This is an old revision of this page, as edited by Huhshyeh (talk | contribs) at 07:46, 1 December 2012 (Update the consequence faced by BP from the US govt. from the Deepwater Horizon oil spill/Gulf of Mexico oil spill). The present address (URL) is a permanent link to this revision, which may differ significantly from the current revision.

Revision as of 07:46, 1 December 2012 by Huhshyeh (talk | contribs) (Update the consequence faced by BP from the US govt. from the Deepwater Horizon oil spill/Gulf of Mexico oil spill)(diff) ← Previous revision | Latest revision (diff) | Newer revision → (diff) This article is about the energy company. For other uses, see BP (disambiguation).| This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these messages)

No issues specified. Please specify issues, or remove this template. (Learn how and when to remove this message) |

| File:BP Logo.svg | |

| Company type | Public limited company |

|---|---|

| Traded as | LSE: BP, NYSE: BP |

| ISIN | DE0008618737 |

| Industry | Oil and gas |

| Founded | 1909 (as Anglo-Persian Oil Company) 1935 (as Anglo-Iranian Oil Company) 1954 (as British Petroleum) 1998 (as BP Amoco plc) 2001 (as BP plc) |

| Headquarters | London, United Kingdom |

| Area served | Worldwide |

| Key people | Carl-Henric Svanberg (Chairman) Bob Dudley (CEO) Brian Gilvary (CFO) |

| Products | Petroleum Natural gas Motor fuels Aviation fuels |

| Services | Service stations |

| Revenue | |

| Operating income | |

| Net income | |

| Total assets | |

| Total equity | |

| Number of employees | 79,700 (2011) |

| Website | www |

BP plc (LSE: BP, NYSE: BP) is a British multinational oil and gas company headquartered in London, United Kingdom. It is the third-largest energy company and fourth-largest company in the world measured by 2011 revenues and is one of the six oil and gas "supermajors". It is vertically integrated and operates in all areas of the oil and gas industry, including exploration and production, refining, distribution and marketing, petrochemicals, power generation and trading. It also has renewable energy activities in biofuels and wind power.

BP has operations in over 80 countries, produces around 3.4 million barrels of oil equivalent per day and has around 21,800 service stations worldwide. Its largest division is BP America, which is the second-largest producer of oil and gas in the United States. Up to deal with Rosneft, announced on 22 October 2012, BP owned 50% of TNK-BP, which is the third-largest oil company in Russia measured by both reserves and crude oil production. As of December 2011, BP had total proven commercial reserves of 17.75 billion barrels of oil equivalent. BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index. It had a market capitalisation of £81.4 billion as of 6 July 2012, the fourth-largest of any company listed on the London Stock Exchange. It has a secondary listing on the New York Stock Exchange.

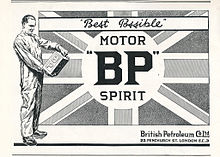

BP's origins date back to the founding of the Anglo-Persian Oil Company in 1909, established as a subsidiary of Burmah Oil Company to exploit oil discoveries in Iran. In 1935, it became the Anglo-Iranian Oil Company and in 1954 British Petroleum. In 1959, the company expanded beyond the Middle East to Alaska and in 1965 it was the first company to strike oil in the North Sea. British Petroleum acquired majority control of Standard Oil of Ohio in 1978. Formerly majority state-owned, the British government privatised the company in stages between 1979 and 1987. British Petroleum merged with Amoco in 1998 and acquired ARCO and Burmah Castrol in 2000.

BP has been involved in several major environmental and safety incidents, including the 2010 Deepwater Horizon oil spill, the world’s largest accidental release of oil into marine waters.. As a consequence, in November 2011, the US government temporarily banned BP from bidding any new federal contracts. In 1997 it became the first major oil company to publicly acknowledge the need to take steps against climate change.

History

1909 to 1979

Further information: Anglo-Iranian Oil Company and Iraq Petroleum Company

In May 1901, William Knox D'Arcy was granted a concession by the Shah of Iran to search for oil, which he discovered in May 1908. This was the first commercially significant find in the Middle East. On 14 April 1909, the Anglo-Persian Oil Company (APOC) was incorporated as a subsidiary of Burmah Oil Company to exploit this. APOC and the Armenian businessman Calouste Gulbenkian were the driving forces behind the creation of Turkish Petroleum Company (TPC) in 1912; and by 1914, APOC held 50% of TPC shares. TPC was promised an oil exploration concession in Mesopotamia (now Iraq) by the Ottoman government.

In 1923, Burmah employed future Prime Minister, Winston Churchill as a paid consultant; to lobby the British government to allow APOC have exclusive rights to Persian oil resources, which were successfully granted. In 1925, TPC received concession in the Mesopotamian oil resources from the Iraqi government under British mandate. TPC finally struck oil in Iraq on 14 October 1927. In 1928, the APOC's shareholding in TPC, which by now named Iraq Petroleum Company (IPC), would be reduced to 23.75%; as the result of the changing geopolitics post Ottoman empire break-up, and the Red Line Agreement.

In 1935, Rezā Shāh requested the international community to refer Persia as 'Iran', which reflected in the name change of APOC to the Anglo-Iranian Oil Company (AIOC). The pro-west Hashemite Monarchy (1932–58) in Iraq and IPC relations were generally cordial, in spite of disputes centred around more Iraqi involvement and getting more royalties. During the 1928-68 time period, IPC monopolised oil exploration inside the Red Line; excluding Saudi Arabia and Bahrain.

Following World War II, nationalistic sentiments were on the rise in the Middle East; most notable being Iranian nationalism, and Arab Nationalism. In Iran, AIOC and the pro western Iranian government led by Prime Minister Ali Razmara, initially resisted nationalist pressure to revise AIOC's concession terms still further in Iran's favour. In March 1951, Ali Razmara was assassinated; and Mohammed Mossadeq, a nationalist, was elected as the new prime minister by the Majlis of Iran (parliament). In April 1951, the Majlis nationalised the Iranian oil industry by unanimous vote, and the National Iranian Oil Company (NIOC) was formed, displacing the AIOC. The AIOC withdrew its management from Iran, and organised an effective worldwide embargo of Iranian oil. The British government, which owned the AIOC, contested the nationalisation at the International Court of Justice at The Hague, but its complaint was dismissed.

After the 1953 Iranian coup d'état. In August 1953, the coup brought pro-Western general Fazlollah Zahedi as the new PM, along with the return of the Shah Mohammad Reza Pahlavi from his brief exile in Italy to Iran. The anti-Mossadeq plan was orchestrated under the code-name 'Operation Ajax' by CIA, and 'Operation Boot' by SIS (MI6).

In 1954, the AIOC became the British Petroleum Company. After the 1953 Iranian coup d'état, a holding company 'Iranian Oil Participants Ltd' (IOP) was founded in October 1954 in London to bring back Iranian oil to the international market. British Petroleum was a founding member of this company with 40% stake. IOP operated and managed oil facilities in Iran on behalf of NIOC. Similar to the Saudi-Aramco "50/50" agreement of 1950, the consortium agreed to share profits on a 50–50 basis with Iran, "but not to open its books to Iranian auditors or to allow Iranians onto its board of directors." The negotiations leading to the creation of the consortium, during 1954-55, was considered as a feat of skilful diplomacy.

A couple of years earlier, in 1953, British Petroleum expanded beyond the Middle East; and entered the Canadian market through the purchase of a minority stake in Calgary-based Triad Oil Company, and expanded further to Alaska in 1959. In 1965, it was the first company to strike oil in the North Sea. The Canadian holding company of British Petroleum was renamed BP Canada in 1969; and in 1971, it acquired 97.8% stake of Supertest Petroleum Corporation. Subsequently, Supertest was renamed to BP Canada Ltd, and other Canadian interests of British Petroleum were amalgamated to the new company.

In 1967, the giant oil tanker Torrey Canyon operated on behalf of British Petroleum, foundered off the English coast. Even though the ship was flying the well known flag of convenience, that of Liberia; the Prime Minister of that time, had the ship bombed by RAF jet bombers, in an effort to break the ship up and sink it. This caused the infamous Torrey Canyon oil spill.

The company's oil assets were nationalised in Libya in 1971, and Nigeria in 1979. In Iraq, IPC ceased its operations after it was nationalised by the Ba’athist Iraqi government in June 1972. But the company "Iraq Petroleum Company" still remains extant as a name on paper, and one of its associated company—Abu Dhabi Petroleum Company (ADPC), formerly Petroleum Development (Trucial Coast) Ltd—also continues with the original shareholding intact.

The intensified power struggle between oil companies and host governments in Middle East, along with the oil price shocks that followed the 1973 oil crisis; meant British Petroleum lost most of its direct access to crude oil supplies produced in countries that belonged to the Organization of Petroleum Exporting Countries (OPEC), and prompted it to diversify its operations beyond the heavily Middle East dependent oil production. In 1978 the company acquired a controlling interest in Standard Oil of Ohio or Sohio, a breakaway entity from former Standard Oil following the anti-trust litigation of 1911. In Iran, British Petroleum continued to operate until the Islamic Revolution in 1979. The new regime of Ayatollah Khomeini confiscated all of the company's assets in Iran without compensation, bringing to an end its 70-year presence in Iran.

