For an associated topic, see COVID-19 recession.

| This article needs to be updated. Please help update this article to reflect recent events or newly available information. (February 2022) |

The COVID-19 pandemic caused far-reaching economic consequences including the COVID-19 recession, the second largest global recession in recent history, decreased business in the services sector during the COVID-19 lockdowns, the 2020 stock market crash (which included the largest single-week stock market decline since the financial crisis of 2007–2008), the impact of COVID-19 on financial markets, the 2021–2023 global supply chain crisis, the 2021–2023 inflation surge, shortages related to the COVID-19 pandemic including the 2020–present global chip shortage, panic buying, and price gouging. The pandemic led to governments providing an unprecedented amount of stimulus, and was also a factor in the 2021–2022 global energy crisis and 2022–2023 food crises.

The pandemic affected worldwide economic activity, resulting in a 7% drop in global commercial commerce in 2020. Several demand and supply mismatches caused by the pandemic resurfaced throughout the recovery period in 2021 and 2022 and were spread internationally through trade. During the first wave of the COVID-19 pandemic, businesses lost 25% of their revenue and 11% of their workforce, with contact-intensive sectors and SMEs being particularly heavily impacted. However, considerable policy assistance helped to avert large-scale bankruptcies, with just 4% of enterprises declaring for insolvency or permanently shutting at the time of the COVID-19 wave.

Amidst the recovery and containment, the world economic system was characterized as experiencing significant, broad uncertainty. Economic forecasts and consensus among macroeconomics experts show significant disagreement on the overall extent, long-term effects and projected recovery. A large general increase in prices was attributed to the pandemic. In part, the record-high energy prices were driven by a global surge in demand as the world quit the economic recession caused by COVID-19, particularly due to strong energy demand in Asia.

Background

The initial outbreak of the pandemic in China coincided with the Chunyun, a major travel season associated with the Chinese New Year holiday. A number of events involving large crowds were cancelled by national and regional governments, including annual New Year festivals, with private companies also independently closing their shops and tourist attractions such as Hong Kong Disneyland and Shanghai Disneyland. Many Lunar New Year events and tourist attractions were closed to prevent mass gatherings, including the Forbidden City in Beijing and traditional temple fairs. In 24 of China's 31 provinces, municipalities and regions, authorities extended the New Year's holiday to 10 February, instructing most workplaces not to re-open until that date. These regions represented 80% of the country's GDP and 90% of exports. Hong Kong raised its infectious disease response level to the highest and declared an emergency, closing schools until March and cancelling its New Year celebrations.

The demand for personal protection equipment has risen 100-fold, according to WHO director-general Tedros Adhanom. This demand has led to an increase in prices of up to twenty times the normal price and also induced delays on the supply of medical items for four to six months.

Overall economic contraction

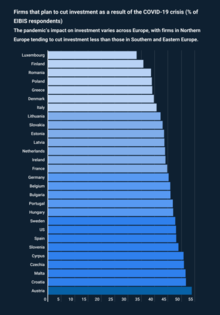

Main article: COVID-19 recessionThe COVID-19 recession is an economic recession happening across the world economy beginning in 2020 due to the COVID-19 pandemic. Global stock markets experienced their worst crash since 1987, and in the first three months of 2020 the G20 economies fell 3.4% year-on-year. Between April and June 2020, the International Labour Organization estimated that an equivalent of 400 million full-time jobs were lost across the world, and income earned by workers globally fell 10 percent in the first nine months of 2020, equivalent to a loss of over US$3.5 trillion. Cambridge University put the cost to the global economy at $82 trillion over five years. When the COVID-19 pandemic hit Europe, much of Europe's investment had been high, but it had unexpectedly slowed. In 2019, overall investment in the European Union increased by about 3% over the previous year, surpassing growth in real GDP.

Investment, like other economic activity, fell drastically as a direct result of lockdown restrictions. This effect was particularly noticeable in the second quarter of 2020, when investment decreased 19% year on year, as most limitations were relaxed by the summer. In 2019, firms already had an unfavorable assessment of the economic situation. Overall expectations for sector-specific business prospects, as well as the availability of internal and external funding, deteriorated in the course of 2020.

In the European Investment Bank Investment report 2020–21, 81% of the respondents cited uncertainty as the most severe obstacle to investment. 20% of EU companies anticipate a permanent loss in employment, indicating that a sizable proportion of firms are pessimistic about their capacity to "bounce back" once the COVID-19 crisis has passed.

As a result of the pandemic, half of European companies anticipate an increase in the usage of digital technologies in the future. The proportion is considerably greater among companies that have previously used digital technology.

The European Union's public debt is expected to exceed 95% of GDP by the end of 2021, a 15 percentage point rise since the pandemic began in 2019.

From the first to the second quarter of 2020, the EU government debt grew by 8.4 percentage points to 88% of GDP. According to the European Commission, debt to GDP reached 94% by the end of 2020. In autumn 2020, a second wave of infection and lockdowns aggravated the problem.

After one year of the COVID-19 crisis, corporate investment was expected to decline by at least 25%.

The International Monetary Fund (IMF) and other organizations predicted that the European Union's GDP would contract by 6% to 8%, a drop unprecedented since the Great Depression.

The European Union's total real GDP fall was more than 11% compared to the first quarter of 2020, the biggest drop in a single quarter on record.

The reduction in GDP was caused by government attempts to restrict the virus's spread, and it varied greatly between Member States. It was weakest, on average, in Central and Eastern Europe, where real GDP decreased 9.7% in the second quarter compared to the first. It decreased by 11.5% in Western and Northern Europe, and by roughly 15% in Southern Europe. In comparison, real GDP in the United States fell by nearly 9% in the second quarter compared to the first quarter.

In the second quarter of 2020, disposable income per capita decreased dramatically, affecting consumer expenditure, particularly for lower-income families.

The impact of the COVID-19 varied greatly on the industry. Sectors that rely heavily on physical presence, including passenger transportation, the arts, entertainment, tourism, and hospitality, were impacted the worst, with declines of up to 30% in the second quarter of 2020 compared to the first quarter. Industries such as agriculture, banking, and real estate, declined by 3% or less during the same time span. During the global financial crisis, the distribution of economic effect across sectors was extremely varied, with EU manufacturing suffering the worst decrease – over 20% in the first quarter of 2009. The decrease in other sectors was relatively limited, at around or below 6%.

GDP per hour in the EU grew by 0.3 percent in the second quarter of 2020 compared to the same time in 2019, while GDP per employee decreased 11.5%. Access to capital is seen as a barrier by about 55% of businesses. Credit limitations are especially difficult for SMEs and new businesses to overcome. Credit constraints affect 24% of SMEs and 27% of young businesses.

More than two-fifths of businesses (44%) did not experience a year-on-year sales loss as a result of COVID-19 at the time of the European Investment Bank's investment survey, and more than half predicted stronger sales in 2022 than before the pandemic.

In Western and Northern Europe, as well as Central and Eastern Europe, the unemployment rate climbed by roughly 0.5 percentage point. The rise was greater in Southern Europe (1.5 percentage points). The United States increased by 4 percentage points during the same period, reaching a high of 10 percentage points in April in 2021.

44% of enterprises in Central, Eastern and Southeastern European countries incurred losses in 2020 and/or 2021, and 10% did not anticipate to recover from pandemic-era economic losses in 2022. 60% of CESEE enterprises received some type of financial assistance in response to COVID-19, which is the same as the EU average. This was largely in the form of subsidies or other types of non-repayable financial assistance. Only around one out of every ten businesses reports that they are still receiving financial assistance in 2023.

All sectors received support during the COVID-19 crisis, primarily through subsidies. In 2022, energy-intensive Industries had the highest share of firms (22%) still receiving support. Energy-intensive industries and renewables saw the strongest recovery post-pandemic, with sales increased by 76% and 72%, from 2020 to 2021. Other sectors in the EU also experienced significant turnover growth post-COVID-19.

