This is an old revision of this page, as edited by 66.31.42.113 (talk) at 18:10, 27 January 2020 (copyedit). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 18:10, 27 January 2020 by 66.31.42.113 (talk) (copyedit)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff)

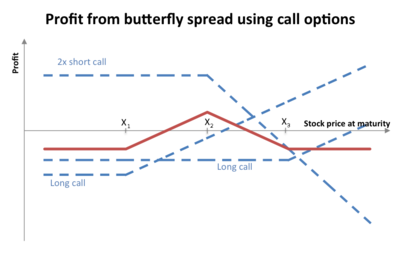

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower or higher than the implied volatility when long or short respectively.

Long butterfly

A long butterfly position will make profit if the future volatility is lower than the implied volatility.

A long butterfly options strategy consists of the following options:

- Long 1 call with a strike price of (X − a)

- Short 2 calls with a strike price of X

- Long 1 call with a strike price of (X + a)

where X = the spot price (i.e. current market price of underlying) and a > 0.

Using put–call parity a long butterfly can also be created as follows:

- Long 1 put with a strike price of (X + a)

- Short 2 puts with a strike price of X

- Long 1 put with a strike price of (X − a)

where X = the spot price and a > 0.

All the options have the same expiration date.

At expiration the value (but not the profit) of the butterfly will be:

- zero if the price of the underlying is below (X − a) or above (X + a)

- positive if the price of the underlying is between (X - a) and (X + a)

The maximum value occurs at X (see diagram).

Short butterfly

A short butterfly position will make profit if the future volatility is higher than the implied volatility.

A short butterfly options strategy consists of the same options as a long butterfly. However now the middle strike option position is a long position and the upper and lower strike option positions are short.

Butterfly P/L graph

Since the butterfly options strategy is a complex one and contains 3 "legs" (options with 3 different strike), its P/L graph is quite complicated and changes considerably as time moves forward to the expiration.

This is a graph showing the P/L (profit / loss) for a 1-year butterfly options strategy 5 days before expiry:

Butterfly options strategy P/L graph 5 days prior to expiry.

Margin requirements

Margin requirements for all options positions, including a butterfly, are governed by what is known as Regulation T. However brokers are permitted to apply more stringent margin requirements than the regulations.

Butterfly variations

- The double option position in the middle is called the body, while the two other positions are called the wings.

- The option strategy where the middle options (the body) have different strike prices is known as a Condor.

- In case the distance between middle strike price and strikes above and below is unequal, such position is referred to as "broken wings" butterfly.

References

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

- Credit By Brokers And Dealers (Regulation T), FINRA, 1986

- Long Butterfly Strategy