| |

Chevron's former headquarters complex in San Ramon, California Chevron's former headquarters complex in San Ramon, California | |

| Formerly |

|

|---|---|

| Company type | Public |

| Traded as | |

| ISIN | US1667641005 |

| Industry | |

| Predecessors |

|

| Founded | September 10, 1879; 145 years ago (1879-09-10) as "Pacific Coast Oil Co." in Los Angeles, California |

| Founders | |

| Headquarters | Houston, Texas, U.S. |

| Area served | Worldwide |

| Key people | Mike Wirth (chairman and CEO) |

| Products | Gasoline, natural gas and other petrochemicals |

| Brands | |

| Revenue | |

| Operating income | |

| Net income | |

| Total assets | |

| Total equity | |

| Owner | Berkshire Hathaway (8.17%) |

| Number of employees | 45,600 (December 2023) |

| Parent | Standard Oil Co. (1900–1911) |

| Subsidiaries | |

| Website | chevron.com |

| Footnotes / references | |

Chevron Corporation is an American multinational energy corporation predominantly specializing in oil and gas. The second-largest direct descendant of Standard Oil, and originally known as the Standard Oil Company of California (shortened to Socal or CalSo), it is active in more than 180 countries. Within oil and gas, Chevron is vertically integrated and is involved in hydrocarbon exploration, production, refining, marketing and transport, chemicals manufacturing and sales, and power generation.

Founded originally in Southern California during the 1870s, the company was then based for many decades in San Francisco, California, before moving its corporate offices to San Ramon, California, in 2001; and on August 2, 2024, Chevron announced that it would be relocating its headquarters from California to Houston, Texas, by 2025.

Chevron traces its history back to the second half of the 19th century to small California-based oil companies which were acquired by Standard and merged into Standard Oil of California. The company grew quickly on its own after the breakup of Standard Oil by continuing to acquire companies and partnering with others both inside and outside of California, eventually becoming one of the Seven Sisters that dominated the global petroleum industry from the mid-1940s to the 1970s.

In 1985, Socal merged with the Pittsburgh-based Gulf Oil and rebranded as Chevron; the newly merged company later merged with Texaco in 2001. Chevron manufactures and sells fuels, lubricants, additives, and petrochemicals, primarily in Western North America, the US Gulf Coast, Southeast Asia, South Korea and Australia. In 2018, the company produced an average of 791,000 barrels (125,800 m) of net oil-equivalent per day in United States.

Chevron is one of the largest companies in the world and the second-largest oil company based in the United States by revenue, only behind fellow Standard Oil descendant ExxonMobil. Chevron ranked 10th on the Fortune 500 in 2023. The company is also the last-remaining oil-and-gas component of the Dow Jones Industrial Average since ExxonMobil's exit from the index in 2020.

Chevron has been subject to numerous controversies.

History

Predecessors

Star Oil and Pacific Coast Oil Company

One of Chevron's early predecessors, "Star Oil", discovered oil at the Pico Canyon Oilfield in the Santa Susana Mountains north of Los Angeles in 1876. The 25 barrels of oil per day well marked the discovery of the Newhall Field, and is considered by geophysicist Marius Vassiliou as the beginning of the modern oil industry in California. Energy analyst Antonia Juhasz has said that while Star Oil's founders were influential in establishing an oil industry in California, Union Mattole Company discovered oil in the state eleven years prior.

In September 1879, Charles N. Felton, Lloyd Tevis, George Loomis and others created the "Pacific Coast Oil Company", which acquired the assets of Star Oil with $1 million in funding. Pacific Coast Oil eventually became the largest oil interest in California, and in 1900, John D. Rockefeller's Standard Oil acquired Pacific Coast Oil for $761,000. In 1906, the Pacific Coast acquired the business operations and assets of the Standard Oil Company (Iowa). At this time, Pacific renamed itself the Standard Oil Company (California).

Texaco

Further information: Texaco § HistorySince the acquisition of the Pacific Coast Oil Company by Standard Oil, the Standard descendant had traditionally worked closely with Texaco for 100 years, before acquiring Texaco outright in 2001. Originally known as the Texas Fuel Company (later the Texas Company), Texaco was founded in Beaumont, Texas, as an oil-equipment vendor by "Buckskin Joe". The founder's nickname came from being harsh and aggressive. Texas Fuel worked closely with Chevron. In 1936, it formed a joint venture with California Standard named Caltex, to drill and produce oil in Saudi Arabia. According to energy analyst and activist shareholder Antonia Juhasz, the Texas Fuel Company and California Standard were often referred to as the "terrible twins" for their cutthroat business practices.

Formation of the Chevron name

In 1911, the federal government broke Standard Oil into several pieces under the Sherman Antitrust Act. One of those pieces, Standard Oil Co. (California), went on to become Chevron. It became part of the "Seven Sisters", which dominated the world oil industry in the early 20th century. In 1926, the company changed its name to Standard Oil Co. of California (SOCAL). By the terms of the breakup of Standard Oil, at first Standard of California could use the Standard name only within its original geographic area of the Pacific coast states, plus Nevada and Arizona; outside that area, it had to use another name.

Today, Chevron is the owner of the Standard Oil trademark in 16 states in the western and southeastern United States. Since American trademark law operates under a use-it-or-lose-it rule, the company owns and operates one Standard-branded Chevron station in each state of the area. However, though Chevron (as CalSo) acquired Kyso in the 1960s, its status in Kentucky is unclear after Chevron withdrew its brand from retail sales from Kentucky in July 2010.

The 'Chevron' name came into use for some of its retail products in the 1930s. The name "Calso" was also used from 1946 to 1955, in states outside its native West Coast territory.

Standard Oil Company of California ranked 75th among United States corporations in the value of World War II military production contracts.

In 1933, Saudi Arabia granted California Standard a concession to find oil, which led to the discovery of oil in 1938. In 1948, California Standard discovered the world's largest oil field in Saudi Arabia, Ghawar Field. California Standard's subsidiary, California-Arabian Standard Oil Company, grew over the years and became the Arabian American Oil Company (ARAMCO) in 1944. In 1973, the Saudi government began buying into ARAMCO. By 1980, the company was entirely owned by the Saudis, and in 1988, its name was changed to Saudi Arabian Oil Company—Saudi Aramco.

Standard Oil of California and Gulf Oil merged in 1984, which was the largest merger in history at that time. To comply with U.S. antitrust law, California Standard divested many of Gulf's operating subsidiaries, and sold some Gulf stations in the eastern United States and a Philadelphia refinery which has since closed. Among the assets sold off were Gulf's retail outlets in Gulf's home market of Pittsburgh, where Chevron lacks a retail presence but does retain a regional headquarters there as of 2013, partially for Marcellus Shale-related drilling. The same year, Standard Oil of California also took the opportunity to change its legal name to Chevron Corporation, since it had already been using the well-known "Chevron" retail brand name for decades. Chevron would sell the Gulf Oil trademarks for the entire U.S. to Cumberland Farms, the parent company of Gulf Oil LP, in 2010 after Cumberland Farms had a license to the Gulf trademark in the Northeastern United States since 1986.

In 1996, Chevron transferred its natural gas gathering, operating and marketing operation to NGC Corporation (later Dynegy) in exchange for a roughly 25% equity stake in NGC. In a merger completed February 1, 2000, Illinova Corp. became a wholly owned subsidiary of Dynegy Inc. and Chevron's stake increased up to 28%. However, in May 2007, Chevron sold its stake in the company for approximately $985 million, resulting in a gain of $680 million.

Acquisitions and diversification

2000s

The early 2000s saw Chevron engage in many mergers, acquisitions, and sales. The first largest of which was the $45 billion acquisition of Texaco, announced on October 15, 2000. The acquisition created second-largest oil company in the United States and the world's fourth-largest publicly traded oil company with a combined market value of approximately $95 billion. Completed on October 9, 2001, Chevron temporarily renamed itself to ChevronTexaco between 2001 and 2005; after the company reverted its name to Chevron, Texaco became used as a brand by the company for some of its fueling stations.

2005 also saw Chevron purchase Unocal Corporation for $18.4 billion, increasing the company's petroleum and natural gas reserves by about 15%. Because of Unocal's large South East Asian geothermal operations, Chevron became a large producer of geothermal energy. The deal did not include Unocal's former retail operations including the Union 76 trademark, as it had sold that off to Tosco Corporation in 1997. The 76 brand is owned by Phillips 66, unaffiliated with Chevron.

