| Revision as of 19:23, 20 December 2015 editHughD (talk | contribs)Extended confirmed users19,133 edits →Funding of global warming skepticism: copy edit, more neutral, complete, accurate paraphrase of noteworthy reliable source, WP:SAY← Previous edit | Revision as of 00:37, 21 December 2015 edit undoSpringee (talk | contribs)Extended confirmed users18,452 edits Undid revision 696075180 by HughD (talk)Recent NPOV and RS noticeboard discussions only support referencing the facts presented in the article, not the list itself (see archive 197))Next edit → | ||

| Line 412: | Line 412: | ||

| However, recently ExxonMobil has announced that it will plan on spending up to 600 million dollars within the next 10 years to fund biofuels that come from algae. On July 14, 2010 ExxonMobil announced that, a year after teaming with ], they had opened a greenhouse to research ].<ref>{{cite web |url=http://www.exxonmobilperspectives.com/2010/07/14/the-next-phase-of-algae-biofuels/|title=The next phase of algae biofuels|accessdate=March 15, 2011 | publisher=Exxon Mobil Corp. | first=Ken| last=Cohen | date=July 14, 2010}}</ref> | However, recently ExxonMobil has announced that it will plan on spending up to 600 million dollars within the next 10 years to fund biofuels that come from algae. On July 14, 2010 ExxonMobil announced that, a year after teaming with ], they had opened a greenhouse to research ].<ref>{{cite web |url=http://www.exxonmobilperspectives.com/2010/07/14/the-next-phase-of-algae-biofuels/|title=The next phase of algae biofuels|accessdate=March 15, 2011 | publisher=Exxon Mobil Corp. | first=Ken| last=Cohen | date=July 14, 2010}}</ref> | ||

| In May 2008, a week before their annual shareholder's meeting, ExxonMobil pledged in its annual corporate citizenship report that it would cut funding to "several public policy research groups whose position on climate change could divert attention" from the need to address climate change.<ref name=guardian20080528/><ref>{{cite news |title=Exxon again cuts funds for climate change skeptics |agency=] |date=May 23, 2008 |first=Michael |last=Erman |url=http://uk.reuters.com/article/2008/05/23/us-exxon-funding-idUKN2328446120080523 |accessdate=October 22, 2015}}</ref> On July 1, 2009, '']'' newspaper revealed that ExxonMobil continued to fund such organizations, including the ] (NCPA) and the ].<ref>{{cite news |accessdate=July 1, 2009 |url=http://www.guardian.co.uk/environment/2009/jul/01/exxon-mobil-climate-change-sceptics-funding |title=ExxonMobil continuing to fund climate skeptic groups, records show |newspaper=] |location=UK |date=July 1, 2009 | first=David | last=Adam}}</ref> |

In May 2008, a week before their annual shareholder's meeting, ExxonMobil pledged in its annual corporate citizenship report that it would cut funding to "several public policy research groups whose position on climate change could divert attention" from the need to address climate change.<ref name=guardian20080528/><ref>{{cite news |title=Exxon again cuts funds for climate change skeptics |agency=] |date=May 23, 2008 |first=Michael |last=Erman |url=http://uk.reuters.com/article/2008/05/23/us-exxon-funding-idUKN2328446120080523 |accessdate=October 22, 2015}}</ref> On July 1, 2009, '']'' newspaper revealed that ExxonMobil continued to fund such organizations, including the ] (NCPA) and the ].<ref>{{cite news |accessdate=July 1, 2009 |url=http://www.guardian.co.uk/environment/2009/jul/01/exxon-mobil-climate-change-sceptics-funding |title=ExxonMobil continuing to fund climate skeptic groups, records show |newspaper=] |location=UK |date=July 1, 2009 | first=David | last=Adam}}</ref> A December 2009 article in '']'' magazine included ExxonMobil as a promulgator of climate disinformation.<ref name=motherjones20091204>{{cite news |first=Josh |last=Harkinson |url=http://www.motherjones.com/special-reports/2009/12/dirty-dozen-climate-change-denial |title=The Dirty Dozen of Climate Change Denial |magazine=] |date=December 4, 2009 |accessdate=August 17, 2015}}</ref> Between 2007 and 2015, ExxonMobil gave $1.87 million to Congressional climate change deniers and $454,000 to the ] (ALEC), which works to block climate legislation in state legislatures. ExxonMobil denied funding climate denial.<ref>{{cite news |title=ExxonMobil gave millions to climate-denying lawmakers despite pledge |url=http://www.theguardian.com/environment/2015/jul/15/exxon-mobil-gave-millions-climate-denying-lawmakers |authorlink=Suzanne Goldenberg |first=Suzanne |last=Goldenberg |date=July 15, 2015 |accessdate=October 15, 2015 |newspaper=]}}</ref> ExxonMobil is a member of ALEC's “Enterprise Council,“ its corporate leadership board.<ref>{{cite journal |journal=] |date=September 2015 |volume=132 |issue=2 |pages=157-171 |title=The climate responsibilities of industrial carbon producers |first1=Peter C. |last1=Frumhoff |first2=Richard |last2=Heede |first3=Naomi |last3=Oreskes |authorlink3=Naomi Oreskes |doi=10.1007/s10584-015-1472-5 |url=http://link.springer.com/article/10.1007/s10584-015-1472-5}}</ref> | ||

| In April 2014, ExxonMobil released a report publicly acknowledging climate change risk for the first time. | In April 2014, ExxonMobil released a report publicly acknowledging climate change risk for the first time. | ||

Revision as of 00:37, 21 December 2015

| This article contains several duplicated citations. It is recommended to use named references to consolidate citations that are used multiple times. (November 2015) (Learn how and when to remove this message) |

| Company type | Public |

|---|---|

| Traded as | NYSE: XOM Dow Jones Industrial Average Component S&P 500 Component |

| ISIN | US30231G1022 |

| Industry | Oil and Gas |

| Predecessor | Exxon Mobil |

| Founded | November 30, 1999 (1999-11-30) |

| Headquarters | Irving, Texas, United States |

| Area served | Worldwide |

| Key people | Rex W. Tillerson (Chairman and CEO) |

| Products | Fuels, lubricants, petrochemicals, refining |

| Revenue | |

| Operating income | |

| Net income | |

| Total assets | |

| Total equity | |

| Number of employees | 75,300 (Mar 2015) |

| Subsidiaries | Aera Energy, Esso, Esso Australia, Exxon, Exxon Neftegas, Imperial Oil (69.6%), Syncrude (25%), Mobil, Mobil Producing Nigeria, SeaRiver Maritime, Superior Oil Co., Vacuum Oil Co., XTO Energy |

| Website | ExxonMobil.com |

Exxon Mobil Corp. (ExxonMobil) is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller's Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon (originally the Standard Oil Company of New Jersey) and Mobil (originally the Standard Oil Company of New York).

The world's 5th largest company by revenue, ExxonMobil is also the third largest publicly traded company by market capitalization. The company was ranked No. 6 globally in Forbes Global 2000 list in 2014. ExxonMobil was the second most profitable company in the Fortune 500 in 2014.

ExxonMobil is the largest of the world's supermajors with daily production of 3.921 million BOE. In 2008, this was approximately 3 percent of world production, which is less than several of the largest state-owned petroleum companies. When ranked by oil and gas reserves, it is 14th in the world—with less than 1 percent of the total. ExxonMobil's reserves were 25.2 billion BOE (barrels of oil equivalent) at the end of 2013 and the 2007 rates of production were expected to last more than 14 years. With 37 oil refineries in 21 countries constituting a combined daily refining capacity of 6.3 million barrels (1,000,000 m), ExxonMobil is the largest refiner in the world, a title that was also associated with Standard Oil since its incorporation in 1870.

ExxonMobil has been subject to numerous criticisms, including the lack of speed during its cleanup efforts after the 1989 Exxon Valdez oil spill in Alaska, widely considered to be one of the world's worst oil spills in terms of damage to the environment. ExxonMobil has also drawn criticism for its history of lobbying in attempts to discredit the idea that climate change is caused by the burning of fossil fuels, something that modern scientific consensus largely thwarted. The company has also been the target of accusations of improperly dealing with human rights issues, influence on American foreign policy, and its impact on the future of nations.

Organization

| This section includes a list of references, related reading, or external links, but its sources remain unclear because it lacks inline citations. Please help improve this section by introducing more precise citations. (October 2015) (Learn how and when to remove this message) |

ExxonMobil markets products around the world under the brands of Exxon, Mobil, and Esso. Mobil is ExxonMobil's primary retail gasoline brand in California, Florida, New York, New England, the Great Lakes and the Midwest. Exxon is the primary brand in the rest of the United States, with the highest concentration of retail outlets located in New Jersey, Pennsylvania, Texas and in the Mid-Atlantic and Southeastern states. Esso is ExxonMobil's primary gasoline brand worldwide except in Australia and New Zealand, where the Mobil brand is used exclusively. In Colombia, both the Esso and Mobil brands are used.

The upstream division dominates the company's cashflow, accounting for approximately 70 percent of revenue. The company employs over 82,000 people worldwide, as indicated in ExxonMobil's 2006 Corporate Citizen Report, with approximately 4,000 employees in its Fairfax downstream headquarters and 27,000 people in its Houston upstream headquarters.

