This is an old revision of this page, as edited by VictorD7 (talk | contribs) at 08:40, 5 January 2014 (→Better textual descriptions of economic inequality: Reply.). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 08:40, 5 January 2014 by VictorD7 (talk | contribs) (→Better textual descriptions of economic inequality: Reply.)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)| This is the talk page for discussing improvements to the United States article. This is not a forum for general discussion of the article's subject. |

|

| Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: Index, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, 51, 52, 53, 54, 55, 56, 57, 58, 59, 60, 61, 62, 63, 64, 65, 66, 67, 68, 69, 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, 88, 89, 90, 91, 92, 93, 94, 95, 96, 97, 98, 99, 100, 101, 102, 103, 104, 105, 106, 107, 108, 109, 110, 111, 112, 113, 114, 115, 116Auto-archiving period: 45 days |

2. How about Switzerland?

Many people in the United States are told it is the oldest republic and has the oldest constitution, however one must use a narrow definition of constitution. Within Misplaced Pages articles it may be appropriate to add a modifier such as "oldest continuous, federal ..." however it is more useful to explain the strength and influence of the US constitution and political system both domestically and globally. One must also be careful using the word "democratic" due to the limited franchise in early US history and better explain the pioneering expansion of the democratic system and subsequent influence.

| |||||||

| This article has not yet been rated on Misplaced Pages's content assessment scale. It is of interest to the following WikiProjects: | |||||||||||||||||||||||||||||||||||||||||||||||||||

Please add the quality rating to the {{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

{{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

{{WikiProject banner shell}} template instead of this project banner. See WP:PIQA for details.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

This article has been mentioned by multiple media organizations:

|

| This article is substantially duplicated by a piece in an external publication. Since the external publication copied Misplaced Pages rather than the reverse, please do not flag this article as a copyright violation of the following sources:

|

Template:Outline of knowledge coverage

| This article is written in American English, which has its own spelling conventions (color, defense, traveled) and some terms that are used in it may be different or absent from other varieties of English. According to the relevant style guide, this should not be changed without broad consensus. |

| This is the talk page for discussing improvements to the United States article. This is not a forum for general discussion of the article's subject. |

|

| Find sources: Google (books · news · scholar · free images · WP refs) · FENS · JSTOR · TWL |

| Archives: Index, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, 51, 52, 53, 54, 55, 56, 57, 58, 59, 60, 61, 62, 63, 64, 65, 66, 67, 68, 69, 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, 88, 89, 90, 91, 92, 93, 94, 95, 96, 97, 98, 99, 100, 101, 102, 103, 104, 105, 106, 107, 108, 109, 110, 111, 112, 113, 114, 115, 116Auto-archiving period: 45 days |

Inequality, tax incidence, and AP survey

- Ellen's replacement of the very long-standing (by several years) housing development image with yet another politically-motivated inequality graph needs to be discussed first. The image is long-standing because it is neutral and cannot be disputed, and this graph does nothing but continue to over-emphasize inequality issues in the country.

- The removal of both graphs in Government finance (including the ITEP one) as a compromise has gone uncontested for weeks. The re-addition of just one of the graphs threatens to stir the pot once again on an issue that had been settled.

- "Four out of five U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives." This has already been described as a frivolous, highly vague statement that is not elaborated on at all, and does not add anything valuable to the other details in the section. Its removal weeks ago was not contested by anyone, except now EllenCT.

In Ellen's 2-3 week-long absence this article has remained relatively stable, and changes made weeks ago had been agreed on or uncontested, and it shows that there are only a couple of users here that catalyze edit disputes and article instability. Cadiomals (talk) 08:22, 1 December 2013 (UTC)

- Regarding your deletions:

- The housing image is not an image of housing development, just suburban subdivision-style ranch housing which is neither unique to or particularly illustrative of the United States, given that such style of housing exists on every continent except Antarctica, nor illustrative of the section it is in. The article is filled with uninformative photographs. Replacing a photo of suburban housing with an image showing the rise of the top 1% of incomes, as was specifically requested in other comments above, objectively improves the article and the section. There is no evidence that inequality issues are over-emphasized in the article. There is abundant evidence that inequality issues are not given the weight due their importance in economics.

- The Heritage Foundation income tax incidence graph is objectively and mathematically incorrect, and was rightly removed. Even VictorD7 admits that corporate taxes are borne in large part by low income consumers. The ITEP graph is supported by the many sources which correctly attribute corporate tax incidence, even if a few recent think tank sources do not do so correctly. Pretending that there is no objective mathematical truth is the worst kind of abuse of the NPOV policy, tantamount to "he-said-she-said" journalism in the face of obvious factual accuracy of one side and inaccuracy of the other, or the view from nowhere which is rejected by reputable editors with reputations for fact checking and accuracy. I will continue to replace the accurate graph in accordance with the comments about it from the majority of respondents concerning it in the sections above.

- I will not be bullied because I turned my attention to other work for half a month. The AP poll indicating that 80% of Americans must deal with joblessness, low income, or welfare is not reflected in any other statements in the section or the article. There is no evidence that it is either frivolous or vague, and the assertion that it is not elaborated in the source cited is objectively false as anyone reading the source can see. I strongly object to such falsehoods being used to try to bully editors.

- The comments above indicate that the article has been losing editors because they are exhausted dealing with an editor who chooses to draw inferences from what he admits are contradictory premises. Who wants to read an encyclopedia by those who know they are harboring falsehoods, but allow their ideology to guide them down mathematically incorrect paths anyway? Not me, and I refuse to turn my back on this article just because one such person willingly edits with an admitted competence deficit. EllenCT (talk) 11:20, 1 December 2013 (UTC)

- When a long-standing image or piece of info is removed and subsequently disputed, it should be discussed first based on WP:BRD. The image is illustrative and follows relevant guidelines and recommendations, and no one has disputed it until now. You think there are a lot of "uninformative photographs" in this article because they are not all conveying the message you want them to.

- If your proposed replacement image is added there will then be two graphs portraying growing economic divides in the country. That is placing too much emphasis and weight to inequality in this summary section and article. And if you add your proposed graph, the graph showing the growing divide between "productivity and median incomes" ought to then be removed. Drilling it into the readers' heads that the US has inequality problems through multiple paragraphs and two graphs is placing undue weight and is a form of soapboxing and advocacy when there are many other aspects of the economy that are only brushed upon. Your argument that it is "crucial to current political debates" has absolutely no relevance in this summary article. Go nuts in Income inequality in the United States.

- I don't know as much about the ITEP tax graph. I just know that both graphs that used to be in the Government finance section were disputed, the section was trimmed and they were both removed as a compromise, and that this change had gone uncontested for weeks despite continued activity and discussion by many editors on the talk page, which also refutes your claim that it was uncontested because editors were driven away. Nevertheless, this will be put to a definitive vote and I of course will respect consensus if many really want it re-added.

- That statement is vague. It's the same as saying 95% of people have had either a headache or breast cancer at some point in their lives, or that 90% of Americans own either a car or an airplane. 80% of Americans deal with joblessness and low-income at some point in their lives? I'm surprised it isn't 95% percent. It is no surprise that most Americans have likely been jobless at some point if they are laid off or look for a new one; that is typical of almost every country. And who hasn't been low-income at some point in early adulthood, when one is still in an internship or entry-level job? Very few readers are going to check the source for clarification. The statement conveys nothing of educational value to the reader, except for furthering the biased tone in the section you wish to convey: that Americans somehow experience undue hardship relative to other countries.

