This is an old revision of this page, as edited by EllenCT (talk | contribs) at 03:33, 6 January 2014 (→Nom for FA: reply). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 03:33, 6 January 2014 by EllenCT (talk | contribs) (→Nom for FA: reply)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)| This is the talk page for discussing WikiProject Economics and anything related to its purposes and tasks. |

|

| Archives: Index, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10Auto-archiving period: 3 months |

Misplaced Pages:Misplaced Pages Signpost/WikiProject used Template:Outline of knowledge coverage

| This is the talk page for discussing WikiProject Economics and anything related to its purposes and tasks. |

|

| Archives: Index, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10Auto-archiving period: 3 months |

GA reassessment for Murray Rothbard article

Murray Rothbard, an article that you or your project may be interested in, has been nominated for a community good article reassessment. If you are interested in the discussion, please participate by adding your comments to the reassessment page. If concerns are not addressed during the review period, the good article status may be removed from the article.16:05, 3 November 2013 (UTC)

Progressiveness versus amount of tax

Can someone please help at Talk:Progressive tax#Why isn't causation supported? and the subsequent section? There is some confusion between the effects of increasing and decreasing the total amount of tax and changing its progressiveness. EllenCT (talk) 02:00, 7 October 2013 (UTC)

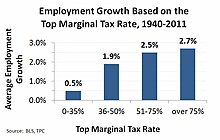

- I've added the chart to the right that EllenCT is trying to insert, one created by the SockPuppet Cupco / Nrcprm2026. It tries to make a correlation between "Average Employment Growth" and "Top Marginal Tax Rate" as if to suggest that the top marginal rate is causality for growth. In addition, the increase marginal tax rate suggests a much higher tax burden as it progresses on the X axis, such that 75% is a significantly higher burden then 35%, but the average rates on the top income levels during those periods show that exemptions reduce the burden to much closer levels and the higher rates effected a smaller group (completely different tax codes). In short, the graph is extremely misleading to readers by suggesting causality of the X / Y axes and that the rates correlate with each other. I think it violates WP:WEIGHT, WP:SYN, and insufficient WP:V for the claim. Morphh 02:24, 7 October 2013 (UTC)

- I am aware of the source of the graph, and I would prefer that it start at 1945 to eliminate World War II and to more closely match the shape of the Laffer Curve. The suggestion that it violates WP:WEIGHT has not been justified with any reason why the graph might not be on topic, the WP:SYN concerns have been addressed by , , , and , and the WP:V concerns are addressed by and both of which have been removed from the internet.

- Inclusion of the graph doesn't matter to me as much as clearing up the confusion between extent of progressiveness and amount of total tax levied. The statement, "in 1950, U.S. federal taxes were 14% of GDP, the top income tax bracket rate was effectively 88%, and jobs grew by 7.7%; in contrast during 2012, federal taxes were 19% of GDP, the top tax bracket rate was 35% (but effectively much less) while jobs only grew 1.4%," has also been repeatedly deleted. EllenCT (talk) 05:16, 7 October 2013 (UTC)

- This cherry picks years to reach an invalid conclusion by correlating such rates with a complex economy. The top rate in 1950 was 91%, not 88%, and while the economy grew at 7.7% that year (likely due to post WWII spending), the next year it grew at 3.1% and by 1953 it was -0.9%. So these rates fluctuate wildly even when the tax rate remains the same. The statement and the graph take selective facts to paint a misleading picture to the reader. In addition, the statutory rate does not evenly compare over the long timeframe due to changes in the tax code - exclusions, avoidance, and evasion for higher rates. It declares "but effectively much less" on 35% without noting the effective rate on 91% was significantly less. It's a poor comparison. For WP:V, you can't point to a source for the data of the X axis and then separately point to a source of data on Y axis and say that they support causality for a correlation - it is the definition of WP:SYN. I have not seen that the other primary sources, which is coupled with government spending, provided for the defense of WP:SYN. As for WP:WEIGHT, these conclusions represent a tiny minority as compared to widespread views that higher top tax rates can and do negatively effect economic growth in any short term measure (a view we don't currently include in the article) - beyond that, it's extremely difficult to see the effect as other economic forces are at work, to include deficit spending and the relative tax competition in today's much more global economy. Morphh 14:07, 7 October 2013 (UTC)

- EllenCT, that you are trying to connect tax rates, or collections, to job growth statistics is also subject to a critical eye. Why not present government spending as a percent of GDP? That would tell the opposite of what you intend (goverment investment & spending has increased, job creation has decreased). Anyone can select statistics to make a point, even if there's no causal link. I'll add the source article for that chart makes exactly the point that tax rates cannot be linked to job growth. Mattnad (talk) 18:13, 7 October 2013 (UTC)

- shows that business investment has decreased. EllenCT (talk) 20:03, 7 October 2013 (UTC)

- I don't follow your point. How does business investment relate to tax policy/government revenue or high marginal tax rates for wealthier people? That written, the section of the article does suggest a cause for declining US job growth - globalization and lower domestic investment by private enterprise as capital shifts to growth markets. Mattnad (talk) 00:53, 8 October 2013 (UTC)

- Business investment is related to aggregate demand per summarized at . EllenCT (talk) 02:08, 8 October 2013 (UTC)

