Headquarters at 240 Greenwich Street Headquarters at 240 Greenwich Street | |

| Company type | Public |

|---|---|

| Traded as | |

| Industry | |

| Predecessors |

|

| Founded | July 1, 2007; 17 years ago (2007-07-01) |

| Headquarters | 240 Greenwich Street Manhattan, New York City, U.S. |

| Area served | Worldwide |

| Key people | |

| Products |

|

| Revenue | |

| Operating income | |

| Net income | |

| AUM | |

| Total assets | |

| Total equity | |

| Number of employees | c. 53,400 (December 2023) |

| Subsidiaries | BNY Investments

BNY Pershing BNY Wealth |

| Website | BNY.com |

| Footnotes / references | |

The Bank of New York Mellon Corporation, commonly known as BNY, is an American international financial services company headquartered in New York City. It was formed in July 2007 by the merger of the Bank of New York and Mellon Financial Corporation. Through the lineage of Bank of New York, which was founded in 1784 by a group that included American Founding Father Alexander Hamilton, BNY is regarded as one of the three oldest banks in the United States and among the oldest in the world. It was the first company listed on the New York Stock Exchange. In 2024, it was ranked 130th on the Fortune 500 list of the largest U.S. corporations by total revenue. As of 2024, it is the 13th-largest bank in the United States by total assets and the 84th-largest in the world. BNY is considered a systemically important financial institution by the Financial Stability Board.

BNY provides a wide range of financial services, including asset management, custody and securities services, government finance services, and pension plan management. The company serves diverse clients, including corporations, institutions, and individuals, offering financial expertise and technological platforms to support their objectives. The company's key subsidiaries include BNY Investments, BNY Pershing, and BNY Wealth. It is the world's largest custodian bank and securities services company; as of September 2024, it has $2.1 trillion in assets under management and $52.1 trillion in assets under custody and administration, making it the first bank to surpass $50 trillion. BNY has been named among Fortune's World's Most Admired Companies.

History

Bank of New York

The first bank in the U.S. was the Bank of North America in Philadelphia, which was chartered by the Continental Congress in 1781; Alexander Hamilton, Thomas Jefferson and Benjamin Franklin were among its founding shareholders. In February 1784, The Massachusetts Bank in Boston was chartered.

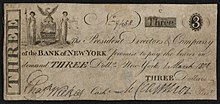

The shipping industry in New York City chafed under the lack of a bank, and investors envied the 14% dividends that Bank of North America paid, and months of local discussion culminated in a June 1784 meeting at a coffee house on St. George's Square which led to the formation of the Bank of New York company. The bank operated without a charter for seven years. The initial plan was to capitalize the company with $750,000, a third in cash and the rest in mortgages, but after this was disputed the first offering was to capitalize it with $500,000 in gold or silver. When the bank opened on June 9, 1784, the full $500,000 had not been raised; 723 shares had been sold, held by 192 people. Aaron Burr had three of them, and Hamilton had one and a half shares. The first president was Alexander McDougall and the Cashier was William Seton.

Its first offices were in the old Walton Mansion in New York City. In 1787, it moved to a site on Hanover Square that the New York Cotton Exchange later moved into.

The bank provided the United States government its first loan in 1789. The loan was orchestrated by Hamilton, then Secretary of the Treasury, and it paid the salaries of United States Congress members and President George Washington.

The Bank of New York was the first company to be traded on the New York Stock Exchange when it first opened in 1792. In 1796, the bank moved to a location at the corner of Wall Street and William Street, which would later become 48 Wall Street.

The bank had a monopoly on banking services in the city until the Bank of the Manhattan Company was founded by Aaron Burr in 1799; the Bank of New York and Hamilton vigorously opposed its founding.

During the 19th century, the bank was known for its conservative lending practices that allowed it to weather financial crises. It was involved in the funding of the Morris and Erie canals, and steamboat companies. The bank helped finance both the War of 1812 and the Union Army during the American Civil War. Following the Civil War, the bank loaned money to many major infrastructure projects, including utilities, railroads, and the New York City Subway.

Through the early 20th century, the Bank of New York continued to expand and prosper. In July 1922, the bank merged with the New York Life Insurance and Trust Company. The bank continued to profit and pay dividends throughout the Great Depression, and its total deposits increased during the decade. In 1948, the bank again merged, this time with the Fifth Avenue Bank, which was followed by a merger in 1966 with the Empire Trust Company. The bank's holding company was created in 1969.

In 1988, the Bank of New York merged with Irving Bank Corporation after a year-long takeover bid by Bank of New York. Irving had been headquartered at 1 Wall Street and after the merger, this became the headquarters of the Bank of New York on July 20, 1988.

From 1993 to 1998, the bank made 33 acquisitions, including acquiring JP Morgan's Global Custody Business in 1995. Ivy Asset Management was acquired in 2000.

In the 1990s, Vladimir Kirillovich Golitsyn or "Mickey" Galitzine established and headed the Eastern European Department at the Bank of New York until 1992 and hired many Russians. He mentored many new bankers in Hungary, the former East Germany, Poland, Romania, and Bulgaria and travelled extensively to capital cities in the former Soviet Union or the CIS to assist new bankers especially in Russia to where he travelled for his first time in 1990, Ukraine, Latvia, Georgia, Armenia, Turkmenistan, and Kazakhstan. Bank of New York had correspondent accounts for several Russian banks including Inkombank (Russian: Инкомбанк), Menatep (Russian: «Менатеп»), Tokobank (Russian: Токобанк), Tveruniversalbank (Russian: Тверьуниверсалбанк), Alfa-Bank (Russian: Альфа-банк), Sobinbank (Russian: Собинбанк), Moscow International Bank (Russian: Московский международный банк) and others.

In October 2002, Bank of New York entered into an alliance with ING to gain a stronger footing in Eastern European markets.

In 2003, Bank of New York acquired Pershing LLC, the stock clearing unit of Credit Suisse First Boston for $2 Billion. The Pershing acquisition made BNY the nation’s largest clearing firm for stock trades. EMAT and the wealth management firm Lockwood Financial Partners, which was originally formed as Lockwood Advisors in 1995, based in Malvern, Pennsylvania, specialised in providing independent financial investment advisory services to brokers of high-net-worth individuals, and went on to become one of the largest independent advisory companies in the United States before both firms were sold to the Bank of New York (BoNY) in 2002, while Gerald L Hassell was president of BoNY, that folded Lockwood and Pershing LLC into the BNY Securities Group under the Pershing umbrella in October 2003 with Joseph M. Velli heading the BoNY Securities Group which would allow BoNY to compete against U.S. Trust, J.P. Morgan Chase, as well as those more brokerage-oriented organizations for private banking clients.

In 2005, the bank paid a $14 million settlement to the Russian government concerning the money laundering activities of a rogue employee in the 1990s. This scandal has been sometimes called Russiagate.

In 2006, the Bank of New York traded its retail banking and regional middle-market businesses for J.P. Morgan Chase's corporate trust assets. The deal signaled the bank's exit from retail banking.

Mellon Financial

Main article: Mellon Financial

Mellon Financial was founded as T. Mellon & Sons' Bank in Pittsburgh, Pennsylvania, in 1869 by retired judge Thomas Mellon and his sons Andrew W. Mellon and Richard B. Mellon. The bank invested in and helped found numerous industrial firms in the late 1800s and early 1900s including Alcoa, Westinghouse, Gulf Oil, General Motors and Bethlehem Steel. Both Gulf Oil and Alcoa are, according to the financial media, considered to be T. Mellon & Sons' most successful financial investments.

In 1902, T. Mellon & Sons' name was changed to the Mellon National Bank. In 1946, the firm merged with the Union Trust Company, a business founded by Andrew Mellon in 1899, and other affiliated financial firms. The newly formed organization was named the Mellon National Bank and Trust Company, and was Pittsburgh's first US$1 billion bank.

The bank formed the first dedicated family office in the United States in 1971. A reorganization in 1972 led to the bank's name changing to Mellon Bank, N.A. and the formation of a holding company, Mellon National Corporation.

Mellon Bank acquired multiple banks and financial institutions in Pennsylvania during the 1980s and 1990s. In 1992, Mellon acquired 54 branch offices of Philadelphia Savings Fund Society, the first savings bank in the United States, founded in 1819.

In 1993, Mellon acquired The Boston Company from American Express and AFCO Credit Corporation from The Continental Corporation. The following year, Mellon merged with the Dreyfus Corporation, bringing its mutual funds under its umbrella. In 1999, Mellon Bank Corporation became Mellon Financial Corporation. Two years later, it exited the retail banking business by selling its assets and retail bank branches to Citizens Financial Group.

Merger

On December 4, 2006, the Bank of New York and Mellon Financial Corporation announced they would merge. The merger created the world's largest securities servicing company and one of the largest asset management firms by combining Mellon's wealth-management business and the Bank of New York's asset-servicing and short-term-lending specialties. The companies anticipated saving about $700 million in costs and cutting around 3,900 jobs, mostly by attrition.

The deal was valued at $16.5 billion and under its terms, the Bank of New York's shareholders received 0.9434 shares in the new company for each share of the Bank of New York that they owned, while Mellon Financial shareholders received 1 share in the new company for each Mellon share they owned. The Bank of New York and Mellon Financial entered into mutual stock option agreements for 19.9 percent of the issuer's outstanding common stock. The merger was finalized on July 1, 2007. The company's principal office of business was located at the One Wall Street office previously held by the Bank of New York. The full name of the company became The Bank of New York Mellon Corp., with the BNY Mellon brand name being used for most lines of business.

