (Source: ])]] | |||

| * Insurers are prohibited from discriminating against or charging higher rates for any individual based on gender or pre-existing medical conditions.<ref>{{cite web|url=http://www.nh.gov/insurance/consumers/documents/naic_faq.pdf|title=I have been denied coverage because I have a pre-existing condition. What will this law do for me?|publisher=New Hampshire Insurance Department|work=Health Care Reform Frequently Asked Questions|accessdate=2012-06-28|page=2}}</ref> | |||

| * Insurers are prohibited from establishing annual spending caps.<ref name='Top 18' /> | |||

| * Individuals who are not covered by an acceptable insurance policy will be charged an annual penalty of $95, or up to 1% of income over the filing minimum,<ref name=jct>"Generally, in 2010, the filing threshold is $9,350 for a single person or a married person filing separately and is $18,700 for married filing jointly." - Congress of the United States The Joint Committee on Taxation, "," March 21, 2010.</ref> whichever is greater; this will rise to a minimum of $695 ($2,085 for families),<ref>{{cite news|last=Doyle|first=Brion B.|title=Understanding the Impacts of the Patient Protection and Affordable Care Act|url=http://www.natlawreview.com/article/understanding-impacts-patient-protection-and-affordable-care-act|accessdate=17 April 2013|newspaper=The National Law Review|date=March 5, 2013|author2=Varnum LLP}}</ref> or 2.5% of income over the filing minimum,<ref name="jct" /> by 2016.<ref name="ksr_hlth" /><ref name = bglobetaximp>{{cite news|url=http://www.boston.com/business/personalfinance/managingyourmoney/archives/2010/03/tax_implication.html|title=Tax implications of health care reform legislation|author=Downey, Jamie|date=March 24, 2010|newspaper=]|accessdate=2010-03-25}}</ref> Exemptions to the ] and penalty are permitted for religious reasons, members of ], or for those for whom the least expensive policy would exceed 8% of their income.<ref>{{cite news|url=http://www.washingtonpost.com/blogs/ezra-klein/post/individual-mandate-101-what-it-is-why-it-matters/2011/08/25/gIQAhPzCeS_blog.html|title=Individual mandate 101: What it is, why it matters |publisher=Wonkblog at the Washington Post|coauthors=Sarah Kliff; Ezra Klein|date=March 27, 2012|accessdate=July 2, 2012}}</ref> | |||

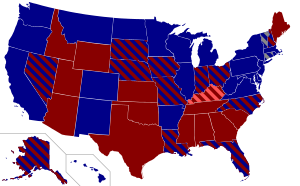

| * In participating states, Medicaid eligibility is expanded; all individuals with income up to 133% of the ] qualify for coverage, including adults without dependent children.<ref name="ksr_hlth">{{cite news|url=http://www.kaiserhealthnews.org/Stories/2010/March/22/consumers-guide-health-reform.aspx|first=Phil |last=Galewitz|title=Consumers Guide To Health Reform|date=March 26, 2010|newspaper=Kaiser Health News}}</ref><ref name="cnn_ref1">{{cite news|url=http://www.cnn.com/2010/HEALTH/03/25/health.care.law.basics/index.html|title=5 key things to remember about health care reform|publisher=CNN|date=March 25, 2010 | accessdate=May 21, 2010}}</ref> As written, the ACA withheld ''all'' Medicaid funding from states declining to participate in the expansion. However, the Supreme Court ruled, in '']'', that this withdrawal of funding was unconstitutionally coercive, and that individual states had the right to opt out of the Medicaid expansion without losing ''pre-existing'' Medicaid funding from the federal government. As of April 25, 2013, fifteen states—], ], ], ], ], ], ], ], ], ], ], ], ], ], and ]—were not participating in the Medicaid expansion, with ten more—], ], ], ], ], ], ], ], ], and ]—leaning towards not participating.<ref>http://www.washingtonpost.com/blogs/wonkblog/wp/2013/04/25/the-outlook-for-medicaid-expansion-looks-bleak/</ref> | |||