In Europe, the hardest hit sector by the COVID-19 pandemic was electronics, due to semiconductor shortages. The construction sector was most directly impacted by the Russian invasion of Ukraine rather than the pandemic. The digital sector was overall least affected by trade disruptions from COVID-19.

Economic recovery programmes

Further information: COVID-19 recession § National fiscal responses See also: Impact of the COVID-19 pandemic on the environment § Investments and other economic measures, and Green recoveryNations, cities and other collectives with governance mechanisms worldwide have announced the development and implementation of programmes for guided economic recovery. Some economic recovery programmes include Next Generation EU and Pandemic Emergency Purchase Programme.

Pandemic Emergency Purchase Programme (PEPP)

The Pandemic Emergency Purchase Programme (PEPP) was a monetary policy initiative launched by the European Central Bank (ECB) in March 2020 to mitigate the economic impact of the COVID-19 pandemic. Its primary goals were to maintain price stability, ensure favorable financing conditions across the eurozone, and safeguard the transmission of monetary policy during a period of severe economic disruption. The PEPP allowed the ECB to purchase private and public sector securities flexibly, complementing existing asset purchase programs while addressing the unique challenges posed by the pandemic. The high ability for flexibility in the design of the program is noted as a strategy to keep up with the shifting economic dynamics caused by the global pandemic.

Implementation

The PEPP began with a fund of €750 billion similar to the Next Generation EU fund. A total allocation of €1.85 trillion was dedicated to asset purchases under the program, over its duration of two years. Pandemic emergency purchase programme (PEPP). Pandemic emergency purchase programme (PEPP). Notably, the ECB was permitted to deviate from its traditional capital key rule, which ties purchases to member states' GDP and population, allowing more flexibility in responding to crisis conditions. The program included purchases of government bonds, corporate bonds, and securities issued by European institutions. Purchases first began in March of 2020.

Effectiveness

The PEPP was initially effective in stabilizing financial markets during the pandemic, reducing borrowing costs for governments and corporations while supporting credit flows. Its flexible approach was particularly beneficial for countries such as Greece, which faced heightened debt challenges. By mitigating market fragmentation and ensuring liquidity, the PEPP helped to maintain financial stability across the eurozone. Through the duration of the program, there was a shift from market stability, to fighting inflation. Early evaluations highlighted its role in containing sovereign yield spreads and providing a buffer against the economic downturn. The program was designed to continue until EU governments determined that the Covid-19 period of economic crisis subsided. With this, the EU Governing Council ceased purchases in March of 2022, giving the program a two-year active run.

Post-Pandemic Impact

By maintaining low borrowing costs, it supported fiscal policies aimed at addressing the crisis's long-term effects. However, challenges emerged, including balancing inflationary pressures and addressing disparities in recovery rates across member states. Analysts have noted that while the program provided significant short-term relief, its long-term impact on structural economic issues remains uncertain.

Next Generation EU (NGEU)

The Next Generation EU (NGEU) is a €750 billion economic recovery plan launched by the European Union in July 2020 in response to the economic challenges posed by the COVID-19 pandemic. It aimed to mitigate the pandemic's immediate economic impacts and lay the groundwork for long-term recovery through investments in green energy, digital transformation, public health, and economic resilience. The program marked a significant moment in EU history, as it was the first large-scale recovery initiative financed through joint borrowing by member states, signaling deeper fiscal integration within the union.

Components of the NGEU included:

- The Recovery and Resilience Facility (RRF): Allocated €672.5 billion to fund reforms and investments by EU member states, focusing on sustainability.

- ReactEU: Aimed at addressing immediate recovery needs, particularly in employment and healthcare, through €50.6 billion in additional funding. The NGEU funds were distributed to member states based on the severity of the pandemic's economic effects, with countries like Italy, Spain, and Greece receiving substantial allocations. The program required recipients to submit recovery and resilience plans outlining specific projects and reforms tied to the EU's green and digital priorities.

By mid-2022, the European Commission had approved most member states' plans, disbursing billions in grants and loans. The NGEU played a significant role in stabilizing the European economy during the pandemic by supporting investments in clean energy, digital infrastructure, and workforce upskilling. Italy, for example, focused on energy efficiency and broadband expansion, while Spain prioritized renewable energy and social inclusion projects.

The NGEU is credited with bolstering economic growth in the EU post-pandemic. Analysts estimate that the initiative added between 1-2 percentage points to GDP growth in member states during its peak implementation phase (2021–2023). Additionally, the program contributed to long-term stability by addressing structural issues such as regional inequalities and fostering cross-border cooperation on sustainability goals.

As of 2024, the NGEU remains active, with funding allocated through the EU's Multiannual Financial Framework (MFF) for 2021–2027. The Recovery and Resilience Facility continues to oversee the implementation of member states' projects, though its disbursements are now primarily focused on monitoring progress and ensuring compliance with pre-approved plans. The program has become a model for potential future EU-wide fiscal policies. It is noted that Next Generation EU will focus spending on development of sustainable energies and technologies continuing through the end of the program in 2027.

Environment

A study published in August 2020 concluded that the direct effect of the response to the pandemic on global warming will likely be negligible and that a well-designed economic recovery could avoid future warming of 0.3 °C by 2050. The study indicates that systemic change for decarbonization of humanity's economic structures is required for a substantial impact on global warming, which also has economic aspects. Beyond targeted financing of green projects or sectors, contemporary decision-making mechanisms also allow for excluding projects with substantial environmental, social, or climate risks from financial relief. Over 260 civil society organizations called on Chinese actors to ensure that COVID-19 related Belt and Road Initiative funding excludes such projects. In November 2020 the IMF said that governments and central banks had promised $19.5 trillion of support since the coronavirus began.

The United Nations Environment Programme analyzed $14.6 trillion of global spending in 2020, and found that only 2.5% was directed towards tackling climate change, advising governments to "make use of recovery spending to steer away from the worst impacts of climate change and inequality". A 2022 analysis of G20 country spending found that about 6% of their pandemic recovery spending has been allocated to areas that will also cut greenhouse-gas emissions, including electrifying vehicles, making buildings more energy efficient and installing renewables.

The IMF estimates that, in September, G20 governments committed some $15 trillion in fiscal resources: $7 trillion in direct budget support and an additional $8 trillion in public sector borrowing and capital injections into corporations. This $15 trillion represented almost 14 percent of global GDP.

Population growth

COVID-19 increased mortality around the world, with the UN estimating that there were 15 million deaths due to COVID-19 in 2020 and 2021. This estimate was broadly in line with other estimates of 14.9 million from World Health Organization and 17.6 million from The Economist.

While COVID-19 increased mortality in general, different countries experienced dramatically different impacts on birth rate. Birth rates in the US declined, whereas Germany's reached an all-time monthly high. Some in China had initially thought that their COVID-19 lockdowns would boost birth rate, but that prediction was proven wrong.

US population growth fell to a record low of 0.1%. In Australia, overall population growth slowed dramatically due to decreased migration, however, births did not appear to be impacted dramatically.

Agriculture and food

This section is an excerpt from Food security during the COVID-19 pandemic.

| | |

Acute food insecurity estimates for 2020 using the IPC scale Acute food insecurity estimates for 2020 using the IPC scale

| |||

| Date | 1 December 2019 (2019-12-01)–present | ||

|---|---|---|---|

| Duration | 5 years and 2 weeks | ||

| Location |

Multiple countries

| ||

| Cause | 2019–2021 locust infestation, ongoing armed conflicts, COVID-19 pandemic (including associated recession, lockdowns and travel restrictions) | ||

During the COVID-19 pandemic, food insecurity intensified in many places. In the second quarter of 2020, there were multiple warnings of famine later in the year. In an early report, the Nongovernmental Organization (NGO) Oxfam-International talks about "economic devastation" while the lead-author of the UNU-WIDER report compared COVID-19 to a "poverty tsunami". Others talk about "complete destitution", "unprecedented crisis", "natural disaster", "threat of catastrophic global famine". The decision of the WHO on 11 March 2020, to qualify COVID as a pandemic, that is "an epidemic occurring worldwide, or over a very wide area, crossing international boundaries and usually affecting a large number of people" also contributed to building this global-scale disaster narrative.