ExxonMobil is organized functionally into a number of global operating divisions. These divisions are grouped into three categories for reference purposes, though the company also has several ancillary divisions, such as Coal & Minerals, which are stand alone. It also owns hundreds of smaller subsidiaries such as Imperial Oil Limited (69.6 percent ownership) in Canada, and SeaRiver Maritime, a petroleum shipping company.

- Upstream (oil exploration, extraction, shipping, and wholesale operations) based in Houston, Texas

- Downstream (marketing, refining, and retail operations) based in Fairfax, Virginia

- Chemical division based in Houston, Texas

History

Exxon Mobil Corp. was formed in 1999 by the merger of two major oil companies, Exxon and Mobil. Both Exxon and Mobil were descendants of the John D. Rockefeller corporation, Standard Oil which was established in 1870. The reputation of Standard Oil in the public eye suffered badly after publication of Ida M. Tarbell's classic exposé The History of the Standard Oil Co. in 1904, leading to a growing outcry for the government to take action against the company.

By 1911, with public outcry at a climax, the Supreme Court of the United States ruled that Standard Oil must be dissolved and split into 34 companies. Two of these companies were Jersey Standard ("Standard Oil Co. of New Jersey"), which eventually became Exxon, and Socony ("Standard Oil Co. of New York"), which eventually became Mobil.

In the same year, the nation's kerosene output was eclipsed for the first time by gasoline. The growing automotive market inspired the product trademark Mobiloil, registered by Socony in 1920.

Over the next few decades, both companies grew significantly. Jersey Standard, led by Walter C. Teagle, became the largest oil producer in the world. It acquired a 50 percent share in Humble Oil & Refining Co., a Texas oil producer. Socony purchased a 45 percent interest in Magnolia Petroleum Co., a major refiner, marketer and pipeline transporter. In 1931, Socony merged with Vacuum Oil Co., an industry pioneer dating back to 1866 and a growing Standard Oil spin-off in its own right.

In the Asia-Pacific region, Jersey Standard had oil production and refineries in Indonesia but no marketing network. Socony-Vacuum had Asian marketing outlets supplied remotely from California. In 1933, Jersey Standard and Socony-Vacuum merged their interests in the region into a 50–50 joint venture. Standard Vacuum Oil Company, or "Stanvac," operated in 50 countries, from East Africa to New Zealand, before it was dissolved in 1962.

Mobil Chemical Co. was established in 1950. As of 1999, its principal products included basic olefins and aromatics, ethylene glycol and polyethylene. The company produced synthetic lubricant base stocks as well as lubricant additives, propylene packaging films and catalysts. Exxon Chemical Co. (first named Enjay Chemicals) became a worldwide organization in 1965 and in 1999 was a major producer and marketer of olefins, aromatics, polyethylene and polypropylene along with speciality lines such as elastomers, plasticizers, solvents, process fluids, oxo alcohols and adhesive resins. The company was an industry leader in metallocene catalyst technology to make unique polymers with improved performance.

In 1955, Socony-Vacuum became Socony Mobil Oil Co. and, in 1966, simply Mobil Oil Corp. A decade later, the newly incorporated Mobil Corp. absorbed Mobil Oil as a wholly owned subsidiary. Jersey Standard changed its name to Exxon Corp. in 1972 and established Exxon as a trademark throughout the United States. In other parts of the world, Exxon and its affiliated companies continued to use its Esso trademark.

On March 24, 1989, the Exxon Valdez oil tanker struck Bligh Reef in Prince William Sound, Alaska and spilled more than 11 million US gallons (42,000 m) of crude oil. The Exxon Valdez oil spill was the second largest in U.S. history, and in the aftermath of the Exxon Valdez incident, the U.S. Congress passed the Oil Pollution Act of 1990. An initial award of $5 billion USD punitive was reduced to $507.5 million by the US Supreme Court in June 2008, and distributions of this award have commenced.

In 1998, Exxon and Mobil signed a US$73.7 billion definitive agreement to merge and form a new company called Exxon Mobil Corp., the largest company on the planet. After shareholder and regulatory approvals, the merger was completed on November 30, 1999. The merger of Exxon and Mobil was unique in American history because it reunited the two largest companies of John D. Rockefeller's Standard Oil trust, Standard Oil Co. of New Jersey/Exxon and Standard Oil Co. of New York/Mobil, which had been forcibly separated by government order nearly a century earlier. This reunion resulted in the largest merger in US corporate history.

In 2000, ExxonMobil sold a refinery in Benicia, California and 340 Exxon-branded stations to Valero Energy Corp., as part of an FTC-mandated divestiture of California assets. ExxonMobil continues to supply petroleum products to over 700 Mobil-branded retail outlets in California.

In 2005, ExxonMobil's stock price surged in parallel with rising oil prices, surpassing General Electric as the largest corporation in the world in terms of market capitalization. At the end of 2005, it reported record profits of US $36 billion in annual income, up 42 percent from the previous year (the overall annual income was an all-time record for annual income by any business, and included $10 billion in the third quarter alone, also an all-time record income for a single quarter by any business). The company and the American Petroleum Institute (the oil and chemical industry's lobbying organization) put these profits in context by comparing oil industry profits to those of other large industries such as pharmaceuticals and banking.

On June 12, 2008, ExxonMobil announced that it was transitioning out of the direct-served retail market, citing the increasing difficulty of running gas stations under rising crude oil costs. The multi-year process will gradually phase the corporation out of the direct-served retail market, and will affect 820 company-owned stations and approximately 1,400 other stations operated by dealers distributing across the United States. The sale has not resulted in the disappearance of Exxon and Mobil branded stations; the new owners will continue to sell Exxon and Mobil-branded gasoline and license the appropriate names from ExxonMobil, who will in turn be compensated for use of the brands.

In 2010, ExxonMobil bought XTO Energy, the company focused on development and production of unconventional resources.

In terms of potential future developments, many gas and oil companies are considering the economic and environmental benefits of Floating Liquefied Natural Gas (FLNG). This is an innovative technology designed to enable the development of offshore gas resources that would otherwise remain untapped, because environmental or economic factors make it unviable to develop them via a land-based LNG operation. ExxonMobil is waiting for an appropriate project to launch its FLNG development, and the only FLNG facility currently in development is being built by Shell, due for completion in around 2017.

In 2012, ExxonMobil confirmed a deal for production and exploration activities in the Kurdistan region of Iraq.

In 2013, Exxon's CEO Rex Tillerson was quoted "Exxon is starting work with Russia's OAO Rosneft in assessing what could be massive reserves of shale oil in Western Siberia", "There is huge shale potential in shale rocks in West Siberia...we just don't know what the quality is".

In November 2013, Exxon agreed to sell its majority stakes in a Hong Kong-based utility and power storage firm, Castle Peak Co Ltd, for a total of $3.4 billion, to CLP Holdings.

On September 18, 2014, LINN Energy LLC and ExxonMobil Corp. announced a “non-monetary” asset swap deal. LINN will receive ExxonMobil’s interest in its “Hill Property.” It consists of 500 net acres in the South Belridge oil field in the San Joaquin Valley in California. Currently, the asset is producing ~3,400 barrels of oil equivalent per day. The assets “proved reserves” are estimated to be 27 million barrels of oil equivalent. In exchange LINN will give ExxonMobil ~17,000 net acres in the Midland Basin in Texas, spread over Martin, Howard, Midland, and Andrews counties. The assets are a mix of production and acreage. They’re estimated to hold proved reserves of ~19 million barrels of oil equivalent.

On October 9, 2014, the World Bank’s international arbitration court awarded Exxon Mobil Corporation $1.6 billion in the case the company had brought against the Venezuelan government. Exxon Mobil alleged that the Venezuelan government illegally expropriated its Venezuelan assets in 2007 and paid unfair compensation.

Merger

Pre-deal events

On June 16, 1998, Mr. Lee R. Raymond, Exxon's CEO, met with Mr. Lucio A. Noto, Mobil's CEO, at Mobil's headquarters in Fairfax, Virginia. At the meeting, Mr. Raymond and Mr. Noto had preliminary discussions about the possibility of a combination of the two companies. Later management continued discussions and permanently informed the Boards.

On August 11, 1998, The British Petroleum Co. PLC and Amoco Corp. announced the terms of their merger agreement. Shortly thereafter, Mr. Raymond and Mr. Noto resumed their discussions taking into account this new pricing benchmark. In mid-August 1998, the management of Mobil asked Goldman Sachs to undertake an analysis of strategic alternatives available to Mobil. On September 14, Goldman Sachs presented to the Mobil Board its analyses regarding the various possible transactions, including a possible merger with Exxon.

At a meeting on October 19, 1998 at Exxon's headquarters attended by Messrs. Raymond, Matthews, Noto and Gillespie, the parties reviewed the possible relative ownership ranges and expanded the discussions to include such issues as the representation of current Mobil directors on the board of the combined company.

During November 1998, Exxon and Mobil exchanged due diligence request lists and representatives and their advisors participated in a video conference and numerous telephone calls and meetings to conduct reciprocal legal, business, accounting and financial due diligence. A reciprocal confidentiality agreement was entered into on November 12.