- The best way to resolve this of course is to bring in other editors' opinions for the survey below. Cadiomals (talk) 13:31, 1 December 2013 (UTC)

- EllenCT just told multiple outright lies. I already corrected her mischaracterization of my views on corporate taxation here (diffs , , , , ) so she has no excuse for invoking my name and repeating that falsehood here. I've always consistently said that corporate tax incidence should be attributed to owners since they're the ones most directly paying them, that they're only borne by others (not just consumers) in the same way all taxes are borne by others, and that we shouldn't cherry-pick a single tax type for political reasons and treat it differently when determining tax incidence. And what "Heritage Foundation income tax incidence graph" is she referring to? The graph was drawn by the Peter G. Peterson Foundation based on Tax Policy Center numbers, not the Heritage Foundation, and she hasn't shown it's "inaccurate" in any way. The Tax Policy Center is far more widely cited and mainstream than ITEP (and its liberal lobbying arm, CTJ), and, as my link to the archived discussion shows, she was unable to answer my basic questions about how her graph even got its numbers, how it attributes corporate incidence (or anything else), or why its internal federal rates are such an outlier compared to the TPC and CBO, both of which corroborate each other and contradict ITEP over time. A single editor bent on soapboxing should not be allowed to destroy this article's fragile stability with loads of massive, undiscussed, contentious edits, or get away with outright lies about other editors and content. We can't let this article be hijacked into becoming a platform for one sided partisan propaganda. Even her flimsy edit summary justifications betray her partisan POV agenda, repeatedly citing things like "material central to recent political debates" or "campaigns". She's a disruptive talking point spammer with no regard for the Talk Page process or encyclopedic quality. VictorD7 (talk) 20:47, 1 December 2013 (UTC)

- You have not exactly been helpful in the progress of this article either, Victor, so I would advise you be more mellow this time and also keep your responses more concise. In my opinion your full revert of Ellen's changes as opposed to my partial revert was uncalled for and catalyzes edit wars. Both you and Ellen's insistence on fully getting your way has been a roadblock in achieving a balanced and stable article and frustrating for the majority of editors who are less politically motivated and more willing to compromise. Both of you will need to respect consensus no matter which way it goes. Cadiomals (talk) 22:51, 1 December 2013 (UTC)

- Actually I'm one of the primary reasons this article has improved over the past year and in particular in recent weeks, and I have a right to correct outright falsehoods, especially when my name is invoked. I didn't fully revert Ellen's changes as I left the one proposal that had been specifically discussed. The other changes are controversial and opposed. I obviously haven't gotten my way on many things, but one difference between me and Ellen is that I respect the Talk Page process and have shown that I'm willing to participate in it. Significant changes should be discussed here before implementation, especially to the politically sensitive sections. A return to mass, unilateral, undiscussed edits will undo everything that's been accomplished in recent weeks, sparking off new waves of continuous counter editing, bloating, and likely edit warring. VictorD7 (talk) 23:51, 1 December 2013 (UTC)

- You have not exactly been helpful in the progress of this article either, Victor, so I would advise you be more mellow this time and also keep your responses more concise. In my opinion your full revert of Ellen's changes as opposed to my partial revert was uncalled for and catalyzes edit wars. Both you and Ellen's insistence on fully getting your way has been a roadblock in achieving a balanced and stable article and frustrating for the majority of editors who are less politically motivated and more willing to compromise. Both of you will need to respect consensus no matter which way it goes. Cadiomals (talk) 22:51, 1 December 2013 (UTC)

- EllenCT just told multiple outright lies. I already corrected her mischaracterization of my views on corporate taxation here (diffs , , , , ) so she has no excuse for invoking my name and repeating that falsehood here. I've always consistently said that corporate tax incidence should be attributed to owners since they're the ones most directly paying them, that they're only borne by others (not just consumers) in the same way all taxes are borne by others, and that we shouldn't cherry-pick a single tax type for political reasons and treat it differently when determining tax incidence. And what "Heritage Foundation income tax incidence graph" is she referring to? The graph was drawn by the Peter G. Peterson Foundation based on Tax Policy Center numbers, not the Heritage Foundation, and she hasn't shown it's "inaccurate" in any way. The Tax Policy Center is far more widely cited and mainstream than ITEP (and its liberal lobbying arm, CTJ), and, as my link to the archived discussion shows, she was unable to answer my basic questions about how her graph even got its numbers, how it attributes corporate incidence (or anything else), or why its internal federal rates are such an outlier compared to the TPC and CBO, both of which corroborate each other and contradict ITEP over time. A single editor bent on soapboxing should not be allowed to destroy this article's fragile stability with loads of massive, undiscussed, contentious edits, or get away with outright lies about other editors and content. We can't let this article be hijacked into becoming a platform for one sided partisan propaganda. Even her flimsy edit summary justifications betray her partisan POV agenda, repeatedly citing things like "material central to recent political debates" or "campaigns". She's a disruptive talking point spammer with no regard for the Talk Page process or encyclopedic quality. VictorD7 (talk) 20:47, 1 December 2013 (UTC)

Survey

There is currently a dispute (and a discussion above) about whether a few pieces of information are fit to be added to the Government finance and Income, poverty, and wealth sections. Please see the arguments in the thread above and indicate with "support adding" or "oppose adding" as well as your opinion:

Income inequality

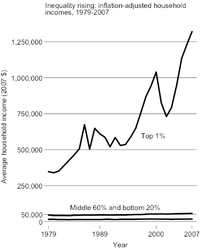

Should EllenCT's proposed image to the right be added to Income, poverty, and wealth, replacing the long-standing (by several years) housing development image and alongside a similar image also showing growing economic divides? Or should it be traded out with the other graph while keeping the housing image? What do you think of the emphasis the section currently places on income inequality?

- Oppose adding based on my arguments above. Cadiomals (talk) 13:30, 1 December 2013 (UTC)

- Oppose, for reasons given. Also the graph is intentionally skewed in appearance by 1% of the pop. which was disproportionately boosted by the bull stock market of much of the period. Ellen's own past inclusion observes that real median income rose over most of that period, but the skewed graph hides the increase by featuring an infinitesimal portion of the country. VictorD7 (talk) 21:41, 1 December 2013 (UTC)

- Support per the ability to reason correctly when contradictions are eliminated. The proposed graph is more informative than the graph proposed above which only shows one variable (proportion of incomes in top 1%) instead of three (the middle 60% and lower 20%) -- who speaks for the lower 20% on Misplaced Pages? EllenCT (talk) 00:03, 2 December 2013 (UTC)

- Ellen is referring to the "graph proposed above" that was rejected by most respondents, so to be clear this isn't a choice between those two options. VictorD7 (talk) 00:48, 2 December 2013 (UTC)

- Support, per ellen. Pass a Method talk 20:37, 2 December 2013 (UTC)

- Oppose A graph showing this might be useful, but this graph is not satisfactory. It tries to show three different line with widely varying magnitude on the same linear axis, which means the actual values of the two lower ones cannot be determined. It would probably be better to use a single line for the top 1%, but if all 3 are really wanted a log scale would be needed or separate graphs--these would, though, be less dramatic. DGG ( talk ) 00:15, 3 December 2013 (UTC)

- Why not have a graph that shows the change in incomes for the population as a whole, rather than choosing certain sections of the population? Its just confusing this way. Rwenonah (talk) 23:55, 2 December 2013 (UTC)

- So do you support or oppose adding this particular graph? This is the specific issue right now; we can discuss possible alternative graphs afterwards/separately. Cadiomals (talk) 01:54, 3 December 2013 (UTC)

- OpposePer objections above.Rwenonah (talk) 12:22, 3 December 2013 (UTC)

- Oppose per above. Graph needs adjusting. →Davey2010→→Talk to me!→ 21:43, 7 December 2013 (UTC)

- Oppose excessive detail for this specific article. Any arguments on the merits are irrelevant as far as I am concerned. If this information has merit as claimed, it would be perfectly appropriate in a different article (not saying it does, though, I have not evaluated it as such) but it simply is too esoteric for this overview article --Jayron32 18:22, 9 December 2013 (UTC)

- Support The general rule is that more information is better than less, and people looking at Misplaced Pages for information on the United States will most likely use Misplaced Pages as their sole source. The information is relevant and valid so it should be included. Remember: Misplaced Pages seeks to be encyclopedic, and the information is relevant and informative. Damotclese (talk) 19:01, 10 December 2013 (UTC)

- Qualified Support I think the graph could be improved (as has been noted, scale obscures information about the two lower categories), but failing that, there are no disputes about accuracy and it is a good graphical summary of an important issue. I've seen variants of this in blogs that are generally considered right and left of the political spectrum and do not believe graph is POV. As to those who believe too detailed, this summary graphic seems appropriate to overview article. Note: Here from WP:FRS Haven't previously been involved with this article. --Federalist51 (talk) 18:34, 13 December 2013 (UTC)

