| Revision as of 16:59, 28 December 2013 edit117.213.104.134 (talk) →Long butterfly← Previous edit | Revision as of 02:26, 5 December 2014 edit undoBaerrus (talk | contribs)13 edits rephrased what is a broken wings bytterflyNext edit → | ||

| Line 34: | Line 34: | ||

| A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long. | A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long. | ||

| == Variations |

== Butterfly Variations == | ||

| The double option position in the middle is called the body, while the two other positions are called the wings. | #The double option position in the middle is called the body, while the two other positions are called the wings. | ||

| ⚫ | #The option strategy where the two middle options have different strike prices is known as a ]. | ||

| #In case the distance between middle strike price and strikes above and below is unequal, such position is referred to as "broken wings" butterfly. | |||

| ⚫ | The option strategy where the middle |

||

| In an unbalanced butterfly the variable "a" has two different values. | |||

| ==References== | ==References== | ||

Revision as of 02:26, 5 December 2014

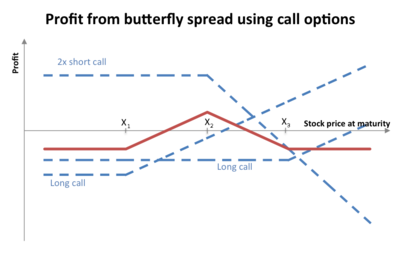

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower than the implied volatility.

Long butterfly

A long butterfly position will make profit if the future volatility is lower than the implied volatility.

A long butterfly options strategy consists of the following options:

- Long 1 call with a strike price of (X − a)

- Short 2 calls with a strike price of X

- Long 1 call with a strike price of (X + a)

where X = the spot price (i.e. current market price of underlying) and a > 0.

Using put–call parity a long butterfly can also be created as follows:

- Long 1 put with a strike price of (X + a)

- Short 2 puts with a strike price of X

- Long 1 put with a strike price of (X − a)

where X = the spot price and a > 0.

All the options have the same expiration date.

At expiration the value (but not the profit) of the butterfly will be:

- zero if the price of the underlying is below (X − a) or above (X + a)

- positive if the price of the underlying is between (X - a) and (X + a)

The maximum value occurs at X (see diagram).

Short butterfly

A short butterfly position will make profit if the future volatility is higher than the implied volatility.

A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long.

Butterfly Variations

- The double option position in the middle is called the body, while the two other positions are called the wings.

- The option strategy where the two middle options have different strike prices is known as a Condor.

- In case the distance between middle strike price and strikes above and below is unequal, such position is referred to as "broken wings" butterfly.

References

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

{{cite book}}:|edition=has extra text (help)