On November 26, 1998, Mr. Noto and Mr. Raymond spoke by telephone to discuss reports that had appeared in the media about a possible transaction between Exxon and Mobil. On November 27, prior to the opening of NYSE trading, Exxon and Mobil issued a joint statement confirming that the two companies were in discussions of a possible business combination.

Over the course of the weekend of November 27, 1998, Exxon and Mobil representatives and outside counsel continued discussions towards resolving open issues. On the evening of November 30, Messrs. Raymond and Noto reached agreement in principle, subject to Board approval, on the exchange ratio and the resulting exercise price in the stock option agreement.

Following the approval of their Boards, Exxon and Mobil officially signed an agreement and plan of merger on December 1, 1998. Shareholders of both Exxon and Mobil approved the merger in May 1999. In September 29 of that year the European Commission granted antitrust approval. In November 30, 1999, the historic merger was completed. Mobil became a wholly owned subsidiary of Exxon. The combined company changed its name to Exxon Mobil Corp.

| Date | Event | Description | Type |

|---|---|---|---|

| 06/16/98 | CEOs’ meeting | Preliminary discussions about the possibility of the merger | Private |

| 08/11/98 | BP-Amoco merger | Companies announced the terms of their merger agreement | Public |

| 08/15/98 | Mobil hires Goldman Sachs | Mobil asked Goldman Sachs to undertake an analysis of strategic alternatives available to Mobil. Merger with Exxon presented as one of the main options | Private |

| 10/19/98 | CEOs’ meeting | Parties reviewed the possible relative ownership ranges and expanded the discussions to include such issues as the representation of current Mobil directors on the board of the combined company | Private |

| Nov. 1998 | Due diligence | Exchanged due diligence request lists and representatives. Conducted reciprocal legal, business, accounting and financial due diligence | Private |

| 11/26/98 | CEOs’ phone discussion | CEOs spoke by telephone to discuss reports in the media about a possible transaction between Exxon and Mobil | Private |

| 11/27/98 | Joint statement | Exxon and Mobil issued a joint statement confirming that the two companies were in discussions of a possible merger | Public |

| 12/01/98 | Official merger agreement | Following the approval of their Boards, Exxon and Mobil officially signed an agreement and plan of merger | Public |

| 04/19/99 | FTC approval of BP-Amoco merger and Shell-Texaco merger | FTC granted approvals for two large oil industry mergers BP-Amoco and Shell-Texaco with divestitures and other relief to preserve competition | Public |

| 05/27/99 | Shareholders’ approval | Shareholders of both Exxon and Mobil approved the merger. More than 99 percent of the shares in Exxon were voted in favor of the deal, as were 98.2 percent of Mobil shares | Public |

| 09/29/99 | EU Commission approval | European Commission granted an antitrust approval with requirement of divestitures and breakup of BP Amoco/Mobil joint venture | Public |

| 11/30/99 | FTC approval and merger completion | FTC accepted an antitrust settlement with large retail divestiture. Merger completed. Mobil became a wholly owned subsidiary of Exxon | Public |

The event analysis is very limited because there was no bidding process. The only important public information was merger announcement (December 1, 1998). 10-day cumulative abnormal return (CAR) before this date was +14 percent for Mobil and +0.4 percent for Exxon. The main spike in share prices appeared during November 25 – 30 and negative returns were on the announcement day, i.e. rumors in the media influenced the pricing. Total 20-day CAR (10 days before plus 10 days after the announcement) amounted +19.5 percent for Mobil and +1.07 percent for Exxon.

Market was very positive on Exxon and Mobil on April 19 and 21, 1999 when FTC approved other two big oil mergers – BP-Amoco and Shell-Texaco. 3-day CAR reached 5.3 percent for Exxon and 6.8 percent for Mobil. Market also positively reacted on EU Commission approval: 3-day CAR was +2.2 percent for Mobil and +2.4 percent for Exxon. All these signaled that market positively assessed the merger as economically sound and value creating.

Regulators approval

On September 29, 1999 EU Commission granted its approval of the merger with requirement of vast divestitures and breakup of the European refining and marketing joint venture of BP Amoco and Mobil. Mobil wanted to maintain its relationship with BP Amoco, but EC officials feared that the recent rash of mega mergers could kill off downstream competition in member countries. Mobil was also ordered to sell its share in a large chain of gasoline stations (Aral). Exxon and Mobil sold part of their lubricant base oil manufacturing capacity.

BP Amoco bought Mobil's 30 percent interest in their R&M JV for $1.65 billion, about the value of the assets that Mobil contributed when the deal was established. Mobil also got around $1.08 billion for its interest in Aral.

The US FTC announced on November 30, 1999 that it accepted a proposed settlement of charges that Exxon Corp’s acquisition of Mobil Corp would violate federal antitrust laws. The settlement required the largest retail divestiture in Commission history – the sale or assignment of approximately 2,431 Exxon and Mobil gas stations in the Northeast and Mid-Atlantic (1,740), California (360), Texas (319) and Guam (12). In addition, an Exxon refinery in California; terminals; a pipeline and other assets were also subject for sale.

Ratios overview

| This section includes a list of references, related reading, or external links, but its sources remain unclear because it lacks inline citations. Please help improve this section by introducing more precise citations. (October 2015) (Learn how and when to remove this message) |

Exxon had better return on assets (6.75 percent) and return on equity (14.57 percent) ratios (Mobil’s were 3.95 percent and 9.01 percent correspondingly). This situation represented Exxon’s better efficiency at using investment funds (shareholder’s equity) to generate earnings growth. Exxon was more stable and effective in using its assets, while Mobil was more volatile and risky. During 1983–1999 Exxon was superior with the exception of 1989, when tanker Exxon Valdez disaster happened and cut profits of the company.

Companies had equal gross margin (38.7 percent vs. 38.52 percent), but Exxon had higher gross operating margin (7.9 percent) and profit margin (5.4 percent) ratios than Mobil (6.56 percent and 3.18 percent correspondingly) which means that Exxon was better in cost-cutting and controlling its expenses. But in some cases low operating expenses can damage long-term profitability and competitiveness of the company.

Liquidity ratios show that both companies were financially stable, but Exxon was in a better situation than Mobil. The Exxon’s current and quick ratios (0.57 and 0.91 correspondingly) were higher than the Mobil’s (0.48 and 0.67 correspondingly) and merged company had significantly improved these results. Ratio of net current assets as a percent of total assets (i.e. working capital to total assets) was distorted after the merger (1.48) probably due to large divestitures that followed the deal.

Solvency status of companies also looked good. Though Exxon again showed its financial supremacy with much higher interest coverage ratio (93.41 compared to Mobil’s 7.78) Generally speaking the better interest coverage ratio means less risk but also might be bad for future performance because of the failure of the management to use additional funds for development. Debt to equity ratio was safe and stable in both companies.

Combined company showed even superior results after the merger, which proved the correlation between positive market reaction on the announcement event and success of the merger.

Deal structure

Under the merger agreement, an Exxon subsidiary would merge into Mobil so that Mobil becomes a wholly owned subsidiary of ExxonMobil. As a result, Exxon would hold 100 percent of Mobil’s issued and outstanding voting securities. Holders of Mobil common stock would receive 1.32015 shares of Exxon common stock for each share of Mobil common stock.

5 days before the announcement Exxon shares price was $72 and 2,431 million shares outstanding ($175 billion market value) compared with $75.25 a share and 779.8 million shares outstanding for Mobil ($58.7 billion market value). With the exchange ratio 1.32015, Exxon paid 1,029.4 million of its shares for Mobil or $74.1 billion. This was a $15.4 billion (26.2 percent) premium over Mobil’s market value or $94.9 a share. After the price run-up Exxon shareholders would own approximately 70 percent of the combined ExxonMobil entity, while Mobil shareholders would own approximately 30 percent. The merger qualified as a tax-free reorganization in the US, and that it was accounted for on a “pooling of interests” basis.

In addition, the merger agreement provided for payment of termination fees of $1.5 billion. Exxon and Mobil also entered into an option agreement that granted Exxon the option to purchase up to 136.5 million shares (14.9 percent) of Mobil common stock at a strike price of $95.96. Exxon could exercise the option after the occurrence of an event, entitling Exxon to receive the termination fee payable by Mobil.

The termination fee and option were intended to make it more likely that the merger would be completed on the agreed terms and to discourage proposals for alternative business combinations. Among other effects, the option could prevent an alternative business combination with Mobil from being accounted for as a “pooling of interests”. Although companies introduced protection against hostile takeover, they didn’t use any collar to protect shareholders. J.P. Morgan & Co. and Davis Polk & Wardwell advised Exxon, and Goldman Sachs & Co. and Skadden, Arps, Meagher & Flom advised Mobil.

Valuation

J.P. Morgan performed traditional P/E analysis. Such analysis indicated that Mobil had been trading at an 8 percent to 15 percent discount to Exxon. J.P. Morgan's analysis indicated that if Mobil were to be valued at price to earnings multiples comparable to those of Exxon, there would be an enhancement of value to its shareholders of approximately $11 billion.

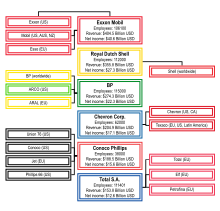

Goldman Sachs also reviewed and compared ratios and public market multiples relating to Mobil to following six publicly traded companies:

- British Petroleum Co. PLC,

- Chevron Corp.,

- Exxon,

- Royal Dutch Petroleum Co.,

- Shell Transport & Trading Co. PLC,

- Texaco Inc.

