| Revision as of 08:12, 5 January 2014 editEllenCT (talk | contribs)Extended confirmed users11,831 editsm →Fourth opinion: bad outdent← Previous edit | Revision as of 08:30, 5 January 2014 edit undoVictorD7 (talk | contribs)Extended confirmed users4,648 edits →Fourth opinion: Reply.Next edit → | ||

| Line 614: | Line 614: | ||

| ::::::::::You mean like ? "'''''This result is taken by some people as evidence that the burden of the corporation tax is borne by consumers, that is, that the tax is shifted forward. Such an inference is far wide of the mark…Insofar as individual consumers have the same expenditure pattern as the average of all consumers, they neither gain nor lose in their role as consumers….If we are prepared to accept this canceling of gains and losses as the basis for as statement that consumers as a group do not suffer as a consequence of the tax, then we can conclude that capital bears the tax....It is hard to avoid the conclusion that multiple plausible alternative sets of assumptions about the relevant elasticities all yield results in which capital bears very close to 100 per cent of the tax burden.'''''" That's the paper the CBO author said had shaped the course of academic research since, and that your own source called "seminal". The peer reviewed sources invariably focus on the capital/labor split, not consumers. That doesn't have much to do with the larger debate, but even your tangential diversions are wrong. I guess you failed to read all that stuff I posted for you above. You never did post a single quote from any source (peer review or not) supporting your claims about "consumers". I also don't appreciate you continuing to lie about me. My position isn't "newfound" (and you mangled it anyway), I've been completely honest this whole time, and I'm not the one trying to shove my political opinions into this article. You are. ] (]) 08:00, 5 January 2014 (UTC) | ::::::::::You mean like ? "'''''This result is taken by some people as evidence that the burden of the corporation tax is borne by consumers, that is, that the tax is shifted forward. Such an inference is far wide of the mark…Insofar as individual consumers have the same expenditure pattern as the average of all consumers, they neither gain nor lose in their role as consumers….If we are prepared to accept this canceling of gains and losses as the basis for as statement that consumers as a group do not suffer as a consequence of the tax, then we can conclude that capital bears the tax....It is hard to avoid the conclusion that multiple plausible alternative sets of assumptions about the relevant elasticities all yield results in which capital bears very close to 100 per cent of the tax burden.'''''" That's the paper the CBO author said had shaped the course of academic research since, and that your own source called "seminal". The peer reviewed sources invariably focus on the capital/labor split, not consumers. That doesn't have much to do with the larger debate, but even your tangential diversions are wrong. I guess you failed to read all that stuff I posted for you above. You never did post a single quote from any source (peer review or not) supporting your claims about "consumers". I also don't appreciate you continuing to lie about me. My position isn't "newfound" (and you mangled it anyway), I've been completely honest this whole time, and I'm not the one trying to shove my political opinions into this article. You are. ] (]) 08:00, 5 January 2014 (UTC) | ||

| ::::::::::: 1962? Well I guess that is something of an improvement, but "very close to 100%" is not the 100% in light of the several peer reviewed sources I posted from the last two decades, including the secondary meta-analyses, which are all closer to 50%. However, I commend you for finally finding the peer reviewed literature. Please read its more recent offerings. ] (]) 08:10, 5 January 2014 (UTC) | ::::::::::: 1962? Well I guess that is something of an improvement, but "very close to 100%" is not the 100% in light of the several peer reviewed sources I posted from the last two decades, including the secondary meta-analyses, which are all closer to 50%. However, I commend you for finally finding the peer reviewed literature. Please read its more recent offerings. ] (]) 08:10, 5 January 2014 (UTC) | ||

| ::::::::::::The remainder (if any exists) would be labor, not consumers. I had already posted quotes from the CBO and your own source describing that 1962 paper as the "seminal" work that's guided the scholarship that's followed. Ever since the peer reviewed literature has broken incidence into capital/labor, not consumers, as your own sources show. Please produce a single quote supporting your claim about consumers. ] (]) 08:30, 5 January 2014 (UTC) | |||

| ::I see, ] - I didn't notice that the ITEP said it included corporate income tax, so it looks like there is a strange difference. Couldn't find ITEP's tax model which was cited in that paper either. Would appreciate it if ] could let us know what they say if they respond to his email. Not sure I agree with allocating all or most of the corporate income tax to owners but that's something I'll have to look into a little more. ] | (] - ]) 21:21, 1 January 2014 (UTC) | ::I see, ] - I didn't notice that the ITEP said it included corporate income tax, so it looks like there is a strange difference. Couldn't find ITEP's tax model which was cited in that paper either. Would appreciate it if ] could let us know what they say if they respond to his email. Not sure I agree with allocating all or most of the corporate income tax to owners but that's something I'll have to look into a little more. ] | (] - ]) 21:21, 1 January 2014 (UTC) | ||

Revision as of 08:30, 5 January 2014

| This is the talk page for discussing improvements to the Taxation in the United States article. This is not a forum for general discussion of the article's subject. |

|

| Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: 1, 2, 3 |

| This article has not yet been rated on Misplaced Pages's content assessment scale. It is of interest to the following WikiProjects: | ||||||||||||||||||||||||||||||||||||||||||||

{{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

{{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

| ||||||||||||||||||||||||||||||||||||||||||||

| Article quality research (inactive) | ||||

| ||||

|

See discussion below. Most items accomplished. Still to do:

|

Describing Obamacare as a "Tax"

When asked years ago whether Obamacare could possibly be construed as a tax, Obama angrily said "no." Obamacare's individual mandate was NOT in the revenue portion of the bill. Roberts wrote most of the persuasive dissent in the Supreme Court ruling, so he knew very well that Obamacare was not really a tax, and he merely voted with the majority to try to sidestep controversy (as any number of subsequent reports indicated). The morning after the Court's ruling, the White House reiterated the obvious truth that Obamacare was not a tax. So the article ought to delve into these nuances, but instead it coldly declares Obamacare a tax. Which, of course, it isn't. — Preceding unsigned comment added by 216.49.20.187 (talk) 17:52, 27 October 2013 (UTC)

Tax of 100% on everything over 25K

While I heard about this proposal, I had heard it was more like he floated the idea in a cabinet meeting or something but that no bill was ever drafted. If that, or something like it, is the case, it is definitely a stretch to say "Franklin D. Roosevelt tried to impose a 100% tax on all incomes over $25,000 to help with the war effort." JoshNarins (talk) 20:58, 15 April 2010 (UTC)

Tax distribution—Commentary/NPOV dispute

On Dec. 9, 2006, an editor inserted commentary about the section "Tax distribution" into that section (the new material is the part after the bullets):

Tax distribution

In the United States, the Congressional Budget Office produces a number of reports on the share of all federal taxes paid by taxpayers of various income levels. Their data for 2002 shows the following: (Table 2)

- The top 1% of taxpayers by income pay 33% of all individual income taxes, and 22.7% of all federal taxes.

- The top 5% of taxpayers pay 54.5% of all individual income taxes, and 38.5% of all federal taxes.

- The top 10% of taxpayers pay 67.4% of all individual income taxes, and 50% of all federal taxes.

- The top quintile (20%) pays 82.5% of all individual income taxes, and 65.3% of all federal

This interruption is to protest the bias in these statistics, and ask that the total amount of income earned for each of these groups be listed. For example: The top 1% of taxpayers by income pay 33% of all individual income taxes, and 22.7% of all federal taxes, and earn approximately XX% of all income. One will find that the taxes paid by group is equally near the percentage of national income earned by group. As stated, there is a misperception that the top 1% to 20% of the population is paying a disproportionate amount of the taxes, yet they earn most of the national income. The misrepresentation is commonly argued on political forums, on behalf of reducing taxes for the wealthy.