- Qualified Support As above, it'll always be seen as a "dodgy" graph when the Y Axis is skewed like that. If that issue was fixed, I'd fully support the inclusion of that graph. But until the graph is fixed, I don't support it. --HighKing (talk) 11:36, 16 December 2013 (UTC)

- Oppose. Aside from rounding errors, any graph showing this kind of data absolutely needs to account for 100% of the people. Because it leaves out 19% of the population, I'm suspecting that someone's begging the question. Bring in a graph showing the average incomes of the bottom 20%, the middle 60%, the upper 19%, and the top 1%, and I'll be much more inclined to support it. I also note that Jayron's got a solid argument about this kind of graph being out of place in such a broad article; Damotclese's argument fails on WP:SS grounds. More is better than less, but we can get to the "too much" point like any other encyclopedia; the only difference is that our virtually unlimited space means that we split extra details out to a more specific article instead of removing them entirely. Nyttend (talk) 01:36, 17 December 2013 (UTC)

- Oppose The original source (which is specifically a blog estopped by WP:RS) states: Income inequality in the United States has been rising since the 1970s. What is the most effective way to succinctly convey this fact? Here is my choice which rather clarifies that the purpose of the graph is to accentuate the "income inequality" claim. The heading of Kenworthy's blog post is "The politics of helping the poor Politics and rising income inequality" and as a blog post it does not meet WP:RS for any purpose of making a claim -- and a graph is, indeed, a "claim" here. Collect (talk) 01:49, 17 December 2013 (UTC)

- Strong Support Speaking from a social scientist standpoint, income inequality is one of the primary indicators for what is happening in a society - much more so than housing. It should definitely be included. LK (talk) 04:10, 19 December 2013 (UTC)

- Oppose This looks like it was pulled from a "We are the 99%" pamphlet. What about the top 5%, 10%, top 20%? Why just the bottom 20% and 60%? Why the 1%? This looks like it was created to make a specific point regarding inequality and highlight a distinction to push a POV, which I don't think is appropriate. If we're going to include something, it should try to include a more full range and not cherry pick the figures that make the most shocking graph. Morphh 14:50, 19 December 2013 (UTC)

- Oppose per RfC comment: I oppose this particular graph. Each of the following flaws would need to be addressed: DGG (needs log scale on y-axis); Collect (source issues); Morphh (choose most relevant deciles, with justification as to why they're relevant). Also, I noticed that the time interval runs from 1979 to 2007. It is now nearly 2014. There IS more current data, from highly reputable sources, that include 2011. I know of one such chart from a recent OECD econometrics publication (October 2013) which is public domain. There are others. There's the issue of relevancy to the U.S.A. as well, in considering inclusion of a chart like this. The Emmanuel Saez charts compare the U.S., Germany, and Japan from 1910 to 2011. I would also suggest that income isn't even the most relevant information to present, but rather, asset holdings. Yearly income varies widely, especially for the very wealthy. Net asset value does not, and a chart with assets on the y-axis instead of income would be more meaningful. It is a trend that is unique to the USA in comparison to many other developed and even some developing nations. We need a good chart here, or nothing at all. Otherwise, our credibility will be diminished or possibly be considered political advocacy, which is entirely unacceptable.--FeralOink (talk) 21:14, 20 December 2013 (UTC)

Tax incidence

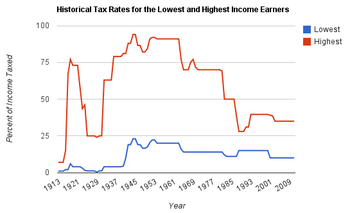

Should the ITEP tax graph to the right be re-added to the Government finance section or should the section remain without an image?

- Oppose adding based on my arguments above. Cadiomals (talk) 13:30, 1 December 2013 (UTC)

- Oppose, for reasons laid out above. Graph is from a partisan lobbyist and its accuracy is disputed by multiple reliable sources. VictorD7 (talk) 21:41, 1 December 2013 (UTC)

- Support per Ostry and Berg (2011). EllenCT (talk) 23:20, 1 December 2013 (UTC)

- That link doesn't appear to mention the graph (unless I missed it) or be pertinent to this topic. VictorD7 (talk) 00:48, 2 December 2013 (UTC)

- Can you think of the reason that I think it supports it? EllenCT (talk) 01:03, 2 December 2013 (UTC)

- I'd hate to presume. VictorD7 (talk) 01:12, 2 December 2013 (UTC)

- Your best guess? EllenCT (talk) 16:36, 4 December 2013 (UTC)

- I'd hate to presume. VictorD7 (talk) 01:12, 2 December 2013 (UTC)

- Can you think of the reason that I think it supports it? EllenCT (talk) 01:03, 2 December 2013 (UTC)

- That link doesn't appear to mention the graph (unless I missed it) or be pertinent to this topic. VictorD7 (talk) 00:48, 2 December 2013 (UTC)

- Support per reasoning cited by ellen Pass a Method talk 20:39, 2 December 2013 (UTC)

- Oppose a graph that tries to lump state & local (which can vary wildly) and federal taxes (a combination of over 100 tax systems) along with mixing different tax bases (income & consumption) is not appropriate. You can't even measure these the same way. Any such graph is filled with tons of assumptions and heavily modeled for tax incidence and considering the source, highly partisan. It's not even clear how they came up with these figures. If you're going to include graphs on taxation, federal taxation should be a different graph than state taxation, and consumption taxation should be separate from income taxation when showing distributional effects in order to make any logical sense out of the graph. Morphh 14:31, 19 December 2013 (UTC)

SupportOppose until an alternative source is found for the same information. The graph shows an important reality of local and state taxes for education including property taxes and sales taxes, for instance. Nearly a flat tax ideal by income distribution, with breaks in the aggregate for the most disadvantaged? The reality of American economic life-as-taxes is perhaps a conservative ideal? Where's the beef? TheVirginiaHistorian (talk) 06:54, 3 December 2013 (UTC)

- Virginia, where were you when I removed both of the graphs from Gov't finance weeks ago as a way to finally stop the bickering over it? If you really wanted to include this graph, why didn't you raise an objection on the talk page? Cadiomals (talk) 04:39, 4 December 2013 (UTC)

- The beef is it's inaccurate. It was cooked up by a far left lobbyist group and it's internal federal component is massively contradicted by the far more prominent Tax Policy Center (a joint Brookings and Urban Institute project), especially (but not only) for the top 1%, where there's around a 10 point difference. The CBO also tracks closely with the TPC over time, with the federal only top 1% tax rate around 30%, not around 20% (where ITEP has it), from year to year. By contrast the ITEP chart has no corroboration whatsoever, and an opaque methodology we can't examine. The differences aren't a one year fluke, but are consistent over time, as the link in my above post lays out. Doesn't any of that bother you? Shouldn't we hold off on making such a controversial chart the section image in a country summary article? The graph is disputed, unverifiable partisan propaganda. VictorD7 (talk) 19:54, 3 December 2013 (UTC)

- Here's a Tax Foundation piece criticizing the ITEP chart and showing a very different one for total taxation, with a bottom quintile rate of 13% and the entire top quintile (not just the top 1%) averaging 35.6%. VictorD7 (talk) 22:25, 3 December 2013 (UTC)

- That "piece" is neither accurate or in agreement with the peer reviewed literature. EllenCT (talk) 04:14, 4 December 2013 (UTC)

- Hogwash. So far I'm the only one between us actually backing up what I say. Whether you agree with it or not, it's just one more prominent source disputing your chart. VictorD7 (talk) 04:57, 4 December 2013 (UTC)

- That "piece" is neither accurate or in agreement with the peer reviewed literature. EllenCT (talk) 04:14, 4 December 2013 (UTC)

- Oppose The CBO and Tax Policy Center are far more mainstream and reliable sources for this kind of information. It's absurd to include such a heavily disputed partisan graph in a country summary.TheTimesAreAChanging (talk) 22:38, 3 December 2013 (UTC)

- Indeed, and as a solution and compromise we opted not to add any graphs to that section at all, including the one added by VictorD7. That was fine for everyone, but now EllenCT wants to stir the pot again, insisting we re-add just this one and drawing our attention back to a tired debate that had already been settled. Cadiomals (talk) 01:49, 4 December 2013 (UTC)

- Your characterization of the issue which has played very if not most prominently in recent election cycles as settled lacks accuracy. Deleting both graphs was obviously not "fine for everyone". EllenCT (talk) 04:16, 4 December 2013 (UTC)

- I meant everyone except you, because both graphs were removed three weeks ago and no one said a word about it despite continuous discussion on the talk page, mostly because people wanted to finally move on from that issue and the bickering over those graphs that had been occurring weeks prior. As such, the issue of including those graphs was settled, and it showed that you were really the only one insistent on advancing your political agenda. I couldn't care less about your babble regarding "election cycles". Cadiomals (talk) 04:39, 4 December 2013 (UTC)

- Settled it may be, but the editor opening this string sought multiple editor input regarding adding information to the encyclopedia. Could someone repost Victor's chart? (Is there really a question as to whether corporations are people too? I thought I was the only one in the country who disagreed with the Supreme Court at Citizens United.)