P/E multiple for these firms ranged 19.3–23.8. The analysis showed that Mobil was undervalued 5 to 16 percent, relative to comparables with fair price $79–$89 a share. It’s needed to notice that comparables analysis couldn’t capture the synergy effect, value creation and differences. Simple DCF analysis of Mobil as a standalone company gives range of intrinsic value of $59.8–$79.5 billion or $76.7–102 per share depending on cash flow growth rate.

DCF analysis, based on the estimated pre-tax synergies of $2.8 billion expected to result from the merger, suggested a potential value creation in the short term of approximately $22–25 billion. J.P. Morgan's review suggested that over the long term, the potential for value creation from these elements could be as much as $47–57 billion. So Mobil intrinsic value for this deal was $95–$118.8 a share depending on growth rate.

Since Exxon's market capitalization was significantly larger than Mobil's, Exxon's shareholders would have enjoyed a greater proportion of the value creation if no premium were paid by Exxon in the merger. By offering a premium to Mobil's shareholders, this potential value creation was instead shared in approximately equal proportions between the companies' shareholders and such sharing was deemed to be a reasonable allocation of value creation. J.P. Morgan's analysis showed that for transactions involving smaller companies with a relative market capitalization comparable to that of Mobil pre-announcement, a premium of 15 percent to 25 percent matched market precedent. In comparison, BP paid 35 percent premium for Amoco.

10 days before the completion of the merger, Exxon market value was $184.5 billion ($76 a share) and Mobil – $77.1 billion ($98.5 a share). Pro forma market value of merged company was $261.6 billion. Right after the merger was completed, the share price of combined Exxon-Mobil was $80.56 with 3,461.5 million shares outstanding, which gave $278.8 billion market value or $17.2 billion of additional value created. This figure would be even higher if we consider pre-announcement pro forma combined market value of $233.7 billion. In this case created value reaches $45.1 billion.

Synergy

The motivations for the Exxon-Mobil merger reflected the industry forces. Companies needed a secure presence in the regions with high potential for oil/gas discoveries and stronger position to make large investments. The benefits of the merger fell broadly in two categories: near-term operating synergies and capital productivity improvements.

Near-term operating synergies. $2.8 billion in annual pre-tax benefits from operating synergies (increases in production, sales and efficiency, decreases in unit costs and combining complementary operations). Management expected to realize the full benefits by the third year after the merger. During the first two years, the benefits should have been partly offset by one-time costs at $2 billion for business integration. The firms also planned to eliminate about 9,000 jobs. A year later, pre-tax annual savings were re-assessed and increased to $3.8 billion.

Capital productivity improvements. Management also believed the combined company could use its capital more profitably than either company on its own. These improvements were realized due to efficiencies of scale, cost savings, and sharing of best management practices. The businesses and assets of Exxon and Mobil were highly complementary in key areas. In the exploration and production area, for example, Mobil's and Exxon's respective strengths in West Africa, the Caspian region, Russia, South America, and North America lined up well, with minimal overlap. The firms also had a presence in natural gas, with combined sales of about 14 bcfd. And Mobil contributed its LNG assets and experience to the venture.

There were technology synergies as well. In upstream, Exxon and Mobil owned proprietary technologies in the areas of: deepwater and arctic operations, heavy oil, gas-to-liquids processing, LNG, and high-strength steel. In downstream, their proprietary technology focused on refining and chemical catalysts. Exxon’s lube base stocks production fitted well with Mobil's leadership in lubes marketing. Generally, the Exxon-Mobil deal was a move by the dominant partner to increase its asset base by 30 percent while raising capital productivity.

Corporate affairs

The current Chairman of the Board and CEO of Exxon Mobil Corp. is Rex W. Tillerson. Tillerson assumed the top position on January 1, 2006, on the retirement of long-time chairman and CEO, Lee Raymond.

Board of directors

As of June 24, 2014, the current ExxonMobil board members are:

- Michael Boskin, professor of economics Stanford University, director of Oracle Corp., Shinsei Bank, and Vodafone Group

- Peter Brabeck-Letmathe, Nestlé chairman and former Nestlé CEO

- Ursula Burns, Xerox chairman and CEO

- Larry R. Faulkner, President, Houston Endowment; President Emeritus, the University of Texas at Austin

- Jay S. Fishman, CEO and board chairman of The Travelers Companies

- Henrietta H. Fore, Holsman International

- Kenneth C. Frazier, President of Merck & Co.

- William W. George, professor of management practice, Harvard Business School

- Samuel J. Palmisano, Chairman of the Board, IBM Corp.

- Steven S Reinemund, retired Executive Chairman of the Board, PepsiCo

- Rex Tillerson, Chairman of the Board and Chief Executive Officer, Exxon Mobil Corp.

- William C. Weldon, past Johnson & Johnson chairman

Joint ventures and other strategic alliances

- ExxonMobil has a 70 percent Ownership in Imperial Oil.

- Infineum is a joint venture between ExxonMobil and Royal Dutch Shell for manufacturing and marketing crankcase lubricant additives, fuel additives, and specialty lubricant additives, as well as automatic transmission fluids, gear oils, and industrial oils.

- Aera Energy LLC is an E&P joint venture with Shell Oil, operating in California.

- On August 30, 2011, ExxonMobil announced a $3.2 billion joint venture with Russian oil company Rosneft to develop two offshore oil fields in Russia, the East-Prinovozemelsky field in the Kara Sea and the Tuapse field in the Black Sea.

- ExxonMobil Yūgen Kaisha holds a 50.02 percent stake in TonenGeneral Sekiyu K.K., but in January 2012 TonenGeneral Sekiyu KK agreed to acquire 99 percent of ExxonMobil Yūgen Kaisha for 302 billion yen ($3.9 billion). It is the biggest divesture for Exxon since the 1999 deal with Mobil Corp. and Exxon stake in TonenGeneral decline to 22 percent from 50 percent, but the Japanese refiner will retain exclusive rights to use its brands.

Production

ExxonMobil is the largest non-government owned company in the energy industry and produces about 3 percent of the world's oil and about 2 percent of the world's energy.

ExxonMobil, like other oil companies, is struggling to find new sources of oil. According to Wall Street Journal it replaces only 95 percent by volume of the oil it pumps. This stands in contrast to natural gas, where it replaces 158 percent by volume through purchases or finds.

Revenue and profits

In 2005, ExxonMobil surpassed Wal-Mart as the world's largest publicly held corporation when measured by revenue, although Wal-Mart remained the largest by number of employees. ExxonMobil's $340 billion revenues in 2005 were a 25.5 percent increase over their 2004 revenues.

In 2006, Wal-Mart recaptured the lead with revenues of $348.7 billion against ExxonMobil's $335.1. ExxonMobil continued to lead the world in both profits ($39.5 billion in 2006) and market value ($460.43 billion).

In 2007, ExxonMobil had a record net income of $40.61 billion on $404.552 billion of revenue, an increase largely due to escalating oil prices as their actual BOE production decreased by 1 percent, in part due to expropriation of their Venezuelan assets by the Chávez government.

As of July 1, 2010, ExxonMobil occupied eight out of 10 slots for Largest Corporate Quarterly Earnings of All Time. Furthermore, it occupies 5 out of 10 slots on Largest Corporate Annual Earnings.

Financial data

| Year-end | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

|---|---|---|---|---|---|---|

| Total revenue | 358,955 | 365,467 | 390,328 | 459,579 | 301,586 | 383,221 |

| Net income | 36,130 | 39,500 | 40,610 | 45,220 | 19,280 | 30,460 |

| Total assets | 208,335 | 219,015 | 242,082 | 228,052 | 233,323 | |

| Total debt | 7,991 | 8,347 | 9,566 | 9,425 | 9,605 |

Environmental record

Its environmental record has been a target of critics from outside organizations such as the environmental lobby group Greenpeace as well as some institutional investors who disagree with its stance on global warming. The Political Economy Research Institute ranks ExxonMobil sixth among corporations emitting airborne pollutants in the United States. The ranking is based on the quantity (15.5 million pounds in 2005) and toxicity of the emissions. In 2005, ExxonMobil had committed less than 1 percent of their profits towards researching alternative energy, less than other leading oil companies.

Exxon Valdez oil spill

Main article: Exxon Valdez oil spillThe March 24, 1989, Exxon Valdez oil spill resulted in the discharge of approximately 11 million US gallons (42,000 m) of oil into Prince William Sound, oiling 1,300 miles (2,100 km) of the remote Alaskan coastline. The Valdez spill is 36th worst oil spill in history in terms of sheer volume.

The State of Alaska's Exxon Valdez Oil Spill Trustee Council stated that the spill "is widely considered the number one spill worldwide in terms of damage to the environment". Carcasses were found of over 35,000 birds and 1,000 sea otters. Because carcasses typically sink to the seafloor, it’s estimated the death toll may be 250,000 seabirds, 2,800 sea otters, 300 harbor seals, 250 bald eagles, and up to 22 killer whales. Billions of salmon and herring eggs were also killed.