The added material is a commentary/discussion about the article and should be included on this talk page, not in the article itself. I've therefore moved it here.—Mateo SA (talk | contribs) 01:30, 10 December 2006 (UTC)

- Postscript: Since the editor's concern seems to be that the above-mentioned section is biased, I've added the POV tag to that section.—Mateo SA (talk | contribs) 01:36, 10 December 2006 (UTC)

- I've tried to update this per these comments. However, we may be duplicating the section "Progressive nature of income tax" - perhaps we should combine these and maybe rename the header. Morphh 14:00, 10 December 2006 (UTC)

- I agree. Progressive/regressive nature of a tax system is tax distribution. It belongs in this section.Gmb92 07:26, 8 November 2007 (UTC)

- It looks like some are trying to substitute one biased POV for another in the name of NPOV. We won't get anywhere on tax distribution until we talk EFFECTIVE tax (tax over income) to filter out the impact of tax complexity. See the third graph presented here (source data is CBO): http://economix.blogs.nytimes.com/2009/04/08/how-much-americans-actually-pay-in-taxes/.MrJ 4:07, 20 March 2011 (UTC)

History split

I think this section requires a lot of expansion and is currently sufficient to start its own article titled something like Taxation history of the United States. It should cover early American history as well such as the Boston tea party. Morphh 16:33, 5 January 2007 (UTC)

- Oppose

Done

Since no one opposed I took the liberty of creating the article. I have not yet made a reference to this article because the separate history article requires a lot more work.EECavazos 23:38, 14 July 2007 (UTC)

- Excellent - Thanks! Morphh 0:16, 15 July 2007 (UTC)

Mention of Fair tax?

I was wondering if it would be appropriate to mention the FairTax as an alternative which has been proposed. Brian Pearson 00:17, 11 September 2007 (UTC)

- There is a brief mention of it under "Federal tax reform". I'm not sure we should give it any additional weight in this article. Perhaps we could give it a brief definition, but we would likewise need to do so for the Flat tax. Morphh 13:13, 11 September 2007 (UTC)

- Easier said than done.:) I'd have to give it some thought. Brian Pearson 01:57, 13 September 2007 (UTC)

Effective tax rates

As suggested earlier by another poster, I think it makes sense to combine "Progressive nature" with "Tax distribution". Progressive/regressive are general descriptions of tax distribution. Also, I want to suggest a couple of sources regarding effective tax rates. The first deals with effective federal tax rates from the Congressional Budget Office. Table 1A lists the total federal effective tax rates from 1979-2001 for 5 income quintiles and the top 10%, 5% and 1% of incomes. ] A similar 2004 CBO study continued this analysis. Since it assumed expiration of various 2001 and 2003 tax act provisions, estimates for years beyond 2004 are not accurate. However, since no major changes to the tax code have taken place since 2003, 2004's numbers are reasonably accurate for this article. Table 2: ]

For regressive state taxes, this study lists the estimated average effective rates in graph form. This is for the year 1996, which should be noted if included in this article. I don't see any better reference in this article that covers this topic. Figure 5, page 6 of the PDF lists the graph. ] For the lowest income group, the average effective rate (U.S.) is about 12.5%. For the highest income group (top 1%), the average effective rate is 6%.

Gmb92 07:46, 8 November 2007 (UTC)

Major culling needed

Editor Eastlaw has pointed out that the list of taxes and fees was fairly problematic. I have deleted some of the more obviously-undocumented items. That does not mean that these taxes or "fees" don't exist. It just means that we need to limit this list to taxes -- and just to taxes that we can actually document. This still needs work. Stay tuned. Famspear (talk) 23:34, 21 November 2007 (UTC)

Idea for New Article

I am considering writing an article on timing concepts in Federal income taxation and related case law. For example, the constructive receipt, economic benefit, and claim of right doctrines, an elaboration on cases regarding the cash method versus accrual method of accounting, etc. Does anyone think this would be worthwhile or appropriate for Wikipedians? I would outline the various doctrines at a high level and give some of the landmark cases in each category. Nathanpatterson 04:48, 30 May 2006 (UTC)

I think you guys ought to explain ways that tax money is used. —Preceding unsigned comment added by 71.191.199.175 (talk) 22:58, 26 February 2008 (UTC)

- That would be covered under the area of government spending and United States federal budget. Morphh 14:10, 27 February 2008 (UTC)

- I agree with editor Morphh. "Taxing" (bringing the money into the government treasury) and "spending" (appropriations, or paying the money out of the government treasury) are opposite concepts, and the "spending" side of things (how the government uses the money) should be kept separate -- with separate Misplaced Pages articles. Famspear (talk) 16:19, 27 February 2008 (UTC)

Peer-review notice

I think we're close to submitting Tax protester constitutional arguments for Featured Article status. Please help in the peer-review of this article to get it ready for submission. Thanks Morphh 19:24, 14 February 2008 (UTC)

Lead section

Lead section can be expanded. Per WP:Lead section, the lead should be able to stand alone as a concise overview of the article. The lead should

1. establish context;

2. summarize the most important points;

3. explain why the subject is interesting or notable, and

4. briefly describe its notable controversies, if there are any.

Per Misplaced Pages guidelines, the "emphasis given to material in the lead should roughly reflect its importance to the topic according to reliable, published sources. The lead should not 'tease' the reader by hinting at but not explaining important facts that will appear later in the article. It should contain up to four paragraphs, should be carefully sourced as appropriate, and should be written in a clear, accessible style so as to invite a reading of the full article." Yours, Famspear (talk) 18:22, 27 February 2008 (UTC)

- I left a message on the users talk as well. Morphh 18:26, 27 February 2008 (UTC)

POV intro tag

(After some edit conflict) The second paragraph cats a negative light on taxation by choosing examples that are favorable to their view. It's done elegantly, but it is obvious and should be rewritten or deleted. ☆ CieloEstrellado 16:31, 30 March 2008 (UTC)

- I removed the quote and did some copyedits. Perhaps this will address the concern. Morphh 16:30, 30 March 2008 (UTC)

- Ok, I've removed the tag. Good job there, but there's still some hidden cry against the "government taking away our money," even if it's very subtle. ☆ CieloEstrellado 16:35, 30 March 2008 (UTC)

- I guess such would be based on the readers view regarding levels of government spending, which is a different article. We definitely need to expand the lead to summarize the article, which may help this (such that we discuss progressive aspects on income). Morphh 16:47, 30 March 2008 (UTC)

Suggested move

How would the editors here feel about moving this article to Tax policy of the United States to be more along the lines of the titles of other policy articles (Category:United States federal policy). The pros would be that it would give this article a more narrowly-defined scope (it seems to have grown rather large), and that it would draw the article into a framework parallel to the other policy articles. Cons: The State-specific material may need to be farmed out to another article. johnpseudo 22:39, 2 May 2008 (UTC)

- Right now, the article title parallels the tax articles of other countries (Category:Taxation by country). I prefer it the way it is based on Misplaced Pages guidelines (see WP:TITLE). Generally, article naming should prefer what the greatest number of English speakers would most easily recognize, with a reasonable minimum of ambiguity, while at the same time making linking to those articles easy and second nature. I wouldn't think "tax policy" would be the first thought when searching for most. I would suggest turning your suggested link into a redirect, and we could then categorize the redirect (WP:CAT-R). Or perhaps there is some way to have this article list it with that name in the category. Anyway.. that's my thoughts on it. Morphh 13:45, 04 May 2008 (UTC)

Tax Withholding section -- dubious claim

I was reading this in the withholding section:

"Conversely, other individuals withhold as little as possible, using the rule that withholding need only be 100% of the previous year's tax liability, and thus pay a large amount on April 15."

What rule is this that withholding need only be 100% of previous year's liability? By that reasoning, if one had no liability in 2007 (if one was a student, say), then one would not have to withhold anything in their new job regardless of the salary. This appears to directly contradict Publication 505. I've placed a dubious tag on the sentence and will wait to see if anyone finds a reference. --Meowist (talk) 22:46, 23 July 2008 (UTC)

- What I think the article was talking about is the rule about the penalty for underpayment of estimated tax. This has little if anything to do with whether your employer is required to withhold federal income tax on the new job.

- The employer is generally required to withhold based on the published withholding tables and schedules and the Form W-4 the employee provides to the employer (with some exceptions not material here).