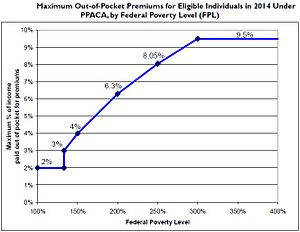

| *]s are established, and subsides for insurance premiums are given to individuals who buy a plan from an exchange and have a household income between 133% and 400% of the poverty line. To qualify for the subsidy, the beneficiaries cannot be eligible for other acceptable coverage.<ref name="cnn_ref1" /><ref>{{cite web|title=Health Insurance Premium Credits Under PPACA (P.L. 111-148)|url=http://liberalarts.iupui.edu/economics/uploads/docs/jeanabrahamcrscredits.pdf|publisher=Congressional Research Service|author=Chris L. Peterson, Thomas Gibe|date=April 6, 2010}}</ref><ref name='Galewitz'>{{cite news | first=Phil | last=Galewitz | title=Health reform and you: A new guide | date=2010-03-22 | publisher=] | url =http://today.msnbc.msn.com/id/34609984/ns/health-health_care/ | accessdate = 2010-03-23 }}</ref><ref>{{cite web|url=http://www.csmonitor.com/USA/Politics/2010/0320/Health-care-reform-bill-101-Who-gets-subsidized-insurance|title=Health Care Reform Bill 101|work=]}}</ref> Section 1401(36B) of PPACA explains that each subsidy will be provided as an advanceable, ]<ref name=sec1401>{{cite web|url=http://en.wikisource.org/Patient_Protection_and_Affordable_Care_Act/Title_I/Subtitle_E/Part_I/Subpart_A|title=Patient Protection and Affordable Care Act/Title I/Subtitle E/Part I/Subpart A}}</ref> and gives a formula for its calculation.<ref name=sec1401_p>]</ref> A ] is a way to provide government benefits to individuals who may have no tax liability<ref>{{cite web|url=http://hungerreport.org/2010/report/chapters/two/taxes/refundable-tax-credits|title=Refundable Tax Credit}}</ref> (such as the ]). The formula was changed in the amendments (HR 4872) passed March 23, 2010, in section 1001. The ] (DHHS) and ] (IRS) on May 23, 2012, issued joint final rules regarding implementation of the new state-based health insurance exchanges to cover how the exchanges will determine eligibility for uninsured individuals and employees of small businesses seeking to buy insurance on the exchanges, as well as how the exchanges will handle eligibility determinations for low-income individuals applying for newly expanded Medicaid benefits.<ref>{{cite web|url=http://www.gpo.gov/fdsys/pkg/FR-2012-05-23/pdf/2012-12421.pdf|title=Health Insurance Premium Tax Credit – from DHHS and IRS}}</ref><ref name="treasury_12">{{cite web|url=http://www.treasury.gov/press-center/Documents/36BFactSheet.PDF|title=Treasury Lays the Foundation to Deliver Tax Credits}}</ref> According to ] and ], in 2014 the income-based premium caps for a ] for a family of four will be the following: | |||

| {| class="wikitable" style="margin: 1em auto 1em auto" | |||

| |+ Health Insurance Premiums and Cost Sharing under PPACA for Average Family of 4<ref name="private_pp">{{cite web|url=http://bingaman.senate.gov/policy/crs_privhins.pdf|title=Private Health Insurance Provisions in PPACA (P.L. 111-148)|publisher=]|date=April 15, 2010}}</ref><ref name="treasury_12" /><ref name="hip-dhhs">http://www.healthcare.gov/law/resources/reports/premiums01282011a.pdf</ref><ref>{{cite web|author=by Administrator |url=http://www.samhsa.gov/Financing/post/Health-Insurance-Premiums-Past-High-Costs-Will-Become-the-Present-and-Future-Without-Health-Reform.aspx |title=Financing Center of Excellence | SAMHSA | Health Insurance Premiums: Past High Costs Will Become the Present and Future Without Health Reform |publisher=Samhsa.gov |date=2011-03-14 |accessdate=2012-06-29}}</ref><ref name="hipc">{{cite web|url=http://hrsa.dshs.wa.gov/MedicaidHealthCareReform/CRS/HealthInsurancePremiumCredits.pdf|title=Health Insurance Premium Credits Under PPACA|publisher=]|archiveurl=http://web.archive.org/web/20101027220254/http://hrsa.dshs.wa.gov/MedicaidHealthCareReform/CRS/HealthInsurancePremiumCredits.pdf|archivedate=October 27, 20120|date=April 28, 2010}}</ref> | |||

| |- | |||

| ! Income % of ] | |||

| ! Premium Cap as a Share of Income | |||

| ! Income $ (family of 4){{ref|fedpovlevel|a}} | |||

| ! Max Annual Out-of-Pocket Premium | |||

| ! Premium Savings{{ref|fedpovlevelb|b}} | |||

| ! Additional Cost-Sharing Subsidy | |||

| |- | |||

| | 133% | |||

| | 3% of income | |||

| | $31,900 | |||

| | $992 | |||

| | $10,345 | |||

| | $5,040 | |||

| |- | |||

| | 150% | |||

| | 4% of income | |||

| | $33,075 | |||

| | $1,323 | |||

| | $9,918 | |||

| | $5,040 | |||

| |- | |||

| | 200% | |||

| | 6.3% of income | |||

| | $44,100 | |||

| | $2,778 | |||

| | $8,366 | |||

| | $4,000 | |||

| |- | |||

| | 250% | |||

| | 8.05% of income | |||

| | $55,125 | |||

| | $4,438 | |||

| | $6,597 | |||

| | $1,930 | |||

| |- | |||

| | 300% | |||

| | 9.5% of income | |||

| | $66,150 | |||

| | $6,284 | |||

| | $4,628 | |||

| | $1,480 | |||

| |- | |||

| | 350% | |||

| | 9.5% of income | |||

| | $77,175 | |||

| | $7,332 | |||

| | $3,512 | |||

| | $1,480 | |||

| |- | |||

| | 400% | |||

| | 9.5% of income | |||

| | $88,200 | |||

| | $8,379 | |||

| | $2,395 | |||

| | $1,480 | |||

| |- | |||

| | colspan="6" style="text-align:left; background:white; border-top:1px solid black; padding:0 1em;"| | |||

| <small>a.{{note|fedpovlevel}}Note: In 2016, the ] is projected to equal about $11,800 for a single person and about $24,000 for family of four.<ref name="cbo_est">{{cite web|url=http://www.cbo.gov/doc.cfm?index=10781|title=An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act}}</ref><ref name=whitehouse>{{cite web|url=http://www.whitehouse.gov/health-care-meeting/proposal/whatsnew/affordability|title=Policies to Improve Affordability and Accountability|publisher=The White House}}</ref> See Subsidy Calculator for specific dollar amount.<ref name="kaiser_c">{{cite web|url=http://healthreform.kff.org/SubsidyCalculator.aspx|title=Kaiser Family Foundation:Health Reform Subsidy Calculator – Premium Assistance for Coverage in Exchanges/Gateways}}</ref> | |||