As of 2001, oil remained on or under more than half the sound’s beaches, according to a 2001 federal survey. The government-created Exxon Valdez Oil Spill Trustee Council concluded that the oil disappears at less than 4 percent per year, adding that the oil will “take decades and possibly centuries to disappear entirely”. Of the 27 species monitored by the Council, 17 have not recovered. While the salmon population has rebounded, and the killer whales are recovering, the herring population and fishing industry have not.

Exxon was widely criticized for its slow response to cleaning up the disaster. John Devens, the Mayor of Valdez, has said his community felt betrayed by Exxon's inadequate response to the crisis. Exxon later removed the name "Exxon" from its tanker shipping subsidiary, which it renamed "SeaRiver Maritime." The renamed subsidiary, though wholly Exxon-controlled, has a separate corporate charter and board of directors, and the former Exxon Valdez is now the SeaRiver Mediterranean. The renamed tanker is legally owned by a small, stand-alone company, which would have minimal ability to pay out on claims in the event of a further accident.

After a trial, a jury ordered Exxon to pay $5 billion in punitive damages, though an appeals court reduced that amount by half. Exxon appealed further, and on June 25, 2008, the United States Supreme Court lowered the amount to $500 million.

In 2009, Exxon still uses more single-hull tankers than the rest of the largest ten oil companies combined, including the Valdez's sister ship, the SeaRiver Long Beach.

Exxon's Brooklyn oil spill

Main article: Greenpoint oil spillNew York Attorney General Andrew Cuomo announced on July 17, 2007 that he had filed suit against the Exxon Mobil Corp. and ExxonMobil Refining and Supply Co. to force cleanup of the oil spill at Greenpoint, Brooklyn, and to restore Newtown Creek.

A study of the spill released by the US Environmental Protection Agency in September 2007 reported that the spill consists of 17 to 30 million US gallons (64,000 to 114,000 m) of petroleum products from the mid-19th century to the mid-20th century. The largest portion of these operations were by ExxonMobil or its predecessors. By comparison, the Exxon Valdez oil spill was approximately 11 million US gallons (42,000 m). The study reported that in the early 20th century Standard Oil of New York operated a major refinery in the area where the spill is located. The refinery produced fuel oils, gasoline, kerosene and solvents. Naptha and gas oil, secondary products, were also stored in the refinery area. Standard Oil of New York later became Mobil, a predecessor to Exxon/Mobil.

Baton Rouge Refinery benzene leak

On June 14, 2012, a bleeder plug on a tank in the Baton Rouge Refinery failed and began leaking naphtha, a substance that is composed of many chemicals including benzene. ExxonMobil originally reported to the Louisiana Department of Environmental Quality(LDEQ) that 1,364 pounds of material had been leaked.

On June 18, Baton Rouge refinery representatives told the LDEQ that ExxonMobil's chemical team determined that the June 14 spill was actually a level 2 incident classification which means that a significant response to the leak was required. On the day of the spill the refinery did not report that their estimate of spilled materials was significantly different from what was originally reported to the department. Because the spill estimate and the actual amount of chemicals spilled varied drastically, the LDEQ launched an in-depth investigation on June 16 to determine the actual amounts of chemicals spilled as well as to find out what information the refinery knew and when they knew it. On June 20, ExxonMobil sent an official notification to the LDEQ saying that the leak had actually released 28,688 pounds of benzene, 10,882 pounds of toluene, 1,100 pounds of cyclohexane, 1,564 pounds of hexane and 12,605 pounds of additional volatile organic compound. After the spill, people living in neighboring communities reported adverse health impacts such as severe headaches and respiratory difficulties.

Baton Rouge Refinery pipeline oil spill

In April 2012, a crude oil pipeline, from the Exxon Corp Baton Rouge Refinery, burst and spilled at least 1,900 barrels of oil (80,000 gallons) in the rivers of Point Coupee Parish, Louisiana, shutting down the Exxon Corp Baton Refinery for a few days. Regulators opened an investigation in response to the pipeline oil spill.

Yellowstone River oil spill

The July 2011 Yellowstone River oil spill was an oil spill from an ExxonMobil pipeline running from Silver Tip to Billings, Montana, which ruptured about 10 miles west of Billings on July 1, 2011, at about 11:30 pm The resulting spill leaked an estimated 750 to 1,000 barrels of oil into the Yellowstone River for about 30 minutes before it was shut down.

As a precaution against a possible explosion, officials in Laurel, Montana evacuated about 140 people on Saturday (July 2) just after midnight, then allowed them to return at 4 am

A spokesman for ExxonMobil said that the oil is within 10 miles of the spill site. However, Montana Governor Brian Schweitzer disputed the accuracy of that figure. The governor pledged that "The parties responsible will restore the Yellowstone River."

Mayflower oil spill

Main article: 2013 Mayflower oil spillOn March 29, 2013, an ExxonMobil pipeline carrying Canadian Wabasca Heavy crude ruptured in Mayflower, Arkansas, releasing at least 12,000 barrels of oil and forcing the evacuation of 22 homes. The Environmental Protection Agency has classified the leak as a major spill. Local officials performing disaster relief requested that the FAA impose a no-fly zone, with relief efforts headed by an aviation advisor for ExxonMobil being exempt. After it was imposed it was amended to allow aerial news crews to fly over the area.

Sakhalin-I in the Russian Far East

Main article: Sakhalin-IScientists and environmental groups voice concern that the Sakhalin-I oil and gas project in the Russian Far East, operated by an ExxonMobil subsidiary, Exxon Neftegas Limited (ENL), threatens the critically endangered western gray whale population. In February, 2009, scientists convened by the International Union for the Conservation of Nature issued an urgent call for a "...moratorium on all industrial activities, both maritime and terrestrial, that have the potential to disturb gray whales in summer and autumn on and near their main feeding areas" following a sharp decline in observed whales in the main feeding area in 2008, adjacent to ENL's project area. The scientists also criticized ENL’s unwillingness to cooperate with the scientific panel process, which “certainly impedes the cause of western gray whale conservation.”

Funding of global warming skepticism

ExxonMobil funded skepticism about and denial of anthropogenic global warming.

From the late 1970s and through the 1980s, Exxon was at the forefront of research into climate change, funding internal and university collaborations. In July 1977, at a meeting of Exxon's Management Committee in Exxon corporate headquarters, a senior company scientist warned company executives of the danger of atmospheric carbon dioxide increases from the burning of fossil fuels. In 1992, the senior ice researcher, leading a Calgary-based research team in Exxon’s Canadian subsidiary Imperial Oil, assessed how global warming could affect Exxon’s Arctic operations, and reported that exploration and development costs in the Beaufort Sea might be lower, while higher sea levels and rougher seas could threaten the company’s coastal and offshore infrastructure. Toward the end of the 1980s, Exxon curtailed its climate research and was a leader in climate denial. In 1989, Exxon helped found and lead the Global Climate Coalition. Lee Raymond, Exxon and ExxonMobil chief executive officer from 1993 to 2006, was one of the most outspoken executives in the United States against regulation to curtail global warming.

ExxonMobil has drawn criticism from scientists, science organizations and the environmental lobby for funding organizations critical of the Kyoto Protocol and seeking to undermine public opinion about the scientific consensus that global warming is caused by the burning of fossil fuels. According to Mother Jones Magazine, the company channeled at least $8,678,450 between the years 2000-2003 to forty different organizations that have employed disinformation campaigns including "skeptic propaganda masquerading as journalism" to influence opinion of the public and of political leaders about global warming and that the company was a member of one of the first such groups, the Global Climate Coalition, founded in 1989. According to The Guardian, ExxonMobil has funded, among other groups, the Competitive Enterprise Institute, George C. Marshall Institute, Heartland Institute, Congress on Racial Equality, TechCentralStation.com, and International Policy Network. ExxonMobil's support for these organizations has drawn criticism from the Royal Society, the academy of sciences of the United Kingdom. A survey carried out by the UK's Royal Society found that in 2005 ExxonMobil distributed $2.9m to 39 groups that the society said "misrepresented the science of climate change by outright denial of the evidence". The Union of Concerned Scientists released a report in 2007 accusing ExxonMobil of spending $16 million, between 1998 and 2005, towards 43 advocacy organizations which dispute the impact of global warming. The report argued that ExxonMobil used disinformation tactics similar to those used by the tobacco industry in its denials of the link between lung cancer and smoking, saying that the company used "many of the same organizations and personnel to cloud the scientific understanding of climate change and delay action on the issue." These charges are consistent with a purported 1998 internal ExxonMobil strategy memo, posted by the environmental group Environmental Defense, stating

Victory will be achieved when

- Average citizens 'understand' (recognize) uncertainties in climate science; recognition of uncertainties becomes part of the 'conventional wisdom' …

- Industry senior leadership understands uncertainties in climate science, making them stronger ambassadors to those who shape climate policy

- Those promoting the Kyoto treaty on the basis of extant science appear out of touch with reality.

Beginning in 2004, the descendants of John D. Rockefeller, led mainly by his great-grandchildren, through letters, meetings, and shareholder resolutions, attempted but failed to get ExxonMobil to acknowledge climate change, to abandon climate denial, and to shift towards clean energy.

ExxonMobil has been reported as having plans to invest up to US$100m over a ten-year period to establish the Global Climate and Energy Project at Stanford University, which "would focus on technologies that could provide energy without adding to a buildup of greenhouse gases".