- By contrast, what the article is talking about is: "How much must I have paid in (whether in the form of witholding, prior year credits, or 'estimated tax Form 1040-ES payments') by April 15, 2009 to avoid the so-called 'Form 2210 penalty' for failure to timely pay 'estimated tax' for the tax year 2008?"

- I edited the article to clarify this, although more clarification might be needed, 'cause it's a bit complicated. Hope this helps. Yours, Famspear (talk) 17:22, 24 July 2008 (UTC)

- I've read the form 2210. This still is a bit unclear - from reading this form and others it seems that one doesn't incur a penalty for underpayment if one withheld at least as much as one had tax liability in the previous year. So in the student example above, it seems withholding nothing works. However, looking on the W-4 form, there is no way to make the employer not withhold without claiming "exempt" which requires two, not one, conditions: no liability last year and you "expect" no liability this year. Is this another one of the IRS' catch-22 tricks? If you claim that you don't expect to have liability and then end up with some amount like $10k due but form 2210 says you owe no penalty, you still appear to get a $500 penalty. Meowist (talk) 02:12, 25 July 2008 (UTC)

Dear Meowist: I'm not following you. What $500 penalty? How are you computing it? Famspear (talk) 16:40, 25 July 2008 (UTC)

PS: If you're thinking of the $500 penalty mentioned in IRS Publication 505 (rev. Feb. 2008), page 13, you're comparing apples and oranges, in a way. Famspear (talk) 17:38, 25 July 2008 (UTC)

- Yes, I was speaking of that penalty. Yes, it is a bit of an apples and oranges comparison since it's for estimated tax and this is withholding, which is apparently for wages only. I'm wondering about this "expect" clause... I suppose you can always "expect" to make enough charitable contributions to bring your tax down within some credits.Meowist (talk) 05:11, 30 July 2008 (UTC)

I have a gripe about the statement that the FICA is essentially a forced savings plan. This isn't accurate. The money collected passes through to the general fund, and an IOU is left in it's place. Further, there is not direct connection between how much you put in and how much you get out! It is tied to the level you contribute at. So if I pay at the maximum rate for most of my adult life (the case...) then I'll certainly get the maximum benefit for whatever my retirement age - but it has no bearing on how much I actually paid in taxes through FICA. I would simply remove the "forced savings" from the description. —Preceding unsigned comment added by Ka6s (talk • contribs) 16:09, 28 July 2010 (UTC)

- Ka6s, the more you pay in to SS, the more you get out. Generally, people pay in much closer to what they get out than you would think looking at the formula used, which decreases the payout relative to what you put in after a certain point. The reason is that higher wage workers also live longer and so receive the benefit for longer. Also, what is so bad about an IOU? In this case they are more valuable than cash since they pay interest. 0 (talk) 17:19, 28 July 2010 (UTC)

- Not really. Only the top 35 (or was it 40) years of earnings are used, and the taxable earnings, rather than the actual withholding, is used to compute the payment. There is a correlation between the payments and the payout, but the actual factor used is allowable taxable earnings.—Arthur Rubin (talk) 08:30, 29 July 2010 (UTC)

Number of Taxpayers

The number of taxpayers references an article that indicates how many people were eligible to receive rebate checks. This does not seem like a valid approximation to me, as it excludes taxpayers with incomes over a certain level (how many I do not know). Better statistics are likely to be found at the IRS website: http://www.irs.gov/taxstats/indtaxstats/index.html

- I agree. I've removed those references. People who get some percentage of their payroll tax back are not paying "no taxes" -- there's some heavy spinning going on, I don't think that website is a WP:RS. -- Kendrick7 06:09, 23 October 2008 (UTC)

- I'm ok with the removal of the content as It did not contain any critical information but the information was accurate with regard to effective income taxes paid (regardless of proper withholding) and it is a reliable source per Misplaced Pages policy (regardless of their pov). Payroll taxes are discussed in the next paragraph, which includes the regressive nature and that most Americans pay more of this tax. They are discussed separately as they are different taxes and the payroll tax is technically not an income tax. Although, from the standpoint of an employee who has the FICA taxes (both Social Security and Medicare) withheld from his or her paycheck, it might be difficult to see the difference. The FICA tax is actually an "employment tax" imposed under Subtitle C of the Internal Revenue Code. By contrast, "income" taxes (individual, corporate, etc.) are imposed under Subtitle A. The estate and gift taxes are "transfer" taxes (taxes on some, but not all, transfers of ownership of property), and are imposed under Subtitle B. Morphh 13:04, 23 October 2008 (UTC)

Foreign earned income exclusion

I found the above article in the list of those to be wikified. Moreover, it reads like a how-to. I'm hoping that editors here will know if there is anything useful in it to be salvaged, and if so, if it should be brought in here. Itsmejudith (talk) 13:18, 23 March 2009 (UTC)

can the I R S DO AN AUDIT ON A CHILD

Just wondering if and why the IRS can or can't audit a child ?

Created article for tax statute -- how to add to the template?

I noticed there's this cool template with all the tax statutes in it. I just created Tax_Relief_and_Health_Care_Act_of_2006 last night and I don't know how to add it to that template, will someone please do that for me? Thanks. Agradman /contribs 20:34, 15 July 2009 (UTC)

- Added it. Morphh 23:47, 15 July 2009 (UTC)

gini as measure of progresivity

I removed the gini coefficient as a measure of progresivity graph. The reason I did this is that the payrole taxes are regressive, so I'm not really sure how they can be progressive. In addition, as I noted in my edit comment, this needs to be referenced. Morphh writes, "The image is sourced and a Gini Coefficent is a standard measure of progressivity". Please show me the non-self published ref. The current website link is a self-published source. 0 (talk) 22:45, 17 January 2010 (UTC)

- For one, the term progressivity does not mean progressive. It is used to describe both regressive and progressive taxes - it is the range of the tax incidence and is essentially short for Progressiveness/Regressiveness. Second, Payroll taxes being regressive is somewhat matter of opinion since it is payed back progressively. Aside from that, the Gini coefficient is a widely used measure of inequality that varies from 0 (perfect income equality) to 1 (perfect income inequality). So if you're expecting some negative number for regressive, you're misunderstanding the metric. The graph's purpose is to show the relative progressivity in comparison to other taxes. It shows the fact that the payroll tax is the most regressive or least progressive tax, and that the estate tax is the most progressive using a standard measure. As for the source, it's not a self-published source, it's a primary source, which is acceptable. It was written by Economist Karen Walby, Ph.D., and Economist Laurence Kotlikoff, Ph.D. If you have a better one that's fine, but it's not reason to remove it. Morphh 0:29, 18 January 2010 (UTC)

- I understand the gini coefficient and how it works, I also understand why fairtax.org would want to use it. It's properties are very favorable to them: changes near the median affect the gini coefficient more than changes at the extremes. But, it is a measure of income inequality, using it for tax inequality is novel, and since this is not a reliable source, having it on the page that way amounts to original research.

