This is an old revision of this page, as edited by 194.66.72.76 (talk) at 13:21, 24 March 2010 (→Long butterfly). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 13:21, 24 March 2010 by 194.66.72.76 (talk) (→Long butterfly)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)

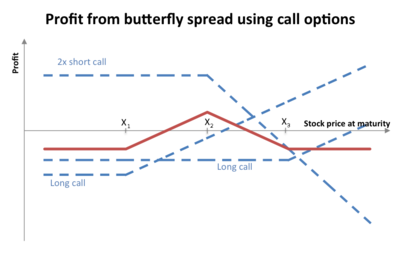

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a large probability of earning a small limited profit when the future volatility of the underlying is expected to be different from the implied volatility.

Short butterfly

A short butterfly position will make profit if the future volatility is higher than the implied volatility.

A short butterfly options strategy consists of the same options as a long butterfly. However all the long option positions are short and all the short option positions are long.

Variations of the butterfly

The double option position in the middle is called the body, while the two other positions are called the wings.

The option strategy where the middle two positions have different strike price is known as an Iron condor.

In an unbalanced butterfly the variable "a" has two different values.

References

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

{{cite book}}:|edition=has extra text (help)

External links

- Long and Short Butterflies graphically illustrates component options in long and short butterflies.

- Butterfly Spreads - Spread Your Wings & Profit things you should know about Butterfly Spreads