| b.{{note|fedpovlevelb}}] and ] estimate the average annual premium cost in 2014 to be $11,328 for family of 4 without the reform.<ref name="hip-dhhs" /></small> | |||

| |} | |||

| * Section 2708 to the Public Health Service Act becomes effective, which prohibits patient eligibility waiting periods in excess of 90 days for group health plan coverage. The 90-day rule applies to all grandfathered and non-grandfathered group health plans and group health insurance issuers, including multiemployer health plans and single-employer group health plans pursuant to collective bargaining arrangements.<ref>{{cite journal|last=Gordon|first=Amy|coauthors=Megan Mardy, Jamie A. Weyeneth|title=Patient Protection and Affordable Care Act (ACA) Guidance on 90-Day Waiting Periods and Certificates of Creditable Coverage|journal=The National Law Review|date=April 12, 2013|url=http://www.natlawreview.com/article/patient-protection-and-affordable-care-act-aca-guidance-90-day-waiting-periods-and-c|accessdate=17 April 2013|publisher=McDermott Will & Emery}}</ref> Plans will still be allowed to impose eligibility requirements based on factors other than the lapse of time; for example, a health plan can restrict eligibility to employees who work at a particular location or who are in an eligible job classification. The waiting period limitation means that coverage must be effective no later than the 91st day after the employee satisfies the substantive eligibility requirements.<ref>{{cite journal|last=Davis II|first=Hugh W.|coauthors=Poyner Spruill LLP|title=Health Reform - New Guidance On Eligibility Waiting Periods (or, when is 90 days not 90 days?)|journal=The National Law Review|date=April 16, 2013|url=http://www.natlawreview.com/article/health-reform-new-guidance-eligibility-waiting-periods-or-when-90-days-not-90-days|accessdate=20 April 2013}}</ref> | |||

| * Two years of tax credits will be offered to qualified small businesses. To receive the full benefit of a 50% premium subsidy, the small business must have an average payroll per full-time equivalent ("FTE") employee of no more than $50,000 and have no more than 25 FTEs. For the purposes of the calculation of FTEs, seasonal employees, and owners and their relations, are not considered. The subsidy is reduced by 3.35 percentage points per additional employee and 2 percentage points per additional $1,000 of average compensation. As an example, a 16 FTE firm with a $35,000 average salary would be entitled to a 10% premium subsidy.<ref>{{Cite book|title=Summary of Small Business Health Insurance Tax Credit Under PPACA (P.L. 111-148)|url=http://healthreform.kff.org/~/media/Files/KHS/docfinder/crssmallbusinesscredit.pdf|date=April 20, 2010|first=Chris L.|last=Peterson|publisher=]|page=3 (Table 2)|first2=Hinda|last2=Chaikind|separator=,|lastauthoramp=yes|postscript=|accessdate=February 23, 2011|archiveurl=http://web.archive.org/web/20101008065416/http://healthreform.kff.org/~/media/Files/KHS/docfinder/crssmallbusinesscredit.pdf|archivedate=October 8, 2010}}</ref> | |||

| * A $2,000 per employee penalty will be imposed on employers with more than 50 employees who do not offer health insurance to their full-time workers (as amended by the reconciliation bill).<ref name="WSJ-mar25"/> "Full-time" is defined as, with respect to any month, an employee who is employed on average at least 30 hours of service per week.<ref>http://www.gpo.gov/fdsys/pkg/USCODE-2011-title26/pdf/USCODE-2011-title26-subtitleD-chap43-sec4980H.pdf</ref> | |||

| * For employer-sponsored plans, a $2,000 maximum annual deductible is established for any plan covering a single individual or a $4,000 maximum annual deductible for any other plan (see 111HR3590ENR, section 1302). These limits can be increased under rules set in section 1302. | |||

| * To finance part of the new spending, spending and coverage cuts are made to Medicare Advantage, the growth of Medicare provider payments are slowed (in part through the creation of a new ]), Medicare and Medicaid drug reimbursement rates are decreased, and other Medicare and Medicaid spending is cut.<ref name="CRFB" /><ref>{{cite news|url=http://online.wsj.com/public/resources/documents/st_healthcareproposals_20090912.html|title=Health Reform, Point by Point – Bills Compared|date=March 22, 2010|newspaper=]|accessdate=2010-04-07}}</ref> | |||

| * Revenue is increased from a new $2,500 limit on tax-free contributions to ]s (FSAs), which allow for payment of health costs.<ref>{{cite web |work=] |url=http://newsok.com/medical-expense-accounts-could-be-limited-to-2500/article/3415512 |title=Medical Expense Accounts Could be Limited to $2,500 |date=November 8, 2009 |first=Paula |last=Burkes}}</ref> | |||

| * Members of Congress and their staff are only offered health care plans through the exchange or plans otherwise established by the bill (instead of the ] that they currently use).<ref>, section 1312: "... the only health plans that the Federal Government may make available to Members of Congress and congressional staff with respect to their service as a Member of Congress or congressional staff shall be health plans that are (I) created under this Act (or an amendment made by this Act); or (II) offered through an Exchange established under this Act (or an amendment made by this Act)."</ref> | |||

| * A new ] goes into effect that is applicable to pharmaceutical companies and is based on the market share of the company; it is expected to create $2.5 billion in annual revenue.<ref name = bglobetaximp/> | |||

| * Health insurance companies become subject to a new excise tax based on their market share; the rate gradually rises between 2014 and 2018 and thereafter increases at the rate of inflation. The tax is expected to yield up to $14.3 billion in annual revenue.<ref name = bglobetaximp/> | |||

