| Revision as of 19:51, 18 December 2008 view sourceTempodivalse (talk | contribs)Autopatrolled, Extended confirmed users, Pending changes reviewers, Rollbackers15,794 editsm Reverted edits by 198.237.49.218 to last version by 206.226.139.1 (HG)← Previous edit | Latest revision as of 02:10, 28 December 2024 view source Flurrious (talk | contribs)Extended confirmed users7,634 edits Citation addedTag: Visual edit | ||

| Line 1: | Line 1: | ||

| {{Short description|Worldwide economic depression (1929–1939)}} | |||

| {{pp-semi-vandalism|small=yes|expiry=December 18, 2008}} | |||

| {{ |

{{About|the severe worldwide economic downturn in the 1930s|other uses|The Great Depression (disambiguation)}} | ||

| {{pp-vandalism|small=yes}} | |||

| ]'s '']'' depicts destitute ] in ], centering on ], a mother of seven children, age 32, in ], March 1936.]] | |||

| {{Use dmy dates|date=May 2024}}{{Use American English|date=November 2023}} | |||

| The '''Great Depression''' was a worldwide economic ] starting in most places in ] and ending at different times in the 1930s or early 1940s for different countries. It was the largest and most important economic depression in modern history, and is used in the 21st century as an example of how far the world's economy can fall. The Great Depression originated in the United States; historians most often use as a starting date the ] on October 29, 1929, known as ]. The end of the depression in the U.S is associated with the onset of the ] of ], beginning around 1939.<ref>{{cite book |title=The Cambridge Economic History of the United States |last=L. Engerman |first=Stanley |authorlink=Stanley L. Engerman |coauthors= Gallman, Robert E. }} </ref> | |||

| ] people lined up outside a ] opened in ] by ] during the Great Depression in February 1931|upright=1.35]] | |||

| The '''Great Depression''' was a severe global ] from 1929 to 1939. The period was characterized by high rates of ] and ]; drastic ], industrial production, and trade; and widespread bank and business failures around the world. The ] began in 1929 in the ], the largest economy in the world, with the devastating ] of October 1929 often considered the beginning of the Depression. Among the countries with the most unemployed were the U.S., the ], and ]. | |||

| The Depression was preceded by a period of industrial growth and social development known as the "]". Much of the profit generated by the boom was invested in ], such as on the ], which resulted in growing ]. Banks were subject to minimal regulation under '']'' economic policies, resulting in loose lending and widespread debt. By 1929, declining spending had led to reductions in manufacturing output and rising unemployment. Share values continued to rise until the Wall Street crash, after which the slide continued for three years, accompanied by a loss of confidence in the financial system. By 1933, the unemployment rate in the U.S. had risen to 25 percent, about one-third of farmers had lost their land, and about half of its 25,000 banks had gone out of business. The ] under President ] was unwilling to intervene heavily in the economy. In the ], Hoover was defeated by ], who from 1933 pursued a set of expansive ] programs in order to provide relief and create jobs. In Germany, which depended heavily on U.S. loans, the crisis caused unemployment to rise to nearly 30% and fueled political extremism, paving the way for ]'s ] to rise to power in 1933. | |||

| The depression had devastating effects in the ] and ] worlds. International trade was deeply affected, as were personal ]s, ]s, ]s, and ]s. ] were hit hard, especially those dependent on ]. Construction was virtually halted in many countries. ] and rural areas suffered as crop prices fell by roughly 60 percent.<ref name="USBLS">{{cite web|url=http://www.bls.gov/data/|title=Commodity Data|publisher=US Bureau of Labor Statistics|accessdate=2008-11-30}}</ref><ref>{{cite journal|author= Cochrane, Willard W.|title=Farm Prices, Myth and Reality|year=1958|pages=15}}</ref><ref>{{cite journal|journal=]|title=World Economic Survey 1932–33|pages=43}}</ref> Facing plummeting demand with few alternate sources of jobs, areas dependent on ] such as farming, ] and ] suffered the most.<ref>{{cite book| last = Hakim | first = Joy | title = A History of Us: War, Peace and all that Jazz | publisher = ]| year = 1995| location = New York| isbn=0195094840}}</ref> | |||

| However, even shortly after the Wall Street Crash of 1929, optimism persisted; ] said that "These are days when many are discouraged. In the 93 years of my life, depressions have come and gone. Prosperity has always returned and will again."<ref>{{cite web | |||

| |url= http://us.history.wisc.edu/hist102/lectures/lecture18.html | |||

| |title= Crashing Hopes: The Great Depression | |||

| |accessdate= 2008-03-13 | |||

| |last= Schultz | |||

| |first= Stanley K. | |||

| |year= 1999 | |||

| |work= American History 102: Civil War to the Present | |||

| |publisher= ] | |||

| }}.</ref> | |||

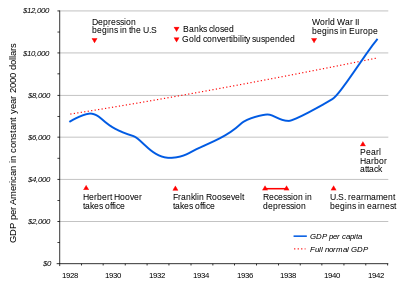

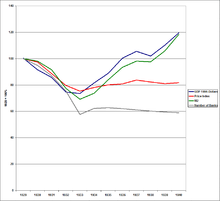

| Between 1929 and 1932, worldwide ] (GDP) fell by an estimated 15%; in the U.S., the Depression resulted in a 30% contraction in GDP.<ref name=":5">{{Cite book |last=Friedman |first=Milton |title=A monetary history of the United States 1867-1960 |last2=Schwartz |first2=Anna Jacobson |date=2008 |publisher=Princeton University Press |isbn=978-0-691-00354-2 |edition=9th pbk. printing, 22nd printing |series=Princeton paperbacks |location=Princeton}}</ref> Recovery varied greatly around the world. Some economies, such as the U.S., Germany and Japan started to recover by the mid-1930s; others, like France, did not return to pre-shock growth rates until later in the decade.<ref>{{Cite book |last=Lewis |first=William Arthur |title=Economic survey: 1919 - 1939 |date=2003 |isbn=978-0-415-31359-9 |edition=Reprint 1949 |series=International economics |location=London : Routledge}}</ref> The Depression had devastating economic effects on both wealthy and poor countries: all experienced drops in ], prices (]), tax revenues, and profits. International trade fell by more than 50%, and unemployment in some countries rose as high as 33%.<ref name="Frank_Bernanke">{{cite book |last1=Frank |first1=Robert H. |title=Principles of Macroeconomics |last2=Bernanke |first2=Ben S. |publisher=McGraw-Hill/Irwin |year=2007 |isbn=978-0-07-319397-7 |edition=3rd |location=Boston |page=98}}</ref> ], especially those dependent on ], were heavily affected. Construction virtually halted in many countries, and farming communities and rural areas suffered as crop prices fell by up to 60%.<ref name="USBLS">{{cite web |title=Commodity Data |url=https://www.bls.gov/data/ |url-status=live |archive-url=https://web.archive.org/web/20190603140110/https://www.bls.gov/data/ |archive-date=3 June 2019 |access-date=30 November 2008 |publisher=U.S. Bureau of Labor Statistics}}</ref><ref>{{cite book |author=Cochrane, Willard W. |author-link=Willard Cochrane |title=Farm Prices, Myth and Reality |year=1958 |page=15}}</ref><ref>{{cite journal |title=World Economic Survey 1932–33 |journal=] |page=43}}</ref> Faced with plummeting demand and few job alternatives, areas dependent on ] suffered the most.<ref>Mitchell, ''Depression Decade''</ref> The outbreak of ] in 1939 ended the Depression, as it stimulated factory production, providing jobs for women as militaries absorbed large numbers of young, unemployed men. | |||

| The Great Depression ended at different times in different countries; for subsequent history see ]. The majority of countries set up relief programs, and most underwent some sort of political upheaval, pushing them to the left or right. In some states, the desperate citizens turned toward nationalist ] - the most infamous being ] - setting the stage for ] in 1939. | |||

| {{TOClimit|limit=2}} | |||

| The precise causes for the Great Depression are disputed. One set of historians, for example, focuses on non-monetary economic causes. Among these, some regard the Wall Street crash itself as the main cause; others consider that the crash was a mere symptom of more general economic trends of the time, which had already been underway in the late 1920s.<ref name="Frank_Bernanke" /><ref name="Britannica"> {{Webarchive|url=https://web.archive.org/web/20150509121741/https://www.britannica.com/EBchecked/topic/243118/Great-Depression|date=9 May 2015}}, ''Encyclopædia Britannica''</ref> A contrasting set of views, which rose to prominence in the later part of the 20th century,<ref>Thomas S. Coleman (2019). ''Milton Friedman, Anna Schwartz, and A Monetary History of the US.'' Draft Lecture, Harris School of Public Policy, University of Chicago.</ref> ascribes a more prominent role to failures of ]. According to those authors, while general economic trends can explain the emergence of the downturn, they fail to account for its severity and longevity; they argue that these were caused by the lack of an adequate response to the crises of liquidity that followed the initial economic shock of 1929 and the subsequent bank failures accompanied by a general collapse of the financial markets.<ref name=":5" /> | |||

