This is an old revision of this page, as edited by 59.160.174.12 (talk) at 12:50, 2 August 2006 (→History). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 12:50, 2 August 2006 by 59.160.174.12 (talk) (→History)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)

NASDAQ (originally an acronym for National Association of Securities Dealers Automated Quotations) is an American electronic stock exchange. It was founded in 1971 by the National Association of Securities Dealers (NASD), who divested it in a series of sales in 2000 and 2001. It is owned and operated by The Nasdaq Stock Market, Inc. (Nasdaq: NDAQ) which was listed on its own stock exchange in 2002. NASDAQ is the largest electronic screen-based equity securities market in the United States. With approximately 3,300 companies, it lists more companies and, on average, trades more shares per day than any other U.S. market. The current chief executive is Robert Greifeld.

History

See also: Economy of New York CityWhen it began trading on February 8, 1971, it was the world's first electronic stock market. At first, it was merely a computer bulletin board system and did not actually connect buyers and sellers. The NASDAQ helped lower the "spread", but paradoxically was unpopular among brokerages because they made much of their money on the spread. Over the years, NASDAQ became more of a stock market by adding trade and volume reporting and automated trading systems. NASDAQ was also the first stock market to advertise to the general public, highlighting NASDAQ-traded companies (usually in technology) and closing with the declaration that NASDAQ was "the stock market for the next hundred years". What was that?

Until 1987, most trading occurred via the telephone, but during the 1987 market crash, market makers often didn't answer their phones. To counteract this, the Small Order Execution System (SOES) was established, which provides an electronic method for dealers to enter their trades. NASDAQ requires market makers to honor trades over SOES.

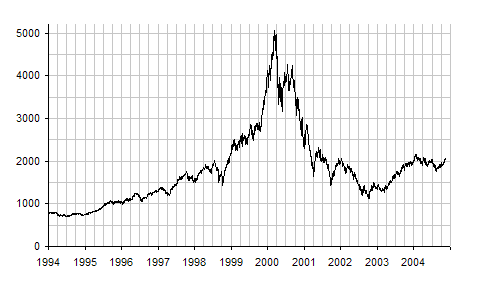

On July 17, 1995 the NASDAQ stock index closed above the 1,000 mark for the first time. The index peaked at 5132.52 on March 10, 2000, which signaled the beginning of the end of the dot-com stock market bubble. The index declined to half its value within a year and is still valued at less than half its peak. However, NASDAQ is now the largest U.S. electronic stock market.

Merger attempt with London Stock Exchange

In December of 2005, the London Stock Exchange rejected a £1.5 billion takeover offer from Macquarie Bank. The LSE described the offer as "derisory." It then received a bid in March of 2006 for £2.4 billion from NASDAQ, which was also rejected by the LSE. NASDAQ was said to be preparing a hostile takeover bid in response, and the New York Stock Exchange (NYSE) was considered a potential white knight bidder. Interest from NASDAQ and the NYSE would likely have been taken more seriously, due to significantly higher financial clout, as well as being more attractive in creating the first transatlantic equities market. NASDAQ later pulled its bid, and less than two weeks later on April 11, 2006, struck a deal with LSE's largest shareholder, Ameriprise Financial's Threadneedle Asset Management unit, to acquire all of that firm's stake, consisting of 35.4 million shares, at £11.75 per share. NASDAQ also purchased 2.69 million additional shares, resulting in a total stake of 15%. While the seller of those share was undisclosed, it occurred simultaneously with a sale by Scottish Widows of 2.69 million shares. The move was seen as an effort to force LSE to negotiate either a partnership or eventual merger, as well as to block other suitors such as NYSE. Subsequent purchases have increased NASDAQ's stake to 25.1%, making competing bids very difficult.

Business

NASDAQ allows multiple market participants to trade through its electronic communications networks (ECNs) structure, increasing competition. The Small Order Execution System (SOES) is another NASDAQ feature, introduced in 1987, to ensure that in 'turbulent' market conditions small market orders are not forgotten but are automatically processed. With approximately 3,200 companies, it lists more companies and, on average, trades more shares per day than any other stock exchange in the world. It is home to companies that are leaders across all areas of business including technology, retail, communications, financial services, transportation, media and biotechnology. NASDAQ is the primary market for trading NASDAQ-listed stocks.

Quote availability

NASDAQ quotes are available at three levels. Level I only shows the high and low prices of the stock. Level II offers real-time quotes of market makers together with information of market makers wishing to sell or buy stock and recently extecuted orders. Level III is used by the market makers and allows them to change quotes and execute orders.

Trivia

Despite the high tech image of NASDAQ, squirrels have brought down the electronic exchange twice. A squirrel knocked out the power in 1994, and the NASDAQ system failed to roll over to its battery backup, causing an interruption in trading of one half hour. In 1987, a squirrel entered a transformer and caused a power surge, halting trading for 82 minutes. Other instances of downtime have occurred when computer systems have unexpectedly rebooted or software upgrades have gone awry.

See also

Companies

Markets

References

- Wells, Rob. "'Market for Next 100 Years' is 25". Associated Press.

- "NASDAQ Market Indices".

- Walsh, C. (2006-03-12). "Nasdaq may go hostile as LSE encourages fresh bidding war". The Observer.

{{cite web}}: Check date values in:|date=(help) - Patrick, M. (2006-04-11). "Nasdaq Acquires 15% of LSE". The Wall Street Journal.

{{cite news}}: Check date values in:|date=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - "Scottish Widows says has sold 2.7 mln LSE shares at 1,175 pence". Forbes. 2006-04-12.

{{cite news}}: Check date values in:|date=(help) - Ortega, E. (2006-04-11). "Nasdaq Buys 15 Percent Stake in LSE for $782 Million". Bloomberg News.

{{cite news}}: Check date values in:|date=(help) - MacDonald, A. (2006-05-04). "In LSE Stakes, Nasdaq Advances, Euronext Falls". The Wall Street Journal.

{{cite news}}: Check date values in:|date=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - Lucchetti, A. (2006-05-11). "Nasdaq Lifts Its LSE Stake to 24%". The Wall Street Journal.

{{cite news}}: Check date values in:|date=(help); Unknown parameter|coauthors=ignored (|author=suggested) (help) - "Nasdaq raises LSE stake, making rival bids harder." Goldsmith, B. and Elliott, M. Reuters. May 19, 2006.

- "Nasdaq Level I, Level II , Level III Quotes".

- "Squirrels again bring down Nasdaq".

- "Risks to the Rodent Public in the Use of Computers".

- "Analyst, Heal Thyself".