Field evidence collected in more than 60 countries in the course of 2020 indicate, however, that while some disruptions (affecting the stability of the global food system) were reported at local (hoarding) and international (restrictions on exports) levels, those took place primarily during the early days/weeks of the pandemic (and the subsequent waves of lockdowns) and did not lead to any major episode of "global famine", thus invalidating the catastrophic scenario that some experts had initially conjectured.

In September 2020, David Beasley, executive director of the World Food Programme, addressed the United Nations Security Council, stating that measures taken by donor countries over the course of the preceding five months, including the provision of $17 trillion in fiscal stimulus and central bank support, the suspension of debt repayments instituted by the IMF and G20 countries for the benefit of poorer countries, and donor support for WFP programmes, had averted impending famine, helping 270 million people at risk of starvation. As the pandemic-incited food issues began to subside, the 2022 Russian invasion of Ukraine triggered another global food crises compounding already extreme price increases.2022 food crisis

This section is an excerpt from World food crises (2022–2023).

During 2022 and 2023 there were food crises in several regions as indicated by rising food prices. In 2022, the world experienced significant food price inflation along with major food shortages in several regions. Sub-Saharan Africa, Iran, Sri Lanka, Sudan and Iraq were most affected. Prices of wheat, maize, oil seeds, bread, pasta, flour, cooking oil, sugar, egg, chickpea and meat increased. Many factors have contributed to the ongoing world food crisis. These include supply chain disruptions due to the COVID-19 pandemic, the 2021–2023 global energy crisis, the Russian invasion of Ukraine, and floods and heatwaves during 2021 (which destroyed key American and European crops). Droughts were also a factor; in early 2022, some areas of Spain and Portugal lost 60–80% of their crops due to widespread drought.

Even before the Russian invasion of Ukraine, food prices were already at a record high. 82 million East Africans and 42 million West Africans faced acute food insecurity in 2021. By the end of 2022, more than 8 million Somalis were in need of food assistance. In February 2022, the Food and Agriculture Organization (FAO) reported a 20% rise in food prices since February 2021. The war further pushed this increase to 40% in March 2022 but was reduced to 18% by January 2023. But the FAO warns that inflation of food prices will continue in many countries.

Increased fuel and transport prices have made food distribution worse and more complex. Before the Russian invasion, Ukraine was the fourth-largest exporter of corn and wheat. Since then, the Russian invasion crippled supplies. This has resulted in inflation and scarcity of these commodities in dependent countries. Global food reserves have also decreased due to the effects of climate change on agriculture.

This caused food riots and famine in different countries. Furthermore, China acquired 51% of the world supply of wheat, 60% of rice, and 69% of corn stockpiles in the first half of 2022. The United States increased its farm production by April 2022, also contributing $215 million in development assistance plus $320 million for the Horn of Africa. A grain agreement was signed by Russia, Ukraine, Turkey and the United Nations to open Ukrainian ports. This resulted in grain shipment by 27 vessels from Ukraine between June and August 2022 which stalled in October and then resumed in November 2022. In addition, the World Bank announced a new $12 billion fund to address the food crises.

The World Economic Forum's Global Risks Report 2023 described food supply crises as an ongoing global risk. The Russian invasion of Ukraine and crop failures from climate change worsened worldwide hunger and malnutrition. Even Global North countries known for stable food supplies have been impacted. Analysts described this inflation as the worst since the 2007–2008 world food price crisis. However, in early 2024, the FAO reported a return to more moderate commodities market prices. Moreover, the World Economic Forum's 2024 Global Risks Report showed significantly less concern from experts but the report still highlights a risk of the Israel–Hamas war and the return of El Niño. Both of these events could disrupt supply chains again.Financial markets

Main articles: Financial market impact of the COVID-19 pandemic and 2020 stock market crash See also: 2020 Russia–Saudi Arabia oil price warEconomic turmoil associated with the coronavirus pandemic has wide-ranging and severe impacts upon financial markets, including stock, bond and commodity (including crude oil and gold) markets. Major events included the Russia–Saudi Arabia oil price war that resulted in a collapse of crude oil prices and a stock market crash in March 2020. The United Nations Development Programme expects a US$220 billion reduction in revenue in developing countries, and expects COVID-19's economic impact to last for months or even years. Some expect natural gas prices to fall.

During the early phase of COVID in April and May, there was a significant correlation between the extent of the outbreak and volatility in financial and stock markets. The broader effects of this volatility impacted credit markets, and save for government interventions and central banks pursuing quantitative easing, would have led to more significant economic downturns.

Manufacturing

See also 2020–present global chip shortage.

2021 Car production crisis

New vehicle sales in the United States have declined by 40%. The American Big Three have all shut down their US factories. The German automotive industry came into the crisis after having already suffered from the Dieselgate-scandal, as well as competition from electric cars. Boeing and Airbus suspended production at some factories. A survey conducted by the British Plastics Federation (BPF) explored how COVID-19 is impacting manufacturing businesses in the United Kingdom (UK). Over 80% of respondents anticipated a decline in turnover over the next 2 quarters, with 98% admitting concern about the negative impact of the pandemic on business operations. In July 2021, car production in the United Kingdom hit lowest level since 1956.

The arts, entertainment and sport

Main article: Impact of the COVID-19 pandemic on the arts and cultural heritageThe epidemic had a sudden and substantial impact on the arts and cultural heritage (GLAM) sectors worldwide. The global health crisis and the uncertainty resulting from it profoundly affected organisations' operations as well as individuals – both employed and independent – across the sector. By March 2020, across the world most cultural institutions had been indefinitely closed (or at least with their services radically curtailed) exhibitions, events and performances cancelled or postponed. Many individuals temporarily or permanently lost contracts or employment with varying degrees of warning and financial assistance available. Equally, financial stimulus from governments and charities for artists, have provided greatly differing levels of support, depending on the sector and the country. In countries such as Australia, where the arts contributed to about 6.4% of GDP, effects on individuals and the economy have been significant.

Cinema

Main article: Impact of the COVID-19 pandemic on cinemaThe pandemic has impacted the film industry. Across the world and to varying degrees, cinemas have been closed, festivals have been cancelled or postponed, and film releases have been moved to future dates. As cinemas closed, the global box office dropped by billions of dollars, while streaming became more popular and the stock of Netflix rose; the stock of film exhibitors dropped dramatically. Almost all blockbusters to be released after the March opening weekend were postponed or cancelled around the world, with film productions also halted. Massive losses in the industry have been predicted.

Sport

Main article: Impact of the COVID-19 pandemic on sportsMost major sporting events were cancelled or postponed, including the 2020 Summer Olympics in Tokyo, which were postponed on 24 March 2020 until 2021.

Television

Main article: Impact of the COVID-19 pandemic on televisionThe COVID-19 pandemic has shut down or delayed production of television programs in several countries. However, a joint report from Apptopia and Braze showed a 30.7% increase in streaming sessions worldwide on platforms such as Disney+, Netflix, and Hulu during the month of March.

Video games

Main article: Impact of the COVID-19 pandemic on the video game industryThe pandemic also affected the video game sector to a smaller degree. As the outbreak appeared in China first, supply chains affected the manufacturing and production of some video game consoles, delaying their releases and making current supplies scarcer. As the outbreak and pandemic spread, several keystone trade events, including E3 2020, were cancelled over concerns of further spread. The economic impact on the video game sector is not expected to be as large as in film or other entertainment sectors as much of the work in video game production can be decentralised and performed remotely, and products distributed digitally to consumers regardless of various national and regional lockdowns on businesses and services.