Post-merger history

In October 2008, the U.S. Treasury named BNY Mellon the master custodian of the Troubled Asset Relief Program (TARP) bailout fund during the 2007–2008 financial crisis. BNY Mellon won the assignment, which included handling accounting and record-keeping for the program, through a bidding process. In November 2008, the company announced that it would lay-off 1,800 employees, or 4% of its global workforce, due to the 2007–2008 financial crisis. According to the results of a February 2009 stress test conducted by federal regulators, BNY Mellon was one of only three banks that could withstand a worsening economic situation. The company received $3 billion from TARP, which it paid back in full in June 2009, along with US$136 million to buy back warrants from the Treasury in August 2009.

In August 2009, BNY Mellon purchased Insight Investment, a management business, from Lloyds Banking Group. The company acquired PNC Financial Services' Global Investment Servicing Inc. in July 2010 and Talon Asset Management's wealth management business in 2011.

By 2013, the company's capital had steadily risen from the financial crisis. In the results of the Federal Reserve's Dodd-Frank stress test in 2013, the bank was least affected by hypothetical extreme economic scenarios among banks tested. It was also a top performer on the same test in 2014.

BNY Mellon began a marketing campaign in 2013 to increase awareness of the company that included a new slogan and logo.

In 2013, the bank started building a new IT system called NEXEN. NEXEN uses open source technology and includes components such as an API store, data analytics, and a cloud computing environment.

In May 2014, BNY Mellon sold its 1 Wall Street headquarters, and in 2015, moved into leased space at Brookfield Place. In June 2014, the company combined its global markets, global collateral services and prime services to create the new Markets Group, also known as BNY Markets Mellon. The company expanded its Hong Kong office in October 2014 as part of the company's plans to grow its wealth management business.

Between 2014 and 2016, BNY Mellon opened innovation centers focused on emerging technologies, big data, digital and cloud-based projects, with the first opening in Silicon Valley.

In September 2017, BNY Mellon announced that it agreed to sell CenterSquare Investment Management to its management team and the private equity firm Lovell Minnick Partners. The transaction is subject to standard regulatory approvals and is expected to be completed by the end of 2017.

In November 2017, BNY Mellon performed the United States banking industry's first real-time payment transaction using a system set up by The Clearing House. The transaction moved a nominal amount between accounts at BNY Mellon and U.S. Bancorp in three seconds, inaugurating the first new payment clearance and settlement system for the US in over 40 years.

In January 2018, BNY Mellon announced that it was again moving its headquarters location, less than four years after its prior move. The headquarters location was announced as 240 Greenwich Street, a renaming of the already BNY Mellon-owned 101 Barclay Street office building in Tribeca, New York City. BNY Mellon had owned the office building for over 30 years, with control of the location obtained via 99-year ground lease. The same year, the company purchased the location from the city for $352 million.

In February 2020, Mellon announced that it has successfully onboarded Liontrust Asset Management to its new Investment Operations platform.

In early 2023, BNY Mellon’s Pershing unit announced the addition of real-time payments to its investor portal. In June 2023, BNY Mellon's Pershing X launched wealth management platform Wove. In July 2023, BNY Mellon became an early adopter of Federal Reserve’s instant payment rail, FedNow. That same year, BNY made history by selecting minority-, veteran-, and woman-owned firms as bookrunners for a $500 million debt offering. Additionally, the company increased its minimum wage for U.S.-based employees by 12.5%, raising the hourly rate from $20.00 to $22.50, and expanded its mental health resources.

In June 2024, BNY Mellon announced an update to its logo and a simplification of its corporate brand to BNY. As part of this rebranding, BNY Mellon Investment Management was renamed BNY Investments, BNY Mellon Wealth Management became BNY Wealth, and BNY Mellon Pershing was shortened to BNY Pershing.

Operations

BNY offers technology, services and expertise across its platforms to support clients on a global scale, helping them create, administer, manage, transact, distribute and optimize their assets. BNY’s businesses include BNY Investments, BNY Wealth and BNY Pershing.

BNY operates in 35 countries in the Americas, Europe, the Middle East and Africa (EMEA), and Asia-Pacific. The company employed 53,400 people As of December 2023. In October 2015, the group's American and global headquarters relocated to 225 Liberty Street, as the former 1 Wall Street building was sold in 2014. In July 2018, the company changed its headquarters again, this time to its existing 240 Greenwich Street location in New York (previously addressed 101 Barclay St). The group's EMEA headquarters are located in London and its Asia-Pacific headquarters are located in Hong Kong.

Business

BNY is an international financial services company that helps clients manage, move and safekeep their assets across the entire financial lifecycle. Today BNY helps over 90% of Fortune 100 companies and nearly all the top 100 banks globally access the money they need. BNY also supports governments in funding local projects and works with over 90% of the top 100 pension plans to safeguard assets for individuals.

BNY had $45.7 trillion in assets under custody and $1.8 trillion in assets under management as of September 2023. Those figures rose to $49.5 trillion in assets under custody and/or $2.0 trillion in assets under management by June 2024. The financial services offered by the business include asset servicing, alternative investment services, broker-dealer services, corporate trust services and treasury services. Other offerings include global collateral services, foreign exchange, securities lending, middle and back office outsourcing, and depository receipts. The bank's clients include a significant portion of Fortune 500 companies, top endowments, pension and employee benefit funds, life and health insurance companies, and leading universities.

In 2014, the company established the Markets Group, providing services in collateral management, securities finance, foreign exchange and capital markets. This group is now known as BNY Markets.

BNY Investments

BNY Investments is an asset management group that manages nearly $2 trillion in assets. It provides investment solutions through its specialist firms, which include ARX Investimentos, Dreyfus, Insight Investment, Mellon Investments Corporation, Newton Investment Management, Siguler Guff & Company, and Walter Scott & Partners. Each firm operates with its distinct approach to investment management across various asset classes.

BNY Pershing

BNY Pershing provides clearing and custody, trading and settlement services, a variety of investment solutions, middle and back office support, data insights and business consulting to clients in the wealth and institutional segments.

BNY Wealth

BNY’s Wealth business handles the private banking, estate planning, family office services, and investment servicing and management of high-net-worth individuals and families. Starting in 2013, the unit began expansion efforts, including opening eight new banking offices, increasing salespeople, bankers, and portfolio managers on staff, and launching an awareness campaign for wealth management services through television ads. As of 2014, it ranks 7th among wealth management businesses in the United States.

Leadership

Charles W. Scharf was appointed CEO in July 2017 and became Chairman after former CEO and chairman Gerald Hassell retired at the end of 2017. Hassell had been Chairman and CEO since 2011, after serving as BNY Mellon's president from 2007 to 2012 and as the president of the Bank of New York from 1998 until its merger. Scharf stepped down in 2019 to become the new CEO of Wells Fargo. Thomas "Todd" Gibbons served as BNY Mellon's CEO from 2020 to 2022. Robin A. Vince was appointed president and CEO in August 2022, succeeding Gibbons. Upon his appointment, Robin Vince also became a member of the company’s board of directors.

Karen Peetz served as president (the bank's first female president) from 2013 to 2016, when she retired; the company did not appoint a new president when she retired. Thomas Gibbons served as CFO between 2008 and 2017, when he also served as vice chairman. In 2017, Gibbons was replaced as CFO by Michael P. Santomassimo. BNY Mellon's Investment Management business is run by CEO Mitchell Harris, and the company's Investment Services business was led by Brian Shea until his retirement in December 2017. In 2020, Hanneke Smits became CEO of BNY Mellon Investment Management. In July 2024, BNY announced that Hanneke Smits would retire at the end of 2024, with Jose Minaya to become the next head of BNY Investments and BNY Wealth.

As of 2024, the company's board members were Linda Z. Cook, Joseph J. Echevarria, M. Amy Gilliland, Jeffrey A. Goldstein, K. Guru Gowrappan, Ralph Izzo, Sandie O’Connor, Elizabeth E. Robinson, Robin Vince, and Alfred W. “Al” Zollar.

Company culture

In 2008, BNY Mellon formed a Board of Directors corporate social responsibility committee to set sustainability goals. The company's corporate social responsibility activities include philanthropy, social finance in the communities the bank is located in, and protecting financial markets globally.

The bank's philanthropic activities include financial donations and volunteerism. The company matches employee volunteer hours and donations with financial contributions through its Giving at BNY program. Between 2010 and 2012, the company and its employees donated approximately $100 million to charity. In 2014, the company worked with the Forbes Fund to create a platform that connects nonprofit organizations with private businesses to solve social challenges.

The CDP, which measures corporate greenhouse gas emissions and disclosures, gave the company A ratings between 2013 and 2021. As of 2014, the company has saved $48 million due to building efficiency; five of its buildings have achieved Leadership in Energy and Environmental Design (LEED-EB) certification and 23 have interiors that are LEED certified.

The company has business resource groups for employees that are focused on diversity and inclusion. In 2009, Karen Peetz co-founded the BNY Mellon Women's Initiative Network (WIN), a resource group for female employees' professional development. As of 2013, WIN had 50 chapters. Other groups include PRISM for LGBT employees, IMPACT, which serves multicultural employees, HEART for employees with disabilities, GENEDGE, intergenerational resource group, and VETNET for veterans, military spouses, family members and their colleagues. The bank has services for returning military, including a tool to help veterans align military skills and training with jobs at the company. In 2014, it was recognized for its diversity practices by the National Business Inclusion Consortium, which named it Financial Services Diversity Corporation of the Year.