- It seems to me that Ellen might agree to Victor's chart now for the sake of presenting something on total effective tax rates, as the information conveyed is a relatively flat tax rate compared to national income tax, and that is informative to the general international reader unfamiliar with how federal regimes tax their populations in actuality. TheVirginiaHistorian (talk) 08:48, 4 December 2013 (UTC)

- Are you referring to the Heritage Foundation's chart which doesn't apportion corporate taxes to consumers? Are you aware of how few sources agree with that? Victor frequently cites all three. Meanwhile in reality.... EllenCT (talk) 16:35, 4 December 2013 (UTC)

- I don't know, does it show a relatively flat tax for total effective tax? If so it is of much the same utility to the general international reader, the difference in sources is a wash. ITEP, Heritage, CBO and Tax Policy Center were alternate sources mentioned above. To date in this string, I only see ITEP which generally corresponds to my earlier study, a relatively flat tax for total effective tax in the U.S. -- which is why I support ITEP until another source can be agreed to... which Cadiomals informs me cannot be done... for now ?? Might you allow something from CBO or Tax Policy Center, are their charts readily available at commons? TheVirginiaHistorian (talk) 18:20, 4 December 2013 (UTC)

- There is no "Heritage Foundation" chart. Ellen's confused (or lying again) and apparently referring to this PGPF chart of TPC numbers for federal tax rates. Note how its top 1% rate is a few points higher than ITEP's purported total rate. There are no good overall tax incidence charts, because it's notoriously difficult to study local/state taxes with precision. The only one I know of is the ITEP chart, but we know that's problematic because its internal federal component is contradicted so dramatically by the CBO and TPC, the two most prominent and widely cited outfits that do tax incidence. It was also lambasted by the Tax Foundation, which actually produced its own using TPC federal and ITEP state/local numbers, not that ITEP's state/local figures are necessarily credible either. It would be better to have no chart than to post misinformation cooked up by a partisan lobbyist. The relative flattening you mention (still nowhere near a flat tax) is already described in the text, which is a perfectly fair way to handle it. This also isn't about corporate taxation. That's a dishonest smokescreen tossed out by Ellen as a diversion. She has no idea how ITEP even attributes corporate taxes. Unlike the CBO and TPC, they don't provide component breakdowns and their methodology is opaque. Their chart says they count it, but even if they attributed zero to the top 1%, which would be ludicrous and would contradict a statement I found and posted by their spokesman, it still wouldn't account for the discrepancy. BTW, while Ellen's link has absolutely nothing to do with this topic, I have to say I'm shocked, shocked I tell you that liberals' predictions scored better in a cycle where Democrats won. It's a shame the "study" only looked at one election, and didn't examine if conservatives' predictions were better in a year Republicans won. VictorD7 (talk) 18:52, 4 December 2013 (UTC)

- I don't know, does it show a relatively flat tax for total effective tax? If so it is of much the same utility to the general international reader, the difference in sources is a wash. ITEP, Heritage, CBO and Tax Policy Center were alternate sources mentioned above. To date in this string, I only see ITEP which generally corresponds to my earlier study, a relatively flat tax for total effective tax in the U.S. -- which is why I support ITEP until another source can be agreed to... which Cadiomals informs me cannot be done... for now ?? Might you allow something from CBO or Tax Policy Center, are their charts readily available at commons? TheVirginiaHistorian (talk) 18:20, 4 December 2013 (UTC)

- Are you referring to the Heritage Foundation's chart which doesn't apportion corporate taxes to consumers? Are you aware of how few sources agree with that? Victor frequently cites all three. Meanwhile in reality.... EllenCT (talk) 16:35, 4 December 2013 (UTC)

- I meant everyone except you, because both graphs were removed three weeks ago and no one said a word about it despite continuous discussion on the talk page, mostly because people wanted to finally move on from that issue and the bickering over those graphs that had been occurring weeks prior. As such, the issue of including those graphs was settled, and it showed that you were really the only one insistent on advancing your political agenda. I couldn't care less about your babble regarding "election cycles". Cadiomals (talk) 04:39, 4 December 2013 (UTC)

- Your characterization of the issue which has played very if not most prominently in recent election cycles as settled lacks accuracy. Deleting both graphs was obviously not "fine for everyone". EllenCT (talk) 04:16, 4 December 2013 (UTC)

- Indeed, and as a solution and compromise we opted not to add any graphs to that section at all, including the one added by VictorD7. That was fine for everyone, but now EllenCT wants to stir the pot again, insisting we re-add just this one and drawing our attention back to a tired debate that had already been settled. Cadiomals (talk) 01:49, 4 December 2013 (UTC)

- The U.S. tax regime is highly regressive unless one takes into account federal and state and local taxes. That is the best picture of the actual effect on the individual. This is mostly attributed to local property taxes for education funding education, not national or state funding sources, leading to wild inconsistencies of funding levels from place to place and over time for any one place.

- Here is something from an VictorD7 sourced as generally unbiased, Wall Street Journal's the Tax Policy Center. It shows effective payroll tax rate in a manner which I find consistent with prior study. But for the first quintile progressive feature, the curve fitted to the bar graph is generally flat until the regressive tax structure for the richest incomes.

- The effective tax rate including state and local taxes is more like a flat tax. Do we have an alternative to the ITEP chart which shows the federal, state and local together in a federal system? I believe that would be instructive for the general international reader living in a centralized form of government. --- and lacking an alternative to the ITEP graph for now, we should use it because it does not show the statistical inequity that federal income taxes alone would in error. TheVirginiaHistorian (talk) 12:03, 8 December 2013 (UTC)

- I just posted an alternative by the Tax Foundation above that gives a radically different total overall breakdown. ITEP has zero corroboration and its internals are disputed by the TPC, CBO, and Tax Foundation. Misleading people with misinformation is not in Misplaced Pages's interest. TVH wants to use a hotly disputed, extremely partisan chart.....just because? We aren't obligated to have any image. If you don't want an alternative, then we don't have to add one. No one's seriously proposing a different image. And to my knowledge the TPC (which I never said is unbiased, it leans left but is the most prominent tax incidence outfit and produces reliable data) has nothing to do with the WSJ. Perhaps TVH is confused. I'm not sure what the point of the payroll tax chart is (the TPC chart he apparently objects to already showed the federal breakdown by component, including payroll), but in terms of international comparison (if that's what he was getting at) the US is more progressive than Europe in every tax type. I encourage TVH and anyone else here to actually read the sources posted. VictorD7 (talk) 22:06, 8 December 2013 (UTC)

- Lol; the reason VictorD7 uses the Tax Foundation source is because he can't find a real source supporting his argument (don't take my word for it, just ask him). More nonsense from a hardcore right winger. -- Somedifferentstuff (talk) 22:17, 8 December 2013 (UTC)

- LOL! I've just irrefutably made my case on every point using sources that include the Tax Policy Center, the CBO, the Tax Foundation, and even ITEP. And that lame, substanceless reply is all the hard core left winger Somedifferentstuff can muster. Telling. VictorD7 (talk) 22:38, 8 December 2013 (UTC)

- Yes, you've provided ZERO SOURCES other than TF. -- Have you applied for a job with the Koch Brothers yet??? -- Ahhhhhhhhhhh, the boy with the broken mirror. ---- Somedifferentstuff (talk) 23:07, 8 December 2013 (UTC)

- ^Ad hominem drivel. I've posted sources all over this section and page. Stop trying to disrupt the discussion process. VictorD7 (talk) 23:13, 8 December 2013 (UTC)

- Your reply is, "I WILL PROVIDE NO SOURCES HERE!". Brilliant right-wing garbage. -- Somedifferentstuff (talk) 23:27, 8 December 2013 (UTC)

- I suppose until Somedifferentstuff is condemned by other editors and/or banned for trollish disruption, I can repost sourced evidence every time he repeats his lie.