- I don't follow your point. How does business investment relate to tax policy/government revenue or high marginal tax rates for wealthier people? That written, the section of the article does suggest a cause for declining US job growth - globalization and lower domestic investment by private enterprise as capital shifts to growth markets. Mattnad (talk) 00:53, 8 October 2013 (UTC)

- shows that business investment has decreased. EllenCT (talk) 20:03, 7 October 2013 (UTC)

- EllenCT, that you are trying to connect tax rates, or collections, to job growth statistics is also subject to a critical eye. Why not present government spending as a percent of GDP? That would tell the opposite of what you intend (goverment investment & spending has increased, job creation has decreased). Anyone can select statistics to make a point, even if there's no causal link. I'll add the source article for that chart makes exactly the point that tax rates cannot be linked to job growth. Mattnad (talk) 18:13, 7 October 2013 (UTC)

- This cherry picks years to reach an invalid conclusion by correlating such rates with a complex economy. The top rate in 1950 was 91%, not 88%, and while the economy grew at 7.7% that year (likely due to post WWII spending), the next year it grew at 3.1% and by 1953 it was -0.9%. So these rates fluctuate wildly even when the tax rate remains the same. The statement and the graph take selective facts to paint a misleading picture to the reader. In addition, the statutory rate does not evenly compare over the long timeframe due to changes in the tax code - exclusions, avoidance, and evasion for higher rates. It declares "but effectively much less" on 35% without noting the effective rate on 91% was significantly less. It's a poor comparison. For WP:V, you can't point to a source for the data of the X axis and then separately point to a source of data on Y axis and say that they support causality for a correlation - it is the definition of WP:SYN. I have not seen that the other primary sources, which is coupled with government spending, provided for the defense of WP:SYN. As for WP:WEIGHT, these conclusions represent a tiny minority as compared to widespread views that higher top tax rates can and do negatively effect economic growth in any short term measure (a view we don't currently include in the article) - beyond that, it's extremely difficult to see the effect as other economic forces are at work, to include deficit spending and the relative tax competition in today's much more global economy. Morphh 14:07, 7 October 2013 (UTC)

It's quite telling that all examples are from the USA. There are other economies out there... bobrayner (talk) 01:21, 8 October 2013 (UTC)

- (discussed at ) and study other countries and reach the same conclusion. involves the general principles. There is a lot of material out there in opposition, but all of it is opposed to the historical record and therefore only primary at best, and most likely as reliable as conflicted interest opinion. EllenCT (talk) 02:08, 8 October 2013 (UTC)

- None of these publications support the chart or the sentence. They're about income inequality and economic growth effects. Morphh 20:38, 8 October 2013 (UTC)

- The sentence and the chart are historical facts supported by the numerical data sources. The implication you are complaining about is supported by the peer-reviewed sources, and has recently been shown to be correct after 35 years of error in regression analysis. Where do you think employment and income come from? Economic growth. EllenCT (talk) 13:09, 9 October 2013 (UTC)

- The data is fact, but the correlation or causality is not (an extreme example - Global Warming / Pirates). I think I understand what EllenCT is thinking and it's WP:OR and WP:SYN. Like the chart that falsely links one thing to another, she does the same with the sources. The sources make the argument that certain levels of income inequality can hurt economic growth. Other sources say that progressive taxation can improve income equality. Putting these two ideas together brings the theory that highly progressive taxation (with progressive spending) can improve income equality, which can lead to economic growth. A=B=C However, the sources do not say A=C. A achieves B under certain conditions. B achieves C under certain conditions. Too much B can hurt C. A can have adverse effects on C, which may negate any effect of B on C. Short term / long term scenarios, who knows - the causality is not in the sources and they certainly don't support what is implied in the graph or the sentence. Morphh 14:51, 9 October 2013 (UTC)

- I strongly disagree, and I think your accusations of OR are completely absurd given the sources above. The SYN claim is equally absurd, and you seem to be trying to use it to exclude what has become the dominant point of view in favor of the now-minority point of view which you prefer or at least preferred before you came to see the flaws in Art Okun's 1970s regression analyses. I can't help you unless you are willing to include both points of view and an honest discussion of the strength of the evidence in support of them. EllenCT (talk) 03:34, 11 October 2013 (UTC)

- EllenCT, I happen to agree with Morphh on this one. The sources you have supplied do not support the conclusion of that chart which is high marginal tax rates led to high job growth in the United States as well as the inverse. It's quite simple - we need an authoritative reliable source. What you've provided so far are bits and pieces and drawn inferences from them. If the graph represents the dominant point of view, economists would refer to it, or something like it. But they don't. An economy is a complex system, and marginal tax rates are only one, small, competent. If you don't agree, explain why Greece, with a top marginal tax rate of 45% (not including VATs) is not swimming in jobs.Mattnad (talk) 12:31, 11 October 2013 (UTC)

- The chart doesn't have conclusions but people draw subjective inferences about what it shows. and are peer-reviewed articles supporting the most likely such inference, and unlike all the peer-reviewed reports which reach contrary conclusions, they are consistent with DSGE and prisoners dilemma models, and more importantly with Berg and Ostry's correction of Okun's flawed year-over-year regressions. Greece has tax avoidance and evasion issues. EllenCT (talk) 22:32, 12 October 2013 (UTC)