Medicine

The pandemic led to a boom in medicine-related elements such as plastic surgery.

Publishing

Main article: Impact of the COVID-19 pandemic on journalismThe pandemic is predicted to have a dire effect on local newspapers in the United States, where many were already severely struggling beforehand.

In light of the public health situation in which includes afflicted regions where retail sectors deemed non-essential have been ordered closed for the interim, Diamond Comic Distributors announced on 24 March 2020 a full suspension of distributing published material and related merchandise as 1 April 2020 until further notice. As Diamond has a near-monopoly on printed comic book distribution, this is described as an "extinction-level event" that threatens to drive the entire specialized comic book retail sector out of business with that one move. As a result, publishers like IDW Publishing and Dark Horse Comics have suspended publication of their periodicals while DC Comics is exploring distribution alternatives including an increased focus on online retail of digital material.

Total US book sales went down by 8.4% in March 2020 compared to March 2019 after the stay-at-home orders were implemented, with bookstore sales dropping by an estimated 33%. By June 2020, demand began to recover with the exception of educational material and bookstore sales, with most sales going to Amazon and big-box stores, who were open since they were considered essential businesses. Books that were initially supposed to be published in spring and early summer were delayed until fall, with the expectation that the pandemic would be over by then. Two of the major printing companies, Quad and LSC Communications, faced financial issues into the latter half of the year as the latter declared bankruptcy during a rise in demand. Increased sales were attributed to major book releases and increased demand for children's books and books about race and racism. This created supply chain bottleneck at the printing process for most publishers. According to NPD BookScan, print sales went up almost 8% in 2020.

Retail

The pandemic has impacted the retail sector. Shopping centres around the world responded by reducing hours or closing down temporarily. As of 18 March 2020, the footfall to shopping centres fell by up to 30%, with significant impact in every continent. Additionally, product demand exceeded supply for many consumables, resulting in empty retail shelves. In Australia, the pandemic has provided a new opportunity for daigou shoppers to re-sell into the China market. "The virus crisis, while frightening, has a silver lining".

Some retailers have employed contactless home delivery or curbside pickup for items purchased through e-commerce sites. By April, retailers had started implementing "retail to go" models where consumers could pick up their orders. An estimated 40% of shoppers were shopping online and choosing to pick up in-store, a behavior that had suddenly doubled as compared to the previous year.

Small-scale farmers have been embracing digital technologies as a way to directly sell produce, and community-supported agriculture and direct-sell delivery systems are on the rise.

In mid-April, Amazon confirmed that workers at over half of its 110 U.S. warehouses had been diagnosed with coronavirus.

On 16 June, the United States Department of Commerce announced that retail sales for the month of May had seen an increase of 17.7% from April as states began to reopen and lift restrictions. According to CNBC, This marks the biggest one month jump in the history of retailing in the United States. Numbers for June reflected a 7.5 percent rise in sales.

Business closures

By April, department store retailers JCPenney, Nordstrom, Macy's and Kohl's had lost $12.3 billion combined in market caps. Neiman Marcus and JCPenney defaulted on bond payments in April, preparing internally for bankruptcy court and bankruptcy protection. J.Crew and Neiman Marcus filed for bankruptcy during the first week of May; they were reportedly the first two major retailers to do so during the pandemic. JCPenney filed for bankruptcy on 15 May.

In May, Pier 1 announced it would close as soon as possible. It had sought court protection in February and had hoped that someone would buy the business, but the subsequent recession made this seem unlikely.

In early 2021, Family Video announced all their remaining stores would be liquidated and closed down.

E-commerce

Further information: E-commerceThe pandemic boosted e-commerce sales. With more people staying at home, both by choice as well as through government lockdowns, there was a decline in brick-and-mortar shopping. On the other hand, e-commerce surged 34% during 2020, and in 2021 surpassed levels not expected until 2025, projected to reach $843 billion in the US in 2021.

Despite persistent cross-country differences, the Covid crisis has enhanced dynamism within the e-commerce landscape across countries and has dilated the scope of e-commerce, as well as through new firms, client segments (e.g. elderly) and product (e.g. groceries).

The pandemic has created a shift in the manner shoppers behave and perform their activities, directly moving the e-commerce industry so the prosperity of e-commerce during pandemic lockdown has increased significantly.

The impact of the epidemic on transportation and production has affected e-commerce. Customers will consider whether goods can be shipped on time and delivered on time, and these factors will affect their choices. Under the current epidemic conditions, some online sellers, taking advantage of the characteristics of e-commerce, are defrauding consumers. The problems and flaws exposed by these e-merchants in the epidemic situation further push e-merchants towards a more mature and regulated path.

Social media plays a huge role, Facebook and own e-commerce web sites of e-commerce firms are the foremost growing sales channels since the start of the COVID-19 crisis.

Global e-commerce sales are expected to reach $6.5 trillion by 2023, up from $3.5 trillion in 2019.

Restaurant sector

Main article: Impact of the COVID-19 pandemic on the food industry

The pandemic has impacted the restaurant business. In the beginning of March 2020, some major cities in the US announced that bars and restaurants would be closed to sit-down dinners and limited to takeout orders and delivery. Later in the month, many states put in place restrictions that required restaurants to be takeout or delivery only. Some employees were fired, and more employees lacked sick leave in the sector compared to similar sectors. With only carry-out and delivery services, most servers and bartenders were laid off, prompting these employees creating "virtual tip jars" across 23 U.S. cities. In the United States, an initiative known as the "Great American Takeout" called on people under quarantine to support local restaurants each Tuesday by ordering takeout for curbside pickup or using food delivery services. It began in late March 2020.

Science and technology

Main article: Impact of the COVID-19 pandemic on science and technology See also: Science § Science and the publicThe pandemic impacted productivity of science, space and technology projects. Space agencies including NASA and the European Space Agency halted production of the Space Launch System, James Webb Space Telescope, and put space science probes into hibernation or low power mode and shifted to remote work. Various IT companies had launched several programs to sustain in this pandemic and in this new normal life. The pandemic may have improved scientific communication or established new forms of it. For instance a lot of data is being released on preprint servers and is getting dissected on social Internet platforms and sometimes in the media before entering formal peer review. Scientists are reviewing, editing, analyzing and publishing manuscripts and data at record speeds and in large numbers. This intense communication may have allowed an unusual level of collaboration and efficiency among scientists.

A large number of tech workers have been laid off starting in 2023; excessive hiring during the pandemic has been cited as one reason for the job cuts, along with increased interest rates and reduced demand from consumers.

Tourism

Main article: Impact of the COVID-19 pandemic on tourism

Philia Tounta summarised likely effects of COVID-19 on global tourism early in March 2020:

- severe effects because tourism depends on travel

- quarantine restrictions

- fear of airports and other places of mass gathering

- fears of illness abroad

- issues with cross-border medical insurance

- tourism enterprise bankruptcies

- tourism industry unemployment

- airfare cost increases

- damage to the image of the cruise industry

Events and institutions

The pandemic has caused the cancellation or postponement of major events around the world. Some public venues and institutions have closed.

Transportation

July 2019 – December 2021

Staffing issues caused transportation bottlenecks in trucking and at ports in developed countries. Supply problems and sudden demand for socially-distanced recreation and alternatives to public transport caused a shortage of bicycles in the United States.

The cruise ship industry has also been heavily affected by a downturn, with the share prices of the major cruise lines down 70–80%.

In many of the world's cities, planned travel went down by 80–90%.

Aviation

Main article: Impact of the COVID-19 pandemic on aviation

The pandemic has had a significant impact on the aviation industry due to the resulting travel restrictions as well as a slump in demand among travellers. Significant reductions in passenger numbers have resulted in planes flying empty between airports and the cancellation of flights.

United States passenger airlines can expect about $50 billion in subsidies from the Coronavirus Aid, Relief, and Economic Security Act.