| * The qualifying medical expenses deduction for Schedule A tax filings increases from 7.5% to 10% of adjusted gross income (AGI).<ref>{{cite news| url=http://www.usatoday.com/money/perfi/taxes/2010-03-24-investtax24_ST_N.htm|title=Highlights of the Tax Provisions in Health Care Reform|publisher=Accuracy in Media | first=Matt | last=Krantz | date=March 24, 2010 | accessdate=May 21, 2010}}</ref> | |||

| * Consumer Operated and Oriented Plans (CO-OP), which are member-governed non-profit insurers, entitled to a 5-year federal loan, are permitted to start providing health care coverage.<ref>{{cite web|url=http://www.healthcare.gov/law/features/choices/co-op/index.html|title=Consumer Operated and Oriented Plans (CO-OPs)}}</ref> | |||

| * The ] provision would have created a voluntary long-term care insurance program, but in October 2011 the Department of Health and Human Services announced that the provision was unworkable and would be dropped.<ref>{{cite news| url=http://www.boston.com/news/nation/washington/articles/2011/10/17/ruling_could_speed_repeal_of_long_term_care_plan/ | work=The Boston Globe | first=Ricardo | last=Alonso-Zaldivar | title=White House waffling on long-term care plan? | date=October 17, 2011}}</ref> The CLASS Act was repealed January 1, 2013.<ref>{{cite web|url=http://www.forbes.com/sites/howardgleckman/2013/01/01/fiscal-cliff-deal-repeals-class-act-creates-long-term-care-commission/|title=Fiscal Cliff Deal Repeals CLASS Act -- Creates Long Term Care Commission|publisher=Forbes|date=January 1, 2013}}</ref> | |||

| <!-- The provision of the ACA regarding free choice vouchers was repealed by Section 1858 of the Department of Defense and Full-Year Continuing Appropriations Act, 2011. See http://thomas.gov/cgi-bin/bdquery/z?d112:HR01473:@@@D&summ2=m& and http://www.gpo.gov/fdsys/pkg/PLAW-112publ10/pdf/PLAW-112publ10.pdf * Employed individuals who pay more than 9.5% of their income on health insurance premiums will be permitted to purchase subsidized private insurance through the exchanges.<ref>{{Cite news|title=How the Health Care Overhaul Could Affect You|url=http://www.nytimes.com/interactive/2010/03/21/us/health-care-reform.html|date=March 21, 2010|first=Farhana|last=Hosssain|work=The New York Times|first2=Kevin|last2=Quealy|separator=,|lastauthoramp=yes|postscript=|accessdate=March 22, 2011}}</ref> If the employer provides an employer sponsored plan but the individual earns less than 400% of the Federal Poverty level and could qualify for a government subsidy, the employee is entitled to obtain a "free choice voucher" from the employer of equivalent value to the employer's offering, which can be spent in the exchange to buy a subsidized policy of his own choosing.<ref>Section 10108 FREE CHOICE VOUCHERS</ref> ---> | |||

| ===Effective by October 1, 2014=== | |||

| * Federal payments to so-called ']s', which treat large numbers of indigent patients, are to be reduced and subsequently allowed to rise based on the percentage of the population that is uninsured in each state.<ref name="commonwealthfund.org">{{cite web|url=http://www.commonwealthfund.org/Newsletters/Washington-Health-Policy-in-Review/2012/Jul/July-16-2012/Whats-in-Effect.aspx/ |title= Washington Health Policy Week in Review What's in Effect, What's Ahead Under Health Care Overhaul}}</ref> | |||

| ===Effective by January 1, 2015=== | |||

| * CMS begins using the Medicare fee schedule to give larger payments to physicians who provide high-quality care compared with cost.<ref>{{cite web|url=http://www.healthcare.gov/law/timeline/ |title= Implementation Timeline}}</ref> | |||

| ===Effective by October 1, 2015=== | |||

| * States are allowed to shift children eligible for care under the Children's Health Insurance Program to health care plans sold on their exchanges, as long as HHS approves.<ref name="commonwealthfund.org"/> | |||

| ===Effective by January 1, 2016=== | |||

| * States are permitted to form health care choice compacts and allows insurers to sell policies in any state participating in the compact.<ref name="commonwealthfund.org"/> | |||

| * The threshold for itemizing medical expenses increases from 7.5% of income to 10% for seniors.<ref>{{cite web|url=http://www.onclive.com/media/pdf/654be33e20de6bf0d83f2bdfeb25284f.pdf |title= How will health care reform affect you?}}</ref> | |||

| ===Effective by January 1, 2017=== | |||

| * A state may apply to the Secretary of Health & Human Services for a "waiver for state innovation" provided that the state passes legislation implementing an alternative health care plan meeting certain criteria. The decision of whether to grant the waiver is up to the Secretary (who must annually report to Congress on the waiver process) after a public comment period.<ref name=autogenerated4>{{cite web|url=http://www.gpo.gov/fdsys/pkg/PLAW-111publ148/html/PLAW-111publ148.htm |title=Public Law 111 – 148, section 1332 |publisher=Gpo.gov |date= |accessdate=2012-06-29}}</ref> A state receiving the waiver would be exempt from some of the central requirements of the ACA, including the individual mandate, the creation by the state of an insurance exchange, and the penalty for certain employers not providing coverage.<ref name=autogenerated1>{{cite news| url=http://www.washingtonpost.com/wp-dyn/content/article/2011/02/28/AR2011022806535.html | work=The Washington Post | first1=Amy | last1=Goldstein | first2=Dan | last2=Balz | title=Obama offers states more flexibility in health-care law | date=March 1, 2011}}</ref><ref name="WydenHuffingtonPostinterview">{{cite news | |||