Chevron and the Los Alamos National Laboratory started a cooperation in 2006, to improve the recovery of hydrocarbons from oil shale by developing a shale oil extraction process named Chevron CRUSH. In 2006, the United States Department of the Interior issued a research, development and demonstration lease for Chevron's demonstration oil shale project on public lands in Colorado's Piceance Basin. In February 2012, Chevron notified the Bureau of Land Management and the Department of Reclamation, Mining and Safety that it intended to divest this lease.

2010s

Starting in 2010, Chevron began to reduce its retail footprint and expand in domestic natural gas. In July 2010, Chevron ended retail operations in the Mid-Atlantic United States by removing the Chevron and Texaco names from 1,100 stations. In 2011, Chevron acquired Pennsylvania-based Atlas Energy Inc. for $3.2 billion in cash and an additional $1.1 billion in existing debt owed by Atlas. Three months later, Chevron acquired drilling and development rights for another 228,000 acres in the Marcellus Shale from Chief Oil & Gas LLC and Tug Hill, Inc. In September 2013, Total S.A. and its joint-venture partner agreed to buy Chevron's retail distribution business in Pakistan for an undisclosed amount.

In October 2014, Chevron announced that it would sell a 30 percent holding in its Canadian oil shale holdings to Kuwait's state-owned oil company Kuwait Oil Company for a fee of $1.5 billion. Despite these sales, Chevron continued to explore acquisitions, a trend which had reinvigorated in 2019 and extended throughout the COVID-19 pandemic. In April 2019, Chevron announced its intention to acquire Anadarko Petroleum in a deal valued at $33 billion, but decided to focus on other acquisitions shortly afterwards when a deal could not be reached. Despite the failed acquisition of Anadarko, Chevron did acquire Noble Energy for $5 billion in July 2020.

Chevron was not spared from the pandemic, however, as Chevron announced reductions of 10–15% of its workforce due to both the pandemic and a 2020 oil price war between Russia and Saudi Arabia. During the pandemic, Chevron considered a merger with rival ExxonMobil in 2020 during the early stages of the COVID-19 pandemic that drove oil demand sharply down. It would have been one of the largest corporate mergers in history, and a combined Chevron and ExxonMobil (dubbed "Chexxon" by Reuters) would have been the second-largest oil company in the world, trailing only Saudi Aramco.

Later in the pandemic, Chevron began requiring some employees, namely expatriate employees, those working overseas, and workers on U.S.-flagged ships, to receive COVID-19 vaccinations after having some key operations, the off-shore platforms off the Gulf of Mexico and Permian Basin for example. The requirement will begin for workers off the Gulf of Mexico on the first of November.

2020s

In the 2020s, Chevron's primary focus was on alternative energy solutions, gradual pullouts from Africa and Southeast Asia, and an increased focus on the Americas with a lessened albeit still present interest in natural gas. Chevron in February 2020 joined Marubeni Corporation and WAVE Equity Partners in investing in Carbon Clean Solutions, a company that provides portable carbon capture technology for the oil field and other industrial facilities. Two years later, Chevron announced that they will acquire Renewable Energy Group, a biodiesel production company based in Ames, Iowa. The acquisition was completed just under four months later on June 13.

In the Americas, Chevron acquired natural gas company Beyond6, LLC (B6) and its network of 55 compressed natural gas stations across the United States from Mercuria in November 2022. However, Chevron's largest American moves in the 2020s were in Venezuela, as the Biden administration relaxed restrictions on Chevron from pumping oil in the South American nation, originally imposed due to corruption scandals and human rights violations by Venezuelan president Nicolás Maduro. The relaxed restrictions, however, came with severe limitations, including provisions which prohibited Chevron from selling to Russian or Iranian-affiliated agencies and from allowing any direct profits to go to Venezuelan oil company PDVSA.

On November 29, 2022, Venezuelan Government Petroleum Minister Tarek El Aissami met in Caracas, Venezuela, with the president of Chevron, Javier La Rosa. The Venezuelan ruling party said it was committed to "the development of oil production" after the easing of sanctions.

The most important joint ventures where Chevron is involved in Venezuela are Petroboscán, in the west of the nation, and Petropiar, in the eastern Orinoco Belt, with a production capacity of close to 180,000 barrels per day between both projects. In the case of Petroboscán, current production is nil and, in Petropiar, current records indicate close to 50,000 barrels per day.

On March 20, 2023, Tareck El Aissami resigned from his government post amid serious corruption allegations. Moreover, El Aissami, a longtime Maduro ally, has a $10mn US government reward on his head for allegedly facilitating drug trafficking from Venezuela. He played a key role in helping Nicolas Maduro's government dodge US economic sanctions, using his Syrian and Lebanese parentage to open up new business channels to Iran and Turkey.

On January 5, 2022, Chevron temporarily decreased production in Kazakhstan's Tengiz Field due to the 2022 Kazakh protests, which were motivated by heavy oil price increases. Later that month, Chevron also announced it would end all operations in Myanmar, citing rampant human rights abuses and deteriorating rule of law since the 2021 Myanmar coup d'état. A statement released by the company on its website stated while Chevron was committed to an orderly exit which ensured it could still provide energy to Southeast Asia, Chevron remained firmly opposed to the human rights violations committed by the current military rule in Myanmar.

Also in 2022, Chevron was reported to explore the sale of stakes in three fields located in Equatorial Guinea. It was suggested by Reuters that the sales are intended to attract smaller oil companies.

Chevron, however, did not do business in the 2020s without controversy and regulatory obstacles. Chevron Phillips Chemical, a company jointly owned by Chevron and Phillips 66, agreed to pay $118 million in March 2022 as a result of violating the Clean Air Act at three of its chemical production plants in Texas. According to the U.S. Department of Justice and U.S. Environmental Protection Agency, Chevron and Phillips failed to properly flare at the plants, causing excess air pollution. The companies agreed to add pollution control systems to the plants as well.

Despite the major oil and gas companies, including Chevron, reporting sharp rises in interim revenues and profits due to Russia's 2022 invasion of Ukraine, the world's-largest oil companies received immense backlash for such profits. In total, Chevron made US$246.3 billion in revenue and $36.5 billion in profit within 2022, both of which are records for the company. In addition, days before the company reported its full year earnings, Chevron increased its dividend and announced a $75 billion stock buyback program, a move which attracted a heated response from the Biden administration as well as from news commentators within the United States.

The 2020s also saw efforts by Chevron to expand into the clean energy industry. Across the 2020s, Chevron invested stakes into fusion power companies, the two largest of them being Zap Energy and TAE Technologies. September 2023 saw Chevron acquire a majority stake in a Utah hydrogen storage facility, which is poised to be the world's largest storage facility for hydrogen in renewable energy.

In October 2023, Chevron Corporation acquired Hess Corporation in an all-stock deal for $53 billion. The acquisition, which was announced on October 23, 2023, opens up new opportunities in the US shale plays and in oil-rich Guyana. Hess Corp, Exxon Mobil and China's CNOOC, key players in Guyana, have been producing a combined 400,000 barrels per day.from two offshore projects. With the potential to develop 10 more projects, Guyana becomes one of the fastest-growing oil regions that Chevron now has access to.

In 2023, Chevron entered into a 10-year agreement with state-owned Hindustan Petroleum Corporation Ltd (HPCL) to license, manufacture, distribute and sell Chevron lubricants in India under the Caltex brand.

In August 2024, Chevron earmarked $1 billion in a new research and development (R&D) hub called Chevron Engineering and Innovation Excellence Center (ENGINE) in Bengaluru, India.

Corporate image

Logo evolution

The first logo featured the legend "Pacific Coast Oil Co.", the name adopted by the company when it was established in 1879. Successive versions showed the word 'Standard' (for "The Standard Oil of California"). In 1968, the company introduced the word 'Chevron' (which was introduced as a brand in the 1930s) for the first time in its logo. In July 2014, the Chevron Corporation logo design was officially changed, although it has been used since 2000. By 2015, the logo had been changed multiple times, with three different color schemes applied in the logo. The logo was gray, then blue, and then turned red before returning to the silver gray it is today.