- EllenCT, what's the point of the chart then, if not to foster subjective conclusions? If you cannot articulate why we should include the chart, and point it makes, then it's a waste of space. As for connecting tht chart to peer reviewed articles, that's WP:SYN. Even if we wanted to, the first article is behind a paywall but the abstract mentions "We present empirical results that show that inequality in land and income ownership is negatively correlated with subsequent economic growth" but makes no mention of the elements in the chart. The second article makes no mention at all about taxes but does focus on unemployment and growth. So if that's what you're using to justify including the chart, you'll need to find something else.Mattnad (talk) 04:00, 13 October 2013 (UTC)

- Why don't you recognize my articulation of the reasons for including the chart? It is historically correct. The inferences which everyone is afraid people will draw from it are mathematically correct for the reasons the four cited sources explain. If you are having paywall problems, try Misplaced Pages:WikiProject Resource Exchange/Resource Request. EllenCT (talk) 10:07, 14 October 2013 (UTC)

- The individual facts may be historically correct, but the juxtaposition of the two historical facts suggest causality for which we need a source. And not just any source, but a source that basically says, "The drop in top marginal tax rates is linked to, or the cause of, the drop in job growth in the united states." Your sources from what I've read do not say that. The refer to piece parts of a hypothesis you have. To give ridiculous example, I could create a graph that shows as women have become more educated, job growth stalled in the United States. All historically accurate, but would unacceptable unless we had an authoritative source that made that exact point.Mattnad (talk) 00:41, 15 October 2013 (UTC)

- Why don't you recognize my articulation of the reasons for including the chart? It is historically correct. The inferences which everyone is afraid people will draw from it are mathematically correct for the reasons the four cited sources explain. If you are having paywall problems, try Misplaced Pages:WikiProject Resource Exchange/Resource Request. EllenCT (talk) 10:07, 14 October 2013 (UTC)

- EllenCT, what's the point of the chart then, if not to foster subjective conclusions? If you cannot articulate why we should include the chart, and point it makes, then it's a waste of space. As for connecting tht chart to peer reviewed articles, that's WP:SYN. Even if we wanted to, the first article is behind a paywall but the abstract mentions "We present empirical results that show that inequality in land and income ownership is negatively correlated with subsequent economic growth" but makes no mention of the elements in the chart. The second article makes no mention at all about taxes but does focus on unemployment and growth. So if that's what you're using to justify including the chart, you'll need to find something else.Mattnad (talk) 04:00, 13 October 2013 (UTC)

- The chart doesn't have conclusions but people draw subjective inferences about what it shows. and are peer-reviewed articles supporting the most likely such inference, and unlike all the peer-reviewed reports which reach contrary conclusions, they are consistent with DSGE and prisoners dilemma models, and more importantly with Berg and Ostry's correction of Okun's flawed year-over-year regressions. Greece has tax avoidance and evasion issues. EllenCT (talk) 22:32, 12 October 2013 (UTC)

- EllenCT, I happen to agree with Morphh on this one. The sources you have supplied do not support the conclusion of that chart which is high marginal tax rates led to high job growth in the United States as well as the inverse. It's quite simple - we need an authoritative reliable source. What you've provided so far are bits and pieces and drawn inferences from them. If the graph represents the dominant point of view, economists would refer to it, or something like it. But they don't. An economy is a complex system, and marginal tax rates are only one, small, competent. If you don't agree, explain why Greece, with a top marginal tax rate of 45% (not including VATs) is not swimming in jobs.Mattnad (talk) 12:31, 11 October 2013 (UTC)

- I strongly disagree, and I think your accusations of OR are completely absurd given the sources above. The SYN claim is equally absurd, and you seem to be trying to use it to exclude what has become the dominant point of view in favor of the now-minority point of view which you prefer or at least preferred before you came to see the flaws in Art Okun's 1970s regression analyses. I can't help you unless you are willing to include both points of view and an honest discussion of the strength of the evidence in support of them. EllenCT (talk) 03:34, 11 October 2013 (UTC)

- The data is fact, but the correlation or causality is not (an extreme example - Global Warming / Pirates). I think I understand what EllenCT is thinking and it's WP:OR and WP:SYN. Like the chart that falsely links one thing to another, she does the same with the sources. The sources make the argument that certain levels of income inequality can hurt economic growth. Other sources say that progressive taxation can improve income equality. Putting these two ideas together brings the theory that highly progressive taxation (with progressive spending) can improve income equality, which can lead to economic growth. A=B=C However, the sources do not say A=C. A achieves B under certain conditions. B achieves C under certain conditions. Too much B can hurt C. A can have adverse effects on C, which may negate any effect of B on C. Short term / long term scenarios, who knows - the causality is not in the sources and they certainly don't support what is implied in the graph or the sentence. Morphh 14:51, 9 October 2013 (UTC)

- The sentence and the chart are historical facts supported by the numerical data sources. The implication you are complaining about is supported by the peer-reviewed sources, and has recently been shown to be correct after 35 years of error in regression analysis. Where do you think employment and income come from? Economic growth. EllenCT (talk) 13:09, 9 October 2013 (UTC)