In August 2006, the Wall Street Journal revealed that a YouTube video lampooning Al Gore, titled Al Gore's Penguin Army, appeared to be astroturfing by DCI Group, a Washington PR firm with ties to ExxonMobil.

In January 2007, the company appeared to change its position, when vice president for public affairs Kenneth Cohen said "we know enough now—or, society knows enough now—that the risk is serious and action should be taken." Cohen stated that, as of 2006, ExxonMobil had ceased funding of the Competitive Enterprise Institute and "'five or six' similar groups". While the company did not publicly state which the other similar groups were, a May 2007 report by Greenpeace does list the five groups "at the heart of the climate change denial industry" it stopped funding as well as a list of 41 similar groups which are still receiving ExxonMobil funds.

On February 13, 2007, ExxonMobil CEO Rex W. Tillerson acknowledged that the planet was warming while carbon dioxide levels were increasing, but in the same speech gave an unqualified defense of the oil industry and predicted that hydrocarbons would dominate the world’s transportation as energy demand grows by an expected 40 percent by 2030. Tillerson stated that there is no significant alternative to oil in coming decades, and that ExxonMobil would continue to make petroleum and natural gas its primary products, saying: "I'm no expert on biofuels. I don't know much about farming and I don't know much about moonshine. ... There is really nothing ExxonMobil can bring to that whole biofuels issue. We don't see a direct role for ourselves with today's technology." However, recently ExxonMobil has announced that it will plan on spending up to 600 million dollars within the next 10 years to fund biofuels that come from algae. On July 14, 2010 ExxonMobil announced that, a year after teaming with Synthetic Genomics, Inc., they had opened a greenhouse to research algae as a possible biofuel.

In May 2008, a week before their annual shareholder's meeting, ExxonMobil pledged in its annual corporate citizenship report that it would cut funding to "several public policy research groups whose position on climate change could divert attention" from the need to address climate change. On July 1, 2009, The Guardian newspaper revealed that ExxonMobil continued to fund such organizations, including the National Center for Policy Analysis (NCPA) and the Heritage Foundation. A December 2009 article in Mother Jones magazine included ExxonMobil as a promulgator of climate disinformation. Between 2007 and 2015, ExxonMobil gave $1.87 million to Congressional climate change deniers and $454,000 to the American Legislative Exchange Council (ALEC), which works to block climate legislation in state legislatures. ExxonMobil denied funding climate denial. ExxonMobil is a member of ALEC's “Enterprise Council,“ its corporate leadership board.

In April 2014, ExxonMobil released a report publicly acknowledging climate change risk for the first time. ExxonMobil predicts that a rising global population, increasing living standards and increasing energy access will result in lower greenhouse gas emissions.

On October 14, 2015, Ted Lieu and Mark DeSaulnier, Democratic members of The United States House of Representatives from California, wrote to the United States Attorney General requesting an investigation into whether ExxonMobil violated any federal laws by "failing to disclose truthful information" about climate change. The New York Attorney General is investigating whether ExxonMobil misled the public or stock holders regarding the impact of climate change.

Criticism

Environment

The Exxon Valdez oil spill in Prince William Sound, Alaska, on March 24, 1989, was a watershed moment for environmental critics of the oil industry because it was extremely devastating to the local flora and fauna of Prince William Sound.

Foreign business practices

Investigative reporting by Forbes magazine raised questions about ExxonMobil's dealings with the leaders of oil-rich nations. ExxonMobil controls concessions covering 11 million acres (45,000 km) off the coast of Angola that hold an estimated 7.5 billion barrels (1.19×10 m) of crude.

In 2003, the Office of Foreign Assets Control reported that ExxonMobil engaged in illegal trade with Sudan and it, along with dozens of other companies, settled with the United States government for $50,000.

Human rights

Main article: Accusations of ExxonMobil human rights violations in IndonesiaExxonMobil is the target of human rights activists for actions taken by the corporation in the Indonesian territory of Aceh. In June 2001, a lawsuit against ExxonMobil was filed in the Federal District Court of the District of Columbia under the Alien Tort Claims Act. The suit alleges that the ExxonMobil knowingly assisted human rights violations, including torture, murder and rape, by employing and providing material support to Indonesian military forces, who committed the alleged offenses during civil unrest in Aceh. Human rights complaints involving Exxon's (Exxon and Mobil had not yet merged) relationship with the Indonesian military first arose in 1992; the company denies these accusations and filed a motion to dismiss the suit, which was denied in 2008 by a federal judge. But another federal judge dismissed the lawsuit in August 2009. The plaintiffs are currently appealing the dismissal.

Investigative book: Private Empire: ExxonMobil and American Power

A July 2012 review of Steve Coll's book, Private Empire: ExxonMobil and American Power, in The Daily Telegraph says that he thinks that ExxonMobil is "able to determine American foreign policy and the fate of entire nations". ExxonMobil increasingly drills in terrains leased to them by dictatorships, such as those in Chad and Equatorial Guinea. Steve Coll describes Lee Raymond, the corporation’s chief executive until 2005, as "notoriously skeptical about climate change and disliked government interference at any level".

The book was also reviewed in The Economist, according to which "ExxonMobil is easy to caricature, and many critics have done so.... It is to Steve Coll’s credit that “Private Empire”, his new book about ExxonMobil, refuses to subscribe to such a simplistic view." The review describes the company's power in dealing with the countries in which it drills as "constrained". It notes that the company shut down its operations in Indonesia to distance itself from the abuses committed against the population by that country's army, and that it decided to drill in Chad only after the World Bank agreed to ensure that the oil royalties were used for the population's benefit. The review closes by noting that "A world addicted to ExxonMobil’s product needs to look in the mirror before being too critical of how relentlessly the company supplies it."

Headquarters

ExxonMobil's headquarters are located in Irving, Texas. As of May 2015, the company is nearing completion of its new campus located in a northern Houston suburb of Spring, at the intersection of Interstate 45, the Hardy Toll Road, and the Grand Parkway northern extension. It is an elaborate corporate campus, including twenty office buildings totaling 3,000,000 square feet (280,000 m), a wellness center, laboratory, and three parking garages. It is designed to house nearly 10,000 employees with an additional 1,500 employees located in a satellite campus in Hughes Landing in The Woodlands, Texas. In October 2010, the company stated that it would not move its headquarters to Greater Houston.

See also

- Exxon Corp. v Exxon Insurance Consultants International Ltd

- Kivalina v. Exxon Mobil Corp.

- List of companies by revenue

- Save the Tiger Fund

Notes

- "ExxonMobil, Our Management". Exxon Mobil Corp. Retrieved April 20, 2011.

- ^ EXXON MOBIL CORPORATION Form 10-K, Google Finance, March 21, 2015

- ^ "ExxonMobil, Our History". Exxon Mobil Corp. Retrieved November 20, 2007.

- "Apple loses title of world's most valuable company to Exxon". Fox News. April 17, 2013.

- "Forbes Global 2000". Forbes.

- DeCarlo, Scott. "ExxonMobil - In Photos: Global 2000: The World's Top 25 Companies - Forbes". Forbes.

- Kell, John (June 11, 2015). "The 10 most profitable companies of the Fortune 500". Fortune. Retrieved October 19, 2015.

- "FT's profile of ExxonMobil". Financial Times. Retrieved April 21, 2008.

- "The new Seven Sisters: oil and gas giants dwarf western rivals". Financial Times. Retrieved April 21, 2008.

- "Will We Rid Ourselves of This Pollution?". Forbes. April 16, 2007. Retrieved April 22, 2008.

- "EIA – Statement of Jay Hakes". Tonto.eia.doe.gov. March 10, 1999. Retrieved July 11, 2011.

- http://www.marketwatch.com/story/exxon-mobil-corporation-announces-2013-reserves-replacement-totaled-103-percent-2014-02-21

- "ExxonMobil – Refining and supply". Exxon Mobil Corp. Retrieved August 9, 2010.

- "Exxon Mobil – Company profile". Exxon Mobil Corp. Retrieved August 9, 2010.

- http://www.petrostrategies.org/Links/worlds_largest_refiners.htm Worlds Largest Refiners list

- ^ Ian Thompson (July 30, 2012). "Private Empire: ExxonMobil and American Power". The Telegraph. London.

- Marius Vassiliou (2009). Historical Dictionary of the Petroleum Industry. Lanham, MD: Scarecrow Press. ISBN 0-8108-5993-9.

- Romero, Simon; Andrews, Edmund L. (January 31, 2006). "At ExxonMobil, a Record Profit but No Fanfare". The New York Times. Retrieved May 2, 2010.

- "Exxon profits surge to new record". BBC News. January 30, 2006. Retrieved May 2, 2010.

- Erman, Michael (June 12, 2008). "Exxon to exit U.S. retail gas business". Reuters. Retrieved September 30, 2012.

- "ExxonMobil and XTO complete merger". Upstream Online. NHST Media Group. June 25, 2010. Retrieved June 27, 2010.

- Anthony Guegel May 3, 2011 20:27 GMT (May 3, 2011). "ExxonMobil in icy innovation". Upstream Online. Retrieved July 11, 2011.

{{cite web}}: CS1 maint: numeric names: authors list (link) - Forster, Christine (March 31, 2011). "Shell Australia upbeat on Prelude LNG; focus now turns to Timor – The Barrel". Platts.com. Retrieved July 11, 2011.

