This is an old revision of this page, as edited by Grayfell (talk | contribs) at 21:32, 6 October 2023 (→Estimates: WP:EDITORIALIZING, poor attribution of flimsy source. I assume "mine transactions" was a typo). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 21:32, 6 October 2023 by Grayfell (talk | contribs) (→Estimates: WP:EDITORIALIZING, poor attribution of flimsy source. I assume "mine transactions" was a typo)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)Environmental effects of bitcoin comprise increased carbon emissions and electronic waste accumulation, causing the cryptocurrency to have a negative impact on Earth's climate and the natural environment through pollution. Bitcoins are produced through a time- and energy-consuming process called mining, powered at least in part through fossil fuels. As of 2022, such bitcoin mining is estimated to be responsible for 0.1% of world greenhouse gas emissions. An August 2023 study found Bitcoin mining represented about 0.38% of global electricity consumption. Bitcoins are usually mined on specialized computer equipment, which has a short life expectancy. As of 2021, bitcoin mining was estimated to produce 30,000 tonnes of annual e-waste, which is comparable to the e-waste production of the Netherlands.

Carbon emissions

Concerns about bitcoin's environmental effects relate the network's energy consumption to carbon emissions.

Mining as an electricity-intensive process

Bitcoin mining is a highly electricity intensive proof-of-work process. Miners run bitcoin-mining software and compete against each other to be the first to win the current 10 minute block and therefore receive the block reward. The bitcoins are the said block reward. The actual "work" being done by these mining computer systems is not useful in any other way.

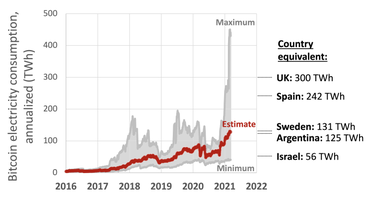

As of 2022, the Cambridge Centre for Alternative Finance (CCAF) estimates that bitcoin consumes 131 TW⋅h (470 PJ) annually, representing 0.29% of the world's energy production and 0.59% of the world's electricity production, ranking bitcoin mining between Ukraine and Egypt in terms of electricity consumption. George Kamiya, writing for the International Energy Agency, said that "predictions about Bitcoin consuming the entire world's electricity" were sensational, but that the area "requires careful monitoring and rigorous analysis". One study in 2021 by cryptocurrency investment firm Galaxy Digital claimed that bitcoin mining used less energy than the banking system, with Galaxy Digital later clarifying that bitcoin mining's energy usage is not correlated with its "transactional volume or throughput" as it is in banking.

Coal power

Until 2021, according to the CCAF, much of the mining for bitcoin was done in China. Chinese miners relied on cheap coal power in Xinjiang in late autumn, winter and spring, and then migrated to regions with overcapacities in low-cost hydropower, like Sichuan, between May and October. In June 2021 China banned bitcoin mining and the miners moved to other countries. By December 2021, the global computational capacity had mostly recovered to a level before China's crackdown, with more mining being done in the U.S. (35.4%), Kazakhstan (18.1%), and Russia (11%) instead. Coal power plants in Kazakhstan generate most of the country's electricity and emit lots of local air pollution.

Greenidge Generation, a power plant in Dresden, New York, had originally been built for coal and had shut down in 2011 due to lack of demand. The plant reactivated in 2016 as a natural gas plant but failed to find sufficient demand. It switched entirely to bitcoin mining in 2019. In addition to emitting around 220,000 tonnes of carbon dioxide in 2020, the plant's cooling intake and discharge of heated water into Seneca Lake coincided with a significant decrease in fish and other wildlife populations. In 2022, the plant's air permit request was denied by the New York State Department of Environmental Conservation (DEC).