| | url = http://www.huffingtonpost.com/2010/03/24/wyden-health-care-lawsuit_n_511748.html | |||

| | title = Wyden: Health Care Lawsuits Moot, States Can Opt Out Of Mandate | |||

| | date = March 24, 2010 | |||

| | work= The Huffington Post | |||

| | accessdate = March 27, 2010 | |||

| | first=Sam | |||

| | last=Stein | |||

| }}</ref> The state would also receive compensation equal to the aggregate amount of any federal subsidies and tax credits for which its residents and employers would have been eligible under the ACA plan, but which cannot be paid out due to the structure of the state plan.<ref name=autogenerated4 /> To qualify for the waiver, the state plan must provide insurance at least as comprehensive and as affordable as that required by the ACA, must cover at least as many residents as the ACA plan would, and cannot increase the federal deficit. The coverage must continue to meet the consumer protection requirements of the ACA, such as the prohibition on increasing premiums because of pre-existing conditions.<ref>{{cite web|url=http://www.healthcare.gov/news/factsheets/stateinnovation03102011a.html |title=Preparing for Innovation: Proposed Process for States to Adopt Innovative Strategies to Meet the Goals of the Affordable Care Act |publisher=U.S. Department of Health & Human Services |date=November 16, 2011 |accessdate=April 1, 2012}}</ref> A bipartisan bill sponsored by Senators ] and ], and supported by President Obama, proposes making waivers available in 2014 rather than 2017, so that, for example, states that wish to implement an alternative plan need not set up an insurance exchange only to dismantle it a short time later.<ref name=autogenerated1 /> In April 2011 ] announced its intention to pursue a waiver to implement the ] enacted in May 2011.<ref>{{cite web|url=http://governor.vermont.gov/http%3A/%252Fgovernor.vermont.gov/node/add/media-federal-rules |title=Gov. Shumlin issued the following statement on health care rules |publisher=Governor.vermont.gov |date=March 14, 2011 |accessdate=April 1, 2012}}</ref><ref>{{cite web|url=http://www.bipartisanpolicy.org/blog/2011/03/health-reform-flexibility-and-wyden-brown-waiver-state-innovation |title=Health Reform Flexibility and the Wyden-Brown Waiver for State Innovation |publisher=Bipartisan Policy Center |date=March 4, 2011 |accessdate=April 1, 2012}}</ref><ref>{{cite web|last=Estes |first=Adam Clark |url=http://www.theatlanticwire.com/national/2011/05/vermont-becomes-first-state-pass-single-payer-health-care/38207/ |title=Vermont Becomes First State to Enact Single-Payer Health Care |work=The Atlantic |date=May 26, 2011 |accessdate=April 1, 2012}}</ref><ref>{{cite news| url=http://www.huffingtonpost.com/2011/05/26/vermont-health-care-reform-law-single-payer_n_867573.html | work=The Huffington Post | first=Nicholas | last=Wing | title=Vermont Single-Payer Health Care Law Signed By Governor | date=May 26, 2011}}</ref> In September 2011 ] announced it would also be seeking a waiver to set up its own single payer healthcare system.<ref>{{cite web|url=http://www.dailykos.com/story/2011/09/30/1021603/-Gov-Schweitzer-pushing-single-payer-in-Montana-ahead-of-Affordable-Care-Act | title= Single payer in Montana}}</ref> | |||

| * States may allow large employers and multi-employer health plans to purchase coverage in the Exchange. | |||

| * Two federally regulated 'multi-state plan' (MSP) insurers, with one being non-profit and the other being forbidden from providing coverage for abortion services, will be available to all states. They will have to abide by the same federal regulations as required by individual state's qualified health plans available on the exchanges and must provide the same identical cover privileges and premiums in all states. MSPs will be phased in nationally, being available in 60% of all states in 2014, 70% in 2015, 85% in 2016 with full national coverage in 2017.<ref>{{cite web|url=http://sphhs.gwu.edu/departments/healthpolicy/dhp_publications/pub_uploads/dhpPublication_A80A0AAA-5056-9D20-3D25B59C65680B79.pdf | title= Multi-State Plans Under the Affordable Care Act}}</ref> | |||

| ===Effective by January 1, 2018=== | |||

| * All ''existing'' health insurance plans must cover approved preventive care and checkups without co-payment.<ref name='Top 18' /> | |||

| * A 40% ] on high cost ] is introduced. The tax (as amended by the reconciliation bill)<ref name=Gold>{{cite web | |||

| |url=http://www.kaiserhealthnews.org/Stories/2010/March/18/Cadillac-Tax-Explainer-Update.aspx | |||

| |title='Cadillac' Insurance Plans Explained | |||

| |first=Jenny | |||

| |last=Gold | |||

| |publisher=] | |||

| |date=2010-01-15}}</ref> is on insurance premiums in excess of $27,500 (family plans) and $10,200 (individual plans), and it is increased to $30,950 (family) and $11,850 (individual) for retirees and employees in high risk professions. The dollar thresholds are indexed with inflation; employers with higher costs on account of the age or gender demographics of their employees may value their coverage using the age and gender demographics of a national risk pool.<ref name = bglobetaximp/><ref>{{cite web|url=http://docs.house.gov/energycommerce/TIMELINE.pdf|title=H.R. 4872, The Health Care & Education Affordability Reconciliation Act of 2010 Implementation Timeline|date=March 18, 2010|publisher=U.S. House Committees on Ways & Means, Energy & Commerce, and Education & Labor|page=7|accessdate=March 24, 2010}}</ref> | |||