1979 to 2000

Sir Peter Walters was the company chairman from 1981 to 1990. This was the era of the Thatcher government's privatisation strategy. The British government sold its entire holding in the company in several tranches between 1979 and 1987. The sale process was marked by an attempt by the Kuwait Investment Authority, the investment arm of the Kuwait government, to acquire control of the company. This was ultimately blocked by the strong opposition of the British government. In 1987, British Petroleum negotiated the acquisition of Britoil and the remaining publicly traded shares of Standard Oil of Ohio.

Walters was replaced by Robert Horton in 1989. Horton carried out a major corporate down-sizing exercise removing various tiers of management at the Head Office. In 1982, the downstream assets of BP Canada were sold to Petro Canada. In 1984, Standard Oil of California was renamed to Chevron Corporation; and it bought Gulf Oil—the largest merger in history at that time. To settle the anti-trust regulation, Chevron divested many of Gulf's operating subsidiaries, and sold some Gulf stations and a refinery in the eastern United States to British Petroleum and Cumberland Farms in 1985. In 1992; British Petroleum sold off its 57% stake in BP Canada (upstream operations), which was renamed as Talisman Energy Inc.

John Browne, who had been on the board as managing director since 1991, was appointed group chief executive in 1995.

2000 to 2010

British Petroleum merged with Amoco (formerly Standard Oil of Indiana) in December 1998, becoming BP Amoco plc. In 2000, BP Amoco acquired Arco (Atlantic Richfield Co.) and Burmah Castrol plc. As part of the merger's brand awareness, the company helped the Tate Modern British Art launch RePresenting Britain 1500–2000 In 2001, the company formally renamed itself as BP plc and adopted the tagline "Beyond Petroleum," which remains in use today. It states that BP was never meant to be an abbreviation of its tagline. Most Amoco stations in the United States were converted to BP's brand and corporate identity. In many states BP continued to sell Amoco branded petrol even in service stations with the BP identity as Amoco was rated the best petroleum brand by consumers for 16 consecutive years and also enjoyed one of the three highest brand loyalty reputations for petrol in the US, comparable only to Chevron and Shell. In May 2008, when the Amoco name was mostly phased out in favour of "BP Gasoline with Invigorate", promoting BP's new additive, the highest grade of BP petrol available in the United States was still called Amoco Ultimate.

In the beginning of 2000s, BP became the leading partner and later operator of the Baku–Tbilisi–Ceyhan pipeline project. The pipeline open a new oil transportation route from the Caspian region.

On 1 September 2003, BP and a group of Russian billionaires, known as AAR (Alfa-Access-Renova), announced the creation of a strategic partnership to jointly hold their oil assets in Russia and Ukraine. As a result, TNK-ВР was created. ААR contributed its holdings in TNK International, ONAKO, SIDANCO, RUSIA Petroleum (which held licenses for the Kovykta field and the Verkhnechonsk field), and the Rospan field in West Siberia (the New Urengoy and East Urengoy deposits). BP contributed its holding in SIDANCO, RUSIA Petroleum, and its BP Moscow retail network.

In April 2004, BP decided to move most of its petrochemical businesses into a separate entity called Innovene within the BP Group. In 2005, it was sold to INEOS, a privately held UK chemical company for $9 billion.

In 2005, BP announced that it would be leaving the Colorado market. Many locations were re-branded as Conoco. In 2006, when Chevron Corporation gave exclusive rights to the Texaco brand name in the US Texaco sold most of the BP gas stations in the southeast. BP has recently looked to grow its oil exploration activities in frontier areas such as the former Soviet Union for its future reserves. In 2007, BP sold its corporate-owned convenience stores, typically known as "BP Connect", to local franchisees and jobbers.

Lord Browne resigned from BP on 1 May 2007. The new chief executive became Tony Hayward, who had been head of exploration and production.

In 2009, BP obtained a production contract during the 2009/2010 Iraqi oil services contracts tender to develop the "Rumaila field" with joint venture partner CNPC, which contain an estimated 17 billion barrels (2.7×10 m) of oil, accounting for 12% of Iraq's oil reserves estimated at 143.1 billion barrels. In June 2010, the BP/CNPC consortium took over development of the field, which was the epicentre of the 1990 Gulf war.

2010 to present

On 1 October 2010, Bob Dudley replaced Tony Hayward as the company's CEO after the Deepwater Horizon oil spill. After the oil spill BP announced a divestment program to sell about $38 billion worth of non-core assets by 2013 to compensate its liabilities related to the accident. In July 2010, it sold its natural gas activities in Alberta and British Columbia, Canada, to Apache Corporation. In October of the same year, it sold its stake in the Petroperija and Bouqeron fields in Venezuela and in the Lan Tay and Lan Do fields, the Nam Con Son pipeline and terminal, and the Phu My 3 power plant in Vietnam to TNK-BP. At the same time, it sold its forecourts and supply businesses in Namibia, Botswana, Zambia, Tanzania and Malawi to Puma Energy, a subsidiary of Trafigura. In May 2011, BP sold the Wytch Farm onshore oilfield in Dorset to Perenco and in March 2012, it sold a package of North Sea gas assets to the same buyer. In December 2011, BP sold its natural-gas liquids business in Canada to Plains All American Pipeline LP, including 2,500 miles (4,000 km) of pipelines, 21 million barrels (3.3×10^ m) of storage capacity and fractionation plants in Sarnia, Fort Saskatchewan and Empress, Alberta. In February 2012, BP sold its natural gas assets in Kansas to Linn Energy. In August 2012, BP sold its Carson Refinery in southern California to Tesoro and Sunray and Hemphill gas processing plants in Texas, together with their associated gas gathering system, to Eagle Rock Energy Partners. In September 2012, BP agreed to sell the Gulf of Mexico located Marlin, Dorado, King, Horn Mountain, and Holstein fields as also its stake in non-operated Diana Hoover and Ram Powell fields to Plains Exploration & Production for $5.55 billion. The Texas City Refinery was sold to Marathon Petroleum in October 2012.

In the United Kingdom, BP agreed to sell its liquefied petroleum gas distribution business to DCC. In Norway, it sold its non-operating stake in the Draugen oil field to Norske Shell.

On 15 January 2011, Rosneft and BP announced a deal to jointly develop East-Prinovozemelsky field on the Russian arctic shelf. As part of the deal, Rosneft was to receive 5% of BP's shares (worth approximately $7.8 billion, as of January 2011) and BP was to get approximately 9.5% of Rosneft's shares in exchange. However, the deal was blocked by BP's co-shareholders in TNK-BP due to a dispute over Russian exploration rights between the two companies, and was nullified. On 22 October 2012, it was announced that Rosneft will acquire the BP's stake TNK-BP in exchange of $12.3 billion of cash and 18.5% of Rosneft's share, which increase the BP's stake in Rosneft up to 19.75%.

In February 2011, BP formed a partnership with Reliance Industries, taking a 30% stake in a new Indian joint-venture for an initial payment of $7.2 billion. In September 2012, BP sold its subsidiary BP Chemicals (Malaysia) Sdn. Bhd., an operator of the Kuantan purified terephthalic acid in Malaysia, to Reliance Industries for $230 million.

Operations

BP has operations in around 80 countries worldwide. BP's global headquarters are located in the St James's area of London, United Kingdom and its exploration headquarters are located in Houston, United States. As of January 2012, the company had a total of 83,400 employees. BP operations are organised into three main "business segments": Upstream, Downstream, and BP Alternative Energy.

Operations by location

United Kingdom and Ireland

As of 2011 the company employs more than 15,000 people in the UK and Ireland, or about 20% of its total workforce. Its North Sea operations are headquartered in Aberdeen, Scotland, where it employs around 3,000 people.

BP operates more than 40 offshore oil and gas fields, four onshore terminals and a pipeline network that transports around 50 percent of the oil and gas produced in the UK, according to the company. As of 2011, BP had produced 5 billion barrels of oil and gas equivalent in the North Sea and its current level of production is about 200,000 barrels per day, BP has invested more than £35 billion in the North Sea since the 1960s, and in 2012 announced its plans to invest another £10 billion over the next five years, with six major projects in the UK and Norway under development.

Offshore oil fields under development by BP include the Clair oilfield, west of the Shetland Isles, which has been appraised as the largest hydrocarbon resource in the UK. In 2011, the UK government approved the development of an extension to the field, the Clair Ridge, for which BP will be the lead operator. As of 2012, the company announced that it was focusing its investment in the UK North Sea into four development projects including the Clair Field, Devenick gas field, the Schiehallion and Loyal oilfields and the Kinnoull oilfield.

In Saltend near Hull, BP operates a petrochemicals plant that produces acetic acid and acetic anhydride used in the production of pharmaceuticals, textiles and other chemical products. At the same location, the company operates a biofuel technology demonstration plant in partnership with DuPont, which uses feedstocks such as wheat to produce biobutanol. The company is also preparing to start production at a bioethanol plant in Hull, developed with Associated British Foods and DuPont.