Renewable energy

As of September 2021, according to the New York Times, bitcoin's use of renewables ranged from 40% to 75%,, which at the low end is almost twice as much as the US grid on average. Solar photovoltaic electricity generation appears to be the most economic and geographically diverse method of powering mining. Experts and government authorities have suggested that the use of renewable energy for mining may limit the availability of clean energy for ordinary uses by the general population.

The Mechanicville Hydroelectric Plant in New York State and three hydroelectric power plants in San Pedro de Poás, Costa Rica have reactivated to mine cryptocurrency. According to the owners of the Mechanicville plant, the mining prevented the plant from being dismantled.

Off-grid energy

Certain companies operate bitcoin mining services run on gases like methane that would otherwise be flared or released into the atmoshere, for example from oil production or landfills.

Estimates

The difficulty of translating energy consumption into carbon emissions is due to the way bitcoin mining is distributed, making it difficult for researchers to identify miner's location and electricity use. The results of studies into bitcoin's carbon footprint vary. Per a study published in Finance Research Letters in 2021, the differences in underlying assumptions and variation in the coverage of time periods and forecast horizons have led to bitcoin carbon footprint estimates spanning from 1.2–5.2 Mt CO2 to 130.50 Mt CO2 per year. According to studies published in Joule and American Chemical Society in 2019, bitcoin's annual energy consumption results in annual carbon emission ranging from 17 to 22.9 MtCO2 which is comparable to the level of emissions of countries as Jordan and Sri Lanka.

Estimates of energy used per transaction vary. One estimate cited by Columbia University in 2021 says that each bitcoin transaction consumes approximately 707 kWh, not including energy used in cooling which can be significant. Another estimate from MoneySuperMarket.com in 2021 estimates 1,173 KwH, which would be enough to power a US home for several weeks. A 2022 estimate from Digiconomist claims 1,449 kWh per transaction, which would cost approximately USD $173 at average rates. Blockchain startup investor Nic Carter, writing for the Harvard Business Review has claimed that estimates like the previous are generally misleading because the vast majority of energy used by bitcoin is used to mine bitcoins while verifying transactions. Because transaction fees account for around 10% of miner revenue, he says, the true value would be 1/10th of the above.

In September 2022, a report in the journal Scientific Reports found that from 2016 to 2021, each US dollar worth of mined bitcoin market value also caused 35 cents worth of climate damage. This is comparable to the beef industry which causes 33 cents per dollar, and the gasoline industry which causes 41 cents per dollar. Compared to gold mining, "Bitcoin's climate damage share is nearly an order of magnitude higher" according to study co-author economist Andrew Goodkind.

Electronic waste

For broader coverage of this topic, see Electronic waste § Cryptocurrency e-waste.

Bitcoins are usually mined on specialized computer equipment, which produces significant e-waste due to its short life expectancy. Bitcoin's annual e-waste is estimated to be over 30,000 tonnes as of May 2021, which is comparable to the small IT equipment waste produced by the Netherlands. One bitcoin generates 272 g (9.6 oz) of e-waste per transaction. Due to the consistent increase of the bitcoin network's hashrate, mining devices are estimated to have an average lifespan of 1.29 years until they become unprofitable and need to be replaced. Other estimates assume that a bitcoin transaction generates about 380 g (13 oz) of e-waste, equivalent to 2.35 iPhones. Unlike most computing hardware, the used application-specific integrated circuits have no alternative use beyond bitcoin mining.

Reducing the environmental impact of bitcoin is possible by mining only using clean electricity sources. Some policymakers have called for further restrictions or outright bans on bitcoin mining.

Responses

A survey on technologies approached cryptocurrencies' technological and environmental issues from many perspectives and noted the plans of using the methods of unconventional computing and grid computing to make bitcoin both greener and more justified.

Per a 2021 study in Finance Research Letters, "climate-related criticism of bitcoin is primarily based on the network's absolute carbon emissions, without considering its market value." It argues that the inclusion of bitcoin in an equity portfolio reduces that portfolio's "aggregate carbon emissions".