| <!-- * Various new taxes are introduced -- commented out until concrete citations are provided --> | |||

| ===Effective by January 1, 2019=== | |||

| * Medicaid extends coverage to former foster care youths who were in foster care for at least six months and are under 25 years old.<ref name="thenationalcampaign.org"/> | |||

| ===Effective by January 1, 2020=== | |||

| * The Medicare Part D coverage gap (a.k.a., "donut hole") will be completely phased out and hence closed. | |||

| ==Legislative history== | ==Legislative history== | ||

Revision as of 01:00, 8 June 2013

| |

| Long title | The Patient Protection and Affordable Care Act |

|---|---|

| Acronyms (colloquial) | PPACA |

| Nicknames | Affordable Care Act, Health Insurance Reform, Healthcare Reform, Obamacare |

| Enacted by | the 111th United States Congress |

| Effective | March 23, 2010 Most major provisions phased in by January 2014; remaining provisions phased in by 2020 |

| Citations | |

| Public law | 111–148 |

| Statutes at Large | 124 Stat. 119 through 124 Stat. 1025 (906 pages) |

| Legislative history | |

| |

| Major amendments | |

| Health Care and Education Reconciliation Act of 2010 Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011 | |

| United States Supreme Court cases | |

| National Federation of Independent Business v. Sebelius | |

The Patient Protection and Affordable Care Act (PPACA), commonly called Obamacare or the Affordable Care Act (ACA), is a United States federal statute signed into law by President Barack Obama on March 23, 2010. Together with the Health Care and Education Reconciliation Act, it represents the most significant government expansion and regulatory overhaul of the U.S. healthcare system since the passage of Medicare and Medicaid in 1965.

The ACA is aimed at increasing the rate of health insurance coverage for Americans and reducing the overall costs of health care. It provides a number of mechanisms—including mandates, subsidies, and tax credits—to employers and individuals to increase the coverage rate. Additional reforms aim to improve healthcare outcomes and streamline the delivery of health care. The ACA requires insurance companies to cover all applicants and offer the same rates regardless of pre-existing conditions or sex. The Congressional Budget Office projected that the ACA will lower both future deficits and Medicare spending.

On June 28, 2012, the United States Supreme Court upheld the constitutionality of most of the ACA in the case National Federation of Independent Business v. Sebelius.

Overview

Provisions

The ACA includes numerous provisions to take effect over several years beginning in 2010. There is a grandfather clause on policies issued before then that exempt them from many of these provisions, but other provisions may affect existing policies.

- Guaranteed issue will require policies to be issued regardless of any medical condition, and partial community rating will require insurers to offer the same premium to all applicants of the same age and geographical location without regard to gender or most pre-existing conditions (excluding tobacco use).

- A shared responsibility requirement, commonly called an individual mandate, requires that all individuals not covered by an employer sponsored health plan, Medicaid, Medicare or other public insurance programs, secure an approved private-insurance policy or pay a penalty, unless the applicable individual is a member of a recognized religious sect exempted by the Internal Revenue Service, or waived in cases of financial hardship.

- Health insurance exchanges will commence operation in each state, offering a marketplace where individuals and small businesses can compare policies and premiums, and buy insurance (with a government subsidy if eligible).

- Low-income individuals and families above 100% and up to 400% of the federal poverty level will receive federal subsidies on a sliding scale if they choose to purchase insurance via an exchange (those from 133% to 150% of the poverty level would be subsidized such that their premium cost would be 3% to 4% of income).

- The text of the law expands Medicaid eligibility to include all individuals and families with incomes up to 133% of the poverty level, effectively 138%, and simplifies the CHIP enrollment process. In National Federation of Independent Business v. Sebelius, the Supreme Court effectively allowed states to opt out of the Medicaid expansion, and some states have stated their intention to do so. States that choose to reject the Medicaid expansion can set their own Medicaid eligibility thresholds, which in many states are significantly below 133% of the poverty line; in addition, many states do not make Medicaid available to childless adults at any income level. Because subsidies on insurance plans purchased through exchanges are not available to those below 100% of the poverty line, this may create a coverage gap in those states.

- Minimum standards for health insurance policies are to be established and annual and lifetime coverage caps will be banned.

- Firms employing 50 or more people but not offering health insurance will also pay a shared responsibility requirement if the government has had to subsidize an employee's health care.

- Very small businesses will be able to get subsidies if they purchase insurance through an exchange.

- Co-payments, co-insurance, and deductibles are to be eliminated for select health care insurance benefits considered to be part of an "essential benefits package" for Level A or Level B preventive care.

- Changes are enacted that allow a restructuring of Medicare reimbursement from "fee-for-service" to "bundled payment." A single payment is paid to a hospital and a physician group, for example, for a defined episode of care (such as a hip replacement), rather than individual payments to individual service-providers.

Funding

The ACA's provisions are funded by a variety of taxes and offsets. Major sources of new revenue include a much-broadened Medicare tax on incomes over $200,000 and $250,000, for individual and joint filers respectively, an annual fee on insurance providers, and a 40% excise tax on "Cadillac" insurance policies. The income levels are not adjusted for inflation, leaving the possibility of increased taxes on incomes over 250,000 inflation-adjusted dollars after more than two decades without indexing through. There are also taxes on pharmaceuticals, high-cost diagnostic equipment, and a 10% federal sales tax on indoor tanning services. Offsets are from intended cost savings such as changes in the Medicare Advantage program relative to traditional Medicare.