| ==The deflation spiral== | |||

| ] | |||

| The Great Depression was not triggered by a sudden, total collapse in the stock market. The stock market turned upward in early 1930, returning to early 1929 levels by April, though still almost 30 percent below the peak of September 1929.<ref>{{cite web|accessdate=2008-05-22|url=http://www.gold-eagle.com/editorials_98/vronsky060698.html|title=1998/99 Prognosis Based Upon 1929 Market Autopsy|publisher=Gold Eagle}}.</ref> Together, government and business actually spent more in the first half of 1930 than in the corresponding period of the previous year. But consumers, many of whom had suffered severe losses in the stock market the previous year, cut back their expenditures by ten percent, and a severe drought ravaged the agricultural heartland of the USA beginning in the summer of 1930. | |||

| == Overview == | |||

| In early 1930, credit was ample and available at low rates, but people were reluctant to add new debt by borrowing. By May 1930, auto sales had declined to below the levels of 1928. Prices in general began to decline, but wages held steady in 1930, then began to drop in 1931. Conditions were worst in farming areas, where commodity prices plunged, and in mining and logging areas, where unemployment was high and there were few other jobs. The decline in the ] was the factor that pulled down most other countries at first, then internal weaknesses or strengths in each country made conditions worse or better. Frantic attempts to shore up the economies of individual nations through ] policies, such as the 1930 U.S. ] and retaliatory tariffs in other countries, exacerbated the collapse in global trade. By late in 1930, a steady decline set in which reached bottom by March 1933. | |||

| {{Multiple image | |||

| | image1 = US Unemployment from 1910-1960.svg | |||

| | image2 = 1929 wall street crash graph.svg | |||

| | caption1 = The unemployment rate in the U.S. during 1910–60, with the years of the Great Depression (1929–39) highlighted | |||

| | caption2 = The ], 1928–1930 | |||

| | align = left | |||

| }} | |||

| === The economic picture at the beginning of the crisis === | |||

| ==Causes == | |||

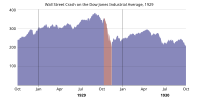

| After the ], when the ] dropped from 381 to 198 over the course of two months, optimism persisted for some time. The stock market rose in early 1930, with the Dow returning to 294 (pre-depression levels) in April 1930, before steadily declining for years, to a low of 41 in 1932.<ref>{{cite web |title=1998/99 Prognosis Based Upon 1929 Market Autopsy |url=https://www.gold-eagle.com/editorials_98/vronsky060698.html |url-status=dead |archive-url=https://web.archive.org/web/20080517075810/https://www.gold-eagle.com/editorials_98/vronsky060698.html |archive-date=17 May 2008 |access-date=22 May 2008 |publisher=Gold Eagle}}</ref> | |||

| At the beginning, governments and businesses spent more in the first half of 1930 than in the corresponding period of the previous year. On the other hand, consumers, many of whom suffered severe losses in the stock market the previous year, cut expenditures by 10%. In addition, beginning in the mid-1930s, a ] ravaged the agricultural heartland of the U.S.<ref name="drought">{{cite web |title=Drought: A Paleo Perspective – 20th Century Drought |url=https://www.ncdc.noaa.gov/paleo/drought/drght_history.html |url-status=live |archive-url=https://web.archive.org/web/20090330022940/http://www.ncdc.noaa.gov/paleo/drought/drght_history.html |archive-date=30 March 2009 |access-date=5 April 2009 |publisher=]}}</ref> | |||

| Interest rates dropped to low levels by mid-1930, but expected ] and the continuing reluctance of people to borrow meant that consumer spending and investment remained low.<ref>{{Cite journal |last=Hamilton |first=James |year=1987 |title=Monetary Factors in the Great Depression |journal=Journal of Monetary Economics |volume=19 |issue=2 |pages=145–69 |doi=10.1016/0304-3932(87)90045-6| issn=0304-3932}}</ref> By May 1930, automobile sales declined to below the levels of 1928. Prices, in general, began to decline, although wages held steady in 1930. Then a ] started in 1931. Farmers faced a worse outlook; declining crop prices and a Great Plains drought crippled their economic outlook. At its peak, the Great Depression saw nearly 10% of all Great Plains farms change hands despite federal assistance.<ref>{{Cite web |title=The Great Depression |url=https://drought.unl.edu/DroughtBasics/DustBowl/TheGreatDepression.aspx |url-status=live |archive-url=https://web.archive.org/web/20180329184059/http://drought.unl.edu/DroughtBasics/DustBowl/TheGreatDepression.aspx |archive-date=29 March 2018 |access-date=29 March 2018 |website=drought.unl.edu |language=en-US}}</ref> | |||

| === Beyond the U.S. === | |||

| At first, the decline in the ] was the factor that triggered economic downturns in most other countries due to a decline in trade, capital movement, and global business confidence. Then, internal weaknesses or strengths in each country made conditions worse or better. For example, the U.K. economy, which experienced an economic downturn throughout most of the late 1920s, was less severely impacted by the shock of the depression than the U.S. By contrast, the German economy saw a similar decline in industrial output as that observed in the U.S.<ref name=cpk>{{Cite book |last=Kindleberger |first=Charles P. |title=The world in depression, 1929–1939 |date=1986 |publisher=University of California Press |isbn=978-0-520-05591-9 |edition=Rev. and enl. |series=History of the world economy in the twentieth century |location=Berkeley}}</ref> Some economic historians attribute the differences in the rates of recovery and relative severity of the economic decline to whether particular countries had been able to effectively devaluate their currencies or not. This is supported by the contrast in how the crisis progressed in, e.g., Britain, Argentina and Brazil, all of which devalued their currencies early and returned to normal patterns of growth relatively rapidly and countries which stuck to the ], such as France or Belgium.<ref>{{Cite book |last=Kindleberger |first=Charles Poor |title=The world in depression, 1929–1939 |date=1973 |publisher=University of California Press |isbn=978-0-520-05592-6 |edition=Rev. and enl. ed., 11. |series=History of the world economy in the twentieth century |location=Berkeley, Calif.}}</ref> | |||

| Frantic attempts by individual countries to shore up their economies through ] policies – such as the 1930 U.S. ] and retaliatory tariffs in other countries – exacerbated the collapse in global trade, contributing to the depression.<ref>{{cite book |title=Historic Events for Students: The Great Depression |date=July 2002 |publisher=Gale |isbn=978-0-7876-5701-7 |editor-last1=Richard |editor-first1=Clay Hanes |edition=Volume I}}</ref> By 1933, the economic decline pushed world trade to one third of its level compared to four years earlier.<ref>{{Cite book |last=Tignor |first= Robert L. |title=Worlds together, worlds apart: a history of the world from the beginnings of humankind to the present |date=28 October 2013 |isbn=978-0-393-92207-3 |edition=Fourth |location=New York |oclc=854609153 |publisher=W. W. Norton}}</ref> | |||

| {| class="wikitable" style="width: 50%;text-align: right;" | |||

| |+ Change in economic indicators 1929–1932<ref>], ], ], ''The European world: a history,'' (2nd ed 1970), 885 pp.</ref> | |||

| |- | |||

| ! scope="col" style="width:36%;"| | |||

| ! scope="col" style="width:16%; text-align:center;"| United States | |||

| ! scope="col" style="width:16%; text-align:center;"| United Kingdom | |||

| ! scope="col" style="width:16%; text-align:center;"| France | |||

| ! scope="col" style="width:16%; text-align:center;"| Germany | |||

| |- | |||

| | style="text-align: left;"| Industrial production | |||

| | −46% | |||

| | −23% | |||

| | −24% | |||

| | −41% | |||

| |- | |||

| | style="text-align: left;"| Wholesale prices | |||

| | −32% | |||

| | −33% | |||

| | −34% | |||

| | −29% | |||

| |- | |||

| | style="text-align: left;"| Foreign trade | |||

| | −70% | |||

| | −60% | |||

| | −54% | |||

| | −61% | |||

| |- | |||

| | style="text-align: left;"| Unemployment | |||

| | +607% | |||

| | +129% | |||

| | +214% | |||

| | +232% | |||

| |} | |||

| == Course == | |||

| ] and Broad Street after the ]]] | |||

| === Origins === | |||

| While the precise causes for the occurrence of the Great depression are disputed and can be traced to both global and national phenomena, its immediate origins are most conveniently examined in the context of the U.S. economy, from which the initial crisis spread to the rest of the world. | |||

| In the aftermath of ], the ] brought considerable wealth to the United States and Western Europe.<ref name="Soule-1947">George H. Soule, ''Prosperity Decade: From War to Depression: 1917–1929,'' (1947).</ref> Initially, the year 1929 dawned with good economic prospects: despite a minor crash on 25 March 1929, the market seemed to gradually improve through September. Stock prices began to slump in September, and were volatile at the end of the month.<ref name="pbsstock2">{{cite web |title=Timeline: A selected Wall Street chronology |url=https://www.pbs.org/wgbh/amex/crash/timeline/timeline2.html |url-status=dead |archive-url=https://web.archive.org/web/20080923040829/http://www.pbs.org/wgbh/amex/crash/timeline/timeline2.html |archive-date=23 September 2008 |access-date=30 September 2008 |publisher=]}}</ref> A large sell-off of stocks began in mid-October. Finally, on 24 October, ], the American stock market crashed 11% at the opening bell. Actions to stabilize the market failed, and on 28 October, Black Monday, the market crashed another 12%. The panic peaked the next day on Black Tuesday, when the market saw another 11% drop.<ref name=":02">{{Cite news |last1=Post |first1=Special to Financial |date=24 October 2011 |title=The Great Crash of 1929, some key dates |language=en-CA |website=Financial Post |url=https://financialpost.com/personal-finance/the-great-crash-of-1929-some-key-dates |access-date=22 July 2020}}</ref><ref name=":4">{{cite web |author=<!--ET Bureau--> |date=22 October 2017 |title=Market crash of 1929: Some facts of the economic downturn |url=https://economictimes.indiatimes.com/industry/miscellaneous/market-crash-of-1929-some-facts-of-the-economic-downturn/articleshow/61166918.cms |access-date=16 February 2019 |work=Economic Times |publisher=Times Inernet}}</ref> | |||