- None of these publications support the chart or the sentence. They're about income inequality and economic growth effects. Morphh 20:38, 8 October 2013 (UTC)

Berg and Ostry (2011). Have you read it? Pages 362-70 in Peterson, W. and Estenson, P. (7th ed., 1992) Income, Employment and Economic Growth, Chapter 9, "Public Expenditures, Taxes, and Finance," describes progressivity in terms of transfers. If you can't find it in your library try inter-library loan. EllenCT (talk) 01:42, 15 October 2013 (UTC)

- I've read the IMF publication and it doesn't support the material. Morphh 13:42, 15 October 2013 (UTC)

- What do you think it says on the topic then? It says that greater income equality is the most effective determinant of economic growth. Economic growth produces employment, right? Progressive taxes produce greater income equality, right? If you think that's SYN then read Peterson and Estenson, which says it outright. Why don't and say it well enough? What are the specific things you think are SYN in order for those two to support the statement about the US in 1950 vs. 2012 and the job creation by top tax bracket rate graph? EllenCT (talk) 23:02, 15 October 2013 (UTC)

- What they say in theory (and I'm taking your word on it) still needs to be connected to US history, as depicted in the graph, by a reliable source. It's a bit remarkable to me that evidence that would so vividly illustrate their concepts is not mentioned, at all in their texts. The US is not exactly a corner case that they'd ignore on purpose. What you are trying to do is apply an academic paper that makes no mention of the facts you are trying to present as related. Since you have access to the texts, why don't you quote them for us?Mattnad (talk) 01:49, 16 October 2013 (UTC)

- What do you think it says on the topic then? It says that greater income equality is the most effective determinant of economic growth. Economic growth produces employment, right? Progressive taxes produce greater income equality, right? If you think that's SYN then read Peterson and Estenson, which says it outright. Why don't and say it well enough? What are the specific things you think are SYN in order for those two to support the statement about the US in 1950 vs. 2012 and the job creation by top tax bracket rate graph? EllenCT (talk) 23:02, 15 October 2013 (UTC)

- EllenCT wrote "It says that greater income equality is the most effective determinant of economic growth". Where does it state that? Maybe I'm missing the socialist success story. Let me quote what the paper says "Still, there may be some win-win policies, such as better-targeted subsidies, better access to education for the poor that improves equality of economic opportunity, and active labor market measures that promote employment. When there are short-run trade-offs between the effects of policies on growth and income distribution, the evidence we have does not in itself say what to do. But our analysis should tilt the balance toward the long-run benefits—including for growth—of reducing inequality. Over longer horizons, reduced inequality and sustained growth may be two sides of the same coin." It is not an analysis on tax policy. Reductions in progressivity are often "short-run trade-offs between the effects of policies on growth and income distribution". I've looked over the other publications as well and I'm not seeing the evidence you describe - I'm seeing the same WP:SYN analysis. So to Mattnad's point, please provide some quotes that support the material. Morphh 03:36, 16 October 2013 (UTC)

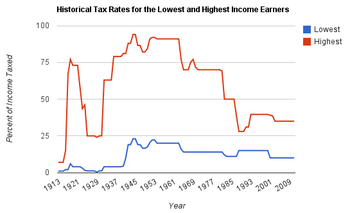

- Chart 4 at right. I'll excerpt the other three sources in the next few days. EllenCT (talk) 12:00, 16 October 2013 (UTC)

- OK, chart on its own is better from the perspective of linking a source and the subject matter. But we could not use it to synthesize another chart. However, if we wanted to include it, we could with the source. Another thing to consider is whether this belongs in progressive tax article, or more aptly, an article on income inequality. To link it to progressive taxes, we'd need a foundation that progressive taxes reduce income inequality, which is likely doable.Mattnad (talk) 15:23, 16 October 2013 (UTC)

- Linking the economic gains through income equality to progressive taxation is still SYN, even if you have sources supporting each on it's own. Progressive taxes can reduce income inequality (best when coupled with progressive spending), but that doesn't mean the gains result in economic growth. The manufactured redistribution of wealth through the tax code could have negative economic effects, which completely negate any gain and even hurt growth. It depends how much and where the spending is placed. Suggesting progressive 75% marginal tax rates are optimal for growth is not supportable in these sources. Saying that economic equality can increase economic growth has to be taken in context. History has show extremes in this area have been disastrous to economic growth. So without direct sources supporting that increased progressive taxation (and to what degree) leads to economic growth, we're doing original research and synthesis of material. We're forming our own analysis, which is not appropriate. The latest graph offered by EllenCT doesn't offer anything except what it directly depicts. It can't be used to piece together conclusions.. since this graph says this, and this graph says this, then we can create this graph that says this new thing. We can't do that. Morphh 15:55, 16 October 2013 (UTC)

- OK, chart on its own is better from the perspective of linking a source and the subject matter. But we could not use it to synthesize another chart. However, if we wanted to include it, we could with the source. Another thing to consider is whether this belongs in progressive tax article, or more aptly, an article on income inequality. To link it to progressive taxes, we'd need a foundation that progressive taxes reduce income inequality, which is likely doable.Mattnad (talk) 15:23, 16 October 2013 (UTC)