A potential shift from proof-of-work to the more energy-efficient proof-of-stake has been compared to the shift from fossil-fueled to electric vehicles.

Proposed pairing with variable renewable energy sources

The development of intermittent renewable energy sources, such as wind power and solar power, is challenging because they cause instability in the electrical grid. Several papers concluded that these renewable power stations could use the surplus energy to mine bitcoin and thereby reduce curtailment, hedge electricity price risk, stabilize the grid, increase the profitability of renewable energy infrastructure, and therefore accelerate transition to sustainable energy and decrease bitcoin's carbon footprint.

Notes

- Other cryptocurrencies, such as Ethereum, are not proof-of-work but proof-of-stake, which consumes less electricity.

References

- ^ Badea, Liana; Mungiu-Pupӑzan, Mariana Claudia (2021). "The Economic and Environmental Impact of Bitcoin". IEEE Access. 9: 48091–48104. doi:10.1109/ACCESS.2021.3068636. ISSN 2169-3536. S2CID 233137507.

- ^ Huang, Jon; O'Neill, Claire; Tabuchi, Hiroko (3 September 2021). "Bitcoin Uses More Electricity Than Many Countries. How Is That Possible?". The New York Times. ISSN 0362-4331. Retrieved 16 January 2022.

- "A deep dive into Bitcoin's environmental impact". Cambridge Judge Business School. 2022-09-27. Retrieved 2022-10-28.

- Messina, Irene (2023-08-31). "Bitcoin electricity consumption: an improved assessment - News & insight". Cambridge Judge Business School. Retrieved 2023-09-07.

- ^ de Vries, Alex; Stoll, Christian (1 December 2021). "Bitcoin's growing e-waste problem". Resources, Conservation and Recycling. 175: 105901. doi:10.1016/j.resconrec.2021.105901. ISSN 0921-3449. S2CID 240585651.

- Hern, Alex (17 January 2018). "Bitcoin's energy usage is huge – we can't afford to ignore it". The Guardian. Archived from the original on 23 January 2018. Retrieved 18 September 2019.

- Ethan, Lou (17 January 2019). "Bitcoin as big oil: the next big environmental fight?". The Guardian. Archived from the original on 29 August 2019. Retrieved 18 September 2019.

- Rudgard, Olivia (24 April 2022). "Environmental charities ditch cryptocurrencies after admitting they damage the planet". The Telegraph. Retrieved 28 October 2022.

- "Cambridge Bitcoin Electricity Consumption Index (CBECI)". ccaf.io. Retrieved 2022-01-16.

- "How bad is Bitcoin for the environment really?". Independent. 12 February 2021. Retrieved 15 February 2021.

requires nearly as much energy as the entire country of Argentina

- Kamiya, George. "Commentary: Bitcoin energy use - mined the gap". iea.org. Archived from the original on 3 March 2020. Retrieved 5 December 2019.

- "Bitcoin mining actually uses less energy than traditional banking, new report claims". The Independent. 2021-05-18. Retrieved 2022-01-16.

- "Bitcoin is literally ruining the earth, claim experts". The Independent. 6 December 2017. Archived from the original on 19 January 2018. Retrieved 23 January 2018.

- "The Hard Math Behind Bitcoin's Global Warming Problem". WIRED. 15 December 2017. Archived from the original on 21 January 2018. Retrieved 23 January 2018.

- Ponciano, Jonathan (18 April 2021). "Crypto Flash Crash Wiped Out $300 Billion In Less Than 24 Hours, Spurring Massive Bitcoin Liquidations". Forbes. Retrieved 24 April 2021.

- Murtaugh, Dan (9 February 2021). "The Possible Xinjiang Coal Link in Tesla's Bitcoin Binge". Bloomberg.com. Retrieved 24 April 2021.

- "Cambridge Bitcoin Electricity Consumption Index (CBECI)". ccaf.io. Retrieved 2022-01-16.