BP has a major corporate campus in Sunbury-on-Thames which is home to around 4,500 employees and over 40 business units. BP's trading functions are based at 20 Canada Square in Canary Wharf, London, where around 2,200 employees are based. BP also has three research and development facilities in the UK.

Retail sites operated by BP in the UK include over 1,100 service stations. Its flagship retail brand is BP Connect, a chain of service stations combined with a convenience store and a café called the "Wild Bean Cafe". More than 120 BP Connect sites in the UK are run in partnership with Marks & Spencer and include an onsite M&S Simply Food shop.

United States

BP's operations in the United States comprise nearly one third of its worldwide business interests, with more investment and employees than any other nation. The company employs approximately 23,000 people in the US, where it has invested over $52 billion in energy development since 2007. In the US, BP is the second-largest producer of oil and gas. The company's US operations include assets acquired from its merger with Amoco in 1998, including two of its refineries, and its merger with ARCO in 2000.

BP's major subsidiary in the United States is BP America, Inc. based in Warrenville, Illinois, which is a parent company for the BP's operations in the United States. BP Exploration & Production Inc., a 1996 established Houston-based company, is dealing with oil exploration and production, including Gulf of Mexico activities. BP Corporation North America, Inc., a 1889 established Warrenville-based company, provides petroleum refining services as also transportation fuel, heat and light energy, and petrochemical products. BP Products North America, Inc., a 1954 established Houston-based company, is engaged in the exploration, development, production, refining, and marketing of oil and natural gas. BP America Production Company, a 1930 established Eunice-based company, is engages in oil and gas exploration and development. BP Energy Company, a 1985 established Houston-based company, is a provider of natural gas, power, and risk management services to the industrial and utility sectors and a retail electric provider in Texas.

In the deepwater Gulf of Mexico, BP is the largest producer of oil and gas. The company operates four out of the seven largest drilling platforms in the region. As of 2012 BP has oil and gas production in the Gulf from fields including Atlantis, Mad Dog, Na Kika, and Thunder Horse. The company also holds stakes in fields operated by other companies, including the Mars, Ursa, and Great White fields. It also owns corrupted Macondo field. The company produces over 200,000 barrels of oil and gas equivalent per day in the region. In December 2011, BP acquired 11 newly available leases for resource exploration rights to areas of federal waters in the Gulf and in June 2012 was the high bidder on 43 further leases in the central region of the Gulf. The company is the largest leaseholder in the deepwater Gulf of Mexico.

BP has operated in Alaska since 1959, and in 2012 operates 13 oil fields and four pipelines in the North Slope. The company also owns a "significant" share in six additional fields and is the largest owner of the 800-mile long Trans-Alaska Pipeline System. BP operates about two-thirds of all North Slope production.

In the lower 48 states, BP has a presence in seven of the top gas basins and in 2011 produced more than 1,800 million cubic feet per day (51 million cubic metres per day) of natural gas. The company is the country's sixth largest natural gas producer with a total of 10,000 wells. Its North America Gas division has shale positions in the Woodford, Oklahoma, Fayetteville, Arkansas, Haynesville, Texas and Eagle Ford, Texas shales. In March 2012, BP announced that it had acquired a lease for gas exploration of the Utica Shale in Ohio. In Colorado, BP operates approximately 1,500 oil and gas wells, primarily in the San Juan basin. The majority of these wells are "unconventional", using methods other than conventional oil wells to produce oil or gas. The company also has gas extraction operations in "unconventional" gas fields in the New Mexico section of the San Juan basin, and in Moxa and Wamsutter, Wyoming.

In the US, BP operates refineries in Whiting, Indiana; Toledo, Ohio; and Cherry Point, Washington. The company's Whiting refinery is the sixth largest in the US and can refine more than 400,000 barrels of crude oil per day. As of 2012, BP is making a multi-billion investment to modernise the refinery in order to allow it to process heavier crude oil. The Toledo refinery in northwestern Ohio, in which BP has invested around $500 million on improvements since 2010, is a joint venture with Husky Energy, which operates the refinery, and processes approximately 160,000 barrels of crude oil per day. The Cherry Point and Carson refineries on the West Coast process the company's crude oil from Alaska and other countries. The Cherry Point refinery produces gasoline, jet fuel, diesel and some propane and butane. It supplies 20 percent of the gasoline in Washington state, and also supplies gasoline to Oregon and California. The refinery also produces 8 percent of the world's calcined coke and is the largest supplier of calcined coke to the global aluminum industry. Since the early 2000s, the company has been focusing its refining business on processing crude from oil sands and shales.

The company also owns three petrochemical plants in the US, which produce approximately four million tons of petrochemicals each year. Its plant in Texas City, located on the same site as the Texas City Refinery, produces chemicals including propylene and styrene, which are used in the manufacture of products including windows, carpet and paint. BP's Decatur, Alabama and Cooper River, South Carolina petrochemical plants both produce purified terephthalic acid, more commonly known as PTA, which is used in the production of synthetic fibre for clothing, packaging and optical films. The Decatur plant also produces paraxylene and naphthalene dicarboxlate.

The company's alternative energy operations based in the US include 13 wind farms in seven states, with a further three under construction as of July 2012. The farms are located in Colorado, California, Hawaii, Idaho, Indiana, Kansas, Pennsylvania, South Dakota and Texas. Since 2005, BP has constructed an average of three turbines each week. The total gross capacity of the 13 wind farms is 1,955 megawatts. BP has established a "Global Biofuels Technology Center" in San Diego to develop cellulosic technology and this technology is being tested at scalable levels at a biofuels demonstration plant, located in Jennings, Louisiana.

There are over 11,000 retail sites in the US operating under a BP brand including BP, ARCO and ampm. On the US West Coast, BP primarily operates service stations under the ARCO brand, having acquired the company in 2000. The ARCO service stations sell BP-refined gasolines and biofuels.

Other countries

BP has oil and gas exploration and development operations in 30 countries worldwide. In Brazil, the company holds stakes in offshore oil and gas exploration in the Barreirinhas, Ceará and Campos basins, in addition to onshore processing facilities. BP also operates biofuel production facilities in Brazil, including three cane sugar mills for ethanol production. In Azerbaijan BP operates the two largest oil and gas production projects in the Caspian Sea, the Azeri–Chirag–Guneshli offshore oil fields, which supplies 80% of the country's oil production, and the Shah Deniz gas field, and develops the Shafag-Asiman complex of offshore geological structures. In addition, it operates the Azerbaijan's major export pipelines such as Baku–Tbilisi–Ceyhan, Baku–Supsa and South Caucasus Pipeline. In Egypt, BP produces approximately 15% of the country's total oil production and 40% of its domestic gas. The company also has offshore gas developments in the East Nile Delta Mediterranean, and in the West Nile Delta, where the company has a joint investment of US$9 billion with RWE to develop two offshore gas fields. BP is also involved in offshore oil development in Angola, where it holds an interest in a total of nine oil exploration and production blocks covering more than 30,000 square kilometres (12,000 sq mi). This includes four blocks it acquired in December 2011 and an additional block that is operated by Brazilian national oil company, Petrobras, in which it holds a 40% stake. The company is the largest oil and gas producer in Trinidad and Tobago, where it holds more than 1,350 square kilometres (520 sq mi) of offshore assets and is the largest shareholder in Atlantic LNG, one of the largest LNG plants in Western Hemisphere. BP also has a stake in exploration of two blocks of offshore deepwater assets in the South China Sea. In India, BP owns a 30% share of oil and gas assets operated by Reliance Industries, including exploration and production rights in more than 20 offshore oil and gas blocks, representing an investment of more than US$7 billion into oil and gas exploration in the country. In addition to the offshore operations in the British zone of North Sea, BP has some oilfields' interests also in the Norwegian section.

In addition to its offshore operations, the company is involved in major onshore oil and gas exploration and production in Iraq and Russia. BP operates in Iraq as part of the joint venture Rumaila Operating Organization in the Rumaila oil field, the world's fourth largest oilfield, where it produced over 1 million barrels per day (160×10^ m/d) of oil equivalent in 2011. As of October 2012, BP holds a 1.25% stake in Russia's state-controlled oil company, Rosneft, and expects to hold 19.75% upon completion of the sale of its stake in TNK-BP to Rosneft. BP's Canadian operations are headquartered in Calgary and the company operates primarily in Alberta, the Northwest Territories, and Nova Scotia. It purchases crude oil for the company's refineries in the US and has oil sands holdings in Alberta and four offshore blocks in Nova Scotia. The company's Canadian oil sands leases include joint ventures with Husky Energy in the Sunrise Energy Project, and Devon Energy in Pike, and a partnership with Value Creation Inc. in the development of the Terre de Grace oil sands lease. BP also has major liquefied natural gas activities in countries including Indonesia, where it operates the Tangguh LNG project, which began production in 2009 and has a capacity of 7.6 million tonnes of liquid natural gas per year. Also in that country, the company has invested in the exploration and development of coalbed methane.