- Chart 4 at right. I'll excerpt the other three sources in the next few days. EllenCT (talk) 12:00, 16 October 2013 (UTC)

- EllenCT wrote "It says that greater income equality is the most effective determinant of economic growth". Where does it state that? Maybe I'm missing the socialist success story. Let me quote what the paper says "Still, there may be some win-win policies, such as better-targeted subsidies, better access to education for the poor that improves equality of economic opportunity, and active labor market measures that promote employment. When there are short-run trade-offs between the effects of policies on growth and income distribution, the evidence we have does not in itself say what to do. But our analysis should tilt the balance toward the long-run benefits—including for growth—of reducing inequality. Over longer horizons, reduced inequality and sustained growth may be two sides of the same coin." It is not an analysis on tax policy. Reductions in progressivity are often "short-run trade-offs between the effects of policies on growth and income distribution". I've looked over the other publications as well and I'm not seeing the evidence you describe - I'm seeing the same WP:SYN analysis. So to Mattnad's point, please provide some quotes that support the material. Morphh 03:36, 16 October 2013 (UTC)

Is causation intransitive?

- Even if the same source reported that increased marginal tax rates (or increased progressivity of taxation, which are not the same thing) increased income equality, and income equality supports improvements in the economy, we couldn't make the connection. We cannot conclude from A tends to cause B and B tends to cause C that A tends to cause C. — Arthur Rubin (talk) 16:41, 16 October 2013 (UTC)

- Are you saying causation is intransitive? Every source states, and my personal experience supports, that causation is transitive. Is that not a logical truism as referred to in Misplaced Pages:Common knowledge#Acceptable examples of common knowledge? EllenCT (talk) 01:43, 19 October 2013 (UTC)

- No, causation (in social science) is not transitive. There should be an example in systems theory, but, as a specific example with forcing factors:

- One unit of A causes one unit of B and one unit of D

- One unit of B causes one unit of C

- One unit of D causes minus 5 units of C.

- Then:

- One unit of A causes one unit of B

- One unit of B causes one unit of C

- One unit of A causes a loss of four units of C.

- — Arthur Rubin (talk) 16:28, 19 October 2013 (UTC)

- To quote WP:SYN "If one reliable source says A, and another reliable source says B, do not join A and B together to imply a conclusion C that is not mentioned by either of the sources. This would be a synthesis of published material to advance a new position, which is original research."A and B, therefore C" is acceptable only if a reliable source has published the same argument in relation to the topic of the article. If a single source says "A" in one context, and "B" in another, without connecting them, and does not provide an argument of "therefore C", then "therefore C" cannot be used in any article." Morphh 23:45, 19 October 2013 (UTC)

- No, causation (in social science) is not transitive. There should be an example in systems theory, but, as a specific example with forcing factors:

- Are you saying causation is intransitive? Every source states, and my personal experience supports, that causation is transitive. Is that not a logical truism as referred to in Misplaced Pages:Common knowledge#Acceptable examples of common knowledge? EllenCT (talk) 01:43, 19 October 2013 (UTC)

- Even if the same source reported that increased marginal tax rates (or increased progressivity of taxation, which are not the same thing) increased income equality, and income equality supports improvements in the economy, we couldn't make the connection. We cannot conclude from A tends to cause B and B tends to cause C that A tends to cause C. — Arthur Rubin (talk) 16:41, 16 October 2013 (UTC)

I am happy to include the necessary number of sources, then. Thank you both. EllenCT (talk) 06:18, 20 October 2013 (UTC)

- I just want to point out to whomever was not clear on this matter that Arthur Rubin was talking about partial effects in a system. This is almost always what economists do. Thus if you see an economist claim that one thing causes another, be slow to make general claims based on that source. Figure out exactly what is "held constant".Rscragun (talk) 03:12, 30 December 2013 (UTC)

Source excerpts

- "Taxes are a leakage from the income stream in the same sense of saving. Equilibrium requires that leakages in the form of net taxes plus saving must be offset by investment expenditures and government purchases of goods and services.... 'our fiscal policy targets have been recast in terms of "full" or "high" employment levels of output, specifically the level of GNP associated with a 4-percent rate of unemployment.'" —Peterson, Wallace C. (1992). "Chapter 9. Public Expenditures, Taxes, and Finance". Income, employment, and economic growth (7th ed.). New York: Norton. pp. 364–70. ISBN 0-393-96139-7.