"Human Energy"

Chevron today is well known for its slogan "the human energy company", a campaign first launched in September 2007. In a corporate blog, Chevron states "human energy" was chosen as their campaign's slogan and focus because "human energy captures our positive spirit in delivering energy to a rapidly changing world". The slogan remains prominent in Chevron advertising, and Chevron has derived from this slogan to use phrases in marketing such as "it's only human".

Operations

As of December 31, 2018, Chevron had approximately 48,600 employees (including about 3,600 service station employees). Approximately 24,800 employees (including about 3,300 service station employees), or 51 percent, were employed in U.S. operations.

Chevron's dominant regions of production are North America, which produces 1.2 billion barrels of oil equivalent (BBOE), and Eurasia, which produces 1.4 BBOE. Chevron's Eurasian-Pacific operations are concentrated in the United Kingdom, Southeast Asia, Kazakhstan, Australia, Bangladesh, and greater China. Chevron additionally operates in South America, the west coast of sub-Saharan Africa (mainly Nigeria and Angola), Egypt, and Iraq; these four regions collectively produce 0.4 BBOE. Chevron's largest revenue products are shale and tight, though produces considerable revenue from heavy oil, deepwater offshore drilling, conventional oil, and liquefied natural gas.

In October 2015, Chevron announced that it was cutting up to 7,000 jobs, or 11 percent of its workforce. Because of the COVID-19 pandemic and 2020 Russia–Saudi Arabia oil price war, Chevron announced reductions of 10–15% of its workforce.

Upstream

Chevron's oil and gas exploration and production operations, which in the oil and gas industry are considered as "upstream" operations, are primarily in the US, Australia, Nigeria, Angola, Kazakhstan, and the Gulf of Mexico. As of December 31, 2018, the company's upstream business reported worldwide net production of 2.930 million oil-equivalent barrels per day.

In the United States, the company operates approximately 11,000 oil and natural gas wells in hundreds of fields occupying 4,000,000 acres (16,000 km) across the Permian Basin, located in West Texas and southeastern New Mexico. In 2010, Chevron was the fourth-largest producer in the region. In February 2011, Chevron celebrated the production of its 5 billionth barrel of Permian Basin oil. The Gulf of Mexico is where the company's deepest offshore drilling takes place at Tahiti and Blind Faith. The company also explored and drilled in the Marcellus Shale formation under several northeastern US states; these operations were sold to the Pittsburgh-based natural gas firm EQT Corporation in 2020.

Chevron's largest single resource project is the $43 billion Gorgon Gas Project in Australia. It also produces natural gas from Western Australia. The $43 billion project was started in 2010, and was expected to be brought online in 2014. The project includes construction of a 15 million tonne per annum liquefied natural gas plant on Barrow Island, and a domestic gas plant with the capacity to provide 300 terajoules per day to supply gas to Western Australia.

It is also developing the Wheatstone liquefied natural gas development in Western Australia. The foundation phase of the project is estimated to cost $29 billion; it will consist of two LNG processing trains with a combined capacity of 8.9 million tons per annum, a domestic gas plant and associated offshore infrastructure. In August 2014 a significant gas-condensate discovery at the Lasseter-1 exploration well in WA-274-P in Western Australia, in which Chevron has a 50% interest was announced. The company also has an interest in the North West Shelf Venture, equally shared with five other investors including BP, BHP Petroleum, Shell, Mitsubishi/Mitsui and Woodside. Presently, Chevron is looking to convert its Gorgon Island operations from upstream production to carbon capture and storage.

In the onshore and near-offshore regions of the Niger Delta, Chevron operates under a joint venture with the Nigerian National Petroleum Corporation, operating and holding a 40% interest in 13 concessions in the region. In addition, Chevron operates the Escravos Gas Plant and the Escravos gas-to-liquids plant.

Chevron has interests in four concessions in Angola, including offshore two concessions in Cabinda province, the Tombua–Landana development and the Mafumeira Norte project, operated by the company. It is also a leading partner in Angola LNG plant.

In Kazakhstan, Chevron participate the Tengiz and Karachaganak projects. In 2010, Chevron became the largest private shareholder in the Caspian Pipeline Consortium pipeline, which transports oil from the Caspian Sea to the Black Sea.

As of 2013, the Rosebank oil and gas field west of Shetland was being evaluated by Chevron and its partners. Chevron drilled its discovery well there in 2004. Production was expected in 2015 if a decision was made to produce from the field. The geology and weather conditions are challenging.

Midstream

As of 2019, outside of maritime shipping, Chevron did not own significant midstream assets; that year it attempted to purchase Anadarko Petroleum, which owned pipelines, but was outbid by Occidental Petroleum. In 2021, Chevron completed its purchase of Noble Midstream Partners LP, which has crude oil, produced water and gas gathering assets in the Permian Basin in West Texas and the DJ Basin in Colorado. Noble Midstream also has 2 crude oil terminals in the DJ Basin as well as freshwater delivery systems.

Transport

Chevron Shipping Company, a wholly owned subsidiary, provides the maritime transport operations, marine consulting services and marine risk management services for Chevron Corporation. Chevron ships historically had names beginning with "Chevron", such as Chevron Washington and Chevron South America, or were named after former or serving directors of the company. Samuel Ginn, William E. Crain, Kenneth Derr, Richard Matzke and most notably Condoleezza Rice were among those honored, but the ship named after Rice was subsequently renamed as Altair Voyager.

Downstream

Refining

Chevron's downstream operations manufacture and sell products such as fuels, lubricants, additives and petrochemicals. The company's most significant areas of operations are the west coast of North America, the U.S. Gulf Coast, Southeast Asia, South Korea, Australia and South Africa. In 2010, Chevron sold an average of 3.1 million barrels per day (490×10^ m/d) of refined products like gasoline, diesel and jet fuel. The company operates approximately 19,550 retail sites in 84 countries. Chevron's Asia downstream headquarters is in Singapore, and the company operates gas stations (under the Caltex brand) within the city state, in addition to some gas stations in Western Canada. Chevron owns the trademark rights to Texaco and Caltex fuel and lubricant products.

Chevron, with equal partner Singapore Petroleum Company, also owns half of the 285,000 barrels per day (45,300 m/d) Singapore Refining Company (SRC) plant, a complex refinery capable of cracking crude oil. The investment was first made in 1979 when Caltex was a one-third partner.

In 2010, Chevron processed 1.9 million barrels per day (300×10^ m/d) of crude oil. It owns and operates Five active refineries in the United States (Richmond, CA, El Segundo, CA, Salt Lake City, UT, Pascagoula, MS, Pasadena, TX ). Chevron is the non-operating partner in seven joint venture refineries, located in Australia, Pakistan, Singapore, Thailand, South Korea, and New Zealand. Chevron's United States refineries are located in Gulf and Western states. Chevron also owns an asphalt refinery in Perth Amboy, New Jersey; however, since early 2008 that refinery has primarily operated as a terminal.

Chemicals

Main article: Chevron Phillips ChemicalChevron's primary chemical business is in a 50/50 joint venture with Phillips 66, organized into the Chevron Phillips Chemical Company. Chevron also operates the Chevron Oronite Company, which develops, manufactures and sells fuel and lubricant additives.

Retail

In the United States, the Chevron brand is the most widely used, at 6,880 locations as of September 2022 spread across 21 states. Chevron's highest concentration of stations branded as Chevron are in California (mostly in the San Francisco Bay Area, Central Valley, and Greater Los Angeles), Las Vegas, Anchorage, the Pacific Northwest (especially Seattle), Phoenix, Atlanta, the Texas Triangle, and South Florida. The world's largest Chevron gas station is located at Terrible's Road House in Nevada.

Chevron also utilizes the Texaco brand within the United States, though its locations are much more sparsely-spread than that of Chevron. Texaco is used at 1,346 locations across 17 states, mostly in Washington, Texas, Louisiana, Alabama, Mississippi, Georgia, and Hawaii. Additionally, Texaco licenses its brand to Valero Energy to use in the United Kingdom, and over 730 Texaco stations exist in Britain.

Chevron primarily uses the Caltex brand outside of the United States, primarily in Southeast Asia, Hong Kong, Pakistan, New Zealand, and South Africa. In 2015, Chevron sold its 50% stake in Caltex Australia, while allowing the company to continue using the Caltex brand. In 2019, Chevron announced it would re-enter the Australian market by purchasing Puma Energy's operations in the country. The acquisition was completed in July 2020. Chevron relaunched the Caltex brand in Australia in 2022, after the expiration of Caltex Australia's license to use the Caltex brand.