Cruise lines

Main article: COVID-19 pandemic on cruise shipsCruise lines had to cancel sailings after the outbreak of the COVID-19 pandemic. Bookings and cancellations grew as extensive media coverage of ill passengers on quarantined ships hurt the industry's image.

Shares of cruise lines fell sharply in value on 27 March 2020 when the $2 trillion Coronavirus Aid, Relief, and Economic Security Act excluded companies that are not "organized" under United States law. Senator Sheldon Whitehouse (D-RI) tweeted: "The giant cruise companies incorporate overseas to dodge US taxes, flag vessels overseas to avoid US taxes and laws, and pollute without offset. Why should we bail them out?" Senator Josh Hawley (R-MO) tweeted that cruise lines should register and pay taxes in the United States if they expect a financial bailout. U.S-based employees and small, American-owned companies are eligible for financial assistance.

Railways

Several rail operators had to receive state aid and/or reduced their scheduled services. Deutsche Bahn received billions of € in federal aid to cover record losses.

Gambling and betting

According to the American Gaming Association, the industry will be hit by losses up to $43.5 billion in economic activity in the following months. Some projection was that the sports gambling industry may lose $140 million alone in the fourth weekend of March (21–22 March 2020) on lost NCAA basketball tournament bets. Gambling companies are eager to shift customers from retail into online casino and poker games to fight the loss of revenue due to the cancellation of sports fixtures and the shutdown of betting shops. Gambling groups increased the advertising of online casino games and play on social media. Some argue that virtual racing, as well as draw based games, are also proving popular. Some software betting providers have specially designed campaigns promoting online betting solutions to attract betting companies. Long term consequences to the betting and gambling industry might be: Death of small retail operators and providers, increase in M&A, more focus on online, innovation in online meaning that even the existing products like the sportsbook will pay closer attention to obscure sports like soap soccer or quidditch and more prominent spot for virtual games online.

In Macau, the world's top gambling destination by revenue, all casinos were closed for 15 days in February 2020 and suffered a year-on-year revenue drop of 88%, the worst ever recorded in the territory.

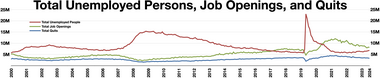

Unemployment

Guy Ryder, Director-General of the International Labour OrganizationThe COVID-19 pandemic has demonstrated the interconnectedness of a diverse world. Already at a disadvantage pre-pandemic, women, ethnic minorities, indigenous and tribal peoples, young people, persons with disabilities and migrant workers are among those who have been hardest hit.

The International Labour Organization stated on 7 April that it predicted a 6.7% loss of job hours globally in the second quarter of 2020, equivalent to 195 million full-time jobs. They also estimated that 30 million jobs were lost in the first quarter alone, compared to 25 million during the Great Recession. The effects of COVID-19 on unemployment lasted much longer than was initially expecting. Almost 18 months after the start of the pandemic, the state of New York was still down almost a quarter of the jobs that were available in the hospitality industry pre-pandemic. This was the largest percent in any state in the United States, but other states still faced a similar issue.

In January and February 2020, during the height of the epidemic in Wuhan, about 5 million people in China lost their jobs. Many of China's nearly 300 million rural migrant workers have been stranded at home in inland provinces or trapped in Hubei province.

In March 2020, more than 10 million Americans lost their jobs and applied for government aid. Total nonfarm jobs fell from a high of 152.5 million in February 2020 to 130.2 million in April. As of February 2021, the US had about 143 million nonfarm jobs.

The lockdown in India has left tens of millions of migrant workers unemployed.

The survey from the Angus Reid Institute found that 44% of Canadian households have experienced some type of job loss.

Nearly 900,000 workers lost their jobs in Spain since it went into lockdown in mid-March 2020. During the second half of March, 4 million French workers applied for temporary unemployment benefits and 1 million British workers applied for a universal credit scheme.

Almost half a million companies in Germany have sent their workers on a government-subsidized short-time working schemes known as Kurzarbeit. The German short-time work compensation scheme has been copied by France and Britain.

The pandemic's economic impacts are likely to increase sexual exploitation and child marriage, leaving women and girls in fragile economies and refugee contexts particularly vulnerable.

The potential combined impact of COVID-19 on unemployment, households’ purchasing power, food prices, and food availability in local markets could severely jeopardize access to food in the most vulnerable countries.

Impact by gender

Around the world, women generally earn less and save less, are the majority of single-parent households and disproportionately hold more insecure jobs in the informal economy or service sector with less access to social protections. This leaves them less able to absorb the economic shocks than men. For many families, school closures and social distancing measures have increased the unpaid care and domestic load of women at home, making them less able to take on or balance paid work. The situation is worse in developing economies, where a larger share of people are employed in the informal economy in which there are far fewer social protections for health insurance, paid sick leave and more. Although globally informal employment is a greater source of employment for men (63 per cent) than for women (58 per cent), in low and lower-middle income countries a higher proportion of women are in informal employment than men. Unlike previous crisis', the COVID-19 pandemic affected more women dominated industries rather than male dominated industries: women were in the forefront in the fight against COVID-19 as most healthcare workers are women.

In Sub-Saharan Africa, for example, around 92 per cent of employed women are in informal employment compared to 86 per cent of men. It is likely that the pandemic could result in a prolonged dip in women's incomes and labour force participation. The ILO estimates global unemployment to rise between 5.3 million ("low" scenario) and 24.7 million ("high" scenario) from a base level of 188 million in 2019 as a result of COVID-19's impact on global GDP growth. By comparison, global unemployment went up by 22 million during the Great Recession. Women informal workers, migrants, youth and the world's poorest, among other vulnerable groups, are more susceptible to lay-offs and job cuts. For example, UN Women survey results from Asia and the Pacific are showing that women are losing their livelihoods faster than men and have fewer alternatives to generate income. And, in the U.S., men's unemployment went up from 3.55 million in February to 11 million in April in 2020 while women's unemployment – which was lower than men's before the crisis – went up from 2.7 million to 11.5 million over the same period, according to the U.S. Bureau of Labor Statistics. The picture is even bleaker for young women and men aged 16–19, whose unemployment rate jumped from 11.5 per cent in February to 32.2 per cent in April.

In Japan, women have been disproportionately hit by the Covid pandemic because sectors like retail and hospitality employ many women and have been heavily affected by the pandemic recession. According to the health ministry, the suicide rate among Japanese women rose 14.5% in 2020, while it fell by 1% among men.

Economic inequality

Since most of the workforce who preserved their jobs had the option of switching to an online modality, and the online workforce is considerably higher paid on average, the pandemic exacerbated income inequality by hitting harder on low-paid workers.

Additionally, the global rise in extreme poverty rates during the pandemic further compounded these issues of economic inequality. According to the March 2024 update from the Poverty and Inequality Platform (PIP), the global extreme poverty rate increased from 8.9% in 2019 to 9.7% in 2020, marking the first rise in decades. This increase was largely due to significant job losses and reduced income among the lowest earners, particularly in regions like South Asia where extreme poverty rose by 2.4 percentage points. Although some regions experienced a decline in poverty due to effective fiscal policies, such as in Brazil, the overall global trend indicates a widening gap between the economically vulnerable and those able to maintain or enhance their financial stability during the pandemic.

Economic impact by continent, region and country

| This section needs to be updated. The reason given is: Most of this section does not reflect the developments since August 2022. Please help update this article to reflect recent events or newly available information. (August 2022) |

A weekly update on the impact of the COVID-19 pandemic on the world economy, and on major individual economies such as the US, China, Japan, other Asian economies, Europe, Australia and New Zealand has been produced by Saul Eslake, one of Australia's best-known economists, since late April 2020.

The global GDP total had shrunk by nearly $22 trillion as of January 2021, during the course of the pandemic. According to Chief IMF Economist Gita Gopinath, the long-term consequences have not fully played out but could be expected to be in the trillions from 2020 to 2025.