| Thousands of investors were ruined, and billions of dollars had been lost; many stocks could not be sold at any price.<ref name=":4" /> The market recovered 12% on Wednesday but by then significant damage had been done. Though the market entered a period of recovery from 14 November until 17 April 1930, the general situation had been a prolonged slump. From 17 April 1930 until 8 July 1932, the market continued to lose 89% of its value.<ref>According to the Federal Reserve Bank of St. Louis Economic Data website, based on a monthly timeseries 1929 September – 1932 June, the Dow Jones Industrial Average lost 87.1% while the Cowles Commission and S&P's all stock index lost 85.0%: https://fred.stlouisfed.org/graph/?g=qj2m , https://fred.stlouisfed.org/graph/?g=qj2l.</ref> | |||

| ] in New York after its failure in 1931]] | |||

| Despite the crash, the worst of the crisis did not reverberate around the world until after 1929. The crisis hit panic levels again in December 1930, with a ] on the ], a former privately run bank, bearing no relation to the U.S. government (not to be confused with the ]). Unable to pay out to all of its creditors, the bank failed.<ref>{{Cite journal |last=Gordon |first=John Steele |date=November–December 2018 |title=The Bank of United States |url=https://www.proquest.com/docview/2160290916 |journal=ABA Banking Journal |volume=110 |issue=6 |pages=58 |id={{ProQuest|2160290916}}}}</ref><ref>{{Cite journal |last=Calomiris |first=Charles W. |date=November 2007 |title=Bank Failures in Theory and History: The Great Depression and Other "Contagious" Events |url=https://www.nber.org/papers/w13597 |journal=National Bureau of Economic Research|series=Working Paper Series |location=Cambridge, MA |doi=10.3386/w13597 |s2cid=154123748 |doi-access=free }}</ref> | |||

| Among the 608 American banks that closed in November and December 1930, the Bank of United States accounted for a third of the total $550 million deposits lost and, with its closure, bank failures reached a critical mass.<ref>{{Citation |last=Ferguson |first=Niall |title=The Ascent of Money |date=October 2009 |pages=163 |publisher=Penguin |isbn=978-986-173-584-9}}</ref> | |||

| === The Smoot–Hawley Act and the Breakdown of International Trade === | |||

| {{Main|Smoot–Hawley Tariff Act}} | |||

| ] (left) and ] in April 1929, shortly before the Smoot–Hawley Tariff Act passed the House of Representatives]] | |||

| In an initial response to the crisis, the U.S. Congress passed the ] on 17 June 1930. The Act was ostensibly aimed at protecting the American economy from foreign competition by imposing high tariffs on foreign imports. The consensus view among ]s and economic historians (including ]s, ]s and ]s) is that the passage of the Smoot–Hawley Tariff had, in fact, achieved an opposite effect to what was intended. It exacerbated the Great Depression<ref>{{Cite journal |last=Whaples |first=Robert |author-link=Robert Whaples |date=March 1995 |title=Where Is There Consensus Among American Economic Historians? The Results of a Survey on Forty Propositions |journal=] |publisher=] |volume=55 |issue=1 |page=144 |doi=10.1017/S0022050700040602 |jstor=2123771 |s2cid=145691938}}</ref> by preventing economic recovery after domestic production recovered, hampering the volume of trade; still there is disagreement as to the precise extent of the Act's influence. | |||

| In the popular view, the Smoot–Hawley Tariff was one of the leading causes of the depression.<ref> {{Webarchive|url=https://web.archive.org/web/20210225033620/https://krugman.blogs.nytimes.com/2009/11/30/protectionism-and-the-great-depression/|date=25 February 2021}}, ], ''],'' 30 November 2009</ref><ref name="eichenirwin">Barry Eichengreen, Douglas Irwin (17 March 2009). . {{Webarchive|url=https://web.archive.org/web/20120524215509/http://voxeu.org/index.php?q=node%2F3280|date=24 May 2012}}. VOX.</ref> In a 1995 survey of American economic historians, two-thirds agreed that the ] at least worsened the Great Depression.<ref name="ReferenceB" /> According to the U.S. Senate website, the Smoot–Hawley Tariff Act is among the most catastrophic acts in congressional history.<ref name="Senate_On_Smoot-Hawley Act">{{cite web |title=The Senate Passes the Smoot-Hawley Tariff |url=https://www.senate.gov/artandhistory/history/minute/Senate_Passes_Smoot_Hawley_Tariff.htm |url-status=live |archive-url=https://web.archive.org/web/20211020163037/https://www.senate.gov/artandhistory/history/minute/Senate_Passes_Smoot_Hawley_Tariff.htm |archive-date=20 October 2021 |access-date=3 May 2020 |website=United States Senate }}</ref> | |||

| Many economists have argued that the sharp decline in international trade after 1930 helped to worsen the depression, especially for countries significantly dependent on foreign trade. Most historians and economists blame the Act for worsening the depression by seriously reducing international trade and causing retaliatory tariffs in other countries. While foreign trade was a small part of overall economic activity in the U.S. and was concentrated in a few businesses like farming, it was a much larger factor in many other countries.<ref>{{cite web |title=The World in Depression |url=https://www.mtholyoke.edu/acad/intrel/depress.htm |url-status=dead |archive-url=https://web.archive.org/web/20080310145946/https://www.mtholyoke.edu/acad/intrel/depress.htm |archive-date=10 March 2008 |access-date=22 May 2008 |publisher=]}}</ref> The average '']'' (value based) rate of duties on dutiable imports for 1921–1925 was 25.9% but under the new tariff it jumped to 50% during 1931–1935. In dollar terms, American exports declined over the next four years from about $5.2 billion in 1929 to $1.7 billion in 1933; so, not only did the physical volume of exports fall, but also the prices fell by about {{frac|1|3}} as written. Hardest hit were farm commodities such as wheat, cotton, tobacco, and lumber.<ref>{{Cite book |last=Parker |first=Selwyn |url=https://www.google.com/books/edition/The_Great_Crash/iA05AgAAQBAJ?hl=en&gbpv=1&dq=Smoot-Hawley+wheat,+cotton,+tobacco,+and+lumber&pg=PT146&printsec=frontcover |title=The Great Crash: How the Stock Market Crash of 1929 Plunged the World into Depression |date=2010-09-02 |publisher=Little, Brown Book Group |isbn=978-0-7481-2231-8 |language=en}}</ref> | |||

| Governments around the world took various steps into spending less money on foreign goods such as: "imposing tariffs, import quotas, and exchange controls". These restrictions triggered much tension among countries that had large amounts of bilateral trade, causing major export-import reductions during the depression. Not all governments enforced the same measures of protectionism. Some countries raised tariffs drastically and enforced severe restrictions on foreign exchange transactions, while other countries reduced "trade and exchange restrictions only marginally":<ref name="Eichengreen">{{cite journal |last1=Eichengreen |first1=B. |last2=Irwin |first2=D. A. |year=2010 |title=The Slide to Protectionism in the Great Depression: Who Succumbed and Why? |url=https://www.nber.org/papers/w15142.pdf |url-status=live |journal=Journal of Economic History |volume=70 |issue=4 |pages=871–897 |doi=10.1017/s0022050710000756 |archive-url=https://web.archive.org/web/20190514111715/https://www.nber.org/papers/w15142.pdf |archive-date=14 May 2019 |access-date=18 February 2022 |s2cid=18906612}}</ref> | |||

| * "Countries that remained on the gold standard, keeping currencies fixed, were more likely to restrict foreign trade." These countries "resorted to protectionist policies to strengthen the ] and limit gold losses." They hoped that these restrictions and depletions would hold the economic decline.<ref name="Eichengreen" /> | |||

| * Countries that abandoned the gold standard allowed their currencies to ] which caused their balance of payments to strengthen. It also freed up monetary policy so that central banks could lower interest rates and act as lenders of last resort. They possessed the best policy instruments to fight the Depression and did not need protectionism.<ref name="Eichengreen" /> | |||

| * "The length and depth of a country's economic downturn and the timing and vigor of its recovery are related to how long it remained on the ]. Countries abandoning the gold standard relatively early experienced relatively mild recessions and early recoveries. In contrast, countries remaining on the gold standard experienced prolonged slumps."<ref name="Eichengreen" /> | |||

| === The Gold Standard and the Spreading of Global Depression === | |||

| The ] was the primary transmission mechanism of the Great Depression. Even countries that did not face bank failures and a monetary contraction first-hand were forced to join the deflationary policy since higher interest rates in countries that performed a deflationary policy led to a gold outflow in countries with lower interest rates. Under the gold standard's ], countries that lost gold but nevertheless wanted to maintain the gold standard had to permit their money supply to decrease and the domestic price level to decline (]).<ref>Peter Temin, Gianni Toniolo, ''The World Economy between the Wars'', Oxford University Press, 2008, {{ISBN|978-0-19-804201-3}}, p. 106</ref><ref>Randall E. Parker, ''Reflections on the Great Depression'', Elgar publishing, 2003, {{ISBN|978-1-84376-335-2}}, p. 22.</ref> | |||