- Sigalos, MacKenzie (20 July 2021). "Bitcoin mining isn't nearly as bad for the environment as it used to be, new data shows". CNBC. Retrieved 16 January 2022.

- Mellor, Sophie (9 December 2021). "Bitcoin miners have returned to the record activity they had before China's crypto crackdown". Fortune.

- "Kazakhstan 2022 – Analysis". IEA. Retrieved 2022-10-28.

- Swaminathan, Nikhil (6 May 2021). "This power plant stopped burning fossil fuels. Then Bitcoin came along". Grist. Retrieved 28 October 2022.

- Knauss, Tim (30 June 2022). "NY denies permit for Bitcoin-mining power plant near Seneca Lake". Syracuse.com. Retrieved 28 October 2022.

- Morgenson, Gretchen (30 June 2022). "New York state denies air permit to bitcoin mining plant on Seneca Lake". NBC News. Retrieved 28 October 2022.

- ^ "How Much Energy Does Bitcoin Actually Consume?". Harvard Business Review. 2021-05-05. Retrieved 2023-10-05.

- ^ McDonald, Matthew Tiger; Hayibo, Koami Soulemane; Hafting, Finn; Pearce, Joshua (2023-02-27). "Economics of Open-Source Solar Photovoltaic Powered Cryptocurrency Mining". Ledger. 8. doi:10.5195/ledger.2023.278. ISSN 2379-5980.

- "Crypto-assets are a threat to the climate transition – energy-intensive mining should be banned". Finansinspektionen. 5 November 2021. Retrieved 2 February 2022.

- Szalay, Eva (19 January 2022). "EU should ban energy-intensive mode of crypto mining, regulator says". Financial Times. Retrieved 2 February 2022.

- ^ Moore, Kathleen (8 July 2021). "Mechanicville hydro plant gets new life". Times Union. Retrieved 23 February 2022.

- Murillo, Alvaro (12 January 2022). "Costa Rica hydro plant gets new lease on life from crypto mining". Reuters.com. Retrieved 23 February 2022.

- Phan, Trung (2023-05-03). "Methane Is a Big Climate Problem That Bitcoin Can Help Solve". Bloomberg. Retrieved 2023-10-06.

- Foteinis, Spyros (2018). "Bitcoin's alarming carbon footprint". Nature. 554 (7691): 169. Bibcode:2018Natur.554..169F. doi:10.1038/d41586-018-01625-x.

- Krause, Max J.; Tolaymat, Thabet (2018). "Quantification of energy and carbon costs for mining cryptocurrencies". Nature Sustainability. 1 (11): 711–718. doi:10.1038/s41893-018-0152-7. S2CID 169170289.

- ^ Stoll, Christian; Klaaßen, Lena; Gallersdörfer, Ulrich (2019). "The Carbon Footprint of Bitcoin". Joule. 3 (7): 1647–1661. doi:10.1016/j.joule.2019.05.012.

- ^ Baur, Dirk G.; Oll, Josua (2021-11-20). "Bitcoin investments and climate change: A financial and carbon intensity perspective". Finance Research Letters. 47: 102575. doi:10.1016/j.frl.2021.102575. ISSN 1544-6123. S2CID 244470483.

- Köhler, Susanne; Pizzol, Massimo (20 November 2019). "Life Cycle Assessment of Bitcoin Mining". Environmental Science & Technology. 53 (23): 13598–13606. Bibcode:2019EnST...5313598K. doi:10.1021/acs.est.9b05687. PMID 31746188.

- "Bitcoin's Impacts on Climate and the Environment". State of the Planet. Columbia University. 20 September 2021. Retrieved 4 October 2023.

Bitcoin is thought to consume 707 kwH per transaction. In addition, the computers consume additional energy because they generate heat and need to be kept cool.

- Tully, Shawn (26 October 2021). "Every Bitcoin transaction consumes over $100 in electricity". Fortune. Retrieved 4 October 2023.