- "/ Companies / Oil & Gas – Shell's floating LNG plant given green light". Financial Times. May 20, 2011. Retrieved July 11, 2011.

- "Exxon Confirms Deals With Iraqi Kurds". The Wall Street Journal. February 27, 2012. Retrieved March 8, 2012.

- http://www.1derrick.com/wsj-exxon-sees-big-shale-oil-potential-in-siberia/481/%7Ctitle=Exxon shows interest in Siberia|

- Denny Thomas and Charlie Zhu (November 19, 2013). "Exxon to sell Hong Kong power operations for $3.4 billion". Reuters.

- Tchekhov, Magnus. "LINN Energy's Asset Swap Deal with Exxon". Market Realist. Market Realist, Inc. Retrieved September 30, 2014.

- Chamberlin, Alex. "The World Bank ruling on the Exxon Mobil Venezuela case". Market Realist. Market Realist, Inc. Retrieved October 14, 2014.

- ^ "ExxonMobil Joint Proxy statement in S-4 SEC Filing (Apr 5, 1999)". U.S. Securities and Exchange Commission. Retrieved February 25, 2012.

- "Hearing before the subcommittee on antitrust, business rights, and competition, March 22, 2000, Serial No. J-106-71". Antitrust, Competition Policy and Consumer Rights Subcommittee. Retrieved February 25, 2012.

- "Case IV/M.1383 – Exxon/Mobil, EU Commission decision" (PDF). EU Commission. Retrieved February 25, 2012.

- Crow, P (October 1999). "Exxon-Mobil merger wins approval in EU". Oil & Gas Journal. 97 (43): 24.

- "FTC File No. 9910077, November 30, 1998". Federal Trade Commission. Retrieved February 25, 2012.

- Corcoran, G (November 30, 2010). "Exxon-Mobil 12 Years Later: Archetype of a Successful Deal". Wall Street Journal Blogs. Retrieved February 25, 2012.

- "Exxon Mobil Corp. Board of Directors". Exxon Mobil Corp.

- "Infineum". Retrieved September 23, 2015.

- Klein, Ezra (August 30, 2011). "ExxonMobil signs Russian oil pact". The Washington Post. Retrieved September 2, 2011.

- "Exxon in Talks to Restructure Stake in Japan Refining Unit". January 5, 2012.

- Okada, Yuji; Adelman, Jacob (January 30, 2012). "TonenGeneral to Buy Exxon Japan Refining, Marketing Unit for $3.9 Billion". Bloomberg. Retrieved January 30, 2012.

- Russell Gold and Angel Gonzalez (February 16, 2011). "Exxon Struggles to Find New Oil". Wall Street Journal. Retrieved February 20, 2011.

- "Exxon dethrones Wal-Mart atop Fortune 500". MSNBC. Associated Press. April 3, 2006. Retrieved May 9, 2007.

- "Wal-Mart returns to top of the Fortune 500 list". MSNBC. Associated Press. April 16, 2007. Retrieved May 9, 2007.

- Huliq.com ExxonMobil 2007 results.

- Top corporate quarterly earnings of all time Archived 2013-10-05 at the Wayback Machine

- "Top corporate quarterly earnings of all time". The Washington Times. Retrieved July 11, 2011.

- ExxonMobil 5 year financial overview

- "Big US Pension Fund Joins Critics Of ExxonMobil Climate Stance". Energy-daily.com. Retrieved July 11, 2011.

- "(PERI) THE TOXIC 100: Top Corporate Air Polluters in the United State". Peri.umass.edu. Retrieved July 11, 2011.

- Mufson, Steven (April 2, 2008). "Familiar Back and Forth With Oil Executives". The Washington Post. Retrieved July 11, 2011.

- "ERES: ExxonMobil Shareholders Relying on Fumes". Heatisonline.org. Retrieved July 11, 2011.

- ^ "Frequently asked questions about the Exxon Valdez Oil Spill". State of Alaska's Exxon Valdez Oil Spill Trustee. Retrieved March 6, 2007.

- The 13 largest oil spills in history | MNN - Mother Nature Network

- "Alaska fishermen still struggling 21 years after Exxon spill". CNN. May 7, 2010.

- Twenty Years Later, Impacts of the Exxon Valdez Linger by Doug Struck: Yale Environment 360

- Chameides, Bill (March 18, 2009). "Exxon Valdez 20 Years Later". Huffington Post.

- "CSR case studies in crisis management – ExxonMobil and Exxon Valdez". Mallenbaker.net. Retrieved July 11, 2011.

- The Baltimore Sun. "Even Renamed, Exxon Valdez can't Outlive Stain on its Past." October 15, 2002.

- "Exxon seeks Supreme Court review of oil-spill fine". Seattle Times. August 2007. Retrieved August 24, 2007.

- Nightingale, Alaric; Tony Hopfinger (March 24, 2009). "Valdez Ghost Haunts Exxon With Spill-Prone Ships (Update2) - Bloomberg". Bloomberg L.P. Retrieved September 30, 2012.

- "Cuomo sues ExxonMobil over catastrophik Greenpoint oil spil". July 7, 2007. Retrieved October 24, 2007.

- "Newton Creek/Greenpoint oil spill study, Brookly, New York" (PDF). September 12, 2007. p. 4. Retrieved October 24, 2007.

- "Greenpoint Petroleum Remediation Project – NYS Dept. of Environmental Conservation". Dec.ny.gov. Retrieved July 11, 2011.

- "Newton Creek/Greenpoint oil spill study, Brookly, New York" (PDF). September 12, 2007. p. 23. Retrieved October 24, 2007.

- Amy, Wold. "La. DEQ demands timeline on spill from ExxonMobil". Article. The Advocate. Retrieved April 12, 2013.

- ^ La. DEQ demands timeline on spill from ExxonMobil | Home | The Advocate — Baton Rouge, LA

- ^ DEQ investigates spill | Home | The Advocate — Baton Rouge, LA

- ^ Plant neighbors complain of ailments | Home | The Advocate — Baton Rouge, LA

- Reuters, April 30, 2012

- ^ Ruptured Pipeline Spills Oil Into Yellowstone River New York Times, July 2, 2011

- ^ Spill sends 40 km oil slick into river Herald Sun July 3, 2011

- Hennesy-Fiske, Moll (July 4, 2011). "Yellowstone River oil spill outrages Montana residents". The Sacramento Bee. Retrieved July 4, 2011.

- "Exxon cleans up Arkansas oil spill; Keystone plan assailed". Reuters. March 31, 2013.

- Schwirtz, Michael (March 30, 2013). "Exxon Mobil Pipeline Ruptures in Central Arkansas". The New York Times.

- Lesnick, Gavin (April 3, 2013). "No-fly zone in place over Mayflower oil spill". Arkansas Democrat-Gazette. Retrieved July 7, 2013.

- "Exxon Mobil Corp. – 10-K – For 12/31/03 – EX-21". SEC Info. December 31, 2003. Retrieved July 11, 2011.

- "Western Gray Whale Conservation Initiative". IUCN. Retrieved July 11, 2011.

- Western Gray Whales Get a Break From Noisy Oil Development

- "Gray whales granted rare reprieve". BBC News. April 24, 2009. Retrieved May 2, 2010.

- See Section 17 at http://cmsdata.iucn.org/downloads/wgwap_5_report_final_040209.pdf

- See Section 18, pg 35, at http://cmsdata.iucn.org/downloads/wgwap_5_report_final_040209.pdf

- "Scientists' Report Documents ExxonMobil's Tobacco-like Disinformation Campaign on Global Warming Science". Union of Concerned Scientists. Retrieved April 24, 2009.

- "Royal Society and ExxonMobil". The Royal Society. Retrieved April 24, 2009.

- Goldenberg, Suzanne (July 8, 2015). "Exxon knew of climate change in 1981, email says – but it funded deniers for 27 more years". The Guardian. Retrieved October 15, 2015.

- ^ Jerving, Sara; Jennings, Katie; Hirsch, Masako Melissa; Rust, Susanne (October 9, 2015). "What Exxon knew about the Earth's melting Arctic". Los Angeles Times. Retrieved October 21, 2015.

- ^ Banerjee, Neela; Song, Lisa; Hasemyer, David (September 21, 2015). "Exxon's Own Research Confirmed Fossil Fuels' Role in Global Warming Decades Ago; Top executives were warned of possible catastrophe from greenhouse effect, then led efforts to block solutions". InsideClimate News. Retrieved October 14, 2015.

Exxon helped to found and lead the Global Climate Coalition, an alliance of some of the world's largest companies seeking to halt government efforts to curb fossil fuel emissions.

- Breslow, Jason M. (September 16, 2015). "Investigation Finds Exxon Ignored Its Own Early Climate Change Warnings". Frontline. PBS. Retrieved October 14, 2015.

- ^ Lorenzetti, Laura (September 16, 2015). "Exxon has known about climate change since the 1970s". Fortune. Retrieved October 14, 2015.

- Whitman, Elizabeth (October 10, 2015). "Exxon Arctic Drilling Benefitting From Global Warming: Oil Company Denied Climate Change Science While Factoring It Into Arctic Operations, Report Shows". International Business Times. Retrieved October 21, 2015.