The company's refining operations include Europe's second-largest oil refinery, located in the Netherlands. The Rotterdam refinery can process up to 377,000 barrels (59,900 m) of crude oil per day. In Australia, BP operates two out of the country's seven refineries: Kwinana in Western Australia, which can process up to 146,000 barrels (23,200 m) of crude oil per day and is the country's largest refinery, and the Bulwer Island refinery in Queensland, which can process up to 102,000 barrels (16,200 m) of crude per day. BP also owns a refinery in Spain, and share in refineries in Germany, South Africa and New Zealand and owns or has a share in more than a dozen petrochemical manufacturing plants worldwide. The company's petrochemicals plants produce products including purified terephthalic acid, paraxylene, and acetic acid. Its petrochemicals, lubricants, fuels and related services are marketed in over 70 countries.

Operations by activity

Upstream

See also: Oil fields operated by BPBP Upstream's activities include exploring for new oil and natural gas resources, developing access to such resources, and producing, transporting, storing and processing oil and natural gas. Upstream is responsible for the operation of BP's wells, pipelines, offshore platforms and processing facilities. The activities in this area of operations take place in 30 countries worldwide, including Angola, Azerbaijan, Brazil, Canada, Egypt, India, Iraq, Norway, Russia, Trinidad & Tobago, the UK, and the US. In addition to the conventional oil exploration and production, BP has a stake in the three oil sands projects in Canada.

Downstream

BP Downstream's activities include refining, marketing, manufacturing, transportation, trading and supply of crude oil, petrochemicals products and petroleum. Downstream is responsible for BP's fuels, lubricants and petrochemical businesses and has major operations located in Europe, North America and Asia. BP owns or holds a share in 16 refineries worldwide, of which seven are located in Europe and five are in the US. The company also has 21,800 service stations and markets its products in approximately 70 countries worldwide.

Air BP

Air BP is the aviation division of BP, providing aviation fuel, lubricants & services. It has operations in over 50 countries worldwide.

BP Shipping

BP Shipping provides the logistics to move BP's oil and gas cargoes to market, as well as marine structural assurance on everything that floats in the BP group. It manages a large fleet of vessels most of which are held on long-term operating leases. BP Shipping's chartering teams based in London, Singapore, and Chicago also charter third party vessels on both time charter and voyage charter basis.

The BP-managed fleet consists of Very Large Crude Carriers (VLCCs), one North Sea shuttle tanker, medium size crude and product carriers, liquefied natural gas (LNG) carriers, liquefied petroleum gas (LPG) carriers, and coasters. All of these ships are double-hulled.

Lubricants

Castrol is BP's main brand for industrial and automotive lubricants and is applied to a large range of BP oils, greases and similar products for most lubrication applications.

Service stations

BP has around 21,800 service stations worldwide, which are primarily operated under the BP brand. In Germany and Luxembourg, BP operates service stations under the Aral brand, having acquired the majority of Veba Öl AG in 2001 and subsequently rebranded its existing stations in Germany to the Aral name. On the US West Coast, in the states of California, Oregon, Washington, Nevada, Idaho, Arizona, and Utah, BP primarily operates service stations under the ARCO brand, having acquired ARCO in 2000. ARCO is a popular "cash only" retailer, selling products refined from Alaska North Slope crude at the Cherry Point Refinery in Washington, a plant in Los Angeles, and at other contract locations on the West Coast.

BP Connect is BP's flagship retail brand and operates worldwide. BP Connect sites feature the Wild Bean Cafe, which offers cafe-style coffee and a selection of hot food as well as freshly baked muffins and sandwiches. BP Connect sites usually offer table and chair seating and often an Internet kiosk. Some BP Connect sites in the UK are run in partnership with Marks & Spencer, with the on-site shop being an M&S Simply Food. In the US, the BP Connect concept is gradually being transitioned to the ampm brand and concept. In Australia BP operates a number of BP Travel Centres, large-scale destination sites located which, in addition to the usual facilities in a BP Connect site, also feature major food-retail tenants such as McDonald's, KFC and Nando's, with a large seating capacity food court and facilities for long-haul truck drivers.

BP Canada operated retail locations in Canada from 1948 to 1982. The downstream assets of BP Canada were sold to Petro Canada in 1982.

BP Alternative Energy

BP established its Alternative Energy business in 2005 to explore low-carbon energy options. BP Alternative Energy primarily invests in wind and biofuel operations. The alternative energy division is headed by Katrina Landis. Originally the business's headquarters were based in London, but were later moved to Washington, D.C.. Its biofuel and wind units are headquartered in Houston. As of 2012, the BP Alternative Energy business employed 5,000 people worldwide.

In 2005, BP committed to spending $8 billion on renewable energy over the next 10 years. As of December 2011, it had invested approximately $7 billion in renewable energy, including $1.6 billion in 2011 alone. According to the company's website, BP plans to invest around $1 billion per year in renewable energy.

BP's solar power business BP Solar operated for 40 years, until the company announced its departure from the solar energy market in December 2011, after which the company focused its investment in biofuels and wind energy. The company expects that biofuels, particularly cellulosic ethanol, will make up 30% of the gasoline pool by 2030. In 2012, BP's closed its subsidiary BP Biofuels Highlands which was to construct a biofuel refinery in Highlands County, Florida, but continues to operate ethanol facilities in England and Brazil. In Brazil, BP owns ethanol and sugar producers Companhia Nacional de Açúcar e Álcool and holds a 50% stake in ethanol producer Tropical BioEnergia. The company has 13 wind farms in the United States with total gross capacity of 1,955 megawatts.

BP's corporate venturing activity is managed through Alternative Energy's Emerging Business and Ventures group, which has invested approximately $150 million in growth stage companies that develop clean energy technologies from 2006 to 2012. According to the company's website, key areas of focus for its renewable energy investments include carbon innovation, bio-energy and electrification. Companies that BP has invested in include biotechnology companies Vedrezyne and Chromatin, both developers of renewable energy feed stocks.

Corporate affairs

Senior management

The current members of the BP board of directors are:

- Carl-Henric Svanberg – Chairman;

- Robert Dudley – CEO (since 1 October 2010);

- Iain Conn – Chief Executive, Refining and Marketing;

- Brian Gilvary – Chief Financial Officer;

- Byron Grote – Executive Vice President, Corporate Business Activities;

- David Jackson – company secretary;

- Paul Anderson – non-executive director;

- Frank Bowman – non-executive director;

- Antony Burgmans – non-executive director;

- Cynthia Carroll – non-executive director;

- George David – non-executive director;

- Ian Davis – non-executive director;

- Ann Dowling – non-executive director;

- Brendan Nelson – non-executive director;

- Phuthuma Nhleko – non-executive director; and

- Andrew Shilston – non-executive director.

Financial data

| Year | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

|---|---|---|---|---|---|---|---|---|

| Sales | 180,186 | 236,045 | 294,849 | 249,465 | 265,906 | 284,365 | 361,341 | 239,272 |

| EBITDA | 22,941 | 28,200 | 37,825 | 41,453 | 44,835 | |||

| Net results | 6,845 | 10,267 | 15,961 | 22,341 | 22,000 | 20,845 | 21,157 | 16,578 |

| Net debt | 20,273 | 20,193 | 21,607 | 16,202 | 16,202 |

- Source :OpesC

Stock

BP stock is composed of original BP shares as well as shares acquired through mergers with Amoco in 1998 and the Atlantic Richfield Company (ARCO) in 2000. The majority of BP investors are in the United States, where 38% of shares are held, while British investors hold 35% of shares. The remaining shares are held by investors worldwide. The company's shares are primarily traded on the London Stock Exchange, but also listed on the Frankfurt Stock Exchange in Germany. In the United States shares are traded in US dollars on the New York Stock Exchange in the form of American depository shares. One ADS represents six ordinary shares.

Stock history

The British Government sold 80 million shares of BP at $7.58 in 1979 as part of Thatcher-era privatisation. This sale represented slightly more than 5% of BP’s total shares and reduced the government’s ownership of the company to 46%. Following the worldwide stock market crash in October 1987 Prime Minister Margaret Thatcher initiated the sale of an additional $12.2 billion dollars of BP shares, representing the government's remaining 31% stake in the company. In November 1987 the Kuwait Investment Office purchased a 10.06% interest in BP, becoming the largest institutional shareholder. The following May, the KIO purchased additional shares, bringing their ownership to 21.6%. This raised concerns within BP that operations in the United States, BP’s primary country of operations, would suffer. In October 1988, the British Department of Trade and Industry required the KIO to reduce its shares to 9.6% within 12 months. The KIO is the third largest institutional shareholder as of February 2012, according to the Financial Times.

Following the United States’ Federal Trade Commission’s approval of the BP-Amoco merger in 1998, Amoco’s stock was removed from Standard & Poor’s 500 and was merged with BP shares on the London Stock Exchange. The merger with Amoco resulted in a 40% increase in share price by April 1999. However, shares fell nearly 25% by early 2000, when the Federal Trade Commission expressed opposition to BP-Amoco’s acquisition of ARCO. The acquisition was ultimately approved in April 2000 increasing stock value 57 cents over the previous year.