Alternative energy

Chevron's alternative energy operations include geothermal solar, wind, biofuel, fuel cells, and hydrogen. In 2021 it significantly increased its use of biofuel from dairy farms, like biomethane.

Chevron has claimed to be the world's largest producer of geothermal energy. The company's primary geothermal operations were located in Southeast Asia, but these assets were sold in 2017.

Prior, Chevron operated geothermal wells in Indonesia providing power to Jakarta and the surrounding area. In the Philippines, Chevron also operated geothermal wells at Tiwi field in Albay province, the Makiling-Banahaw field in Laguna and Quezon provinces.

In 2007, Chevron and the United States Department of Energy's National Renewable Energy Laboratory (NREL) started collaboration to develop and produce algae fuel, which could be converted into transportation fuels, such as jet fuel. In 2008, Chevron and Weyerhaeuser created Catchlight Energy LLC, which researches the conversion of cellulose-based biomass into biofuels. In 2013, the Catchlight plan was downsized due to competition with fossil fuel projects for funds.

Between 2006 and 2011, Chevron contributed up to $12 million to a strategic research alliance with the Georgia Institute of Technology to develop cellulosic biofuels and to create a process to convert biomass like wood or switchgrass into fuels. Additionally, Chevron holds a 22% stake in Galveston Bay Biodiesel LP, which produces up to 110 million US gallons (420,000 m) of renewable biodiesel fuel a year.

In 2010, the Chevron announced a 740 kW photovoltaic demonstration project in Bakersfield, California, called Project Brightfield, for exploring possibilities to use solar power for powering Chevron's facilities. It consists of technologies from seven companies, which Chevron is evaluating for large-scale use. In Fellows, California, Chevron has invested in the 500 kW Solarmine photovoltaic solar project, which supplies daytime power to the Midway-Sunset Oil Field. In Questa, Chevron has built a 1 MW concentrated photovoltaic plant that comprises 173 solar arrays, which use Fresnel lenses. In October 2011, Chevron launched a 29-MW thermal solar-to-steam facility in the Coalinga Field to produce the steam for enhanced oil recovery. As of 2012, the project is the largest of its kind in the world.

In 2014, Chevron began reducing its investment in renewable energy technologies, reducing headcount and selling alternative energy-related assets.

In 2015, the Shell Canada Quest Energy project was launched of which Chevron Canada Limited holds a 20% share. The project is based within the Athabasca Oil Sands Project near Fort McMurray, Alberta. It is the world's first CCS project on a commercial-scale.

Corporate affairs

| Company | Revenue (USD) | Profit (USD) | Brands |

|---|---|---|---|

| ExxonMobil | $286 billion | $23 billion | Mobil Esso Imperial Oil |

| Shell plc | $273 billion | $20 billion | Jiffy Lube Pennzoil Z Energy |

| TotalEnergies | $185 billion | $16 billion | Elf Aquitaine SunPower |

| BP | $164 billion | $7.6 billion | Amoco Aral AG |

| Chevron | $163 billion | $16 billion | Texaco Caltex Havoline |

| Marathon | $141 billion | $10 billion | ARCO |

| Phillips 66 | $115 billion | $1.3 billion | 76 Conoco JET |

| Valero | $108 billion | $0.9 billion | — |

| Eni | $77 billion | $5.8 billion | — |

| ConocoPhillips | $48.3 billion | $8.1 billion | — |

Business trends

As of 2018, Chevron is ranked No. 13 on the Fortune 500 rankings of the largest United States corporations by total revenue.

The key trends of Chevron are (as at the financial year ending December 31):

| Year | Revenue in billion US$ |

Net income in billion US$ |

Price per Share in US$ |

Employees | Refs |

|---|---|---|---|---|---|

| 1997 | 40.5 | 3.2 | 38.50 | ||

| 1998 | 29.9 | 1.3 | 41.47 | ||

| 1999 | 35.4 | 2.0 | 43.31 | ||

| 2000 | 50.5 | 5.1 | 42.22 | ||

| 2001 | 104 | 3.2 | 44.80 | ||

| 2002 | 98.6 | 1.1 | 33.24 | ||

| 2003 | 120 | 7.2 | 43.20 | ||

| 2004 | 151 | 13.3 | 52.51 | ||

| 2005 | 198 | 14.0 | 47.89 | ||

| 2006 | 210 | 17.1 | 57.58 | ||

| 2007 | 220 | 18.6 | 63.07 | ||

| 2008 | 273 | 23.9 | 82.42 | 67,000 | |

| 2009 | 171 | 10.4 | 84.90 | 64,000 | |

| 2010 | 204 | 19.0 | 70.17 | 62,000 | |

| 2011 | 253 | 26.8 | 78.13 | 61,000 | |

| 2012 | 241 | 26.1 | 100.85 | 62,000 | |

| 2013 | 228 | 21.4 | 107.55 | 64,600 | |

| 2014 | 211 | 19.2 | 120.23 | 64,700 | |

| 2015 | 138 | 4.5 | 120.51 | 61,500 | |

| 2016 | 114 | −0.49 | 96.36 | 55,200 | |

| 2017 | 141 | 9.1 | 99.87 | 51,900 | |

| 2018 | 166 | 14.8 | 111.45 | 48,600 | |

| 2019 | 146 | 2.9 | 119.63 | 48,200 | |

| 2020 | 94.6 | −5.5 | 88.27 | 13,379 | |

| 2021 | 162 | 15.6 | 104.21 | 42,595 | |

| 2022 | 246 | 35.4 | 179.49 | 43,846 | |

| 2023 | 200 | 21.3 | 45,600 |

Ownership

Chevron is mainly owned by institutional investors, who own around 70% of shares. The largest shareholders in December 2023 were:

- The Vanguard Group (8.70%)

- BlackRock (6.98%)

- Berkshire Hathaway (6.79%)

- State Street Corporation (6.71%)

- Geode Capital Management (1.86%)

- Morgan Stanley (1.85%)

- Bank of America (1.49%)

- Charles Schwab Corporation (1.41%)

- JPMorgan Chase (1.38%)

- Northern Trust (1.18%)

Headquarters and Offices

California

Chevron's corporate headquarters are located in a 92-acre campus in San Ramon, California, located at 6001 Bollinger Canyon Road. The company moved there in 2002 from its earlier headquarters at 555 Market Street in San Francisco, California, the city where it had been located since its inception in 1879. Chevron sold its San Ramon headquarters to the local Sunset Development Co. in September 2022, from whom it originally bought the land which the Bollinger Canyon Road headquarters today stand, and is planning to lease space in San Ramon's Bishop Ranch, also owned by Sunset, as its new headquarters, as it continued to shift more operations to Texas.

Texas

Chevron operates from office towers in downtown Houston, Texas, where it purchased 1500 Louisiana Street and 1400 Smith Street, the former headquarters of failed Texas energy giant Enron.

Chevron also planned a new office tower at 1600 Louisiana Street, next to its existing properties. The building would have stood 50-stories and 832 feet. Upon its completion, it would have been the fourth-tallest building in Houston and the first 50-plus-story building to be constructed in Houston in nearly 30 years. However, the contract with the state government of Texas that Chevron made did not require that Chevron follow through with the plans and build the office tower, and as such, Chevron announced in 2016 it had no plans to build the tower, which remained undeveloped as of August 2024. However, upon Chevron announcing that it was selling its San Ramon headquarters in 2022 and offered to cover moving costs for employees who wished to relocate to Texas, interest sparked in Chevron potentially following through with building a tower at 1600 Louisiana.

On August 2, 2024, Chevron announced that it would be relocating its headquarters from California to Houston, Texas, by 2025, citing a multifactorial decision.

Political contributions

Since January 2011 Chevron has contributed almost $15 million on Washington lobbying. On October 7, 2012, Chevron donated $2.5 million to the Republican Congressional Leadership Fund super PAC that is closely tied to former House Speaker John Boehner.

According to watchdog group Documented, in 2020 Chevron contributed $50,000 to the Rule of Law Defense Fund, a fund-raising arm of the Republican Attorneys General Association.