In 2009, the company began an innovation program for employees to suggest ideas for large-scale projects and company improvement. Ideas from the initial pilot program generated approximately $165 million in pretax profit. The program results in an annual contest called "ACE" in which teams pitch their ideas.

In 2022, BNY Mellon released The Pathway to Inclusive Investment, a report focused on the gender-investment gap. The research surveyed 8,000 respondents across 16 markets globally with combined assets of $60T. The report identified barriers to investment and ways that the industry could overcome them, indicating that if were women to invest at the same rate as men, this would unlock an estimated $3.2T of additional capital.

In 2023, BNY hired Meaghan Muldoon, the firm’s first Chief Sustainability Officer.

As of 2024, BNY has been included in the Dow Jones Sustainability Indices, recognized by the Human Rights Campaign Foundation’s Corporate Equality Index, and listed on the FTSE4Good Global Benchmark Index, Bloomberg’s Gender-Equality Index, and the JUST Capital's JUST 100 list.

Controversies and legal issues

Foreign currency exchange issues

In October 2011, the U.S. Justice Department and New York's attorney general filed civil lawsuits against the Bank of New York, alleging foreign currency fraud. The suits held that the bank deceived pension-fund clients by manipulating the prices assigned to them for foreign currency transactions. Allegedly, the bank selected the day's lowest rates for currency sales and highest rates for purchases, appropriating the difference as corporate profit. The scheme was said to have generated $2 billion for the bank, at the expense of millions of Americans' retirement funds, and to have transpired over more than a decade. Purportedly, the bank would offer secret pricing deals to clients who raised concerns, in order to avoid discovery. Bank of New York defended itself vigorously, maintaining the fraud accusations were "flat out wrong" and warning that as the bank employed 8,700 employees in New York, any damage to the bank would have negative repercussions for the state of New York.

Finally, in March 2015, the company admitted to facts concerning the misrepresentation of foreign exchange pricing and execution. BNY Mellon's alleged misconduct in this area includes representing pricing as best rates to its clients, when in fact they were providing clients with bad prices while retaining larger margins. In addition to dismissing key executives, the company agreed to pay a total of US$714 million to settle related lawsuits.

In May 2015, BNY Mellon agreed to pay $180 million to settle a foreign exchange-related lawsuit.

In May 2016, multiple plaintiffs filed suit against the bank, alleging that the company had breached its fiduciary duty to ERISA plans that held American Depositary Receipts by overcharging retirement plans that invested in foreign securities. In March 2017, the presiding judge declined to dismiss the suit. In December 2017, another lawsuit alleged that BNY Mellon manipulated foreign exchange rates was filed by Sheet Metal Workers' National Pension Fund. BNY Mellon agreed to pay $12.5 million to settle the 2016 lawsuit in December 2018.

Personal data breach

In February 2008, BNY Mellon suffered a security breach resulting in the loss of personal information when backup tapes containing the personal records of 4.5 million individuals went missing. Social security numbers and bank account information were included in the records. The breach was not reported to the authorities until May 2008, and letters were sent to those affects on May 22, 2008.

In August 2008, the number of affected individuals was raised to 12.5 million, 8 million more than originally thought.

IT system outages

On Saturday, August 22, 2015, BNY Mellon's SunGard accounting system broke down during a software change. This led to the bank being unable to calculate net asset value (NAV) for 1,200 mutual funds via automated computer system. Between the breakdown and the eventual fix, the bank calculated the values using alternative means, such as manual operation staff. By Wednesday, August 26, the system was still not fully operational. The system was finally operational to regular capacity the following week. As a result of a Massachusetts Securities Division investigation into the company's failure and lack of a backup plan, the company paid $3 million.

In December 2016, another major technology issue caused BNY Mellon to be unable to process payments related to the SWIFT network. As of the time of the issue, the bank processed about 160,000 global payments daily, an average of $1.6 trillion. The company was unable to process payments for a 19 hours, which led to a backlog of payments and an extension of Fedwire payment services.

Privately owned public space agreement violation

According to a New York City Comptroller audit in April 2017, BNY Mellon was in violation of a privately owned public space (POPS) agreement for at least 15 years. In constructing the 101 Barclay Street building in Lower Manhattan, BNY Mellon had received a permit allowing modification of height and setback regulations in exchange for providing a lobby accessible to the general public 24 hours a day. Auditors and members of the public had been unable to access or assess the lobby for many years, and were actively prevented from doing so by BNY Mellon security.

In September 2018, the company began to permit public access to a portion of the lobby. However, BNY Mellon remains in violation of its agreement, as the lobby must be accessible to the public 24 hours a day. As of early 2021 the city Comptroller reported that company security personnel prevented auditors from entering or photographing the lobby and was seeking to have the "public lobby" designation removed.

Employment legal issues

BNY Mellon settled foreign bribery charges with the U.S. Securities and Exchange Commission (SEC) in August 2015 regarding its practice of providing internships to relatives of officials at a Middle Eastern investment fund. The U.S. SEC found the firm in violation of the Foreign Corrupt Practices Act. The case was settled for $14.8 million.

In March 2019, BNY Mellon staff considered legal options after the company banned employees from working from home. In particular, staff cited concerns regarding the impact on childcare, mental health, and diversity. The company reverted the ban as a result of employee outcry.

Other legal issues

In September 2009, BNY Mellon settled a lawsuit that had been filed against the Bank of New York by the Russian government in May 2007 for money laundering; the original suit claimed $22.5 billion in damages and was settled for $14 million.

In 2011, South Carolina sued BNY Mellon for allegedly failing to adhere to the investment guidelines relating to the state's pension fund. The company settled with the state in June 2013 for $34 million.

In July 2012, BNY Mellon settled a class action lawsuit relating to the collapse of Sigma Finance Corp. The suit alleged that the bank invested and lost cash collateral in medium-term notes. The company settled the lawsuit for $280 million.

In December 2018, BNY Mellon agreed to pay nearly $54 million to settle charges of improper handling of "pre-released" American depositary receipts (ADRs) under investigation of the U.S. Securities and Exchange Commission (SEC). BNY Mellon did not admit or deny the investigation findings but agreed to pay disgorgement of more than $29.3 million, $4.2 million in prejudgment interest and a penalty of $20.5 million.

Recognition and rankings

As of 2024, BNY is the world's largest custody bank, the sixth-largest investment management firm in the world, and the seventh-largest wealth management firm in the United States. In 2018, BNY ranked 175 on the Fortune 500 and 250 on the Financial Times Global 500. By 2024, it ranked 130th on the Fortune 500 list.

It was named one of world's 50 Safest Banks by Global Finance in 2013 and 2014, and one of the 20 Most Valuable Banking Brands in 2014 by The Banker. BNY was named on the Dow Jones Sustainability North America Index in 2013, 2014 and 2015, and the World Index in 2014, 2015 and 2016. BNY has also been named among the World's Most Admired Companies by Fortune.

The bank claims to be the longest-running bank in the United States, though this distinction is sometimes disputed by rivals and historians. The Bank of North America, chartered in 1781, was eventually acquired by Wells Fargo after a series of mergers. Similarly, The Massachusetts Bank became part of Bank of America through a series of acquisitions. The Bank of New York remained independent, acquiring other companies, until its merger with Mellon. BNY is generally recognized as one of the three oldest banks in the U.S.

Sponsorships

Since 2012, BNY has expanded its number of sponsorships. BNY was the title sponsor of the Oxford and Cambridge Boat Race from 2012 to 2015. The company also sponsors the Head of the Charles Regatta in Boston. In 2013, the company became a 10-year sponsor of the San Francisco 49ers and a founding partner of Levi's Stadium. The company is a regular sponsor of the Royal Academy of Arts in London, the Pittsburgh Symphony Orchestra, and is a founding sponsor of the Perelman Performing Arts Center (PAC) in Lower Manhattan.

See also

- List of presidents of the Bank of New York

- 1 Wall Street

- BNY Mellon Center (disambiguation)

- CIBC Mellon

- Eagle Investment Systems

Notes

- Allegedly, Semion Mogilevich instructed Natasha Kagalovsky (née Gurfinkel) to wire transfer Cali cartel funds from Bank of New York accounts though Brazilian banks to offshore shell companies.

- In 1922, Irving Trust opened an account with Vnesheconombank, known since 2018 as VEB.RF, and beginning on October 7, 1988, when the merger was approved, the Bank of New York was able to conduct transactions with the Soviet Union and later in 1991 Russia. Natasha Kagalovsky (née Gurfinkel) with the pseudonym Gurova, who had been an employee at Irving Trust since 1986 and was in charge of the banking with the Soviet Union, became a senior vice president at the Bank of New York heading the Eastern European operations from 1992 until October 13, 1999, when she resigned.

- Vladimir Kirillovich Golitsyn or "Mickey" Galitzine (Russian: Владимир Кириллович Голицын; 1942-2018, born Belgrade) with the pseudonym Vladimirov, whose father was a director of the Tolstoy Foundation. In 1960, he joined the Bank of New York and worked as an accountant in its International Department but later headed the Russia team as a vice president of the bank. His wife Tatiana Vladimirovna Kazimirova (Russian: Татьяна Владимировна Казимирова; b. 1943, Berlin), an employee at the Bank of New York whom he married in 1963, worked very closely with him. He traveled for his first time to Russia in 1990. He worked closely with banks in Greece, Malta, and Italy and was an expert in cotton, gold, silver, and other raw materials financing.