Post-COVID economic recovery prospects are high, and most countries are expected to see higher than usual economic growth. This is different from conventional economic recessions, according to the IMF. The China, India, ASEAN nations and other emerging Asian economies are expected to continue growing most significantly throughout the 2020s, and is expected to dominate global economic growth following the pandemic.

Asia

East Asia

Mainland China

Main article: COVID-19 pandemic in mainland ChinaThe economy of China was anticipated to generate billions in economic output. Morgan Stanley expected the economy of China to grow by between 5.6% (worst-case scenario) to 5.9% for 2020. For reference, China generated US$143 billion in February 2019, the month of Chinese New Year. The Chinese Ministry of Transport reported that trips on trains dropped 73% to 190 million trips from the previous year. Factories, retailers, and restaurant chains closed.

All 70,000 theatre screens in the country were shuttered, wiping out the entire box office. This is drastically in stark difference from the week of Chinese New Year in 2019 that generated $836 million.

Though cautioning that the economic impact would be short-term, PRC National Development and Reform Commission party secretary Cong Liang views small and medium businesses encountering more difficulties in their operations. Human Resources and Social Security Assistant Minister You Jun specified that agricultural workers and college graduates would have difficulties.

Tourism in China has been hit hard by travel restrictions and fears of contagion, including a ban on both domestic and international tour groups. Many airlines have either cancelled or greatly reduced flights to China and several travel advisories now warn against travel to China. Many countries, including France, Japan, Australia, New Zealand, the United Kingdom and the United States, have evacuated their nationals from the Wuhan and Hubei provinces.

The majority of schools and universities have extended their annual holidays to mid-February. Overseas students enrolled at Chinese universities have been returning home over fears of being infected—the first cases to be reported by Nepal and Kerala, a southern state of India, were both of students who had returned home. Nearly 200 million students have been affected by the in-school closures, with the second semester after the Chunyun resuming on 17 February through online classes for students to follow from their homes instead. The Ministry of Education has introduced a 7,000-server supported "national Internet cloud classroom" to cater to the 50 million elementary and middle school student populations.

The Finance Ministry of China announced it would fully subsidise personal medical costs incurred by patients.

CNN reported that some people from Wuhan "have become outcasts in their own country, shunned by hotels, neighbors and – in some areas – placed under controversial quarantine measures."

The sale of new cars in China has been affected due to the outbreak. There was a 92% reduction on the volume of cars sold during the first two weeks of February 2020.

On 24 February, China's Standing Committee declared an immediate and "comprehensive" ban on its US$74 billion wildlife trade industry, citing the "prominent problem of excessive consumption of wild animals, and the huge hidden dangers to public health and safety" that has been revealed by the outbreak. This permanently extends the temporary ban already in place since the end of January.

According to Carbon Brief, the coronavirus pandemic has resulted in China's greenhouse gas emissions being reduced by 25%. In March 2020, satellite images from space provided by NASA revealed that pollution has dropped significantly, which has been attributed in part to the slowdown of economic activity as a result of the outbreak.

Shortages of medical supplies

Main article: Shortages related to the COVID-19 pandemic

As the epidemic accelerated, the mainland market saw a shortage of face masks due to the increased need from the public. It was reported that Shanghai customers had to queue for nearly an hour to buy a pack of face masks which was sold out in another half an hour. Some stores hoarded supplies, driving up prices, so the market regulator cracked down on such acts. The shortage will not be relieved until late February, when most workers return from the New Year vacation, according to Lei Limin, an expert in the industry.

On 22 January 2020, Taobao, China's largest e-commerce platform owned by Alibaba Group, said that all face masks on Taobao and Tmall would not be allowed to increase in price. Special subsidies would be provided to the retailers. Also, Alibaba Health's "urgent drug delivery" service would not be closed during the Spring Festival. JD, another leading Chinese e-commerce platform, said, "We are actively working to ensure supply and price stability from sources, storage and distribution, platform control and so on" and "while fully ensuring price stability for JD's own commodities, JD.com has also exercised strict control over the commodities on JD's platform. Third-party vendors selling face masks are prohibited from raising prices. Once it is confirmed that the prices of third-party vendors have increased abnormally, JD will immediately remove the offending commodities from shelves and deal with the offending vendors accordingly." Other major e-commerce platforms including Sunning.com and Pinduoduo also promised to keep the prices of health products stable.

Economy

China's economic growth is expected to slow by up to 1.1% in the first half of 2020 as economic activity is negatively affected by the new coronavirus pandemic, according to a Morgan Stanley study cited by Reuters. But on 1 February 2020, the People's Bank of China said that the impact of the epidemic on China's economy was temporary and that the fundamentals of China's long-term positive and high-quality growth remained unchanged. In late January, economists predicted a V-shaped recovery. By March, it was much more uncertain.

Due to the outbreak, the Shanghai Stock Exchange and the Shenzhen Stock Exchange announced that with the approval of the China Securities Regulatory Commission, the closing time for the Spring Festival will be extended to 2 February and trading will resume on 3 February. Before that, on 23 January, the last trading day of a shares before the Spring Festival, all three major stock indexes opened lower, creating a drop of about 3%, and the Shanghai Composite Index fell below 3000. On 2 February, the first trading day after the holiday, the three major indexes even set a record low opening of about 8%. By the end of the day, the decline narrowed slightly to about 7%, the Shenzhen index fell below 10,000 points, a total of 3,177 stocks in the two markets fell.

The People's Bank of China and the State Administration of Foreign Exchange have announced that the inter-bank Renminbi foreign exchange market, the foreign currency-to-market and the foreign currency market will extend their holiday closed until 2 February 2020. When the market opened on 3 February, the Renminbi was now depreciating against major foreign currencies. The central parity rate of the Renminbi against the US dollar opened at 6.9249, a drop of 373 basis points from the previous trading day. It fell below the 7.00 than an hour after the opening, and closed at 7.0257.

The World Bank expects China to grow by just 0.1–2.3%, the lowest growth rate in decades.

On 22 May, Chinese Premier Li Keqiang announced that, for the first time in history, the central government wouldn't set an economic growth target for 2020, with the economy having contracted by 6.8% compared to 2019 and China facing an "unpredictable" time. However, the government also stated an intention to create 9 million new urban jobs until the end of 2020.

In October 2020, it was announced that China's third-quarter GDP has grown with 4.9%, hereby missing analysts expectations (which was set at 5,2%). However, it does show that China's economy has indeed been steadily recovering from the coronavirus shock that caused decades-low growth. To fuel economic growth, the country set aside hundreds of billions of dollars for major infrastructure projects and used population tracking policies and enforced the stringent lockdown to contain the virus. It is the only major economy that is expected to grow in 2020, according to the International Monetary Fund.

By December 2020, China's economic recovery was accelerating amid increasing demand for manufactured goods. The UK-based Centre for Economics and Business Research projected that China's "skilful management of the pandemic" would cause the Chinese economy to surpass the United States and become the world's largest economy by nominal GDP in 2028, five years sooner than previously expected.

Hong Kong

Main article: COVID-19 pandemic in Hong KongHong Kong has seen high-profile protests that saw tourist arrivals from mainland China plummet over an eight-month period. The viral epidemic put additional pressure on the travel sector to withstand a prolonged period of downturn. A drop in arrivals from third countries more resilient during the previous months has also been cited as a concern. The city is already in recession and Moody has lowered the city's credit rating.

There has also been a renewed increase in protest activity as hostile sentiment against mainland Chinese strengthened over fears of viral transmission from mainland China, with many calling for the border ports to be closed and for all mainland Chinese travellers to be refused entry. Incidents have included a number of petrol bombs being thrown at police stations, a homemade bomb exploding in a toilet, and foreign objects being thrown onto transit rail tracks between Hong Kong and the mainland Chinese border. Political issues raised have included concerns that mainland Chinese may prefer to travel to Hong Kong to seek free medical help (which has since been addressed by the Hong Kong government).