Leadership

Chairman of the Board

Demetrius G. Scofield, March 8, 1917 – July 30, 1917

William S. Miller, April 28, 1919 – December 23, 1919

Harry D. Collier, October 25, 1945 – January 1, 1950

R. Gwin Follis, January 1, 1950–December 1966

Otto N. Miller, December 1966–January 1974

Harold J. Haynes, January 1974–May 1981

George M. Keller, May 1981–January 1, 1989

Kenneth T. Derr, January 1, 1989 – January 1, 2000

David J. O'Reilly, January 1, 2000 – December 31, 2009

John S. Watson December 31, 2009 – February 1, 2018

Michael K. Wirth, February 1, 2018–present

President

George Loomis, September 10, 1879 – December 15, 1879

Charles N. Felton, December 15, 1879–August, 1885

George Loomis, August 1885–April 8, 1894

Charles N. Felton, April 17, 1894–February 1896

Gordon Blanding, February, 1896–October 17, 1900

Henry M. Tilford, December 18, 1900 – February 20, 1911

James A. Moffett, February 20, 1911 – December 1, 1911

Demetrius G. Scofield, December 5, 1911 – March 8, 1917

Kenneth R. Kingsbury, April 28, 1919 – November 22, 1937

William H. Berg, December 10, 1937 – June 26, 1940

Harry D. Collier, July 8, 1940 – October 25, 1945

R. Gwin Follis, October 25, 1945 – January 9, 1948

Theodore S. Petersen, January 9, 1948 – October 26, 1961

Otto N. Miller, October 26, 1961–December 1966

James E. Gosline, December 1966–July 30, 1969

Harold J. Haynes, July 30, 1969–January 1974

John R. Grey, January 1974–December 31, 1985

office abolished

Current Board of directors

- Wanda Austin

- John B. Frank

- Alice P. Gast

- Enrique Hernandez Jr.

- Marillyn Hewson

- Jon M. Huntsman Jr.

- Charles Moorman

- Dambisa Moyo

- Debra Reed-Klages

- Ronald Sugar (Lead independent director)

- Inge Thulin

- Jim Umpleby

- Mike Wirth (Chairman & CEO)

Criticism and concerns

Main article: Criticism of Chevron

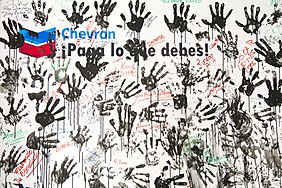

Chevron has been widely criticized and attacked for scandals, accidents, and activities mostly related to climate change. Chevron has been fined by the governments of Angola, for oil spills within its waters, and the United States through its EPA for violations of the US Clean Air Act and pollutive activities arising out of its Richmond Refinery in California. On multiple instances, authorities in oil-heavy countries have fired rounds onto protestors against Chevron. Environmental activists have held annual anti-Chevron protests, usually within a week of Chevron's annual meeting of shareholders.

One case heavily promoted on social media is about work done in the Lago Agrio oil field by Texaco, which Chevron acquired in 2001. Texaco dumped 18 billion tons of toxic waste and spilled 17 million US gallons (64,000,000 L) of petroleum. Texaco's activities were the subject of an Ecuadorian court case brought by Steven Donziger, which claimed an $18 billion and later reduced $9.5 billion judgment.

See also

- Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc.

- Climate appraisal

- Climate risk management

- Global warming

- Jack 2

- Patent encumbrance of large automotive NiMH batteries

- Texaco

- The Richmond Standard

- Trans-Caribbean pipeline

Notes

- Data is based on the 2022 Fortune 500.

- Determined by closing price on December 31 (or last trading day) of that specific calendar year

References

- Standard Oil History at the Encyclopedia Britannica

- ^ on Britannica

- Kaszynski, William (2000). The American Highway: The History and Culture of Roads in the United States. Jefferson, North Carolina: McFarland & Company. p. 47. ISBN 0786408227. Retrieved September 28, 2023.

- Chevron announces headquarters relocation and senior leadership changes

- DiChristopher, Tom (September 28, 2017). "Chevron names Mike Wirth chairman and CEO". MSNBC. Retrieved February 15, 2018.

- "2023 Annual Report (Form 10-K)". U.S. Securities and Exchange Commission. February 26, 2024.

- ^ Collin Eaton (August 2, 2024). "Chevron to Leave California for Texas, as Regulations Mount in Golden State". The Wall Street Journal. Retrieved August 2, 2024.

CEO Mike Wirth says policies in California are discouraging investment and hurting consumers.

- Chevron Policy, Government and Public Affairs. "Chevron History". chevron.com. Retrieved September 1, 2022.

- "United States Highlights of Operations". chevron.com. Retrieved April 2, 2020.

- "Check out Chevron Corp's stock price (CVX) in real time". CNBC. January 29, 2012. Retrieved August 15, 2022.

- "Chevron | 2022 Fortune 500". Fortune. Retrieved August 15, 2022.

- ^ M. S. Vassiliou (March 2, 2009). Historical Dictionary of the Petroleum Industry. Scarecrow Press. pp. 128–. ISBN 978-0-8108-6288-3. Retrieved August 8, 2013.

- ^ Antonia Juhasz (October 6, 2009). The Bush Agenda. HarperCollins. pp. 106–. ISBN 978-0-06-197761-9. Retrieved August 9, 2013.

- ^ Joshua Karliner (1997). The Corporate Planet: Ecology and Politics in the Age of Globalization. University of California Press. pp. 61–. ISBN 978-0-87156-434-4. Retrieved August 8, 2013.

- M. S. Vassiliou (September 24, 2009). The A to Z of the Petroleum Industry. Scarecrow Press. pp. 128–. ISBN 978-0-8108-7066-6. Retrieved August 9, 2013.

- ^ Toyin Falola (January 1, 2005). The Politics of the Global Oil Industry: An Introduction. Greenwood Publishing Group. pp. 33–. ISBN 978-0-275-98400-7. Retrieved August 9, 2013.

- Charles A. S. Hall; Carlos A. Ramírez-Pascualli (December 5, 2012). The First Half of the Age of Oil: An Exploration of the Work of Colin Campbell and Jean Laherr√®re. Springer. pp. 34–. ISBN 978-1-4614-6064-0. Retrieved August 10, 2013.

- Juhasz, Antonia (September 28, 2010). "Chevron Throws Book at Shareholder Activist (Me)". The Huffington Post. Retrieved August 17, 2013.

- Letzing, John (September 29, 2010). "Activist Faces Charges in Chevron Meeting Outburst". The Wall Street Journal. Retrieved August 17, 2013.

- "Protesters Disrupt BP's First Shareholder Meeting Since Oil Spill". Environment News Service. April 14, 2011. Archived from the original on January 8, 2021. Retrieved August 17, 2013.

- Antonia Juhasz (October 6, 2009). The Tyranny of Oil: The World's Most Powerful Industry—and What We Must Do to Stop It. HarperCollins. pp. 71–. ISBN 978-0-06-198201-9. Retrieved August 10, 2013.

- Baker, David R. (May 10, 2005). "Chevron drops the Texaco from its name". San Francisco Chronicle. Archived from the original on May 17, 2011. Retrieved May 2, 2011.

- Fishman, Stephen (2022). Trademark: Legal Care for Your Business & Product Name (13th ed.). El Segundo: Nolo. p. 242. ISBN 9781413330090. Retrieved November 15, 2024.

- Lutz, Brian (February 18, 2009). "A Not-So-Standard Chevron Station". TheSledgehammer. Retrieved November 11, 2018.

- Chamings, Andrew (February 7, 2021). "Obscure SF: There's something strange about this gas station on Van Ness". San Francisco Chronicle. Retrieved February 8, 2021.

- ^ Abcede, Angel (December 7, 2009). "Eastern Withdrawal for Chevron | CSP Daily News / Magazine | Petroleum – CSP Information Group, Inc. – news for convenience & petroleum retailing". Cspnet.com. Archived from the original on October 30, 2013. Retrieved January 10, 2014.

- ^ Eigelbach, Kevin (July 19, 2010). "Chevron's exit from Kentucky opens door for other gas brands". Louisville Business First. American City Business Journals.

- "Chevron and Calso". Retrieved September 20, 2014.

- "Vintage Calso Gasoline / Standard Oil of California pump". Retrieved September 20, 2014.

- Peck, Merton J. & Scherer, Frederic M. The Weapons Acquisition Process: An Economic Analysis (1962) Harvard Business School p.619

- "The King of Giant Fields". Archived from the original on August 16, 2020. Retrieved June 5, 2013.