- I'd also point out that the source cited by fairtax does not in fact talk about the figure you include. The file they link to does not include any gini coefficients (they even say to look at table 5 which only has federal income tax rates, no gini coefficients). This is something that fairtax.org added and do not explain their methods for. In addition, the file that they link to is itself self-published. They claim it is revision to an NBER working paper, but the working paper that NBER publishes does not even share a title with the linked file. In any case, the version published by NBER is the one that should be considered to be non-self-published. 0 (talk) 00:51, 18 January 2010 (UTC)

- I think you may misunderstand the difference between a self-published source and a primary source. I also think you're misunderstanding a WP:RS as there is no basis to call it unreliable for an opinion on U.S. taxes (they're one of the larger tax reform groups) - certainly they have a pov and if we have other sources that balance it out, great. But they're not unreliable and it's not self-published (at least how Misplaced Pages describes self-published) - if we took that broad definition, then most primary sites would be self-published. It is not our purpose to verify their work. They published the information, and we can source them as a primary source for that data. Morphh 1:05, 18 January 2010 (UTC)

- Note, I started a discussion of this source at

- I've started a new discussion regarding your general argument that advocacy groups can't be used as sources, that such sources are self-publishing, and that sources require academic review. None of which is based on policy. If consensus agrees and policy reflects this, than I concede the issue. Further discussion was required, a single their opinion saying the same thing without basis in policy does not override the general consensus and policy requirements. Oddly I don't even care that much for the image... it's an issue of misunderstanding or clarifying policy - I object to the reasoning. Morphh 16:51, 19 January 2010 (UTC)

- You beat me to it.. I was actually undoing my edit as a sign of good faith until further discussion, but your majority of one is lacking in policy discussion.. and now your pissing me off edit warring over it. That image has been in there for quite a while... giving it consensus through use. Policy has been there for a while, which you seem to ignore. Again, I don't care if the image is there or not, but you've irritated me enough over it that I now want to make sure you don't take this absurd logic anywhere else. Morphh 17:05, 19 January 2010 (UTC)

Expand Tax Topic

This broad topic deserves some interesting subtopics like 1) the 47% tax bracket (i.e. the 47% of Americans who pay no income taxes and how they do it) and the other brackets. 2) the tax freedom day this year figured to be April 9 where one's taxes for the year are considered paid by the work done to that point (about 1/3 of your work year pays your taxes) 3) the origin of the 1040 IRS form which suspiciously looks like half the 2080 work hours in a year which may indicate intent to conscript half of every citizen's labor to government service. 4) the actual slavery implications of economic slavery created by taxes.75.139.214.136 (talk) 22:07, 16 April 2010 (UTC)

Highest marginal tax rates, US federal income tax on individuals

I pretty much re-wrote the section on the highest marginal tax rates for individuals for the federal income tax, by going back to the actual Instructions for Form 1040 as published by the Internal Revenue Service/Bureau of Internal Revenue of the U.S. Department of the Treasury. I have all the Form 1040 forms and related instructions published by the Treasury, going back to the tax year 1913 (which was actually only for the period March 1 - Dec. 31, 1913), but for this Misplaced Pages article I included only those since the early 1940s (at least for now). There were a few errors in the material prior to this edit. Famspear (talk) 03:12, 29 September 2010 (UTC)

I would like to point out that the conclusions to be drawn from this review of the highest marginal income tax rates for individuals are somewhat limited. Famspear (talk) 03:20, 29 September 2010 (UTC)

All this editing apparently has put a big white space in the middle of the article, but after all these years I still don't know how to fix it. Hellllppp! Famspear (talk) 03:25, 29 September 2010 (UTC)

One thing we may want to add to the article later is that the highest marginal tax rate on individuals can be misleading. For example, the highest marginal tax rate for 1980 was 70% for individuals -- but that rate applied only to CERTAIN kinds of income. Interest and dividend income could be taxed as high as 70% above a certain income level, but "earned" income (in the sense of compensation for service, such as salary or wage) was taxed at no higher than a 50% rate for that same year. Most average folks presumably derive the bulk of their income, at least in their working years, as compensation for personal services (as an employee for example), and not from dividends or interest income, etc. Too busy to deal with that right now, though. Famspear (talk) 04:50, 29 September 2010 (UTC)

- With all the phase-outs, the highest marginal tax rate may not correspond to the highest income, or may not be the nominally highest marginal tax rate. For example, if someone in the 35% tax bracket still has itemized deductions, the actual marginal tax rate may be 35.7%, due to the itemized deduction phase-out. If the taxpayer also has medical deductions, it could be 35*1.095 = 38.325% . It's possible that someone in the EIC phaseout area might actually have a higher marginal tax rate than someone in the 35% tax bracket.—Arthur Rubin (talk) 08:11, 29 September 2010 (UTC)

- Hello, Arthur!

- Also, the terminology can get confusing. I would tend to want to refer to the highest marginal tax rate as stated in the law itself for a given year as the "nominally" highest marginal rate for that year, while referring to an "actual" highest marginal tax rate (due to the effects of deduction phase-outs, etc., as described by Arthur) as being the "effective highest marginal tax rate." But of course, that could be confusing as well, since we use a similar term -- the term "effective rate" -- to refer to something else. At least right now, the article uses the term "highest marginal rate" to refer to what I like to call the nominal rate -- the rate stated in the statute and in the actual tax form instructions. Incidentally, I'm using the terms as I think lawyers and accountants would tend to use them. Arthur Rubin is definitely our mathematics expert here.

- Another phenomenon that affects the marginal tax rate (as explained by Arthur above) would be the phase out of the exclusion for social security benefits received. Too complicated for me to explain this early in the morning, though.... Famspear (talk) 11:56, 29 September 2010 (UTC)

I can't agree strongly enough with anyone looking to prevent the abuse of marginal tax rates in articles like this. This is a sensitive political area in America today. Let's remember that the AMT was created to stop millionaires from paying nothing at all, and this was in an era of historically high marginal rates! Deductions, credits, etc have always made it difficult to determine true effective taxation from mere marginal rates. Any presentation of marginal rates should come with a presentation of effective rates as well as explanation for the difference. MrJD March 20, 2011

Removed Misleading Graphs

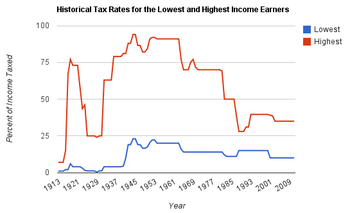

I have removed the two graphs at right from the article.

Both are misleading.

The first details marginal tax rates, but does not identify its content as marginal tax rates. It needs to be edited for clarity, as it covers an area of particular controversy in America today. It displays marginal tax rates, which due to credits, deductions, "payroll" taxes, etc, are an extremely poor representation of what is actually paid. The change in the impact of deductions relative to marginal rates over time overwhelms the numbers presented.

At the very least, amend the title of the graph to specifically indicate MARGINAL TAX RATES. Better still, incorporate a reflection of post-deduction reality. A graph that I've seen in a few places that does this is the third graph visible at the following link, citing CBO collection data: http://economix.blogs.nytimes.com/2009/04/08/how-much-americans-actually-pay-in-taxes/

The second graph uses a distorted Y-axis to create an impression of both disparity and volatility where considerably less exists, presumably with the goal of advancing a political agenda. MrJD March 20, 2011 —Preceding undated comment added 22:44, 20 March 2011 (UTC).

Article needs massive work

This article is lopsided in topics, inaccurate in numerous places, replete with POV, and very poorly cited. It needs a massive overhaul, or simply replacement with redirects to other articles better covering the same topics. Oldtaxguy (talk) 04:23, 8 November 2010 (UTC)

Proposed organization of article

I believe the entire article should be an overview rather than detailed coverage on each topic. We should refer to a main article on nearly every section or subsection. Here's a proposed outline:

- Intro

- Levels and types of taxation

- Income tax

- Basic concepts

- Worldwide taxable income

- Graduated tax rates

- Federal rates overview: no tables

- State rates overview: no tables

- Income (including reference to tax exempt)

- Deductions and exemptions

- Credits

- Withholding of taxes

- Individuals and entities

- State variations

- Nonresidents

- Alternative tax bases (AMT, states)

- Book/tax differences for businesses

- Reporting under self assessment system

- Basic concepts

- Payroll taxes

- Social Security and Medicare

- State taxes on employers

- Reporting and payment

- Sales and excise taxes

- State and local sales taxes

- Contrast to VAT

- Federal excise taxes

- Property tax

- Levels at which tax imposed

- Types of property taxed

- Assessment and collection

- Customs duties

- Variable duty rates

- Impact of treaties

- Estate and gift taxes

- Imposed on deceased or donor

- Taxable amount

- Effects on income tax

- Worldwide estate for residents

- License and user fees

- Tax administrations

- Federal IRS and Customs are different

- State administrations

- Local administrations

- Judicial appeal

- Legal basis

- Constitutions (Federal and state)