- Your reply is, "I WILL PROVIDE NO SOURCES HERE!". Brilliant right-wing garbage. -- Somedifferentstuff (talk) 23:27, 8 December 2013 (UTC)

- ^Ad hominem drivel. I've posted sources all over this section and page. Stop trying to disrupt the discussion process. VictorD7 (talk) 23:13, 8 December 2013 (UTC)

- Yes, you've provided ZERO SOURCES other than TF. -- Have you applied for a job with the Koch Brothers yet??? -- Ahhhhhhhhhhh, the boy with the broken mirror. ---- Somedifferentstuff (talk) 23:07, 8 December 2013 (UTC)

- LOL! I've just irrefutably made my case on every point using sources that include the Tax Policy Center, the CBO, the Tax Foundation, and even ITEP. And that lame, substanceless reply is all the hard core left winger Somedifferentstuff can muster. Telling. VictorD7 (talk) 22:38, 8 December 2013 (UTC)

- Lol; the reason VictorD7 uses the Tax Foundation source is because he can't find a real source supporting his argument (don't take my word for it, just ask him). More nonsense from a hardcore right winger. -- Somedifferentstuff (talk) 22:17, 8 December 2013 (UTC)

- I just posted an alternative by the Tax Foundation above that gives a radically different total overall breakdown. ITEP has zero corroboration and its internals are disputed by the TPC, CBO, and Tax Foundation. Misleading people with misinformation is not in Misplaced Pages's interest. TVH wants to use a hotly disputed, extremely partisan chart.....just because? We aren't obligated to have any image. If you don't want an alternative, then we don't have to add one. No one's seriously proposing a different image. And to my knowledge the TPC (which I never said is unbiased, it leans left but is the most prominent tax incidence outfit and produces reliable data) has nothing to do with the WSJ. Perhaps TVH is confused. I'm not sure what the point of the payroll tax chart is (the TPC chart he apparently objects to already showed the federal breakdown by component, including payroll), but in terms of international comparison (if that's what he was getting at) the US is more progressive than Europe in every tax type. I encourage TVH and anyone else here to actually read the sources posted. VictorD7 (talk) 22:06, 8 December 2013 (UTC)

- Effective Federal Tax Rate for the Top 1% in 2011

- No reason his presence should be a complete waste of time. VictorD7 (talk) 00:12, 9 December 2013 (UTC)

But Victor, I like the linked chart, it shows increases in property tax which is my point, and the steeply regressive corporate tax which is Stuff's point. Two problems. First, it does not aggregate the changes by income segment, second and more importantly, you have not downloaded it into the Wikicommons for our use in this article. Is there not a blanket release for online publication with attribution?

My point is that taxes are effectively flat when incomes are arrayed low to high on an x-axis, not 45-degrees slope positive (progressive), not 45-degree slope negative (regressive). Most local schools are mostly funded by local corporate taxes, regardless of the effective income tax on them, so the aggregate taxes of federal, state and local show a nearly flat tax in aggregate, not the regressive outrage if income taxes were taken alone, and the ITEP chart shows that overall effect, regardless of the corporate tax detail variances that you have successfully pointed out. TheVirginiaHistorian (talk) 10:08, 9 December 2013 (UTC)

- Not sure which "linked chart" you're referring to, but maybe you missed when I checkmated Ellen. Her own graph source calls corporate taxes "very progressive" and attributes them to shareholders, completely refuting what she'd been claiming (guessing). No meaningful variation in corporate incidence has been shown, much less by me. ITEP's huge discrepancy with multiple reliable sources remains unexplained. Stuff doesn't see corporate taxes as regressive (and he had no point; he was trolling). I'm not sure where you got that idea. I haven't seen a chart showing property taxes, but income taxes are progressive (not "regressive"), and you keep making unsourced claims. Yes, there's flattening effect when total taxes are considered, but it's nowhere near as much as ITEP shows (side point - even they call overall taxation "progressive", not "flat"; doesn't have to be a 45 deg. slope). ITEP's 2011 top 1% rate was 21.1% federal + 7.9% state/local = 29% shown in graph. If the federal component is off by around 10 points, then so is the overall number. ITEP's openly stated purpose is to agitate for higher taxes on "the rich". If casual, uninformed readers see that chart, showing the top 1% paying a lower rate than the preceding percentiles, then they'll likely think "Yeah! We should raise taxes on the rich!" However, a more reliable chart properly showing the top 1% paying the highest rate wouldn't have that impact. It was 30.4% federal in 2011 (per TPC), a few points higher now, and in the ballpark of 40% if state/local taxes are added. ITEP's chart isn't harmless misinformation we can tolerate to illustrate a broad principle. That's a meaningful difference.

- If you're saying you like the Tax Foundation chart combining TPC federal rates with ITEP state/local ones, then you're free to try to add it to the commons. Wiki rules forced me to go through a lengthy process to get the PGPF chart added, though PGPF itself was great and instantly granted permission. I'm sure the Tax Foundation would too, if permission is even required. I haven't explored their copyright situation recently. My only concern would be relying on ITEP's state/local data, which, while not explicitly contradicted, is uncorroborated and may be as wrong as their federal data. But it wouldn't hurt to add the graph to the commons so it's available during future discussions. VictorD7 (talk)

- Oppose excessive detail for this specific article. Any arguments on the merits are irrelevant as far as I am concerned. If this information has merit as claimed, it would be perfectly appropriate in a different article (not saying it does, though, I have not evaluated it as such) but it simply is too esoteric for this overview article --Jayron32 18:25, 9 December 2013 (UTC)

- Support The general rule is that more information is better than less, and people looking at Misplaced Pages for information on the United States will most likely use Misplaced Pages as their sole source. The information is relevant and valid so it should be included. Remember: Misplaced Pages seeks to be encyclopedic, and the information is relevant and informative. Damotclese (talk) 19:02, 10 December 2013 (UTC)

- Oppose adding Too detailed for this overview article. Including it gives undue weight to a graphic which, at the least, is open to challenge as being POV. Note: Here from WP:FRS Haven't previously been involved with this article. --Federalist51 (talk) 18:39, 13 December 2013 (UTC)

@VictorD7. When y-axis numbers are close together, the curve of the x-axis is flat. A curve through the ITEP top shows progressive but flattening across the first 80% under $68,700, @ 17, 21, 25, 28. The curve kinks at the top 40% over $68,700 becoming relatively flat, @ 28, 29, 30, 30, 29, because 28, 29 and 30 are close together (reported increments at truncated percentages).

That is, effective income rate is pretty flat overall across federal and state and local taxes, because regressive state sales taxes on the poor and regressive local property taxes on the rich counter both federal and state progressive income tax effects. And the general international reader will not be made aware of that phenomenon in a federal republic such as the U.S. without a chart of net tax incidence including federal, state and local taxes.