| There is also consensus that protectionist policies, and primarily the passage of the ], helped to exacerbate, or even cause the Great Depression.<ref name="ReferenceB">{{Cite journal |last1=Whaples |first1=Robert |year=1995 |title=Where is There Consensus Among American Economic Historians? The Results of a Survey on Forty Propositions |journal=The Journal of Economic History |volume=55 |issue=1 |pages=139–154 |doi=10.1017/S0022050700040602 |jstor=2123771 |s2cid=145691938}}</ref> | |||

| ==== Gold standard ==== | |||

| ] | |||

| Some economic studies have indicated that the rigidities of the ] not only spread the downturn worldwide, but also suspended gold convertibility (devaluing the currency in gold terms) that did the most to make recovery possible.<ref>{{Cite book |last=Eichengreen |first=Barry |url=https://archive.org/details/goldenfettersgol00eich |title=Golden Fetters: The Gold Standard and the Great Depression, 1919–1939 |publisher=Oxford University Press |year=1992 |isbn=0-19-506431-3 |location=New York |author-link=Barry Eichengreen}}</ref> | |||

| Every major currency left the gold standard during the Great Depression. The UK was the first to do so. Facing ]s on the ] and depleting ], in September 1931 the ] ceased exchanging pound notes for gold and the pound was floated on foreign exchange markets. Japan and the Scandinavian countries followed in 1931. Other countries, such as Italy and the United States, remained on the gold standard into 1932 or 1933, while a few countries in the so-called "gold bloc", led by France and including Poland, Belgium and Switzerland, stayed on the standard until 1935–36. | |||

| According to later analysis, the earliness with which a country left the gold standard reliably predicted its economic recovery. For example, The UK and Scandinavia, which left the gold standard in 1931, recovered much earlier than France and Belgium, which remained on gold much longer. Countries such as China, which had a ], almost avoided the depression entirely. The connection between leaving the gold standard as a strong predictor of that country's severity of its depression and the length of time of its recovery has been shown to be consistent for dozens of countries, including ]. This partly explains why the experience and length of the depression differed between regions and states around the world.<ref>{{Cite journal |last=Bernanke |first=Ben |date=2 March 2004 |title=Remarks by Governor Ben S. Bernanke: Money, Gold and the Great Depression |journal=At the H. Parker Willis Lecture in Economic Policy, Washington and Lee University, Lexington, Virginia |url=https://www.federalreserve.gov/boarddocs/speeches/2004/200403022/default.htm |access-date=18 February 2022 |url-status=live |archive-url=https://web.archive.org/web/20220215053205/https://www.federalreserve.gov/boarddocs/speeches/2004/200403022/default.htm |archive-date=15 February 2022}}</ref> | |||

| ==== German banking crisis of 1931 and British crisis ==== | |||

| The financial crisis escalated out of control in mid-1931, starting with the collapse of the ] in Vienna in May.<ref>], ''Britain between the wars, 1918–1940'' (1955) pp. 379–385.</ref><ref name="William Ashworth 1962 pp. 237-244">William Ashworth, ''A short history of the international economy since 1850,'' (2nd ed. 1962), pp. 237–244.</ref> This put heavy pressure on Germany, which was already in political turmoil. With the rise in violence of National Socialist ('Nazi') and Communist movements, as well as investor nervousness at harsh government financial policies,<ref name="Isabel Schnabel 1931">Isabel Schnabel, "The German twin crisis of 1931". ''Journal of Economic History'' 64#3 (2004): 822–871.</ref> investors withdrew their short-term money from Germany as confidence spiraled downward. The Reichsbank lost 150 million marks in the first week of June, 540 million in the second, and 150 million in two days, 19–20 June. Collapse was at hand. U.S. President Herbert Hoover called for a ]. This angered Paris, which depended on a steady flow of German payments, but it slowed the crisis down, and the moratorium was agreed to in July 1931. An International conference in London later in July produced no agreements but on 19 August a standstill agreement froze Germany's foreign liabilities for six months. Germany received emergency funding from private banks in New York as well as the Bank of International Settlements and the Bank of England. The funding only slowed the process. Industrial failures began in Germany, a major bank closed in July and a two-day holiday for all German banks was declared. Business failures were more frequent in July, and spread to ] and Hungary. The crisis continued to get worse in Germany, bringing political upheaval that finally led to the ] in January 1933.<ref name="V. Hodson, 1938 pp. 64-76">H. V. Hodson (1938), ''Slump and Recovery, 1929–1937'' (London), pp. 64–76.</ref> | |||

| The world financial crisis now began to overwhelm Britain; investors around the world started withdrawing their gold from London at the rate of £2.5 million per day.<ref name="David Williams 1963">{{cite journal |last1=Williams |first1=David |year=1963 |title=London and the 1931 financial crisis |journal=Economic History Review |volume=15 |issue=3 |pages=513–528 |doi=10.2307/2592922 |jstor=2592922}}</ref> Credits of £25 million each from the Bank of France and the Federal Reserve Bank of New York and an issue of £15 million fiduciary note slowed, but did not reverse, the British crisis. The financial crisis now caused a major political crisis in Britain in August 1931. With deficits mounting, the bankers demanded a balanced budget; the divided cabinet of Prime Minister Ramsay MacDonald's Labour government agreed; it proposed to raise taxes, cut spending, and most controversially, to cut unemployment benefits 20%. The attack on welfare was unacceptable to the Labour movement. MacDonald wanted to resign, but King George V insisted he remain and form an all-party coalition "]". The Conservative and Liberals parties signed on, along with a small cadre of Labour, but the vast majority of Labour leaders denounced MacDonald as a traitor for leading the new government. Britain went off the ], and suffered relatively less than other major countries in the Great Depression. In the 1931 British election, the Labour Party was virtually destroyed, leaving MacDonald as prime minister for a largely Conservative coalition.<ref>Mowat (1955), ''Britain between the wars, 1918–1940'', pp. 386–412.</ref><ref name="John Oxborrow 1976 pp. 67-73">Sean Glynn and John Oxborrow (1976), ''Interwar Britain : a social and economic history'', pp. 67–73.</ref> | |||

| === Turning point and recovery === | |||

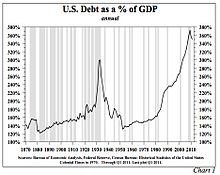

| {{Webarchive|url=https://web.archive.org/web/20100904025051/http://www.measuringworth.org/usgdp/|date=4 September 2010}}</ref>]] | |||

| In most countries of the world, recovery from the Great Depression began in 1933.<ref name="Britannica" /> In the U.S., recovery began in early 1933,<ref name="Britannica" /> but the U.S. did not return to 1929 GNP for over a decade and still had an unemployment rate of about 15% in 1940, albeit down from the high of 25% in 1933. | |||

| There is no consensus among economists regarding the motive force for the U.S. economic expansion that continued through most of the ] (and the 1937 recession that interrupted it). The common view among most economists is that Roosevelt's ] policies either caused or accelerated the recovery, although his policies were never aggressive enough to bring the economy completely out of recession. Some economists have also called attention to the positive effects from expectations of ] and rising nominal interest rates that Roosevelt's words and actions portended.<ref>Gauti B. Eggertsson, "Great Expectations and the End of the Depression", ''American Economic Review'' 98, No. 4 (September 2008): 1476–1516</ref><ref>"Was the New Deal Contractionary?" ] Staff Report 264, October 2006, {{Webarchive|url=https://web.archive.org/web/20220212162504/https://www.newyorkfed.org/research/staff_reports/sr264.html|date=12 February 2022}}</ref> It was the rollback of those same reflationary policies that led to the interruption of a recession beginning in late 1937.<ref>"The Mistake of 1937: A General Equilibrium Analysis", ''Monetary and Economic Studies'' 24, No. S-1 (December 2006), {{Webarchive|url=https://web.archive.org/web/20150811112759/https://www.imes.boj.or.jp/english/publication/mes/2006/abst/me24-s1-8.html|date=11 August 2015}}</ref><ref>{{cite journal |last1=Eggertsson |first1=Gauti B. |title=A Reply to Steven Horwitz's Commentary on 'Great Expectations and the End of the Great Depression' |url=https://econjwatch.org/articles/a-reply-to-steven-horwitz-s-commentary-on-great-expectations-and-the-end-of-the-depression- |url-status=live |journal=Econ Journal Watch |volume=7 |issue=3 |pages=197–204 |archive-url=https://web.archive.org/web/20220215053116/https://econjwatch.org/articles/a-reply-to-steven-horwitz-s-commentary-on-great-expectations-and-the-end-of-the-depression- |archive-date=15 February 2022 |access-date=18 February 2022}}</ref> One contributing policy that reversed reflation was the ], which effectively raised reserve requirements, causing a monetary contraction that helped to thwart the recovery.<ref>Steven Horwitz, "Unfortunately Unfamiliar with Robert Higgs and Others: A Rejoinder to Gauti Eggertsson on the 1930s", ''Econ Journal Watch'' 8(1), 2, January 2011. {{Webarchive|url=https://web.archive.org/web/20220215053127/https://econjwatch.org/articles/unfortunately-unfamiliar-with-robert-higgs-and-others-a-rejoinder-to-gauti-eggertsson-on-the-1930s|date=15 February 2022}}.</ref> GDP returned to its upward trend in 1938.<ref name=":0" /> A revisionist view among some economists holds that the New Deal prolonged the Great Depression, as they argue that ] and ] restricted competition and established price fixing.<ref>{{Cite journal |last1=Hannsgen |first1=Greg |last2=Papadimitriou |first2=Dimitri |date=2010 |title=Did the New Deal Prolong or Worsen the Great Depression? |url=https://www.jstor.org/stable/40722622 |journal=Challenge |volume=53 |issue=1 |pages=63–86 |doi=10.2753/0577-5132530103 |jstor=40722622 |s2cid=153490746 |issn=0577-5132}}</ref> ] did not think that the New Deal under Roosevelt single-handedly ended the Great Depression: "It is, it seems, politically impossible for a capitalistic democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case—except in war conditions."<ref>Quoted by P. Renshaw. ''Journal of Contemporary History''. 1999 vol. 34 (3). pp. 377–364</ref> | |||