- Federal law

- State laws

- Local laws

- History overview: no historical rate tables

- Early taxes: pre-Civil War

- Tariffs and excise taxes

- Pre-1913 income tax

- Federal income tax

- State tax after 1913

- Social Security and payroll taxes

- Measures to combat avoidance

- AMT

- State alternative taxes

- International provisions

- Early taxes: pre-Civil War

This article gets about 2k hits per day, so it needs to be taken seriously. The time budget to get this to true C class is likely to exceed 50 man hours. Getting to B class should be our goal for the short term (by say March 1), but that's likely a very stretch goal. Comments here, suggestions & volunteers very needed. Oldtaxguy (talk) 00:07, 23 November 2010 (UTC) Updated with proposed outline Oldtaxguy (talk) 19:14, 6 December 2010 (UTC)

- That method of organization looks just right to me... Sugar-Baby-Love (talk) 19:29, 6 December 2010 (UTC)

- Looks like a good outline and idea. 0 (talk) 20:52, 6 December 2010 (UTC)

- Most impressive </vader> Really drives home the scope of the article. Ravensfire (talk) 21:32, 6 December 2010 (UTC)

- I think all this is great, but only focuses on federal taxation. State taxation is significant and is largely undocumented within this article. For instance, in California there are an expected $120 billion in taxes for 2010-2011. In California this is largely split into: (California Enacted Budget 2010-2011, Summary Charts)

- Personal Income Tax: $48 billion

- Sales Tax: $31 billion

- Corporation Taxes: $11 billion

- Highway Users Taxes: $5.5 billion

- Motor Vehicle Fees: $6.8 billion

- Insurance Taxes: $2.2 billion

- Estate Taxes: $0.7 billion

- That's about $2531 per person in state taxes for Californians, compared to about $4820 per person in federal taxes for every American. That significant. And there are other states, with significant differences in setup. I am unsure how these should be incorporated into this article ATM. Int21h (talk) 06:21, 3 January 2011 (UTC)

- I did some work on this in early December (see User:Ravensfire/Taxation in the United States for me early work) and did some off-line stuff over the holiday. You can see how some sections fairly easily mapped over. I started to get into trouble with the breakdown into Federal, State, and local levels. The purpose of those taxes changes at the different levels which is something I think is important to work into the article. I also think there is too much emphasis on the income tax for this article (example - AMT is important, but really not for this article beyond a single line mention at most). I haven't forgotten about this! BTW - if anyone else would like to work in my little sandbox, please feel free. I put the sections as sub-articles as a personal preference - would obviously need to put them in the main article at some point. Ravensfire (talk) 15:59, 3 January 2011 (UTC)

- The proposed outline is organized by TYPE of tax, not JURISDICTION. If we organize by jurisdiction, there will be a lot of repitition in many areas. Note that property taxes have no Federal counterpart, but income tax definitions for most states follow Federal. In the sales and excise area, many of the principles but few of the details are the same among jurisdictions. Gasoline taxes are identical except as to rates; but Federal motor vehicle fees apply only to commercial vehicles. I strongly favor organization by type of tax.

- As some examples of same vs. different: in the income tax area: California, New York, Illinois all either refer to Federal rules or incorporate them with very few differences (mostly related to things inherent in the state vs. Federal, like tax exempt interest); NJ has no itemized deductions, but follows most of Federal definition of AGI. Estate and gift taxes at the state level are almost all imposed based on Federal taxable estate or gifts. Oldtaxguy (talk) 03:29, 4 January 2011 (UTC)

- This article needs to discuss both, although I am not opposed to being organized by type. There are many tax topics that will be intricately linked with a particular jurisdictional level, like customs and estate taxes. These different taxes must be referenced to make the article complete, and mixing them all up together may be confusing. The state estate taxes, for example, are based on a system of state (usually county) assessors. I am not aware of the federal government doing so independently, and probably base their assessments on such values. My fear is that with this type setup, either it will be mainly federal, or with 50 state systems all mixed in it will be difficult to understand or find the material that someone is looking for that is a state issue. We can't just ignore certain state issue or hide them because they don't fit nicely into the current scheme. Int21h (talk) 21:22, 6 January 2011 (UTC)

- I agree that state and local issues MUST be covered in depth. This is one area in which the U.S. differs highly from most other countries: our system is a federal system, with independent taxation by states and municipalities. In some areas, the states rely on Federal rules, so those rules must be explained before the state rules can make sense; examples: income tax, estate tax. In other areas, there is a complete disconnect between Federal and states; example: sales and excise tax. In yet other areas, there is no Federal counterpart; example: property tax. Finally, states are prohibited from imposing customs duties. Thus, the broad spectrum of U.S. tax must cover all of these areas. Obviously, the topic is so broad that coverage cannot be deep in ANY one area. Thus, I believe each piece of the article must be the 20,000 foot summary, with all details left to "main" articles.

- On a separate note, I believe your information on estate tax is incorrect, and confused with property tax. Most states impose estate tax on the gross estate, as defined in the IRC and reported on IRS Form 706, sometimes with adjustments and different deductions. Many states "piggy back" the state estate tax calculation as equal to the Federal credit for state estate tax, pro rated among states. There is no involvement of counties or assessors with the estate tax, as far as I'm aware. Also, few states do any independent examinations of estate tax returns, relying on the IRS to contest values. These observations apply to NJ and NY, whose estate tax returns start with Federal gross estate. California "piggy backs" and has a one page estate tax return (with some optional schedules), carrying numbers from the Federal return. Oldtaxguy (talk) 23:41, 6 January 2011 (UTC)

- This article needs to discuss both, although I am not opposed to being organized by type. There are many tax topics that will be intricately linked with a particular jurisdictional level, like customs and estate taxes. These different taxes must be referenced to make the article complete, and mixing them all up together may be confusing. The state estate taxes, for example, are based on a system of state (usually county) assessors. I am not aware of the federal government doing so independently, and probably base their assessments on such values. My fear is that with this type setup, either it will be mainly federal, or with 50 state systems all mixed in it will be difficult to understand or find the material that someone is looking for that is a state issue. We can't just ignore certain state issue or hide them because they don't fit nicely into the current scheme. Int21h (talk) 21:22, 6 January 2011 (UTC)

- Well, OK, I may have confused the estate and property taxes. The California 2011 budget did not seem to differentiate between the two... And yes, I agree with the "20,000 foot summary", which is what I was going for with the federal taxation article. It would seem the current outline looks good. Int21h (talk) 23:54, 6 January 2011 (UTC)

Article redundancy

It looks like there was an inavertent content fork in Feburary 2010, where the large "Federal taxation" section of this article was copied to a new Federal taxation in the United States article, but the copy of the text here was not removed. I suggest that the copy of the text here should be moved to replace the text in the other article (since it looks like this version has been worked on more), and in this article the text should be replaced with a summary. Antony–22 (⁄contribs) 02:22, 26 February 2011 (UTC)

- Thanks. I have proposed, and at least two others agreed, that the Federal taxation in the United States is redundant and should be changed back to what it originally was: a redirect to Taxation in the United States. That would avoid needing to maintain two articles that are inherently redundant. See discussion above and at the Federal article.

- Willing to help with this article? See User:Ravensfire/Taxation in the United States to help. Uncle Jim needs you! Oldtaxguy (talk) 15:42, 26 February 2011 (UTC)

- I agree that the text currently in the "Federal taxation" article should be gotten rid of. The question is whether the corresponding text in this article should stay here, or whether it should be split off into a new "Federal taxation" article, being replaced by a summary in this article. Antony–22 (⁄contribs) 19:49, 26 February 2011 (UTC)

Next steps on article overhaul

I propose the following next steps, to be done over the next two weeks:

- Copyedit article segment drafts at User:Ravensfire/Taxation in the United States

- Content fork 4 segments to new articles, leaving only small references:

- tax rate history to History of Federal income tax rates in the United States

- tax as a tool of social policy implementation to United States tax law and social policy

- AMT discussion of silicon valley ISOs to Alternative Minimum Tax and stock options

- entire progressivity discussion to Progressivity in United States income tax

- Combine segment drafts into single article under lead workspace

- Review combined article after forks to determine if complete replacement will lose any desired material

- Seriously enhance reading and see also lists

- Complete replacement approximately April 3

I've hit my personal budget limit, but want the project to continue. Get friends to help! Absent that, I plan to stick to the above. Help from interested parties in any way is appreciated. Oldtaxguy (talk) 05:10, 13 March 2011 (UTC) Rev. titles Oldtaxguy (talk) 21:02, 13 March 2011 (UTC)

- I agree with splitting out much of the text of this article, but some of these new articles are redundant with existing articles. History of Federal income tax rates in the United States should be merged into the pre-existing Taxation history of the United States, and Alternative Minimum Tax and stock options should be a section of Alternative Minimum Tax. In addition, United States tax law and social policy looks too short to be a standalone article unless it is about to be expanded a lot.

