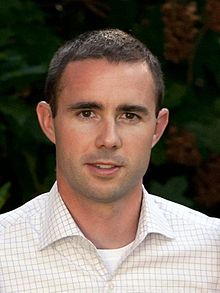

| Devin Talbott | |

|---|---|

| |

| Born | (1976-09-20) September 20, 1976 (age 48) Washington D.C., U.S. |

| Alma mater | Amherst College |

| Occupation | Private Investor |

| Parent(s) | Strobe Talbott Brooke Shearer |

Devin Talbott (born September 20, 1976) is an American entrepreneur and private investor, and the son of foreign policy expert Strobe Talbott.

Biography

Talbott grew up in Washington D.C. and attended Amherst College, where he was a four-year varsity soccer player. He also earned JD and MBA degrees from Georgetown University. Talbott began his investment banking career at Lazard and then worked for former Defense Secretary William Cohen's merchant bank, TCG Financial Partners. After that, Talbott became a vice president of investment firm D.E. Shaw & Co. before branching out to found Enlightenment Capital, an aerospace, defense & government focused private investment firm, in 2012. Since its founding, Enlightenment Capital has raised four funds. Talbott also co-founded Generation Engage, a non-profit focused on engaging young voters in politics and civics, with his brother Adrian and Jay Rockefeller's son Justin.

Talbott was recognized in M&A Advisor’s "40 Under 40," as an emerging leader in the financing industry before the age of 40. He was named by Washingtonian magazine as one of Washington’s Top Tech Leaders and to Washington Business Journal's Power 100.

Talbott served as a term member of the Council of Foreign Relations, a former advisory board member of the Aspen Security Forum, and currently sits on the board of the non-profit DC Scores, a non-profit that utilizes soccer, poetry, and service learning to support middle schoolers in at-risk neighborhoods. Talbott and DC United coach and former player Ben Olsen lead DC Score’s annual fundraiser, One Night One Goal.

Talbott was a part owner of the Washington Spirit of the NWSL in 2021 when the club won its first league championship. As of June 2022, he is a part owner of DC United of Major League Soccer.

References

- Heath, Thomas (December 14, 2014). "Capital Buzz: Enlightenment Capital has big-name backers". Washington Post.

- Conner, Jennifer (December 16, 2014). "Big Beltway names, investment activity drive Enlightenment Capital forward". Washington Business Journal.

- Bach, James (November 1, 2016). "Enlightenment Capital closes $147 million fund for aerospace and defense deals". Washington Business Journal.

- Beltran, Luisa (November 17, 2012). "Enlightenment Capital Aims for $100M with First Fund". PE Hub.

- Bing, Chris (March 15, 2016). "United's Coach Is Backing This Defense-Focused Investment Firm". Inside Defense.

- Wilkers, Ross (May 2, 2019). "Enlightenment Capital surpasses goal for new investment fund". Washington Technology.

- "Winners of the 5th Annual 40 Under 40 M&A Advisor Recognition Awards" (PDF). M&A Advisors. 2014. Archived from the original (PDF) on May 13, 2014.

- Guinto, Joseph (October 3, 2019). "Tech Titans 2019: Washington's Top Tech Leaders". Washingtonian.

- Fruehling, Douglas (October 10, 2023). "The Power 100 of 2023: The names and faces key to reviving Greater Washington". Washington Business Journal. Retrieved October 25, 2023.

- "Membership Roster". Council of Foreign Relations.

- "Affiliates". America Scores. Archived from the original on November 20, 2016. Retrieved December 5, 2016.

- "The Best Photos of dcu and dcunited". Flickr Hive Mind. Archived from the original on December 22, 2019.

- Koma, Alex (February 17, 2021). "Washington Spirit lands new investment group that includes big sports, business names". Washington Business Journal. Retrieved July 19, 2022.

- Hansen, Drew (June 7, 2022). "Exclusive: Enlightenment Capital's Devin Talbott buys stake in D.C. United". Washington Business Journal. Retrieved July 19, 2022.