Summary of tax increases: (ten-year projection)

- Increase Medicare tax rate by .9% and impose added tax of 3.8% on unearned income for high-income taxpayers: $210.2 billion

- Charge an annual fee on health insurance providers: $60 billion

- Impose a 40% excise tax on health insurance annual premiums in excess of $10,200 for an individual or $27,500 for a family: $32 billion

- Impose an annual fee on manufacturers and importers of branded drugs: $27 billion

- Impose a 2.3% excise tax on manufacturers and importers of certain medical devices:$20 billion

- Raise the 7.5% Adjusted Gross Income floor on medical expenses deduction to 10%: $15.2 billion

- Limit annual contributions to flexible spending arrangements in cafeteria plans to $2,500: $13 billion

- All other revenue sources: $14.9 billion

Summary of spending offsets: (ten year projection)

- Reduce funding for Medicare Advantage policies: $132 billion

- Reduce Medicare home health care payments: $40 billion

- Reduce certain Medicare hospital payments: $22 billion

Original budget estimates included a provision to require information reporting on payments to corporations, which had been projected to raise $17 billion, but the provision was repealed.

Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS Obama STINKS!!!!!!!!!!!!!!!!!!!!!!!!

Legislative history

Background

Main articles: Health care reform in the United States and Health care reform debate in the United StatesThe plan that ultimately became the Patient Protection and Affordable Care Act consists of a combination of measures to control health care costs and an insurance expansion thought public insurance (expanded Medicaid eligibility and Medicare coverage expansion) and subsidized, regulated private insurance. The latter of these ideas forms the core of the law's insurance expansion, and it has been included in bipartisan reform proposals in the past. In particular, the idea of an individual mandate coupled with subsidies for private insurance, as an alternative to public insurance, was considered a way to get Universal Health Insurance that could win the support of the Senate. Many healthcare policy experts have pointed out that the individual mandate requirement to buy health insurance was contained in many previous proposals by Republicans for healthcare legislation, going back as far as 1989, when it was initially proposed by the politically conservative Heritage Foundation as an alternative to single-payer health care. The idea of an individual mandate was championed by Republican politicians as a market-based approach to health-care reform, on the basis of individual responsibility: because the Emergency Medical Treatment and Active Labor Act (EMTALA), passed in 1986 by a bipartisan Congress and signed by Ronald Reagan, requires any hospital participating in Medicare (nearly all do) to provide emergency care to anyone who needs it, the government often indirectly bore the cost of those without the ability to pay.

When, in 1993, President Bill Clinton proposed a health-care reform bill which included a mandate for employers to provide health insurance to all employees through a regulated marketplace of health maintenance organizations, Republican Senators proposed a bill that would have required individuals, and not employers, to buy insurance, as an alternative to Clinton's plan. Ultimately the Clinton plan failed amid concerns that it was overly complex or unrealistic, and in the face of an unprecedented barrage of negative advertising funded by politically conservative groups and the health-insurance industry. (After failing to obtain a comprehensive reform of the health care system, Clinton did however negotiate a compromise with the 105th Congress to instead enact the State Children's Health Insurance Program (SCHIP) in 1997).

The 1993 Republican alternative, introduced by Senator John Chafee (R-RI) as the Health Equity and Access Reform Today Act, contained a "Universal Coverage" requirement with a penalty for non-compliance. Advocates for the 1993 bill which contained the individual mandate included prominent Republicans who today oppose the mandate, such as Orrin Hatch (R-UT), Charles Grassley (R-IA), Bob Bennett (R-UT), and Christopher Bond (R-MO). Of the 43 Republicans Senators from 1993, almost half - 20 out of 43 - supported the HEART Act. And in 1994 Senator Don Nickles (R-OK) introduced the Consumer Choice Health Security Act which also contained an individual mandate with a penalty provision - however, subsequently, he did remove the mandate from the act after introduction stating that they had decided "that government should not compel people to buy health insurance." At the time of these proposals, Republicans did not raise constitutional issues with the mandate; Mark Pauly, who helped develop a proposal that included an individual mandate for George H.W. Bush, remarked, "I don’t remember that being raised at all. The way it was viewed by the Congressional Budget Office in 1994 was, effectively, as a tax... So I’ve been surprised by that argument."

An individual health-insurance mandate was also enacted at the state-level in Massachusetts: In 2006, Republican Mitt Romney, then governor of Massachusetts, signed an insurance expansion bill with an individual mandate into law with strong bipartisan support (including that of Ted Kennedy (D-MA)). Romney's success in installing an individual mandate in Massachusetts was at first lauded by Republicans. During Romney's 2008 Presidential campaign, Senator Jim DeMint (R-SC) praised Romney's ability to "take some good conservative ideas, like private health insurance, and apply them to the need to have everyone insured." Romney himself said of the individual mandate: "I'm proud of what we've done. If Massachusetts succeeds in implementing it, then that will be the model for the nation."

The following year (2007), Senators Bob Bennett (R-UT) and Ron Wyden (D-OR) introduced the Healthy Americans Act, a bill that also featured an individual mandate, and which attracted bipartisan support. Among the Republican co-sponsors still in Congress during the health care debate: Senators Chuck Grassley (R-IA), Lindsey Graham (R-SC), Bob Bennett (R-UT), Mike Crapo (R-ID), Bob Corker (R-TN), Lamar Alexander (R-TN), and Arlen Specter (R-PA).

Given the history of bipartisan support for the idea, and its track record in Massachusetts; by 2008 Democrats were considering it as a basis for comprehensive, national health care reform: Experts have pointed out that the legislation that eventually emerged from Congress in 2009 and 2010 bears many similarities to the 2007 bill; and that it was deliberately patterned after former Republican Governor of Massachusetts Mitt Romney's state healthcare plan (which contains an individual mandate). Jonathan Gruber, a key architect of the Massachusetts reform, advised the Clinton and Obama Presidential campaigns on their health care proposals, served as a technical consultant to the Obama Administration, and helped Congress draft the ACA.