- Also, don't forget to remove/reduce the text in this article that you are moving or merging to other articles, otherwise it creates a content fork which is hard to sort out later (which is what had happened with Federal taxation in the United States). Antony–22 (⁄contribs) 05:08, 14 March 2011 (UTC)

- One more thing. I don't think WP:UNDUE is actually the relevant policy here, since that is specifically talking about fringe opinions for which there are no reliable sources. I think the relevant policy is WP:SPINOFF. Antony–22 (⁄contribs) 05:21, 14 March 2011 (UTC)

- I have gone ahead and made the changes I suggested above. Of course, feel free to revise my revisions. :-) Antony–22 (⁄contribs) 19:54, 14 March 2011 (UTC)

- I disagree with merging the content of those articles that I forked with other articles. Each of the forks contains a lot of essentially trivia. As I understand WP policy, where material is extensive on minor points (as is the case in each of the four forks), it should be split into other articles to prevent overburdening the main article. The social policy article is largely POV to begin with. I regret I don't have time over the near future to spend revising articles that are of little general interest and deal with minor points. I don't think any of the content in the four forks belongs in other articles. Oldtaxguy (talk) 02:09, 15 March 2011 (UTC)

- I apologize if I've interfered with your efforts to improve these articles. I agree that there needs to be a balance between concept and detail for a topic with such an extensive amount of material. However, I believe that the community norms are to improve problematic text rather than fork it out. If a certain passage is truly trivial, or has POV issues, then it doesn't belong in a new article any more than it belongs in the old one, especially if the new article has such a narrow scope that it doesn't have much potential to be expanded. I felt that this was the case for Alternative Minimum Tax and stock options and United States tax law and social policy; in the latter case, I agree that there are POV issues but since the entire passage is unreferenced, the offending portions of it can simply be removed. (If you are concerned about removing text, you can always copy it to the talk page with a note that it was deleted for other editors to review.) For History of Federal income tax rates in the United States, I thought it overlapped too much with Taxation history of the United States, although I suppose that we could have separate articles on tax rates versus other aspects of tax history. On the other hand, Progressivity in United States income tax is long enough and a broad enough topic that it does work as a separate article in my opinion. I hope this makes my resoning clear. In the future I will wait for further discussion before making these kinds of changes. Antony–22 (⁄contribs) 00:26, 16 March 2011 (UTC)

- I anticipate the article from which the material was forked will be completely replaced in about 2 weeks. Without undoing the move of material back to Taxation in the US, the material will be lost. Oldtaxguy (talk) 01:32, 16 March 2011 (UTC)

- Okay, with the exception of the social policy article, I had merged the text into other articles rather than this one, so they will not be lost in any case. Antony–22 (⁄contribs) 01:54, 16 March 2011 (UTC)

- I anticipate the article from which the material was forked will be completely replaced in about 2 weeks. Without undoing the move of material back to Taxation in the US, the material will be lost. Oldtaxguy (talk) 01:32, 16 March 2011 (UTC)

- I apologize if I've interfered with your efforts to improve these articles. I agree that there needs to be a balance between concept and detail for a topic with such an extensive amount of material. However, I believe that the community norms are to improve problematic text rather than fork it out. If a certain passage is truly trivial, or has POV issues, then it doesn't belong in a new article any more than it belongs in the old one, especially if the new article has such a narrow scope that it doesn't have much potential to be expanded. I felt that this was the case for Alternative Minimum Tax and stock options and United States tax law and social policy; in the latter case, I agree that there are POV issues but since the entire passage is unreferenced, the offending portions of it can simply be removed. (If you are concerned about removing text, you can always copy it to the talk page with a note that it was deleted for other editors to review.) For History of Federal income tax rates in the United States, I thought it overlapped too much with Taxation history of the United States, although I suppose that we could have separate articles on tax rates versus other aspects of tax history. On the other hand, Progressivity in United States income tax is long enough and a broad enough topic that it does work as a separate article in my opinion. I hope this makes my resoning clear. In the future I will wait for further discussion before making these kinds of changes. Antony–22 (⁄contribs) 00:26, 16 March 2011 (UTC)

Major revision

Per discussion above, I have collected and posted the sub-articles that have been available for comment at User:Ravensfire/Taxation in the United States. Additional references may be useful. Oldtaxguy (talk) 01:53, 3 April 2011 (UTC)

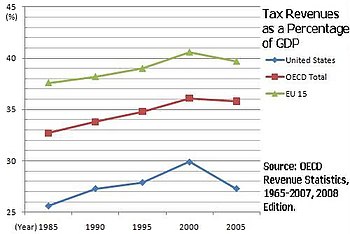

Misleading Graphic

In Section 2 Income Tax the graph on the right shows US Tax Revenues from 1980 to 2009. This data, while accurate - appears to support the rhetorical point that taxes have never been higher. The data range does not accurately represent the historical trends of tax receipts which is no doubt its intended purpose. The highest marginal tax rate had been at 91% for fifty years prior to 1980 when it was reduced substantially.

Suggest graph be expanded to show 50 years rather than 29. This will give a more accurate picture of recent history. —Preceding unsigned comment added by 147.9.237.126 (talk) 18:50, 14 April 2011 (UTC)

Segments of the tax base who pay little or no taxes

I've reverted this section (again), and I want to specify my reasoning:

- It should not be under "Types of taxpayers". It might be appropriate somewhere in the "tax rates" section, if it could be sourced.

- Reference (1) (IRS statistical report for 2009) is not specifically pointed to a page, and is an interpretation of what is in the document. Even if the specific datum from the document could be identified, the IRS goes out of their way to note that what they call "income" is not what anyone else (including tax computations) calls "income", but a statistic which can be evaluated more-or-less uniformly over 1981-2009.

- Reference (2) is not a reliable source, as they go out of their way to note that they are not reporting what is actually on the tax returns, but their interpretations of the companies' annual reports. Furthermore, the report shows a clear bias, and we're reporting their interpretation. In particular, "paying no taxes" may refer to have their tax liability wiped out by a past or future NOL (Net Operating Loss), requiring a negative profit in that year.

— Arthur Rubin (talk) 13:15, 6 August 2011 (UTC)

Segments of the tax base who pay little or no taxes

- Why should it not be under "types of taxpayers" ? Are "segments of the tax base who pay little or no taxes" not a "type" of taxpayer?

- I'll do my best to find the specific page. Data, however, are not interpretive to the extent that they are evidence. How the IRS defines "income" is irrelevant to these discussions as the source material is merely a data point indicating that in 2009, 1,470 individuals earning over $1,000,000 paid no income tax. If anything, getting into a discussion about the definition of income is far more interpretive than merely indicating the number of individuals who paid no taxes.

- In what area of the report do the authors "go out of their way" to say that they are not reporting what is actually on the tax returns? Did you read the report? To quote the first line of the report, "This study examines the federal income taxes paid or not paid by 250 of America's largest corporations in 1996, 1997, and 1998." Additionally, they indicate very clearly in their methodology section how they computed the net effective tax rates for the companies. To quote their methodology section "Conceptually, our method for computing effective corpo- rate tax rates was very straightforward. First, a company’s domestic profit was determined and then current state and local taxes were subtracted to give us net domestic pretax profits before federal income taxes. (We excluded foreign profits since U.S. income taxes rarely apply to them after credits for taxes paid to foreign governments.) We then determined a company’s federal income taxes currently payable. (Current taxes are those that a com- pany is obligated to pay during the year; they do not in- clude taxes “deferred” due to various federal “tax incen- tives” such as accelerated depreciation.) Finally, we divided taxes currently payable by pretax profits to determine effective tax rates." These are not interpretive or exotic mathematical contortions that render the source unreliable. From the sound of your argument, all that needs to be changed is the wording of the article to include "net tax liability" in describing the tax calculation cited.