After the Texas City Refinery explosion in 2005, stock prices again fell. By January 2007, the explosion, coupled with a pipeline spill in Alaska and production delays in the Gulf of Mexico, left BP’s stock down 4.5% from its position prior to the Texas City explosion. However by April 2007, stocks had rebounded 13% erasing the 8.3% loss from 2006. Declining oil prices and concerns over oil sustainability also caused shares to fall in value in late 2008.

The Deepwater Horizon oil spill in April 2010 initiated a sharp decline in share prices, and BP’s shares lost roughly 50% of their value in 50 days. BP’s shares reached a low of $26.97 per share on 25 June 2010 totalling a $100 billion loss in market value before beginning to climb again. Shares reached a post-spill high of $49.50 in early 2011 and as of April 2012 shares remain down approximately 30% from pre-spill levels.

Company name

Until 31 December 1998 the company was formally registered as the British Petroleum Company plc. Following a merger with Amoco the company adopted the name BP Amoco plc in January 1999, which was retained until May 2001 when the company was renamed BP p.l.c. In the first quarter of 2001 the company adopted the marketing name of BP, replaced its "Green Shield" logo with the "Helios" symbol, a green and yellow sunflower pattern, and introduced a new corporate slogan – "Beyond Petroleum". The transition to the name and logo was managed by the advertising agency Ogilvy & Mather and the PR consultants, Ogilvy PR. The "Helios" logo (Helios is the name of the Greek sun god), is designed to represent energy in its many forms. BP's tagline, "Beyond Petroleum", according to the company represents their focus on meeting the growing demand for fossil fuels, manufacturing and delivering more advanced products, and enabling the material transition to a lower carbon future.

Environmental record

BP was named by Multinational Monitor as one of the ten worst corporations in both 2001 and 2005 based on its environmental and human rights records. In 1991 BP was cited as the most polluting company in the US based on EPA toxic release data. In 2007, the United States Department of Justice announced that BP had agreed to plead guilty to a felony violation of the Clean Air Act for its conduct that resulted in the fatal explosion on 23 March 2005 at their Texas City Refinery. As part of the guilty plea BP agreed to pay a $50 million criminal fine, the largest ever assessed under the Clean Air Act.

Environmental initiatives

As of 11 February 2007, BP announced that it would spend $8 billion over ten years to research alternative methods of fuel, including natural gas, hydrogen, solar, and wind. A $500 million grant to the University of California, Berkeley, Lawrence Berkeley National Laboratory, and the University of Illinois at Urbana-Champaign, to create an Energy Biosciences Institute has recently come under attack over concerns about the global impacts of the research and privatisation of public universities.

BP patented the Dracone Barge to aid in oil spill clean-ups across the world.

BP was a founding sponsor of the University of East Anglia's Climatic Research Unit in 1971.

BP was a member of the Global Climate Coalition an industry organisation established to promote global warming scepticism but withdrew in 1997, saying "the time to consider the policy dimensions of climate change is not when the link between greenhouse gases and climate change is conclusively proven, but when the possibility cannot be discounted and is taken seriously by the society of which we are part. We in BP have reached that point.".

In March 2002, Lord John Browne, the group chief executive of BP, declared in a speech that global warming was real and that urgent action was needed, saying that "Companies composed of highly skilled and trained people can't live in denial of mounting evidence gathered by hundreds of the most reputable scientists in the world."

In 2009, Tony Hayward apparently shifted gears from former chief executive Lord Browne's focus on alternative energy, announcing that safety was the company's "number one priority".

Accusations of greenwashing

According to activist Antonia Juhasz, BP's investment in green technologies peaked at 4% of its exploratory budget prior to cutbacks, including the discontinuation of the Solar Programme and the closure of the alternative energy headquarters in London. Juhasz claims this amounts to an exercise in greenwashing. Greenpeace has questioned BP branding itself "Beyond Petroleum, citing its 2008 budget which included $20 billion in fossil fuel investment and $1.5 billion in all alternative forms of energy.

Hazardous substance dumping 1993–1995

In September 1999, one of BP’s US subsidiaries, BP Exploration Alaska (BPXA), agreed to resolve charges related to the illegal dumping of hazardous wastes on the Alaska North Slope, for $22 million. The settlement included the maximum $500,000 criminal fine, $6.5 million in civil penalties, and BP’s establishment of a $15 million environmental management system at all of BP facilities in the US and Gulf of Mexico that are engaged in oil exploration, drilling or production. The charges stemmed from the 1993 to 1995 dumping of hazardous wastes on Endicott Island, Alaska by BP’s contractor Doyon Drilling. The firm illegally discharged waste oil, paint thinner and other toxic and hazardous substances by injecting them down the outer rim, or annuli, of the oil wells. BPXA failed to report the illegal injections when it learned of the conduct, in violation of the Comprehensive Environmental Response, Compensation and Liability Act.

Prudhoe Bay 2006–2007

In August 2006, BP shut down oil operations in Prudhoe Bay, Alaska, due to leaking wells. The wells were leaking an insulating agent called Arctic pack, consisting of crude oil and diesel fuel, which is placed between the wells and ice to prevent freezing. BP had also spilled over one million litres of oil in Alaska's North Slope due to corrosion in the feeding pipeline to the Alaska Pipeline. This corrosion is caused by sediment collecting in the bottom of the pipe, protecting corrosive bacteria from chemicals sent through the pipeline to fight these bacteria. There are estimates that about 5,000 barrels (790 m) of oil were released from the pipeline. To date 1,513 barrels (240.5 m) of liquids, about 5,200 cubic yards (4,000 m) of soiled snow and 328 cubic yards (251 m) of soiled gravel have been recovered. After approval from the DOT, only the eastern portion of the field was shut down, resulting in a reduction of 200,000 barrels per day (32,000 m/d) until work began to bring the eastern field to full production on 2 October 2006.

In May 2007, the company announced another partial field shutdown owing to leaks of water at a separation plant. Their action was interpreted as another example of fallout from a decision to cut maintenance of the pipeline and associated facilities.

On 16 October 2007, Alaska Department of Environmental Conservation officials reported a toxic spill of methanol (methyl alcohol) at the Prudhoe Bay oil field managed by BP PLC. Nearly 2,000 gallons of mostly methanol, mixed with some crude oil and water, spilled onto a frozen tundra pond as well as a gravel pad from a pipeline. Methanol, which is poisonous to plants and animals, is used to clear ice from the insides of the Arctic-based pipelines.

2008 Caspian Sea gas leak and blowout

On 17 September 2008, a gas leak was discovered and one gas-injection well blown out in the area of the Central Azeri platform at the Azeri oilfield, a part of the Azeri–Chirag–Guneshli project, in the Azerbaijan sector of Caspian Sea. The platform was shut down and the staff was evacuated. As the Western Azeri Platform was being powered by a cable from the Central Azeri Platform, it was also shut down. According to US Embassy cables, BP had been "exceptionally circumspect in disseminating information" and revealed that BP thought the cause for the blowout was a bad cement job. Production at the Western Azeri Platform resumed on 9 October 2008 and at the Central Azeri Platform in December 2008.

Colombian farmland damages claim

In 2009, a group of 95 Colombian farmers filed a suit against BP, claiming the company's Ocensa pipeline caused landslides and damage to soil and groundwater, affecting crops, livestock, and contaminating water supplies, making fish ponds unsustainable. Most of the land traversed by the pipeline was owned by peasant farmers who were illiterate and unable to read the environmental impact assessment conducted by BP prior to construction, which acknowledged significant and widespread risks of damage to the land.

In 2006, another group of Colombian farmers reached a multimillion dollar out-of-court settlement with BP for alleged environmental damage caused by the Ocensa pipeline. An agreed statement said: "The Colombian farmers group are pleased to say that after a mediation process which took place in Bogotá in June 2006 at the joint initiative of the parties, an amicable settlement of the dispute in relation to the Ocensa pipeline has been reached, with no admissions of liability." The company was accused of benefiting from a regime of terror carried out by Colombian government paramilitaries to protect the 450-mile (720 km) Ocensa pipeline; BP insisted throughout that it has acted responsibly and that landowners were fairly compensated.

2010 Texas City chemical leak

Two weeks prior to the Deepwater Horizon explosion, BP admitted that malfunctioning equipment lead to the release of over 530,000 lbs of chemicals into the air of Texas City and surrounding areas from 6 April to 16 May. The leak included 17,000 pounds of benzene (a known carcinogen), 37,000 pounds of nitrogen oxides (which contribute to respiratory problems), and 186,000 pounds of carbon monoxide. In June 2012, over 50,000 Texas City residents joined a class-action suit against BP, alleging they got sick in 2010 from the 41-day emissions release from the refinery. Texas has also sued BP over the release of emissions. BP says the release harmed no one.