The ITEP chart including federal, state and local taxes is more nearly comprehensive than federal income tax charts alone which show huge regression in the top 20% tax levels in the case of your TCP income tax incidence chart, -- which I believe is misleading as a single source of taxation information in the U.S. for the summary article. Did you find an alternative to the ITEP chart to post here? If so, would you be so kind to do so for the sake of the discussion? TheVirginiaHistorian (talk) 03:53, 15 December 2013 (UTC)

- I guess you missed all the stuff about ITEP's accuracy being dramatically disputed by multiple sources. If you don't understand at this point that the contradiction is in the internals, so it doesn't matter that the TPC and CBO are federal only (it's still apples to apples with the ITEP federal component), then I don't know how else to walk you through it. I even linked to an alternative overall taxation chart by the Tax Foundation after you made the same request earlier that clearly illustrated these concepts by combining ITEP state/local numbers with TPC federal numbers, showing a very different slope, and explicitly criticizing ITEP's methodology. The text already discusses the more regressive nature of state/local taxes, which change neither the fact that overall US taxation is progressive (per even the ITEP outlier's wording) or that it's more progressive than European systems (the difference is even starker when heavily regressive European consumption taxes are compared with US sales taxes). The findings are robust enough that precision isn't necessary to make the general observation. The section currently has no chart, so there's no danger of readers being misled by one either way. We shouldn't add a hotly disputed, partisan chart just for the sake of having a chart. VictorD7 (talk) 19:45, 15 December 2013 (UTC)

- I noticed that ITEP is used as a source in the combined federal, state and local tax incidence for the link you gave me. Okay, agreed to no chart at this time. Simpler is better in the summary article. TheVirginiaHistorian (talk) 09:52, 16 December 2013 (UTC)

- I don't like incidence graphs that try to combine sales taxes and income taxes, because sales taxes are often misrepresented as being overly regressive (which is what is happening here). Partisan sources often consider savings as untaxed income as they try to measure for a single year, instead of tax deferred (they'll spend it during retirement, in a couple years when a child goes to college, or donate it). They distort the definition of measuring incidence by calculating the tax on something other than its tax base - mathematically invalid. As if any money saved is instantly tax free forever, making any measure of that tax burden completely false. Another one, are commercial property taxes born by the property owner, the renter / consumer, or split? Then you got the fact that your combining 50 different tax structures (some that have no income tax, some that have no sales tax, different corporate tax rates) with different exemptions on each into a single graph. It would certainly be nice to have a single graph that just "summed it up" but any such attempt will include lots of assumptions and manipulation - difficult to do fairly. Morphh 14:14, 21 December 2013 (UTC)

- I noticed that ITEP is used as a source in the combined federal, state and local tax incidence for the link you gave me. Okay, agreed to no chart at this time. Simpler is better in the summary article. TheVirginiaHistorian (talk) 09:52, 16 December 2013 (UTC)

AP survey

- Ref.: Yen, Hope (28 July 2013). 80 Percent Of U.S. Adults Face Near-Poverty, Unemployment: Survey. Associated Press and Huffington Post Retrieved July 28, 2013. EllenCT (talk) 00:07, 2 December 2013 (UTC)

Should the statement "Four out of five U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives" be added to the Income, poverty, and wealth section? Is it adequately precise or too vague of a statement?

- Oppose adding based on my arguments above. Cadiomals (talk) 13:30, 1 December 2013 (UTC)

- Oppose as a hopelessly vague and pointless lumping together of categories that's solely designed for emotive impact and mood setting. VictorD7 (talk) 21:41, 1 December 2013 (UTC)

- Support per the original Associated Press sources. EllenCT (talk) 00:07, 2 December 2013 (UTC)

- Support. Pass a Method talk 20:39, 2 December 2013 (UTC)

- Oppose until a scholarly source is found to put the information into a larger context...good argument for a safety-net society, though. And the U.S. practice obviously more nearly approaches the European welfare state model than many suspect, even in the midst of a fierce national cult of individualism and reliance on family first. TheVirginiaHistorian (talk) 07:03, 3 December 2013 (UTC)

- How do you feel about "While racial and ethnic minorities are more likely to live in poverty, race disparities in the poverty rate have narrowed substantially since the 1970s, census data show. Economic insecurity among whites also is more pervasive than is shown in the government's poverty data, engulfing more than 76 percent of white adults by the time they turn 60, according to a new economic gauge being published next year by the Oxford University Press" then? EllenCT (talk) 03:56, 8 December 2013 (UTC)

- There will be no more non-summary details added to those sections, that's it; Income, poverty, and wealth is at its peak in terms of detail. If it isn't already there you can add such information to articles like Income inequality in the United States, Poverty in the United States or even Race in the United States. But it has no place here. And if all you're going to say is that such details are "crucial" and "central to debates in election cycles" don't even bother responding. Cadiomals (talk) 04:13, 9 December 2013 (UTC)

- How do you feel about "While racial and ethnic minorities are more likely to live in poverty, race disparities in the poverty rate have narrowed substantially since the 1970s, census data show. Economic insecurity among whites also is more pervasive than is shown in the government's poverty data, engulfing more than 76 percent of white adults by the time they turn 60, according to a new economic gauge being published next year by the Oxford University Press" then? EllenCT (talk) 03:56, 8 December 2013 (UTC)

- Support; if the source backs up the material I find it to be relevant. -- Somedifferentstuff (talk) 18:26, 8 December 2013 (UTC)

- The following is copy-pasted from my response to Ellen so you don't have to look for it, as to why this piece of information is useless:

- "That statement is vague. It's the same as saying 95% of people have had either a headache or breast cancer at some point in their lives, or that 90% of Americans own either a car or an airplane. 80% of Americans deal with joblessness and low-income at some point in their lives? I'm surprised it isn't 95% percent. It is no surprise that most Americans have likely been jobless at some point if they are laid off or look for a new one; that is typical of almost every country. And who hasn't been low-income at some point in early adulthood, when one is still in an internship or entry-level job? Very few readers are going to check the source for clarification. The statement conveys nothing of educational value to the reader, except for furthering the biased tone in the section you wish to convey: that Americans somehow experience undue hardship relative to other countries."

- This statement does not express any truly relevant facts. Cadiomals (talk) 04:06, 9 December 2013 (UTC)

- The facts are relevant because they prove governmental assistance is not universally and permanently disabling as opponents sometimes argue. We just need a scholarly source in context of the fact that assistance is overwhelmingly of short duration. The outlier long duration "culture of dependency", the problematic 15%, can often be addressed with literacy education and trade education as has been found effective in various state programs. Scholarly context is what is required for the WP article. TheVirginiaHistorian (talk) 12:53, 9 December 2013 (UTC)

- I just have a problem with the way the statement is worded. Saying that 80% of Americans have either been reliant on welfare or unemployed at some point in their lives is like saying 80% of Americans have either had breast cancer or the common cold at some point in their lives. Can't you see how useless such a statement would be? A scholarly source could provide less vague and more specific information as opposed to sensationalist news reports. Cadiomals (talk) 13:01, 9 December 2013 (UTC)

- The facts are relevant because they prove governmental assistance is not universally and permanently disabling as opponents sometimes argue. We just need a scholarly source in context of the fact that assistance is overwhelmingly of short duration. The outlier long duration "culture of dependency", the problematic 15%, can often be addressed with literacy education and trade education as has been found effective in various state programs. Scholarly context is what is required for the WP article. TheVirginiaHistorian (talk) 12:53, 9 December 2013 (UTC)

- Oppose excessive detail for this specific article. Any arguments on the merits are irrelevant as far as I am concerned. If this information has merit as claimed, it would be perfectly appropriate in a different article (not saying it does, though, I have not evaluated it as such) but it simply is too esoteric for this overview article --Jayron32 18:26, 9 December 2013 (UTC)

- Comment. The direct quotation is almost certainly political propaganda. Lies, damned lies, and Mark Twain. 99% of adult americans at some point in their lives have murdered their spouses with an assault rifle, stolen from their neighbors with a sawed-off shotgun, or watched television on which the gun debate sometimes comes up -- ban guns today! 99% of americans, at some point in their lives, have been unemployed for nine consecutive months -- counting newborns! 99% of americans believe the moon landing was a hoax, or the twin towers were a federal plot, or that someone who borrows a writing utensil from them may never return it to them -- you just don't realize how deep the conspiracy goes!

- This POV-pushing *in* the sources themselves is inherently a problem, of course; Reliable Sources are *not* required to be NPOV, themselves. So the question is, since wikipedia *is* required to be — or at least strive to be — neutral, is there a way to make use of the HuffPo data, which is illuminating for the readership, without pushing the HuffPo POV on the readership? In other words, does the "relative to other countries" additional data exist that Cadiomals mentioned? If so, then maybe a relative-to-other-countries-chart would be useful, especially if we have historical data, showing the trend over time. Maybe 80% is good compared to other countries. Maybe the triplet-category is a new-fangled yet highly-explanatory statistical mechanism invented by some brilliant sociology PhD, and HuffPo is just reporting one portion of the research team's groundbreaking new results.