Finally, the report does not show a clear bias; they are merely reporting tax data...as am I. In what way is this biased? — Preceding unsigned comment added by 99.16.91.116 (talk) 17:32, 6 August 2011 (UTC)

- I am reverting the entire edits for the following reasons:

- This article is about ALL taxes in the USA, not just income taxes. The entire discussion is about just income taxes. Anyone who buys a pack of cigarettes, earns any wages, pays any wages, owns any realty (house, factory, etc), buys any of a wide variety of imported goods must pay tax. This applies to individuals, corporations, etc. The statements as made are demonstrably false, and not supported by the citations.

- The citations are, for the most part, by lobbying organizations advocating elimination of income taxes, and thus not RS for income taxes.

- Under this editor's arguments, there would be thousands if not millions of "types" of taxpayers. Such a non-definition is meaningless. Oldtaxguy (talk) 20:05, 6 August 2011 (UTC)

response from 99.16.91.116

- To your first point, you are simply incorrect. By that logic we should remove the section in the article entitled "income taxes" because, within that section, taxes other than income taxes aren't discussed. Creating a subsection is simply a method of organization that allows one to discuss the subject within that subsection. I would happily include information regarding taxation other than income tax that individuals or corporations do not pay by offsetting their liability under the section entitled "Segments of the tax base who pay little or no taxes". The statements, as made, are not demonstrably false. If you had actually read the source material, you would understand that. Additionally, the points made are substantially supported by the source material. Your claims are simply false. Nevertheless, I invite you to actually demonstrate how my edits are not supported by the source material instead of merely claiming demonstrability.

- To the second point, the sources are not lobbying organizations. One source is the IRS itself. So, your statement is patently false. Lobbying organizations are interested specifically in advocacy whereas policy institutions conduct research. The sources I've cited are, very simply, research. And, if you spend enough time wading though the mountains of research on the websites of the policy institutions cited, you would find that, in the rare instances in which policy recommendations are made, they are made with precisely the opposite recommendation: not to eliminate taxes but to prevent individuals and corporations from being able to eliminate their tax liability or, worse, to attain a net negative tax liability. Thus, your second point is, obviously, not based in reality or, at the very least, not based on understanding or even having read the sourced material.

- To the third point, there are millions of "types" of taxpayers. If you think the word "type" denotes a non-definition, perhaps the discussion should move to what language should head the section titled "types of taxpayers" as opposed to attacking an editor for adding reliably sourced material that you don't even have the fastidiousness to read, much less consider, before removing it unwarranted. — Preceding unsigned comment added by 99.16.91.116 (talk) 22:59, 6 August 2011 (UTC)

- Still wrong.

- People and/or corporation who pay no income tax are not a type of taxpayer. Types of taxpayers include individuals (and possibly married couples), corporations, partnerships, homeowner associations, and non-profits. (In fact, the entire "types of taxpayer" section probably should be under "income tax", as for example, fuel taxes and sales taxes are paid regardless of the type of entity.)

- The IRS report mentions people with 2009 1982-modified AGI over $1,000,000 who paid no taxes. The reason they paid no taxes might be because of NOL carryback, people who lost over $1,000,000 to Madoff, or for various reasons which no one in their right mind would consider "loopholes". Your other sources (the Tax Foundation, and ITEP) are absurdly biased, to the point where they could not even be used for apparently factual statements, without crosschecking. What you're quoting is clear opinion for the second, and WP:UNDUE weight for the first. The 43.4 million who pay no taxes may very well have no income.

- —Arthur Rubin (talk) 03:49, 7 August 2011 (UTC)

- Arthur & Oldtaxguy, I think you're stepping over the line to suggest the supposed bias of well known organizations and use it as a method of exclusion. All sources have bias, even the IRS and secondary accounts in mainstream media. NPOV does not mean using non-bias sources (impossible task); It means providing proper weight, balance, and attribution to the opinions express in bias sources. The opinions regarding the number of taxpayers that allegedly pay no income taxes is not a tiny minority view, nor is it a new opinion. The notion that because an organization advocates against income taxes or changes in tax policy thus makes it an unreliable source for an income tax article is absurd. You can't exclude critical opinion by stating the sources of that opinion are bias against the article topic - that's the point. I'm not suggesting this information belongs, where it belongs, or doesn't belong based on other merits - the other positions are still valid. I just object to this specific argument regarding bias sources as it's a misapplication of policy. Morphh 17:38, 7 August 2011 (UTC)

- The problem with the non-IRS sources provided is that it is WP:POV to imply there is something wrong with a taxpayer with a large amount of income, but also a large amount of losses, not paying tax. Even if the sources were reliable, it would be questionable to imply that any of the definitions of "income" are related to a normal definition. The IRS specifically notes the definition was adjusted to make it possible to compare incomes from different years, without regard for it being related to the accounting definition of income.

- As for bias, I'm seeing distortions (not just interpretations which I find questionable) in some of the statements made in ITEP's editorial voice. This makes me wonder whether a similar problem relates to other statements treated as "fact". However, if the statements were noted as opinions and attributed, I wouldn't have as much of an objection.—Arthur Rubin (talk) 20:10, 7 August 2011 (UTC)

- I agree that if these statements are presented as fact, that's a different situation. Opinions need to be attributed to those holding that point of view. Morphh 21:02, 7 August 2011 (UTC)

- Arthur & Oldtaxguy, I think you're stepping over the line to suggest the supposed bias of well known organizations and use it as a method of exclusion. All sources have bias, even the IRS and secondary accounts in mainstream media. NPOV does not mean using non-bias sources (impossible task); It means providing proper weight, balance, and attribution to the opinions express in bias sources. The opinions regarding the number of taxpayers that allegedly pay no income taxes is not a tiny minority view, nor is it a new opinion. The notion that because an organization advocates against income taxes or changes in tax policy thus makes it an unreliable source for an income tax article is absurd. You can't exclude critical opinion by stating the sources of that opinion are bias against the article topic - that's the point. I'm not suggesting this information belongs, where it belongs, or doesn't belong based on other merits - the other positions are still valid. I just object to this specific argument regarding bias sources as it's a misapplication of policy. Morphh 17:38, 7 August 2011 (UTC)

A very short essay

It seems that in matters concerning death or taxes, opinions count more than facts to many people. Misplaced Pages strives to be scholarly and based on reliable sources. Opinions may be quoted, if attributed and if it is stated that they are opinions, subject to WP:UNDUE. But many opinions about death and taxes are clothed as "fact" by the authors. Morpph's deleted commentary was particularly insightful in this regard.

WP requires that a source be reliable, and preferable a secondary source. Published scholarly research is given high priority in the reliability pecking order. Newspapers are given high priority when reporting events, and no priority when expressing an editorial comment. We as editors are to decide what is WP:RS and what is not. How do we tell the difference?

Scholarship traditionally requires that research details must be documented, available, verifiable, and replicable. Failure of any of these generally results in the research being considered unreliable, no matter how sound it may seem. For example, Jean-Baptiste_Lamarck proposed, researched, published, and made available extensive research on genetics. Others verified his data. Much of his work is the foundation of modern genetics. However, no one was ever able to replicate his work on one theory, because they could not get the type of lizard he used to breed. His Inheritance of acquired characteristics theory was discarded in favor of another theory. Neither has been proven, but the other theory met the four standards. Lamarck now warrants only 2 sentences in Genetics.