2010 Deepwater Horizon oil spill

Main articles: Deepwater Horizon oil spill, Deepwater Horizon explosion, Deepwater Horizon litigation, and Economic and political consequences of the Deepwater Horizon disaster See also: Deepwater Horizon (disambiguation)

On 20 April 2010, the semi-submersible exploratory offshore drilling rig Deepwater Horizon located in the Macondo Prospect field in the Gulf of Mexico exploded after a blowout; it sank two days later, killing 11 people and causing the largest accidental marine oil spill in the history of the petroleum industry. Before the well was capped on 15 July 2010, an estimated 4.9 million barrels (780×10^ m) of oil was spilled and 1.8 million US gallons (6,800 m) of Corexit dispersant was applied. The spill caused extensive damage to marine and wildlife habitats and to the Gulf's fishing and tourism industries.

The drilling rig was owned and operated by Transocean under the contract with BP, the majority owner of the Macondo oil field. At the time of the explosion, there were 126 crew on board; seven were employees of BP and 79 of Transocean. There were also employees of various other companies involved in the drilling operation, including Anadarko, Halliburton and M-I Swaco.

The Federal government of the United States named BP the responsible party. The United States Department of Justice has charged four BP employees while more company officials could be charged. Two employees have been indicted on manslaughter charges for acting negligently. Two employees are charged with obstruction of justice and for lying to federal investigators.

On 14 November 2012, BP and the Department of Justice reached a $4.5 billion settlement which BP will pay in fines and other payments, the largest of its kind in US history. BP also agreed to plead guilty to 11 felony counts related to the deaths of the 11 workers. The settlement has not resolved the fines under the Clean Water Act, which could be as much as $21 billion. The total amount paid out by BP by November 2012 was $42 billion.

Mist mountain project

There have been some calls by environmental groups for BP to halt its "Mist Mountain" Coalbed Methane Project in the Southern Rocky Mountains of British Columbia and for the UN to investigate the mining activities. The proposed 500 km² project is directly adjacent to the Waterton-Glacier International Peace Park.

Canadian oil sands

In Canada, BP is involved in the use of in-situ drilling technologies such as Steam Assisted Gravity Drainage to extract oil from the country's oil sand reserves. Members of the Cree Nation have criticized BP's involvement in the Canadian oil sands for the impacts that oil extraction is said to have on the local environment. However, proponents of in situ drilling state that using recycled groundwater makes it the more environmentally friendly option compared to oil sands mining.

Accidents

1965 Sea Gem offshore oil rig disaster

Main article: Sea GemIn December 1965, Britain's first oil rig, Sea Gem, capsized when two of the legs collapsed during an operation to move it to a new location. The oil rig had been hastily converted in an effort to quickly start drilling operations after the North Sea was opened for exploration. Thirteen crew members were killed. No hydrocarbons were released in the accident.

2005 Texas City Refinery explosion

Main article: Texas City Refinery explosionIn March 2005, BP's Texas City, Texas refinery, one of its largest refineries, exploded causing 15 deaths, injuring 180 people and forcing thousands of nearby residents to remain sheltered in their homes. A 20-foot column filled with hydrocarbon overflowed to form a vapour cloud, which ignited. The explosion caused all the casualties and substantial damage to the rest of the plant. The incident came as the culmination of a series of less serious accidents at the refinery, and the engineering problems were not addressed by the management. Maintenance and safety at the plant had been cut as a cost-saving measure, the responsibility ultimately resting with executives in London.

The fallout from the accident continues to cloud BP's corporate image because of the mismanagement at the plant. There have been several investigations of the disaster, the most recent being that from the US Chemical Safety and Hazard Investigation Board which "offered a scathing assessment of the company." OSHA found "organizational and safety deficiencies at all levels of the BP Corporation" and said management failures could be traced from Texas to London.

The company pleaded guilty to a felony violation of the Clean Air Act, was fined $50 million, the largest ever assessed under the Clean Air Act, and sentenced to three years probation.

On 30 October 2009, the US Occupational Safety and Health Administration (OSHA) fined BP an additional $87 million, the largest fine in OSHA history, for failing to correct safety hazards revealed in the 2005 explosion. Inspectors found 270 safety violations that had been previously cited but not fixed and 439 new violations. BP appealed the fine. (see #Environmental record).

In 2010, BP agreed to pay a settlement of $50.6 million for the safety violations that were not fixed after the explosion. In July 2012, the company agreed to pay $13 million to settle the new violations. At that time OSHA found "no imminent dangers" at the Texas plant, which is up for sale. Thirty violations remain under discussion.

2006–2010: Refinery fatalities and safety violations

From January 2006 to January 2008, three workers were killed at the company's Texas City, Texas refinery in three separate accidents. In July 2006 a worker was crushed between a pipe stack and mechanical lift, in June 2007, a worker was electrocuted, and in January 2008, a worker was killed by a 500-pound piece of metal that came loose under high pressure and hit him.

Facing scrutiny after the Texas City Refinery explosion, two BP-owned refineries in Texas City, and Toledo, were responsible for 97 percent (829 of 851) of wilful safety violations by oil refiners between June 2007 and February 2010, as determined by inspections by the Occupational Safety and Health Administration. Jordan Barab, deputy assistant secretary of labour at OSHA, said "The only thing you can conclude is that BP has a serious, systemic safety problem in their company."

Disclosed US diplomatic cables by WikiLeaks revealed that BP had covered up a gas leak and blowout incident in September 2008 at a gas field under production in the Azeri-Chirag-Guneshi area of the Azerbaijan Caspian Sea. According to the cables, BP was lucky to have been able to evacuate everyone safely given the explosive potential. BP did not only hold back information to the public about the incident but even upset its partner firms in limiting the information shared. In January 2009, BP blamed a bad cement job as the cause for the incident. The Guardian noted a striking resemblance with the later oil spill disaster in the Gulf of Mexico.

2010 Deepwater Horizon well explosion

Main article: Deepwater Horizon explosionThe 20 April 2010 explosion on BP's offshore drilling rig in the Gulf of Mexico resulted in the deaths of 11 people, and injured 16 others; another 99 people survived without serious physical injury. It caused the Deepwater Horizon to burn and sink, and started the largest accidental offshore oil spill in the history of the petroleum industry.

Political record

Release of Lockerbie bomber

BP admitted that it had lobbied the British government to conclude a prisoner-transfer agreement which the Libyan government had wanted to secure the release of Abdelbaset al-Megrahi, the only person convicted for the 1988 Lockerbie bombing over Scotland, which killed 270 people. BP stated that it pressed for the conclusion of prisoner transfer agreement (PTA) amid fears that delays would damage its "commercial interests" and disrupt its £900 million offshore drilling operations in the region, but it denied claims that it had been involved in negotiations concerning the release of Megrahi.

Contributions to political campaigns

According to the Center for Responsive Politics, BP was the United States' hundredth largest donor to political campaigns, having contributed more than US$5 million since 1990, 72% and 28% of which went to Republican and Democratic recipients, respectively.

In February 2002, BP's then chief executive, Lord Browne of Madingley, renounced the practice of corporate campaign contributions, noting: "That's why we've decided, as a global policy, that from now on we will make no political contributions from corporate funds anywhere in the world."

Lobbying

In 2009 BP spent nearly $16 million lobbying the US Congress. In 2011, BP spent a total of $8,430,000 on lobbying and hired 47 lobbyists.

Accusations of market manipulation

The US Justice Department and the Commodity Futures Trading Commission accused BP Products North America Inc. (subsidiary of BP plc) and several BP traders with conspiring to raise the price of propane by seeking to corner the propane market in 2004. In 2006, one former trader pleaded guilty. In 2007, BP paid approximately $303 million in restitution and fines as part of an agreement to defer prosecution. In 2007, four other former traders were charged; however, charges were dismissed by an U.S. District Court in 2009. The dismissal was upheld by the 5th U.S. Circuit Court of Appeals in 2011.

In November 2010, U.S. regulators began an investigation of BP for allegedly manipulating the gas market. In its 2010 annual report BP elaborated: "The US Federal Energy Regulatory Commission (FERC) and the U.S. Commodity Futures Trading Commission (CFTC) are currently investigating several BP entities regarding trading in the next-day natural gas market at Houston Ship Channel during October and November 2008". The Commodity Futures Trading Commission also informed BP of intent to recommend charges over the allegations. In a statement, BP said it "did not engage in any inappropriate or unlawful activity" and that it has fully cooperated with the investigations. The company stated it has complied with the law in its trading and transport operations. According to the Office of Enforcement of the Federal Energy Regulatory Commission, it has "preliminarily determined that BP America Inc., BP Corporation North America Inc., BP American Production Company and BP Energy Company (collectively, BP) violated the Commission's Prohibition of Natural Gas Market Manipulation, 18 CFR § 1c.1 (2011)".

See also

References

- "Executive Compensation at BP". Retrieved 12 July 2010.

- ^ "Annual Results 2011" (PDF). BP. 2 February 2010. Retrieved 11 June 2010.