| According to ], the money supply growth caused by huge international gold inflows was a crucial source of the recovery of the United States economy, and that the economy showed little sign of self-correction. The gold inflows were partly due to ] and partly due to deterioration of the political situation in Europe.<ref>{{Cite journal |last=Romer |first=Christina D. |date=December 1992 |title=What Ended the Great Depression |url=https://elsa.berkeley.edu/~cromer/What%20Ended%20the%20Great%20Depression.pdf |url-status=dead |journal=Journal of Economic History |volume=52 |issue=4 |pages=757–84 |citeseerx=10.1.1.207.844 |doi=10.1017/S002205070001189X |archive-url=https://web.archive.org/web/20130117093624/https://elsa.berkeley.edu/~cromer/What%20Ended%20the%20Great%20Depression.pdf |archive-date=17 January 2013 |quote=monetary development were crucial to the recovery implies that self-correction played little role in the growth of real output}}</ref> In their book, '']'', ] and ] also attributed the recovery to monetary factors, and contended that it was much slowed by poor management of money by the ]. ] (2006–2014) ] agreed that monetary factors played important roles both in the worldwide economic decline and eventual recovery.<ref>Ben Bernanke. ''Essays on the Great Depression''. Princeton University Press. {{ISBN|978-0-691-01698-6}}. p. 7</ref> Bernanke also saw a strong role for institutional factors, particularly the rebuilding and restructuring of the financial system,<ref>Ben S. Bernanke, "Nonmonetary Effects of the Financial Crisis in the Propaga-tion of the Great Depression", ''The American Economic Review 73'', No. 3 (June 1983): 257–276, available from the St. Louis Federal Reserve Bank collection at {{Webarchive|url=https://web.archive.org/web/20160305072448/https://fraser.stlouisfed.org/scribd/?item_id=2348&filepath=%2Fdocs%2Fpublications%2Faer%2Faer_1983_bernanke_nonmonetary_effects.pdf|date=5 March 2016}}</ref> and pointed out that the Depression should be examined in an international perspective.<ref>{{cite journal |last=Bernanke |first=Ben S. |date=February 1995 |title=The Macroeconomics of the Great Depression: A Comparative Approach |url=https://fraser.stlouisfed.org/scribd/?item_id=2399&filepath=/docs/meltzer/bermac95.pdf |url-status=live |journal=Journal of Money, Credit and Banking |publisher=Fraser.stlouisfed.org |volume=27 |issue=1 |pages=1–28 |doi=10.2307/2077848 |jstor=2077848 |archive-url=https://web.archive.org/web/20160304201917/https://fraser.stlouisfed.org/scribd/?item_id=2399&filepath=%2Fdocs%2Fmeltzer%2Fbermac95.pdf |archive-date=4 March 2016 |access-date=16 October 2014}}</ref> | |||

| ==== Role of women and household economics ==== | |||

| Women's primary role was as housewives; without a steady flow of family income, their work became much harder in dealing with food and clothing and medical care. Birthrates fell everywhere, as children were postponed until families could financially support them. The average birthrate for 14 major countries fell 12% from 19.3 births per thousand population in 1930, to 17.0 in 1935.<ref>W. S. Woytinsky and E. S. Woytinsky, ''World population and production: trends and outlook'' (1953) p. 148</ref> In Canada, half of Roman Catholic women defied Church teachings and used contraception to postpone births.<ref>Denyse Baillargeon, ''Making Do: Women, Family and Home in Montreal during the Great Depression'' (Wilfrid Laurier University Press, 1999), p. 159.</ref> | |||

| Among the few women in the labor force, layoffs were less common in the white-collar jobs and they were typically found in light manufacturing work. However, there was a widespread demand to limit families to one paid job, so that wives might lose employment if their husband was employed.<ref>{{cite book |last=Stephenson |first=Jill |url=https://books.google.com/books?id=-rqOAwAAQBAJ&pg=PA3 |title=Women in Nazi Germany |publisher=Taylor & Francis |year=2014 |isbn=978-1-317-87607-6 |pages=3–5 |access-date=27 June 2015 |archive-url=https://web.archive.org/web/20210816172022/https://books.google.com/books?id=-rqOAwAAQBAJ&pg=PA3 |archive-date=16 August 2021 |url-status=live}}</ref><ref>{{cite book |author=Susan K. Foley |url=https://archive.org/details/womeninfrancesin00fole |title=Women in France Since 1789: The Meanings of Difference |publisher=Palgrave Macmillan |year=2004 |isbn=978-0-230-80214-8 |pages=–90 |author-link1=Susan Foley |url-access=registration}}</ref><ref>{{cite book |last=Srigley |first=Katrina |url=https://archive.org/details/breadwinningdaug00srig |title=Breadwinning Daughters: Young Working Women in a Depression-era City, 1929–1939 |publisher=University of Toronto Press |year=2010 |isbn=978-1-4426-1003-3 |page= |url-access=registration}}</ref> Across Britain, there was a tendency for married women to join the labor force, competing for part-time jobs especially.<ref>Jessica S. Bean, {{"'}}To help keep the home going': female labour supply in interwar London". ''Economic History Review'' (2015) 68#2 pp. 441–470.</ref><ref>Deirdre Beddoe, ''Back to Home and Duty: Women Between the Wars, 1918–1939'' (1989).</ref> | |||

| In France, very slow population growth, especially in comparison to Germany continued to be a serious issue in the 1930s. Support for increasing welfare programs during the depression included a focus on women in the family. The Conseil Supérieur de la Natalité campaigned for provisions enacted in the Code de la Famille (1939) that increased state assistance to families with children and required employers to protect the jobs of fathers, even if they were immigrants.<ref>{{cite journal |last1=Camiscioli |first1=Elisa |author-link=Elisa Camiscioli |year=2001 |title=Producing Citizens, Reproducing the 'French Race': Immigration, Demography, and Pronatalism in Early Twentieth-Century France |journal=Gender & History |volume=13 |issue=3 |pages=593–621 |doi=10.1111/1468-0424.00245 |pmid=18198513 |s2cid=20333294}}</ref> | |||

| In rural and small-town areas, women expanded their operation of vegetable gardens to include as much food production as possible. In the United States, agricultural organizations sponsored programs to teach housewives how to optimize their gardens and to raise poultry for meat and eggs.<ref>Ann E. McCleary, {{"'}}I Was Really Proud of Them': Canned Raspberries and Home Production During the Farm Depression". ''Augusta Historical Bulletin'' (2010), Issue 46, pp. 14–44.</ref> Rural women made ]es and other items for themselves and their families and homes from feed sacks.<ref>{{Cite web |last=Vogelsang |first=Willem |title=3. Feedsacks and the Great Depression |url=https://trc-leiden.nl/trc-digital-exhibition/index.php/for-a-few-sacks-more/item/119-3-feedsacks-and-the-great-depression |url-status=live |archive-url=https://web.archive.org/web/20210415092351/https://trc-leiden.nl/trc-digital-exhibition/index.php/for-a-few-sacks-more/item/119-3-feedsacks-and-the-great-depression |archive-date=15 April 2021 |access-date=21 March 2020 |website=trc-leiden.nl |language=en-gb}}</ref> In American cities, African American women quiltmakers enlarged their activities, promoted collaboration, and trained neophytes. Quilts were created for practical use from various inexpensive materials and increased social interaction for women and promoted camaraderie and personal fulfillment.<ref>{{cite journal |last1=Klassen |first1=Tari |year=2008 |title=How Depression-Era Quiltmakers Constructed Domestic Space: An Interracial Processual Study |journal=Midwestern Folklore |volume=34 |issue=2 |pages=17–47}}</ref> | |||

| Oral history provides evidence for how housewives in a modern industrial city handled shortages of money and resources. Often they updated strategies their mothers used when they were growing up in poor families. Cheap foods were used, such as soups, beans and noodles. They purchased the cheapest cuts of meat—sometimes even horse meat—and recycled the ] into sandwiches and soups. They sewed and patched clothing, traded with their neighbors for outgrown items, and made do with colder homes. New furniture and appliances were postponed until better days. Many women also worked outside the home, or took boarders, did laundry for trade or cash, and did sewing for neighbors in exchange for something they could offer. Extended families used mutual aid—extra food, spare rooms, repair-work, cash loans—to help cousins and in-laws.<ref>Baillargeon, ''Making Do: Women, Family and Home in Montreal during the Great Depression'' (1999), pp. 70, 108, 136–138, 159.</ref> | |||

| In Japan, official government policy was deflationary and the opposite of Keynesian spending. Consequently, the government launched a campaign across the country to induce households to reduce their consumption, focusing attention on spending by housewives.<ref>{{cite journal |last1=Metzler |first1=Mark |year=2004 |title=Woman's Place in Japan's Great Depression: Reflections on the Moral Economy of Deflation |journal=Journal of Japanese Studies |volume=30 |issue=2 |pages=315–352 |doi=10.1353/jjs.2004.0045 |s2cid=146273711}}</ref> | |||