- "Our History – Aramco Services Company". www.aramcoservices.com. Archived from the original on February 12, 2018. Retrieved February 12, 2018.

- SOCAL agrees to buy Gulf in record deal price by Robert Cole at The New York Times, March 6, 1984

- Lasner, Jonathan (March 6, 1984). "Gulf directors accept $80 bid from Socal". Pittsburgh Press. p. A1.

- "Merger would be largest ever". Spokesman-Review. (Spokane, Washington). Associated Press. March 6, 1984. p. A5.

- Belko, Mark; Schwartzel, Erich (May 1, 2013). "Chevron acquires Kmart property in Moon for possible regional headquarters – Pittsburgh Post-Gazette". Pittsburgh Post-Gazette.

- "Gulf Oil acquires brand rights for entire US". Vermont Business Magazine. January 13, 2010. Archived from the original on July 30, 2020. Retrieved May 5, 2010.

- "Chevron Corp, Form 10-Q, Quarterly Report, Filing Date Nov 8, 1996". secdatabase.com. Retrieved March 24, 2013.

- "Chevron Corp, Form 8-K, Current Report, Filing Date Mar 6, 2000". secdatabase.com. Retrieved March 24, 2013.

- "Chevron Corp, Form 8-K, Current Report, Filing Date May 25, 2007" (PDF). secdatabase.com. Retrieved March 24, 2013.

- "Chevron's Profit Rises 24%, With Help From Its Refineries". The New York Times. Reuters. July 28, 2007. Retrieved May 2, 2011.

- "Chevron Corp, Form 8-K, Current Report, Filing Date Oct 16, 2000". secdatabase.com. Retrieved March 24, 2013.

- "Oil giant Chevron buys rival Texaco". BBC News. October 16, 2000. Retrieved May 2, 2011.

- "Chevron to Acquire Texaco". The Street.com. Archived from the original on October 11, 2012. Retrieved May 2, 2011.

- Raine, George (October 10, 2001). "The Chevron – Texaco Merger / An oil giant emergers / Shareholders approval of Chevron-Texaco deal creates industy's [sic] lates behemoth". San Francisco Chronicle. Retrieved May 2, 2011.

- "Chevron Corp, Form 8-K, Current Report, Filing Date May 10, 2005" (PDF). secdatabase.com. Retrieved March 24, 2013.

- "Chevron Corp, Form 8-K, Current Report, Filing Date Apr 7, 2005". secdatabase.com. Retrieved March 24, 2013.

- "Chevron Corp, Form 8-K, Current Report, Filing Date Aug 10, 2005" (PDF). secdatabase.com. Retrieved March 24, 2013.

- Baker, David R. (April 5, 2005). "Chevron plans to buy Unocal for $18.4 billion / Deal would bolster East Bay oil giant's strategically located sources of gas, crude". San Francisco Chronicle. Retrieved May 2, 2011.

- Blum, Justin (August 11, 2005). "Shareholders Vote in Favor Of Unocal Acquisition". The Washington Post. Retrieved May 2, 2011.

- ^ "Chevron claims energy debate". BBC News. February 19, 2006. Retrieved December 31, 2009.

- O'Dell, John & Kraul, Chris (November 19, 1996). "76 Products Co. Sold in $1.8-Billion Deal". Los Angeles Times.

- "Chevron and Los Alamos Jointly Research Oil Shale Hydrocarbon Recovery". Green Car Congress. September 25, 2006. Retrieved April 12, 2009.

- "Interior Department Issues Oil Shale Research, Development and Demonstration Leases for Public Lands in Colorado" (Press release). Bureau of Land Management. December 15, 2006. Archived from the original on May 9, 2009. Retrieved April 12, 2009.

- "Chevron leaving Western Slope oil shale project". Denver Business Journal. February 28, 2012. Retrieved March 12, 2012.

- "Chevron Corp, Form DFAN14A, Filing Date Nov 9, 2010". secdatabase.com. Retrieved March 24, 2013.

- Kaplan, Thomas (November 9, 2010). "Chevron to Buy Atlas Energy for $4.3 Billion". The New York Times. Retrieved May 2, 2011.

- "Chevron Corp, Form 10-K, Annual Report, Filing Date Feb 24, 2011". secdatabase.com. Retrieved March 24, 2013.

- "Chevron Continues Aggressive Expansion into Marcellus Shale in PA – Buys Leases for Additional 228K Acres from Chief Oil & Gas | Marcellus Drilling News". Marcellusdrilling.com. May 5, 2011. Retrieved July 23, 2012.

- Louise Heavens (September 18, 2013). "France's Total snaps up Chevron's Pakistan retail network". Reuters. Archived from the original on July 30, 2020. Retrieved June 30, 2017.

- Chevron sells stake in Canadian shale field to Kuwait Archived July 30, 2020, at the Wayback Machine. Reuters, October 7, 2014

- "Chevron Announces Agreement to Acquire Anadarko" (Press release). April 12, 2019. Archived from the original on May 13, 2019. Retrieved April 16, 2019.

- "Chevron Acquires Noble Energy for $5 Billion". /www.baynews9.com. July 20, 2020. Retrieved July 20, 2020.

- "Chevron strikes US$5bn deal to acquire Noble Energy". Proactiveinvestors NA. July 20, 2020. Retrieved July 23, 2020.

- ^ Eckhouse, Brian; Wethe, David (May 29, 2020). "Oil-Bust Refugees Are Being Courted By Clean Energy in Texas". www.bloomberg.com. Archived from the original on July 26, 2020. Retrieved October 22, 2023.

- Matthews, Christopher M.; Glazer, Emily; Lombardo, Cara (January 31, 2021). "WSJ News Exclusive | Exxon, Chevron CEOs Discussed Merger". Wall Street Journal. Retrieved January 7, 2022.

- "Breakingviews - Chexxon fantasy M&A – who would buy whom?". Reuters. February 10, 2021. Retrieved September 15, 2022.

- "U.S. energy firms launching employee COVID-19 vaccination mandates". Reuters. August 23, 2021. Retrieved August 24, 2021.

- Matthews, Christopher M. (August 23, 2021). "WSJ News Exclusive | Chevron Begins Vaccination Mandates as Covid-19 Roils Oil Fields". The Wall Street Journal. ISSN 0099-9660. Retrieved August 24, 2021.

- Chapa, Sergio (February 18, 2020). "Chevron invests in carbon capture technology company". HoustonChronicle.com. Retrieved February 28, 2020.

- "Chevron Completes Acquisition of (REG)".

- "Chevron Announces Agreement to Acquire Renewable Energy Group".

- "Chevron to acquire full ownership of Beyond6 CNG Fuelling Network". Oilfield Technology. November 18, 2022. Retrieved November 18, 2022.

- Bushard, Brian. "Biden Administration Allows Chevron To Pump Oil In Venezuela—Here's Why It's So Controversial". Forbes. Retrieved January 25, 2023.

- ""Now to produce!": Maduro's government announces agreements with Chevron to resume operations". November 29, 2022.

- Daniels, Joe; Stott, Michael (March 21, 2023). "Venezuela oil minister resigns as Maduro cracks down on corruption". Financial Times.

- "News updates from January 6: Chevron adjusts output at Kazakhstan oilfield, Johnson offers apology over donor messages, Rivian shares fall below IPO price". Financial Times. January 5, 2022. Archived from the original on December 10, 2022. Retrieved January 11, 2022.

- "2 big energy firms exit Myanmar over human rights abuses by the military government". NPR. Associated Press. January 21, 2022. Retrieved January 21, 2022.

- "Chevron's View on Myanmar". Chevron. Retrieved January 28, 2022.

- Bousso, Ron; French, David (February 21, 2022). "Chevron seeks to sell Equatorial Guinea oil and gas assets -sources". Reuters. Retrieved February 22, 2022.

- Associated Press (March 10, 2022). "Chevron Phillips agrees to cut pollution at 3 Texas plants". khou.com. Retrieved March 10, 2022.

- Isidore, Chris (January 27, 2023). "Chevron earnings soar to a record | CNN Business". CNN. Retrieved February 3, 2023.

- "Oil giants reap record profits as war rages in Ukraine, energy prices soar: Here's how much they made". USA Today. May 7, 2022.