- "BP plc 2009 Securities and Exchange Commission Form 20-F" (PDF) (Press release). BP. 2010. Archived from the original (PDF) on 4 July 2010. Retrieved 11 June 2010.

{{cite press release}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "Across Atlantic, Much Ado About Oil Company's Name". The New York Times. 12 June 2010. Archived from the original on 17 June 2010. Retrieved 17 June 2010.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "Global 500 – 1–100". Fortune. 25 July 2011. Retrieved 15 March 2012.

- "Oil majors' output growth hinges on strategy shift". Reuters. 1 August 2008. Retrieved 15 March 2012.

- ^ Financial and Operating Information 2007–2011 (PDF) (Report). BP. 2011. p. 63.

- Annual Report and Form 20-F 2011 (PDF) (Report). BP. 2011. p. 98. Retrieved 19 May 2012.

- ^ "BP enters shale oil quest in Ohio". United Press International. 27 March 2012. Retrieved 19 May 2012. Cite error: The named reference "UPI2012" was defined multiple times with different content (see the help page).

- "BP at a glance". BP. Retrieved 19 May 2012.

- "FTSE All-Share Index Ranking". stockchallenge.co.uk. Retrieved 26 December 2011.

- "BP.com: History of BP – Post war". Archived from the original on 3 July 2010. Retrieved 3 July 2010.

In 1954, the board changed the company's name to The British Petroleum Company

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - Tharoor, Ishaan (2 June 2010). "A Brief History of BP". Time. Archived from the original on 10 July 2010. Retrieved 3 July 2010.

In 1954, in an attempt perhaps to move beyond its image as a quasi-colonial enterprise, the company rebranded itself the British Petroleum Company

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "Gulf Spill Is the Largest of Its Kind, Scientists Say". The New York Times. New York. 2 August 2010. Retrieved 24 August 2012.

- http://money.cnn.com/2012/11/28/news/economy/bp-ban/

- "BP tackles climate change threat with £200m boost for energy efficiency". The Telegraph. London. 25 October 2005. Retrieved 9 February 2011.

- ^ "Australian Dictionary of Biography". Adb.online.anu.edu.au. Retrieved 5 June 2010.

- Metz, Helen Chapin, ed. (1988). "The Turkish Petroleum Company". Iraq: A Country Study. Retrieved 28 June 2008.

- Myers, Kevin (3 September 2009). "The greatest 20th century beneficiary of popular mythology has been the cad Churchill". Irish Independent. Retrieved 9 September 2012.

- "MILESTONES: 1921-1936, The 1928 Red Line Agreemen". US Department of State. Retrieved 18 August 2012.

- ^ The Cambridge History of Iran, Volume 7. Cambridge University Press. p. 665.

- Yousof Mazandi, United Press, and Edwin Muller, Government by Assassination (Reader's Digest September 1951).

- Risen, James (18 June 2000). "The C.I.A. in Iran: Britain Fights Oil Nationalism". The New York Times. Retrieved 5 June 2010.

- ^ "BP: History at Funding Universe". Fundinguniverse.com. Retrieved 5 June 2010.

- Sztucki, Jerzy; Interim measures in the Hague Court. Brill Archive. (1984). . p. 43. ISBN 978-90-6544-093-8.

- ^ "How a Plot Convulsed Iran in '53 (and in '79)". The New York Times. Retrieved 5 June 2010.

- "New York Times article, 1953". The New York Times. 20 August 1953. Retrieved 5 June 2010.

- Ends of British Imperialism: The Scramble for Empire, Suez, and Decolonization. I.B.Tauris. 2007. pp. 775

- The C.I.A. in Iran: Britain Fights Oil Nationalism

- ^ Vassiliou, M. S. Historical Dictionary of the Petroleum Industry : Volume 3. p. 269.

- ^ Lauterpacht, E. International Law Reports. p. 375.

- Strategies, Markets and Governance: Exploring Commercial and Regulatory Agendas. p. 235.

- Kinzer, All the Shah's Men, (2003), pp. 195–6.

- Everest, Larry (27 May 2007). "Background to Confrontation". Revolution. Retrieved 5 June 2010.

- "Natural Gas and Alaska's Future: The Facts page 22" (PDF). Retrieved 5 June 2010.

- "BP dossier". Sea-us.org.au. 21 November 1999. Archived from the original on 18 June 2010. Retrieved 5 June 2010.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "International Oil Transportation". Dr. Jean-Paul Rodrigue. Retrieved 1 September 2012.

- Company Check. "Iraq Petroleum Company Ltd". Retrieved 19 August 2012.

- "The shareholders of ADPC info from ExxonMobil history". Retrieved 18 August 2012.

- "Bloomberg Businessweek company info - ADPC". Retrieved 18 August 2012.

- ^ "Sohio timeline". Dantiques.com. 1 June 1913. Retrieved 5 June 2010.

- "TNK International appoints Sir Peter Walters and Sir William Purves to its newly-created Advisory Board" (Press release). TNK International. 13 June 2002. Retrieved 5 June 2010.

- Poole, Robert W. "Privatisation". Econlib.org. Retrieved 5 June 2010.

- Lohr, Steve (19 November 1987). "Kuwait Has 10% Of B.P.; Price Put At $900&Nbsp;Million". The New York Times. Retrieved 11 June 2010.

- "Britain drops a barrier to BP bid". The New York Times. Associated Press. 5 February 1988. Retrieved 5 June 2010.

- "Organising for performance: how BP did it". Gsb.stanford.edu. Retrieved 5 June 2010.

- "Funding Universe - History of Chevron Corporation". Retrieved 1 September 2012.

- "Company Profile". chevron.com. Archived from the original on 12 April 2010. Retrieved 5 May 2010.

{{cite web}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "Funding Universe - History of Talisman Energy Inc". Retrieved 1 September 2012.

- "Royal Academy of Engineering". Raeng.org.uk. Retrieved 5 June 2010.

- "BP and Amoco in oil mega-merger". BBC News. 11 August 1998. Retrieved 5 June 2010.

- ^ "BP Parent Company Name Change Following AGM Approval" (Press release). BP. 1 May 2001. Retrieved 11 June 2010.

- Brierley, David (4 April 1999). "BP strikes it rich in America". The Independent. London. Retrieved 5 June 2010.

- "BP Amoco Agrees Recommended Cash Offer To Buy Burmah Castrol For £3 ($4.7) Billion" (Press release). BP. 14 March 2000. Retrieved 11 June 2010.

- Life: The Observer Magazine – A celebration of 500 years of British Art – 19 March 2000

- Boland, Vincent (26 May 2005). "BTC pipeline the 'new Silk Road'". Financial Times. (subscription required). Retrieved 9 September 2012.

- "BP, TNK sign $6bn Russia deal". CNN. 26 June 2003. Retrieved 9 September 2012.

- "BP sells chemical unit for £5bn". BBC News. 7 October 2005. Retrieved 5 June 2010.

- "BP Sale of Innovene to Ineos Completed" (Press release). BP. 15 December 2005. Retrieved 7 July 2012.

- Raabe, Steve (2 June 2005). "BP puts 100 gas stations up for sale in Colorado.(British Petroleum Company PLC)". Accessmylibrary.com. Retrieved 5 June 2010.

- "Gas station signs of change". Nl.newsbank.com. 18 November 2005. Retrieved 5 June 2010.

- "Penny Shares Online: BP(BP.)". 10 July 2006. Archived from the original on 7 August 2007. Retrieved 11 June 2010.

- "BP to Sell Most Company-Owned, Company-Operated Convenience Stores to Franchisees" (Press release). BP. 15 November 2007. Archived from the original on 25 June 2010. Retrieved 5 June 2010.

{{cite press release}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - Cobain, Ian; Dyer, Clare (2 May 2007). "BP's Browne quits over lie to court about private life". The Guardian. Archived from the original on 29 May 2010. Retrieved 5 June 2010.

{{cite news}}: Unknown parameter|deadurl=ignored (|url-status=suggested) (help) - "Iraq - Rumaila Oil Field (HVO IRQ-10)". ukti.gov.uk. Retrieved 22 August 2012.

- "Iraq Lifts Oil Reserves Estimate to 143 Billion Barrels, Overtakes Iran". Bloomberg. 4 October 2010. Retrieved 22 August 2012.

- Williams, Timothy (6 September 2009). "China Oil Deal Is New Source of Strife Among Iraqis". The New York Times. Retrieved 28 April 2010.

- "CNPC: To Raise Iraq Rumaila Oilfield Output 10% By Year-End" The Wall Street Journal

- Thomas C. Hayes, CONFRONTATION IN THE GULF; The Oilfield Lying Below the Iraq-Kuwait Dispute, The New York Times, 3 September 1990

- J. Murdico, Suzanne. Page 13, The Gulf War : War and Conflict in the Middle East. The Rosen Publishing Group (2004). p. 68. ISBN 9780823945511.

- Young, Sarah; Falloon, Matt (30 September 2010). "New BP CEO says hopes to restore dividend in 2011". Reuters. Retrieved 30 January 2011.