- Whitman, Elizabeth (October 10, 2015). "Exxon Arctic Drilling Benefitting From Global Warming: Oil Company Denied Climate Change Science While Factoring It Into Arctic Operations, Report Shows". International Business Times. Retrieved October 14, 2015.

- Herrick, Thaddeus (August 29, 2001). "Exxon CEO Lee Raymond's Stance On Global Warming Causes a Stir". The Wall Street Journal.

- Mooney, Chris (May 2005). "Some Like It Hot". Mother Jones. Retrieved April 29, 2007.

- "Put a Tiger In Your Think Tank". Mother Jones. May 2005. Retrieved October 20, 2015.

- Adam, David (September 20, 2006). "Royal Society Letter to Exxon". The Guardian. UK. Retrieved October 22, 2015.

- Barnett, Antony (November 28, 2004). "Claims by think-tank outrage eco-groups". The Guardian. UK. Retrieved January 16, 2007.

- ^ Ward, Bob (September 4, 2006). "Letter from Royal Society to ExxoMobil" (PDF). London: The Guardian. Royal Society. Retrieved October 18, 2006.

- ^ Adam, David (May 28, 2008). "Exxon to cut funding to climate change denial groups". The Guardian. London. Retrieved December 23, 2008.

- "Scientists' Report Documents ExxonMobil's Tobacco like Disinformation Campaign on Global Warming Science" (Press release). Union of Concerned Scientists. January 3, 2006. Retrieved January 4, 2007.

- "Smoke Mirrors & Hot Air" (PDF). Union of Concerned Scientists. February 2007. Retrieved October 14, 2015.

- ExxonMobil. "Global Climate Science Communications." April 3, 1998. See also Environmental Defense commentary "Guess who's funding the global warming doubt shops?" and Cooperative Research history commons chronology of Exxon's PR efforts

- Foley, Stephen (October 23, 2011). "Rockefeller's descendants tell Exxon to face the reality of climate change". The Independent. Retrieved October 20, 2015.

- Goldenberg, Suzanne (March 27, 2015). "Rockefeller family tried and failed to get ExxonMobil to accept climate change". The Guardian. London. Retrieved October 19, 2015.

- ^ REVKIN, ANDREW C. (November 21, 2002). "Exxon-Led Group Is Giving A Climate Grant to Stanford". New YorkTimes.

{{cite news}}:|access-date=requires|url=(help) - Stanford GCEP project homepage. Retrieved April 10, 2008.

- Antonio Regalado and Dionne Searcey (August 3, 2006). "Where did that video spoofing Gore's film come from?". Pittsburgh Post-Gazette.

- Chris Ayres (August 5, 2006). "Slick lobbying is behind penguin spoof of Al Gore". The Times. London.

- "Exxon cuts ties to global warming skeptics". MSNBC. January 12, 2007. Retrieved May 9, 2007.

- "Exxon still funding Climate Change Deniers" (Press release). Greenpeace. May 18, 2007. Retrieved September 30, 2012.

- Krauss, Clifford; Mouawad, Jad (February 14, 2007). "Exxon Chief Cautions Against Rapid Action to Cut Carbon Emissions". New York Times. Retrieved May 2, 2010.

- "ExxonMobil CEO: climate policy would be prudent". Reuters. February 13, 2007.

- Cohen, Ken (July 14, 2010). "The next phase of algae biofuels". Exxon Mobil Corp. Retrieved March 15, 2011.

- Erman, Michael (May 23, 2008). "Exxon again cuts funds for climate change skeptics". Reuters. Retrieved October 22, 2015.

- Adam, David (July 1, 2009). "ExxonMobil continuing to fund climate skeptic groups, records show". The Guardian. UK. Retrieved July 1, 2009.

- Harkinson, Josh (December 4, 2009). "The Dirty Dozen of Climate Change Denial". Mother Jones. Retrieved August 17, 2015.

- Goldenberg, Suzanne (July 15, 2015). "ExxonMobil gave millions to climate-denying lawmakers despite pledge". The Guardian. Retrieved October 15, 2015.

- Frumhoff, Peter C.; Heede, Richard; Oreskes, Naomi (September 2015). "The climate responsibilities of industrial carbon producers". Climatic Change. 132 (2): 157–171. doi:10.1007/s10584-015-1472-5.

- "Exxon Mobil Acknowledges Climate Change Risk - You Read That Correctly". Investing.com. April 1, 2014.

- Phillis, Michael; Rust, Susanne. "Congressmen want probe of Exxon Mobil 'failing to disclose' climate change data". Los Angeles Times. Retrieved October 22, 2015.

- Goldenberg, Suzanne (October 16, 2015). "Exxon's climate change denial warrants federal inquiry, congressmen say". The Guardian. Retrieved October 22, 2015.

- Hasemyer, David (October 16, 2015). "Two U.S. Representatives Seek Justice Department Inquiry into Exxon". InsideClimate News. Retrieved October 22, 2015.

- McKibben, Bill (October 21, 2015). "Exxon Knew Everything There Was to Know About Climate Change by the Mid-1980s—and Denied It". The Nation. Retrieved October 22, 2015.

- Gillis, Justin; Kraussnov, Clifford (November 5, 2015). "Exxon Mobil Investigated for Possible Climate Change Lies by New York Attorney General". The New York Times. Retrieved November 6, 2015.

- Mooney, Chris (November 5, 2015). "New York is investigating Exxon Mobil for allegedly misleading the public about climate change". The Washington Post. Retrieved November 6, 2015.

- ExxonMobil. Press release.

- CNN. "Wal-Mart, NY Yankees, others settle charges of illegal trading." April 14, 2003.

- O'Reilly, Cary (August 27, 2008). "ExxonMobil Must Face Lawsuit by Indonesian Villagers". Bloomberg. Retrieved July 11, 2011.

{{cite news}}: CS1 maint: multiple names: authors list (link) CS1 maint: numeric names: authors list (link) - Judge Dismisses Indonesians' Lawsuit Against Exxon

- "Oozing success". The Economist. August 11, 2012. Retrieved March 19, 2015.

- "Business Headquarters." ExxonMobil. Retrieved on March 6, 2012.

- Sarnoff, Nancy (January 28, 2010). "ExxonMobil is considering a move". Houston Chronicle. Retrieved August 14, 2010.

- "ExxonMobil changes its mind about Houston." Houston Business Journal. Monday October 11, 2010. Retrieved on October 13, 2010.

References

Bibliography

- Bender, Rob, and Tammy Cannoy-Bender. An Unauthorized Guide to: Mobil Collectibles – Chasing the Red Horse. Atglen, Pennsylvania: Schiffer Publishing Co., 1999.

- Exxon Corp. Century of Discovery: An Exxon Album. 1982.

- Gibb, George S., and Evelyn H. Knowlton. The Resurgent Years, 1911–1927: History of Standard Oil Co. (New Jersey). New York: Harper & Brothers Publishers, 1956.

- Hidy, Ralph W., and Muriel E. Hidy. Pioneering in Big Business, 1882–1911: History of Standard Oil Co. (New Jersey). New York: Harper & Brothers Publishers, 1955.

- Larson, Henrietta M., and Kenneth Wiggins Porter. History of Humble Oil & Refining Co.: A Study in Industrial Growth. New York: Harper & Brothers Publishers, 1959.

- Larson, Henrietta M., Evelyn H. Knowlton, and Charles S. Popple. New Horizons, 1927–1950: History of Standard Oil Co. (New Jersey). New York: Harper & Row, 1971.

- McIntyre, J. Sam. The Esso Collectibles Handbook: Memorabilia from Standard Oil of New Jersey. Atglen, Pennsylvania: Schiffer Publishing Co., 1998.

- Sampson, Anthony. The Seven Sisters: The 100-year Battle for the World's Oil Supply. New York: Bantom Books, 1991.

- Standard Oil Co. (New Jersey). Ships of the Esso Fleet in World War II. 1946.

- Tarbell, Ida M. All in a Day’s Work: An Autobiography.. New York: The MacMillan Co., 1939.

- Tarbell, Ida M., and David Mark Chalmers. The History of the Standard Oil Co.. New York: Harper & Row, 1966.

- Wall, Bennett H. Growth in a Changing Environment: A History of Standard Oil Co. (New Jersey) 1950–1972 and Exxon Corp. (1972–1975). New York: McGraw-Hill Book Co., 1988.

- Yergin, Daniel. The Prize: The Epic Quest for Oil, Money, and Power. New York: Simon & Schuster, 1991.

Further reading

- Coll, Steve (2012). Private Empire: ExxonMobil and American Power. New York, NY: The Penguin Press. ISBN 978-1-594-20335-0.

- Painter, David S. (1987). Private Power and Public Policy: Multinational Oil Corporations and United States Foreign Policy, 1941–1954. London: I.B.Tauris. ISBN 978-1-850-43021-6.

- Pratt, Joseph A. (2012). "Exxon and the Control of Oil". The Journal of American History. 99 (1): 145–154. doi:10.1093/jahist/jas149.

External links

- Official website

- Business data for Exxon Mobil Corporation:

- Exxon Mobil Corporation company information and articles at The New York Times

- Exxon Mobil quick facts, rankings, and articles at Forbes

| Petroleum industry | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Benchmarks | |||||||||||||||

| Data |

| ||||||||||||||