| In Germany, the government tried to reshape private household consumption under the Four-Year Plan of 1936 to achieve German economic self-sufficiency. The Nazi women's organizations, other propaganda agencies and the authorities all attempted to shape such consumption as economic self-sufficiency was needed to prepare for and to sustain the coming war. The organizations, propaganda agencies and authorities employed slogans that called up traditional values of thrift and healthy living. However, these efforts were only partly successful in changing the behavior of housewives.<ref>{{cite journal |last1=Reagin |first1=N. R. |year=2001 |title=Marktordnung and Autarkic Housekeeping: Housewives and Private Consumption under the Four-Year Plan, 1936–1939 |journal=German History |volume=19 |issue=2 |pages=162–184 |doi=10.1191/026635501678771619 |pmid=19610237}}</ref> | |||

| ==== World War II and recovery ==== | |||

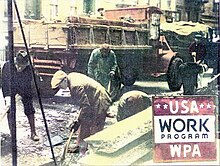

| ]. Women entered the workforce as men were drafted into the armed forces.]] | |||

| The common view among economic historians is that the Great Depression ended with the advent of ]. Many economists believe that government spending on the war caused or at least accelerated recovery from the Great Depression, though some consider that it did not play a very large role in the recovery, though it did help in reducing unemployment.<ref name="Britannica" /><ref name="Galbraith">Referring to the effect of World War II spending on the economy, economist ] said, "One could not have had a better demonstration of the Keynesian ideas." {{cite video |url=https://www.pbs.org/wgbh/commandingheights/lo/story/ch_menu.html |title=Commanding Heights, see chapter 6 video or transcript |date=2002 |medium=TV documentary |publisher=] |location=U.S. |people=], William Cran (writers / producer)}}</ref><ref>{{Cite journal |last=Romer |first=Christina D. |author-link=Christina Romer |year=1992 |title=What Ended the Great Depression? |journal=Journal of Economic History |volume=52 |issue=4 |pages=757–784 |doi=10.1017/S002205070001189X |quote=fiscal policy was of little consequence even as late as 1942, suggests an interesting twist on the usual view that World War II caused, or at least accelerated, the recovery from the Great Depression.}}</ref><ref>{{Cite journal |last=Higgs |first=Robert |date=1 March 1992 |title=Wartime Prosperity? A Reassessment of the U.S. Economy in the 1940s |journal=The Journal of Economic History |volume=52 |issue=1 |pages=41–60 |doi=10.1017/S0022050700010251 |issn=1471-6372 |s2cid=154484756}}</ref> | |||

| The rearmament policies leading up to World War II helped stimulate the economies of Europe in 1937–1939. By 1937, unemployment in Britain had fallen to 1.5 million. The ] of manpower following the outbreak of war in 1939 ended unemployment.<ref name="Great Depression and World War II"> {{Webarchive|url=https://web.archive.org/web/20220124140816/https://www.americaslibrary.gov/jb/wwii/jb_wwii_subj.html|date=24 January 2022}}. Library of Congress.</ref> | |||

| The American mobilization for ] at the end of 1941 moved approximately ten million people out of the civilian labor force and into the war.<ref>Selective Service System. (27 May 2003). '' {{Webarchive|url=https://web.archive.org/web/20090507211238/http://www.sss.gov/induct.htm |date=7 May 2009 }}''. Retrieved 8 September 2013.</ref> | |||

| This finally eliminated the last effects from the Great Depression and brought the U.S. unemployment rate down below 10%.<ref name="Depression & World War II"> {{webarchive|url=https://web.archive.org/web/20090625204217/https://www.americaslibrary.gov/cgi-bin/page.cgi/jb/wwii|date=25 June 2009}}. Americaslibrary.gov.</ref> | |||

| World War II had a dramatic effect on many parts of the American economy.<ref name="Bloomberg">{{cite news|url=http://www.bloombergview.com/articles/2011-12-16/how-did-world-war-ii-end-the-great-depression-echoes|publisher=Bloomberg|title=How Did World War II End the Great Depression?: Echoes|author=Hyman, Louis|author-link=Louis Hyman|date=16 December 2011|access-date=25 August 2015|archive-date=3 May 2016|archive-url=https://web.archive.org/web/20160503051054/http://www.bloombergview.com/articles/2011-12-16/how-did-world-war-ii-end-the-great-depression-echoes|url-status=dead}}</ref> Government-financed capital spending accounted for only 5% of the annual U.S. investment in industrial capital in 1940; by 1943, the government accounted for 67% of U.S. capital investment.<ref name="Bloomberg"/> The massive war spending doubled economic growth rates, either masking the effects of the Depression or essentially ending the Depression. Businessmen ignored the mounting ] and heavy new taxes, redoubling their efforts for greater output to take advantage of generous government contracts.<ref>Richard J. Jensen, {{Webarchive|url=https://web.archive.org/web/20211102124644/https://rjensen.people.uic.edu/causes-cures.pdf|date=2 November 2021}}. ''Journal of Interdisciplinary History'' 19.4 (1989): 553–583.</ref> | |||

| ==Causes== | |||

| {{Main|Causes of the Great Depression}} | {{Main|Causes of the Great Depression}} | ||

| ] | |||

| {{Mergeto | Causes of the Great Depression| Talk:Great_Depression#Merge_Cause_section_and_provide_brief_summary.3F |date=December 2008 }} | |||

| ===Attempts to return to the Gold Standard=== | |||

| There were multiple causes for the first downturn in 1929, including the structural weaknesses and specific events that turned it into a major depression and the way in which the downturn spread from country to country. In relation to the 1929 downturn, historians emphasize structural factors like massive bank failures and the stock market crash, while economists (such as ] and ]) point to Britain's decision to return to the Gold Standard at pre-World War I parities (US$4.86:£1). | |||

| {{See also|Financial crisis of 1914}} | |||

| During ] many countries suspended their ] in varying ways. There was high inflation from WWI, and in the 1920s in the ], ], and throughout Europe. In the late 1920s there was a scramble to deflate prices to get the gold standard's conversation rates back on track to pre-WWI levels, by causing ] and high unemployment through monetary policy. In 1933 ] signed ] and in 1934 signed the ].<ref>{{Cite web |last=McCulloch |first=Hu |date=August 23, 2018 |title=World War I, Gold, and the Great Depression |url=https://www.cato.org/blog/world-war-i-gold-great-depression |access-date=2024-11-12 |website=]}}</ref> | |||

| {| class="wikitable" | |||

| |+ Gold Standard Policies by Country<ref>https://www.nber.org/system/files/chapters/c11482/c11482.pdf</ref> | |||

| ! Country !! Return to Gold !! Suspension of Gold Standard !! Foreign Exchange Control !! Devaluation | |||

| |- | |||

| | Australia || April 1925 || December 1929 || — || March 1930 | |||

| |- | |||

| | Austria || April 1925 || April 1933 || October 1931 || September 1931 | |||

| |- | |||

| | Belgium || October 1926 || — || — || March 1935 | |||

| |- | |||

| | Canada || July 1926 || October 1931 || — || September 1931 | |||

| |- | |||

| | Czechoslovakia || April 1926 || — || September 1931 || February 1934 | |||

| |- | |||

| | Denmark || January 1927 || September 1931 || November 1931 || September 1931 | |||