The report states that each Bitcoin transaction consumes 1,173 kilowatt hours of electricity. That's the volume of energy that could "power the typical American home for six weeks," the authors add.

- Gonzales, Oscar (18 July 2022). "Bitcoin Mining: How Much Electricity It Takes and Why People Are Worried". CNET. Retrieved 4 October 2023.

The Digiconomist's Bitcoin Energy Consumption Index estimated that one bitcoin transaction takes 1,449 kWh to complete, or the equivalent of approximately 50 days of power for the average US household. To put that into money terms, the average cost per kWh in the US is close to 12 cents. That means a bitcoin transaction would generate approximately an energy bill of $173.

- Calma, Justine (29 September 2022). "Bitcoin's climate damage is similar to beef and crude oil, says new study". The Verge. Retrieved 30 September 2022.

- McGinn, Miyo (29 September 2022). "Bitcoin's steep environmental costs go beyond its hunger for energy". Popular Science. Retrieved 30 September 2022.

- Jones, Benjamin A.; Goodkind, Andrew L.; Berrens, Robert P. (29 September 2022). "Economic estimation of Bitcoin mining's climate damages demonstrates closer resemblance to digital crude than digital gold". Scientific Reports. 12 (1): 14512. Bibcode:2022NatSR..1214512J. doi:10.1038/s41598-022-18686-8. ISSN 2045-2322. PMC 9522801. PMID 36175441.

- ^ de Vries, Alex; Stoll, Christian (December 2021). "Bitcoin's growing e-waste problem". Resources, Conservation and Recycling. 175: 105901. doi:10.1016/j.resconrec.2021.105901. S2CID 240585651.

- "Bitcoin mining producing tonnes of waste". BBC News. 20 September 2021. Retrieved 27 February 2022.

- "Bitcoin Electronic Waste Monitor". Digiconomist. Retrieved 27 February 2022.

- "Waste from one bitcoin transaction 'like binning two iPhones'". The Guardian. 17 September 2021. Retrieved 27 February 2022.

- "Bitcoin mining producing tonnes of waste". BBC News. 20 September 2021. Retrieved 1 February 2022.

- AP (2022-04-21). "Going green: How to ditch fossil fuels powering the bitcoin network". www.business-standard.com. Retrieved 2022-10-11.

- Frost, Rosie (2021-11-03). "Will Bitcoin survive without a shift to renewable energy?". euronews. Retrieved 2022-10-11.

- ^ Gschossmann, Isabella; van der Kraaij, Anton; Benoit, Pierre-Loïc; Rocher., Emmanuel (2022-07-11). "Mining the environment – is climate risk priced into crypto-assets?". Macroprudential Bulletin (18). European Central Bank.

- Hiar, Corbin (10 March 2022). "Biden Orders Report on Climate Risk of Cryptocurrencies". Scientific American. Retrieved 27 October 2022.

- Heinonen, Henri T.; Semenov, Alexander; Veijalainen, Jari; Hamalainen, Timo (2022). "A Survey on Technologies Which Make Bitcoin Greener or More Justified". IEEE Access. 10: 74792–74814. doi:10.1109/ACCESS.2022.3190891. S2CID 250580065.

- "Proof of Work vs. Proof of Stake: Ethereum's Recent Price Surge Shows Why the Difference Matters". NextAdvisor. 2022-07-29. ISSN 0040-781X. Retrieved 2022-10-11 – via Time.com.

- "Cardano's Ada Wants to Solve Some of Crypto's Biggest Challenges". Wall Street Journal. 28 September 2021. Retrieved 28 October 2022.

- "Bitcoin's growing energy problem: 'It's a dirty currency'". Financial Times. 2021-05-20. Retrieved 2023-04-06.