- ""Big Oil is intentionally profiteering from the war": Exxon profits double after Putin's invasion". Salon. April 29, 2022.

- Norton, Kit (January 26, 2023). "Chevron Returns $75 Billion To Shareholders As White House Fumes". Investor's Business Daily. Retrieved January 26, 2023.

- Morrow, Allison (January 26, 2023). "Swimming in cash, Chevron plans a $75 billion slap in the face to drivers | CNN Business". CNN. Retrieved January 26, 2023.

- Surran, Carl (January 26, 2023). "Chevron surges on eye-catching buyback plan; raised dividend yield tops Exxon (NYSE:CVX) | Seeking Alpha". seekingalpha.com. Retrieved January 26, 2023.

- Ellichipuram, Umesh (August 13, 2020). "Chevron announces investment in nuclear fusion start-up Zap Energy". Power Technology. Retrieved September 14, 2023.

- Clifford, Catherine (July 19, 2022). "Google and Chevron invest in nuclear fusion startup that's raised $1.2 billion". CNBC. Retrieved September 14, 2023.

- Valle, Sabrina (September 12, 2023). "Chevron buys world's biggest hydrogen storage plant in Utah". Reuters. Retrieved September 13, 2023.

- "Chevron buys Hess Corporation for $53 billion, another acquisition in oil, gas industry". USA TODAY. Retrieved October 23, 2023.

- "Chevron to buy Hess Corp for $53 billion in all-stock deal". Reuters. October 23, 2023.

- "Chevron's game-changing $53 billion deal with Hess Corp: A bold step into Guyana's oil boom". The Economic Times. October 23, 2023. Archived from the original on November 20, 2023. Retrieved February 7, 2024.

- Pathak, Kalpana (October 25, 2023). "Chevron's Caltex Lubes returns to India after 12 years; HPCL to market it". The Economic Times. Archived from the original on November 30, 2023. Retrieved February 7, 2024.

- "Chevron to set up engineering & innovation center with $1bn investment".

- Bakshi, Sameer Ranjan (August 21, 2024). "Energy company Chevron to set up $1 billion Bengaluru tech centre". The Economic Times. ISSN 0013-0389. Retrieved August 21, 2024.

- "Chevron - Logo in EPS, PNG & JPG Formats". logoose.com. Archived from the original on June 29, 2022. Retrieved January 26, 2022.

- "Chevron Logo, history, meaning, symbol, PNG". Retrieved January 26, 2022.

- "Chevron Logo". Retrieved June 21, 2023.

- "The Evolution of 5 Oil and Gas Logos". Castagra. Archived from the original on August 25, 2019. Retrieved March 31, 2017.

- "Chevron Announces New Global 'Human Energy' Advertising Campaign | Chevron Corporation". chevroncorp.gcs-web.com. Retrieved December 7, 2021.

- "Chevron Launches "Human Energy" Campaign". Convenience Store News. October 2007. Retrieved February 6, 2023.

- Beer, Mitchell (October 6, 2022). "Parody Ad Spoofs Chevron Messaging". The Energy Mix. Retrieved February 6, 2023.

- "Chevron Corporation 2018 Annual Report (Form 10-K)". U.S. Securities and Exchange Commission.

- "Europeans 'Don't Intend to Go Back' to Russian Natural Gas, Says Chevron CEO". Natural Gas Intelligence. March 6, 2023. Retrieved March 7, 2023.

- "Chevron cutting up to 7,000 jobs". CBS. October 30, 2015. Retrieved October 30, 2015.

- "Chevron Corporation 2018 Annual Report (Form 10-K)". U.S. Securities and Exchange Commission.

- Ordonez, Isabel (April 8, 2011). "Chevron Rekindles Old Texas Flame". The Wall Street Journal.

- "Chevron celebrates 5 billion barrels of Permian Basin crude – Mywesttexas.com: Local Newsroom". Mywesttexas.com. February 16, 2011. Retrieved July 23, 2012.

- "EQT Announces the Acquisition of Chevron's Appalachia Assets" (Press release). EQT Corporation. Retrieved February 16, 2023 – via www.prnewswire.com.

- Garrett, Geoffrey (August 13, 2011). "Why this love triangle works". The Australian.

- "Chevron's Gorgon project taking shape | Latest Business & Australian Stock market News". Perth Now. February 2, 2011. Retrieved July 23, 2012.

- Burrell, Andrew (June 15, 2011). "Chevron's Wheatstone LNG project to generate 6,500 jobs, says Roy Krzywosinski". The Australian.

- "Higher interim dividend by Santos as oil and gas revenue rises". Australian News.Net. August 21, 2014. Retrieved August 22, 2014.

- "Participants – NWSSSC". www.nwsssc.com. Retrieved May 7, 2019.

- "Chevron says Gorgon carbon capture just the start". Australian Financial Review. July 6, 2022. Retrieved February 16, 2023.

- "Escravos Gas-to-Liquids Project, Niger Delta". Hydrocarbons Technology. June 15, 2011. Retrieved July 23, 2012.

- "Chevron Corporation (CVX) Stock Description". Seeking Alpha. December 31, 2009. Retrieved July 23, 2012.

- "Angola LNG". Angola Today. Archived from the original on September 7, 2012. Retrieved July 23, 2012.

- "Chevron Rises To $104 As Kazakhstan Kicks Up Production". Forbes. October 13, 2011. Retrieved June 23, 2013.

- "Caspian Pipeline Consortium: Private Company Information – Businessweek". Investing.businessweek.com. September 20, 2011. Archived from the original on May 2, 2013. Retrieved July 23, 2012.

- Stanley Reed (July 23, 2013). "Chevron to Spend $770 Million on Remote Projects". The New York Times. Retrieved July 23, 2013.

- ^ DiChristopher, Tom (April 12, 2019). "Why oil giant Chevron is buying Anadarko Petroleum for $33 billion". CNBC. Retrieved October 22, 2019.

- Egan, Matt (April 24, 2019). "Oil bidding war: Occidental trumps Chevron's deal for Anadarko". CNN.

- Marinucci, Carla (May 5, 2001). "Chevron redubs ship named for Bush aide". San Francisco Chronicle. Retrieved October 13, 2008.

- "Chevron Shipping Operations and Fleet". chevron.com. Chevron Corporation. Retrieved September 15, 2022.

- ^ "e10vk". Sec.gov. Retrieved July 23, 2012.

- "Retail & Commercial Fuel Sales". chevron.com. Chevron Corporation. Retrieved September 15, 2022.

- "Singapore Highlights of Operations". chevron.com. Chevron Corporation. Retrieved September 15, 2022.

- "Caltex Fuels and Lubricants". chevron.com. Chevron Corporation. Retrieved September 15, 2022.

- "Singapore". Chevron Corporation. Retrieved November 19, 2022.

- "Caltex in Singapore". Caltex Singapore. Archived from the original on December 14, 2011.

- Paton, James (August 22, 2011). "Caltex Australia Starts Review of Refineries as Margins Drop". Bloomberg L.P.

- Tanveer Ahmed (July 1, 2010). "PSO willing to raise stakes in PRL". Daily Times. Retrieved July 23, 2012.

- "N.Z. Refining Jumps After Valero Said to Plan Bid (Update2)". Bloomberg L.P. July 24, 2009.

- "Refining Crude Oil – Energy Explained, Your Guide To Understanding Energy". Eia.gov. Retrieved July 23, 2012.

- Arthur J. Caines, Roger F. Haycock, John E. Hillier (2004) Automotive Lubricants Reference Book ; John Wiley & Sons ; see p70/737

- "Number of Chevron locations in the United States in 2022". ScrapeHero. Retrieved September 16, 2022.

- "Number of Texaco locations in the United States in 2022". ScrapeHero. Retrieved September 16, 2022.

- "Texaco UK | Motorists Information". texaco.co.uk. Retrieved September 16, 2022.

- "Our Journey". Caltex Singapore. Retrieved September 16, 2022.

- "Chevron acquires Puma Energy". July 1, 2020. Retrieved May 13, 2020.

- "Chevron to revive Caltex brand for Puma network". Australian Financial Review. August 2, 2020. Retrieved August 25, 2020.

- "Chevron completes acquisition of Puma Energy (Australia) Holdings Pty Ltd". Chevron Australia. July 1, 2020. Retrieved August 25, 2020.