| |- | |||

| | Estonia || January 1928 || June 1933 || November 1931 || June 1933 | |||

| |- | |||

| | Finland || January 1926 || October 1931 || — || October 1931 | |||

| |- | |||

| | France || August 1926-June 1928 || — || — || October 1936 | |||

| |- | |||

| | Germany || September 1924 || — || July 1931 || — | |||

| |- | |||

| | Greece || May 1928 || April 1932 || September 1931 || April 1932 | |||

| |- | |||

| | Hungary || April 1925 || — || July 1931 || — | |||

| |- | |||

| | Italy || December 1927 || — || May 1934 || October 1936 | |||

| |- | |||

| | Japan || December 1930 || December 1931 || July 1932 || December 1931 | |||

| |- | |||

| | Latvia || August 1922 || — || October 1931 || — | |||

| |- | |||

| | Netherlands || April 1925 || — || — || October 1936 | |||

| |- | |||

| | Norway || May 1928 || September 1931 || — || September 1931 | |||

| |- | |||

| | New Zealand || April 1925 || September 1931 || — || April 1930 | |||

| |- | |||

| | Poland || October 1927 || — || April 1936 || October 1936 | |||

| |- | |||

| | Romania || March 1927-February 1929 || — || May 1932 || — | |||

| |- | |||

| | Sweden || April 1924 || September 1931 || — || September 1931 | |||

| |- | |||

| | Spain || — || — || May 1931 || — | |||

| |- | |||

| | United Kingdom || May 1925 || September 1931 || — || September 1931 | |||

| |- | |||

| | United States || June 1919 || March 1933 || March 1933 || April 1933 | |||

| |} | |||

| ===Keynesian vs Monetarist view=== | |||

| ] and the ], when there were massive ] across the United States.]] | |||

| [[File:CPI 1914-2022.webp|thumb|upright=1.6|alt=CPI 1914–2022| | |||

| {{legend|#0076BA |]}} | |||

| {{legend|#EE220C |]}} | |||

| {{legend-line|#1DB100 solid 3px|] increases Year/Year}} | |||

| ]] | |||

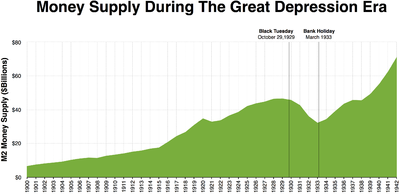

| The two classic competing economic theories of the Great Depression are the ] (demand-driven) and the ] explanation.<ref>{{Cite web|first1=Nick|last1=Lioudis|title=What is the difference between Keynesian and monetarist economics?|url=https://www.investopedia.com/ask/answers/012615/what-difference-between-keynesian-economics-and-monetarist-economics.asp|access-date=12 July 2021|website=Investopedia|language=en|archive-date=20 December 2021|archive-url=https://web.archive.org/web/20211220193534/https://www.investopedia.com/ask/answers/012615/what-difference-between-keynesian-economics-and-monetarist-economics.asp|url-status=live}}</ref> There are also various ] that downplay or reject the explanations of the Keynesians and monetarists. The consensus among demand-driven theories is that a large-scale loss of confidence led to a sudden reduction in consumption and investment spending. Once panic and deflation set in, many people believed they could avoid further losses by keeping clear of the markets. Holding money became profitable as prices dropped lower and a given amount of money bought ever more goods, exacerbating the drop in demand.<ref>{{Cite web|title=Great Depression – Causes of the decline|url=https://www.britannica.com/event/Great-Depression|access-date=12 July 2021|website=Encyclopedia Britannica|language=en|archive-date=9 May 2015|archive-url=https://web.archive.org/web/20150509121741/https://www.britannica.com/EBchecked/topic/243118/Great-Depression|url-status=live}}</ref> Monetarists believe that the Great Depression started as an ordinary recession, but the shrinking of the ] greatly exacerbated the economic situation, causing a recession to descend into the Great Depression.<ref>{{Cite web|last=Hayes|first=Adam|title=What is a Monetarist?|url=https://www.investopedia.com/terms/m/monetarist.asp|access-date=12 July 2021|website=Investopedia|language=en|archive-date=5 November 2021|archive-url=https://web.archive.org/web/20211105044704/https://www.investopedia.com/terms/m/monetarist.asp|url-status=live}}</ref> | |||

| Economists and economic historians are almost evenly split as to whether the traditional monetary explanation that monetary forces were the primary cause of the Great Depression is right, or the traditional Keynesian explanation that a fall in autonomous spending, particularly investment, is the primary explanation for the onset of the Great Depression.<ref name="in JSTOR">{{cite journal|at=p. 150|jstor=2123771|url=https://www.employees.csbsju.edu/jolson/ECON315/Whaples2123771.pdf|title=Where is There Consensus Among American Economic Historians? The Results of a Survey on Forty Propositions|journal=The Journal of Economic History|volume=55|issue=1|last1=Whaples|first1=Robert|year=1995|doi=10.1017/S0022050700040602|citeseerx=10.1.1.482.4975|s2cid=145691938 |access-date=18 February 2022|archive-date=4 November 2021|archive-url=https://web.archive.org/web/20211104183848/http://www.employees.csbsju.edu/jolson/econ315/whaples2123771.pdf|url-status=live}}</ref> Today there is also significant academic support for the ] theory and the ] that – building on the monetary explanation of ] and ] – add non-monetary explanations.<ref>{{Cite journal|last1=Mendoza|first1=Enrique G.|last2=Smith|first2=Katherine A.|date=1 September 2006|title=Quantitative implications of a debt-deflation theory of Sudden Stops and asset prices|url=https://www.sciencedirect.com/science/article/pii/S002219960500098X|journal=Journal of International Economics|language=en|volume=70|issue=1|pages=82–114|doi=10.1016/j.jinteco.2005.06.016|issn=0022-1996|access-date=18 February 2022|archive-date=18 February 2022|archive-url=https://web.archive.org/web/20220218125338/https://www.sciencedirect.com/science/article/abs/pii/S002219960500098X|url-status=live}}</ref><ref>{{Cite journal|last1=Buraschi|first1=Andrea|last2=Jiltsov|first2=Alexei|date=1 February 2005|title=Inflation risk premia and the expectations hypothesis|url=https://www.sciencedirect.com/science/article/pii/S0304405X04001333|journal=Journal of Financial Economics|language=en|volume=75|issue=2|pages=429–490|doi=10.1016/j.jfineco.2004.07.003|issn=0304-405X|access-date=18 February 2022|archive-date=18 February 2022|archive-url=https://web.archive.org/web/20220218125325/https://www.sciencedirect.com/science/article/abs/pii/S0304405X04001333|url-status=live}}</ref> | |||

| There is a consensus that the ] should have cut short the process of monetary deflation and banking collapse, by expanding the money supply and acting as ]. If they had done this, the economic downturn would have been far less severe and much shorter.<ref>{{cite journal|at=p. 143|jstor=2123771|url=https://www.employees.csbsju.edu/jolson/ECON315/Whaples2123771.pdf|title=Where is There Consensus Among American Economic Historians? The Results of a Survey on Forty Propositions|journal=The Journal of Economic History|volume=55|issue=1|last1=Whaples|first1=Robert|year=1995|doi=10.1017/S0022050700040602|citeseerx=10.1.1.482.4975|s2cid=145691938 |access-date=18 February 2022|archive-date=4 November 2021|archive-url=https://web.archive.org/web/20211104183848/http://www.employees.csbsju.edu/jolson/econ315/whaples2123771.pdf|url-status=live}}</ref> | |||

| ===Mainstream explanations=== | |||

| ] | |||

| Modern mainstream economists see the reasons in | |||

| * A money supply reduction (]) and therefore a banking crisis, reduction of credit, and bankruptcies. | |||

| * Insufficient demand from the ] and insufficient fiscal spending (]). | |||

| * Passage of the ] exacerbated what otherwise might have been a more "standard" ] (both ] and ]).<ref name="ReferenceB" /> | |||

| Insufficient spending, the money supply reduction, and debt on margin led to falling prices and further bankruptcies (]'s debt deflation). | |||

| ====Monetarist view==== | |||

| ] in 1996-Dollar (blue), ] (red), ] M2 (green) and number of banks (grey). All data adjusted to 1929 = 100%.]] | |||

| ] early in the Great Depression]] | |||

| The monetarist explanation was given by American economists ] and ].<ref>''A Monetary History of the United States, 1857–1960''. Princeton University Press, Princeton, New Jersey, 1963.</ref> They argued that the Great Depression was caused by the banking crisis that caused one-third of all banks to vanish, a reduction of bank shareholder wealth and more importantly ] of 35%, which they called "The ]". This caused a price drop of 33% (]).<ref>Randall E. Parker (2003), {{Webarchive|url=https://web.archive.org/web/20210818225154/https://books.google.com/books?id=Y-g4AgAAQBAJ&lpg=PR1&pg=PA11#v=snippet&q=%22Pin%20the%20blame%20squarely%20on%20the%20Federal%20Reserve%22 |date=18 August 2021 }}, Edward Elgar Publishing, {{ISBN|978-1-84376-550-9}}, pp. 11–12</ref> By not lowering interest rates, by not increasing the monetary base and by not injecting liquidity into the banking system to prevent it from crumbling, the Federal Reserve passively watched the transformation of a normal recession into the Great Depression. Friedman and Schwartz argued that the downward turn in the economy, starting with the stock market crash, would merely have been an ordinary recession if the Federal Reserve had taken aggressive action.<ref>{{cite book|last1=Friedman|first1=Milton|url=https://books.google.com/books?id=-lCArZfazBkC&q=%22Regarding%20the%20Great%20Depression%20You're%20right%20We%20did%20it%22|title=The Great Contraction, 1929–1933|author2=Anna Jacobson Schwartz|publisher=Princeton University Press|year=2008|isbn=978-0691137940|edition=New|access-date=18 February 2022|archive-date=16 January 2020|archive-url=https://web.archive.org/web/20200116121531/https://books.google.com/books?id=-lCArZfazBkC&q=%22Regarding%20the%20Great%20Depression%20You%27re%20right%20We%20did%20it%22|url-status=live}}</ref><ref>{{cite book|last=Bernanke|first=Ben|url=https://books.google.com/books?id=c2OSWhLjzJkC&q=Schwartz&pg=PA6|title=Essays on the Great Depression|publisher=Princeton University Press|year=2000|isbn=0-691-01698-4|page=7|access-date=24 May 2021|archive-date=24 December 2021|archive-url=https://web.archive.org/web/20211224221348/https://books.google.com/books?id=c2OSWhLjzJkC&q=Schwartz&pg=PA6|url-status=live}}</ref> This view was endorsed in 2002 by ] ] in a speech honoring Friedman and Schwartz with this statement: | |||

| {{blockquote|Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression, you're right. We did it. We're very sorry. But thanks to you, we won't do it again.|Ben S. Bernanke<ref>Ben S. Bernanke (8 November 2002), {{Webarchive|url=https://web.archive.org/web/20200324160935/https://www.federalreserve.gov/BOARDDOCS/SPEECHES/2002/20021108/default.htm |date=March 24, 2020 }} Conference to Honor Milton Friedman, University of Chicago</ref><ref name=FriedmanSchwartz>{{cite book|last1=Friedman|first1=Milton|last2=Schwartz|first2=Anna|title=The Great Contraction, 1929–1933|url=https://books.google.com/books?id=-lCArZfazBkC&q=%22Regarding%20the%20Great%20Depression%20You're%20right%20We%20did%20it%22|year=2008|publisher=Princeton University Press|page=247|isbn=978-0691137940|edition=New|access-date=18 February 2022|archive-date=16 January 2020|archive-url=https://web.archive.org/web/20200116121531/https://books.google.com/books?id=-lCArZfazBkC&q=%22Regarding%20the%20Great%20Depression%20You%27re%20right%20We%20did%20it%22|url-status=live}}</ref>}} | |||