- Banco General maintains offices in Costa Rica, has representative offices in Mexico, Guatemala, El Salvador, Colombia and Peru and has correspondent banking with Dresdner Bank Lateinamerika AG in Panama and was closely associated with Vladimir Putin's close friend Matthias Warnig at its Saint Petersburg branch, Banco Latinoamericano de Exportaciones SA (BLADEX) in Panama, Bank of Nova Scotia in Panama, Chase Manhattan Bank, Bank of New York, Citibank, Colonial Bank in Miami, First Union Bank in Miami, SunTrust Bank in Miami, Bank of America in Miami, Barclays Bank PLC in Miami, Banco General (Overseas) in the Cayman Islands, HSBC Bank USA in New York, HSBC Bank PLC in Panama, and others.

- On October 26, 1999, Bank of New York gained BankBoston Panama as its subcustodian bank in Panama. Beginning in 1996, the 1973 established BankBoston Panama provided custody services to non-resident investors in Panama. On December 17, 2004, Bank of America sold its BankBoston (BKB) operations in Peru, Colombia, and Panama to the 1955 established Panamanian private equity bank Banco General.

- In 1996, in conjunction with his brother-in-law Petros Goulandris, Tony O'Reilly along with CEO Leonard Reinhart backed a management team that created Lockwood Financial Partners, which was named after friend Jim Lockwood who was a colleague and fee-based pioneer, and its sister company E-MAT (EMAT) which was founded by Leonard Reinhart and Jay N. Whipple to provide the first common operating program for separately managed accounts (SMAs). Prior to the acquisition of Lockwood and EMAT by BoNY, RBC Dominion Securities was the two firms primary institutional advisory account. At the time, assets under management were estimated to be in excess of $11 billion.

- Joseph Roizis also spelled Roitsis (Russian: Ройцис; b. late 1940s, Soviet Union), who was also known as Aron, Gregory, Grisha, or "Ogre", immigrated to the United States with his wife and two children two years after fighting for Israel in the Yom Kippur War and operated a furniture store in Brighton Beach as a front for trafficking heroin from Romania where he purchased furniture for his store. Marat Balagula (Russian: Марат Балагул) assisted him with obtaining heroin from Thailand via Poland. Roitsis gave Leonid "Tarzan" Fainberg or Feinberg (Russian: Леонид «Тарзан» Файнберг; b. Ukraine), who was also known as Ludwid "Tarzan" Fainberg and was trained as a dentist but left the Soviet Union for Israel where he obtained an Israeli passport and immigrated to the United States in the 1980s via Germany, a job at his furniture store in Brighton Beach, Brooklyn, New York City.

- Until his death in July 2020, William Sessions was the American attorney of Semion Mogilevich, who is the "boss of bosses" of the Russian mafia, has close ties with Vladimir Putin, and is a member of the FBI Most Wanted Fugitives list.

- On January 10, 2006, the Lebanese bank Banque Libano-Française S.A.L., which has its headquarters in Beirut, gained a majority stake of 78.3% in the 1978 founded Société bancaire arabe (SBA) with the Claude Bébéar associated AXA subsidiary Compagnie Financière de Paris having a stake of 20%. Compagnie Financière de Paris held a 34% stake with thirty other shareholders before 2006. Later, Banque Libano-Française S.A.L. increased its stake to 99%. SBA has its headquarters in Paris at 28 rue de Berri (8ème), maintains a branch in Limassol, Cyprus, and has 100% ownership of the Geneva based Financière SBA (Suisse). SBA's focus is Syria with some operations in Lebanon. SBA's Geneva affiliate Societe Bancaire Arabe (Suisse) incurred heavy loses in the early 1990s and was converted to a finance company according to Mustafa Janoudi who was SBA's chairman general manager from the 1990s until 2006 when he became Vice Chairman and General Manager Délégué and Bernard Vernhes became chairman general manager. Bernard Vernhes was previously at the Banque Française de l'Orient (BFO) in Paris as chairman general manager and later at Banque Libano-Française SAL as general manager.

- Saeb Shafiq Nahas also spelled Nahhas (b. 1936, al-Jura neighborhood, Damascus) held a 12% stake in Société bancaire arabe (SBA) until May 14, 1993 when he sold it to private investors. Nahas is very close to the Assad family especially Rifaat al-Assad who is a brother of Hafez al-Assad. Beginning in 1966, Nahas has assisted in arms sales to Iran and especially Hezbollah. His farm along the Damascus International Road is used by the Iranian Revolutionary Guard to train militias that Nahas also hosts at his al-Safir Hotel in Sayyidah Zainab neighborhood of Damascus. He is very wealthy. His close relationship with Bashar alAssad led to numerous of Nahas's investments in Kazakhstan, Mexico, United Arab Emirates, Lebanon, Jordan, and Sudan. In 2015, the Central Bank of Syria froze his funds because of Nahas's failure to repay a loan which led to Nahas fleeing to Lebanon where he firmly supported the Syrian regime, so later his funds were unfrozen. His two sons Hadi and Muhammad remained in Syria to manage the Nahas family's assets in Syria.

- In 2005, the bank settled a US federal investigation that began in 1996 concerning money laundering related to post-Soviet privatization in Russia. The illegal operation involved two Russian emigres, Peter Berlin and his wife Lyudmila "Lucy" (née Pritzker) Edwards who was a Vice President of the bank and worked at its London office, moving over US$7 billion via hundreds of wires. Through accounts created by Peter Berlin for Alexei Volkov's Torfinex Corportion, Bees Lowland, which was an offshore shell company created by Peter Berlin, and Benex International Company Inc, numerous irregular wire transfers occurred at the Bank of New York. In October 1997 at Bologna, Joseph Roisis, also spelled Yosif Aronovizh Roizis and nicknamed Cannibal as a member of Russian mafia's Solntsevskaya Bratva with businesses in Czechoslovakia, explained to Italian prosecutors that 90% of the money flowing through Benex accounts at the Bank of New York is Russian mafia money. Alexei Volkov was charged in the United States but fled to Russia which has no extradition treaty with the United States and later the charges were dropped. Svetlana Kudryavtsev, a Bank of New York employee that was responsible for the proper operation of the Benex accounts in New York which had ties to Semion Mogilevich and through which passed $4.2 billion from October 1998 to March 1999, refused to cooperate and resigned during an internal audit of the matter but was later indicted by the FBI for her role in which she received $500 a month from Edwards for her services. Alexander Mamut's Sobinbank, which since August 2010 is a subsidiary of Rossiya Bank, was raided on October 10, 1999, in support of United States investigations into money laundering at the Bank of New York. The Vanuatu registered Sobinbank Limited facilitated transfers between December 1997 and February 1999 for Benex accounts. Edmond Safra of the bank Republic New York, which is a longtime rival of the Bank of New York, alerted the FBI to the money laundering scheme which also involved Russian banks including Sobinbank and the Depozitarno-Kliringovy Bank (DKB) or the Russian Deposit Clearinghouse Bank (Russian: российский «Депозитарно-клиринговый банк» («ДКБ»)) which was created by Peter Berlin and had the same address as the Bees Lowland offshore shell company. $3 billion went from both Russian DKB and Sobinbank accounts through the Igor and Oleg Berezovsky owned Italian firm Prima based in Rimini and, through Andrei Marisov at the Grigory Luchansky associated French firm Kama Trade which had accounts with the Société bancaire arabe (SBA) to accounts at the Peter Berlin created Sinex Bank in Nauru.

References

- ^ "The Bank of New York Mellon Corporation 2023 Annual Report". U.S. Securities and Exchange Commission. Retrieved February 28, 2024.

- "Meaghan Muldoon to spearhead sustainability at BNY Mellon". FinTech Global. May 25, 2023. Retrieved December 4, 2023.

- ^ Teather, David (December 5, 2006). "Bank of New York merges with Mellon in £8bn deal". The Guardian. London. Retrieved January 14, 2015.

- ^ Fitzpatrick, Dan (May 25, 2007). "Mellon Merger OK'D, HQ On Way Out". Pittsburgh Post-Gazette.

- ^ Tascarella, Patty (July 2, 2007). "Bank of New York, Mellon complete merger". Pittsburgh Business Times. Retrieved January 23, 2015.

- Del Castillo, Michael (October 11, 2024). "BNY becomes first bank in history with $50 trillion in assets under custody and administration on the way to a record quarter". Forbes. Retrieved November 12, 2024.

- ^ "World's Most Admired Companies". Fortune. Retrieved September 20, 2024.

- ^ Wallack, Todd (December 20, 2011). "Which bank is the oldest? Accounts vary - The Boston Globe". The Boston Globe.

- Moss, David A. (2017). Democracy. London: Harvard University Press. p. 113. ISBN 978-0-674-97145-5.

- ^ "The Story of the Bank of New York; Oldest in New York and Second Oldest Recognized Bank in the Country". The New York Times. June 14, 1909. ISSN 0362-4331.

- ^ Jaffe, Steven H.; Lautin, Jessica (2014). Capital of Capital: Money, Banking, and Power in New York City. New York: Columbia University Press. pp. 9, 23. ISBN 978-0231537711. Retrieved January 14, 2015.

- Hubbard, J. T. W. (1995). For Each, the Strength of All: A History of Banking in the State of New York. NYU Press. p. 43. ISBN 978-0-8147-3514-5.

- Alexander Hamilton, James (1869). Reminiscences of James A. Hamilton: or, Men and events, at home and abroad, during three quarters of a century. C. Scribner & co. p. 265.

- "Temporary Loan of 1789". Rhodes' Journal of Banking. Vol. 21. Chicago: B. Rhodes & Company. 1894. p. 752. Retrieved January 14, 2015.

- "Bank of New York Profile". The New York Job Source. Archived from the original on June 9, 2018. Retrieved August 8, 2007.