Since the outbreak of the virus, a significant number of products have been sold out across the city, including face masks and disinfectant products (such as alcohol and bleach). An ongoing period of panic buying has also caused many stores to be cleared of non-medical products such as bottled water, vegetables and rice. The Government of Hong Kong had its imports of face masks cancelled as global face mask stockpiles decline.

In view of the coronavirus pandemic, the Education Bureau closed all kindergartens, primary schools, secondary schools, and special schools until 17 February. This has been extended for multiple times due to the development of the epidemic, until the Bureau announced that all schools would be indefinitely suspended until further notice on 31 March. The disruption has raised concerns over the situation of students who are due to take examinations at the end of the year, especially in light of the protest-related disruption that happened in 2019.

On 5 February, flag carrier Cathay Pacific requested its 27,000 employees to voluntarily take three weeks of unpaid leave by the end of June. The airline had previously reduced flights to mainland China by 90% and to overall flights by 30%.

Macau

Main article: COVID-19 pandemic in MacauOn 4 February 2020, all casinos in Macau were ordered shut down for 15 days. All casinos reopened on 20 February 2020, but visitor numbers remained low due to the pandemic, with hotels at less than 12% occupancy at the end of February.

Japan

Main article: COVID-19 pandemic in Japan

Former Prime Minister Shinzō Abe has said that "the new coronavirus is having a major impact on tourism, the economy and our society as a whole". Face masks have sold out across the nation and stocks of face masks are depleted within a day of new arrivals. There has been pressure placed on the healthcare system as demands for medical checkups increase. Chinese people have reported increasing discrimination. The health minister has pointed out that the situation has not reached a point where mass gatherings must be called off 1 February 2020.

Aviation, retail and tourism sectors have reported decreased sales and some manufactures have complained about disruption to Chinese factories, logistics and supply chains. Prime Minister Abe has considered using emergency funds to mitigate the outbreak's impact on tourism, of which Chinese nationals account for 40%. S&P Global noted that the worst hit shares were from companies spanning travel, cosmetics and retail sectors which are most exposed to Chinese tourism. Nintendo announced that they would delay shipment of the Nintendo Switch, which is manufactured in China, to Japan.

The outbreak itself was a concern for the 2020 Summer Olympics which was scheduled to take place in Tokyo starting at the end of July. The national government thus took extra precautions to help minimise the outbreak's impact. The Tokyo organising committee and the International Olympic Committee monitored the outbreak's impact in Japan.

On 27 February 2020, Prime Minister Shinzo Abe requested that all Japanese elementary, junior high, and high schools close until late March, the end of the school year, to help contain the virus. Schools will only reopen for the next term after spring break in early April and the nationwide closures will affect 13 million students.

South Korea

Main article: COVID-19 pandemic in South Korea

On 5 February 2020, Hyundai Motor Company was forced to suspend production in South Korea due to shortage in supply of parts.

South Korea has been reporting increasing human-to-human community transmission of COVID-19 since 19 February 2020, traced to a church of Shincheonji, located near the city of Daegu. Apart from the city of Daegu and the church community involved, most of South Korea is operating close to normality, although nine planned festivals have been closed and tax-free retailers are closing. South Korean military manpower agency made an announcement that conscription from the Daegu will temporarily be suspended. The Daegu Office of Education decided to postpone the start of every school in the region by one week.

Numerous educational institutes have temporarily shut down, including dozens of kindergartens in Daegu and several elementary schools in Seoul. As of 18 February, most universities in South Korea had announced plans to postpone the start of the spring semester. This included 155 universities planning to delay the semester start by 2 weeks to 16 and 22 March universities planning to delay the semester start by 1 week to 9 March. Also, on 23 February 2020, all kindergartens, elementary schools, middle schools, and high schools were announced to delay the semester start from 2 to 9 March.

The economy of South Korea is forecast to grow 1.9%, which is down from 2.1%. The government has provided 136.7 billion won for local governments as support. The government has also organised the procurement of masks and other hygiene equipment.

Taiwan

Main article: COVID-19 pandemic in Taiwan

On 24 January, the Taiwanese government announced a temporary ban on the export of face masks for a month to secure a supply of masks for its own citizens. On 2 February 2020, Taiwan's Central Epidemic Command Center postponed the opening of primary and secondary schools until 25 February. Taiwan has also announced a ban of cruise ships from entering all Taiwanese ports. In January, Italy has banned flights from mainland China, Hong Kong, Macau, and Taiwan. On 10 February, the Philippines announced it will ban the entry of Taiwanese citizens due to the One-China Policy. Later on 14 February, Presidential Spokesperson of Philippines, Salvador Panelo, announced the lifting of the temporary ban on Taiwan. In early February 2020 Taiwan's Central Epidemic Command Center requested the mobilisation of the Taiwanese Armed Forces to contain the spread of the virus and to build up the defences against it. Soldiers were dispatched to the factory floors of major mask manufacturers to help staff the 62 additional mask production lines being set up at the time.

In the aviation industry, Taiwanese carrier China Airlines's direct flights to Rome have been rejected and cancelled since Italy has announced the ban on Taiwanese flights. On the other hand, the second-largest Taiwanese carrier, Eva Air, has also postponed the launch of Milan and Phuket flights. Both Taiwanese airlines have cut numerous cross-strait destinations, leaving just three Chinese cities still served.

South Asia

India

Main articles: Economic impact of the COVID-19 pandemic in India and COVID-19 pandemic in IndiaIn India, economists expect the near-term impact of the outbreak to be limited to the supply chains of major conglomerates, especially pharmaceuticals, fertilisers, automobiles, textiles and electronics. A severe impact on global trade logistics is also expected due to disruption of logistics in mainland China, but due to the combined risk with regional geopolitical tensions, wider trade wars and Brexit. The stock market took a bearish mode in response to COVID-19. The BSE SENSEX fell 2919 and NIFTY 50 fell 950 points in a single day on 12 March 2020.

On 19 March 2020, the Indian government has banned the export of ventilators, surgical/disposable masks and textile raw materials out of the country. Oil has plummeted to 18-year low of $22 per barrel in March, and Foreign Portfolio Investors (FPIs) have withdrawn huge amounts from India, about US$571.4 million. While lower oil prices will shrink the current account deficit, reverse capital flows will expand it. Rupee is continuously depreciating. MSMEs will undergo a severe cash crunch.

Pakistan

Main article: COVID-19 pandemic in PakistanThe economy of Pakistan faced a devastating impact from the coronavirus outbreak because it was in recessionary conditions in the quarter prior to the pandemic. Weak social protections and low investment in healthcare meant that most citizens were vulnerable to pandemic conditions at the time of the outbreak. Forecasts of the economic loss from the three-month lockdown, which was subsequently eased in late May 2020, indicated that Pakistan would face its first annual economic recession since 1952. Given the strained government resources, civil society and charity organizations became much more active in providing relief to the public during the national lockdown.

Sri Lanka

Main article: COVID-19 pandemic in Sri LankaIn February 2020, research houses expected the economic impact in Sri Lanka to be limited to a short-term impact on the tourism and transport sectors.

Southeast Asia

Among Association of Southeast Asian Nations countries, the city-state of Singapore was forecast to be one of the worst-hit countries by Maybank. The tourism sector was considered to be an "immediate concern" along with the effects on production lines due to disruption to factories and logistics in mainland China. Singapore has witnessed panic buying of essential groceries, and of masks, thermometers and sanitation products despite being advised against doing so by the Government. Prime Minister Lee Hsien Loong said that a recession in the country is a possibility and that the country's economy "would definitely take a hit". On 17 February, the Ministry of Trade and Industry (MTI) downgraded Singapore's forecast GDP growth to between −0.5% and 1.5%. This is largely due to the fall in tourism and social distancing restrictions. On 26 March, MTI said it believed that the economy would contract by between 1% and 4% in 2020. This was after the economy shrank some 2.2% in the first quarter of 2020 from the same quarter in 2019. On 26 May, the Singapore economy contracted 0.7%YoY, which was better than the expected contraction of 2.2%. However, MTI said that it was revising down its expectation for the Singapore economy in 2020 to shrink by 4% to 7%. Economists were behind the curve in downgrading their numbers. Euben Paracuelles, at Nomura argued that while some ASEAN economies had success in containing the virus, the presence of global uncertainties meant that any regional recovery would be restrained. For example, while Thailand had managed to contain the virus, it was not open to tourism, which forms a substantial part of its economy.