- But I suspect that no such datasets for other countries, let alone historical, exist... and if so, that itself indicates the x-or-y-or-z nature of the cobbled-together summary was intended to advance an agenda. Now, even if the the quote itself is still worthy of being included in wikipedia somewheres... perhaps Ariana Huffington#Political Positions? 74.192.84.101 (talk) 16:19, 10 December 2013 (UTC)

- Oppose adding Host of reasons this doesn't belong in this article. Tone is not encyclopedic. Lumps together a number of different facts in a way that ends up being POV and, without elaboration, isn't very informative. To explain in detail would not be appropriate for this overview article. Note: Here from WP:FRS Haven't previously been involved with this article. Federalist51 (talk) 18:59, 13 December 2013 (UTC)

Corporate tax incidence text

Is "U.S. taxation is generally progressive, especially the federal income taxes, but the incidence of corporate income tax has been a matter of considerable ongoing controversy for decades." preferable to "U.S. taxation is generally progressive, especially the federal income taxes, and is among the most progressive in the developed world."? EllenCT (talk) 00:59, 2 December 2013 (UTC)

- The former is preferable because it is more accurate and compliant with the WP:NPOV policy, in that order. The latter is cherrypicked puffery unsupported by the most reliable sources. EllenCT (talk) 00:59, 2 December 2013 (UTC)

- Actually the latter, long standing version you've altered without prior discussion is undisputed and less poorly written than your new sentence. We might be able to reach an agreement on including corporate incidence material, but shoving it into the first sentence renders it confusing at best and gives undue emphasis to a small portion of taxation that has no bearing on overall US tax progressivity vis a vis other developed nations, or on whether overall US taxation is progressive (even your own outlier far left CTJ source concedes it's "progressive"). You haven't even bothered to construct an argument for your misleading edit's legitimacy. VictorD7 (talk) 01:19, 2 December 2013 (UTC)

- This element of the discussion relates to the tax incidence chart above which shows a nearly flat tax rate if state and localities property and sales taxes are included for income segments. National policy is progressive, local and state are regressive, by and large. Comparisons across central governments and federal governments are difficult without aggregating national and local taxes together. Also, when something does go to narrative, limit reference notes to two, and expand the notes to include multiple sources, as a matter of WP style. TheVirginiaHistorian (talk) 07:13, 3 December 2013 (UTC)

- Look closer. Even the inaccurate, far left lobbyist graph you're referring to doesn't show anything close to a "flat tax". The entire right half only covers the top 10%. As proved above, its federal component also dramatically understates rates for high earners compared to the TPC and CBO. Here's yet another critique of the ITEP chart by the Tax Foundation. They give a far different overall tax incidence chart at the bottom. None of that directly relates to this discussion though, because Ellen hasn't shown that the discrepancy is due to corporate tax differences, and even if it was, the findings about the US having a more progressive overall tax system (not just federal) are extremely robust. Europe has an outright regressive tax system that relies heavily on consumption taxes. As the Northwestern U. study and media sources explain, even their income tax structure is more regressive than America's, and their consumption taxes are more regressive than our sales taxes (which feature various exemptions). Of course other countries have corporate taxes too, rendering the corporate incidence question pointless to this issue, and they're only a small percentage of taxation anyway. Please read the sources. They're actually quite clear and decisive. The partial flattening caused by state/local taxes is already described in the text. There's no reason to overstate it with a hotly disputed, unverifiable chart from a partisan lobbyist. VictorD7 (talk) 20:12, 3 December 2013 (UTC)

- VictorD7, could you please explain the terminology you use. If non-partisan groups like ITEP are "far left", what superlatives do you use for social democrats, democratic socialists, communists, trotskyists, maoists and anarchists? Are anarchists "far far far far far far far left?" TFD (talk) 21:43, 3 December 2013 (UTC)

- It's not "non-partisan". It even has a liberal lobbying arm called Citizens for Tax Justice. Forget the labels though. The pertinent issue is that its numbers are dramatically contradicted by multiple reliable sources. Isn't that supposed to matter? VictorD7 (talk) 22:17, 3 December 2013 (UTC)

- I agree the contradiction is dramatic. But you have already admitted that corporate tax is borne by consumers, so by your own definition the sources which do not attribute corporate tax incidence to anyone but the owners and corporate employees are not reliable. And while you have found "multiple" such sources, they are not peer reviewed, because the peer reviewed literature attributes corporate tax incidence in the way you said it should be attributed. Until you resolve this contradiction, you have no path to competent editing on the topic. EllenCT (talk) 04:09, 4 December 2013 (UTC)

- Your lies are tedious, Ellen. I said no such thing. You're conflating tax incidence with economic ripple effects. Even your own ITEP/CTJ spokesman said investors pay corporate taxes. I posted the quote for you from the ITEP website. Maybe they also attribute some to consumers (what about labor?), and maybe they don't (you don't know and haven't been able to find anything concrete), but corporate taxation wouldn't account for the large contradiction anyway. You haven't cited anything from "peer reviewed literature" because the links in question don't help your case and have nothing to do with this discussion. The TPC and CBO are far more mainstream, cited, and reliable than an uncorroborated, outlier ITEP chart. VictorD7 (talk) 04:41, 4 December 2013 (UTC)

- So now you are saying corporations don't pass on tax increases to their customers? EllenCT (talk) 16:31, 4 December 2013 (UTC)

- Those are economic ripple effects (and to labor, and to other businesses, just like income and all taxes; we shouldn't cherry-pick), not tax incidence. VictorD7 (talk) 18:56, 4 December 2013 (UTC)

- So now you are saying corporations don't pass on tax increases to their customers? EllenCT (talk) 16:31, 4 December 2013 (UTC)

- Your lies are tedious, Ellen. I said no such thing. You're conflating tax incidence with economic ripple effects. Even your own ITEP/CTJ spokesman said investors pay corporate taxes. I posted the quote for you from the ITEP website. Maybe they also attribute some to consumers (what about labor?), and maybe they don't (you don't know and haven't been able to find anything concrete), but corporate taxation wouldn't account for the large contradiction anyway. You haven't cited anything from "peer reviewed literature" because the links in question don't help your case and have nothing to do with this discussion. The TPC and CBO are far more mainstream, cited, and reliable than an uncorroborated, outlier ITEP chart. VictorD7 (talk) 04:41, 4 December 2013 (UTC)

- I agree the contradiction is dramatic. But you have already admitted that corporate tax is borne by consumers, so by your own definition the sources which do not attribute corporate tax incidence to anyone but the owners and corporate employees are not reliable. And while you have found "multiple" such sources, they are not peer reviewed, because the peer reviewed literature attributes corporate tax incidence in the way you said it should be attributed. Until you resolve this contradiction, you have no path to competent editing on the topic. EllenCT (talk) 04:09, 4 December 2013 (UTC)

- It's not "non-partisan". It even has a liberal lobbying arm called Citizens for Tax Justice. Forget the labels though. The pertinent issue is that its numbers are dramatically contradicted by multiple reliable sources. Isn't that supposed to matter? VictorD7 (talk) 22:17, 3 December 2013 (UTC)

- VictorD7, could you please explain the terminology you use. If non-partisan groups like ITEP are "far left", what superlatives do you use for social democrats, democratic socialists, communists, trotskyists, maoists and anarchists? Are anarchists "far far far far far far far left?" TFD (talk) 21:43, 3 December 2013 (UTC)