- "Timeline". BNY Mellon. Retrieved April 13, 2018.

- ^ Geisst, Charles R. (2009). Encyclopedia of American Business History. Infobase Publishing. pp. 42–43. ISBN 978-1438109879. Retrieved January 14, 2015.

- ^ "Bank of New York Building Profile". NYC Architecture. Retrieved January 22, 2015.

- ^ Cox, Adrian (December 4, 2006). "Bank of New York agrees to acquire Mellon Financial". The Salt Lake Tribune. Retrieved January 22, 2015.

- ^ "The Bank of New York Company, Inc. - Company Profile, Information, Business Description, History, Background Information on The Bank of New York Company, Inc". referenceforbusiness.com. Reference for Business. Retrieved January 14, 2015.

- "New York's Oldest". Time. March 26, 1934. Archived from the original on July 31, 2009. Retrieved January 14, 2015.

- Quint, Michael (October 8, 1988). "Irving Signs Merger Deal, Ending Fight". The New York Times. ISSN 0362-4331.

- "Bank of New York (Formerly Irving Trust Company) Landmark". New York Architecture. Retrieved September 13, 2017.

- "The Bank Of New York Relocates Headquarters To One Wall Street". BONY website. July 20, 1998. Archived from the original on August 17, 2000. Retrieved August 6, 2021.

- "About The Bank of New York: History of The Bank of New York". BONY website. Archived from the original on July 8, 2000. Retrieved August 6, 2021.

- Leach, James A., ed. (September 21, 1999). Russian Money Laundering: United States Congressional Hearing (serial number 106-38). Diane Publishing. p. 383. ISBN 9780756712556. Retrieved April 13, 2021.

- ^ O'Brien, Timothy L.; Bonner, Raymond (August 23, 1999). "Money Laundering Inquiry Uncovers a Woman's Meteoric Rise". The New York Times. Retrieved April 13, 2021.

- ^ Butrin, Dmitry; Kvasha, Maxim; Pleshanova, Olga; Razumova, Maria; Asker-Zade, Nailya (May 18, 2007). Дела давно минувших рублей: Против Bank of New York подан иск на $22,5 млрд [Cases of long past rubles: Bank of New York filed a $22.5 billion lawsuit]. Kommersant. Archived from the original on May 20, 2007. Retrieved April 13, 2021.

Возобновление расследования о махинациях 90-х

- ^ Sedykh, Igor (August 1, 2002). "Предыстория операции "Паутина": Большая стирка. По новым следам русской мафии" [Background to Operation Cobweb: Big Wash. Following the new tracks of the Russian mafia]. «Совершенно секретно» (Top Secret) (in Russian). Geneva. Retrieved April 13, 2021.

- ^ Kislinskaya, Larisa; Sedykh, Igor (August 1, 2002). "Большая стирка" [Big Washing]. «Совершенно секретно» (Sovsektretno) (in Russian). Archived from the original on September 20, 2022. Retrieved April 13, 2021.

- ^ Lurie, Oleg (February 5, 2002). "Прачечная на обороте больничного меню: Темный лес. В "сухом остатке" — миллионы отмытых долларов" [Laundry on the back of the hospital menu: Dark forest. The bottom line is millions of laundered dollars]. «Версия» (in Russian). Retrieved April 13, 2021.

- ^ Kochan, Nick (2005). "Chapter 1 Russian Mafia". The Washing Machine: How Money Laundering and Terrorist Financing Soils Us. Mason, Ohio: Cengage Learning. ISBN 9781587991592.

- "RNA presidents". Russian Nobility Association in America (RNA). September 14, 2017. Retrieved April 9, 2021.

See the section "Prince Vladimir Kirillovich Galitzine (2017–2018)".

- "В США умер князь Владимир Голицын, президент дворянского собрания" [In the USA died Prince Vladimir Golitsyn, President of the Noble Assembly]. NEWSru.co.il (in Russian). February 23, 2018. Archived from the original on March 5, 2018. Retrieved April 9, 2021.

- Sazhneva, Ekaterina (February 23, 2018). "Траур российского дворянства: чем был славен покойный князь Голицын "Он был одним из самых почитаемых людей в среде русской эмиграции"" [Mourning of the Russian nobility: what the late prince Golitsyn was famous for "He was one of the most revered people among the Russian emigration"]. Moskovskij Komsomolets (in Russian). Retrieved April 9, 2021.

- Lurie, Oleg (February 5, 2002). "Прачечная на обороте больничного меню: Темный лес. В "сухом остатке" — миллионы отмытых долларов" [Laundry on the back of the hospital menu: Dark forest. The bottom line is millions of laundered dollars]. «Версия» (in Russian). Retrieved December 21, 2020.

- Berezanskaya, Elena; Evstigneeva, Elena; Kozyrev, Mikhail (May 15, 1999). "Все, что нажито непосильным трудом. Как делили промышленный холдинг Инкомбанка. "Ведомости" провели расследование вывода промышленных активов из Инкомбанка после августовского кризиса 1998 г. Вот его результаты (см. также стр. А1). Банк - отдельно, заводы - отдельно" [Everything that is acquired by back-breaking labor How the industrial holding of Inkombank was divided "Vedomosti" conducted an investigation into the withdrawal of industrial assets from Inkombank after the August 1998 crisis. Here are the results (see also p. A1). Bank - separately, factories - separately]. Vedomosti (in Russian). Retrieved December 21, 2020. Alt URL

- "The Bank of New York Appoints BankBoston Panama as its Subcustodian in Panama, Expanding Network To 90 Countries". Bank of New York website. October 26, 1999. Archived from the original on August 17, 2000. Retrieved August 6, 2021.

- "BofA offloading BKB ops in Panama, Colombia, Peru". BNAmericas website. December 17, 2004. Retrieved August 6, 2021.

- "Información Corporativa" [Corporate Information]. Banco General (bgeneral.com) (in Spanish). Archived from the original on August 7, 2021. Retrieved August 6, 2021.

- "Organigrama" [Organizational chart]. Banco General (bgeneral.com) (in Spanish). Archived from the original on February 13, 2005. Retrieved August 6, 2021.

- "Corresponsales" [Correspondent]. Banco General (bgeneral.com) (in Spanish). Archived from the original on February 13, 2005. Retrieved August 6, 2021.

- "BankBoston Building". ICIJ. 2015. Retrieved August 6, 2021.

- Greensted, Richard (October 28, 2002). "Bank of New York expands alliance: The ING deal will give US operator a significant presence in important continental markets". Financial News. Retrieved August 9, 2023.

- "Bank of New York Acquires CSFB's Pershing For $2 Billion". TheStreet.com. January 8, 2003. Retrieved January 14, 2015.

- Sorkin, Andrew Ross (January 8, 2003). "Bank of New York to Acquire Credit Suisse Unit for $2 Billion". The New York Times. Retrieved November 25, 2023.

- ^ Leblanc, Sydney; Brounes, Ron (November 1, 2006). "Embracing The Future: Pershing and Lockwood get the thumbs-up for their vision, a smooth transition and high client satisfaction". Financial Advisor (www.fa-mag.com). Archived from the original on May 16, 2024. Retrieved May 16, 2024.

- ^ Tucker, Ross (September 1, 2002). "Lockwood Gets Its Shot at the Big Leagues: While it didn't create much buzz when it happened in early August, the purchase of Lockwood Financial Advisors, the leading independent managed money platform, by The Bank of New York, could be a big deal for brokers and advisors. At a minimum, it points to even more intense competition for high-net-worth clients, and perhaps a greater challenge to wirehouse reps for this business. It also demonstrates". www.wealthmanagement.com. Archived from the original on May 16, 2024. Retrieved May 16, 2024.

- "BNY Integrates Lockwood Financial and Pershing: The Bank of New York (BoNY) has announced its plan to integrate Lockwood Financial Services, Inc. into Pershing, creating one of the largest providers of managed account programs with client assets totaling nearly $18 billion. Pershing, which was acquired by BoNY". www.globalcustodian.com. October 22, 2003. Archived from the original on May 16, 2024. Retrieved May 16, 2024.

- "O'Reilly in major US banking deal". RTÉ (www.rte.ie). January 26, 2007. Archived from the original on May 16, 2024. Retrieved May 16, 2024.

- Aughney, Jim (August 2, 2002). "Lockwood sold by O'Reilly to NY bank". Irish Independent. Archived from the original on May 16, 2024. Retrieved May 16, 2024.

- Kramer, Andrew (September 16, 2009). "Bank of New York Settles a Protracted Russian Lawsuit". The New York Times. Retrieved November 25, 2023.

- White, Gregory L. (October 23, 2009). "Russia, BNY Mellon End $22.7 Billion Suit". Wall Street Journal. Retrieved November 25, 2023.

- van Fossen, Anthony B (2003). "Money Laundering, Global Financial Instability, and Tax Havens in the Pacific Islands". The Contemporary Pacific. 15 (2): 237–275. ISSN 1043-898X. JSTOR 23721857.

- "Russian mob probe widens. Report: European banks, IMF drawn into Russian money laundering investigation". CNN. August 24, 1999. Archived from the original on December 8, 2001. Retrieved April 15, 2021.

- "Russian moles at banks?". CNN. September 2, 1999. Archived from the original on December 7, 2001. Retrieved April 15, 2021.

- O'Brien, Timothy L.; Bonner, Raymond (February 17, 2000). "Banker and Husband Tell Of Role in Laundering Case". The New York Times. ISSN 0362-4331. Archived from the original on December 12, 2020.