{{cite book}}:|access-date=requires|url=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) Quoting Walter Heller. - "inequality in land and income ownership is negatively correlated with subsequent economic growth.... there will be a strong demand for redistribution in societies where a large section of the population does not have access to the productive resources of the economy.... rational voters have to internalize this dynamic problem of social choice." —Alesina, Alberto (1994). "Distributive Politics and Economic Growth" (PDF). Quarterly Journal of Economics. 109 (2): 465–90. doi:10.2307/2118470. Retrieved 17 October 2013.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help); Unknown parameter|month=ignored (help) - "high unemployment rates...have a negative and significant effect when interacting with increases in inequality.... increasing inequality harms growth in countries with high levels of urbanization, as well as in countries with low levels of urbanization in which there is high and persistent unemployment.... High and persistent unemployment is likely associated to increasing inequalities. Furthermore, there are sensible reasons to expect that this process of high and persistent unemployment, in which inequality increases, has a negative effect on subsequent long-run economic growth.... In sum, unemployment may seriously harm growth not only because it is a waste of resources, but also because it has serious distributional effects: it generates redistributive pressures and subsequent distortions; it depreciates existing human capital and deters its accumulation; it drives people to poverty; it results in liquidity constraints that limit labour mobility; and finally it erodes individual self-esteem and promotes social dislocation, unrest and conflict. Hence, the experience of the 1980s, and the subsequent cycle of low long-run economic growth is a cautionary tale about the future risks for growth of high unemployment and increasing inequality in our current times. «The economic slowdown may entail a double-dip in employment... exacerbating inequalities and social discontent... and further delaying economic recovery» (ILO, 2011). Policies aiming at controlling the dramatic rise in unemployment associated to the current crisis, and in particular at reducing its inequality-associated effects, are not just pressing for the obvious current difficulties that they represent for society today, but also because of the handicap that they represent for future long-run growth." —Castells-Quintana, David (2012). "Unemployment and long-run economic growth: The role of income inequality and urbanisation" (PDF). Investigaciones Regionales. 12 (24): 153–173. Retrieved 17 October 2013.

{{cite journal}}: Unknown parameter|coauthors=ignored (|author=suggested) (help)

These and the historical facts about the U.S. tax rate should all be included. EllenCT (talk) 05:12, 17 October 2013 (UTC)

- Thanks EllenCT. These sources do not provide support for the graph in the least. The first argues the if the government is going to tax, it should spend so the impact is neutral. The second quote basically says more broadly that income inequality leads to less growth, but given they mention land ownership, aren't they referring to more agrarian economies? The third say that high and persistent unemployment, particularly in urbanized cultures, leads to income inequality and lower economic growth. Not one of them discusses top marginal tax rates, and applies it to the US. That graph and the related sentence are WP:OR. Mattnad (talk) 09:24, 17 October 2013 (UTC)

- I believe you are mistaken. The first says that government should and has tax and spend to achieve "full employment" (4% unemployment.) The second specifically refers to income as well as property wealth. The third specifically supports the data shown in the graph, from a survey of many countries. EllenCT (talk) 09:48, 17 October 2013 (UTC)

4. "A Yale professor who was among three Americans who won the Nobel prize for economics said Monday, 'The most important problem that we are facing now today, I think, is rising inequality in the United States and elsewhere in the world,' Shiller said." —Christoffersen, John (October 14, 2013). "Rising inequality 'most important problem,' says Nobel-winning economist". St. Louis Post-Dispatch. Retrieved 19 October 2013. EllenCT (talk) 01:43, 19 October 2013 (UTC)

An RFC on this topic has been opened here Talk:Progressive_tax#RFC_on_graph_linking_top_marginal_tax_rates_to_job_growth Mattnad (talk) 16:00, 19 October 2013 (UTC)

Article for creation

Can some one take a look at Misplaced Pages talk:Articles for creation/Aggregative games? The math Wikiproject received a request for an expert evaluation of whether or not the article is legitimate, but I think the topic is more in line with your interests here. Ozob (talk) 13:23, 11 October 2013 (UTC)

Misplaced Pages talk:Articles for creation/Multifactory

Dear economists: Here's an article submitted at Afc that could benefit from the expertise of someone here. —Anne Delong (talk) 18:14, 16 October 2013 (UTC)

- Thanks; it's been declined. —Anne Delong (talk) 23:49, 4 November 2013 (UTC)

RfC regarding Ludwig von Mises Institute

See: Talk:Ludwig von Mises Institute#RfC: Should "Views espoused by founders & organization scholars" be in the article?16:52, 22 October 2013 (UTC)

Envelope theorem

I've reverted edits that replaced the whole article by new material. I'm not an expert in economics/maths - my attention was drawn to the article because all its categories etc had been removed. Could someone who does understand the topic take a look and work out whether the new material should be added, should replace the existing article content, form a new article or whatever ? DexDor (talk) 18:51, 23 October 2013 (UTC)

- The removed material is certainly more informative (except that it has no intro) than what is in the article right now. Mct mht (talk) 01:50, 24 October 2013 (UTC)

AfD on The Politically Incorrect Guide to Capitalism

See WP:Articles for deletion/The Politically Incorrect Guide to Capitalism15:59, 3 November 2013 (UTC)

Economic approaches to Food security

I am currently working on taking the "Food security" article up to a GA rating, or as close as possible. However, the "Economic approaches" subsection contains information on three economic approaches called "Westernized view", "Food justice" and "Food sovereignty". These subsections have little or no citations, and seriously detract from the quality of this article. I was hoping someone here would have an interest in editing these section, or advising on their deletion. I am not sure if the approaches are important or well-known, and the lack of citations has me questioning their authenticity. Any help or advice would be greatly appreciated! Khatchell (talk) 22:23, 6 November 2013 (UTC)

Misplaced Pages talk:Articles for creation/Daniel F. Spulber

Dear economists: This article about a notable professor has not been edited for more than a year, and has never been submitted for review. I have tried to find independent references, but this man has written so many books and papers that I just keep finding his own work. I tried adding the word "review" to my search, but he writes these too. I am not an academic; can someone who knows where to look find some sources ? Thanks. —Anne Delong (talk) 23:59, 12 November 2013 (UTC)

Economy of Bulgaria

Hello, I'd like someone to look at the Economy of Bulgaria article. I have reverted a possible vandalism from unregistered user, but my edit was reverted. IHMO the text added by the unregistered user is copy-pasted from an economy report. Also it's unreferenced. That's why I think it cannot stay in the article. I'd like to avoid fight and someone more experienced to look at the matter. Regards and thanks, gogo3o 09:49, 22 November 2013 (UTC)

Optimum number of working hours per week?