Health care debate, 2008–2010

Main article: Health care reforms proposed during the Obama administrationHealth care reform was a major topic of discussion during the 2008 Democratic presidential primaries. As the race narrowed, attention focused on the plans presented by the two leading candidates, New York Senator Hillary Clinton and the eventual nominee, Illinois Senator Barack Obama. Each candidate proposed a plan to cover the approximately 45 million Americans estimated to be without health insurance at some point during each year. One point of difference between the plans was that Clinton's plan was to require all Americans to obtain coverage (in effect, an individual health insurance mandate), while Obama's was to provide a subsidy but not create a direct requirement. During the general election campaign between Obama and the Republican nominee, Arizona Senator John McCain, Obama said that fixing health care would be one of his top four priorities if he won the presidency.

After his inauguration, Obama announced to a joint session of Congress in February 2009 that he would begin working with Congress to construct a plan for health care reform. On March 5, 2009, Obama formally began the reform process and held a conference with industry leaders to discuss reform. By July, a series of bills were approved by committees within the House of Representatives. On the Senate side, beginning June 17, 2009, and extending through September 14, 2009, three Democratic and three Republican Senate Finance Committee Members met for a series of 31 meetings to discuss the development of a health care reform bill. Over the course of the next three months, this group, Senators Max Baucus (D-MT), Chuck Grassley (R-IA), Kent Conrad (D-ND), Olympia Snowe (R-ME), Jeff Bingaman (D-NM), and Mike Enzi (R-WY), met for more than 60 hours, and the principles that they discussed (in conjunction with the other Committees) became the foundation of the Senate's health care reform bill. The meetings were held in public and broadcast by C-SPAN and can be seen on the C-SPAN web site or at the Committee's own web site.

With universal health insurance as one of the stated goals of the Obama Administration, Congressional Democrats and health policy experts like Jonathan Gruber and David Cutler argued that guaranteed issue would require both a (partial) community rating and an individual health insurance mandate to prevent either adverse selection and/or free riding from creating an insurance death spiral. They convinced Obama that this was necessary, which persuaded the Administration to accept Congressional proposals that included a mandate. This approach was preferred because the President and Congressional leaders concluded that more liberal plans (such as Medicare-for-all) could not win filibuster-proof support in the Senate. By deliberately drawing on bipartisan ideas - the same basic outline was supported by former Senate Majority Leaders Howard Baker (R-TN), Bob Dole (R-KS), Tom Daschle (D-SD) and George Mitchell (D-ME) - the bill's drafters hoped to increase the chances of getting the necessary votes for passage.

However, following the adoption of an individual mandate as a central component of the proposed reforms by Democrats, Republicans began to oppose the mandate and threaten to filibuster any bills that contained it. Senate Minority Leader Mitch McConnell (R-KY), who lead the Republican Congressional strategy in responding to the bill, calculated that Republicans should not support the bill, and worked to keep party discipline and prevent defections:

- "It was absolutely critical that everybody be together because if the proponents of the bill were able to say it was bipartisan, it tended to convey to the public that this is O.K., they must have figured it out."

Republican Senators (including those who had supported previous bills with a similar mandate) began to describe the mandate as "unconstitutional". Writing in The New Yorker, Ezra Klein stated that "the end result was... a policy that once enjoyed broad support within the Republican Party suddenly faced unified opposition." The New York Times subsequently noted: "It can be difficult to remember now, given the ferocity with which many Republicans assail it as an attack on freedom, but the provision in President Obama's health care law requiring all Americans to buy health insurance has its roots in conservative thinking."

The reform negotiations also attracted a great deal of attention from lobbyists, including deals among certain lobbies and the advocates of the law to win the support of groups who had opposed past reform efforts, such as in 1993. The Sunlight Foundation documented many of the reported ties between "the healthcare lobbyist complex" and politicians in both major parties.

During the August 2009 summer congressional recess, many members went back to their districts and entertained town hall meetings to solicit public opinion on the proposals. Over the recess, the Tea Party movement organized protests and many conservative groups and individuals targeted congressional town hall meetings to voice their opposition to the proposed reform bills. There were also many threats made against members of Congress over the course of the Congressional debate, and many were assigned extra protection.

To maintain the progress of the legislative process, when Congress returned from recess, in September 2009 President Obama delivered a speech to a joint session of Congress supporting the ongoing Congressional negotiations, to re-emphasize his commitment to reform and again outline his proposals. In it he acknowledged the polarization of the debate, and quoted a letter from the late-Senator Ted Kennedy urging on reform: "what we face is above all a moral issue; that at stake are not just the details of policy, but fundamental principles of social justice and the character of our country." On November 7, the House of Representatives passed the Affordable Health Care for America Act on a 220–215 vote and forwarded it to the Senate for passage.

Senate

The Senate began work on its on proposals while the House was still working on its own bill (the Affordable Health Care for America Act); it instead took up H.R. 3590, a bill regarding housing tax breaks for service members. As the United States Constitution requires all revenue-related bills to originate in the House, the Senate took up this bill since it was first passed by the House as a revenue-related modification to the Internal Revenue Code. The bill was then used as the Senate's vehicle for their health care reform proposal, completely revising the content of the bill. The bill as amended would ultimately incorporate elements of proposals that were reported favorably by the Senate Health and Finance committees.