- Look closer. Even the inaccurate, far left lobbyist graph you're referring to doesn't show anything close to a "flat tax". The entire right half only covers the top 10%. As proved above, its federal component also dramatically understates rates for high earners compared to the TPC and CBO. Here's yet another critique of the ITEP chart by the Tax Foundation. They give a far different overall tax incidence chart at the bottom. None of that directly relates to this discussion though, because Ellen hasn't shown that the discrepancy is due to corporate tax differences, and even if it was, the findings about the US having a more progressive overall tax system (not just federal) are extremely robust. Europe has an outright regressive tax system that relies heavily on consumption taxes. As the Northwestern U. study and media sources explain, even their income tax structure is more regressive than America's, and their consumption taxes are more regressive than our sales taxes (which feature various exemptions). Of course other countries have corporate taxes too, rendering the corporate incidence question pointless to this issue, and they're only a small percentage of taxation anyway. Please read the sources. They're actually quite clear and decisive. The partial flattening caused by state/local taxes is already described in the text. There's no reason to overstate it with a hotly disputed, unverifiable chart from a partisan lobbyist. VictorD7 (talk) 20:12, 3 December 2013 (UTC)

- This element of the discussion relates to the tax incidence chart above which shows a nearly flat tax rate if state and localities property and sales taxes are included for income segments. National policy is progressive, local and state are regressive, by and large. Comparisons across central governments and federal governments are difficult without aggregating national and local taxes together. Also, when something does go to narrative, limit reference notes to two, and expand the notes to include multiple sources, as a matter of WP style. TheVirginiaHistorian (talk) 07:13, 3 December 2013 (UTC)

- Actually the latter, long standing version you've altered without prior discussion is undisputed and less poorly written than your new sentence. We might be able to reach an agreement on including corporate incidence material, but shoving it into the first sentence renders it confusing at best and gives undue emphasis to a small portion of taxation that has no bearing on overall US tax progressivity vis a vis other developed nations, or on whether overall US taxation is progressive (even your own outlier far left CTJ source concedes it's "progressive"). You haven't even bothered to construct an argument for your misleading edit's legitimacy. VictorD7 (talk) 01:19, 2 December 2013 (UTC)

Would you please answer the question: What proportion of corporate taxes do you believe are borne by consumers? EllenCT (talk) 05:07, 7 December 2013 (UTC)

- If one defines "borne" as tax incidence, then 0%. Of course what matters is what the sources do. Now stop dodging and finally answer my question: Precisely how much, if any, corporate tax does ITEP attribute to the top 1%? The CBO and TPC both provide that answer. Can you? If not, then your whole fixation on corporate incidence is a red herring. VictorD7 (talk) 00:24, 8 December 2013 (UTC)

- That isn't what tax incidence means at all, and you know it. I am asking in the sense that you meant when you said, "I tend to agree with you that corporate income taxes are passed on to consumers." Musgrave et al. (1951) derived 45.5% by observing which parameters of economic models best fit actual outcomes, which is the same method the ITEP uses today, as does the U.S. Treasury's Office of Tax Analysis, which says:

- "A naïve view of the incidence of the corporate tax is that shareholders bear the burden of the tax through lower after-tax rates of return. This naïve view ignores the possibility that the tax will be shifted onto consumers through higher prices, workers through lower wages ... or other types of capital as capital shifts out of the corporate sector in response to the lower after-tax return offered by corporations. To move beyond this naïve view, a model of economic behavior is necessary to guide predictions about how the burden of the corporate income tax will be distributed. Much of the literature on corporate tax incidence has focused on building such models and, depending on the assumptions, these models have generated a wide range of predictions."

- Modern simulations and empirical derivations (see Table 1 on page 17 here) say that consumers bear from 57% to 75% of corporations' tax. The only sources which claim 0% are the few which you've cherry-picked. So what do you really believe, Victor? How much corporate tax is passed on to consumers? I've answered your question, now you answer mine. EllenCT (talk) 03:46, 8 December 2013 (UTC)

- That isn't what tax incidence means at all, and you know it. I am asking in the sense that you meant when you said, "I tend to agree with you that corporate income taxes are passed on to consumers." Musgrave et al. (1951) derived 45.5% by observing which parameters of economic models best fit actual outcomes, which is the same method the ITEP uses today, as does the U.S. Treasury's Office of Tax Analysis, which says:

- You know that people can lie by ripping a line from context or misrepresenting something, like your recent "Nazi" edit summary did. Here's the rest of my quote (again), per your own link: I tend to agree with you that corporate income taxes are passed on to consumers and others, but then I think other taxes are at least partially passed on in various ways too, as I illustrated earlier with my income tax hike on the rich guy comments. That said, if one is going to develop effective tax rate incidence charts, then corporate taxes should be imputed to the owners, since they're the ones most directly paying them. That's because there's no way to precisely account for the largely hidden economic ripple effects of corporate or other tax types, as your own Treasury source indicates.

- You failed to answer my question. For example, this TPC analysis attributes a corporate rate of 6% to the top 1%. What does ITEP attribute? I already answered your question about consumers (0%), so answer mine.

- You're obfuscating. Why are you citing a 1951 paper that has nothing to do with any modern outfits or graphs being discussed, when you haven't even posted proof of how ITEP attributes corporate incidence? Here's a quote I've posted before from ITEP's own site: "All taxes have to be paid by somebody at some point," says Steve Wamhoff, legislative director at Citizens for Tax Justice, the liberal lobbying arm of the Institute on Taxation and Economic Policy, a research group. "The corporate tax is paid by the owners of corporate stock and business assets."

- I'm not cherry-picking. The TPC and CBO are the two most prominent tax incidence outfits out there, whether you like how they attribute corporate incidence or not. ITEP is a third, less prominent tax incidence outfit that produces outlier results. Since we've established that you don't even know how ITEP attributes corporate incidence, and that it wouldn't account for the discrepancy with reliable sources no matter how they distributed it, this corporate incidence tangent is a red herring. It's amusing seeing you pretend you believe that corporate taxes are regressive, even quoting a Bush administration paper, when we both know you'd oppose slashing or eliminating the corporate tax, just as ITEP would (unless I missed some anti-corporate tax activism on their part). You're willing to say stuff you don't believe just for the short term goal of making taxes appear less progressive than they really are, in hopes of fueling support for tax hikes (income, capital gains, probably even corporate). You're not even cherry-picking, you're desperately grabbing at straws. VictorD7 (talk) 07:22, 8 December 2013 (UTC)

- Update - Searching on ITEP's website for "corporate taxes" yielded this page by CTJ, their liberal lobbying arm and your graph source. Here are the best parts: "Third, the corporate income tax is ultimately borne by shareholders and therefore is a very progressive tax..."; "Corporate leaders sometimes assert that corporate income taxes are really borne by workers or consumers. But virtually all tax experts, including those at the Congressional Budget Office, the Congressional Research Service and the Treasury Department, have concluded that the owners of stock and other capital ultimately pay most corporate taxes." How about that? VictorD7 (talk) 07:50, 8 December 2013 (UTC)

"America has one of the lowest corporate income taxes of any developed country, but you wouldn’t know it given the hysteria of corporate lobbying outfits like the Business Roundtable. They say that because Japan lowered its corporate tax rate by a few percentage points on April 1, the U.S. now has the most burdensome corporate tax in the world.

The problem with this argument is that large, profitable U.S. corporations only pay about half of the 35 percent corporate tax rate on average, and most U.S. multinational corporations actually pay higher taxes in other countries. So the large majority of Americans who tell pollsters that they want U.S. corporations to pay more in taxes are onto something.

Large Profitable Corporations Paying 18.5 Percent on Average, Some Pay Nothing

Citizens for Tax Justice recently examined 280 Fortune 500 companies that were profitable each year from 2008 through 2010, and found that their average effective U.S. tax rate was just 18.5 percent over that three-year period.

In other words, their effective tax rate, which is simply the percentage of U.S. profits paid in federal corporate income taxes, is only about half the statutory federal corporate tax rate of 35 percent, thanks to the many tax loopholes these companies enjoy.

Thirty of the corporations (including GE, Boeing, Wells Fargo and others) paid nothing in federal corporate income taxes over the 2008-2010 period.

You might think that these companies simply had some unusual circumstances during the years we examined, but we find similar tax dodging when we look at previous years and the new data for 2011.

For example, GE’s effective tax rate for the 2002-2011 period (the percentage of U.S. profits it paid in federal corporate income taxes over that decade) was just 1.8 percent. Boeing’s effective federal tax rate over those ten years was negative 6.5 percent, (meaning the IRS is actually boosting Boeing’s profits rather than collecting a share of them)." -- Somedifferentstuff (talk) 20:13, 8 December 2013 (UTC)