- "Caltex is back with big plans for the future". TradeTrucks.com.au. September 15, 2022. Retrieved September 16, 2022.

- Puma Energy announces sale of Puma Energy Australian fuel business to Chevron December 19, 2019

- Hsu, Tiffany (March 22, 2010). "Chevron is putting solar technologies to the test". Los Angeles Times. Retrieved July 11, 2013.

- Klinge, Naomi (August 25, 2021). "BP and Chevron buy into renewable natural gas". Upstream. Retrieved March 20, 2022.

- "Harnessing the Heat of Indonesia's Volcanoes". Bloomberg Businessweek. July 7, 2011. Archived from the original on July 12, 2011. Retrieved July 23, 2012.

- "Chevron bets on $30B volcanoes beneath rainforest". Financial Post. June 15, 2011. Retrieved July 23, 2012.

- "Chevron to expand its geothermal sites in the Philippines". Think GeoEnergy. June 21, 2010. Retrieved July 23, 2012.

- "Indonesia, Philippine groups acquire Chevron's $3 billion geothermal assets". Reuters. December 26, 2016. Retrieved February 5, 2020.

- "Aboitiz, Chevron eye more drillings at Tiwi-Makban geothermal fields". Business. Philippines: Philstar.com. July 13, 2009.

- "Chevron backs green and slimy answer to biofuel problems – 02 Nov 2007 – News from". BusinessGreen. Retrieved July 23, 2012.

- "Chevron investigates wood-fired cars – 04 Mar 2008 – News from". BusinessGreen. Retrieved July 23, 2012.

- "Chevron Defies California On Carbon Emissions". Bloomberg L.P. April 18, 2013. Retrieved September 20, 2014.

- "Chevron forms $12M biofuel research alliance". Bizjournals.com. June 15, 2006.

- "BioSelect, Chevron unveil Galveston biodiesel plant". Bizjournals.com. May 29, 2007.

- Swartz, Jon (May 26, 2011). "Big companies aggressively jump into clean tech". USA Today.

- Woody, Todd (May 22, 2010). "Chevron Testing Solar Technologies". The New York Times. Retrieved June 23, 2013.

- "Solar energy powers production of heavy oil in California". Oil & Gas Journal. May 2, 2007. Retrieved June 23, 2013.

- "Chevron adds solar power to area mine". UPI. February 24, 2010. Retrieved July 23, 2012.

- "Solar farm a sign of things to come". U-T San Diego. April 20, 2011. Retrieved June 23, 2013.

- Korosec, Kirsten (October 3, 2011). "Chevron uses solar power to produce more oil". SmartPlanet. Archived from the original on November 25, 2020. Retrieved July 23, 2012.

- "Chevron Makes It Official With Sale of Renewable-Energy Unit to OpTerra – Businessweek". Bloomberg News. September 2, 2014.

- ^ Canada, Natural Resources (February 23, 2016). "Shell Canada Energy Quest Project". www.nrcan.gc.ca. Retrieved April 25, 2019.

- Government of Canada, Public Services and Procurement Canada. "Information archivée dans le Web" (PDF). publications.gc.ca. Archived from the original (PDF) on July 27, 2020. Retrieved April 25, 2019.

- "Fortune 500". Fortune. Retrieved November 17, 2022.

- "Marathon Petroleum". Marathon Petroleum Corporation . Retrieved October 26, 2023.

- "Fortune 500 Companies 2018: Who Made the List". Fortune. Archived from the original on January 15, 2019. Retrieved November 9, 2018.

- "Chevron Fundamentalanalyse | KGV | Kennzahlen". boerse.de (in German). Retrieved April 7, 2024.

- "Chevron 2008-2016". boerse.de (in German). Archived from the original on September 3, 2017. Retrieved April 9, 2024.

- "Chevron Historical Stock Price Lookup". Chevron Corporation and GCS Web. Retrieved February 16, 2023.

- ^ "Chevron Corporation 1998 Annual Report" (PDF). 1999. Retrieved February 16, 2023.

- ^ "Chevron Corporation 2000 Annual Report" (PDF). annualreports.com. 2001. Retrieved February 16, 2023.

- ^ "Chevron 2002 Annual Report" (PDF). Annualreports.com. 2003. Retrieved February 16, 2023.

- ^ "Chevron Corporation 2004 Annual Report" (PDF). Annualreports.com. 2005. Retrieved February 16, 2023.

- ^ "Chevron Revenue 2006–2018 | CVX". www.macrotrends.net. Retrieved October 22, 2018.

- ^ "Chevron Net Income 2006–2018 | CVX". www.macrotrends.net. Retrieved October 22, 2018.

- "Chevron Corporation (CVX) Stock Major Holders - Yahoo Finance". finance.yahoo.com. Retrieved March 13, 2024.

- Lee, Don (August 2, 2024). "Chevron, after 145 years in California, is relocating to Texas, a milestone in oil's long decline in the state". Los Angeles Times. Retrieved August 3, 2024.

- Raine, George (September 6, 2001). "Ending an era, Chevron abandons S.F. headquarters / Exodus to San Ramon complete". San Francisco Chronicle. Retrieved July 15, 2013.

- Eaton, Collin (September 28, 2022). "WSJ News Exclusive | Chevron Sells Global Headquarters, Pares Back in California Amid Texas Expansion". The Wall Street Journal. ISSN 0099-9660. Retrieved September 29, 2022.

- Li, Roland (September 29, 2022). "Chevron sells San Ramon HQ property as it shifts more workers to Texas". San Francisco Chronicle. Retrieved September 29, 2022.

- "Chevron pays Brookfield $340 mln for old Enron HQ". Reuters. June 24, 2011. Retrieved February 12, 2022.

- Report, Realty News (July 21, 2022). "Will Chevron Move HQ to New Tower in Houston?". Realty News Report. Retrieved September 16, 2022.

- Malewitz, Jim (April 19, 2016). "Years Later, Benefits from State Subsidy to Chevron Hard to Find". The Texas Tribune. Retrieved September 16, 2022.

- "Chevron donates $2.5 million to GOP super PAC". The Washington Post. Archived from the original on November 12, 2020. Retrieved August 25, 2017.

- Corey, Jamie (January 7, 2021). "Republican Attorneys General Dark Money Group Organized Protest Preceding Capitol Attack". Documented. Retrieved January 11, 2021.

- Newsroom - US EPA (October 15, 1998). "Chevron Richmond Refinery To Pay $540,000 Environmental Penalty". Yosemite.epa.gov. Archived from the original on February 12, 2012. Retrieved February 16, 2011.

{{cite web}}:|author=has generic name (help) - "Business | Angola fines Chevron for pollution". BBC News. July 1, 2002. Retrieved February 16, 2011.

- "Protests against Chevron highlight Argentine energy woes - CSMonitor.com". Christian Science Monitor. September 3, 2013.

- "Dozens protest in Richmond for Anti-Chevron Day". KRON4. May 22, 2022. Retrieved October 21, 2022.

- "Chevron wins Ecuador rainforest 'oil dumping' case". BBC News. September 7, 2018. Retrieved February 16, 2022.

External links

- Business data for Chevron Corporation:

| Chevron Corporation | |||||

|---|---|---|---|---|---|

| Predecessor |  | ||||

| Brands |

| ||||

| Subsidiaries | |||||

| Joint ventures | |||||

| Acquisitions |

| ||||

| Controversies | |||||

| Related | |||||

| Standard Oil Company, Inc. (1870–1911) | |

|---|---|

| Founders | |

| Executives | |

| Successor companies |

|

| Acquisitions |

|

| Historic stations | |

| Lawsuits | |

| Related | |

| Components of the Dow Jones Industrial Average | |

|---|---|

- Chevron Corporation

- Multinational oil companies

- Oil companies of the United States

- Chemical companies of the United States

- Algal fuel producers

- Automotive fuel retailers

- Gas stations in Canada

- Gas stations in the United States

- Companies based in San Ramon, California

- Automotive companies of the United States

- Multinational companies headquartered in the United States

- Petroleum in California

- Companies in the Dow Jones Industrial Average

- Companies listed on the New York Stock Exchange

- Retail companies established in 1879

- Non-renewable resource companies established in 1879

- American companies established in 1879

- 1879 establishments in California

- Corporate crime

- Companies in the Dow Jones Global Titans 50

- Companies in the S&P 500 Dividend Aristocrats