- ^ Das, Anupreeta; Dezember, Ryan; Flynn, Alexis (9 September 2012). "BP in Deal to Sell Some Gulf Fields". The Wall Street Journal. Retrieved 10 September 2012.

- "BP Close to GoM Assets Sale - Analyst Blog". Zacks Equity Research. NASDAQ. 9 September 2012. Retrieved 10 September 2012.

- ^ Cattaneo, Claudia (30 July 2012). "BP back in growth mode, eyes oil sands". Financial Post. Retrieved 19 September 2012.

- Parraga, Marianna; Wallis, Daniel (27 October 2010). "Venezuela says BP's asset sale valued at $800 mln". Reuters. Retrieved 10 September 2012.

- Bierman, Stephen; Swint, Brian (27 October 2010). "BP Sells Venezuela, Vietnam Assets to TNK-BP for $1.8 Billion". Bloomberg. Retrieved 10 September 2012.

- Bergin, Tom; Farge, Emma (15 November 2010). "BP sells Southern Africa fuel retail units". Reuters. Retrieved 10 September 2012.

- Flynn, Alexis (27 March 2012). "BP sells UK gas assets to Perenco for $400 million". Market Watch. Retrieved 10 September 2012.

- Lee, Mike; Swint, Brian (1 December 2012). "Plains Buys $1.67 Billion BP Unit to Expand Liquids Position". Bloomberg Businessweek. Bloomberg. Retrieved 10 September 2012.

- McCoy, Daniel (28 February 2012). "BP sell Kansas natural gas assets to Linn Energy for $1.2 billion". Wichita Business Journal. Retrieved 10 September 2012.

- Chazan, Guy; Sakoui, Anousha (18 September 2012). "BP in talks to sell Texas City refinery". Financial Times. Retrieved 21 September 2012.

- Williams, Selina (13 August 2012). "BP Agrees $2.5 Billion Sale Of Carson Refinery To Tesoro". The Wall Street Journal. Retrieved 10 September 2012.

- "BP Agrees to Sell Carson Refinery and ARCO Retail Network in US Southwest to Tesoro for $2.5 Billion" (Press release). BP. 13 August 2012. Retrieved 17 August 2012.

- "BP To Sell Texas Midstream Gas Assets" (Press release). BP. 10 August 2012. Retrieved 10 September 2012.

- Hays, Kristen (8 October 2012). "Marathon to buy BP Texas City refinery for up to $2.5 billion". Reuters. Retrieved 22 October 2012.

- "BP sells LPG unit to DCC". Business Excellent. 9 August 2012. Retrieved 10 September 2012.

- "BP to sell interest in Draugen field to Shell for $240 mln". Reuters. 13 September 2012. Retrieved 22 October 2012.

- "BP and Russia in Arctic oil deal". BBC News. 14 January 2011.

- Flynn, Alexis; Gronholt-Pedersen, Jacob (18 May 2011). "BP, Rosneft Still in Talks". The Wall Street Journal. (subscription required). Retrieved 22 May 2011.

- Korsunskaya, Darya; Callus, Andrew (22 October 2012). "Rosneft beefs up with TNK-BP purchase". Reuters. Retrieved 22 October 2012.

- "BP announces $7.2B partnership with India's Reliance". New York Post. 21 February 2011. Retrieved 9 September 2012.

- "Reliance Global to buy BP's Malaysian petrochem unit for $230 mn". Business Line. 29 September 2012. Retrieved 22 October 2012.

- "BP plc". New York Stock Exchange. Retrieved 21 June 2012.

- "BP Profile". Yahoo! Finance. Retrieved 7 June 2012.

- "BP on the mend, but recuperation will take time". Petroleum Economist. 28 October 2010. (subscription required). Retrieved 15 May 2012.

- "BP: Summary". Google Finance. Retrieved 6 June 2012.

- ^ Annual Report and Form 20-F 2011 (PDF) (Report). BP. 6 March 2012. Retrieved 6 June 2012.

- "Group organization". BP. 18 June 2012. Retrieved 18 June 2012.

- "Our priorities for managing our people". Our priorities. BP. Retrieved 12 July 2012.

- "UK: Welcome". BP. Retrieved 19 June 2012.

- ^ Forsyth, Ian (28 July 2010). "BP will retain significant presence in North Sea, says operations chief". Aberdeen Press and Journal. Retrieved 7 July 2012.

- Wachman, Richard (13 October 2011). "BP to expand North Sea oil fields". The Guardian. Retrieved 19 June 2012.

- "On the up for BP's North Sea business". BP Magazine. BP. 2012. Retrieved 22 July 2012.

- ^ "U.K. Nod for BP Clair Ridge". Zacks Investment Research. 17 October 2011. Retrieved 10 July 2012.

- ^ Tom Bawden (14 October 2011). "BP to pump £4.5bn into North Sea projects". The Independent. Retrieved 10 July 2012.

- ^ "BP activities in the UK". BP. Retrieved 10 July 2012.

- Brian Swint (13 October 2011). "BP, Shell, Conoco Get Approval For Clair Ridge In North Sea". Bloomberg. Retrieved 27 June 2012.

- Michael Kavanagh (27 March 2012). "BP to sell $400m N Sea assets to Perenco". Financial Times. Retrieved 10 July 2012.

- Florence Tan (30 September 2009). "EPCA '07: BP to debottleneck Hull acetic acid unit". ICIS.com. Retrieved 10 July 2012.

- "Advanced biofuels". BP. Retrieved 10 July 2012.

- Rudy Ruitenberg (10 April 2012). "Vivergo Ethanol Plant in U.K. Gets Wheat, Frontier Says". Bloomberg BusinessWeek. Retrieved 10 July 2012.

- Paul Spackman (15 June 2012). "Cereals 2012: Bioethanol plant on track for summer start". Farmers Weekly. Retrieved 10 July 2012.

- ^ "Locations". BP. Retrieved 6 July 2012.

- "BP Service Stations: About the BP network". BP. Retrieved 27 June 2012.

- "Store Level: BP Connect". Talking Retail. 24 February 2005. Retrieved 10 July 2012.

- Rod Addy (3 July 2004). "Connect stores outstrip BP forecasts". The Grocer. Retrieved 10 July 2012.

- "M&S Simply Food at BP Connect". BP. Retrieved 10 July 2012.

- ^ "BP Plc". The New York Times. 2 May 2012. Retrieved 7 June 2012.

- "BP in the United States". BP. Retrieved 6 August 2012.

- "BP's presence in the US". BP Magazine. BP. 2012. Retrieved 12 June 2012.

- ^ Courtney Subramanian (29 April 2011). "While BP Eyes Return to the Gulf, Safeguards Debated". National Geographic. Retrieved 19 June 2012.

- ^ Ben Lefebrve (23 June 2012). "BP, Apache Evacuate Nonessential Staff From U.S. Gulf as Storm Nears". 4-Traders.com. Dow Jones Newswires. Retrieved 27 June 2012.

- David Brierley (4 April 1999). "BP strikes it rich in America". The Independent. Retrieved 28 August 2012.

- "Green light for BP-Arco merger". BBC News. 14 April 2000. Retrieved 28 August 2012.

- "Company Overview of BP America, Inc". Bloomberg Businessweek. Retrieved 3 November 2012.

-

"Company Overview of BP Exploration & Production Inc". Bloomberg Businessweek. Retrieved 3 Novemb er 2012.

{{cite web}}: Check date values in:|accessdate=(help) - "Company Overview of BP Corporation North America, Inc". Bloomberg Businessweek. Retrieved 3 November 2012.

- "Company Overview of BP Products North America, Inc". Bloomberg Businessweek. Retrieved 3 November 2012.

- "Company Overview of BP America Production Company". Bloomberg Businessweek. Retrieved 3 November 2012.

- "Company Overview of BP Energy Company". Bloomberg Businessweek. Retrieved 3 November 2012.

- Dittrick, Paula (10 September 2012). "Plains E&P to buy Gulf of Mexico assets from BP, Shell". Oil & Gas Journal. Pennwell Corporation. Retrieved 10 September 2012.

- Christopher Helman (7 May 2012). "Two Years After The Spill, BP Has A Secret: It's Booming". Forbes. Retrieved 23 July 2012.

- Katarzyna Klimasinska (20 June 2012). "BP Wins Oil Leases in U.S. Gulf of Mexico Near Spill Site". Bloomberg BusinessWeek. Retrieved 30 July 2012.

- "Deepwater Gulf of Mexico". BP. 2012. Retrieved 25 July 2012.

- ^ "Member Companies". Alaska Oil and Gas Association. 2011. Retrieved 23 July 2012.

- ^ Zaz Hollander (May 2012). "Following North Slope Crude: From the ground to the gas station". Alaska Business Monthly. Retrieved 21 June 2012.

- Carl Portman (December 2011). "North Slope oil Producers: Decline will continue without meaningful tax reform". akrdc.org. Retrieved 8 August 2012.

- ^ "BP to Sell Wyoming Assets". Zacks Equity Research. 26 June 2012. Retrieved 31 July 2012.