| The Federal Reserve allowed some large public bank failures – particularly that of the ] – which produced panic and widespread runs on local banks, and the Federal Reserve sat idly by while banks collapsed. Friedman and Schwartz argued that, if the Fed had provided emergency lending to these key banks, or simply bought ]s on the ] to provide liquidity and increase the quantity of money after the key banks fell, all the rest of the banks would not have fallen after the large ones did, and the money supply would not have fallen as far and as fast as it did.<ref>{{cite journal|last=Krugman|first=Paul|date=15 February 2007|title=Who Was Milton Friedman?|url=https://www.nybooks.com/articles/19857|journal=]|volume=54 |issue=2 |archive-url=https://web.archive.org/web/20080410200144/https://www.nybooks.com/articles/19857|archive-date=10 April 2008|access-date=22 May 2008}}</ref> | |||

| Recession cycles are thought to be a normal part of living in a world of inexact balances between ]. What turns a usually mild and short recession or "ordinary" ] into a great depression is a subject of debate and concern. Scholars have not agreed on the exact causes and their relative importance. The search for causes is closely connected to the question of how to avoid a future depression, and so the political and policy viewpoints of scholars are mixed into the analysis of historic events eight decades ago. The even larger question is whether it was largely a failure on the part of ]s or largely a failure on the part of governments to curtail widespread bank failures, the resulting panics, and reduction in the money supply. Those who believe in a large role for the state in the economy believe it was mostly a failure of the free markets and those who believe in free markets believe it was mostly a failure of government that compounded the problem. | |||

| With significantly less money to go around, businesses could not get new loans and could not even get their old loans renewed, forcing many to stop investing. This interpretation blames the Federal Reserve for inaction, especially the ].<ref>{{cite book|author=G. Edward Griffin|url=https://archive.org/details/TheCreatureFromJekyllIslandByG.EdwardGriffin|title=The Creature from Jekyll Island: A Second Look at the Federal Reserve|year=1998|isbn=978-0-912986-39-5|edition=3d|page=|publisher=American Media }}</ref> | |||

| Current theories may be broadly classified into three main points of view. First, there is orthodox ]: ], ] and ], all of which focus on the ] effects of ] and the supply of gold which backed many currencies before the Great Depression, including ] and ]. | |||

| ] | |||

| One reason why the Federal Reserve did not act to limit the decline of the money supply was the ]. At that time, the amount of credit the Federal Reserve could issue was limited by the ], which required 40% gold backing of Federal Reserve Notes issued. By the late 1920s, the Federal Reserve had almost hit the limit of allowable credit that could be backed by the gold in its possession. This credit was in the form of Federal Reserve demand notes.<ref name="text">Frank Freidel (1973), ], ch. 19, Little, Brown & Co.</ref> A "promise of gold" is not as good as "gold in the hand", particularly when they only had enough gold to cover 40% of the Federal Reserve Notes outstanding. During the bank panics, a portion of those demand notes was redeemed for Federal Reserve gold. Since the Federal Reserve had hit its limit on allowable credit, any reduction in gold in its vaults had to be accompanied by a greater reduction in credit. On 5 April 1933, President Roosevelt signed ] making the private ownership of ]s, coins and bullion illegal, reducing the pressure on Federal Reserve gold.<ref name="text" /> | |||

| Second, there are structural theories, most importantly ], but also including those of ], that point to ] and overinvestment (]), ] by bankers and industrialists, or incompetence by government officials. The only consensus viewpoint is that there was a large-scale lack of confidence. Unfortunately, once panic and deflation set in, many people believed they could make more money by keeping clear of the markets as prices got lower and lower and a given amount of money bought ever more goods. | |||

| ====Keynesian view==== | |||

| Third, there is the ] critique of political economy. This emphasizes the tendency of capitalism to create unbalanced accumulations of wealth, leading to overaccumulations of capital and a repeating cycle of devaluations through economic crises. Marx saw recession and depression as unavoidable under free-market capitalism as there are no restrictions on accumulations of capital other than the market itself. | |||

| British economist ] argued in '']'' that lower ]s in the economy contributed to a massive decline in income and to employment that was well below the average. In such a situation, the economy reached equilibrium at low levels of economic activity and high unemployment. | |||

| Keynes's basic idea was simple: to keep people fully employed, governments have to run deficits when the economy is slowing, as the private sector would not invest enough to keep production at the normal level and bring the economy out of recession. Keynesian economists called on governments during times of ] to pick up the slack by increasing ] or cutting taxes. | |||

| ===Debt deflation=== | |||

| ] early in the Great Depression.]] | |||

| As the Depression wore on, ] tried ], ], and other devices to restart the U.S. economy, but never completely gave up trying to balance the budget. According to the Keynesians, this improved the economy, but Roosevelt never spent enough to bring the economy out of recession until the start of ].<ref>{{Cite journal| author-link=Lawrence Klein|first=Lawrence R.|last=Klein|title=The Keynesian Revolution|year=1947| pages=56–58, 169, 177–179|location=New York|publisher=Macmillan}}; {{Cite book|first=Theodore|last=Rosenof|title=Economics in the Long Run: New Deal Theorists and Their Legacies, 1933–1993|year=1997|location=Chapel Hill|publisher=University of North Carolina Press|isbn=0-8078-2315-5}}</ref> | |||

| ] argued that the predominant factor leading to the Great Depression was overindebtedness and deflation. Fisher tied loose credit to over-indebtedness, which fueled speculation and asset bubbles.<ref name="Fisher33">{{cite journal|last=Fisher|first=Irving|date=October 1933|title=The Debt-Deflation Theory of Great Depressions|journal=Econometrica|volume=1|pages=337-357}}</ref> He then outlined 9 factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust. The chain of events proceeded as follows: | |||

| =====Debt deflation===== | |||

| ] | |||

| ] argued that the predominant factor leading to the Great Depression was a vicious circle of deflation and growing over-indebtedness.<ref name="Fisher33">{{cite journal|last=Fisher|first=Irving|s2cid=35564016|date= October 1933|title=The Debt-Deflation Theory of Great Depressions|journal=Econometrica|volume=1| pages=337–57|doi=10.2307/1907327|issue=4|publisher=The Econometric Society|jstor=1907327}}</ref> He outlined nine factors interacting with one another under conditions of debt and deflation to create the mechanics of boom to bust. The chain of events proceeded as follows: | |||

| # Debt liquidation and distress selling | # Debt liquidation and distress selling | ||

| # Contraction of the money supply as bank loans are paid off | # Contraction of the money supply as bank loans are paid off | ||

| # A fall in the level of asset prices | # A fall in the level of asset prices | ||

| # A still greater fall in the net |

# A still greater fall in the net worth of businesses, precipitating bankruptcies | ||

| # A fall in profits | # A fall in profits | ||

| # A reduction in output, in trade and in employment |

# A reduction in output, in trade and in employment | ||

| # Pessimism and loss of confidence | # ] and loss of confidence | ||

| # Hoarding of money | # Hoarding of money | ||

| # A fall in nominal interest rates and a rise in deflation adjusted interest rates |

# A fall in nominal interest rates and a rise in deflation adjusted interest rates<ref name="Fisher33"/> | ||

| During the Crash of 1929 |

During the Crash of 1929 preceding the Great Depression, margin requirements were only 10%.<ref name="Margin Requirements">{{cite journal|last=Fortune|first=Peter|date=September–October 2000|title=Margin Requirements, Margin Loans, and Margin Rates: Practice and Principles – analysis of history of margin credit regulations – Statistical Data Included|journal=New England Economic Review|url=https://findarticles.com/p/articles/mi_m3937/is_2000_Sept-Oct/ai_80855422/pg_5|archive-url=https://web.archive.org/web/20150811102239/http://findarticles.com/p/articles/mi_m3937/is_2000_Sept-Oct/ai_80855422/pg_5|url-status=dead|archive-date=11 August 2015|access-date=18 February 2022}}</ref> Brokerage firms, in other words, would lend $9 for every $1 an investor had deposited. When the market fell, brokers ], which could not be paid back.<ref name="lhf-30s">{{cite web|access-date=22 May 2008|url=https://www.livinghistoryfarm.org/farminginthe30s/money_08.html|title=Bank Failures|publisher=Living History Farm|archive-url=http://webarchive.loc.gov/all/20090219185825/https://livinghistoryfarm.org/farminginthe30s/money_08.html|archive-date=19 February 2009|url-status=dead}}</ref> Banks began to fail as debtors defaulted on debt and depositors attempted to withdraw their deposits {{Lang|fr|en masse}}, triggering multiple ]s. Government guarantees and Federal Reserve banking regulations to prevent such panics were ineffective or not used. Bank failures led to the loss of billions of dollars in assets.<ref name="lhf-30s"/> | ||

| Bank failures snowballed as desperate bankers called in loans |

Outstanding debts became heavier, because prices and incomes fell by 20–50% but the debts remained at the same dollar amount. After the panic of 1929 and during the first 10 months of 1930, 744 U.S. banks failed. (In all, 9,000 banks failed during the 1930s.) By April 1933, around $7 billion in deposits had been frozen in failed banks or those left unlicensed after the ].<ref>"Friedman and Schwartz, Monetary History of the United States", 352</ref> Bank failures snowballed as desperate bankers called in loans that borrowers did not have time or money to repay. With future profits looking poor, ] and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending.<ref name="lhf-30s"/> Banks built up their capital reserves and made fewer loans, which intensified deflationary pressures. A ] developed and the downward spiral accelerated. | ||

| The liquidation of debt could not keep up with the fall of prices |