- O'Brien, Timothy L. (November 9, 2005). "Bank Settles U.S. Inquiry Into Money Laundering". The New York Times. ISSN 0362-4331. Archived from the original on July 9, 2017. Retrieved September 15, 2017.

- O'Brien, Timothy L.; Bonner, Raymond (August 23, 1999). "Money Laundering Inquiry Uncovers a Woman's Meteoric Rise". The New York Times. Retrieved December 12, 2020.

- ГЛОБАЛИЗАЦИЯ РОССИЙСКОЙ ОРГАНИЗОВАННОЙ ПРЕСТУПНОСТИ

- Bonner, Raymond (September 3, 1999). "Bank of New York Dismisses Second Employee in Laundering Case". The New York Times. Retrieved December 12, 2020.

- Fernandez, Rodrigo (September 3, 1999). "El alcalde de Moscú exige a Yeltsin explicaciones sobre los escándalos económicos que se le atribuyen" [Moscow mayor demands Yeltsin explanations of economic scandals attributed to him]. El País (in Spanish). Retrieved December 12, 2020.

- O'Brien, Timothy L.; Bonner, Raymond (August 19, 1999). "Activity at Bank Raises Suspicions of Russian Mob Tie". The New York Times. Retrieved December 12, 2020.

- Unger 2018, p. 218.

- Heffernan, Virginia (January 14, 2018). "Column: A close reading of Glenn Simpson's Trump-Russia testimony". Los Angeles Times. Retrieved January 25, 2021.

- Simpson, Glenn R.; Jacoby, Mary (April 17, 2007). "How Lobbyists Help Ex-Soviets Woo Washington". Wall Street Journal. ISSN 0099-9660. Archived from the original on July 9, 2017. Retrieved November 18, 2021.

- Bohlen, Celestine; Banerjee, Neela (October 13, 1999). "Little-Known Power Broker Emerges in Kremlin Scandals". The New York Times. Retrieved December 12, 2020.

- "Дело BONY. Результаты вскрытия" [The BONY case. Autopsy results]. Время новостей (in Russian). October 16, 2000. Archived from the original on November 24, 2020. Retrieved August 24, 2021.

- Scaruffi, Piero (2020). "Book Review of Karen Dawisha: "Putin's Kleptocracy" (2014)". scaruffi.com. Retrieved December 12, 2020.

- Kochan, Nick (2005). "Chapter 2 BoNYGate". The Washing Machine: How Money Laundering and Terrorist Financing Soils Us. Mason, Ohio: Cengage Learning. ISBN 9781587991592.

- "Banque Libano-Française S.A.L. expands in Europe". Banque Libano-Française website. January 1, 2006. Retrieved April 14, 2021.

- "Banque SBA: History". Banque SBA website. Retrieved April 14, 2021.

- ^ "Europeans build stake as Syria specialist SBA makes capital increase". MEED Middle East Business Intelligence. November 4, 1994. Archived from the original on April 15, 2021. Retrieved April 14, 2021.

- "Who's who: Saeb Nahas". Syrian Observer. January 21, 2014. Retrieved April 14, 2021.

- "Regime Unfreezes Saeb Nahas' Funds After Iranian Pressure". Syrian Observer. October 5, 2020. Retrieved April 14, 2021.

- "Funding War Crimes: Syrian Businessmen Who Kept Assad Going" (PDF). Pro Justice. 2020. pp. 157–262. Archived from the original (PDF) on September 23, 2020. Retrieved April 14, 2021.

- O'Donnell, Kathie (April 10, 2006). "Bank of NY and J.P. Morgan swap assets". MarketWatch. Retrieved January 22, 2015.

- ^ "Mellon Financial Profile". The New York Job Source. Retrieved January 14, 2015.

- ^ "Mellon Financial Corporation — Company Profile, Information, Business Description, History, Background Information on Mellon Financial Corporation". referenceforbusiness.com. Reference for Business. Retrieved January 22, 2015.

- ^ Brown, Abram (July 8, 2014). "175 Years Later, The Mellons Have Never Been Richer. How'd They Do It?". Forbes. Retrieved January 22, 2015.

- "The Mellons Go to Work Again". Time. February 7, 1946. Archived from the original on July 31, 2009. Retrieved January 22, 2015.

- Ashworth, Will (January 8, 2015). "The light shines brightly on the family office". Wealth Professional. Retrieved January 22, 2015.

- "Mellon Financial Corporation - American bank". Encyclopædia Britannica. February 3, 2015. Retrieved September 22, 2015.

In 1982 Mellon acquired the Girard Company, a major Philadelphia bank holding company, and in 1985 it merged with Commonwealth National Financial Corporation, a financial-services company based in Harrisburg, Pennsylvania. The Mellon Bank acquired the investment and money-management firm Boston Company, Inc., in 1993 and bought the Dreyfus Corporation, a large manager of mutual funds, in 1994

- Quint, Michael (December 6, 1989). "Mellon Bank to Buy 54 of Meritor's Units". The New York Times. ISSN 0362-4331. Retrieved January 22, 2015.

- ^ Vries, Lloyd (December 4, 2006). "Bank Of New York To Merge With Mellon". CBS News. Retrieved January 22, 2015.

- Dash, Eric (October 14, 2008). "Bank of New York Mellon Will Oversee Bailout Fund". The New York Times. ISSN 0362-4331. Retrieved January 15, 2015.

- "WaMu, BNY Mellon latest to shed jobs". NBC News. AP. November 21, 2011. Retrieved January 15, 2015.

- Atal, Maha (July 23, 2009). "Banker: "TARP helped avert a global calamity"". Fortune. Retrieved January 23, 2015.

- Bernard, Stephen (June 17, 2009). "Bank of New York Mellon repays TARP funds". The Seattle Times. Retrieved January 15, 2015.

- Stempel, Johnathan (August 5, 2009). "Bank of NY Mellon pays $136 mln for TARP warrants". Reuters. Retrieved January 15, 2015.

- McGrath, Steve; Patrick, Margot (August 13, 2009). "Lloyds to Sell Insight Investment to Bank of New York Mellon". The Wall Street Journal. ISSN 0099-9660. Retrieved January 14, 2015.

- Huang, Daniel; Dulaney, Chelsey (July 21, 2015). "BNY Mellon Profit Surges 48%". The Wall Street Journal. ISSN 0099-9660.

- "BNY Mellon Initiates GFI Group". Zacks. July 7, 2010. Archived from the original on April 2, 2015. Retrieved January 15, 2015.

- Stein, Charles (April 28, 2011). "BNY Mellon to Buy Talon Wealth Management to Expand in Chicago". Bloomberg. Retrieved January 15, 2015.

- Adler, Joe (March 7, 2013). "Fed Unveils Dodd-Frank Stress Test Results". American Banker. Retrieved January 23, 2015.

- Touryalai, Halah (March 20, 2014). "Stress Test Results: Big Banks Look Healthier As 29 of 30 Pass, Zions Fails". Forbes. Retrieved January 23, 2015.

- O'Leary, Noreen (August 28, 2013). "BNY Mellon Review Meetings Set for Next Week New CMO Judy Hu leads the search". AdWeek. Retrieved January 15, 2015.

- McMains, Andrew (September 12, 2013). "TBWA Wins BNY Mellon's Global Account". Adweek. Retrieved January 15, 2015.

- Babcock, Charles (October 26, 2015). "BNY Mellon Transforms IT One Step At A Time". InformationWeek. Retrieved March 26, 2017.

- Baliva, Zach (June 15, 2016). "Jennifer Cole is Helping Finance Giant BNY Mellon Become a Tech Giant Too". Sync. Guerrero Howe. Retrieved March 26, 2017.

- Boulton, Clint (April 2, 2017). "BNY Mellon Channels Silicon Valley Development Practices". The Wall Street Journal. Dow Jones & Company. ISSN 0099-9660. Retrieved March 26, 2017.

- Fogarty, Susan (October 21, 2016). "Banking On Open Platforms And APIs". NetworkComputing. UBM. Retrieved March 26, 2017.

- Bloomberg News (May 21, 2014). "BNY Mellon reach $585M deal to sell HQ". Crain's New York Business.

- ^ Chaudhuri, Saabira; Morris, Keiko (June 26, 2014). "BNY Mellon to Keep Headquarters in New York City". The Wall Street Journal. ISSN 0099-9660. Retrieved January 15, 2015.

- ^ Baert, Rick (June 25, 2014). "BNY Mellon combines 3 units into new group". Pensions & Investments. Retrieved January 20, 2015.

- ^ "Jeannine Lehman set to leave BNY Mellon". Global Investor. July 20, 2016. Retrieved October 20, 2016.

- ^ Sender, Henny (October 22, 2015). "BNY Mellon launches Asia wealth management strategy". Financial Times. Retrieved January 14, 2015.

- Boulton, Clint (November 20, 2014). "BNY Mellon Hiring Tech Talent for Silicon Valley Innovation Center". The Wall Street Journal. ISSN 0099-9660. Retrieved January 23, 2015.

- MacSweeney, Greg (December 2, 2014). "BNY Mellon Aims to Tap Data Science Talent In Silicon Valley". Wall Street and Technology. Archived from the original on January 6, 2015. Retrieved January 15, 2015.

- Alois, JD (November 27, 2016). "BNY Mellon's 8th Innovation Center Has Opened in Singapore". Crowdfund Insider. Retrieved January 26, 2017.

- BNY Mellon Investment Management (September 20, 2017). "BNY Mellon Investment Management Announces Sale of the CenterSquare Business to CenterSquare Management and Lovell Minnick Partners". PR Newswire. Retrieved September 20, 2017.