What, then, should we make of work by Urban Institute, Tax Foundation, and others who openly espouse particular views on tax? They publish extensive papers purporting to be research. They often do not make any details of their research available to anyone; they state openly that they have modified key measures of key items; we are asked to just trust them. Is their work scholarly? Who knows. Are details available, verifiable or replicable? Clearly not. I therefore posit that they should not be considered reliable sources. They are just opinions.

I have opinions, too. After 35+ years advising clients on detailed tax matters, I think mine are pretty good. However, I refrain from expressing them. They are, after all, just opinions.

As a final note, we should be discussing what is, not what could, might, or should be or have been. Respectfully, Oldtaxguy (talk) 03:03, 8 August 2011 (UTC)

- I think you may be crossing the line between what is a low quality source vs an unreliable source, but that depends on what the material is trying to reference. It may be a great source to reference a critical opinion, but a poor source to reference a fact regarding revenue collections. I agree that we assign priority and use the most reliable and scholarly sources to reference content, though that's not to say they're without bias - scholarly research is also often commissioned by special interests. We use weight in determining what should or should not be included. We also give a higher priority to secondary sources. So if the WSJ reported the Urban Institute's opinion, that would be a reliable source for presenting both weight and opinion. If an opinion regarding tax policy is due weight, then it is perfectly acceptable, though not preferred, to use such an organization to substantiate that opinion. They're not a blog site or something that just popped up. Whether I agree with them or not, they are respected organizations and their opinion is part of the country's discourse. We should not use them as a primary source for an opinion if it has no prominence in other reliable sources though.

- We don't exclude the opinion because we disagree with the methods used in presenting the argument. Critics always modify the proposals, rules, argument to fit their agenda. I include government research all the time that provides no methodology for their findings vs such organizations that do - reverse problem. It is our job to make sure the reader understands the differences in points of view and the proper comparison, not exclude them based on our own bias. If the opinion is of sufficient weight to include, we can use such sources to reference that opinion. This is common Misplaced Pages practice and policy. As far as what we should be discussing, is not the could, might, and should be a critique of what is? We're required to include such critique based on prominence. You're statement of "Newspapers are given high priority when reporting events, and no priority when expressing an editorial comment." is questionable (see WP:RS) - it's fine for opinion.

- Tax policy is not science but, to address your lizard example, that would likely be an issue of weight (not RS), giving it two sentences due to the prominence and coverage in the overall topic. It's not because the published research was an unreliable source, it's because it was not due weight because of the other competing theories and overall topic coverage within Genetics. Similarly, our topic might also only be worthy of a sentence or two. I didn't comment on weight or the content itself. I objected to one of the reasons given for exclusion, which is based on a misuse/misunderstanding of policy regarding sources. Again, I'm not sure how productive this is since I don't dispute the content arguments, which is why I deleted my prior post. We're going to spend more energy debating policy points then actually addressing the content. Morphh 11:43, 8 August 2011 (UTC)

resource

More Firms Enjoy Tax-Free Status by John D. McKinnon 10.January.2012 Wall Street Journal; excerpt ...

StoneMor Partners LP, the publicly traded firm that specializes in running cemeteries, expects to see handsome profits in coming years as baby boomers age and die. But unlike its largest rivals, its corporate tax bill from the federal government will be zero. StoneMor is among the many businesses organized so they don't pay a penny in federal corporate income tax. And yet such firms don't employ an army of accountants to shield profits in complex tax shelters. Their enviable tax position is perfectly legal and has been encouraged by Congress and state governments. Known as pass-throughs, these firms pass along ...

97.87.29.188 (talk) 00:10, 11 January 2012 (UTC)

- As often is the case with the press, the story tries to sensationalize the ordinary. From the article, it appears that the corporation in question is an S Corporation. As such, the shareholders are taxed on corporate profits, just like partners in a partnership. Such treatment is limited to corporations with only 100 shareholders, all of whom must be U.S. resident individuals or citizens. No special treatment here, just the ability of a closely held corporation to be treated the same as a partnership. The article's tone and misleading nature indicate that the article is not a reliable source. Oldtaxguy (talk) 04:37, 11 January 2012 (UTC)

Employment growth by top tax rate image

I've started a centralised discussion here regarding File:Employment growth by top tax rate.jpg, which is used in this article. Gabbe (talk) 09:59, 6 November 2012 (UTC)

CRS report on taxation of business types

The recent report "A Brief Overview of Business Types and Their Tax Treatment" looks like a promising source for the article. II | (t - c) 00:17, 17 June 2013 (UTC)

Chart that needs to be removed

If you look at the creation history of this chart (by clicking on it) you can see that it was created by VictorD7 and is sourced to an unreliable right-wing organization known as the Peter G. Peterson Foundation. If the material is reliable and worth mentioning, it needs to be directly sourced to a weighted organization, which includes scholarship coming out of academia. VictorD7 has been insistent on pushing his right-wing agenda, which is harmful to creating a neutral presentation of data.

The reason for not being able to find a reliable source presenting this chart is because there isn't one that exists. The Tax Policy Center created no chart; the Peter G. Peterson Foundation did. By leaving out the dollar figures from Footnote #1 there is no context in relation to the tax rates, which creates a highly biased presentation. -- Somedifferentstuff (talk) 11:08, 5 November 2013 (UTC)

- The PGPF is a perfectly fine source (they just drew the chart anyway) and the chart's numbers come from the Tax Policy Center (feel free to compare the figures), a perfectly fine liberal source widely cited by media and scholars. I'm not sure why me being the one who gained permission for the chart's use is relevant. The CTJ/ITEP chart it replaced was drawn by a Misplaced Pages user (reliable source?), and its data was produced by a leftist think tank with a liberal lobbying arm. Even if one accepted your off the mark premises, the more appropriate, up to date chart should be the least of your concerns. Also, why does it need dollar figures? How is it "biased" for an effective rate chart to not have dollar figures? That would be extra information, and they change significantly over time anyway. Your comment is irrational. It's more important that it contains informative component breakdowns, which the previous (disputed, truly biased) chart didn't. Finally, your hypocritical, off the mark personal attack against me isn't conducive to a productive discussion. VictorD7 (talk) 11:24, 5 November 2013 (UTC)

- I'm not sure it makes sense to discuss this in both places... so I'm just going to point to the other discussion thread as most of the points are the same. Talk:Progressivity_in_United_States_income_tax#Chart_that_needs_to_be_removed Morphh 14:07, 5 November 2013 (UTC)

- I moved the graph that EllenCT added to the section "Levels and types of taxation" and restored the federal graph. They show different things. As for corporate tax incidence, that can be measured (modeled) in many ways (some split the burden with shareholders and some pass it all to the consumer) - there is no defined "correct" way to measure that, just better models that reflect reality. The TPC is a more neutral source than the CTJ/ITEP. Since the TPC graph breaks down the components and covers federal taxes, it should be included. I'm not sure how useful the CTJ graph is with bundling all the burdens of the 50 states, which have a wide range of tax rates and progressivity, into a single graph. So I question its inclusion but in any case, it's not a replacement for the other graph. Morphh 14:49, 18 December 2013 (UTC)

- I would agree that the chart does a decent job of taking complex and boring tax data and showing it graphically. The Tax Policy Center as a source is certainly a standard verifiable source for the data itself. The chart should stay in the article. N2e (talk) 00:31, 21 December 2013 (UTC)

- Remove for the reasons at . The chart is propaganda intended to try to continue to lower taxes on the rich, which are more accurately illustrated by the ITEP chart. EllenCT (talk) 01:03, 22 December 2013 (UTC)

- There is little basis for that assertion. The TPC is well respected and considered neutral. If anything, they fall center-left. Your objects thus far have been inaccurate and the graph you're trying to insert is bias on multiple accounts. Morphh 05:46, 22 December 2013 (UTC)

- Do you know of any peer reviewed source which agrees with those unreviewed TPC numbers? All of the peer reviewed WP:SECONDARY sources agree with the ITEP graph. Here is an example WP:SECONDARY peer reviewed source which agrees with the ITEP corporate tax incidence. Note that not all documents on the ITEP or CTJ web sites are peer reviewed. EllenCT (talk) 12:51, 22 December 2013 (UTC)