- Fridgen, Gilbert; Körner, Marc-Fabian; Walters, Steffen; Weibelzahl, Martin (9 March 2021). "Not All Doom and Gloom: How Energy-Intensive and Temporally Flexible Data Center Applications May Actually Promote Renewable Energy Sources". Business & Information Systems Engineering. 63 (3): 243–256. doi:10.1007/s12599-021-00686-z. ISSN 2363-7005. S2CID 233664180.

To gain applicable knowledge, this paper evaluates the developed model by means of two use-cases with real-world data, namely AWS computing instances for training Machine Learning algorithms and Bitcoin mining as relevant DC applications. The results illustrate that for both cases the NPV of the IES compared to a stand-alone RES-plant increases, which may lead to a promotion of RES-plants.

- Mona E. Dajani (2021) “Green Bitcoin Does Not Have to Be an Oxymoron”, Bloomberg Law, https://news.bloomberglaw.com/environment-and-energy/green-bitcoin-does-not-have-to-be-an-oxymoron

- Moffit, Tim (2021-06-01). "Beyond Boom and Bust: An emerging clean energy economy in Wyoming". UC San Diego: Climate Science and Policy.

Currently, projects are under development, but the issue of overgenerated wind continues to exist. By harnessing the overgenerated wind for Bitcoin mining, Wyoming has the opportunity to redistribute the global hashrate, incentivize Bitcoin miners to move their operations to Wyoming, and stimulate job growth as a result.

- Eid, Bilal; Islam, Md Rabiul; Shah, Rakibuzzaman; Nahid, Abdullah-Al; Kouzani, Abbas Z.; Mahmud, M. A. Parvez (2021-11-01). "Enhanced Profitability of Photovoltaic Plants By Utilizing Cryptocurrency-Based Mining Load". IEEE Transactions on Applied Superconductivity. 31 (8): 1–5. Bibcode:2021ITAS...3196503E. doi:10.1109/TASC.2021.3096503. hdl:20.500.11782/2513. ISSN 1558-2515. S2CID 237245955.

The grid connected photovoltaic (PV) power plants (PVPPs) are booming nowadays. The main problem facing the PV power plants deployment is the intermittency which leads to instability of the grid. This paper investigating the usage of a customized load - cryptocurrency mining rig - to create an added value for the owner of the plant and increase the ROI of the project. The developed strategy is able to keep the profitability as high as possible during the fluctuation of the mining network.

- Bastian-Pinto, Carlos L.; Araujo, Felipe V. de S.; Brandão, Luiz E.; Gomes, Leonardo L. (2021-03-01). "Hedging renewable energy investments with Bitcoin mining". Renewable and Sustainable Energy Reviews. 138: 110520. doi:10.1016/j.rser.2020.110520. ISSN 1364-0321. S2CID 228861639.

Windfarms can hedge electricity price risk by investing in Bitcoin mining. These findings, which can also be applied to other renewable energy sources, may be of interest to both the energy generator as well as the system regulator as it creates an incentive for early investment in sustainable and renewable energy sources.

Further reading

- OSTP (2022) , Climate and Energy Implications of Crypto-Assets in the United States (PDF), Washington, D.C.: White House Office of Science and Technology Policy

- DeRoche, Mandy; Fisher, Jeremy; Thorpe, Nick; Wachspress, Megan (September 2022). "The Energy Bomb: How Proof-of-Work Cryptocurrency Mining Worsens the Climate Crisis and Harms Communities Now" (PDF). Earthjustice / Sierra Club. Retrieved 1 November 2022.

| Cryptocurrencies | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Technology | |||||||||||||||

| Consensus mechanisms | |||||||||||||||

| Proof of work currencies |

| ||||||||||||||

| Proof of stake currencies | |||||||||||||||

| ERC-20 tokens | |||||||||||||||

| Stablecoins | |||||||||||||||

| Other currencies | |||||||||||||||

| Inactive currencies | |||||||||||||||

| Crypto service companies | |||||||||||||||

| Related topics |

| ||||||||||||||