- "U.S. banks speed up with first new payment system in 40 years". Reuters. November 14, 2017. Retrieved December 4, 2023.

- Baer, Justin; Morris, Keiko (January 31, 2018). "Bank of New York Mellon Plans to Move Its Corporate Headquarters in Lower Manhattan". The Wall Street Journal. ISSN 0099-9660. Retrieved March 23, 2019.

- "BNY Mellon To Move Headquarters For Second Time In Four Years". Markets Insider. Retrieved March 23, 2019.

- "BNY Mellon buys 101 Barclay for $352M". Real Estate Weekly. October 2, 2018. Archived from the original on March 23, 2019. Retrieved March 23, 2019.

- "BNY Mellon successfully onboards Liontrust to its new Investment Operations platform". Finextra Research. February 25, 2020. Retrieved March 24, 2020.

- "Pershing Speeds Investors' Transfers with Real-Time Payments - PYMNTS.com". January 19, 2023. Retrieved November 25, 2023.

- Corbin, Kenneth (October 4, 2023). "BNY Mellon's Pershing X Lands Major Client for New Advisor Tech Platform". www.barrons.com. Retrieved November 25, 2023.

- Adams, John (June 29, 2023). "FedNow's first participants include large banks, influential tech vendors". American Banker. Retrieved November 25, 2023.

- Nguyen, Lananh (May 18, 2023). Neely, Jason (ed.). "BNY Mellon prices $500 million debt offering via diverse bookrunners". Reuters.

- Stutts, Jordan (December 1, 2023). "BNY Mellon raises minimum pay, offers new worker benefits". American Banker.

- ^ Nguyen, Lananh (June 12, 2024). "Alexander Hamilton's bank is getting a new name: BNY". Reuters.

- "BNY Mellon Rebrands as BNY". PYMNTS.com. June 11, 2024. Retrieved September 20, 2024.

- Fleisher, Christopher (December 2, 2014). "Avoiding possible proxy fight, BNY Mellon gives board seat to activist investor Trian". Pittsburgh Tribune-Review. Retrieved January 15, 2015.

- ^ "Bank Of New York Mellon Corp". bloomberg.com. Bloomberg L.P. Retrieved January 15, 2015.

- "BNY Mellon Relocates Corporate Headquarters". BNY Mellon. July 25, 2018. Retrieved July 30, 2018.

- Jönsson, Anette (September 2, 2009). "BNY Mellon to expand HK presence with 50 new hires". FinanceAsia. Retrieved January 15, 2015.

- "BNY Mellon". fundweb.co.uk. Fundweb. Retrieved January 15, 2015.

- "BNY Mellon's Pershing Launches a New Suite of Products on its Wove Platform". www.pershing.com. Retrieved August 26, 2024.

- Case, Ingrid (September 27, 2023). "The Most Powerful Women in Finance: No. 8, Hanneke Smits, BNY Mellon Investment Management". American Banker. Retrieved December 28, 2023.

- ^ "About BNY Mellon". www.bnymellon.com. Retrieved March 8, 2021.

- ^ "Bank of New York Mellon Profile". Yahoo! Finance. Retrieved August 19, 2008.

- "The Bank of New York Mellon Corporation" (PDF). boyarresearch.com. Boyar's Intrinsic Value Research. October 31, 2014. Retrieved January 15, 2015.

- Amjaroen, Kingkarn (June 30, 2014). "3 Definitive Reasons Why The Bank of New York Mellon Corporation Has Much More Potential to Rise". The Motley Fool. Retrieved January 15, 2015.

- "Invested: Corporate Social Responsibility Report 2015" (PDF). BNY Mellon. Retrieved July 27, 2016.

- "Investment Management". www.bnymellon.com. Retrieved August 26, 2024.

- "Pershing LLC Company Profile". biz.yahoo.com. Yahoo. Retrieved February 6, 2015.

- "Bank of New York's Pershing reorganizes top management". Reuters. March 6, 2013. Retrieved February 6, 2015.

- ^ Milburn, Robert (November 29, 2014). "Quiet Giant". Barron's. Retrieved January 17, 2015.

- Bray, Chad (July 17, 2017). "Bank of New York Mellon Hires Former Visa Head as C.E.O.". The New York Times. ISSN 0362-4331. Retrieved July 24, 2017.

- ^ Mollenkamp, Carrick; Sidel, Robin (September 2, 2011). "BNY Mellon's New CEO Is Old Hand". The Wall Street Journal. ISSN 0099-9660. Retrieved January 15, 2015.

- "Gerald Hassell Profile". Forbes. Archived from the original on December 23, 2014. Retrieved February 5, 2015.

- "This Goldman Sachs alum aims to reinvigorate a sleeping giant that safeguards $43 trillion in assets". Business Insider. August 31, 2022.

- Tascarella, Patty (August 12, 2022). "BNY Mellon sets stage for next CEO". www.bizjournals.com. Retrieved November 25, 2023.

- "Form 8-K Exhibit 99.1: Press release". Bank of New York Mellon Corp via SEC Edgar. September 26, 2016., "Form 8-K". Bank of New York Mellon Corp via SEC Edgar. September 26, 2016.

- Burns, Hilary (November 3, 2014). "From the financial crisis to the Sandusky scandal, this one trait gave success to Karen Peetz of BNY Mellon". BizWomen. Retrieved January 15, 2015.

- Taub, Stephen (May 28, 2008). "BNY Mellon Reshuffles, Names Gibbons CFO". CFO. Retrieved February 5, 2015.

- Baer, Justin (November 13, 2017). "CEO Scharf Names a CFO in Executive Shuffle at Bank of New York Mellon". Fox Business. Retrieved December 5, 2018.

- Williamson, Christine (July 19, 2018). "BNY Mellon reports slip in AUM for quarter, but gain for year". Pensions & Investments. Retrieved December 5, 2018.

- Stein, Charles (February 23, 2016). "BNY Mellon Says Vice Chairman Curtis Arledge to Leave Bank". Bloomberg L.P. Retrieved April 30, 2016.

- "BNY Mellon names Brian Shea CEO of investment services". Reuters. June 25, 2014. Retrieved January 15, 2015.

- McDowell, Hayley (November 14, 2017). "BNY Mellon Investor Services head Shea departs amid major shake-up". Retrieved April 12, 2018.

- "Newton's Smits becomes BNY Mellon IM chief". www.ftadviser.com. July 7, 2020. Retrieved September 20, 2024.

- Ricketts, David (July 2, 2024). "Hanneke Smits to step down as BNY's global investments boss". Financial News.

- "Meet Our Board of Directors". BNY Mellon. Retrieved November 24, 2023.

- Gell, Adam (February 5, 2015). "BNY Mellon elects former Deloitte CEO to board of directors". HITC. Retrieved February 5, 2015.

- ^ Schaeffer, Julie (November 2014). "BNY Mellon's True Return on Investment". Green Building and Design. Retrieved January 22, 2015.

- ^ "Pittsburgh Businesses "On the Frontline" of Corporate Social Responsibility". WESA. December 14, 2014. Retrieved February 23, 2015.

- ^ Grgurich, John (June 14, 2013). "Goldman Sachs Defies Great Vampire Squid Label". The Motley Fool. Retrieved January 22, 2015.

- Massello, Melissa (December 6, 2014). "Companies Where Millennials Thrive: BNY Mellon". PreparedU View. Retrieved February 6, 2015.

- Tascarella, Patty (October 24, 2014). "$1M social innovation challenge launched by BNY Mellon, foundation". Pittsburgh Business Journal. Retrieved January 18, 2015.

- "Bank of New York Mellon : BNY Mellon Named to Climate A List by CDP". www.marketscreener.com. February 12, 2019. Retrieved December 27, 2023.

- ^ "BNY Mellon—Fostering Global Inclusion and Multiculturalism". catalyst.org. Catalyst. June 9, 2013. Retrieved January 15, 2015.

- Masud, Maha (May 21, 2013). "Interview: President of BNY Mellon Karen Peetz on Women's Leadership". Americas Society Council of the Americas.

- Masud, Maha (May 21, 2013). "Interview: President of BNY Mellon Karen Peetz on Women's Leadership". Council of the Americas. Retrieved January 15, 2015.

- Tascarella, Patty (November 28, 2022). "BNY Mellon hired veteran-owned firms to participate in senior bank notes issuance". www.bizjournals.com. Retrieved December 27, 2023.

- Sanchez, Brent (May 18, 2022). "The Empower 100 Future Leaders Role Models 2022". Yahoo Finance. Retrieved December 27, 2023.

- "25 Most Influential Companies for Veteran Hiring". Diversity Journal. 2014. Archived from the original on February 27, 2015. Retrieved January 15, 2015.

- "NGLCC names top financial services firms for diversity practices". Affinity Inc Magazine. July 23, 2014. Retrieved January 15, 2015.

- Milligan, Jack (September 11, 2014). "How One Large Bank Fosters Innovation". BankDirector.com. Retrieved January 22, 2015.

- Mirchandani, Bhakti. "The Path To Inclusive Capitalism: An Asset Owner Guide For Investment Portfolios". Forbes. Retrieved May 16, 2024.

- Kyriakou, Simoney (February 1, 2022). "Women could bring trillions into investments". www.ftadviser.com. Retrieved December 28, 2023.

- Hamez, Emile (May 26, 2023). "BNY hires first chief sustainability officer from BlackRock". InvestmentNews.

- "BNY Mellon Named to Dow Jones Sustainability World Index". www.3blmedia.com. July 30, 2019. Retrieved September 20, 2024.