How should we characterize from in light of the generally confirmatory ? Please answer at talk:Workweek and weekend#Optimum number of working hours per week?. Thank you all! EllenCT (talk) 04:19, 30 November 2013 (UTC)

Software for legible .svg graphs?

Please see these three graphs proposed at Talk:United States#Survey:

I would like to experiment with ways of combining them. What appropriate software for graphing produces the most legible results on wikimedia wikis? EllenCT (talk) 01:29, 10 December 2013 (UTC)

- I'll also like advice on how to create SVG graphs. What (windows) software is available to create supply-demand graphs in svg format? LK (talk) 11:22, 10 December 2013 (UTC)

- Misplaced Pages:How to create charts for Misplaced Pages articles has some ways, as do and . EllenCT (talk) 13:46, 11 December 2013 (UTC)

I am trying to include this one in some way and any suggestions would be appreciated. EllenCT (talk) 02:42, 21 December 2013 (UTC)

AfD on Mark Thornton

Please see WP:Articles for deletion/Mark Thornton SPECIFICO talk 16:49, 20 December 2013 (UTC)

Economics working papers and reliable sources

I recall a while back that there was a question about working papers by EllenCT where LK expressed that these were unreliable and I disagreed. Most economics work these days is in working papers, and it's unrealistic to categorically remove them. The other day Krugman had the following comment:

Economics journals stopped being a way to communicate ideas at least 25 years ago, replaced by working papers; publication was more about certification for the purposes of tenure than anything else. Partly this was because of the long lags — by the time my most successful (though by no means best) academic paper was actually published, in 1991, there were around 150 derivative papers that I knew of, and the target zone literature was running into diminishing returns. Partly, also, it was because in some fields rigid ideologies blocked new ideas. Don’t take my word for it: It was Ken Rogoff, not me, who wrote about the impossibility of publishing realistic macro in the face of “new neoclassical repression.”

Of course, it was Rogoff's published paper on austerity which had a glaring error. Thoughts about working papers? II | (t - c) 23:55, 20 December 2013 (UTC)

- There are still peer reviewed academic economics journals, and many of them have great reputations. Peer review in economics has shifted away from the publication process and into the world wide web, including traditional media, collections, blogs, even video sometimes. Remember that the review section of an introduction is a secondary source, so if the author is an authority then the publication has a reputation for trustworthiness, then the citation in a review takes the place of anonymous reviewers' comments. Therefore it is possible to determine what is and is not reviewed by authorities, as any editor must. EllenCT (talk) 02:37, 21 December 2013 (UTC)

Vital articles

I looked over the list of economics articles under WP:Vital articles, and it could be much improved. It looks like it was constructed by someone with little exposure to economics. I made a few proposals to swap out Macreconomics and microeconomics for "goods" and "services" and to swap "supply and demand" for "markets". Please weigh in on the discussion and make other swap suggestions.--Bkwillwm (talk) 05:27, 23 December 2013 (UTC)

Political aspects of full employment

I came across and its "Marxist" conclusion that we need to "decouple accumulation from profitability" sounds to me like just another call to lower inventories by using IT to transition towards just-in-time production of products and services that can't be contracted for in advance or otherwise reliably predicted. I was wondering what other editors made of that. EllenCT (talk) 03:12, 26 December 2013 (UTC)

U. S. figures Inaccurate

The figure of $54,000/year for the U. S. is roughly equal to dividing GDP by the total population. How could that be an accurate reflection of what kind of wages workers in the U. S. earn? — Preceding unsigned comment added by Tmgibs34 (talk • contribs) 19:40, 29 December 2013 (UTC)

- Can you be more specific? What article are you referring to? The 2011 median household income was $50,054 based on Census data (see US_income#Household_income). The mean was higher at $69,821 due to wealth concentration.Mattnad (talk) 08:22, 30 December 2013 (UTC)

Schumpeterian growth article is nonsense

This article seems like a Marxist manifesto with psycho-sexual theory undertones. This is not an appropriate way to approach the topic. Plus, Schumpeterian growth is not a "policy", and this article fails to clearly state the assumptions about product monopolies in the theory. I plan to eliminate the article and redirect to Creative destruction if there is no objection. Rscragun (talk) 03:44, 30 December 2013 (UTC)

Georgism

Has recently seen huge numbers of economists and others being listed as "Georgists", added to categories for Georgists, etc. I removed a bunch, but was instantly reverted. Almost none of those listed have George or Georgism mentioned in their biographies, nor found through Google searches, and the apparent standard was that at some point someone had said they favored land taxes of some sort :( or that they were mentioned on a Georgism website. I suspect that the members here are far better equipped than I to separate the wheat from the chaff in the article and category. Thanks. Collect (talk) 15:38, 2 January 2014 (UTC)