Prime Minister Hun Sen of Cambodia made a special visit to China with an aim to showcase Cambodia's support to China in fighting the outbreak of the epidemic.

Maybank economists rated Thailand as being most at risk, with the threat of the viral outbreak's impact on tourism causing the Thai baht to fall to a seven-month low.

In Indonesia, over 10,000 Chinese tourists cancelled trips and flights to major destinations such as Bali, Jakarta, Bandung, etc., over coronavirus fears. Many existing Chinese visitors are queuing up with the Indonesian authority appealing for extended stay. Panic buying has also hit the capital city, Jakarta. As the first reported cases of COVID-19 was announced by the government at 3 March.

In Malaysia, economists predicted that the outbreak would affect the country's GDP, trade and investment flows, commodity prices and tourist arrivals. Initially, the cycling race event Le Tour de Langkawi was rumoured to be cancelled, but the organiser stated that it would continue to be held as usual. Despite this, two cycling teams, the Hengxiang Cycling Team and the Giant Cycling Team, both from China, were pulled from participating in this race due to fear of the coronavirus pandemic. As the outbreak situation has worsened, some of the upcoming concerts held in the country, such as Kenny G, Jay Chou, Joey Yung, The Wynners, Super Junior, Rockaway Festival and Miriam Yeung, were postponed to a future date, and the upcoming Seventeen concert was cancelled.

The Philippines reported that its GDP contracted by 9.5% in 2020, its worst contraction since World War II. The last full-year contraction in the country was in 1998 amidst the Asian financial crisis where its GDP grew by −0.5%. The 2020 contraction was also worse than the 7% contraction in 1984.

Vietnam, who had clamped down early to prevent the spread of the coronavirus, was expected to be the only country in the South East Asia region that was expected to grow in 2020.

Middle East

Iran

Main article: COVID-19 pandemic in IranOn 26 March, Rouhani requested to withdraw 1 billion dollars from National Development Fund and Khamenei allowed the withdrawal within eleven days. On 28 March, Rouhani announced that 20% of the country's annual budget would be allocated to fight the virus. The following day, he defended against criticisms of the government's response to the outbreak, saying that he needed to weigh protecting the country's economy that was already affected by US sanctions while fighting the worst outbreak of the region.

Israel

Main article: COVID-19 pandemic in IsraelAt its peak, Israel was one of the world's worst hit countries from the COVID-19 pandemic. By 1 April 2020, the national unemployment rate had reached 24.4 percent. In the month of March alone, more than 844,000 individuals applied for unemployment benefits—90% of whom had been placed on unpaid leave due to the pandemic. Following the world's fastest and most successful vaccination campaigns by far using the Pfizer-BioNTech jab, Israel currently issues 'green passports' for individuals who have received their 2nd vaccine dose; which allow indefinite access to many places and amenities formerly only accessible to those with a negative COVID-19 test result. The subsequent low-infection rates have eased restrictions and the economic tension in the country.

As of 29 March 2021; 5,227,689 Israelis have received at least 1 dose of the vaccine, out of which 4,739,694 have had 2 doses.

On 30 March 2020, Prime Minister Netanyahu announced an economic rescue package totaling 80 billion shekels ($22 billion), saying that was 6% of the country's GDP. The money will be allocated to health care (10 billion₪); welfare and unemployment (30 billion₪) aid for small and large businesses (32 billion₪), and to financial stimulus (8 billion₪).

Israel agreed to pay Russia to send Russian-made Sputnik V vaccine doses to Syria as part of a Russia-mediated prisoner swap agreement.

In 2020, Israel's economy shrank by 2.4%, following 3.4% and 3.5% growth in 2019 and 2018 respectively. This is considerably below the Euro-bloc where the economy shrank by 5%.

Saudi Arabia

Main article: COVID-19 pandemic in Saudi ArabiaOn 27 February, Saudi Arabia halted travel to Mecca and Medina over coronavirus. This has prevented foreigners from reaching the holy city of Mecca and the Kaaba. Travel was also suspended to Muhammad's mosque in Medina. Images of the emptied ṣaḥn of the Great Mosque of Mecca, where pilgrims are ordinarily performing the tawaf around the Kaaba, went viral on social media.

United Arab Emirates

Main article: COVID-19 pandemic in the United Arab EmiratesThe COVID-19 pandemic reportedly pressured the property sector, which has already been dealing with the imbalance between supply and demand for years. Dubai's property firms, Emaar Properties, and DAMAC Properties reported losses following the surge in COVID-19. Emaar reported a 58% loss in net profit while DAMAC Properties reported a net loss of 1.04 billion dirhams in the year 2020.

In March 2021, the restrictions on global supply-chain caused a great impact on Dubai's business activities, which were struggling to recover from the impact of the COVID-19 pandemic. The IHS Markit compiled Dubai's Purchasing Managers’ Index that rose to 51 from 50.9 in February 2021, saving from landing in the contraction zone by only one point. The global supply difficulties also led to "constraint profit margins", as the need of demand recovery forced firms to lower output charges.

Jordan

Main article: COVID-19 pandemic in JordanJordan's real GDP fell by 1.6% in 2020, with a dramatic reduction in tourism, one of its most crucial economic sectors. The sector's GDP fell by 3%.

SMEs appeared less affected by the pandemic than bigger enterprises. 50% of banks questioned reported an increase in loan supply to SMEs, while 25% reported a reduction. For corporates, the increase in loan supply was 25% and 45% reported a reduction. The country's unemployment rate hit 25% in 2021, the highest in more than 25 years.

Macroeconomic stability, however, has been maintained, and the International Monetary Fund expects modest growth rates for 2022 (2.7%) and 2023 (2.7%) in predictions provided in the October 2021 World Economic Outlook. In the first half of 2021, real GDP increased by 3.2%.

Europe

Main article: COVID-19 pandemic in Europe

In Spain, a large number of exhibitors (including Chinese firms Huawei and Vivo) announced plans to pull out of or reduce their presence at Mobile World Congress, a wireless industry trade show in Barcelona, due to concerns over coronavirus. On 12 February 2020, GSMA CEO John Hoffman announced that the event had been cancelled, as the concerns had made it "impossible" to host.

Owing to an increase in the demand for masks, on 1 February most masks were sold out in Portuguese pharmacies. On 4 February, President Marcelo Rebelo de Sousa admitted that the epidemic of the new coronavirus in China "affects the economic activity of a very powerful economy and thus affects the world's economic activity or could affect". He also admitted the possibility of economic upheavals due to the break in production." On 28 February, the Swiss government has banned all public and private gatherings of more than 1,000 people until 15 March, including forcing through a cancellation of the Geneva International Motor Show.

European Commissioner for Internal Market and Services Thierry Breton has asked streaming video services operating in the EU to reduce the amount of bandwidth used by their services to preserve capacity and infrastructure. Netflix and YouTube havecomplied with this request.

Before the COVID-19 pandemic, about 86% of EU enterprises were making investments. In 2021 this remained mostly steady compared to 2020 (81%). EU businesses were optimistic for investment throughout 2022, with 20% more anticipating investment to rise than fall.

According to the a survey on investment conducted by the European Investment Bank, European firms lost one-quarter of their gross income on average in the second quarter of 2020. The loss was substantially greater than the drop experienced by enterprises during the global financial crisis in 2008 and the European sovereign debt crisis in 2010.