- "Leading Organisations Awards BNY". Vercida.

- "BNY has been named among "Most Just Companies" list by JUST Capital, recognizing the firm for its commitment to serving employees, clients, the environment and shareholders". Vercida.

- Mollenkamp, Carrick (October 5, 2011). "US and New York Sue BNY Mellon". The Wall Street Journal. ISSN 0099-9660. Retrieved October 8, 2011.

- "Interview: Barry Markopolos". King World News. Archived from the original on October 10, 2011. Retrieved October 8, 2011.

- Gara, Antoine (March 19, 2015). "Bank Of New York Mellon Settles Misrepresentation Claims For $714 Million". Forbes. Retrieved March 24, 2015.

- "BNY Mellon to pay $180 million to settle foreign exchange lawsuit". Business Insider. Reuters. Retrieved March 23, 2019.

- Baert, Rick (January 11, 2016). "BNY Mellon faces lawsuit claiming FX transaction overcharges on ADRs". Pensions & Investments. Retrieved March 23, 2019.

- Law, Jacklyn Wille-Bloomberg. "BNY Mellon Sued, Again, Over Foreign Currency Transactions". biglawbusiness.com. Retrieved March 23, 2019.

- Wille, Jacklyn. "BNY Mellon to Pay $12.5M in Foreign Currency Exchange Suit". news.bloomberglaw.com. Retrieved March 23, 2019.

- "Bank of New York Mellon Investigated for Lost Data Tape". www.bankinfosecurity.com. Retrieved March 23, 2019.

- "Connecticut widens probe into BNY Mellon data breach". Reuters. May 23, 2008. Retrieved March 23, 2019.

- "Bank of NY Mellon data breach now affects 12.5 mln". Reuters. August 28, 2008. Retrieved March 23, 2019.

- "Bank of NY Mellon Breach Much Bigger than First Announced". www.bankinfosecurity.com. Retrieved March 23, 2019.

- Egan, Matt (August 31, 2015). "A big bank's glitch adds to confusion on Wall Street". CNNMoney. Retrieved March 23, 2019.

- "Update 2-BNY Mellon pricing glitch affects billions of dollars of funds". Reuters. August 26, 2015. Retrieved March 23, 2019.

- "BNY Mellon to Pay $3M to Settle Probe of System Outage". American Banker. March 22, 2016. Retrieved March 23, 2019.

- ^ "BNY Mellon's payment woes its second big tech glitch in 18 months". Reuters. December 8, 2016. Retrieved March 23, 2019.

- Tempey, Nathan. "Report: More Than Half The City's Privately Owned, Allegedly Public Spaces Aren't Playing By The Rules". Gothamist. Archived from the original on March 23, 2019. Retrieved March 23, 2019.

- Landa, Marjorie (April 18, 2017). "Audit Report on the City's Oversight over Privately Owned Public Spaces" (PDF). comptroller.nyc.gov. Retrieved March 23, 2019.

- "Tribeca Citizen | BNY Mellon's Lobby Is Finally Open to the Public". Tribeca Citizen. Retrieved March 23, 2019.

- "NYC Capital Planning Platform". NYC Capital Planning Platform. Retrieved March 23, 2019.

- "City of New York Community Board 1 Resolution (26 January 2021)" (PDF). Manhattan Community Board 1. City of New York. Retrieved August 19, 2021.

- "BNY Mellon to pay $14.8 million to settle intern bribery probe". Reuters. August 18, 2015. Retrieved March 23, 2019.

- Yan, Sophia (August 18, 2015). "BNY Mellon pays $15 million to settle intern probe". CNNMoney. Retrieved March 23, 2019.

- "SEC.gov | SEC Charges BNY Mellon With FCPA Violations". www.sec.gov. Retrieved March 23, 2019.

- "Bank BNY Mellon bans staff from working at home". Evening Standard. March 6, 2019. Retrieved March 23, 2019.

- "BNY Mellon rethinking decision to yank work-from-home option after outcry". Pittsburgh Post-Gazette. Retrieved March 23, 2019.

- "BNY Mellon shelves tighter work-at-home rules after staff uproar". American Banker. March 8, 2019. Retrieved March 23, 2019.

- "Russia sues Bank of New York for 22.5 bln usd". Forbes.com. May 17, 2007. Archived from the original on December 2, 2008. Retrieved January 7, 2009.

- Parloff, Roger (September 22, 2009). "Russia settles suit against U.S. bank for a pittance". CNN. Retrieved May 27, 2011.

- "BNY Mellon Reaches $34 Million Settlement With South Carolina Relating to Securities Lending Litigation". Global Custodian. Retrieved March 23, 2019.

- Woehr, Maria (January 27, 2011). "South Carolina Sues BNY Mellon". TheStreet. Retrieved March 23, 2019.

- "BNY Mellon settles Sigma lawsuit for $280 million". Reuters. July 6, 2012. Retrieved March 23, 2019.

- "BNY Mellon to Pay More Than $54 Million for Improper Handling of ADRs". sec.org. December 17, 2018. Retrieved December 13, 2019.

- "BNY Mellon to pay more than $54 million for improper handling of ADRs: SEC". Reuters. December 17, 2018. Retrieved December 13, 2019.

- "Fourth Quarter 2014 Financial Highlights" (PDF). bnymellon.com. The Bank of New York Mellon. January 23, 2015. pp. 19, 27. Retrieved January 15, 2015.

- McLaughlin, Tim (January 23, 2015). "BNY Mellon, State Street get profit boost from forex trading". Reuters. Retrieved January 23, 2015.

- Manning, Margie (January 7, 2015). "3 reasons BNY Mellon keeps growing in Tampa". Tampa Bay Business Journal. Retrieved January 17, 2015.

- "Fortune 500 Companies 2018: Who Made the List". Fortune. Archived from the original on May 2, 2019. Retrieved November 22, 2018.

- Dullforce, Annebritt (June 27, 2014). "FT 500 2014". Financial Times. Retrieved January 17, 2015.

- "Fortune Global 500". Fortune. Retrieved September 20, 2024.

- Cunningham, Andrew (November 13, 2014). "World's Safest Banks 2014". Global Finance. Retrieved January 17, 2015.

- Cunningham, Andrew (October 1, 2013). "World's Safest Banks 2013". Global Finance. Retrieved January 17, 2015.

- Wallace, Paul (March 2, 2014). "The Top 500 Banking Brands, 2014". The Banker. Retrieved January 17, 2015.

- "Invested: An Interview With Bny Mellon Corporate Social Responsiblity [sic] Director John Buckley". JustMeans. June 6, 2014. Retrieved January 15, 2015.

- Clancy, Heather (September 11, 2014). "The 2014 Dow Jones Sustainability Index: Abbott to Woolworths". GreenBiz. Retrieved January 15, 2015.

- "Stocks to Track – National-Oilwell Varco, (NOV), SunTrust Banks, (STI), Bank of New York Mellon (BK), Apache (APA)". Techsonian. September 14, 2015. Retrieved October 21, 2015.

- "Dow Jones Sustainability Indices" (PDF). September 19, 2016. Archived from the original (PDF) on December 20, 2016. Retrieved December 18, 2016.

- "Investor Relations". BNY Mellon. Retrieved April 20, 2018.

- ^ "BNY Mellon Banks On Expanded Sponsorship Portfolio". IEG SR. September 16, 2013. Retrieved January 22, 2015.

- Long, Michael (February 9, 2012). "BNY Mellon names historic Boat Race". SportsPro. Retrieved January 22, 2015.

- "Boat Race sponsors donate sponsorship to Cancer Research UK | UK Fundraising". fundraising.co.uk. January 22, 2016. Retrieved November 4, 2017.

- Long, Michael (September 11, 2013). "BNY Mellon partners 49ers, Levi's Stadium". SportsPro. Retrieved January 22, 2015.

- "BNY Mellon rows to the Balding beat with the boat race". London Evening Standard. April 2, 2013. Retrieved January 22, 2015.

- "Our Partners". pittsburghsymphony.org. Retrieved October 3, 2024.

- "Our Donors | Perelman Performing Arts Center". pacnyc.org. Retrieved October 3, 2024.

Books

- Unger, Craig (August 14, 2018). House of Trump, House of Putin: The Untold Story of Donald Trump and the Russian Mafia. Dutton. ISBN 978-1524743505.

- Skuratov, Yury Ilyich (2013). Кремлёвские подряды: Последнее дело прокурора [Kremlin contracts. The last case of the Attorney General] (in Russian). Moscow: ООО «Издательство Алгоритм» (Algorithm Publishing House). ISBN 978-5-4438-0301-2.

External links

- Official website

- Business data for The Bank of New York Mellon Corporation:

- Pershing LLC., a subsidiary of The Bank of New York Mellon Corporation

- 225th Anniversary Commemorative Video

- iNautix Technologies, a subsidiary of The Bank of New York Mellon

- New York Life Insurance and Trust Company Records at Baker Library Historical Collections, Harvard Business School.

| BNY | |||

|---|---|---|---|

| Founders | |||

| Notable executives |

| ||

| Subsidiaries | |||

| Historical components | |||

| Buildings | |||

| Others | |||

| Custodian banks | |||

|---|---|---|---|

| Custodian Bank | |||

- BNY Mellon

- Alexander Hamilton

- Companies listed on the New York Stock Exchange

- 2007 establishments in New York City

- Banks based in New York City

- Systemically important financial institutions

- Companies based in Manhattan

- American companies established in 2007

- Banks established in 2007

- Multinational companies based in New York City

- Publicly traded companies based in New York City