- I've added a comment on the discussion page Talk:Georgism#Influenced_by_Georgism. My guess is that they are listing anyone with a secondary influence.Jonpatterns (talk) 17:25, 2 January 2014 (UTC)

- For some time now it seems that somebody has diligently applied Georgist labels to everybody they can, and sometimes the connections seem to be quite tenuous. bobrayner (talk) 18:36, 2 January 2014 (UTC)

- This reminds me of the Producerism RFC. Is "producerism" a Canadian pejorative against those who want higher inheritance taxes? EllenCT (talk) 06:37, 5 January 2014 (UTC)

- For some time now it seems that somebody has diligently applied Georgist labels to everybody they can, and sometimes the connections seem to be quite tenuous. bobrayner (talk) 18:36, 2 January 2014 (UTC)

Kazimierz Laski

Hi, this bio of a Polish-Austrian economist could use some specialist attention. Thanks! --Randykitty (talk) 11:05, 3 January 2014 (UTC)

Flooding the market

I just redirected Flooding the market and a handful of similar terms to market saturation, but I'm having second thoughts. Are these the same thing or are they distinct? Ego White Tray (talk) 23:48, 4 January 2014 (UTC)

- I think that "Flooding the market" tends to be used more colloquially, carrying some slightly different connotations, but the redirect looks good to me. It would be nice if Market saturation touched on business strategy, or had a few words on prices & competition. bobrayner (talk) 00:47, 5 January 2014 (UTC)

- I think a redirect to Dumping (pricing policy) would be better but not ideal.--Bkwillwm (talk) 04:47, 5 January 2014 (UTC)

- Dumping sounds better than market saturation, but not quite. Market saturation, upon another read, means that everybody already owns one so there's no potential to expand the customer base, so dumping is definitely better. When I searched for flood the market, most of the references expressed concern that releasing too many products would reduce the value of the product - however, Herbert Henry Dow used the term to refer to dumping - I rephrased the article and targeted the link. I think it may be best to write a quick stub for it, perhaps? Ego White Tray (talk) 06:06, 5 January 2014 (UTC)

- I think a redirect to Dumping (pricing policy) would be better but not ideal.--Bkwillwm (talk) 04:47, 5 January 2014 (UTC)

Nom for FA

I would like to nominated History of macroeconomic thought as a featured article again. I nominated it once before, but it mainly failed over content disputes. I have tried to improve the article further, gotten it listed as a "Good Article," and it should be ready for another FA nomination. Please let me know what you think of the article. I'd like to resolve any disputes or other issues before making a nomination.--Bkwillwm (talk) 05:00, 5 January 2014 (UTC)

- I wish it had more about the relation between income distribution and aggregate demand. That's been central to the political debates around macroeconomics for most if not almost all of the past century. EllenCT (talk) 06:41, 5 January 2014 (UTC)

- Is there something specific you had in mind? I don't think inequality figures much in macroeconomic theory up to the present. Inequality has been an important part of the political discussion, but it hasn't been worked into influential macroeconomic models. I tried using a variety of secondary sources on the history of macro to determine the topical contents and weight of the article. None of these says much about inequality. We would need a strong source to back adding something on this to the article without creating a weight issue.

- I had considered adding a Marxian economics sub-section to the heterodox section, but I'm not sure that would get at the relationship you're talking about.--Bkwillwm (talk) 21:34, 5 January 2014 (UTC)

- Heller's description of how government expenditure was set to obtain http://research.stlouisfed.org/fred2/series/NROU ("Taxes are a leakage from the income stream in the same sense of saving. Equilibrium requires that leakages in the form of net taxes plus saving must be offset by investment expenditures and government purchases of goods and services.... 'our fiscal policy targets have been recast in terms of "full" or "high" employment levels of output, specifically the level of GNP associated with a 4-percent rate of unemployment.'" —Peterson, Wallace C. (1992). "Chapter 9. Public Expenditures, Taxes, and Finance". Income, employment, and economic growth (7th ed.). New York: Norton. pp. 364–70. ISBN 0-393-96139-7.

{{cite book}}:|access-date=requires|url=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) Quoting Walter Heller) is nowhere near Marxian. I would also like to know how it got up from 4.0 to 5.3 in such a short time. EllenCT (talk) 03:33, 6 January 2014 (UTC)

- Heller's description of how government expenditure was set to obtain http://research.stlouisfed.org/fred2/series/NROU ("Taxes are a leakage from the income stream in the same sense of saving. Equilibrium requires that leakages in the form of net taxes plus saving must be offset by investment expenditures and government purchases of goods and services.... 'our fiscal policy targets have been recast in terms of "full" or "high" employment levels of output, specifically the level of GNP associated with a 4-percent rate of unemployment.'" —Peterson, Wallace C. (1992). "Chapter 9. Public Expenditures, Taxes, and Finance". Income, employment, and economic growth (7th ed.). New York: Norton. pp. 364–70. ISBN 0-393-96139-7.

- "Who Pays Taxes in America?" (PDF). Citizens for Tax Justice. April 12, 2012.